|

市場調查報告書

商品編碼

1402982

網路安全 -市場佔有率分析、產業趨勢/統計、2024-2029 年成長預測Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

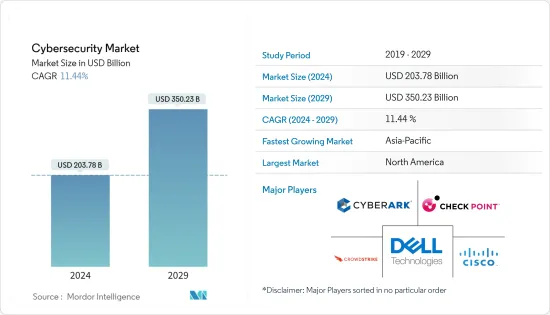

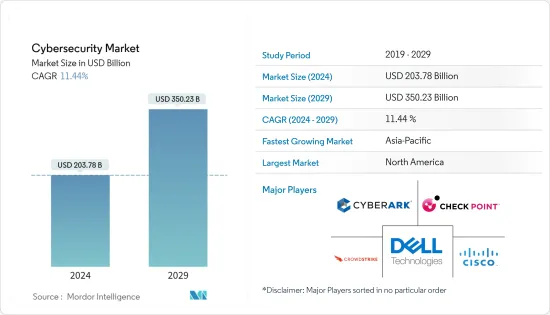

網路安全市場規模預計到 2024 年為 2037.8 億美元,預計到 2029 年將達到 3502.3 億美元,在預測期內(2024-2029 年)複合年成長率為 11.44%。

網路安全保護網路、資訊和個人資料免受網路攻擊。網路安全領域的 BYOD、人工智慧、物聯網和機器學習趨勢正在迅速擴張。例如,機器學習在異常檢測方面具有優勢,有利於網路安全。

主要亮點

- 網路安全產業生態系統由多個網路安全公司區域叢集組成,這些公司為全球市場的動態做出了貢獻。在當前的市場情況下,網路安全產業活躍在三個叢集:舊金山灣區(SFBA)、華盛頓特區和以色列。

- 這三個網路安全叢集有兩個重要特徵。首先,新興企業和高科技創新文化是這三個生態系統的重要成長動力。 SFBA 和以色列擁有蓬勃發展的新興企業生態系統以及相關的創投流動。儘管這些公司以產品為中心,但華盛頓州以服務為基礎的公司比例更高(華盛頓網路安全公司中只有 11% 只專注於產品)。第二個特點是人力資本與國家安全的連結。

- 勒索軟體攻擊已經襲擊了許多州和地方公共機構。在某些情況下,由於敏感資料大規模外洩和服務中斷,整個地方政府被迫宣布進入緊急狀態。例如,2021 年 6 月,全球領先的肉類加工公司之一 JBS Foods 遭受網路攻擊,導致全球多個地點生產中斷,其中包括美國、澳洲和加拿大的生產設施,隨後遭到勒索軟體攻擊。宣布已向威脅行為者REVIL 支付1,100 萬美元贖金。

- 網路攻擊增加的主要原因之一是各行業缺乏熟練的網路安全人才。與金融機構、政府機構和私人公司/產業應對網路威脅的安全專業人員的需求相比,經驗豐富的網路安全專業人員的數量較少,特別是在歐洲、亞太地區、拉丁美洲和中東。

- 隨著 COVID-19 疫情的持續爆發,世界各國都在實施預防措施。隨著學校關閉和社區被要求留在家裡,多個組織已經找到了允許員工在家工作的方法。因此,視訊通訊平台的採用正在增加。

