|

市場調查報告書

商品編碼

1333802

乾混砂漿添加劑和化學品的市場規模和份額分析 - 增長趨勢和預測(2023-2028)Dry-Mix Mortar Additives And Chemicals Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

乾混砂漿添加劑和化學品市場規模預計將從 2023 年的 449 萬噸增長到 2028 年的 560 萬噸,預測期內(2023-2028 年)複合年增長率為 4.52%。

乾混砂漿添加劑和化學品市場在 2020 年受到了 COVID-19 的負面影響。 然而,COVID-19 爆發後的情況於 2021 年開始復蘇,恢復了預測期內市場的增長軌跡。

主要亮點

- 短期內,亞太地區建築活動的增加以及建築行業的長期成本效益是推動市場的主要因素。

- 相反,美國和歐洲建築活動的放緩預計將阻礙市場增長。

- 對環保建築的需求不斷增長可能會給預測期內接受調查的市場帶來機遇。

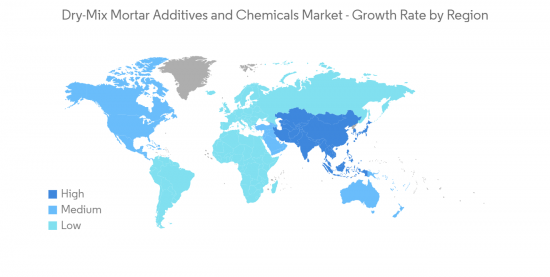

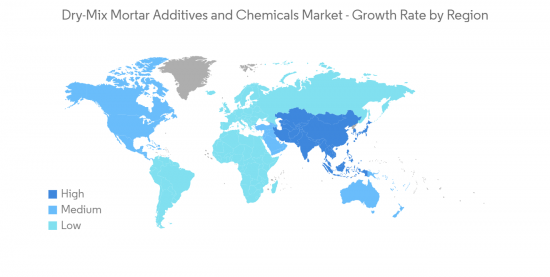

- 亞太地區是最大的市場,由於中國、印度和東盟國家等國家的消費不斷增加,預計亞太地區將成為預測期內增長最快的市場。

乾混砂漿添加劑及化學品市場趨勢

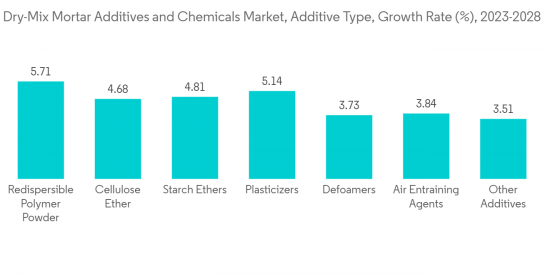

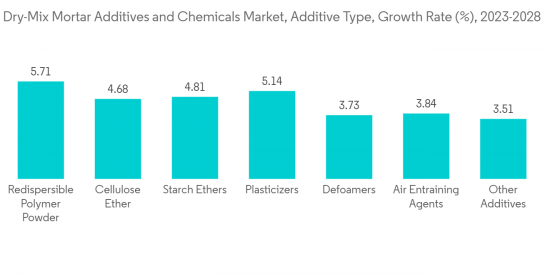

可再分散聚合物粉末可能在添加劑領域佔據主導地位

- 可再分散粉末通過噴霧乾燥含有再分散劑的相應水性聚合物分散體而獲得。 聚合物粉末的再分散性是實現砂漿性能(例如對基材的附著力和耐磨性)的最重要參數。

- 可再分散聚合物粉末是水泥和石膏基乾粉材料中最重要的粘合劑。 可再分散聚合物粉末是聚合物乳液的噴霧乾燥粉末。 它可以與水重新乳化,具有與原乳液相同的性質,即水蒸發後形成薄膜。 該薄膜具有高韌性、耐候性和對基材的附著力。 另外,具有疏水性能的乳膠粉可以提高防水砂漿的防水性能。

- 可再分散乳膠粉在乾砂漿中的性能:

- 提高乾砂漿對各種基材的附著力,保證各種使用條件下砂漿粘結強度的耐候性。 例如,可用於保溫砂漿中,提高砂漿與EPS板、EPS顆粒、混凝土牆、磚牆之間的粘結強度。

