|

市場調查報告書

商品編碼

1523323

FEP塗層(氟樹脂塗層):市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Fluorinated Ethylene Propylene (FEP) Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

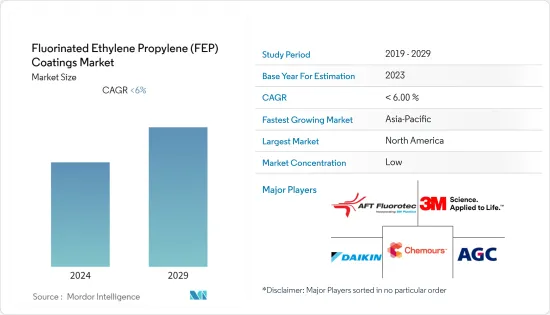

FEP塗料(含氟聚合物塗料)市場規模預計2024年為4.2395億美元,預計2029年將達到5.3928億美元,預測期內(2024-2029年)複合年成長率為4.93%。

2020年,COVID-19大流行對市場產生了負面影響。然而,市場現已達到疫情前的水平,預計未來幾年將穩定成長。

主要亮點

- 電子和食品加工行業的需求不斷成長預計將主導市場。

- 日益嚴重的環境問題和嚴格的環保署 (EPA) 法規可能會阻礙市場成長。

- 光纖產業的新應用預計將在未來幾年推動市場成長。

- 北美主導市場,美國和加拿大等國的消費量最高。

FEP塗料市場趨勢

電氣和電子產業的高需求

- FEP塗層是電子電氣行業重要的塗層材料之一。由於 FEP 是一種優異的絕緣體,因此能夠保留和運輸製造過程中使用的刺激性化學品,因此非常適合提供電氣絕緣,同時在收縮到電線上時具有耐化學性。

- 半導體積體電路透過微影製程、蝕刻、清洗、薄膜沉澱和拋光等製程製造。

- FEP 塗層適用於半導體產業的應用,並用於晶圓載體、管道、附件和泵浦組件等製造流程中,使其成為半導體製造中輸送高純度化學品的理想選擇。

- 特殊等級的 FEP 塗層是為了滿足半導體行業的高要求而開發的,該行業生產個人電腦、行動電話、LCD、等離子和 LED 顯示器等電子設備。

- 根據半導體產業協會(SIA)的結論與預測,2023年全球半導體產業銷售額約5,268億美元,較2022年下降8.2%。 2023年初全球半導體銷售額處於低位,但下半年強勁復甦。此外,預計2024年全球半導體銷售額將出現兩位數左右的市場成長。

- 此外,根據電子情報技術產業協會(JEITA) 的數據,到 2023 年 1 月,國內平面電視出貨量將達到 365,000 台,以支撐市場成長。

- 預計這些因素將在預測期內增加 FEP 塗料市場的需求。

北美市場佔據主導地位

- 對 FEP 塗層的高需求是由於北美食品加工、光纖、電子、石油和天然氣以及化學加工行業的成長。

- 例如,根據加拿大農業、農業和食品部(AAFC)的數據,以產值計算,食品和飲料加工業是加拿大最大的製造業,2022年商品銷售額達1,565億美元。

- 此外,根據全球電信 IT 之聲 VanillaPlus 稱,2022 年新增電纜需求預計約 9,130 萬光纖公里,2025 年將達到 1.27 億光纖公里。這種成長趨勢預計將推動 FEP 塗料市場的發展。

- 由於人們對包裝食品的過度依賴以及食品加工公司的牢固立足點,北美食品加工行業的成長強勁。泰森食品、雀巢和百事可樂是該地區營運的重要食品加工公司。這些公司正在推動市場成長。

- 因此,各種應用需求的不斷成長預計將大幅增加對 FEP 塗料的需求。

FEP塗裝產業概況

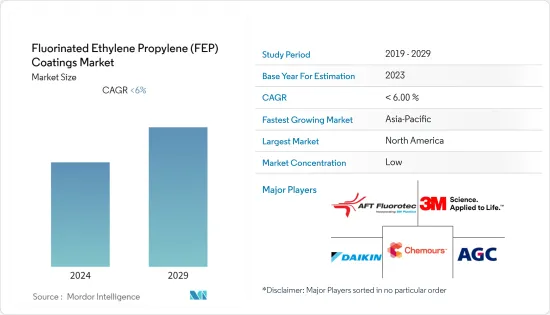

FEP 塗料市場部分分散。該市場的主要參與者包括(排名不分先後)AGC Inc.、3M、DAIKIN INDUSTRIES Ltd.、AFT Fluorotec Limited 和 The Chemours Company。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 食品業不沾黏應用中 PTFE 的經濟高效替代品

- FEP 塗層在電子設備半導體領域的興起

- 抑制因素

- 日益嚴重的環境問題和嚴格的 EPA 法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 依產品類型

- 粉末塗料

- 液體塗料

- 按用途

- 烹調器具/食品加工

- 化學處理

- 油和氣

- 電力/電子

- 光纖

- 醫療保健

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐的

- 土耳其

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 阿拉伯聯合大公國

- 埃及

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- 3M

- AFT Fluorotec Limited

- AGC Inc.

- DAIKIN INDUSTRIES Ltd

- Dongyue Chemical

- GMM Pfaudler

- Fluorocarbon Group

- Hubei Everflon Polymer Co. Ltd

- Impreglon UK Limited

- INOFLON

- Praxair ST Technology Inc.

- Precision Coating Company Inc.

- Rudolf Gutbrod GmbH

- Shanghai 3F New Materials Co. Ltd

- The Chemours Company

- Toefco Engineered Coating Systems Inc.

