|

市場調查報告書

商品編碼

1690748

資料中心發電機:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Data Center Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

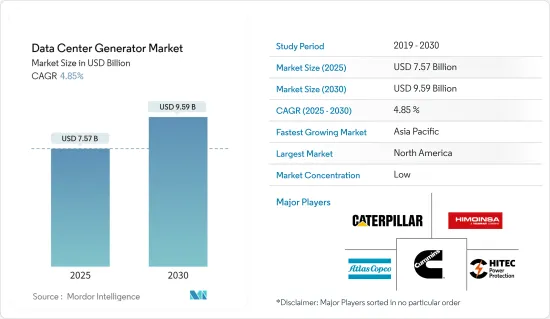

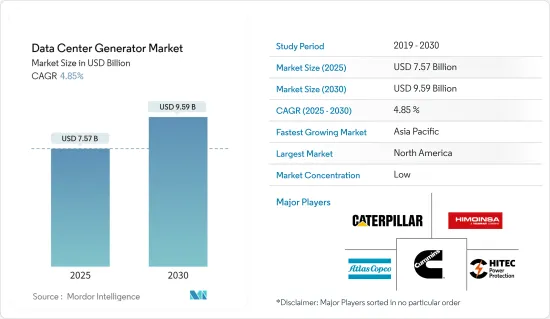

資料中心發電機市場規模預計在 2025 年為 75.7 億美元,預計到 2030 年將達到 95.9 億美元,預測期內(2025-2030 年)的複合年成長率為 4.85%。

由於電網故障、輪流停電、惡劣天氣、自然災害、人為災害和電氣系統故障造成的停電,資料中心面臨營運損失的巨大風險。資料中心使用的系統和組件需要不間斷運作。這就需要每週七天提供可靠、不間斷的電力,進而推動資料中心發電機市場的需求。

數位資料的增加為所研究的市場提供了巨大的推動力。隨著人口不斷成長並且越來越依賴數位基礎設施,對資料中心的需求也不斷增加。全球範圍內產生的數位資料量正在迅速成長。

此外,雲端技術在廣泛資料中心的興起是推動資料中心系統和技術整體需求的主要因素之一,從而推動了所研究市場的成長。預計人工智慧和其他新興技術(如串流遊戲和自動駕駛汽車技術)的快速發展將推動資料中心持續的高需求。隨著營運商努力提供容量以滿足 HPC 日益成長的功率密度要求,這也可能會刺激資料中心設計和技術的創新。

由於資料中心建設的增加以及主機託管和超大規模營運商建造的超大規模建築的興起,全球發電機市場正在擴大。巴西、丹麥、新加坡、澳洲、加拿大、印度、日本、瑞典、韓國等新興經濟體都已確認多個超大規模資料中心計劃。這些國家的計劃正在為能源基礎設施供應商創造機會。

資料中心不斷增加的二氧化碳排放對資料中心營運商及其發電供應商造成了重大拖累。隨著對數位服務和儲存的需求持續飆升,這些設施對環境的影響已成為一個主要問題。本期需要全面檢視減少資料中心碳排放的挑戰和潛在解決方案。

隨著 COVID-19 疫情的爆發,雲端市場獲得了顯著的發展,因為雲端基礎的服務和工具擴大被採用。由於各種規模的企業擴大採用雲端運算,全球大多數資料中心的需求都大幅增加。

資料中心發電機的市場趨勢

天然氣領域強勁成長

- 由於天然氣具有清潔、比其他不可可再生燃料便宜、效率相當高等優勢,預計未來幾年資料中心對天然氣發電機的需求將大幅增加。此外,由於天然氣直接透過管道供應,因此在各大城市都很容易獲得,而且強大的地下管道網路使其不易受到天氣影響,從而積極推動需求。據GGON稱,到2023年10月,全球整體將總合1869條天然氣管道運作中,其中提案的新管道約有400條。

- 發電機技術的最新進展使天然氣發電機成為實現持續電力和實現企業永續性承諾的有吸引力的選擇。天然氣是所有石化燃料中最乾淨的燃燒物,在大多數地方都很容易取得,並且比柴油更具成本效益。由可靠的天然氣天然氣網供電,車載儲存正成為資料中心營運商的一個有吸引力的選擇,因為它避免了營運時間限制和加油風險。

- 資料中心變得越來越動態,規模和複雜性不斷成長,並且耗電量創下了歷史新高。由於這些資料超級用戶對停電的接受度接近零,對天然氣發電機等有彈性、永續的備用電源解決方案的需求對於維持當今 100%執行時間的標準變得越來越重要。此外,與傳統燃料相比,天然氣價格保持相對穩定,確保資料中心營運商的長期成本效益。

- 天然氣開採技術的進步提高了天然氣的可用性並降低了價格,使天然氣成為資料中心電源備援的經濟可行的選擇。創新天然氣燃氣引擎的推出可能會在預測期內進一步對市場成長產生正面影響。