- 可再分散乳膠粉可以降低材料的吸水率,特殊疏水性乳膠粉效果更明顯。 減少水和水對成型砂漿的損害。

- 一些可再分散聚合物粉末可以改善砂漿的抗流掛性和流動性,改善砂漿的施工性能。

- 因此,所研究市場對可再分散聚合物粉末領域的需求可能會增加。

亞太地區主導市場

- 預計在預測期內,亞太地區將佔據整個乾混砂漿添加劑和化學品市場的最大份額。

- 目前,中國、印度和東盟國家是該地區最大的干混砂漿生產國和消費國,也是乾混砂漿消費增長最快的國家。

- 中國在亞太地區乾混砂漿添加劑和化學品市場中佔有最大份額。

- 2021 年,西卡股份公司在中國東部浙江省嘉興市開設了新的砂漿生產工廠,以滿足該地區的高需求。

- 2022 年,西卡股份公司將在中國西南地區重慶開設一家新的液膜和砂漿生產工廠。 成渝地區擁有豐富的汽車、金融和物流行業,建築業受益於這些企業和公司實現更可持續生產的努力。

- 由於該國投資和建設活動增加,預計乾混砂漿添加劑和化學品市場的需求將在預測期內增加。 近年來,中國一直是世界基礎設施建設的主要投資者之一,做出了重大貢獻。 例如,根據國家統計局(NBS)的數據,2022年中國建築業產值達到27.63萬億元人民幣(41085.81億美元),比2021年增長6.6%。

- 此外,據中國住房和城鄉建設部稱,到 2025 年,建築業佔國內生產總值的比重將保持在 6%。 全國裝配式建築趨勢不斷增強,預計新建建築中將有超過30%為裝配式建築。

- 據國家發展和改革委員會稱,中國政府已批准 26 個基礎設施項目,預計投資約 1,420 億美元,預計將於 2023 年完工。 住房需求的增長預計將推動公共和私營部門的住房建設。

- 此外,印度正在大力投資基礎設施項目,預計將為市場創造大量需求。 這樣,印度基礎設施建設不斷取得進展,乾混砂漿添加劑和化學品的需求有望擴大。

- 據 IBEF 稱,在 2022-2023 年聯邦預算中,政府已撥款 100 萬印度盧比(1,305.7 億美元)用於加強基礎設施部門。 此外,印度計劃在未來五年通過國家基礎設施管道投資 1.4 萬億美元用於基礎設施建設。

- 據印度海水淡化協會稱,印度有 1000 多個海水淡化廠,處理能力從 20 立方米/天到 10,000 立方米/天不等。 印度的大型海水淡化廠大部分位於市政部門。 NITI Aayog(政府的中央規劃委員會)計劃在金奈、孟買、加爾各答、蘇拉特和維扎格等缺水城市建立更多工廠。 因此,它有望成為聚合物改性乾混砂漿防水漿料市場的推動力。 防水漿料用於容易風化、應力和開裂的管道和儲罐。 因此,對印度乾混砂漿添加劑和化學品的需求預計將增加。

- 因此,由於上述因素,預計預測期內亞太地區對乾混砂漿添加劑和化學品的需求將快速增長。

乾混砂漿添加劑及化學工業概述

乾混砂漿添加劑和化學品市場得到部分整□□合。 研究市場的主要參與者包括Wacker Chemie AG、The Dow Chemical Company、BASF AG、Evonik Industries AG、Sika AG等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 調查的先決條件

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 亞太地區建築活動增加

- 建築行業的長期成本效益

- 其他司機

- 抑制因素

- 美國和歐洲的建築活動放緩

- 投資成本高

- 行業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第五章市場細分

- 類型

- 添加劑

- 可再分散聚合物粉末

- 增塑劑

- 消泡劑

- 纖維素醚

- AE 代理

- 其他添加劑

- 化學品

- 收縮劑(無水石英)

