|

市場調查報告書

商品編碼

1402992

可程式邏輯控制器 (PLC):市場佔有率分析、產業趨勢/統計、成長預測,2024-2029 年Programmable Logic Controller (PLC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

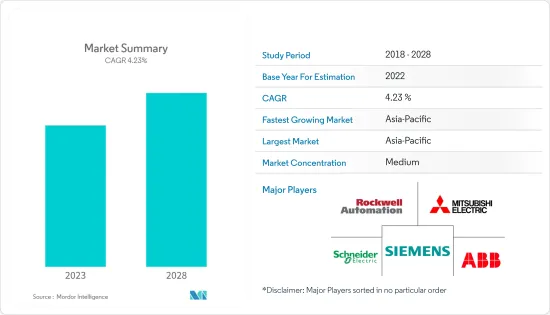

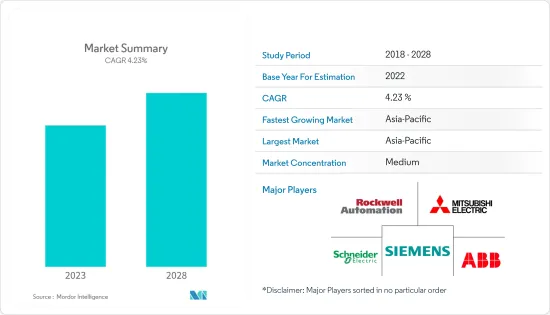

可程式邏輯控制器(PLC)市場規模預計到2024年為128.3億美元,預計到2029年將達到150.7億美元,複合年成長率預計為4.23%。

主要亮點

- PLC 是管理自動化機械的主要計算系統。該系統還有助於檢測錯誤和缺陷並向技術人員發出警報。由於尺寸緊湊,PLC 系統比繼電器和交換器盒等傳統系統更受歡迎。 PLC 的另一個優點是其多功能性(由於其可程式特性,可根據應用進行多種操作)。

- 機器停機時間是影響工業製造效率的關鍵因素。停機時間佔營運期間製造損失的 5-20%。實施 PLC 系統可以識別和糾正錯誤,並在無需人工干預的情況下產生快速反應,從而提高工業流程的效率。

- 工業自動化是推動PLC市場成長的關鍵因素之一。自動化是指透過提高效率和最佳化資源利用來減少流程中人為干預的自動化處理系統。業界現在正在發現利用自動化系統可以實現的可靠性和長期利益。特別是輸送系統和包裝系統可以使用 PLC 系統實現自動化。工業領域自動化滲透率的不斷提高預計也將有利於所研究市場的成長。

- 此外,PLC 還可以幫助控制製造流程,例如組裝、機器人設備或任何需要可靠控制、輕鬆編程和操作故障診斷的活動。 PLC 不斷發展,仍然是各種工業自動化應用的最佳選擇。可擴充性、大內存容量、小型化、高速(Gigabit)乙太網路和內建無線是新興可程式邏輯控制器(PLC)的特徵。

- 現代消費者對個人化產品的需求正在推動產業從大規模生產模式轉向大規模客製化。 PLC 在流程不變的行業中被廣泛接受。然而,隨著最終用戶對產品客製化需求的增加,製造過程變得更加精密和複雜,需要頻繁調整,因此,最終用戶正在使用基於PC或雲端基礎的控制器而不是PLC。投資更靈活的系統,這對研究市場的成長構成了挑戰。

- 區域經濟狀況、地緣政治問題等宏觀經濟因素在產業部門產業部門的成長中發揮重要作用,因為它們影響該部門的投資和擴張能力。例如,最近的俄羅斯和烏克蘭戰爭對一些國家的經濟和地緣政治產生了影響,從而為工業部門的成長創造了不利條件。隨著 PLC 在工業中的廣泛應用,這種趨勢阻礙了市場的成長。

PLC市場趨勢

汽車預計將成為成長最快的最終用戶產業

- PLC 在階段的應用是為了滿足汽車產業不斷成長的需求。最初,它被用作汽車製造中的繼電器替代裝置。 PLC 使製造商能夠更聰明、更快速地工作,隨著自動化流程減少瓶頸的發生,從而降低工業中的營運和生產時間成本。

- 各汽車公司的製造工廠正在進行製造創新,將新技術融入製造流程,以提高生產力和效率。例如,ATS Applied Tech Systems Ltd. 使用 InTrack、InTouch 和 GE-Fanuc PLC 開發了安全氣囊追蹤和追蹤系統,以實現完整的防錯和可追溯性。透過此系統設置,如果在生產過程中檢測到缺陷,則可以在生產後長達 10 年內追蹤安全氣囊的來源和製造機械的狀況。

