|

市場調查報告書

商品編碼

1329484

殺菌劑市場規模和份額分析 - 增長趨勢和預測(2023-2028)Fungicide Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計 2023 年殺菌劑市場規模為 208.2 億美元,預計 2028 年將達到 280 億美元,在預測期內(2023-2028 年)複合年增長率為 6.10%。

主要亮點

- 作物保護化學行業正在因強勁增長、不斷變化的作物結構趨勢和環境法規而發生轉變。 人口增長、耕地面積減少、糧食安全以及提高農業生產力的需要是推動農業增產需求的主要因素,從而促進了全球作物保護行業的增長。 殺菌劑,特別是SDHI殺菌劑,經常與其他化學品結合使用。 例如,在大豆、花生、棉花和馬鈴薯等多種作物的種子處理操作中,萎銹靈經常與福美雙一起使用。

- 推動殺菌劑市場的因素包括耕地面積減少、人口增加以及提高作物產量的需要。 各種真菌對現有殺菌劑的抗藥性以及植物新病害的出現,正促使企業尋找新產品來對抗新的真菌突變並減少農民的損失。 預計在預測期內,對防治作物病害的殺菌劑的需求不斷增加將推動市場發展。 由於人口增長,到2050年全球糧食產量需要增加約70%才能滿足全球不斷增長的糧食需求。 這一趨勢意味著某些食品的產量必須大幅增加。 例如,據糧農組織稱,到 2050 年,糧食產量應達到 30 億噸左右,高於 2018 年的 21 億噸左右。

- 美國環境保護署 (EPA) 等監管機構經常出台嚴格的法律來減少農藥的使用,以減少環境破壞並提高消費者對農藥消費的認識。 預計這些因素將有助於減緩殺菌劑的需求。

殺菌劑市場趨勢

增加生物基殺菌劑的使用

由於對食品中化學品的監管更加嚴格,對生物基消毒劑的需求不斷增加。 在歐洲運營的公司正致力於增加生物基殺菌劑的產量。 儘管合成殺菌劑非常有效,但其重複使用會帶來環境污染、耐藥菌產生和殘留毒性等問題。 這一趨勢加速了相對環保、安全的生物殺菌劑的研發。 重要的市售生物殺菌劑可控制病原體,例如腐霉屬、絲核菌屬、鐮刀菌屬、核盤菌屬、梭孢黴屬、葡萄孢屬和白粉病。

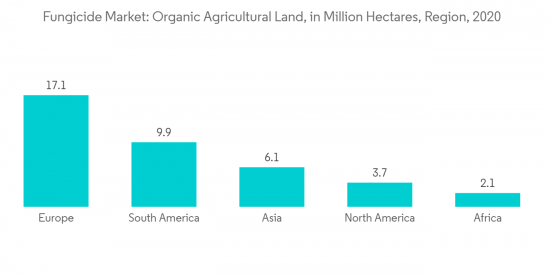

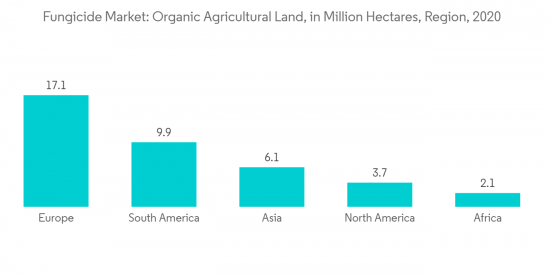

根據聯合國糧食及農業組織的數據,用於穀物、豆類、水果和蔬菜的耕地面積逐年增加,為農民提供了滿足日益增長的國內和國際糧食需求的機會。 例如,2020年,亞洲耕地面積將達到497,818,700公頃,超過上年(497,255,400公頃)。 因此,農民使用殺菌劑來保護農作物免受各種真菌侵擾。

此外,為了限制不必要的殺菌劑使用,隨著市場的成熟,北美、西歐和日本的工業市場未來六個月殺菌劑需求的平均增長可能會維持下去。 因此,由於嚴格的化學法規,預計在預測期內對生物基消毒劑的需求將會增長。