- 阻燃劑

- 檸檬酸鈉

- 酒石酸鈉

- 石膏

- 膦酸阻燃劑

- 加速器

- 甲酸鈣

- 碳酸鈣

- 硝酸鈣

- 碳酸鋰

- CSH 和 CSA 加速器

- 添加劑

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭態勢

- 併購、合資企業、聯盟、協議

- 市場份額 (%)**/排名分析

- 各大公司的戰略

- 公司簡介

- AGRANA Beteiligungs AG

- Ashland

- Avebe

- BASF SE

- Celanese Corporation

- CEMEX S.A.B. de CV

- Chemstar Products Company

- DCC

- Don Construction Products Ltd

- Dow

- Emsland Group

- Evonik Industries AG

- Innospec

- Kima Chemical Co. Ltd

- LOTTE Fine Chemical

- Mapei SpA

- Nouryon

- Rudolf GmbH

- SE Tylose GmbH & Co. KG(ShinEtsu)

- Shandong Head Co. Ltd

- SIDLEY CHEMICAL CO. LTD

- Sika AG

- SMScor

- The Euclid Chemical Company

- Wacker Chemie AG

- Berolan GmbH

第七章市場機會和未來趨勢

- 對綠色建築的需求不斷增加

The Dry-mix Mortar Additives And Chemicals Market size is expected to grow from 4.49 million tons in 2023 to 5.6 million tons by 2028, at a CAGR of 4.52% during the forecast period (2023-2028).

The dry-mix mortar additives and chemicals market was adversely impacted by COVID-19 in 2020. However, post-COVID-19 pandemic, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- Over the short term, increasing construction activities in the Asia-Pacific and long-term cost-effectiveness in the construction industry are the major factors driving the market.

- Conversely, a slowdown of construction activities in the United States and Europe is expected to hinder market growth.

- The increase in demand for eco-friendly construction is likely to act as an opportunity for the market studied over the forecast period.

- Asia-Pacific represents the largest market and is expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and ASEAN Countries.

Dry-mix Mortar Additives And Chemicals Market Trends

Re-dispersible Polymer Powder Likely to Dominate the Additives Segment

- Re-dispersible powders are obtained by spray drying the corresponding aqueous polymer dispersions containing a redispersing agent while adding finely ground inorganic materials as anticaking agents. The re-dispersibility of the polymer powder is the most critical parameter to achieving mortar performances, like adhesion onto the substrate and abrasion resistance.

- Re-dispersible polymer powder is the most important binder in cement- and gypsum-based dry powder material. Re-dispersible polymer powder is a spray-dried powder of polymer emulsion. It is re-emulsified with water and has the same properties as the original emulsion, i.e., a film can be formed after water evaporation. This film has high toughness, weather resistance, and adhesion to a substrate. In addition, the latex powder with hydrophobic properties can improve the waterproof performance of the waterproof mortar.

- Performance of re-dispersible polymer powder in a dry mortar:

- Improves the adhesion of dry mortar to various substrates and ensures the weather resistance of mortar bond strength under different conditions of use. For example, it may be used to improve the bond strength between mortar and EPS board, EPS particles, concrete walls, and brick walls in the thermal mortar.

- Re-dispersible polymer powder can reduce the water absorption of the material, and the special hydrophobic latex powder effect is more pronounced. It reduces water and damage caused by water to the molded mortar.

- Some re-dispersible polymer powders can improve sag resistance and fluidity of the mortar to improve the construction performance of the mortar.

- Thus, the demand for the re-dispersible polymer powder segment is likely to increase in the market studied.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to account for the largest share of the overall dry-mix mortar additives and chemicals market during the forecast period.

- Currently, China, India, and ASEAN Countries are among the largest producer and consumers of dry mix mortar in the region and the fastest-growing countries in terms of consumption of dry mix mortar.

- China holds the largest Asia-Pacific market share for the dry-mix mortar additives and chemicals market.

- In 2021, Sika AG opened a new production facility of mortar in Jiaxing City, in the province of Zhejiang in Eastern China, in response to high demand from the region.

- In 2022, Sika AG opened a new plant for liquid membranes and mortar production in Chongqing, a city in southwestern China. The automotive, finance, and logistics sectors are well represented in the Chengdu-Chongqingregion and the construction industry benefits from these operations and companies' efforts to achieve more sustainable production.

