|

市場調查報告書

商品編碼

1331339

動態交聯熱塑性彈性體 (TPV) 市場規模和份額分析 - 增長趨勢和預測 (2023-2028)Thermoplastic Vulcanizate (TPV) Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

動態交聯熱塑性彈性體 (TPV) 市場規模預計將從 2023 年的 417.05 千噸擴大到 2028 年的 558.11 千噸,預測期內(2023-2028 年)複合年增長率為 6%。

COVID-19 大流行擾亂了動態交聯熱塑性彈性體市場,導致由於運輸限制和各行業需求減少而導致供應減少。 然而,由於汽車、建築行業需求增加,市場於 2022 年復蘇。

主要亮點

- 推動市場的主要因素包括汽車行業需求的激增、消費品行業利用率的提高以及與可回收材料使用相關的政府優惠政策。

- 然而,耐化學性差、耐磨性低以及原材料價格波動可能會限制交聯熱塑性彈性體市場的動態。

- 醫療保健行業的擴大使用和電器需求的激增預計將成為該市場的主要增長機會。

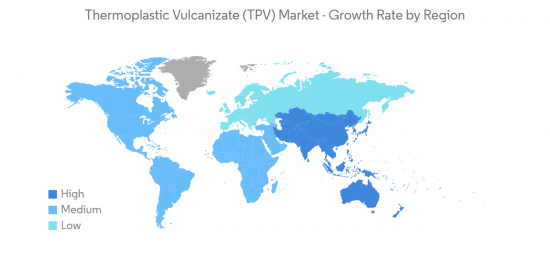

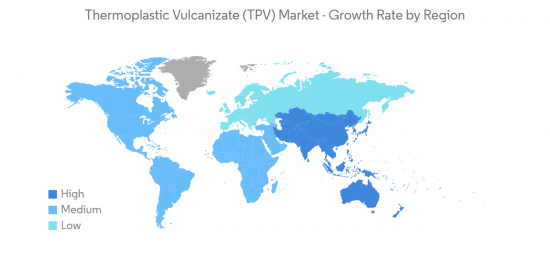

- 預計亞太地區將成為預測期內增長最快的地區。

動態交聯熱塑性彈性體 (TPV) 市場趨勢

汽車領域主導市場

- 近年來,由於對豪華、低排放、安全和高性能車輛的需求不斷增長,輕質汽車材料大幅增長。

- 因此,供應商和製造商推出了各種解決方案,幫助 OEM 滿足不斷收緊的法規並滿足廣泛的消費者偏好。

- TVP在汽車行業的主要應用包括軟管蓋、進氣管蓋、墊圈、密封件、波紋護套、減振器、支柱蓋、點火組件、襯套、車窗密封件等。

- TPV 的柔性發動機罩下汽車部件包括進氣管和波紋管、輪艙喇叭口、轉向系統波紋管和隔音部件。

- 成本是最大的優勢,TPV 比 EPDM 低 10-30%;加上重量更輕、設計靈活性更強以及可回收性,TPV 比 EPDM 低 10-30%。 此外,TPV 更輕,使得車輛更省油。