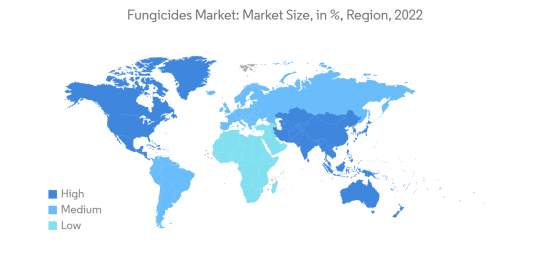

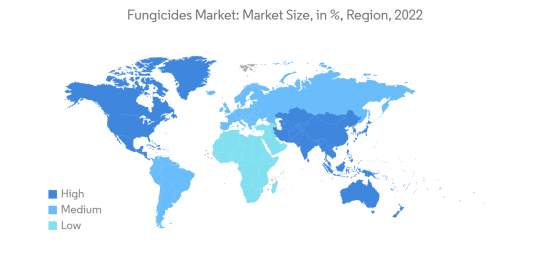

亞太地區主導市場

亞太地區是殺菌劑市場最大的消費國之一。 在研究期間,該地區增加了研發投資,以生產針對農作物真菌的新的、創新的和具有成本效益的解決方案。 該地區穀物、穀物和蔬菜的生產潛力很大,增加了市場對殺菌劑的需求。 殺菌劑,特別是SDHI殺菌劑,在該地區經常與其他化學品結合使用,主要用於種子處理。 例如,萎銹靈經常與福美雙聯合使用來處理大豆、花生、棉花和馬鈴薯等多種作物的種子。 人口增長導致對糧食的需求增加,這是由於提高農作物產量的需要所致。

在印度,農業和農民福利部、生物技術部 (DBT) 和科學技術部等多個政府機構正在促進生物基殺菌劑的研究、開發和商業化。

印度、澳大利亞和日本等國家將其生產的水果和蔬菜出口到歐洲國家。 由於對化學品使用的嚴格規定,該地區對生物基殺菌劑的需求正在增加。 因此,政府的舉措和農產品的高產量預計將支持保護農作物免受真菌侵害的市場的增長。

殺菌劑行業概述

殺菌劑市場得到整合,大公司控制了大部分市場。 主要公司包括 UPL Ltd、BASF SE、Bayer CropScience、Corteva Agriscience 和 Syngenta AG。 該市場公司的主要策略是新產品註冊和收購以進入新市場。 該行業應重點關注綜合害蟲管理技術和可持續實踐,以在不損害環境的情況下提高產量。 新產品推出、合作和收購是國內市場領先企業採取的主要策略。 隨著技術創新和業務擴張,研發投資和新產品組合的開發也將成為未來幾年的關鍵戰略。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 市場概覽

- 市場驅動因素

- 市場製約因素

- 行業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第五章市場細分

- 的由來

- 合成

- 生物基

- 其他

- 作物類型

- 穀物

- 油籽和豆類

- 水果和蔬菜

- 草坪/觀葉植物

- 其他

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 西班牙

- 英國

- 法國

- 德國

- 俄羅斯

- 意大利

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 南非

- 其他中東和非洲地區

- 北美

第6章競爭態勢

- 市場份額分析

- 最常採用的策略

- 公司簡介

- ChemChina Corporation

- American Vanguard Corporation

- BASF SE

- Bayer Cropscience AG

- Bioworks Inc.

- Corteva Agriscience

- FMC Corporation

- Isagro SpA

- Marrone Bio Innovations Inc.

- Nippon Soda Co. Ltd

- Nufarm Ltd

- Sumitomo Chemical

- UPL Limited

第7章 市場機會與今後動向

The Fungicide Market size is estimated at USD 20.82 billion in 2023, and is expected to reach USD 28 billion by 2028, growing at a CAGR of 6.10% during the forecast period (2023-2028).

Key Highlights

- The crop protection chemical industry has been transforming, with robust growth, changing crop mix trends, and environmental regulations. Growing population, declining arable land, food security, and the need for augmented agricultural productivity are the significant factors driving the demand for higher agricultural output, thus augmenting the growth of the crop protection industry globally. Fungicides, especially SDHI fungicides, are often used in combination with other chemicals. For instance, carboxin is often used with thiram to carry out seed treatment operations of various crops, such as soybean, groundnut, cotton, and potato.