亞太地區預計將經歷強勁成長

- 亞太地區資料中心數量的快速成長與政府舉措相輔相成,使該地區成為全球成長最快的資料中心市場之一,同時也促進了該地區金融科技和數位轉型的成長。

- 全球和地區設施營運商的投資增加以及公共雲端和混合雲端服務的採用率不斷提高是推動亞太地區資料中心發電機市場成長的關鍵因素。

- 此外,各領域的數位轉型正在推動對增強資料基礎設施的需求。這就是許多公司在該地區推出資料中心的原因。例如,2023年12月,NTT DATA集團公司的子公司NTT全球資料中心日本公司與東京電力電網公司宣布,兩家公司將成立一家新公司,共同開發和營運位於東京都市圈印西和白井地區的資料中心。

- 這些資料中心是許多亞洲國家經濟發展的支柱,需要可靠的電力解決方案來維持持續營運。由於亞太部分地區的電力供應難以預測,資料中心發電機對於減輕電力波動和停電帶來的風險至關重要。

資料中心發電產業概況

資料中心發電機市場細分化,包括許多大型、技術先進的公司,包括Caterpillar、康明斯、阿特拉斯·科普柯 AB、HITEC Power Protection BV(Air Water Inc.)和 Himoinsa SL。預計競爭將會更加激烈。由於主要參與者在成熟市場中的強大影響力,市場滲透率正在不斷成長。對技術創新的日益關注推動了對不同容量發電機的需求,從而鼓勵了對進一步開發的投資。

2023年12月,康明斯宣布推出1,700kVA至2,000kVA發電機型號C1760D5、C1875D5和C2,000D5B。該公司推出的新款車型搭載KTA50引擎系列,該系列引擎針對多種動力應用進行了設計和最佳化。

2023年10月,三菱重工引擎與渦輪增壓器有限公司(三菱重工 (MHI) 集團的一部分)獲得了 HVO(加氫處理植物油)引擎產品認證。根據其「MISSION NET ZERO」宣言,三菱重工集團的目標是到2040年將二氧化碳排放減少到零,而此次 HVO 認證正是這項努力的一部分。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 市場動態

- 市場促進因素

- 主機代管服務供應商正在建造更多的資料中心

- 超大規模資料中心建設正在興起

- 市場限制

- 資料中心的碳排放增加

- 市場促進因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

- 產業價值鏈分析

- 柴油、天然氣和其他替代燃料對環境的影響。

第5章市場區隔

- 依產品類型

- 柴油引擎

- 天然氣

- 其他

- 按容量

- 小於1MW

- 1~2MW

- 超過2MW

- 分層

- 層級和二級

- 第三層級

- IV層級

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章競爭格局

- 公司簡介

- Caterpillar Inc.

- Atlas Copco AB

- Cummins Inc.

- HITEC Power Protection BV(Air Water Inc.)

- Himoinsa SL

- Kohler Co.

- Mitsubishi Heavy Industries Group(MHI)

- Generac Power Systems Inc.(Generac Holdings Inc.)

- Rolls-Royce Holdings PLC

- Aksa Power Generation

第7章投資分析

第8章:市場的未來

The Data Center Generator Market size is estimated at USD 7.57 billion in 2025, and is expected to reach USD 9.59 billion by 2030, at a CAGR of 4.85% during the forecast period (2025-2030).

Data centers are at significant risk of experiencing operational losses owing to power outages caused by utility grid failures, rolling blackouts, bad weather, natural or artificial calamities, or electrical breakdowns. Systems and components used in data centers are expected to operate nonstop. They require dependable, uninterrupted power seven days a week, creating a demand for the data center generator market.

The growth of digital data has significantly fueled the market studied. The need for data centers has increased as the population grows increasingly connected and dependent on digital infrastructure. The amount of digital data produced globally is growing rapidly.

Moreover, the emerging cloud technology in a wide range of data centers is one of the major factors driving the overall demand for data center systems and technologies, thereby fueling the studied market's growth. Continued high demand for data centers is expected to be driven by fast growth such as AI and other modern technologies, e.g., streaming gaming or autonomous car technology. As operators strive to provide the capacity that will allow them to meet increased power density requirements for HPC, innovation in data center design and technology may also be stimulated.

Due to an increase in data center construction and the increased number of hyperscale buildings by colocation and hyperscale operators, the global market for power generators has expanded. In several emerging countries, such as Brazil, Denmark, Singapore, Australia, Canada, India, Japan, Sweden, South Korea, and so on, several hyperscale data center projects have been identified. These projects in these countries are creating opportunities for suppliers of energy infrastructure.

The escalating growth of carbon emissions from data centers poses a significant restraint for data center operators and their generators. As the demand for digital services and storage continues to surge, the environmental impact of these facilities becomes an important concern. This issue necessitates comprehensively examining the challenges and potential solutions for mitigating carbon emissions from data centers.

With the outbreak of COVID-19, the cloud market gained significant traction as cloud-based services and tools are increasingly adopted due to organizations deploying remote work access amid lockdowns in various countries, as indicated in the graph. Most data centers worldwide witnessed a massive surge in demand owing to the growth of cloud adoption across all sizes of enterprises.

