|

市場調查報告書

商品編碼

1326445

託管基礎設施服務的市場規模和份額分析 - 增長趨勢和預測(2023-2028)Managed Infrastructure Services Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

託管基礎設施服務的市場規模預計將從 2023 年的 1063.1 億美元增長到 2028 年的 1729.4 億美元,預測期內(2023-2028 年)複合年增長率為 10.22%。Masu。

分析、雲、物聯網和認知計算等技術趨勢正在創造新的業務需求。 公司正在利用這些數字技術來創建創新的業務模式、優化業務流程、增強員工的能力並實現個性化的客戶體驗。

主要亮點

- 利用提供專業增值服務(例如應用測試、服務目錄創建和專業諮詢)的託管服務減少冗餘停機時間。 市場開發的基礎是各種監控工具和由不同團隊管理的多層基礎設施。 例如,在BMC的“BMC Helix ITSM”中,系統是集中式的、雲原生的、可觀察連接的,並且針對AIOps進行了優化。 該解決方案充分暴露來自IT基礎設施、應用程序性能、網絡性能和雲服務監控工具的數據。 此外,團隊和個人儀表板是根據每個用戶的需求定制的。

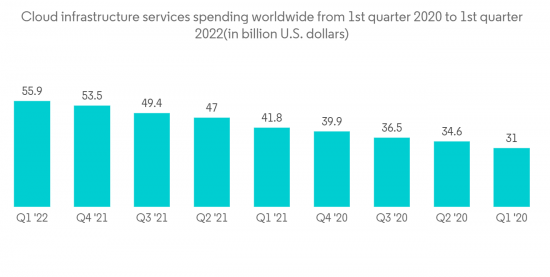

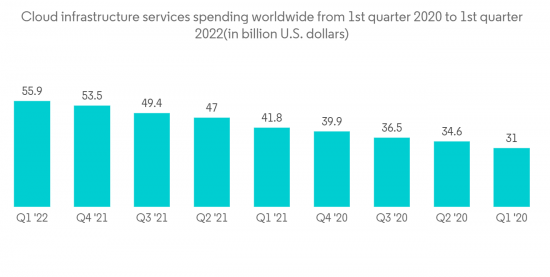

- 基於雲的技術的普及和進步正在推動需求並推動市場。 過去幾年,服務器故障修復和故障排除等日常任務已被外包,以減少對 IT 的關注,從而充分利用 IT 服務供應商的專業知識。 通過移動和雲進行數字化轉型的採用正在不斷增加,基礎設施正在實現現代化。 跟上最新技術改進的需要正在推動組織選擇基礎設施管理服務。

- 成本和運營效率的提高以及老化硬件的更換正在推動市場發展。 託管服務具有多項優勢,其中最重要的是持續關注運營和業務流程的持續改進。 據思科系統公司稱,託管服務可將內部經常性成本降低 30% 至 40%,並將效率提高 50% 至 60%。 此外,隨著新的和增強的設備被引入基礎設施,舊的硬件並不總是兼容。 隨著數據中心運營的增長,硬件可能會成為拖慢運營速度的負債,而不是為運營提供動力的資產。

- 利潤率下降以及對完整性和可靠性的擔憂正在限制市場增長。 移動性和雲計算等新興技術正在迅速改變商業格局。 企業必須與這些技術同步,才能為客戶提供所需的好處。 當將關鍵業務基礎設施託管外包給其他合作夥伴時,可靠性挑戰也會阻礙市場增長。

- 由於新冠肺炎 (COVID-19) 疫情的影響,企業對遠程工作表現出了極大的興趣。 在政府為阻止冠狀病毒傳播而實施的關閉期間,隨著企業越來越關心維持運營,雲服務的使用大幅增長。 大多數公司已經與託管雲服務提供商續簽了合同,預計雲遷移將變得更加普遍,並可能成為企業的推動力。 此外,企業和組織優先考慮將增強現實和機器學習等尖端技術集成到當前的 IT 基礎設施中,以推動數字化轉型。

託管基礎設施服務市場的趨勢

雲細分市場預計將呈現最高增長

- 雲採用的出現改變了託管基礎設施服務提供商 (MISP) 領域,採用了在公共雲或私有雲上提供技術服務的交付模式。 鑑於雲提供的優勢,MISP 與雲提供商(Google、AWS、Microsoft 等)合作,幫助企業選擇合適的雲提供商、遷移到雲以及管理遷移後的雲服務。我正在尋找