網路安全市場趨勢

雲端業務將經歷顯著成長

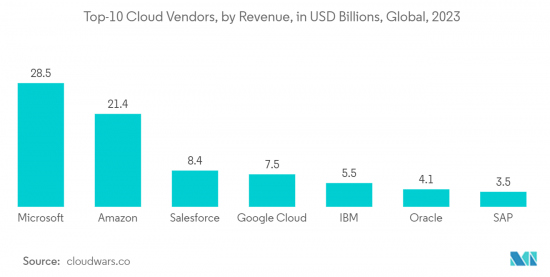

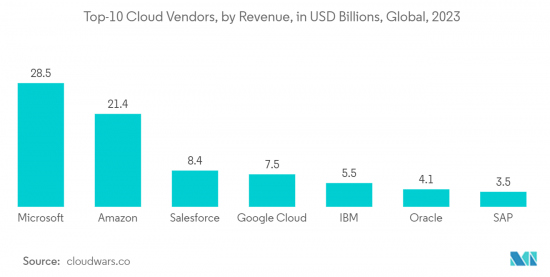

- 隨著企業越來越意識到透過將資料移至雲端基礎而不是建置和維護新的資料儲存來節省成本和資源的重要性,對基於雲端的解決方案的需求正在增加。雲端平台和生態系統具有多種優勢,預計將成為未來幾年數位創新爆炸性步伐和規模的跳板。

- 雲端基礎的解決方案還受益於較低的資本支出需求,使其更具吸引力。透過實施雲端基礎的服務,企業無需投資硬體組件即可顯著降低資本投資需求。雲端解決方案還允許企業更準確地預測其應用程式的成本,因此企業無需初期成本來實施該技術。由於硬體和 IT 支援的節省,雲端基礎的解決方案也變得更加經濟實惠。

- 考慮從本地軟體遷移到雲端基礎的解決方案的公司主要檢查潛在解決方案的標準合規性以及入侵防禦和偵測等關鍵安全功能。

- 2022 年 10 月,Google Cloud 宣布對其可信任雲端生態系進行重大擴展。我們重點介紹與 20 多個合作夥伴的新整合和產品,專注於加強資料主權管理、支援零信任模型、統一身分管理以及提高全球企業的端點安全性。

- 雲端技術使組織能夠根據業務需求彈性增加或減少頻寬。這種方法可以降低成本並為您帶來競爭優勢。

北美預計將佔據主要市場佔有率

- 近年來,由於美國組織和個人面臨的網路威脅和攻擊數量不斷增加,網路安全已成為一個日益重要的領域。根據身分盜竊資源中心的數據,2022 年美國發生了 1,802 起資料外洩事件,影響了 4.2214 億人。

- 網路攻擊的日益頻繁和複雜性正在推動網路安全解決方案在美國的採用。此外,不斷增加的監管要求正在推動許多組織實施和投資網路安全解決方案,因為美國的許多行業都受到 HIPPA、GDPR 和 PCI DSS 等法規的約束。

- 2022 年美國資料外洩和勒索軟體方面,教育、公共部門、大學、醫療保健和市政當局是受網路攻擊影響的主要部門。美國正在大力投資網路安全研究和開發。美國政府撥出了大量資金。例如,2022年4月,美國能源局(DOE)開發了創新的網路安全技術,以確保能源輸送系統的設計、安裝、操作和維護能夠生存並從網路攻擊中快速恢復。宣佈在六個專案中投資1200萬美元新的研發 (RD&D)計劃

- 網路犯罪在加拿大正在迅速蔓延,其影響正在以驚人的速度成長。據魁北克政府數位轉型部稱,大約 3,992 個省級政府網站,包括與健康、教育和政府相關的網站,可能面臨風險。

- 為支持發展強大的國家網路安全生態系統,創新、科學和工業部長於2022年2月宣布,國家網路安全聯盟(NCC)將主導網路安全創新網路(CSIN),並宣布已接受高達80美元的資金百萬。這筆資金對於培育加拿大強大的國家網路安全生態系統並將加拿大定位為網路安全的全球領導者至關重要。

網路安全產業概述

網路安全市場是一個競爭激烈的市場空間,全球和地區的多個參與企業都在爭奪注意力。儘管市場對新參與企業設置了很高的進入壁壘,但一些新參與企業正在引領潮流。主要企業包括 Crowdstrike Holdings Inc.、Check Point Software Technologies Ltd.、Cisco Systems Inc.、Cyberark Software Ltd. 和 Dell Technologies Inc.。

- 2023 年 2 月,Check Point Software Technologies Ltd. 宣布推出協作網路安全解決方案 Check Point Horizon XDR/XPR。透過智慧關聯資料並嘗試阻止所有媒介的攻擊,該產品有效地保護組織免受不斷演變的網路威脅,減少威脅影響,並幫助監督和分析師讓人們更容易理解和回應事件。