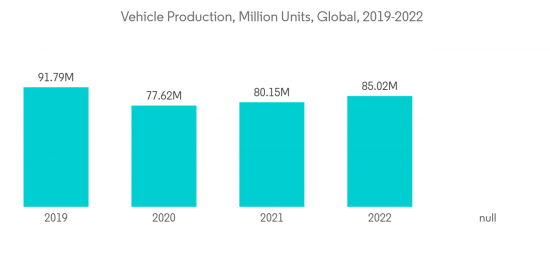

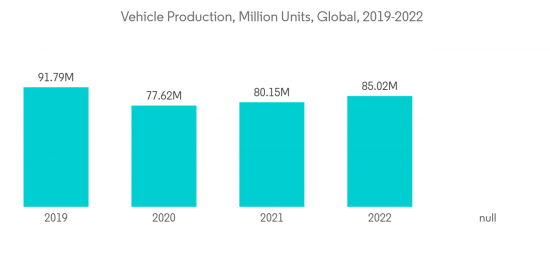

- 根據國際汽車製造商協會 (OICA) 的預測,由於全球私家車需求增加,2022 年全球汽車產量將同比增長 6%。

- 2022年中國汽車產量將達到270,206,615輛,同比增長3%。 2022年加拿大汽車產量也將達到12,28,735輛,比上年增長10%。

- 因此,由於上述因素,汽車行業預計將主導市場。

亞太地區增長迅速

- 中國、日本和印度的廣泛需求是推動亞太市場需求的關鍵原因之一。

- 中國是世界上最大的汽車生產國。 然而,最近中國的汽車產量一直在下降。 經濟波動和中美貿易戰影響了汽車行業的表現。

- 中國正致力於擴大電動汽車的生產和銷售。 為此,中國計劃增加電動汽車(EV)的產量。 國際能源署(IEA)設定了到2025年中國新車產量中電動汽車佔比達到20%的目標。

- 此外,根據國際汽車製造商協會 (OICA) 的數據,2022 年中國汽車總產量為 27,020,615 輛,較 2021 年增長 3%。

- 中國蓬勃發展的經濟為消費品製造商提供了全球最大的增長機會。 被中國消費品市場的巨大潛力所吸引,不少外資企業紛紛在中國設立生產基地。 隨著消費品產量的增長,動態交聯熱塑性彈性體的消費需求也可能會增加。

- 根據世界資源研究所 (WRI) 的數據,中國正處於建設熱潮之中。 該國是全球最大的建築市場,佔全球建築投資的20%。 到 2030 年,預計僅中國的建設投資就將達到約 13 萬億美元。

- 在日本,東京在投資和市場發展前景方面已成為該地區其他主要城市中的頂級市場,在住宅領域佔有很大份額。

- 因此,在預測期內,汽車、建築和消費品行業的預計增長可能會推動亞太地區對動態交聯熱塑性彈性體的國內需求。

動態交聯熱塑性彈性體(TPV)行業概述

動態交聯熱塑性彈性體 (TPV) 市場得到整合,主要參與者佔據約 70% 的市場份額。 主要公司(排名不分先後)包括埃克森美孚公司、三井化學、Teknor Apex、Dawn Group 和 KUMHO POLYCHEM。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 調查的先決條件

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 協調員

- 汽車行業的廣泛需求

- 消費品行業越來越多地使用動態交聯熱塑性彈性體

- 有關使用可回收材料的政府優惠政策

- 抑制因素

- 耐化學性和耐磨性較低

- 原材料價格變化

- 行業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原材料分析

第 5 章市場細分(市場規模:基於數量)

- 最終用戶行業

- 汽車

- 建築/施工

- 消費品

- 醫療保健

- 其他最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭態勢

- 併購、合資企業、聯盟、協議

- 市場份額 (%)**/排名分析

- 各大公司的戰略

- 公司簡介

- Avient Corporation

- Celanese Corporation

- Elastron TPE

- Exxon Mobil Corporation

- FM Plastics

- Kumho Polychem

- LCY GROUP

- LyondellBasell Industries holdings B.V.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Ravago

- RTP Company

- Teknor Apex

- Trinseo

第7章市場機會和未來趨勢

- 擴大醫療保健行業的應用

- 對電氣應用的需求不斷增長

The Thermoplastic Vulcanizate (TPV) Market size is expected to grow from 417.05 kilotons in 2023 to 558.11 kilotons by 2028, at a CAGR of 6% during the forecast period (2023-2028).

The COVID-19 pandemic disrupted the thermoplastic vulcanizate market, resulting in a reduction in supply due to transportation restrictions and a decline in demand from various sectors. Nonetheless, the market rebounded in 2022 due to increased demand from the automotive, building, and construction industries.

Key Highlights

- The major factors driving the market studied are the surge in demand from the automobile industry, the increase in utilization in the consumer goods industry, and favorable government policies related to using recyclable materials.

- However, poor resistance to chemicals and low wear resistance, and fluctuation in raw material prices could restrain the thermoplastic vulcanizate market.

- Growing use in the healthcare industry and surging demand for electrical appliances are expected to be major growth opportunities for the market.

- The Asia-Pacific region is expected to be the largest and fastest-growing region in the forecast period.