- The demand for the dry-mix mortar additives and chemicals market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4,108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, according to the country's Ministry of Housing and Urban-Rural Development, the construction industry will maintain a 6% share of the country's GDP by 2025. There is a growing trend in the country for prefabricated buildings, which is expected to account for more than 30% of the country's new construction.

- According to the National Development and Reform Commission, the Chinese government approved 26 infrastructure projects at an estimated investment of about USD 142 billion, which are estimated to be completed by 2023. The growing demand for housing is expected to drive residential construction in the public and private sectors.

- Furthermore, India is also witnessing considerable investments in infrastructure projects, likely to provide massive demand for the market studied. Thus, growing infrastructural development in India is expected to augment the demand for dry-mix mortar additives and chemicals.

- According to IBEF, in Union Budget 2022-2023, the government allocated INR 10,00,000 crore (USD 130.57 billion) to enhance the infrastructure sector. Moreover, India plans to spend USD 1.4 trillion on infrastructure through the 'National Infrastructure Pipeline' in the next five years.

- According to the Desalination Association of India, there are more than 1000 desalination plants of various capacities ranging from 20 m3/day to 10,000 m3 /day. Most of the large desalination plants in India are in the municipal sector. NITI Aayog (Government Central Planning Commission) plans to set up more plants in water scare cities like Chennai, Mumbai, Kolkata, Surat, and Vizag. This is expected to drive the market of polymer-modified dry-mix mortar waterproofing slurries. Waterproofing slurries are used in pipes and tanks, which might be prone to weathering, stress, and crack formation. Thus, this is expected to bolster India's demand for dry-mix mortar additives and chemicals.

- Hence, owing to the aforementioned factors, the demand for dry-mix mortar additives and chemicals is expected to increase in Asia-Pacific over the forecast period rapidly.

Dry-mix Mortar Additives And Chemicals Industry Overview

The dry-mix mortar additives and chemicals market is partly consolidated. The major companies in the market studied include Wacker Chemie AG, Dow, BASF SE, Evonik Industries AG, and Sika AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in Asia-Pacific

- 4.1.2 Long-term Cost-effectiveness in the Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Slowdown of Construction Activities in the United States and Europe

- 4.2.2 High Cost of Investments

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Additives

- 5.1.1.1 Redispersible Polymer Powder

- 5.1.1.2 Plasticizers

- 5.1.1.3 Defoamers

- 5.1.1.4 Cellulose Ether

- 5.1.1.5 Air Entraining Agents

- 5.1.1.6 Other Additives

- 5.1.2 Chemicals

- 5.1.2.1 Shrinkage (Anhydrites)

- 5.1.2.2 Retarders

- 5.1.2.2.1 Na-citrate

- 5.1.2.2.2 Na-tartrate

- 5.1.2.2.3 Gypsum

- 5.1.2.2.4 Phosphonate-based Retarders

- 5.1.2.3 Accelerators

- 5.1.2.3.1 Ca-Formate

- 5.1.2.3.2 Ca-carbonate

- 5.1.2.3.3 Ca-nitrate

- 5.1.2.3.4 Li-Carbonate

- 5.1.2.3.5 CSH and CSA Accelerators

- 5.1.1 Additives

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East & Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East &Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGRANA Beteiligungs AG

- 6.4.2 Ashland

- 6.4.3 Avebe

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 CEMEX S.A.B. de CV

- 6.4.7 Chemstar Products Company

- 6.4.8 DCC

- 6.4.9 Don Construction Products Ltd

- 6.4.10 Dow

- 6.4.11 Emsland Group

- 6.4.12 Evonik Industries AG

- 6.4.13 Innospec

- 6.4.14 Kima Chemical Co. Ltd

- 6.4.15 LOTTE Fine Chemical

- 6.4.16 Mapei SpA

- 6.4.17 Nouryon

- 6.4.18 Rudolf GmbH

- 6.4.19 SE Tylose GmbH & Co. KG (ShinEtsu)

- 6.4.20 Shandong Head Co. Ltd

- 6.4.21 SIDLEY CHEMICAL CO. LTD

- 6.4.22 Sika AG

- 6.4.23 SMScor

- 6.4.24 The Euclid Chemical Company

- 6.4.25 Wacker Chemie AG

- 6.4.26 Berolan GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in demand for Eco Friendly Construction