- 已經證實,自動化顯著提高了汽車組裝流程的效率。結果,全球生產的汽車數量不斷增加,但成本卻同時下降。多年來,汽車行業一直在各種製造程序的組裝上使用機器人。汽車製造商目前正在探索在更多流程中使用機器人。對於這些生產線來說,機器人更加靈活、有效率、準確、可靠。這項技術也使汽車產業仍然是工業機器人最重要的採用者之一,並持有自動化程度最高的供應鏈之一。

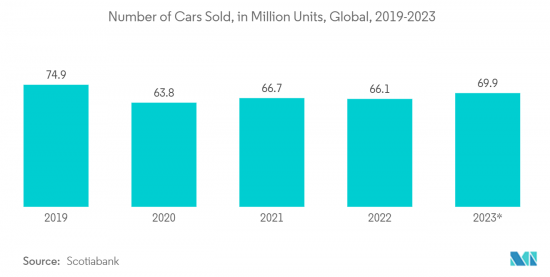

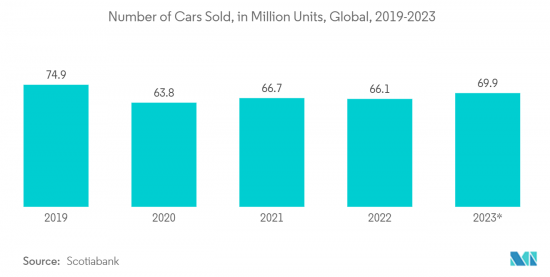

- 世界各地對汽車的需求正在增加。據豐業銀行稱,到 2023 年,全球汽車銷量預計將達到 6,990 萬輛,並在未來幾年進一步成長。

- 此外,車輛電動、聯網汽車和自動駕駛汽車等不斷成長的趨勢也對所研究市場的成長做出了重大貢獻,因為這些車輛通常使用大量電控系統,其中 PLC 發揮重要作用。一種影響。因此,此類上升趨勢預計將在預測期內推動研究市場機會。

亞太地區預計成長更快

- 在過去的幾十年裡,亞太地區的汽車、工業和製造業等各行業都取得了顯著的成長,預計在預測期內這種成長軌跡將持續下去,為所研究的市場提供了成長機會。例如,製造業是中國經濟的重要組成部分,隨著工業4.0圍繞全球製造業的擴張,物聯網的發展正在經歷快速轉型。這一重大轉變使該國在PLC市場上處於領先地位。

- 印度正受到機器人流程自動化 (RPA) 和人工智慧 (AI) 技術的日益使用的推動。根據全球 RPA 論壇 Automation Anywhere 的數據,印度目前是僅次於美國的第二大收益來源。全球產能中心、服務供應商和印度公司是該公司在印度最重要的客戶。

- 印度的工業自動化產業正在透過製造業的數位和實體方面的整合進行轉型,以提供最佳性能。對精益生產和縮短時間的關注正在加速市場成長。

- 日本在機器人製造方面擁有最大的市場佔有率,並引進了工業機器人組裝機器人的方式。根據2022年3月IFR報告,日本是全球第一大工業機器人製造國,供應全球機器人供應量的45%。此類案例預計將推動自動化需求並帶動 PLC 在該地區的發展。

- 亞太地區的其他國家包括韓國、新加坡、印尼、澳洲和泰國。泰國和馬來西亞憑藉著良好的原料可得性和低廉的土地價格,逐漸取代中國成為主要工業中心。這一趨勢預計將有利於亞太地區 PLC 市場的成長。

PLC產業概況

可程式邏輯控制器 (PLC) 市場較為分散,主要企業包括 ABB Ltd、三菱電機、Schneider Electric、羅克韋爾自動化和西門子股份公司。市場上的競爭正在採取聯盟、併購和收購等策略來增強其產品陣容並獲得永續的競爭優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 自動化系統的採用率增加

- PLC 程式設計的易用性和熟悉度支援成長

- 市場抑制因素

- 離散製造業產品客製化需求及從批量加工階段轉向連續加工

- 更採用具有增強安全性和先進控制功能的分散式控制系統 (DCS)

第6章市場區隔

- 按類型

- 硬體和軟體

- 大型PLC

- 奈米PLC

- 小型PLC

- 中型PLC

- 其他

- 按服務

- 硬體和軟體

- 按最終用戶產業

- 食品、菸草、飲料

- 車

- 化學/石化

- 能源/公用事業

- 紙漿/造紙製造

- 油和氣

- 水處理/污水處理

- 製藥

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- ABB Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Rockwell Automation Inc.