- 隨著企業需求的增加,許多公司正在改進其現有的託管雲基礎設施服務。 例如,2022 年 12 月,瑞士金融公司 Klarpay AG 決定使用 Amazon Web Services 構建其基於雲的基礎設施。 該公司沒有將資源投入到運行數據中心,而是專注於更高價值的活動,例如通過開發可擴展、支持 API 的交易功能等新功能來增強其銀行服務。

- 越來越多的消費者正在使用數字平台,這增加了對數字化持續進步的需求,即通過廣泛的網絡進行高速數據傳輸以存儲大量數據。Masu。 遠程學習、多人遊戲、視頻會議和直播都是推動 IT 行業消費者群體增長的技術示例。 IT組織需要巨大的服務器和數據存儲單元來存儲海量數據並提供更好的服務。

- 增強的雲基礎設施和支持物聯網的生態系統等近期技術趨勢為整個美國 IT 行業創造新的業務需求提供了機會,預計疫情期間美國的公有雲滲透率將會更高。 此外,富士通還被亞馬遜網絡服務(AWS)認證為AWS官方託管基礎設施提供商合作夥伴,在加速雲轉型、幫助加速數字化轉型以及加速企業和政府創新方面的能力得到了認可。 預計此類情況將在預測期內推動美國各地的市場需求。

亞太地區市場增長顯著

- 亞太地區的市場增長速度最快,因為它是中國和印度等各國 IT 和 IT 支持服務的主要來源地。 IBEF的數據顯示,2018年印度的IT和IT支持的服務業佔全球服務採購業務的比例超過55%。

- 最近,Yotta Infrastructure 於 2019 年 9 月 27 日啟用了印度首個超大規模數據中心園區。 近日,NTT公司於2019年7月在印度推出服務,成為印度全球11大ICT服務提供商之一。 NTT 計劃為金融服務、製藥、電信、能源和公用事業、製造、汽車和技術領域推出服務。

- 中國正在快速發展,有望成為邊緣計算、人工智能、自動駕駛汽車和物聯網等新興 IT 技術的全球領導者。 因此,對託管基礎設施服務的需求預計在未來幾年將猛增。 最近的舉動來自2019年8月的上海,當時政府發布了《關於促進跨國企業區域總部在上海發展的若干意見》,將上海發展為跨國企業總部。 《建議》旨在促進外資對上海服務業的投資。

託管基礎設施服務行業概覽

託管基礎設施服務市場高度分散,該行業存在許多大型、技術成熟的參與者,預計競爭對手將處於較高水平。 此外,為了維持市場、留住客戶,企業正在採取強有力的競爭策略,競爭企業之間的競爭正在加劇。 主要參與者包括富士通有限公司、思科系統公司和戴爾技術公司。 新興市場近期趨勢如下。

2022 年11 月,數字化轉型、高性能計算和信息技術基礎設施領域的全球領導者Atos 與Amazon.com, Inc. 的子公司Amazon Web Services, Inc. 簽訂基礎設施外包協議,Atos 客戶可以加速工作負載遷移到雲端並完成數字化轉型。 這項業界首創的多年期協議將使 Atos 和 AWS 進一步加強他們的戰略合作夥伴關係。 Atos 選擇 AWS 作為其首選企業雲提供商,AWS 也將 Atos 視為 IT 外包和數據中心轉型的戰略合作夥伴。 該合作夥伴關係將使 Atos 客戶能夠通過接收來自 Atos 的業務和技術諮詢、數字工程和託管服務來加速他們的雲之旅。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 市場定義和範圍

- 調查假設

第二章研究方法

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 行業利益相關者分析

- 行業吸引力 - 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的對抗關係

第五章市場動態

- 市場驅動因素

- 越來越多地使用雲託管基礎設施服務

- 雲技術的傳播和進步將推動需求

- 提高成本和運營效率,更換老化硬件

- 市場製約因素

- 利潤率下降、集成度和可靠性問題

- 新冠肺炎 (COVID-19) 對託管基礎設施服務市場的影響

第六章市場細分

- 按部署類型

- 本地

- 雲

- 按服務類型

- 桌面打印服務

- 服務器

- 庫存

- 其他

- 按最終用戶

- BFSI

- IT/通信

- 醫療保健

- 製造業

- 零售

- 其他最終用戶

- 地區

- 北美

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東/非洲

- 阿拉伯聯合酋長國

- 沙特阿拉伯

- 南非

- 其他中東/非洲

- 北美

第7章競爭格局

- 公司簡介

- Fujitsu Ltd

- Cisco Systems Inc.

