|

市場調查報告書

商品編碼

1329809

聚四亞甲基醚乙二醇 (PTMEG) 市場規模和份額分析 - 增長趨勢和預測(2023-2028)Polytetramethylene Ether Glycol (PTMEG) Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

聚四亞甲基醚二醇(PTMEG)市場規模預計將從2023年的124萬噸增長到2028年的160萬噸,預測期內(2023-2028年)複合年增長率為5.27% 。

COVID-19 的爆發導致全國范圍內停工、製造活動和供應鏈中斷以及世界各地的生產停頓,對市場產生了負面影響。 然而,隨著時間的推移,情況開始復蘇,市場重新回到增長軌道。

主要亮點

- 從中期來看,熱塑性聚氨酯 (TPU) 需求的增加以及服裝和服裝行業的增長預計將推動市場增長。

- 但是,歐洲經濟低迷預計將阻礙市場增長。

- 氨綸纖維在醫療保健行業的新興用途以及生物基產品的趨勢預計將為市場提供機遇。

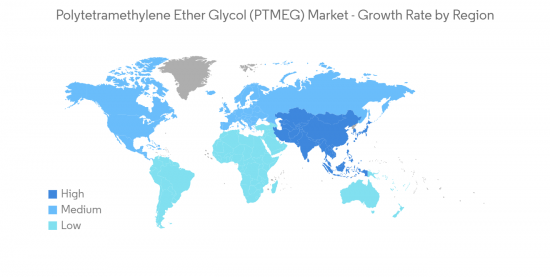

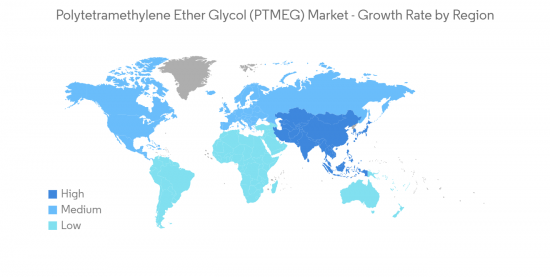

- 預計亞太地區在預測期內將呈現最高增長率。

聚四亞甲基醚乙二醇 (PTMEG) 市場趨勢

紡織行業預計將主導市場

- 東盟國家(印度、孟加拉國等)等新興經濟體的紡織業正在健康發展。 預計在預測期內將進一步增長。 這是由於製造成本較低以及紡織工業在貿易、就業、投資和收入方面的重要作用。

- 各種紡織應用對更高品質彈力織物的需求不斷增長,推動了對聚四亞甲基醚二醇 (PTMEG) 的需求。

- 根據世界體育用品工業聯合會的數據,與其他行業相比,該行業在過去兩年中實現了高增長,並表現出較高的複蘇率,達到或超過了疫情前的水平。Masu 。 據該聯合會稱,2022年,上半年消費者信心逐月改善的趨勢導致企業因預期需求而下大訂單,並避免2021年的供應鏈挑戰。

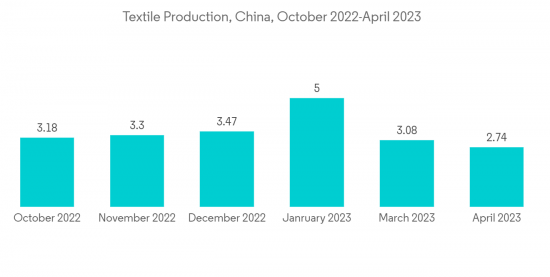

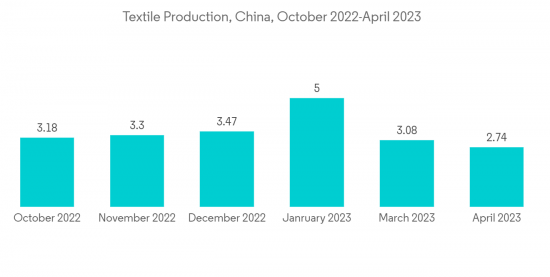

- 中國是全球最大的紡織服裝原材料生產國和出口國。 中國國家統計局數據顯示,2022年前10個月,紡織行業平穩增長。 2022年12月,我國服裝面料產量約34.7億米。 此外,以服裝精品著稱的越南2021年紡織品出口額再創新高,達115億美元,位居全球第六位。

