|

市場調查報告書

商品編碼

1331385

碾米機的市場規模和份額分析 - 增長趨勢和預測(2023-2028)Rice Milling Machinery Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

碾米機市場規模預計到 2023 年為 2.3014 億美元,預計到 2028 年將達到 2.8 億美元,在預測期間(2023-2028 年)複合年增長率為 4%。

主要亮點

- 大米是世界一半以上人口的主食,世界各地均有生產,其中約 90% 產於亞洲。 中國是亞洲最大的稻米生產國。 秈米、香米(茉莉米、巴斯馬蒂米)、粳米和糯米是四大品種,但世界各地也生產許多其他特產品種。

- 對經過認證的碾米機的需求正在推動碾米機市場的增長。 經過認證的碾米機是為了確保高質量的大米加工,這是滿足不斷增長的大米需求所必需的。 由於大米是許多國家的主食,預計大米需求暫時將保持高位。 因此,預計碾米機的需求將持續增加。

- 但是,二手碾米機的供應可能會阻礙市場的增長。 佐竹的NTWP(新美味白工藝)作為碾米技術的最新趨勢具有劃時代意義。 NTWP 工藝生產出的免淘米在口感和外觀方面都具有更高的品質。 這項技術有可能徹底改變碾米行業,提供更高品質的大米,同時減少用水量和加工時間。 對於碾米廠來說,這可以提高效率、降低成本,進而增加利潤。

- 隨著世界人口的增加,對大米的需求不斷增加,許多碾米廠正在開設新碾米廠以支持市場增長。 印度是巴斯馬蒂大米的最大生產國和出口國。 碾米也許是印度最古老、最大的農產品加工業。 據聯合國糧食及農業組織(FAO)統計,2020年印度水稻產量約為1.17億噸,相當於精米約9000萬噸。

碾米機市場趨勢

水稻種植面積增加

- 大米是世界上一半以上人口的主要主食,其中亞洲、撒哈拉以南非洲和南美洲是最大的消費地區。 亞洲是最大的稻米生產國,其中包括中國和印度等國家,它們都是稻米產量和消費量最大的國家之一。 根據聯合國糧食及農業組織(FAO)的數據,印度2021年總收穫面積為4620萬噸,其次是中國2990萬噸、孟加拉國1170萬噸、泰國1120萬噸和印度尼西亞1040萬噸,已經變成了。 收穫面積的增加表明碾米廠從稻穀中提取大米供消費的需求增加。

- 根據 2021 年美國農業部 (USDA) 的報告,美國幾乎所有稻米產量均由四個地區生產:阿肯色州大草原城、密西西比三角洲、墨西哥灣沿岸和加利福尼亞州。這就是薩克拉門託山谷。 每個地區通常專門生產一種特定類型的大米,在美國被稱為長粒、中粒和短粒。

- 美國的長粒穀物在烹飪時通常是乾燥且分離的。 一般來說,美國大米中長粒約佔 75%,中粒約佔 24%,其餘為短粒。 2021年,美國粗米產量將為1.918億噸,比2020年下降16%,但略高於2019年。

- 水稻種植僅限於高溫、高濕、雨量充沛等特定氣候條件的地區。 因此主要栽培於中國、印度、東南亞等亞洲地區以及非洲、南美洲。 然而,隨著高產品種和新栽培技術(例如乾濕交替(AWD))的引入,現在可以在以前不適合種植水稻的地區。

- 對優質大米的需求不斷增長,以及新栽培技術和高產品種的不斷採用,為碾米機市場的參與者創造了巨大的機會。 這些參與者可以提供先進的機械,可以提高碾米過程的效率、降低勞動力成本並提高最終產品的質量。

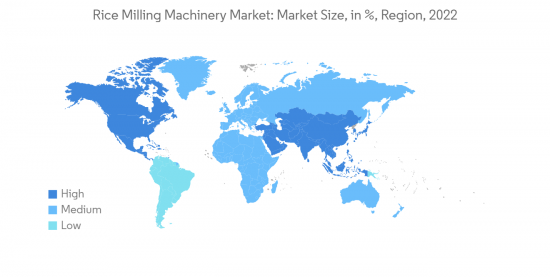

亞太地區主導市場

- 水稻、小麥和玉米是世界各地消費的主糧作物,其中水稻是主要的主糧作物,幫助世界上一半以上的人口滿足日常熱量需求。Masu。 世界上90%以上的稻米產自亞洲,主要是中國、印度、印度尼西亞和孟加拉國。

