|

市場調查報告書

商品編碼

1273522

血液腫瘤學檢測市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Hemato Oncology Testing Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,血液腫瘤檢測市場預計將以近 5% 的複合年增長率增長。

COVID-19 疫情對確保世界各地用於癌症治療的醫院資源產生了重大影響。 例如,根據<血液腫瘤學>(Hematological Oncology) 2022 年 10 月發表的一篇文章,COVID-19 大流行給患者和醫護人員帶來了沉重負擔,包括淋巴瘤護理,這可能會惡化患者的預後。它徹底改變了全球腫瘤學的實踐。 此外,根據 2022 年 9 月發表在<臨床腫瘤學雜誌>上的一篇論文,在美國進行的一項研究發現,在最初的大流行期間,新診斷的多發性骨髓瘤患者減少了 22%。 然而,在大流行的後期階段,對包括血癌在內的癌症診斷的需求有所增加。 因此,儘管在大流行初期面臨重大挑戰,但隨著 SARS-CoV-2 病例開始下降,癌症治療恢復正常,並且隨著時間的推移,市場經歷了顯著增長。

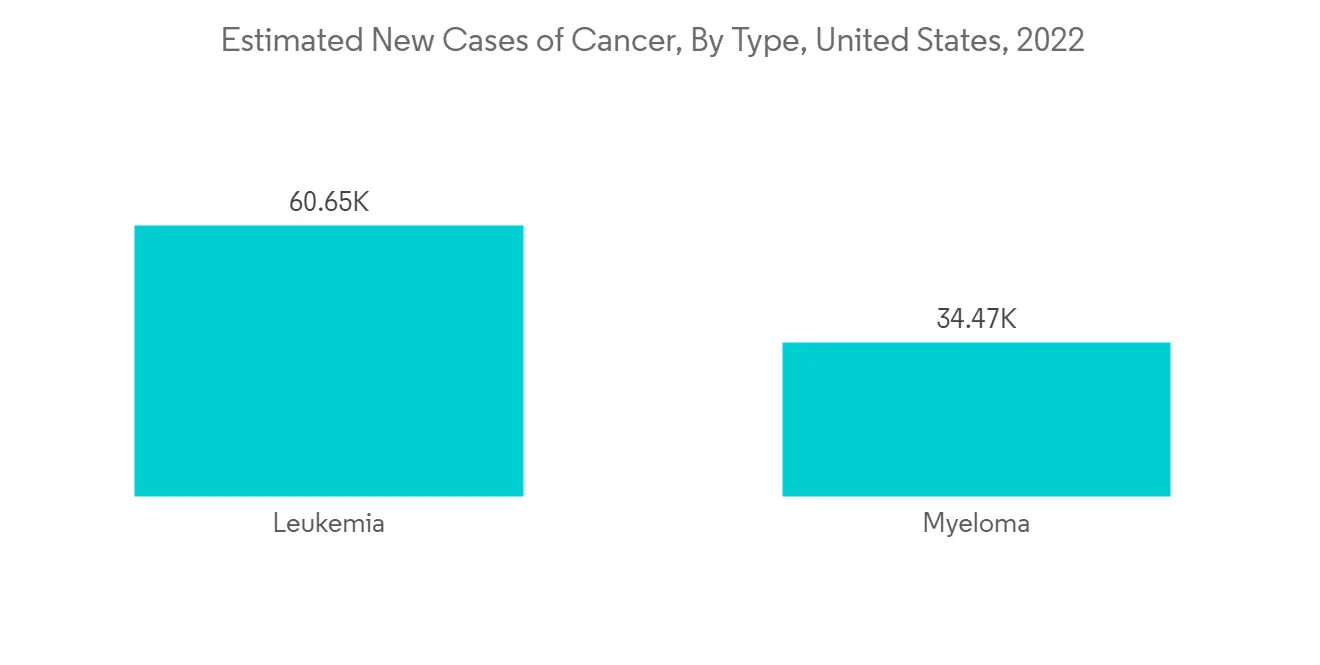

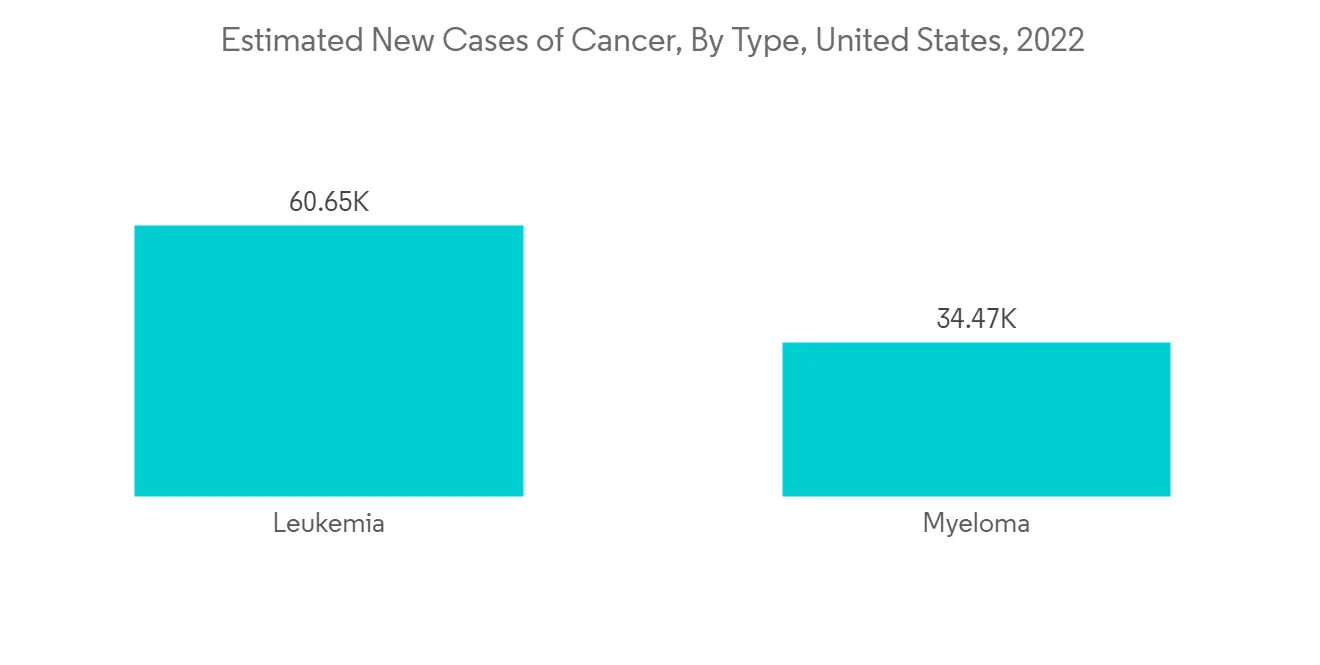