- 2022 年 12 月,CrowdStrike 宣布開發 CrowdStrike Falcon 平台,這是業界最好的主導驅動的外部攻擊面管理 (EASM) 解決方案,可實現更好的對手情報和即時網路存取偵測。我們提供CrowdStrike Falcon Surface 是一個獨立模組,由最近收購的 Reposify 提供支持,作為平台更新的一部分宣布。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章產業生態系分析

第5章市場動態

- 目前的市場情景和網路安全相關業務的演變

- 市場促進因素

- 迅速增加的網路安全事件和有關其報告的法規

- M2M/物聯網連接的增加要求提高企業網路安全

- 市場挑戰

- 網路安全專家短缺

- 高度依賴傳統認證方式且準備不足

- 市場機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

第6章 全球與區域重大安全漏洞分析

第7章 COVID-19 對網路安全市場的影響

第8章市場區隔

- 依產品類型

- 解決方案

- 應用程式安全

- 雲端安全

- 消費者安全軟體

- 資料安全

- 身分和存取管理

- 基礎設施保護

- 整合風險管理

- 網路安全設備

- 其他解決方案

- 服務

- 專業的

- 管理

- 解決方案

- 按發展

- 本地

- 雲

- 按最終用戶產業

- BFSI

- 醫療保健

- 航太/國防

- 資訊科技/通訊

- 政府機關

- 零售

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 北歐地區

- 波蘭

- 俄羅斯

- 亞太地區

- 中國

- 韓國

- 日本

- 印度

- 新加坡

- 馬來西亞

- 澳洲

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 哥倫比亞

- 阿根廷

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 海灣合作理事會國家

- 南非

- 埃及

- 摩洛哥

- 北美洲

第9章供應商市場佔有率分析

第10章競爭形勢

- 公司簡介

- CrowdStrike Holdings Inc.

- Check Point Software Technologies Ltd

- Cisco Systems Inc.

- CyberArk Software Ltd

- Dell Technologies Inc.

- Mandiant Inc.

- Fortinet Inc.

- IBM Corporation

- Imperva Inc.

- Intel Security(Intel Corporation)

- Palo Alto Networks Inc.

- Proofpoint Inc.

- Rapid7 Inc.

- NortonLifelock Inc.

- Trend Micro Inc.

第11章投資分析

第12章投資分析市場的未來

The Cybersecurity Market size is estimated at USD 203.78 billion in 2024, and is expected to reach USD 350.23 billion by 2029, growing at a CAGR of 11.44% during the forecast period (2024-2029).

Cybersecurity protects the network, information, and personal data from cyberattacks. The trends of BYOD, AI, IoT, and machine learning in cybersecurity are rapidly growing. For instance, machine learning offers advantages in outlier detection, which benefits cybersecurity.

Key Highlights

- The cybersecurity industry ecosystem comprises several regional clusters of cybersecurity firms contributing to global market dynamics. In the current market scenario, the cybersecurity industry operates in three distinct mega-clusters: the San Francisco Bay Area (SFBA), Metropolitan Washington, DC, and Israel.

- The three cybersecurity mega-clusters share two essential characteristics. The first is that the startup and high-tech innovation culture is a significant growth driver for all three ecosystems. SFBA and Israel have thriving startup ecosystems with a substantial associated flow of risk capital. They are heavily focused on products, while Washington exhibits a higher proportion of service-based firms (in Washington, only 11% of cybersecurity firms are focused solely on products). The second characteristic is the link between human capital and national security.

- Ransomware attacks have ravaged many state and local public sector agencies. In some cases, entire local governments were forced to declare an emergency due to massive leaks of sensitive data and loss of services. For instance, in June 2021, JBS Foods, the world's leading meatpacking enterprise, declared that it had paid a USD 11 million ransom to REvil ransomware threat actors following a cyberattack that forced the company to shut down production at several sites worldwide, including its production facilities in United States, Australia, and Canada.

- One of the major causes of growing cyberattacks is the lack of skilled cybersecurity personnel in each industry. The number of experienced cybersecurity professionals, especially in Europe, Asia-Pacific, Latin America, and the Middle-East, is low compared to the need for security professionals to handle cyber threats for financial institutes, government organizations, and private sector/industrial businesses.