- 根據聯合國糧食及農業組織 (FAO) 的數據,印度 2021 年總收穫面積為 4,620 萬噸,其次是中國 2,990 萬噸、孟加拉國 1,170 萬噸、泰國 1,120 萬噸,以及印度尼西亞 1040 萬噸。

- 水稻種植的綜合作物管理 (ICM) 方法將本土技術與政府、研究機構和推廣服務的有效機構支持相結合。 該方法旨在優化現有資源的利用,最大限度地減少病蟲害的影響,並提高水稻種植的整體生產力和可持續性。 使用 ICM 方法,農民可以縮小產量差距並增加水稻產量。 政府可以通過提供投入和鄉村信貸供應以及加強研究和推廣聯繫來傳播新知識和技術來支持農民。

- 根據糧農組織的數據,到 2025 年,亞洲的大米消費量將增加 51% 以上。 由於該地區人口增長,對大米的需求增加預計將在預測期內推動精米市場的發展。

碾米行業概況

碾米機市場分散,少數大型企業導緻小型企業之間的競爭。 布勒集團 (Buhler Group)、福勒韋斯特魯普 (Fowler Westrup)、MillTECH Machinery Private Ltd、Savco Sales Pvt.Ltd 和 Satake Group 都是知名企業,在世界各地設有銷售和製造基地。 新產品推出、合作和收購是國內市場領先企業採取的關鍵策略。

除了技術創新和業務擴張之外,投資研發和開發新穎的產品組合也將是未來幾年的重要戰略。 通過與國內公司合作,這些公司建立了戰略合作夥伴關係,擴大了分銷網絡,並推出了創新的新型製粉機械,以滿足當地農民的需求。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章簡介

- 研究假設和市場定義

- 調查範圍

第 2 章研究方法

第 3 章執行摘要

第 4 章市場動態

- 市場概覽

- 市場促進因素

- 市場抑制因素

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第 5 章市場細分

- 機制

- 獨立碾米機

- 碾米機

- 操作

- 預洗機

- 分揀機

- 分級機

- 碾米機

- 其他

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲

- 北美

第 6 章競爭態勢

- 最常採用的策略

- 市場份額分析

- 公司簡介

- Buhler AG

- Fowler Westrup

- AG Growth International Inc.

- MillTECH Machinery Private Ltd

- Yamanoto

- Zhejiang QiLi Machinery Co. Ltd

- Satake Corporation

- Mill Master Machinery Pvt. Ltd

- G S International

- G.G. Dandekar Machine Work

- Hubei Bishan Machinery Co. Ltd

第 7 章市場機會和未來趨勢

The Rice Milling Machinery Market size is estimated at USD 230.14 million in 2023, and is expected to reach USD 280 million by 2028, growing at a CAGR of 4% during the forecast period (2023-2028).

Key Highlights

- Rice, the primary staple for more than half the world's population, is produced worldwide, with about 90 percent grown in Asia. China is the largest producer of rice in Asia. While Indica, Aromatic(Jasmine and Basmati), Japonica, and Glutinous rice are four major categories of rice, many other specialty varieties of rice are also produced globally.

- The demand for certified rice milling machinery is driving the growth of the rice milling machinery market. This is because certified machinery ensures high-quality rice processing, which is necessary to meet the growing demand for rice. As rice is a staple food in many countries, the demand for rice is expected to remain high in the foreseeable future. This, in turn, will continue to drive the demand for rice milling machinery.

- However, the availability of pre-used models of rice milling machinery may impede the market growth. Regarding the latest development in rice milling technology, the Satake New Tasty White Process (NTWP) is a breakthrough in rice processing. The NTWP process produces rinse-free rice of enhanced quality in terms of taste and appearance. This technology has the potential to revolutionize the rice milling industry by offering higher-quality rice while reducing water usage and processing time. This could lead to increased efficiency, reduced costs, and ultimately, higher profits for rice millers.

- The stipulation for rice is expanding with the rising global population, which led to many rice processing plants opening new rice mills and boosting the market's growth. India is the largest producer and exporter of Basmati rice and one of the largest exporters of rice. Rice milling is perhaps the country's oldest and biggest agro-processing industry. According to the Food and Agriculture Organization of the United Nations (FAO), India produced around 117 million metric tons of paddy rice in 2020, which is equivalent to around 90 million metric tons of milled rice.