- 德國、法國、西班牙、意大利、荷蘭和波蘭是歐洲最大的市場,佔歐盟運動服裝進口量的近 75%。

- 在印度,由於外國紡織品牌的增加,消費者的偏好不斷增加,對服裝的需求也在增加。 數字化、社交媒體和應用程序正在推動服裝銷量的增長,需求也在不斷增長。 據一些印度服裝製造商透露,男裝品牌的增長率為7-10%,而女裝和童裝的增長率則在15-20%左右。

- 因此,由於上述因素,紡織行業很可能在預測期內主導市場。

亞太地區主導市場

- 目前,亞太地區的市場份額最高。 由於中國、印度、日本、東盟國家等紡織行業需求的增加,聚四亞甲基醚二醇的需求量不斷增加。

- 中國是全球紡織品、汽車、油漆和塗料的重要市場。 在該國運營的公司,無論是跨國公司還是本地公司,都在擴大產能並投資新項目,以減少對進口的依賴,從而促進該地區的能源安全和自力更生。我正在玩

- 中國對於運動服裝、配飾和鞋類的銷售來說是一個極具吸引力的市場。 由於勞動力成本上升,跨國公司正在將業務轉移到中國境外。 運動服和運動服在中國的需求量很大。

- 亞太地區目前是全球最大的紡織品生產國。 亞太國家,特別是中國、印度、越南、韓國和日本,是少數幾個大量出口紡織品的國家。

- 根據《2022 年世界貿易統計回顧》和聯合國 (UNComtrade) 的數據,中國、歐盟 (EU) 和印度也是 2021 年全球三大紡織品出口國。 2021 年,這三大國家合計佔全球紡織品出口的 68%。

- 此外,東盟國家對用於紡織、油漆和塗料等行業的 PTMEG 的需求也在不斷增加。

- 因此,由於上述因素,亞太地區很可能在預測期內主導市場。

聚四亞甲基醚二醇(PTMEG)行業概覽

全球聚四亞甲基醚二醇 (PTMEG) 市場適度整合,大部分市場份額被少數參與者瓜分。 市場主要參與者包括巴斯夫、DCC(大連化學)、英威達、中石化長城、曉星等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 對熱塑性聚氨酯 (TPU) 的需求不斷增加

- 新興國家對服裝的需求不斷增加

- 其他司機

- 抑制因素

- 嚴格的環境法規

- 歐洲經濟放緩

- 工業價值鏈分析

- 行業吸引力 - 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(市場規模:基於數量)

- 按用途

- 聚氨酯纖維(氨綸)

- 熱塑性聚氨酯彈性體

- 其他用途

- 按最終用戶行業劃分

- 油漆/塗料

- 汽車

- 纖維

- 其他最終用戶行業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東盟國家

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭態勢

- 併購、合資企業、聯盟、協議

- 市場份額 (%)**/排名分析

- 各大公司的戰略

- 公司簡介

- BASF SE

- Chang Chun Group

- Henan Energy Chemical Group Hebi

- Hyosung Corporation

- INVISTA

- Korea PTG

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Sinopec Great Wall Energy & Chemical Co. Ltd(Sinopec Corp.)

- Shanxi Sanwei Group Co. Ltd

第7章市場機會和未來趨勢

- 生物基二醇衍生物的開發

- 氨綸纖維在醫療保健行業的新應用

The Polytetramethylene Ether Glycol (PTMEG) Market size is expected to grow from 1.24 million tons in 2023 to 1.60 million tons by 2028, at a CAGR of 5.27% during the forecast period (2023-2028).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market. However, the conditions started recovering over time, restoring the market's growth trajectory.

Key Highlights

- Over the medium term, the increasing demand for thermoplastic polyurethane (TPU) and the growth in the apparel and clothing industry is expected to drive the market growth.

- However, the economic downfall in the European economies is expected to hinder the growth of the market studied.

- The emerging usage of spandex fibers in the healthcare industry and shifting trends toward bio-based products are expected to provide opportunities for the market.

- Asia-Pacific is expected to witness the highest growth rate during the forecast period.