市場增長的驅動因素是血液系統癌症的發病率不斷上升以及對個性化治療的需求不斷增加。 根據 PubMed Central 於 2022 年 4 月更新的一篇論文,白血病是 5 歲以下兒童中最常見的癌症之一,導致高比例的死亡並給個人、家庭和國家帶來沉重負擔。 兒童白血病的爆發導致對血液腫瘤學檢測的需求增加,從而推動了對相關產品和服務的需求。

此外,對個性化醫療不斷增長的需求也對市場增長做出了重大貢獻。 個性化醫療旨在根據患者疾病的分子基礎為個體患者提供量身定制的治療,近年來變得流行起來。 各種類型癌症的患病率上升,針對癌症藥物和其他各種疾病適應症的個性化藥物治療的可負擔性,個性化藥物的副作用較少,新興市場的價格較高滲透率是創造個性化藥物需求的一個因素。 此外,多家公司正在進行研究,以證明個性化醫療在血液相關癌症中的有效性。 例如,2021 年 9 月,加州大學癌症中心的研究人員參加了一項全國協作的個性化醫學臨床試驗,以開發血液癌和骨癌的個性化治療方法。

此外,產品發布也在推動市場的增長。 例如,2022 年 5 月,Genes2Me 在印度推出了基於下一代測序 (NGS) 的腫瘤學、個性化醫療和遺傳病臨床組合。 此外,2021 年 10 月,Sysmex Inostics 開發了一種新的液體活檢測試,用於檢測急性髓性白血病(AML)中的微小殘留病(MRD)。 這項名為"AML-MRD-SEQ"的新測試使用靶向下一代測序 (NGS) 面板,涵蓋 20 個基因和 68 個區域,包括已建立的 MRD 標記,如 NPM1。