Data Center Generator Market Trends

Natural Gas Segment to Witness Major Growth

- The demand for natural gas generators in the data centers is expected to experience significant growth in the coming years owing to the benefits associated with natural gas, such as being cleaner, less expensive than other non-renewable fuels, and considerably efficient. Natural gas is also readily available in large cities since it is delivered directly through pipelines, thus positively driving the demand as the strong underground pipeline network is rarely impacted by weather. According to GGON, by October 2023, there was a total of 1,869 operational gas pipelines, and around 400 were newly proposed globally.

- Recent advances in generator technology make natural gas generators an attractive option to achieve continuous power and make strides toward corporate sustainability commitments. Natural gas is the cleanest burning of fossil fuels, is readily available in most locations, and is more cost-efficient than diesel. Built-in storage with a highly reliable natural gas grid avoids risks of limited run times and refueling, thus emerging as an attractive option for data center operators.

- Data centers are becoming more dynamic, reaching scale in size and complexity and achieving record power usage levels. As these data superusers approach zero tolerance for power outages, the demand for resilient and sustainable backup power solutions such as natural gas generators is becoming increasingly critical to maintaining today's standard for 100% uptime. Additionally, natural gas prices have remained relatively stable compared to traditional fuels, ensuring long-term cost-effectiveness for data center operators.

- Advancements in gas extraction technologies have increased availability and reduced prices, making natural gas an economically viable option for power backup in data centers. New launches of innovative natural gas engines may further positively influence the market's growth during the forecast period.

Asia-Pacific is Expected to Witness Significant Growth

- Rapid growth in the number of data centers in Asia-Pacific, supplemented with the government's initiatives, has made the region one of the fastest-expanding data center markets in the world, with fintech growth and digital transformation in the region.

- The increasing investments by global and regional facility operators and the rising adoption of public cloud and hybrid cloud services are the primary factors contributing to the growth of the APAC region's data center generator market.

- Moreover, the digital transformation across various sectors has intensified the demand for increasing data infrastructure. Due to this, many companies are launching data centers in the region. For instance, in December 2023, NTT Global Data Centers Japan, a subsidiary of NTT DATA Group Corporation, and TEPCO Power Grid, Inc. announced that both companies would launch a new company to jointly develop and operate data centers in the Inzai-Shiroi area of Greater Tokyo, Japan.

- These data centers are the backbone for the economic development of many Asian countries and require reliable power solutions to maintain continuous operations. The unpredictable nature of power supply in certain parts of the Asia-Pacific region has made data center generators indispensable for mitigating the risks associated with power fluctuations and outages.

Data Center Generator Industry Overview

The data center generator market is fragmented, with many large, technologically advanced players, such as Caterpillar, Cummins, Atlas Copco AB, HITEC Power Protection BV (Air Water Inc.), Himoinsa SL, etc. The rivalry is expected to be on the higher side. Market penetration is growing with the strong presence of major players in established markets. With the increasing focus on innovation, the demand for generators with different capacities is growing, which, in turn, is driving investments for further developments.

In December 2023, Cummins Inc. announced the launch of C1760D5, C1875D5, and C2000D5B generator models between 1700 kVA and 2000 kVA. The new models launched by the company are powered with the KTA50 engine series, designed and optimized for diverse power applications.

In October 2023, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET), a part of Mitsubishi Heavy Industries (MHI) Group, approved its engine products for use with Hydrotreated Vegetable Oil (HVO). MHI Group is pursuing to achieve net zero CO2 emission by 2040 according to its declaration of "MISSION NET ZERO," and the approval of HVO aligns the effort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increasing Construction of Data Centers by Colocation Service Providers

- 4.2.1.2 Growing Construction of Hyperscale Data Centers

- 4.2.2 Market Restraints

- 4.2.2.1 Growing Carbon Emissions from Data Centers

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

- 4.5 Industry Value Chain Analysis

- 4.6 Environmental Impact of Diesel vs Natural Gas and Other Alternatives

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Diesel

- 5.1.2 Natural Gas

- 5.1.3 Other Product Types

- 5.2 By Capacity

- 5.2.1 Less than 1MW

- 5.2.2 1-2MW

- 5.2.3 Greater than 2MW

- 5.3 By Tier

- 5.3.1 Tier I and II

- 5.3.2 Tier III

- 5.3.3 Tier IV

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Caterpillar Inc.

- 6.1.2 Atlas Copco AB

- 6.1.3 Cummins Inc.

- 6.1.4 HITEC Power Protection BV (Air Water Inc.)

- 6.1.5 Himoinsa SL

- 6.1.6 Kohler Co.

- 6.1.7 Mitsubishi Heavy Industries Group (MHI)

- 6.1.8 Generac Power Systems Inc. (Generac Holdings Inc.)

- 6.1.9 Rolls-Royce Holdings PLC

- 6.1.10 Aksa Power Generation