|

市場調查報告書

商品編碼

1334415

液體合成橡膠市場規模和份額分析-增長趨勢和預測(2023-2028)Liquid Synthetic Rubber Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

液體合成橡膠的全球市場規模預計將從2023年的158.7億美元增長到2028年的199.9億美元,預測期內(2023-2028年)複合年增長率為4.72%。

COVID-19 對 2020-2021 年的市場產生了負面影響。 鑑於大流行情況,在政府為遏制新的COVID-19病例傳播而採取的封鎖措施期間,汽車製造活動暫時停止,導致輪胎、傳動帶、密封件和墊片的生產。軟管和油箱襯裡等汽車零部件價格下跌。 然而,市場預計將在 2023 年恢復增長軌跡,並且在預測期內可能遵循類似的軌跡。

主要亮點

- 短期內,粘合劑行業需求的增加預計將推動市場增長。

- 另一方面,原材料價格波動預計將阻礙市場增長。

- 生物基合成橡膠原材料的開發在預測期內可能是一個機遇。

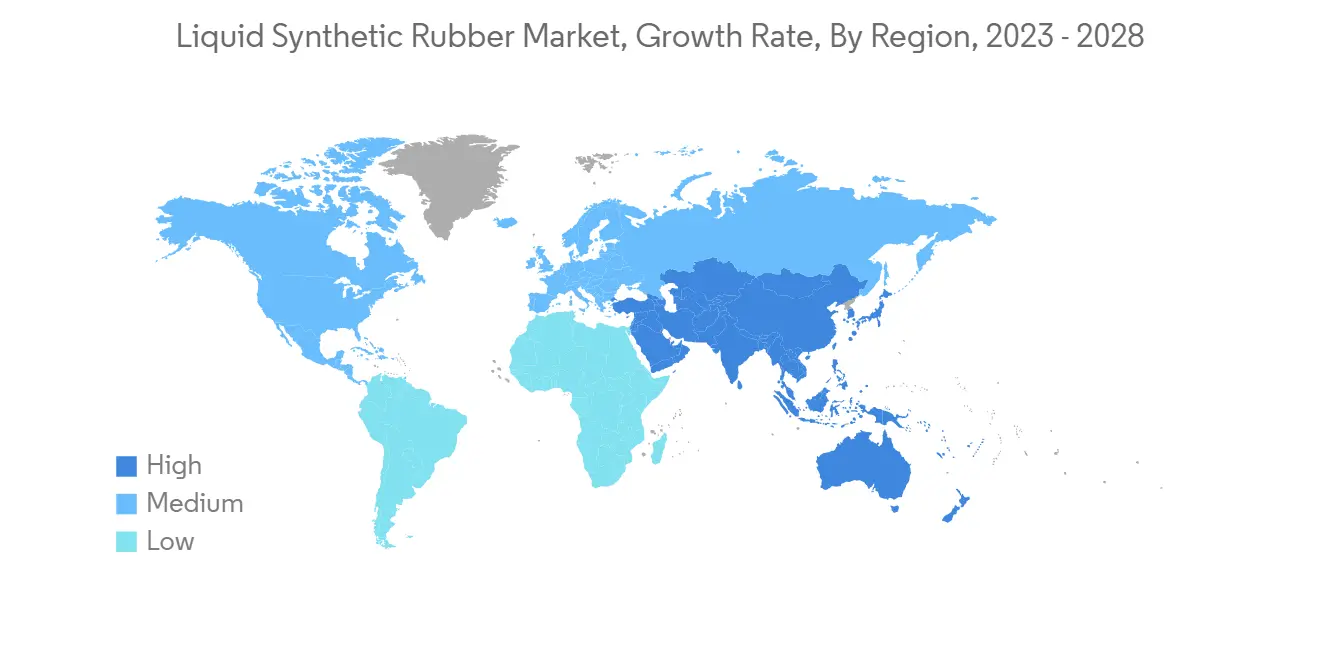

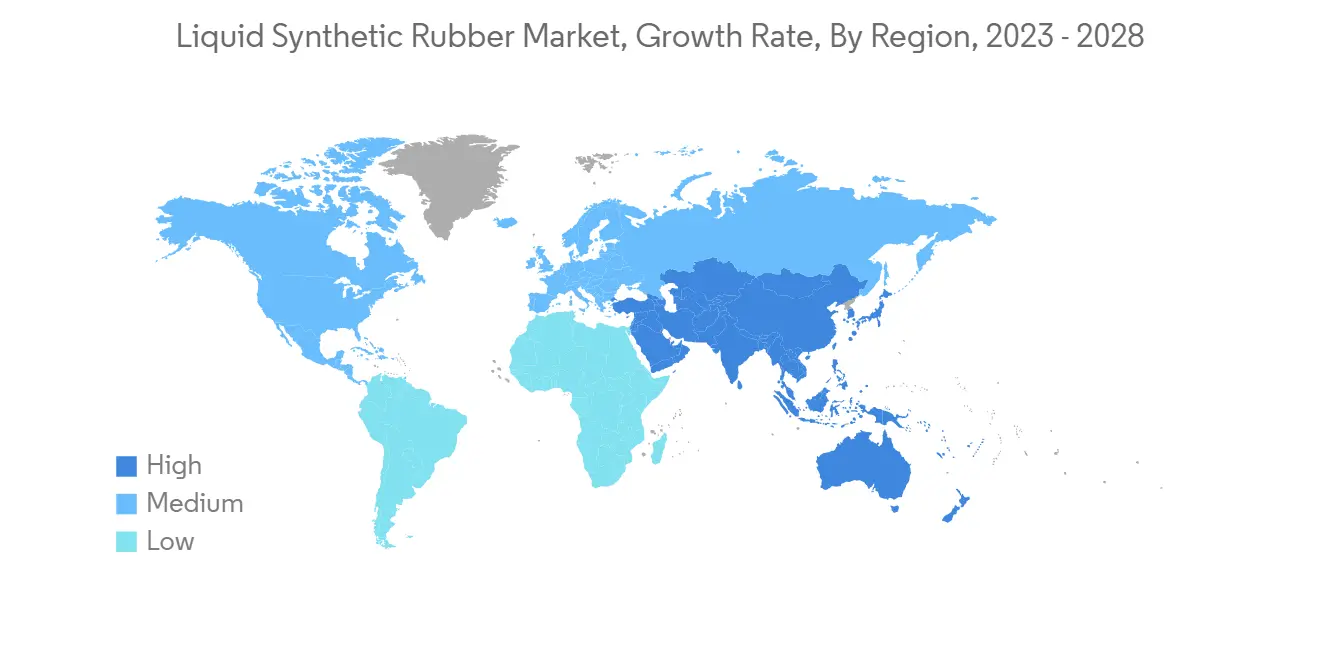

- 亞太地區在液體合成橡膠市場佔據主導地位,其中中國、印度和日本等國家的消費量最高。

液體合成橡膠市場趨勢

輪胎領域的需求增加

- 液體合成橡膠廣泛應用於輪胎製造,因為隨著輪胎標籤法規的採用,它們可提供更高的耐用性和卓越的性能。

- 輪胎製造中使用的主要產品是聚丁二烯。 主要用作輪胎胎側,改善行駛時連續彎曲引起的疲勞。 此外,丁二烯在其他汽車零部件中也有多種用途。

- 根據美國輪胎製造商協會的數據,乘用車和輕型卡車輪胎中合成橡膠的體積比為24%,重型卡車輪胎中合成橡膠的體積比為11%。 此外,約50%的乘用車輪胎由丁苯橡膠與天然橡膠混合製成。

- 根據國際輪胎橡膠協會 (ITRA) 的數據,中國和美國是全球兩個最大的輪胎生產國。 中國海關總署數據顯示,2022年上半年,中國共出口橡膠輪胎377萬噸,同比增長7.2%。