但是,不利的贖回情景可能會減緩所研究市場的增長。

血液腫瘤學市場趨勢

預計服務業在預測期內將經歷顯著增長

在預測期內,預計血液腫瘤檢測市場的服務領域將出現顯著增長。 這是由於人們對個性化醫療等先進療法的認識不斷提高,以及白血病、非霍奇金淋巴瘤和骨髓瘤等癌症的患病率不斷上升。

與傳統醫學不同,精準醫學基於每個患者獨特的基因構成,並為血液系統惡性腫瘤提供更好的治療選擇。 例如,2022年7月,國家癌症中心對國家癌症中心與大塚製藥株式會社聯合開發的血液系統癌症(血液系統惡性腫瘤)基因組檢測進行了前瞻性隊列研究,結果顯示非常有用。 因此,預計這種血液腫瘤檢測方法將促進血液惡性腫瘤的檢測服務。

此外,白血病、非霍奇金淋巴瘤和骨髓瘤在世界範圍內的高患病率正在推動研究領域的增長。 例如,根據澳大利亞癌症協會2022年8月公佈的數據,2022年澳大利亞估計有5202例新診斷的白血病病例。 因此,全球淋巴瘤、白血病和骨髓瘤癌症的高發增加了對血液腫瘤檢測服務的需求,從而推動了研究市場的增長。

同樣,根據 2021 年 ICMR-國家疾病信息學和研究中心的一份報告,白血病佔印度 0-14 歲男性和女性所有兒童癌症的近一半。2021 年男孩的患病率為 46.4%女孩為 44.3%。 2021 年,男孩中另一種常見的兒童癌症是淋巴瘤 (16.4%)。 因此,預計血液癌症的高患病率將推動被調查市場的增長。