- Siemens AG

- Honeywell International Inc.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Emerson Electric Co.

- Hitachi Ltd

- Toshiba International Corporation

第8章投資分析

第9章市場的未來

The Programmable Logic Controller Market size is estimated at USD 12.83 billion in 2024, and is expected to reach USD 15.07 billion by 2029, growing at a CAGR of 4.23% during the forecast period (2024-2029).

Key Highlights

- PLC is the major computing system that manages automated machines. The system also assists in detecting errors or flaws and cautions the technician. Due to their packed sizes, PLC systems are desired over traditional ones, like relays and switch boxes. Another benefit of PLCs is their multi-functionality (due to their programmable nature that can be utilized for multiple operations relying on the application).

- Machine downtime is a significant factor affecting an industry's manufacturing efficiency. Downtime is responsible for 5-20% of the manufacturing losses during operation. Installing PLC systems allows the identification and rectification of errors and can create quick reactions even without human intervention, thereby bringing efficiency into industrial processes.

- Industry automation is one of the significant factors driving the growth of the PLC market. Automation can be described as automatic processing systems to improve the efficiency and reduce human intervention in the process via the optimal usage of resources. The industries have now discovered the reliability and long-term profits that can be accomplished by utilizing automated systems. Conveyor systems & packaging systems, among others, can be automated using PLC systems. The growing penetration of automation in the industrial sector isn also anticipated to favor the studied market's growth.

- Furtheremore, PLCs also help control manufacturing processes, like assembly lines, robotic devices, or any activity requiring high-reliability control and easy programming & operation fault diagnosis. PLCs are growing and remain the best choice for different industrial automation applications. Scalability, greater memory, smaller sizes, high-speed (gigabit) Ethernet, & built-in wireless are among the emerging programmable logic controller capabilities.

- Due to modern consumers' need for personalized products, industries have driven themselves from a mass production model into mass customization. PLCs are broadly embraced in industries whose processes do not change. However, the growing end-user need for customization of products has made the manufacturing processes more refined and complicated, with the need for frequent adjustments, consequently fueling the end-users to adopt and invest in more flexible systems, like PC-based and cloud-based controllers, rather than PLCs which is challenging the studied market's growth.

- Macroeconomic factors such as the genera economic condition of a region, geopolitical issues, etc. plays a crucial role in the industrial sector's growth as these factors influence the investment and expansion capabilities of the industrial sector. For instance, the recent Russia Ukraine war is impacting several countries on both economic as well as geopolitical stability verticals, which in turn is creating an unfavorable condition for the growth of the industrial sector. As PLCs are widely used in industries, such trends hamper the studied market's growth.

PLC Market Trends

Automotive is Expected to Be the Fastest-growing End-user Industry

- PLCs are used at the manufacturing stage to handle the growing demands of the automotive industry. Initially, these were employed as relay replacement equipment in automotive manufacturing. PLCs let manufacturers work smarter & faster, and as automated processes reduce the occurrence of bottlenecks, this reduces expenses in operation and production time in the industry.

- Manufacturing plants of various automotive companies have been experiencing manufacturing changes to integrate new technology into the manufacturing stream to improve productivity and efficiency. For instance, ATS Applied Tech Systems Ltd developed a tracking and tracing system for airbags using InTrack, InTouch, and GE-Fanuc PLCs to gain full error-proofing and traceability. Using the system set-up, it is feasible to trace the airbag's origin and the production machines' status during manufacturing, in case a fault is detected, even up to 10 years after production.

- It has been identified that automation has significantly increased the efficiency of auto assembly process. As a result, it is showing a growing pattern in the number of cars being produced globally while simultaneously cutting costs, paving the way for the growth of smart factories' implementation in this sector. For many years, the automotive industry has used robots in the assembly lines for various manufacturing processes. Nowadays, automakers are exploring the use of robotics in more procedures. Robots are more flexible, efficient, accurate, and dependable for these product lines. This technology also enables the automotive industry to remain one of the most significant adopters of industrial and possess one of the most automated supply chains.

- There has been an increasing demand for automobiles across the world. According to Scotiabank, worldwide automobile sales will reach 69.9 million units by 2023 and are anticipated to be more in forthcoming years.