- 此外,根據美國輪胎製造商協會的數據,乘用車和輕型卡車使用的輪胎中有 24% 是合成橡膠(如 SBR),重型卡車使用的輪胎有 11% 是合成橡膠。

- 根據國際汽車製造商組織 (OICA) 的數據,2022 年全球汽車產量將達到約 8,501 萬輛,較 2021 年的 8,020.5 萬輛增長 5.99%。這表明汽車行業對輪胎的需求將增加行業。 2022年,全球乘用車產量將在6000萬輛左右,較2021年增長近7.35%。

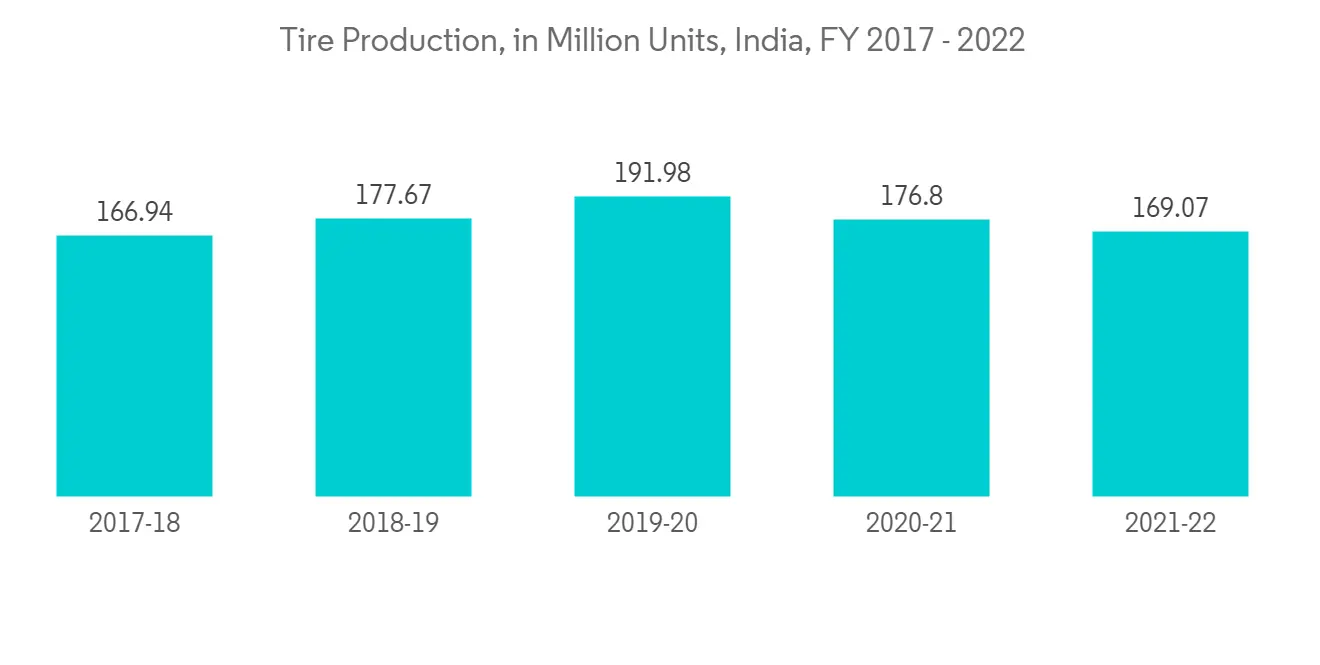

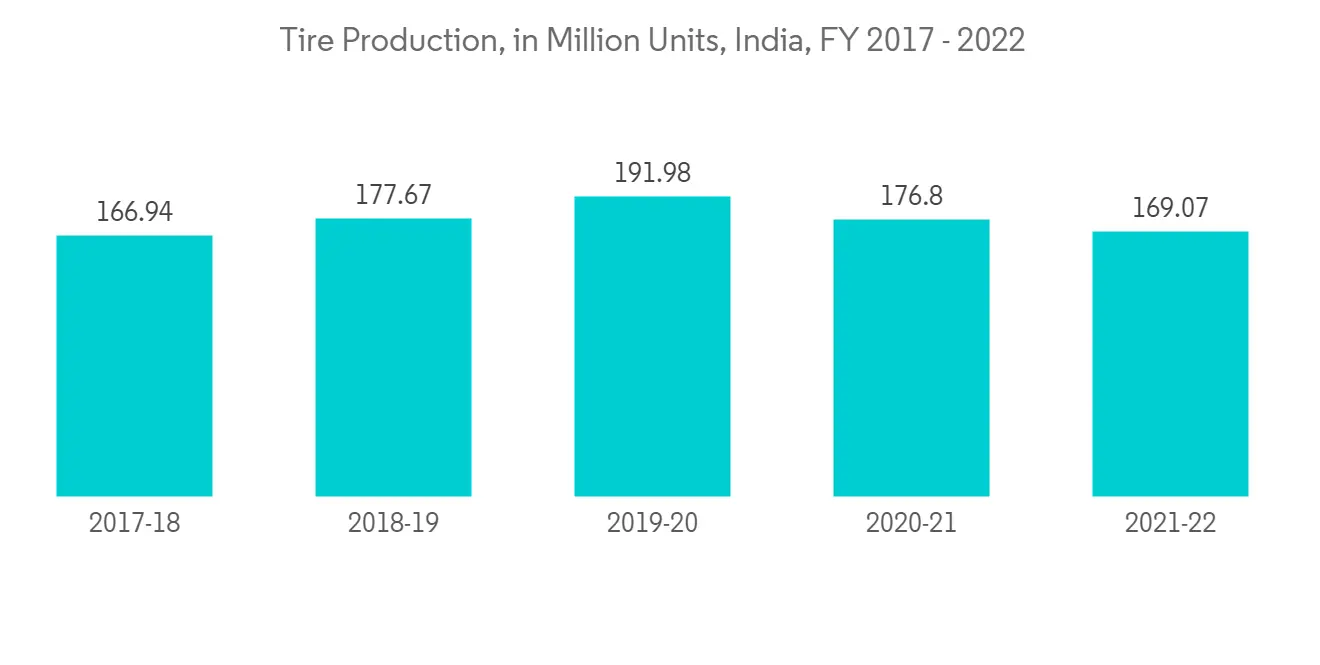

- 但是,在亞洲和歐洲的一些國家,售後市場和 OEM(原始設備製造商)的需求都在下降,導致輪胎產量緩慢但持續下降。 例如,根據ATMA公佈的數據,2021-2022年印度輪胎總產量同比下降4%,至1.6907億條。

- 總體而言,上述所有因素都影響了輪胎生產,預計這將進一步影響液體合成橡膠市場。

亞太地區主導市場

- 預計亞太地區將在預測期內主導液體合成橡膠市場。 這是因為中國、印度和日本等國家的輪胎製造、工業橡膠製造、粘合劑、密封劑、塗料和聚合物改性等應用的需求不斷增長。

- 中國是最大的汽車生產國和消費國。 中國汽車工業協會的報告顯示,2022年,中國汽車銷量同比增長約2.1%。 2022 年銷量約為 2,686 萬輛,而 2021 年銷量為 2,627 萬輛。

- 液體合成橡膠也應用於建築行業。 據國家發展和改革委員會稱,中國政府已批准26個基礎設施項目,預計投資約1420億美元,預計將於2023年底完工,目前正在進行中。 摩天大樓和酒店建設的增加正在推動市場研究。

- 截至 2022 年,印度是全球第四大橡膠消費國。 印度人均橡膠消費量目前為 1.2 公斤,而全球人均橡膠消費量為 3.2 公斤。 印度橡膠工業的產值約為 12,000 印度盧比(14.5 億美元)。 輪胎行業消耗了印度橡膠產量的大部分,佔該國總產量的一半以上。