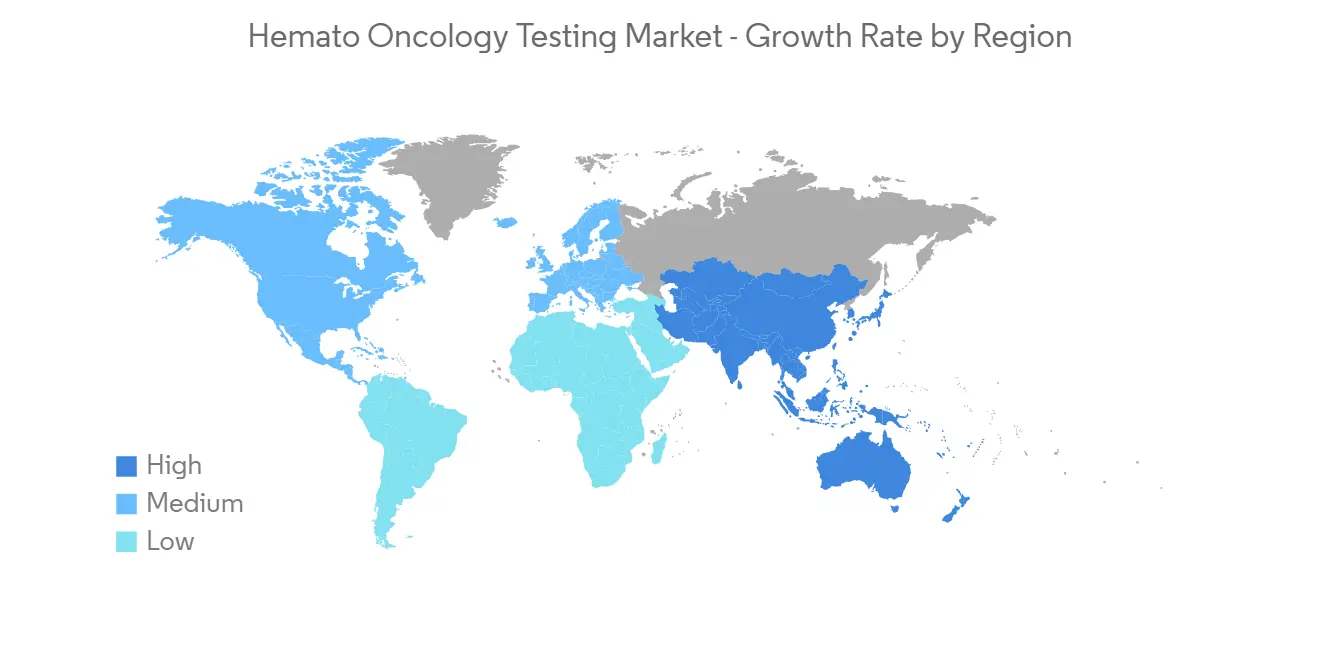

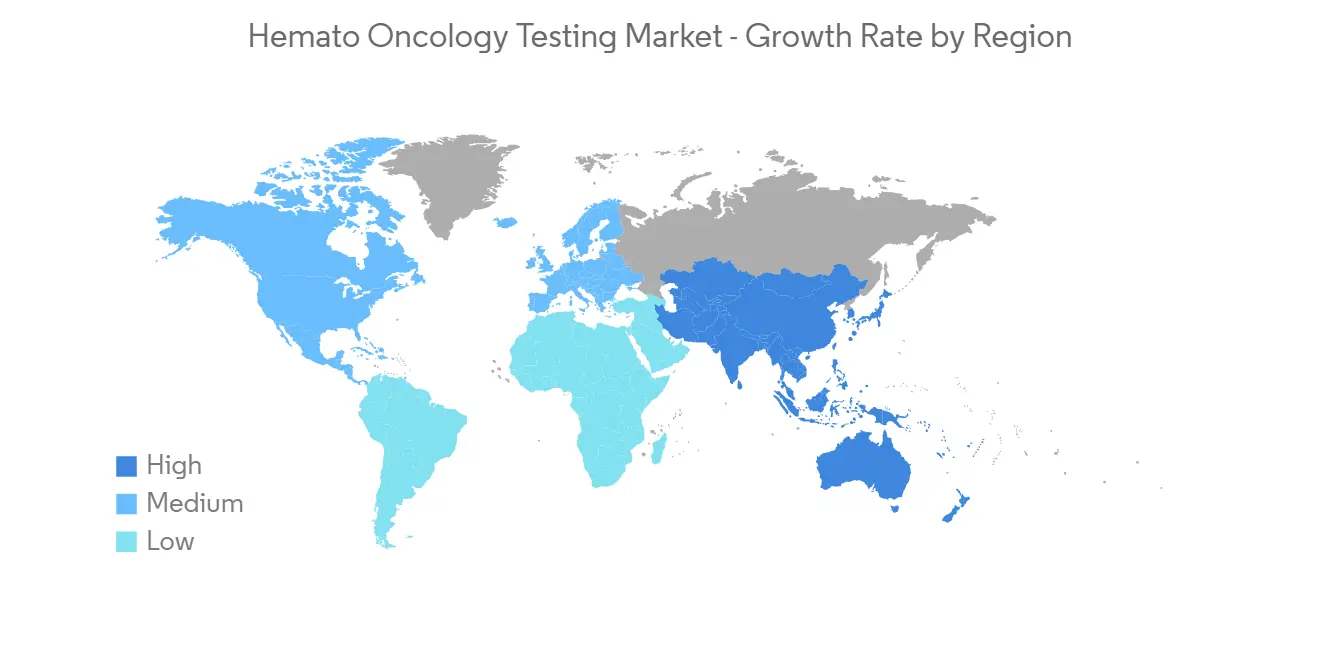

預計在預測期內北美將顯著增長

北美處於該地區增長的前沿,也是全球舞台上重要的收入來源。 該細分市場的很大份額主要歸因於血癌的高發率、人口老齡化、對先進治療的認識以及該地區行業參與者的強大影響力。

白血病、淋巴瘤和多發性骨髓瘤患病率上升正在推動該地區的市場增長。 例如,根據加拿大癌症協會2022年的統計數據,2021年約有6700名加拿大人被診斷出患有白血病,其中男性4000人,女性2700人。 此外,根據美國癌症協會2023年的數據,預計2023年美國將診斷出約59,610例新發白血病病例和20,380例急性髓性白血病(AML)病例。 因此,血液腫瘤患者的高發病率導致血液腫瘤檢測的增加,推動了該地區的市場。

此外,各種組織正在採取措施改善血癌治療,這有望推動市場增長。 例如,2021 年,白血病和淋巴瘤協會 (LLS) 宣布已提供超過 2.41 億美元的贈款,幫助美國 42,000 多名血癌患者。 因此,這些努力也支持了市場的增長。