- Due to the ongoing COVID-19 pandemic, countries worldwide have implemented preventive measures. With schools being closed and communities being asked to stay at home, multiple organizations have found a way to enable their employees to work from their homes. This has, thus, resulted in a rise in the adoption of video communication platforms.

Cybersecurity Market Trends

The Cloud Segment to Witness Significant Growth

- The increasing realization among enterprises about the importance of saving money and resources by moving their data to the cloud instead of building and maintaining new data storage drives the demand for cloud-based solutions. Owing to multiple benefits, cloud platforms and ecosystems are anticipated to serve as a launchpad for the explosion in the pace and scale of digital innovation over the next few years.

- Cloud-based solutions also benefit from lower capital expenditure requirements, making them much more compelling. Deploying cloud-based services can significantly reduce the Capex requirements as companies need not invest in hardware components. Cloud solutions also enable better prediction of the cost of an application, and companies don't incur much upfront cost to incorporate the technology. Also, the hardware and IT support savings make cloud-based solutions much more affordable.

- Companies that are considering moving from on-premise software to cloud-based solutions are primarily checking the potential solutions for their key security features, including standards compliance and intrusion prevention and detection.

- In October 2022, Google Cloud declared a significant expansion of its trusted cloud ecosystem. It highlighted new integrations and offerings with more than twenty partners, focusing on enabling greater data sovereignty controls, supporting Zero Trust models, unifying identity management, and improving endpoint security for global businesses.

- Cloud technology provides organizations with the flexibility they need to increase and decrease their bandwidth with the needs of their operations. This approach can cut costs and give businesses an edge over the competition.

North America is Expected to Hold Major Market Share

- Cybersecurity has become an increasingly important area of focus in the United States in recent years due to the growing number of cyber threats and attacks that organizations and individuals face. According to the Identity Theft Resource Center, the number of data compromises and individuals impacted in the United States in 2022 was 1,802 and 422.14 million, respectively.

- The increasing frequency and sophistication of cyber-attacks are driving the adoption of cybersecurity solutions in the United States. Moreover, the growing regulatory requirement leads many organizations to adopt and invest in cybersecurity solutions, as many industries in the United States are subject to regulations such as HIPPA, GDPR, and PCI DSS.

- Education, the public sector, universities, healthcare, and municipalities were among the major sectors affected by cyber-attacks in terms of data breaches and ransomware in the United States in 2022. There has been significant investment in cybersecurity research and development in the United States. The United States government is allocating a large number of funds. For instance, in April 2022, the United States Department of Energy (DOE) announced that it would invest USD 12 million in six new research, development, and demonstration (RD&D) projects to develop innovative cybersecurity technology to ensure that energy delivery systems are designed, installed, operated, and maintained to survive and recover quickly from cyberattacks.

- In Canada, cybercrime is rapidly gaining traction, and the impact is increasing alarmingly. According to the Ministry for Government Digital Transformation, Quebec, around 3,992 provincial government websites, including those related to health, education, and public administration, can be at risk.

- In order to support the development of a strong national cyber security ecosystem, the Minister of Innovation, Science and Industry announced that the National Cybersecurity Consortium (NCC) received up to USD 80 million to lead the Cyber Security Innovation Network (CSIN) in February 2022. This funding was crucial to foster a strong national cyber security ecosystem in Canada and position the country as a global leader in cyber security.

Cybersecurity Industry Overview

The cybersecurity market comprises several global and regional players vying for attention in a fairly contested market space. Although the market poses high barriers to entry for new players, several new entrants have been able to gain traction. Crowdstrike Holdings Inc., Check Point Software Technologies Ltd, Cisco Systems Inc., Cyberark Software Ltd, and Dell Technologies Inc. are major players in the market.

- In February 2023, Check Point Software Technologies Ltd announced the introduction of Check Point Horizon XDR/XPR, a cooperative cybersecurity solution. It effectively protects organizations against developing cyber threats by smartly correlating data and trying to thwart attacks across all vectors, reducing the impact of threats and making it simple for supervisors and analysts to comprehend and respond to incidents.