- 印度的橡膠工業是橡膠生產部門與快速增長的橡膠製品製造和消費部門並存的。 推動該國橡膠工業發展的因素包括旨在自給自足和進口替代的機構的積極干預。

- 該地區對輪胎、工業橡膠、粘合劑、密封劑等的需求持續增長,行業內幾家主要公司正在擴建生產工廠,預計增長穩定。

液體合成橡膠行業概況

液體合成橡膠市場較為分散,世界各地都有不同的參與者。 在全球市場上保持著較大份額的參與者包括中國石油天然氣集團公司、ENEOS公司、贏創工業股份公司、錦湖石化和沙特阿拉伯石油公司阿朗新公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章簡介

- 調查的先決條件

- 調查範圍

第 2 章研究方法

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 黏合劑行業的需求增加

- 全球輪胎產量增長

- 抑制因素

- 原材料價格變化

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 產品類型

- 液體異戊二烯

- 液體丁二烯

- 液體苯乙烯丁二烯

- 其他產品類型(液體 EPDM、液體 NBR)

- 應用

- 黏合劑

- 工業橡膠

- 輪胎

- 聚合物改性

- 其他用途(防水塗料和鞋類)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 意大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第 6 章競爭態勢

- 併購、合資企業、聯盟、協議

- 市場排名分析

- 各大公司的戰略

- 公司簡介

- Asahi Kasei Advance Corporation

- China National Petroleum Corporation

- ENEOS Corporation

- Evonik Industries AG

- H.B. Fuller Company

- KUMHO PETROCHEMICAL

- Kuraray Co. Ltd

- Linshi Chem(Puyang)Advanced Material Co. Ltd.

- Lion Elastomers

- NIPPON SODA CO. LTD.

- Saudi Arabian Oil Co.(Arlanxeo)

- SIBUR Holding PJSC

- Synthomer PLC

- TER Group

第 7 章市場機會和未來趨勢

- 合成橡膠生物基原材料的開發

The Global Liquid Synthetic Rubber Market size is expected to grow from USD 15.87 billion in 2023 to USD 19.99 billion by 2028, at a CAGR of 4.72% during the forecast period (2023-2028).

COVID-19 negatively impacted the market in 2020-2021. Considering the pandemic scenario, automotive manufacturing activities were temporarily stopped during the government-imposed lockdown to curb the spread of new COVID-19 cases, thereby reducing the demand for liquid synthetic rubber-based automotive parts such as tires, drive belts, seals, gaskets, hoses, tank linings, and others. However, the market is expected to regain its growth trajectory in 2023 and is likely to follow a similar trajectory during the forecast period.

Key Highlights

- Over the short term, the rising demand from the adhesive segment is expected to drive the market's growth.

- On the flip side, fluctuating raw material prices are expected to hinder the market growth.

- Developing bio-based feedstock for synthetic rubber will likely act as an opportunity during the forecast period.

- The Asia-Pacific region dominated the liquid synthetic rubber market, with the largest consumption from countries such as China, India, and Japan.

Liquid Synthetic Rubber Market Trends

Increasing Demand from the Tire Segment

- Liquid synthetic rubber has wide applications in the manufacturing of tires because it provides enhanced durability and superior performance, along with the adoption of tire labeling regulations.

- The primary product used in the manufacturing of tires is polybutadiene. It is primarily used as a sidewall in tires to improve fatigue caused by continuous flexing during the run. Besides, butadiene has various applications in other automobile parts.

- According to the US Tire Manufacturers Association, tires used in passenger and light trucks have 24% synthetic rubber by volume, and tires used in heavy trucks have 11% synthetic rubber by volume. Furthermore, around 50% of car tires are made of styrene-butadiene rubber, which blends with natural rubber.

- According to the International Tyre and Rubber Association (ITRA), China and the United States are the two largest tire-producing countries in the world. According to data from the General Administration of Customs of the PRC, 3.77 million tons of rubber tires were cumulatively exported from China in the first half of 2022, up 7.2% from the same period last year.

- The US Tire Manufacturers Association also stated that tires used in passenger and light trucks use 24% synthetic rubber (such as SBR), and heavy trucks use 11% synthetic rubber by volume.