血液腫瘤行業概覽

血液腫瘤學市場分散且競爭激烈。 公司採用各種戰略,包括收購、合作、研究活動投資和新產品發布,以在全球市場上從競爭對手中脫穎而出。 該市場由幾家大型企業組成,其中幾家大型企業目前主導著市場,包括 F. Hoffmann-La Roche Ltd、Abbott、QIAGEN、Thermo Fisher Scientific Inc. 和 Illumina Inc.。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 血癌發病率增加

- 對個性化治療的需求不斷增長

- 市場製約因素

- 不利的保險報銷情況

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按產品/服務

- 檢測試劑盒和試劑

- 服務

- 按癌症類型

- 白血病

- 淋巴瘤

- 多發性骨髓瘤

- 其他

- 按技術

- 聚合□鍊式反應 (PCR)

- 免疫組織化學 (IHC)

- 下一代測序 (NGS)

- 其他技術

- 最終用戶

- 醫院

- 學術和研究機構

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- F. Hoffmann-La Roche Ltd

- Abbott

- Invitae Corporation(Archerdx, Inc)

- QIAGEN

- Thermo Fisher Scientific Inc.

- Illumina Inc.

- Bio-Rad Laboratories, Inc.-

- Molecularmd(Subsidiary of Icon PLC)

- Asuragen, Inc.

- Arup Laboratories Inc.

- Icon PLC

- Adaptive Biotechnologies.

- Invivoscribe, Inc.

第7章 市場機會與將來動向

The Hemato Oncology Testing Market is expected to register a CAGR of nearly 5% during the forecast period.

The COVID-19 outbreak significantly impacted the availability of hospital resources for cancer care worldwide. For instance, according to an article published by Hematological Oncology in October 2022, the COVID-19 pandemic introduced significant changes in oncologic practice globally, including lymphoma care with a substantial burden on patients and healthcare providers and the potential worsening of patient outcomes. Moreover, according to an article published by the Journal of Clinical Oncology in September 2022, a study was conducted in the United States, which showed that the number of newly diagnosed multiple myeloma patients decreased by 22% during the initial pandemic. However, in the later phase of the pandemic, there was an increase in the demand for cancer diagnostics, including hematological cancers. Thus, the market witnessed significant challenges during the initial phase of the pandemic, but as the SARS-CoV-2 cases started to decline, cancer care went back to normal, and the market witnessed significant growth over time.

The factors that are driving the market growth are the increasing incidence of hematologic cancer and the growing demand for personalized therapy. According to an article updated by PubMed Central in April 2022, leukemia is considered one of the most common cancers in children younger than five years of age, and it accounts for a high percentage of deaths, creating a significant burden on individuals, families, and countries. The occurrence of leukemia in children is leading to the increase in demand for hemato oncology testing, thereby driving the demand for products and services associated with it.

Besides, the growing demand for personalized therapy is also significantly contributing to the market growth. Personalized medicine aims to provide tailor-made therapies to individual patients depending on the molecular basis of the disease, and it has become popular over recent years. The rise in the prevalence of various types of cancer, affordability of personalized medicine therapy in cancer drugs and various other disease indications, fewer side-effects of personalized medicine, and high adoption in developed markets are factors that are creating demand for personalized therapy. Moreover, various firms are conduction studies to prove the effectiveness of personalized medicine in blood-related cancer. For instance, in September 2021, the UC Cancer Center researchers joined a national collaborative, personalized medicine clinical trial for developing personalized treatments for blood and bone cancer.

Additionally, the launch of products is also propelling the market's growth. For instance, in May 2022, Genes2Me launched next-generation sequencing (NGS) based clinical panels for oncology, personalized medicine, and hereditary diseases in India. Furthermore, in October 2021, Sysmex Inostics developed a new liquid biopsy test for the detection of minimal residual disease (MRD) in acute myeloid leukemia (AML). The new test, AML-MRD-SEQ, uses a targeted next-generation sequencing (NGS) panel that covers 68 regions across 20 genes, including established MRD markers such as NPM1.

However, unfavorable reimbursement scenarios may slow down the growth of the studied market.

Hemato Oncology Testing Market Trends

Services Segment is Expected to Witness Significant Growth over the Forecast Period

The services segment is expected to witness significant growth in the hemato-oncology testing market over the forecast period. This can be attributed to increasing awareness of advanced therapies such as personalized medicine and the rising prevalence of leukemia, non-Hodgkin lymphoma, and myeloma cancers.

