|

市場調查報告書

商品編碼

1273442

手術和手術托盤市場——增長、趨勢、COVID-19 的影響和預測 (2023-2028)Procedure Trays Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,程序和手術托盤市場預計將以 7.5% 的複合年增長率增長。

COVID-19 在大流行期間對市場增長產生了重大影響。 這是由於對執行手術和限制感染傳播的醫療程序和手術托盤的需求不斷增長。 2022 年 2 月在國家醫學圖書館發表的研究結果發現,在最初的 COVID-19 激增期間,外科服務暫時停止,但醫療系統繼續支持胸外科患者,尤其是那些有腫瘤原因的患者。我們繼續提供安全護理給我們的病人。 此外,Avia S. Mattingly 及其同事於 2021 年 12 月發表的一項研究發現,在美國,在 2020 年 3 月建議停止擇期手術後,手術總數立即下降了 48.0%。 然而,在大流行期間最初有所下降之後,手術數量有所增加,研究中的市場預計將在未來幾年全面反彈。

市場增長歸因於手術數量的增加、採購時間和成本的減少,以及政府對預防和控制醫療保健相關感染的有利監管。 根據經合組織2022年8月更新的統計數據,2021年葡萄牙、丹麥、愛爾蘭、挪威等部分歐洲國家的手術量(單位:千例)分別為94.87例、49.33例、32.84例、21.5例。 歐洲發達國家如此龐大的手術數量將導致手術期間手術和手術托盤的採用率增加,從而推動預測期內手術和手術托盤市場的增長。

此外,醫療保健支出的增加以及對新醫院和診所的投資以及現有醫院的擴建預計將在預測期內推動研究領域的增長。 例如,2021 年 3 月,加拿大安大略省政府宣布計劃擴建新的 Gray Bruce Health Services Markdale 醫院以及設備採購等其他活動,預計將對市場增長產生積極影響。投資美國4180萬美元至 因此,預計增加對醫院的投資將提高治療能力,並在預測期內提高手術和手術托盤市場的增長率。

但是,缺乏標準化預計會限制預測期內的市場增長。

治療和手術托盤市場趨勢

預計在預測期內門診手術中心部分將佔據很大的市場份額

門診手術中心 (ASC) 是一個最先進的醫療機構,提供當日手術護理,包括診斷和預防程序。 也被稱為不需要住院的門診手術中心,該國對 ASC 服務不斷增長的需求預計將推動研究部門的增長。 此外,全球越來越多的 ASC 預計將推動採用具有成本效益和節省時間的程序和手術托盤。