Rice Milling Machinery Market Trends

Rising Area Under Rice Cultivation

- Rice is the primary staple food for more than half the world's population, with Asia, Sub-Saharan Africa, and South America as the largest consuming regions. Asia is the largest producer of rice, including countries like China and India, which are among the largest producers and consumers of rice. According to the Food and Agriculture Organization (FAO), in 2021, the total area harvested by India accounted for 46.2 million metric tons, followed by China with 29.9 million metric tons, Bangladesh with 11.7 million metric tons, Thailand with 11.2 million metric tons, and Indonesia with 10.4 million metric tons. This increase in the area harvested shows the increase in the requirement for more milling machinery to extract rice from paddy for consumption.

- According to the United States Department of Agriculture (USDA) report 2021, four regions produced almost the entire United States rice crop production: Arkansas Grand Prairie, Mississippi Delta, Gulf Coast, and Sacramento Valley of California. Each region normally specializes in a specific type of rice, referred to in the United States by the long, medium, and short grain length.

- The United States long-grain rice is typically dry and separates when cooked, while medium- and short-grain rice are typically moist and clingy. In general, long-grain production accounts for around 75 percent of United States rice production, medium-grain production for about 24 percent, and short-grain for the remainder. In 2021, the United States produced 191.8 million hundredweight (cwt) of rough rice, down 16 percent from 2020 but slightly above 2019.

- Paddy rice cultivation is limited to areas with specific climatic conditions, such as high temperatures, high humidity, and abundant rainfall. As a result, it is grown primarily in regions of Asia, such as China, India, and Southeast Asia, as well as in regions of Africa and South America. However, the rising adoption of high-yielding varieties and new cultivation techniques, such as alternate wetting and drying (AWD), has allowed for increased rice cultivation in areas that were previously unsuitable.

- The rising demand for high-quality rice and the increasing adoption of new cultivation techniques and high-yielding varieties presents a significant opportunity for players in the rice milling machinery market. These players can offer advanced machines that can improve the efficiency of the rice milling process, reduce labor costs, and increase the quality of the final product.

Asia-Pacific Dominates the Market

- Rice, wheat, and corn are the major consumed staple crops worldwide, whereas rice is a major staple crop among the three, helping more than half of the global population meet its daily calorie requirements. More than 90 percent of the world's rice is grown in Asia, principally in China, India, Indonesia, and Bangladesh, with smaller amounts grown in Japan, Pakistan, and various Southeast Asian nations.

- According to the Food and Agriculture Organization (FAO), in the year 2021, the total area harvested by India accounted for 46.2 million metric tons, followed by China with 29.9 million metric tons, Bangladesh with 11.7 million metric tons, Thailand with 11.2 million metric tons and Indonesia with 10.4 million metric tons.

- Integrated Crop Management (ICM) approaches for rice crops involve location-specific technologies combined with effective institutional support from governments, research institutions, and extension services. This approach aims to optimize the use of available resources, minimize the impact of pests and diseases, and improve the overall productivity and sustainability of rice farming. Using ICM approaches, farmers can bridge the yield gap and increase their rice production. Governments can support farmers by providing access to input and village credit supplies, as well as strengthening research and extension linkages to disseminate new knowledge and technologies.

- According to FAO, rice consumption in Asia by 2025 will increase by more than 51 percent. This increase in demand for rice due to the population increase in the region will drive the rice milling market during the forecast year.

Rice Milling Machinery Industry Overview

The rice milling machinery market is fragmented with a few big players, resulting in competition between small players. Buhler Group, Fowler Westrup, MillTECH Machinery Private Ltd, Savco Sales Pvt. Ltd and Satake Group are some of the prominent players with their distribution and manufacturing facilities worldwide. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market in the country.

Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years. These companies are making strategic partnerships by partnering with domestic companies to expand their distribution network and launch new innovative milling machinery that caters to the needs of the farmers in the respective regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Mechanism

- 5.1.1 Fraction Rice Milling Machine

- 5.1.2 Grind Rice Milling Machine

- 5.2 Operations

- 5.2.1 Pre-cleaning Machinery

- 5.2.2 Separating Machinery

- 5.2.3 Grading Machinery

- 5.2.4 Rice Whitening Machinery

- 5.2.5 Other Operations

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Buhler AG

- 6.3.2 Fowler Westrup

- 6.3.3 AG Growth International Inc.

- 6.3.4 MillTECH Machinery Private Ltd

- 6.3.5 Yamanoto

- 6.3.6 Zhejiang QiLi Machinery Co. Ltd

- 6.3.7 Satake Corporation

- 6.3.8 Mill Master Machinery Pvt. Ltd

- 6.3.9 G S International

- 6.3.10 G.G. Dandekar Machine Work

- 6.3.11 Hubei Bishan Machinery Co. Ltd