- Dell Technologies Inc.

- IBM Corporation

- Hewlett Packard Enterprise

- Microsoft Corporation

- TCS Limited

- Canon Inc.

- Alcatel-Lucent SA(Nokia Corporation)

- Toshiba Corporation

- Verizon Communications Inc.

- Citrix Systems Inc.

- Deutsche Telekom AG

- Xerox Corporation

- Ricoh Company Ltd

- Lexmark International Inc.

- Konica Minolta Inc.

第8章 投資分析

第9章 市場機會與將來動向

The Managed Infrastructure Services Market size is expected to grow from USD 106.31 billion in 2023 to USD 172.94 billion by 2028, at a CAGR of 10.22% during the forecast period (2023-2028).

Technology trends such as analytics, Cloud, IoT, and Cognitive Computing are creating new business imperatives. Companies are adopting these digital technologies to build innovative business models, optimize business processes, empower their workforce, and personalize the customer experience.

Key Highlights

- Redundant downtime is reduced through managed services, which offer specialized value-added services like application testing, service catalog creation, and professional consulting. The market's development is aided by various monitoring tools and numerous layers of infrastructure controlled by separate teams. For instance, in BMC's "BMC Helix ITSM" the system is centralized, cloud-native, connected with observability, and optimized for AIOps. This solution fully exposes data from monitoring tools for IT infrastructure, application performance, network performance, and cloud services. Additionally, team and individual dashboards are customized to each user's needs.

- Technological proliferation and advancement of cloud-based technology boosting the demand is driving the market. Over the past few years, daily operations of break-fix and troubleshooting of servers have been outsourced to reduce their attention over IT, thereby allowing the expertise of IT service vendors. An increase in the adoption of digital transformation with mobility and cloud has led to infrastructure modernization. The need to keep up with the latest technological enhancements has led organizations to opt for infrastructure-managed services.

- Improved cost and operational efficiency and updates of outdated hardware are driving the market. Managed services offer several benefits, relentless focus on continuous improvement of operational and business processes being the most significant one. According to Cisco Systems, managed services reduce recurring in-house costs by 30-40% and increase efficiency by 50-60%. Moreover, as new and enhanced equipment is introduced to the infrastructure, the old hardware might not always be compatible. As data center operations increase, the hardware could become more of a liability which slows down operations, than an asset that enhances them.

- Declining profit margins and integration and reliability concerns are restraining the market to grow. Emerging technologies, such as mobility and cloud computing, are rapidly changing the business landscape. Companies have to be in sync with these technologies to deliver desired benefits to the customers. Reliability concerns are also challenging the market to grow when hiring another partner to host critical business infrastructure.

- Businesses are putting a lot of attention on remote working due to the COVID-19 pandemic. The use of cloud services grew significantly as companies became more concerned with maintaining operations during lockdowns imposed by various governments to stop the spread of the coronavirus. In anticipation of cloud migration becoming more widespread among corporations and, in some cases, even gaining traction, most businesses have already renewed their contracts with managed cloud service providers. Additionally, businesses and organizations prioritized integrating cutting-edge technologies like augmented reality and machine learning into their current IT infrastructure to promote digital transformation.

Managed Infrastructure Services Market Trends

The Cloud Segment is Expected to Exhibit the Highest Growth

- The advent of cloud deployment has brought changes in the managed infrastructure services providers (MISP) space and made them embrace a delivery model for delivering technology services over a public or private cloud. Considering the advantages the cloud offers, businesses are seeking MISPs that have partnerships with cloud providers (such as Google, AWS, Microsoft, etc.) to choose the right cloud providers, migrate to the cloud, and manage cloud services after the transition.

- With the increasing demand from enterprises, various companies have made advancements in their existing managed cloud infrastructure service. For instance, in December 2022, the Swiss finance company Klarpay AG decided to use Amazon Web Services to create its cloud-based infrastructure. Instead of spending its resources to operate a data center, the company concentrated on high-value tasks, such as enhancing its banking product by creating new features like scalable and API-enabled transactional capabilities.