- Factors driving the market for fungicides include decreasing arable land, increasing population, and the need to improve crop yields. Resistance of various fungi to the existing fungicides and the emergence of new diseases in plants led the companies to find novel products for fighting the new fungus mutations and reducing the loss to farmers. The increasing demand for fungicides to fight crop diseases is expected to drive the market during the forecast period. Due to the increasing population, global food production needs to increase by about 70% by 2050 to meet the growing food demand globally. This trend implies that there must be a significant increase in the production of certain food commodities. For instance, according to the FAO, the production of cereals must reach around 3 billion metric ton by 2050, an increase from nearly 2.1 billion metric ton in 2018.

- Regulatory authorities such as the EPA (Environment Protection Agency) frequently introduce stringent laws related to curbing pesticide use to alleviate environmental damage and increase consumer awareness about pesticide consumption. Such factors are expected to be instrumental in slowing down the demand for fungicides.

Fungicide Market Trends

Increasing Use of Bio-based Fungicides

There is a rise in the demand for bio-based fungicides due to stringent regulations for chemicals in food. Companies operating in Europe are focused on increasing the production of bio-based fungicides. Although synthetic fungicides are highly effective, their repeated use has led to environmental pollution, resistance development, and residual toxicity. This trend has accelerated the R&D on biofungicides, which is comparatively eco-friendly and safe. Important commercial biofungicides available in the market protect against pathogens, such as Pythium, Rhizoctonia, Fusarium, Sclerotinia, Thielaviopsis, Botrytis, and powdery mildew.

According to the Food and Agriculture Organization, the total arable land for cereals, pulses, fruits, and vegetables is increasing yearly, presenting opportunities for farmers to meet the increasing domestic and international food demand. For instance, in 2020, Asia occupied 497,818.7 thousand ha of arable land, which is higher than the previous year (497,255.4 thousand ha). Hence, farmers are adopting fungicides to protect their crops against various fungal infestations.

Additionally, aimed at restricting unnecessary utilization of fungicides, the industrial markets of North America, Western Europe, and Japan are likely to sustain average growth in the demand for fungicides over the coming half a decade due to maturity in the markets. Therefore, the demand for bio-based fungicides is expected to grow during the forecast period due to stringent chemical regulations.

Asia-Pacific Dominates the Market

Asia-Pacific is among the largest consumer of fungicides in the market. During the study period, there was increased investment in R&D for manufacturing novel, innovative, and cost-efficient solutions against fungi in crops in the region. The region's high production potential for grains, cereals, and vegetables increased the demand for fungicides in the market. Fungicides, especially SDHI fungicides, are often used in combination with other chemicals, mainly for seed treatments in the region. For instance, carboxin is often used with thiram for seed treatment of various crops, such as soybean, groundnut, cotton, and potato. The increased demand for food among the growing population can be attributed to the need to enhance crop yield.

In India, several government agencies, such as the Ministry of Agriculture and Farmers Welfare, the Department of Biotechnology (DBT), and the Ministry of Science and Technology, have been promoting the research, development, and commercialization of bio-based fungicides.

Countries such as India, Australia, and Japan export their produced fruits and vegetables to European countries. Due to stringent regulations on chemical usage, the demand for bio-based fungicides has increased in the region. Therefore, government initiatives and high production of agricultural products are expected to help drive the market's growth to protect crops from fungi.

Fungicide Industry Overview

The fungicide market is consolidated, with major companies occupying most of the market. Major companies include UPL Ltd, BASF SE, Bayer CropScience, Corteva Agriscience, and Syngenta AG. The key strategies used by companies in the market are new product registrations and acquisitions to enter new markets. The focus in the industry should be on integrated pest management techniques and sustainable practices for an improved yield without harming the environment. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market in the country. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Origin

- 5.1.1 Synthetic

- 5.1.2 Bio-based

- 5.1.3 Other Originss

- 5.2 Crop Type

- 5.2.1 Cereals and Grains

- 5.2.2 Oilseeds and Pulses

- 5.2.3 Fruits and Vegetables

- 5.2.4 Turf and Ornamentals

- 5.2.5 Other Crop Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 ChemChina Corporation

- 6.3.2 American Vanguard Corporation

- 6.3.3 BASF SE

- 6.3.4 Bayer Cropscience AG

- 6.3.5 Bioworks Inc.

- 6.3.6 Corteva Agriscience

- 6.3.7 FMC Corporation

- 6.3.8 Isagro SpA

- 6.3.9 Marrone Bio Innovations Inc.

- 6.3.10 Nippon Soda Co. Ltd

- 6.3.11 Nufarm Ltd

- 6.3.12 Sumitomo Chemical

- 6.3.13 UPL Limited