- Zeus Company Inc.

第7章 市場機會及未來趨勢

The Fluorinated Ethylene Propylene Coatings Market size is estimated at USD 423.95 million in 2024, and is expected to reach USD 539.28 million by 2029, growing at a CAGR of 4.93% during the forecast period (2024-2029).

In 2020, the COVID-19 pandemic negatively impacted the market. However, the market has now reached pre-pandemic levels and is expected to grow steadily in the coming years.

Key Highlights

- The increasing demand for electronic appliances and the food processing sector is expected to dominate the market.

- Rising environmental concerns and stringent EPA regulations may hinder the growth of the market.

- In the coming years, the market is expected to grow due to new applications in the optical fiber industry.

- North America dominated the market, with the largest consumption in countries such as the United States and Canada.

Fluorinated Ethylene Propylene (FEP) Coatings Market Trends

High Demand from Electrical & Electronics Industry

- FEP coatings are one of the important coatings materials in the electrical and electronics industry. They have the ability to hold and transport harsh chemicals that are used during manufacturing processes since FEP is an outstanding insulator and is ideal in providing electrical insulation while conferring chemical resistance when shrunk over wires.

- Integrated circuits of semiconductors are produced using photolithography, etching, cleaning, thin film deposition, and polishing.

- FEP coatings are well suited for applications in the semiconductor industry, where they are used in the process of manufacturing wafer carriers, tubing, fittings, and pump parts, which are ideal for transporting high-purity chemicals in semiconductor manufacturing.

- Special grades of FEP coatings are being developed to meet the high demand of the semiconductor industry, which produces electronic equipment such as personal computers, cellular phones, LCDs, plasma, and LED displays.

- As per the conclusions and estimations of the Semiconductor Industry Association (SIA), global semiconductor industry sales were around USD 526.8 billion in 2023, marking a decrease of 8.2% compared to 2022. It was observed that global semiconductor sales were low in early 2023 but rebounded strongly during the second half of the year. Furthermore, it was estimated that around double-digit market growth will be observed in the global semiconductor sales in 2024.

- As per the Japan Electronics and Information Technology Industries Association (JEITA), Japan transported 365 thousand units of flat-panel-display TVs domestically in January 2023, thereby boosting market growth.

- These aforementioned factors are expected to increase the demand in the FEP coatings market during the forecast period.

North America to Dominate the Market

- The high demand for fluorinated ethylene propylene (FEP) coatings is due to the rising food processing, fiber optics, electronics, oil and gas, and chemical processing industries in North America.

- For instance, according to Agriculture and Agri-Food Canada (AAFC), the food and beverage processing industry was the most significant manufacturing industry in Canada in terms of value of production, with sales of goods worth USD 156.5 billion in 2022.

- Furthermore, the demand for new cabling was about 91.3 million f-km (fiber kilometers) in 2022, and it is projected to reach 127 million fk-m by 2025, according to VanillaPlus - the global voice for telecoms IT. Such growth trends are expected to propel the market for fluorinated ethylene propylene (FEP) coatings.

- The growth of the food processing sector in North America is robust due to people's excessive dependence on packaged food products and the strong foothold of food processing companies. Tyson Foods, Nestle, and PepsiCo are important food processing companies operating in the region. These companies help boost market growth.

- In March 2022, Nestle announced an investnment plan of USD 675 million in a new plant in Metro Phoenix, Arizona, United States, to produce beverages such as oat milk coffee creamers to meet the increasing consumer demand for plant-based products. The plant is expected to start operation in 2024, thus boosting market growth in the food processing sector.

- Thus, the increasing demand from various applications is expected to surge the demand for fluorinated ethylene propylene (FEP) coatings in the near future.

Fluorinated Ethylene Propylene (FEP) Coatings Industry Overview

The fluorinated ethylene propylene (FEP) coatings market is partially fragmented. Some of the major players in the market include AGC Inc., 3M, DAIKIN INDUSTRIES Ltd, AFT Fluorotec Limited, and The Chemours Company (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Cost-effective Alternative to PTFE in Non-stick Applications of the Food Industry

- 4.1.2 Rising Prominence of FEP Coatings in the Semiconductors of Electronic Appliances

- 4.2 Restraints

- 4.2.1 Rising Environmental Concerns and Stringent EPA Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product Type

- 5.1.1 Powder Coating

- 5.1.2 Liquid Coating

- 5.2 By Application

- 5.2.1 Cookware and Food Processing

- 5.2.2 Chemical Processing

- 5.2.3 Oil and Gas

- 5.2.4 Electrical & Electronics

- 5.2.5 Fiber Optics

- 5.2.6 Medical

- 5.2.7 Othe Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AFT Fluorotec Limited

- 6.4.3 AGC Inc.

- 6.4.4 DAIKIN INDUSTRIES Ltd

- 6.4.5 Dongyue Chemical

- 6.4.6 GMM Pfaudler

- 6.4.7 Fluorocarbon Group

- 6.4.8 Hubei Everflon Polymer Co. Ltd

- 6.4.9 Impreglon UK Limited

- 6.4.10 INOFLON

- 6.4.11 Praxair S.T. Technology Inc.

- 6.4.12 Precision Coating Company Inc.

- 6.4.13 Rudolf Gutbrod GmbH

- 6.4.14 Shanghai 3F New Materials Co. Ltd

- 6.4.15 The Chemours Company

- 6.4.16 Toefco Engineered Coating Systems Inc.

- 6.4.17 Zeus Company Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications in the Optical Fiber Industry