- Increasingly more consumers are using digital platforms, which has increased the demand for ongoing digitalization advancements for high-speed data transport with wide network coverage for large amounts of data storage. Examples of technologies that have accelerated the growth of the consumer base in the IT business include distance learning, multiplayer gaming, videoconferencing, and live streaming. Enormous servers and data storage units are necessary for IT organizations to store large amounts of data and offer improved services.

- Recent technology trends, such as enhanced cloud infrastructure, IoT enabled ecosystems, have provided opportunities in creating new business imperatives across the US IT sector, and the penetration of public cloud in the United States is predicted to be higher during a pandemic. Additionally, Fujitsu has been recognized by Amazon Web Services (AWS) as an official AWS-managed infrastructure provider partner, thereby validating the company's capabilities in accelerating cloud transformation and helping fast-track digital transformation, and accelerating innovation for enterprises and government. Such instances are expected to fuel the demand of the market across the United States during the forecast period.

Asia-Pacific Account for a Significant Market Growth

- Asia-Pacific accounts to hold the highest market growth due to dominating sources of IT and IT-enabled services in various countries such as China and India. According to IBEF, the Indian IT and IT-enabled services industry accounted for over 55% of the global services sourcing businesses in 2018.

- India most recently got its first hyper-scale data center park on September 27, 2019, where Yotta Infrastructure inaugurated this facility. Also, most recently, In July 2019, NTT Ltd launched its services in India and became the world's top 11 ICT service provider to enter India. NTT plans to introduce an array of services for financial services, pharmaceuticals, telecommunications, energy & utilities, manufacturing, automotive and technology sectors.

- China is going through rapid development and is set to be the global leader in new emerging IT technologies like Edge computing, Artificial intelligence, Autonomous cars, and IoT. Due to which, there is going to be a surge in demand for managed infrastructure services in the future. The most recent development in August 2019 was from Shanghai, where the Government released the "Several Opinions on Promoting the Development of Multinational Corporation Regional Headquarters in Shanghai" to develop Shanghai as the headquarters for MNCs. This suggestion was made to boost foreign investment in the service sector of Shanghai.

Managed Infrastructure Services Industry Overview

The managed infrastructure services market is highly fragmented as many large, technologically established players are present in the industry, and the rivalry is expected to be on the higher side. Additionally, in order to sustain in the market and retain their clients, companies are employing powerful competitive strategies, thereby intensifying competitive rivalry in the market. Key players are Fujitsu Ltd, Cisco Systems Inc., Dell Technologies Inc., etc. Recent developments in the market are -

In November 2022, Atos, a global leader in digital transformation, high-performance computing, and information technology infrastructure, and Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, Inc., today announced a global Strategic Transformation Agreement. This agreement enables Atos customers with large-scale infrastructure outsourcing contracts to accelerate workload migrations to the cloud and complete digital transformation. With the multiyear, first-in-the-industry deal, Atos and AWS can further their strategic partnership. Atos has chosen AWS as its preferred enterprise cloud provider, and AWS has identified Atos as a strategic partner for IT outsourcing and data center transformation. With the help of this arrangement, Atos' clients may hasten their transitions to the cloud by receiving business and technology advisory, digital engineering, and managed services from Atos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing use of Cloud Managed Infrastructure Services

- 5.1.2 Technological Proliferation and Advancement of Cloud Based Technology Boosting the Demand

- 5.1.3 Improved cost and Operational Efficiency and Update of Outdated Hardware

- 5.2 Market Restraints

- 5.2.1 Declining Profit Margins and Integration and Reliability Concerns

- 5.3 Impact of COVID-19 on Managed Infrastructure Services Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Services Type

- 6.2.1 Desktop and Print Services

- 6.2.2 Servers

- 6.2.3 Inventory

- 6.2.4 Other Types

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Retail

- 6.3.6 Other End Users

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 UK

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 UAE

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Dell Technologies Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Hewlett Packard Enterprise

- 7.1.6 Microsoft Corporation

- 7.1.7 TCS Limited

- 7.1.8 Canon Inc.

- 7.1.9 Alcatel-Lucent SA (Nokia Corporation)

- 7.1.10 Toshiba Corporation

- 7.1.11 Verizon Communications Inc.

- 7.1.12 Citrix Systems Inc.

- 7.1.13 Deutsche Telekom AG

- 7.1.14 Xerox Corporation

- 7.1.15 Ricoh Company Ltd

- 7.1.16 Lexmark International Inc.

- 7.1.17 Konica Minolta Inc.