- In December 2022, CrowdStrike announced the development of the CrowdStrike Falcon platform to give the sector's finest adversary-driven external attack surface management (EASM) solution for better adversary intelligence and real-time internet access detection. CrowdStrike Falcon Surface, a standalone module featuring abilities from the recent acquisition of Reposify, was announced as part of the platform update.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 INDUSTRY ECOSYSTEM ANALYSIS

5 MARKET DYNAMICS

- 5.1 Current Market Scenario and Evolution of Cybersecurity Related Practices

- 5.2 Market Drivers

- 5.2.1 Rapidly Increasing Cybersecurity Incidents and Regulations Regarding their Reporting

- 5.2.2 Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 5.3 Market Challenges

- 5.3.1 Lack of Cybersecurity Professionals

- 5.3.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 5.4 Market Opportunities

- 5.5 Industry Attractiveness - Porter's Five Forces Analysis

- 5.5.1 Bargaining Power of Suppliers

- 5.5.2 Bargaining Power of Consumers

- 5.5.3 Threat of New Entrants

- 5.5.4 Competitive Rivalry within the Industry

- 5.5.5 Threat of Substitutes

6 ANALYSIS OF MAJOR SECURITY BREACHES AT A GLOBAL AND REGIONAL LEVEL

7 IMPACT OF COVID-19 ON THE CYBERSECURITY MARKET

8 MARKET SEGMENTATION

- 8.1 By Product Type

- 8.1.1 Solutions

- 8.1.1.1 Application Security

- 8.1.1.2 Cloud Security

- 8.1.1.3 Consumer Security Software

- 8.1.1.4 Data Security

- 8.1.1.5 Identity and Access Management

- 8.1.1.6 Infrastructure Protection

- 8.1.1.7 Integrated Risk Management

- 8.1.1.8 Network Security Equipment

- 8.1.1.9 Other Solutions

- 8.1.2 Services

- 8.1.2.1 Professional

- 8.1.2.2 Managed

- 8.1.1 Solutions

- 8.2 By Deployment

- 8.2.1 On-premise

- 8.2.2 Cloud

- 8.3 By End-user Industry

- 8.3.1 BFSI

- 8.3.2 Healthcare

- 8.3.3 Aerospace and Defense

- 8.3.4 IT and Telecommunication

- 8.3.5 Government

- 8.3.6 Retail

- 8.3.7 Manufacturing

- 8.3.8 Other End-user Industries

- 8.4 By Geography

- 8.4.1 North America

- 8.4.1.1 United States

- 8.4.1.2 Canada

- 8.4.2 Europe

- 8.4.2.1 United Kingdom

- 8.4.2.2 Germany

- 8.4.2.3 France

- 8.4.2.4 Italy

- 8.4.2.5 Spain

- 8.4.2.6 The Netherlands

- 8.4.2.7 Nordic Region

- 8.4.2.8 Poland

- 8.4.2.9 Russia

- 8.4.3 Asia-Pacific

- 8.4.3.1 China

- 8.4.3.2 South Korea

- 8.4.3.3 Japan

- 8.4.3.4 India

- 8.4.3.5 Singapore

- 8.4.3.6 Malaysia

- 8.4.3.7 Australia

- 8.4.3.8 Indonesia

- 8.4.4 Latin America**

- 8.4.4.1 Brazil

- 8.4.4.2 Mexico

- 8.4.4.3 Colombia

- 8.4.4.4 Argentina

- 8.4.5 Middle East and Africa**

- 8.4.5.1 Saudi Arabia

- 8.4.5.2 United Arab Emirates

- 8.4.5.3 GCC***

- 8.4.5.4 South Africa

- 8.4.5.5 Egypt

- 8.4.5.6 Morocco

- 8.4.1 North America

9 VENDOR MARKET SHARE ANALYSIS

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles*

- 10.1.1 CrowdStrike Holdings Inc.

- 10.1.2 Check Point Software Technologies Ltd

- 10.1.3 Cisco Systems Inc.

- 10.1.4 CyberArk Software Ltd

- 10.1.5 Dell Technologies Inc.

- 10.1.6 Mandiant Inc.

- 10.1.7 Fortinet Inc.

- 10.1.8 IBM Corporation

- 10.1.9 Imperva Inc.

- 10.1.10 Intel Security (Intel Corporation)

- 10.1.11 Palo Alto Networks Inc.

- 10.1.12 Proofpoint Inc.

- 10.1.13 Rapid7 Inc.

- 10.1.14 NortonLifelock Inc.

- 10.1.15 Trend Micro Inc.