- According to the Organisation Internationale Des Constructeurs d'Automobiles (OICA), in 2022, around 85.01 million vehicles were produced across the globe, witnessing a growth rate of 5.99% compared to 80.205 million vehicles in 2021, thereby indicating an increased demand for tires from the automotive industry. In 2022, around 60 million passenger cars were manufactured worldwide, up nearly 7.35% compared to 2021.

- However, in several Asian and European countries, production of tires has been witnessing a gradual yet consistent decline due to reduced demand in both the replacement and original equipment manufacturer (OEM) segments. For instance, the total tire production in India declined by 4% to 169.07 million in FY 2021-2022, compared to the previous year, as per the data released from ATMA.

- Overall, all the factors above have impacted tire production, which is further expected to affect the liquid synthetic rubber market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for liquid synthetic rubber during the forecast period. In countries like China, India, and Japan, owing to the increasing demand from applications such as tire manufacturing, industrial rubber manufacturing, adhesives, sealants, coatings, and polymer modification.

- China is the largest producer and consumer of automotive vehicles. The China Association of Automobile Manufacturers reports that, compared to the prior year, China's automobile sales increased by about 2.1% in 2022. Compared to the 26.27 million automobiles sold in 2021, around 26.86 million were sold in 2022.

- Liquid synthetic rubber also finds application in the construction industry. According to the National Development and Reform Commission, the Chinese government approved 26 infrastructure projects at an estimated investment of about USD 142 billion, estimated to be completed by the end of 2023 and ongoing. The increase in the construction of tall buildings and hotels is driving the market study.

- India is the fourth-largest consumer of rubber in the world as of 2022. Rubber usage per capita in India is currently 1.2 kg, compared to 3.2 kg globally. India's rubber industry generates approximately INR 12,000 crore (USD 1.45 billion). The tire sector consumes most of India's rubber production, accounting for over half of the country's total output.

- The Indian rubber industry exhibits the co-existence of the rubber production sector and the fast-growing rubber product manufacturing and consumption sectors. Factors driving the rubber industry in the country include the positive intervention of institutional agencies that aim at self-sufficiency and import substitution.

- With the ever-increasing demand for tires, industrial rubber, adhesives, and sealants in the region and the expansion of production plants by several major players in the industry, the market for liquid synthetic rubber is also expected to grow steadily during the forecast period.

Liquid Synthetic Rubber Industry Overview

The liquid synthetic rubber market is fragmented in nature, with the presence of a wide range of players worldwide. Some of the players that maintain a significant share in the global market include (not in particular order) China National Petroleum Corporation, ENEOS Corporation, Evonik Industries AG, Kumho Petrochemical, and Saudi Arabian Oil Co. (Arlanxeo).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Adhesive Segment

- 4.1.2 Growth in Tire Production Worldwide

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Liquid Isoprene

- 5.1.2 Liquid Butadiene

- 5.1.3 Liquid Styrene Butadiene

- 5.1.4 Other Product Types (Liquid EPDM and Liquid NBR)

- 5.2 Application

- 5.2.1 Adhesives

- 5.2.2 Industrial Rubber

- 5.2.3 Tire

- 5.2.4 Polymer Modification

- 5.2.5 Other Applications (Waterproofing Coatings and Footwear)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asahi Kasei Advance Corporation

- 6.4.2 China National Petroleum Corporation

- 6.4.3 ENEOS Corporation

- 6.4.4 Evonik Industries AG

- 6.4.5 H.B. Fuller Company

- 6.4.6 KUMHO PETROCHEMICAL

- 6.4.7 Kuraray Co. Ltd

- 6.4.8 Linshi Chem (Puyang) Advanced Material Co. Ltd.

- 6.4.9 Lion Elastomers

- 6.4.10 NIPPON SODA CO. LTD.

- 6.4.11 Saudi Arabian Oil Co. (Arlanxeo)

- 6.4.12 SIBUR Holding PJSC

- 6.4.13 Synthomer PLC

- 6.4.14 TER Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Feedstock for Synthetic Rubber