Thermoplastic Vulcanizate (TPV) Market Trends

The Automotive Segment to Dominate the Market

- Automotive lightweight materials grew robustly over the past couple of years due to the increasing demand for luxurious, low-on-emission, safe, and high-performance vehicles.

- As a result, suppliers and manufacturers introduced various solutions that help OEMs meet continually tightening regulations and satisfy the widening range of consumers' tastes.

- The major applications of TVP in the automotive industry include hose coverings, air inlet duct covers, gaskets, seals, convoluted boots, vibration dampeners, strut covers, ignition components, bushings, and window seals.

- TPV flexible automotive under-the-hood components include air intake tubes and bellows, wheel well flares, steering system bellows, and sound abatement parts.

- Cost is the biggest advantage, with TPVs being 10-30% lower than EPDM, coupled with lower weight, improved design flexibility, and recyclability. Furthermore, the lightweight of TPV enables more fuel-efficient vehicles.

- In 2022, According to the International Organization of Motor Vehicle Manufacturers (OICA), global automobile production increased by 6% compared to the previous year due to increasing global demand for private mobility.

- In China, the total vehicle production was 270,20,615, with an increase of 3% in 2022 compared to the previous year. Also, in Canada, the total vehicle production was 12,28,735 in 2022, with an increase of 10% in the production of vehicles in the country compared to the previous year.

- Thus, based on the factors above, the automotive segment is expected to dominate the market.

Asia-Pacific to Witness the Fastest Growth

- Extensive demand from China, Japan, and India is one of the key reasons driving the demand in the market in Asia-Pacific.

- China is the world's largest automotive producer. However, the country witnessed a decline in the production of vehicles in the recent past. The economic shifts and China's trade war with the United States affected the automotive industry's performance.

- China is focusing on increasing the production and sales of electric vehicles. For this purpose, the country planned to increase the production of electric vehicles (EVs). It targeted to reach the share of electric vehicles to 20% of China's total new car production by 2025, stated the International Energy Agency (IEA).

- Moreover, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, the total vehicle production in China stood at 27,020,615 units, which increased by 3% compared to 2021.

- China's booming economy offered consumer product companies some of the world's greatest growth opportunities. Attracted by the huge potential of China's consumer goods market, many foreign companies entered China and set up production units. With the growth of consumer goods production, thermoplastic vulcanizate consumption may also see an increased demand.

- According to World Resources Institute (WRI), China is in the middle of a construction mega-boom. The country includes the largest building market in the world, making up 20% of all construction investment globally. The country alone is expected to spend nearly USD 13 trillion on buildings by 2030.

- In Japan, Tokyo emerged as a top market among the rest of the major cities in the region for investments and development prospects, of which the residential sector accounted for the major share.

- Thus, the anticipated growth in the automotive, construction, and consumer goods industries will likely drive the domestic demand for thermoplastic vulcanizate during the forecast period in Asia-Pacific.

Thermoplastic Vulcanizate (TPV) Industry Overview

The thermoplastic vulcanizate (TPV) market is consolidated, with the top players accounting for around 70% of the market share. The major companies (in no particular order) include Exxon Mobil Corporation, Mitsui Chemicals Inc., Teknor Apex, Dawn Group, and KUMHO POLYCHEM.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Extensive Demand from the Automobile Industry

- 4.1.2 Increase in Use of Thermoplastic Vulcanizate in the Consumer Goods Industry

- 4.1.3 Favourable Government Policies Related to the Use of Recyclable Materials

- 4.2 Restraints

- 4.2.1 Poor Chemical and Wear Resistance

- 4.2.2 Fluctuation in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Automotive

- 5.1.2 Building and Construction

- 5.1.3 Consumer Goods

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avient Corporation

- 6.4.2 Celanese Corporation

- 6.4.3 Elastron TPE

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 FM Plastics

- 6.4.6 Kumho Polychem

- 6.4.7 LCY GROUP

- 6.4.8 LyondellBasell Industries holdings B.V.

- 6.4.9 Mitsubishi Chemical Corporation

- 6.4.10 Mitsui Chemicals Inc.

- 6.4.11 Ravago

- 6.4.12 RTP Company

- 6.4.13 Teknor Apex

- 6.4.14 Trinseo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Usage in the Healthcare Industry

- 7.2 Growing Demand in Electrical Applicances