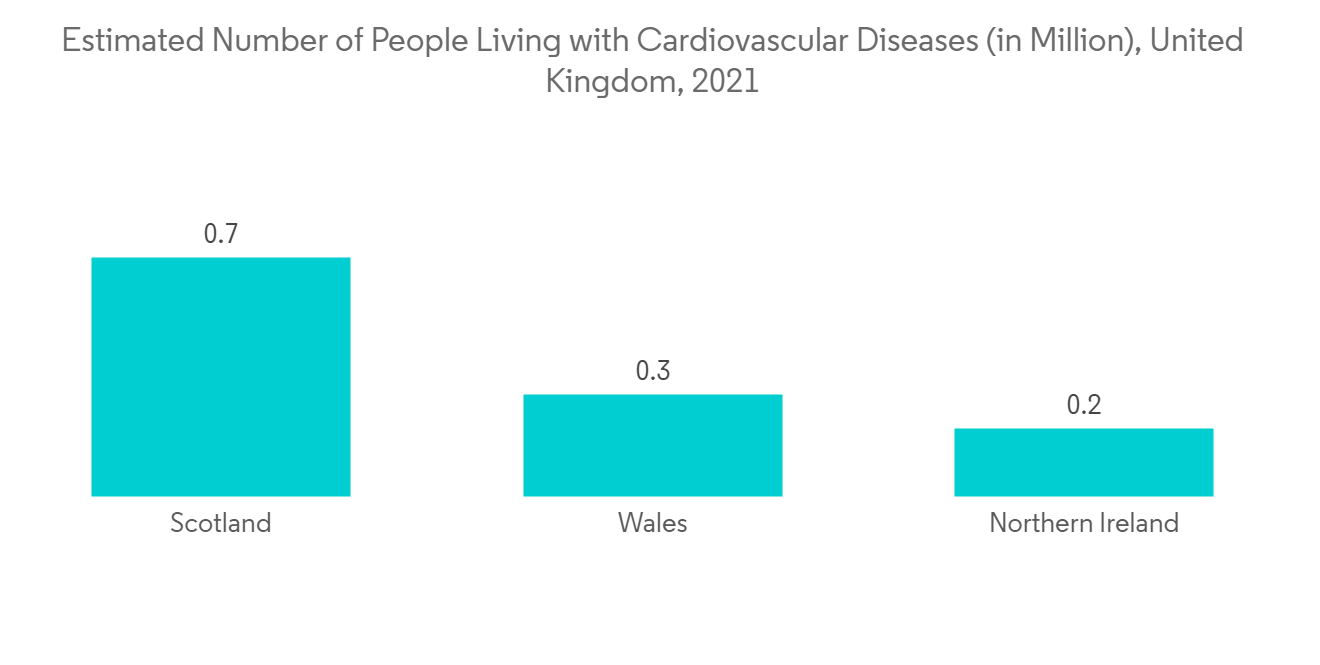

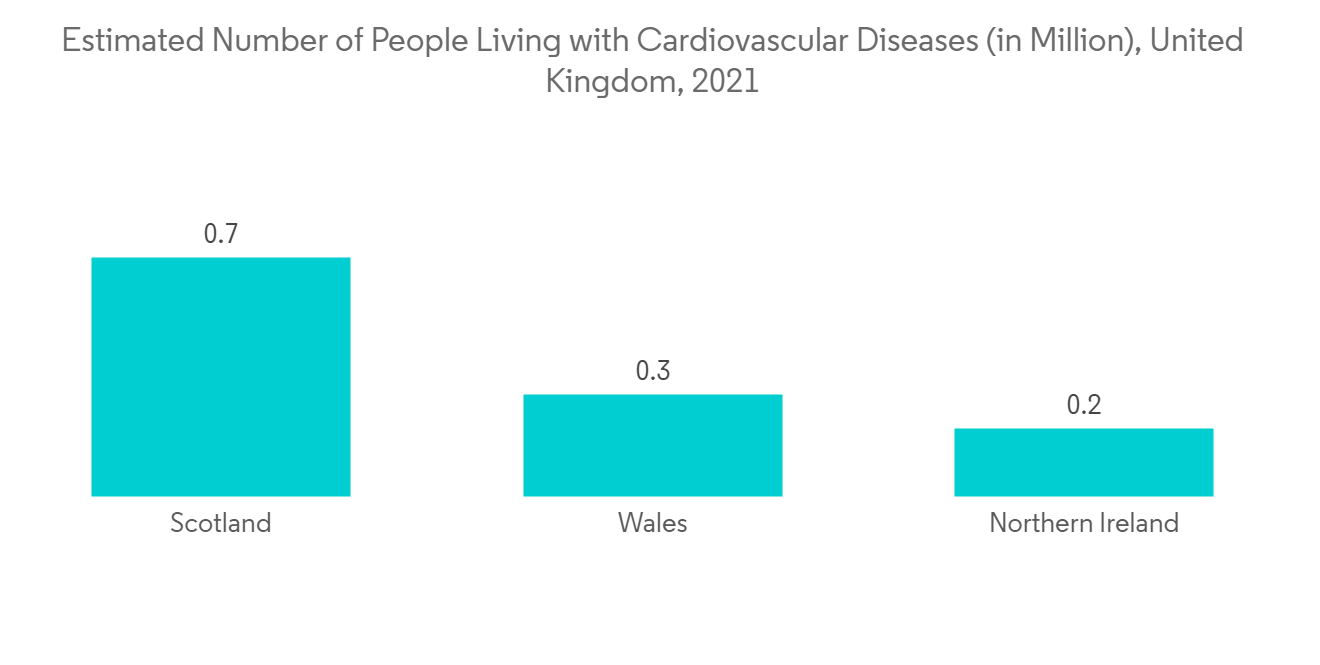

心血管疾病等慢性病患病率的增加預計將推動該細分市場的增長。 例如,根據 BHF 於 2022 年發布的一項研究,到 2021 年英國將有約 760 萬人患有心血管疾病。 此外,根據美國心臟協會2021年發表的一篇論文,美國每年約有4萬名兒童接受先天性心臟手術。 心血管手術的這種增加導致程序托盤的廣泛使用,有助於預測期內研究部分的增長。