Polytetramethylene Ether Glycol (PTMEG) Market Trends

Textile Industry is Likely to Dominate the Market

- The textile industry has been growing at a healthy rate in emerging economies like ASEAN countries, viz., India, Bangladesh, etc. It is expected to grow further over the forecast period. This is due to low manufacturing costs and the industry's significant role in trade, employment, investment, and revenue.

- Increasing demand for enhanced quality stretch fabric across various textile applications drives the demand for polytetramethylene ether glycol (PTMEG).

- According to the World Federation of the Sporting Goods Industry, compared to other industries, the past two years have shown a high recovery rate in this segment by recording high growth and equaling or outperforming pre-pandemic levels. According to the federation, in 2022, companies placed large orders in anticipation of demand and to avoid the supply chain challenges of 2021 owing to the improving consumer sentiment trends seen every month in the first half of the year.

- China is the world's largest producer and exporter of raw textile materials and garments. According to the National Bureau of Statistics of China data, the textile sector grew steadily in the first ten months of 2022. In December 2022, approximately 3.47 billion meters of clothing fabric were produced in China. In addition, Vietnam, known for its competitive clothing products, achieved a new high of USD 11.5 billion in textile exports in 2021 and ranked sixth globally.

- Germany, France, Spain, Italy, the Netherlands, and Poland are the largest European markets, accounting for nearly 75% of all EU sportswear imports worldwide.

- In India, the demand for apparel has increased with the growing consumer preference in response to the growing number of foreign textile brands. The demand has been augmented by digitalization, social networking sites, and apps, which help increase garments sales. As per some apparel manufacturers in India, the growth rate in menswear brands is 7-10%, while the growth rate of women's and kids' apparel is around 15-20%.

- Hence, owing to the abovementioned factors, the textile industry will likely dominate the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- Currently, the Asia-Pacific region accounts for the highest market share. Due to the increasing demand from the textile industry in countries such as China, India, Japan, and the ASEAN countries, the demand for polytetramethylene ether glycol is increasing.

- China is a significant market for global textiles, automotive, and paints and coatings. Companies present in the country, multinationals, and locals are expanding their production capacities and investing in new projects to decrease their dependence on imports, thereby fueling regional energy security and autonomy.

- China has been an attractive market for athletic apparel, accessories, and footwear sales. Multinational companies are shifting operations outside China due to rising labor costs; the country has a high demand for sportswear and activewear.

- Currently, Asia-Pacific is the largest producer of textiles globally. The Asia-Pacific countries, notably China, India, Vietnam, South Korea, and Japan, are among the few that export textiles in substantial quantities.

- According to the World Trade Statistical Review 2022 and the United Nations (UNComtrade), China, the European Union (EU), and India remained the world's three largest textile exporters in 2021. Together, these top three accounted for 68% of the world's textile exports in 2021.

- Additionally, there has been an increasing demand for PTMEG in the ASEAN countries for usage in industries like textiles, paints and coatings, etc.

- Hence, owing to the abovementioned factors, Asia-Pacific will likely dominate the market studied during the forecast period.

Polytetramethylene Ether Glycol (PTMEG) Industry Overview

The global polytetramethylene ether glycol (PTMEG) market is moderately consolidated as the majority of the market share is divided among a few players. Some of the key players in the market include BASF SE, DCC (Dairen Chemical Corporation), INVISTA, Sinopec Great Wall, and HYOSUNG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Thermoplastic Polyurethane (TPU)

- 4.1.2 Growing Demand for Apparels and Clothing in Emerging Economies

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Slowdown in the European Economy

- 4.3 Industry Value-chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Polyurethane Fibers (Spandex)

- 5.1.2 Thermoplastic Urethane Elastomers

- 5.1.3 Other Applications

- 5.2 By End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Automotive

- 5.2.3 Textiles

- 5.2.4 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Chang Chun Group

- 6.4.3 Henan Energy Chemical Group Hebi

- 6.4.4 Hyosung Corporation

- 6.4.5 INVISTA

- 6.4.6 Korea PTG

- 6.4.7 LyondellBasell Industries Holdings BV

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 Sinopec Great Wall Energy & Chemical Co. Ltd (Sinopec Corp.)

- 6.4.10 Shanxi Sanwei Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Glycol Derivatives

- 7.2 Emerging Usage of Spandex Fibers in the Healthcare Industry