- Furthermore, the growing proliferation of trends such as electrification of vehicles, connected and autonomous cars, etc. are also anticipated to influence the studied market's growth significantly as these automobiles generally use a larger number of electronic and control units wherein PLCs play a crucial role. Hence, the growing such trends are anticipated to drive opportunities in the studied market during the forecast period.

Asia-Pacific is Expected to Witness a Faster Growth

- In the last few decades, the Asia Pacific region has witnessed remarkable growth across various sectors, including automotive, industrial, manufacturing, etc., and is anticipated to continue its upward growth trajectory during the forecast period, creating opportunities in the studied market. For instance, the manufacturing sector constitutes a substantial part of China's economy, which is experiencing a fast transformation with the current growth in IoT due to the expansion of Industry 4.0 around the manufacturing industries worldwide. This large-scale conversion has put the country in one of the top positions in the PLC market.

- India is fueled by the increasing usage of robotic process automation (RPA) & artificial intelligence (AI)-based technologies. According to the global RPA forum Automation Anywhere, India is presently its second-biggest revenue generator behind the United States. Global capacity centers, service providers, and Indian enterprises are its most prominent customers in India.

- India's industrial automation sector has been transformed by the integration of digital and physical aspects of manufacturing to provide optimum performance. The emphasis on acquiring zero waste production and a faster time to reach the market has augmented the market's growth.

- Japan has the most significant market share in the robot manufacturing industry and installed methods where industrial robots are used to assemble robots. According to a report by IFR in March 2022, Japan is the world's number on industrial robot manufacturer, delivering 45% of the global supply for robots worldwide. Such instances are anticipated to drive the demand for automation, resulting in the developing of PLCs in the region.

- The other countries from the Asia-Pacific region include countries like South Korea, Singapore, Indonesia, Australia, and Thailand. With the excellent availability of raw materials and cheaper land rates, Thailand and Malaysia are gradually emerging as major industrial hubs, an alternative to China. This trend is anticipated to favor the growth of the PLC market in Asia-Pacific.

PLC Industry Overview

The programmable logic controller (PLC) Market is moderately fragmented, with major players such as ABB Ltd, Mitsubishi Electric Corporation, Schneider Electric SE, Rockwell Automation Inc, and Siemens AG. Players in the market are adopting strategies like partnerships, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2023 - Siemens launched a complete virtual programmable logic controller. The Simatic S7-1500V expands the company's existing Simatic portfolio to special market requirements, including virtual hosting of PLC computing. According to the company, Simatic S7-1500V is part of Industrial Operations X, under which the company is consistently focusing on integrating IT and software capabilities into the automation landscape.

- November 2022 - Arduino announced its "first micro PLC," the Opta, a powerful gadget devised with the Industrial Internet of Things (IIoT) at the fore. In addition, it is designed in partnership with Finder. It uses an STMicro STM32H747XI dual-core microcontroller, which contains a single high-performance Arm Cortex-M7 core operating at up to 480MHz & a lower-power Cortex-M4 core driving at up to 240MHz alongside a disseminated floating-point unit (FPU), Chrom-ART accelerator, a hardware JPEG accelerator, 2MB flash, a total of 1,056kB of RAM plus 1,024-byte and 4kB backup static RAM (SRAM).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Automation Systems

- 5.1.2 Ease of Use and Familiarity with PLC Programming to Sustain Growth

- 5.2 Market Restraints

- 5.2.1 Demand for Customization of Products and Gradual Shift from Batch to Continuous Processing in the Discrete Industries

- 5.2.2 Increase in Adoption of Distributed Control Systems (DCS), with Enhanced Safety and Advanced Control Capabilities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware and Software

- 6.1.1.1 Large PLC

- 6.1.1.2 Nano PLC

- 6.1.1.3 Small PLC

- 6.1.1.4 Medium PLC

- 6.1.1.5 Other Types

- 6.1.2 Services

- 6.1.1 Hardware and Software

- 6.2 By End-user Industry

- 6.2.1 Food, Tobacco, and Beverage

- 6.2.2 Automotive

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Energy and Utilities

- 6.2.5 Pulp and Paper

- 6.2.6 Oil and Gas

- 6.2.7 Water and Wastewater Treatment

- 6.2.8 Pharmaceutical

- 6.2.9 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Schneider Electric SE

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 Siemens AG

- 7.1.6 Honeywell International Inc.

- 7.1.7 Omron Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Emerson Electric Co.

- 7.1.11 Hitachi Ltd

- 7.1.12 Toshiba International Corporation