Precision medicine is based on each patient's unique genetic makeup as opposed to traditional medicine, and it provides better treatment for hemato oncology treatment. For instance, in July 2022, The National Cancer Center conducted a prospective cohort study on the gene panel testing for blood cancers (hematological malignancies) developed with Otsuka Pharmaceutical Co., and it showed that the clinical utility of the panel testing was notably high in diagnosis and prognosis. Thus, such initiatives in hemato-oncology testing are expected to boost the testing services for hemato-oncological diseases.

Also, the high global prevalence of leukemia, non-Hodgkin's lymphoma, and myeloma cancer is driving the growth of the studied segment. For instance, according to the data published by Cancer Australia in August 2022, an estimated 5,202 new cases of leukemia were diagnosed in Australia in 2022. Thus, the high incidence of lymphoma, leukemia and myeloma cancer globally is increasing the demand for hemato oncology testing services, thereby propelling the growth of the studied market.

Similarly, according to a report published by ICMR-National Centre for Disease Informatics and Research in 2021, leukemia accounted for nearly half of all childhood cancers in both genders in the 0-14 years age group in India; it had a prevalence of 46.4% in boys and 44.3% in girls in 2021. The other common childhood cancer in boys was found to be lymphoma (16.4%) in 2021. Hence, the high prevalence of hematologic cancers is expected to drive the growth of the studied market.

North America Region is Expected to Witness Significant Growth over the Forecast Period

North America is at the forefront of growth in the region and is also an important revenue contributor in the global arena. The large share of this segment can primarily be attributed to the high incidences of hematologic cancer, the aging population, awareness regarding advanced treatment methods, and the strong presence of industry players in the region.

The rising prevalence of leukemia, lymphoma, and multiple myeloma is stimulating the growth of the market in the region. For instance, as per the Canada Cancer Society's statistics for 2022, around 6,700 Canadians were diagnosed with leukemia in 2021, out of which 4,000 were men and 2,700 were women. Also, as per the American Cancer Society's data for 2023, around 59,610 new cases of leukemia and 20,380 new cases of acute myeloid leukemia (AML) are expected to be diagnosed in the United States in 2023. Thus, the high incidence of blood cancer cases is leading to an increase in hemato oncology testing, thereby driving the market in the region.

Furthermore, various organizations are taking initiatives for better blood cancer care which is expected to drive market growth. For instance, in 2021, the Leukemia & Lymphoma Society (LLS) announced that they provided more than USD 241 million in grants to support over 42,000 blood cancer patients in the United States. Hence, such initiatives are also supporting market growth.

Hemato Oncology Testing Industry Overview

The hemato-oncology testing market is fragmented and competitive in nature. The companies have been following various strategies such as acquisitions, partnerships, investments in research activities, and new product launches to sustain themselves among the competitors in the global market. The market consists of several major players, and a few of the major players are currently dominating the market, which include F. Hoffmann-La Roche Ltd, Abbott, QIAGEN, Thermo Fisher Scientific Inc., and Illumina Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Hematologic Cancer

- 4.2.2 Growing Demand for Personalized Therapy

- 4.3 Market Restraints

- 4.3.1 Unfavorable Reimbursement Scenario

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product & Services

- 5.1.1 Assay Kits and Reagents

- 5.1.2 Services

- 5.2 By Cancer Type

- 5.2.1 Leukemia

- 5.2.2 Lymphoma

- 5.2.3 Multiple Myeloma

- 5.2.4 Others

- 5.3 By Technology

- 5.3.1 Polymerase chain reaction (PCR)

- 5.3.2 Immunohistochemistry (IHC)

- 5.3.3 Next-Generation Sequencing (NGS)

- 5.3.4 Other Technology

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Academic & Research Institutes

- 5.4.3 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 F. Hoffmann-La Roche Ltd

- 6.1.2 Abbott

- 6.1.3 Invitae Corporation (Archerdx, Inc)

- 6.1.4 QIAGEN

- 6.1.5 Thermo Fisher Scientific Inc.

- 6.1.6 Illumina Inc.

- 6.1.7 Bio-Rad Laboratories, Inc.-

- 6.1.8 Molecularmd (Subsidiary of Icon PLC)

- 6.1.9 Asuragen, Inc.

- 6.1.10 Arup Laboratories Inc.

- 6.1.11 Icon PLC

- 6.1.12 Adaptive Biotechnologies.

- 6.1.13 Invivoscribe, Inc.