此外,增加對 ASC 的投資也是推動細分市場增長的因素之一。 例如,2021 年 5 月,總部位於亞利桑那州的 Joel Rainwater 在亞利桑那州吉爾伯特推出了一個旗艦綜合外科中心,其中包括三個配備先進成像系統的手術室。 該公司已從投資者那裡獲得 1.25 億美元的資金,併計劃在未來兩年內開設 20 家分店。 同樣,2021 年 4 月,超級混合門診手術中心將在南加州開業,提供奧蘭治縣最全面的門診血管手術服務,並展示對門診手術未來的變革願景。我來了。 因此,慢性病患病率的增加以及對 ASC 投資的增加預計將在預測期內增加細分市場的增長。

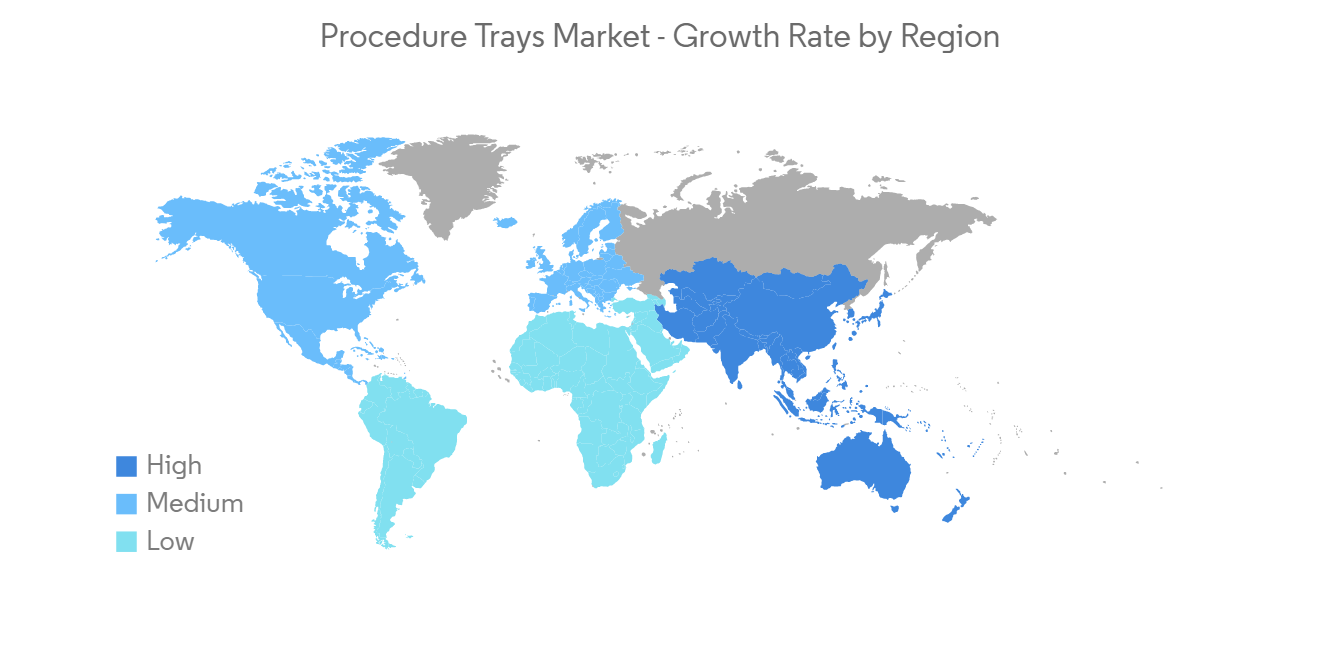

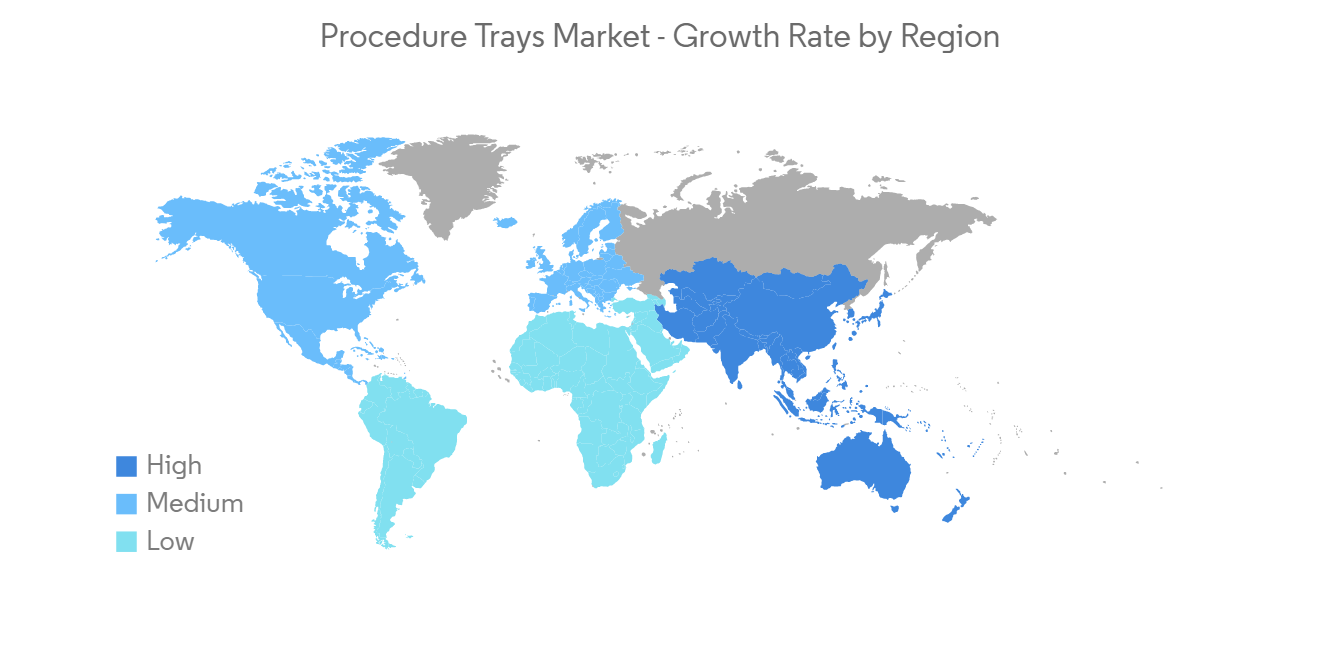

預計在預測期內北美將佔據很大的市場份額

由於外科手術數量的增加、研發支出的增加、患者對微創手術的偏好增加以及技術進步,預計北美將在全球手術和手術托盤市場中佔據重要的市場份額。冠心病是根據美國疾病控制與預防中心 (CDC) 於 2022 年 7 月更新的數據,最常見的心髒病類型影響了大約 2010 萬 20 歲及以上的美國人。 此外,增加對美國醫院基礎設施的投資預計將有助於分析期間的市場增長。 例如,2022 年 5 月,醫療保健信息管理系統協會 (HIMSS) 宣布,州、領地、地方和部落 (STLT) 公共衛生建議在十年內總投資近 367 億美元,以實現基礎設施現代化。 此類公共衛生基礎設施發展投資計劃有望為程序托盤創造機會,並推動預測期內研究的市場增長。

此外,加拿大政府正在增加對醫療保健的投資,以確保可獲得、公共和高質量的醫療保健。 2022 年 3 月,聯邦政府向眾議院提交了 C-17 法案,以提供 20 億美元的額外醫療資金,清理因 COVID-19 大流行而延遲的 700,000 例手術和其他醫療程序,支持數千例後續手術。 預計此類手術的增加將增加對手術期間使用的輔助托盤的需求。 從而促進所研究市場的增長。

同樣,2022 年 4 月,墨西哥哈利斯科州政府將在未來三年內投資 3.015 億美元用於醫療保健基礎設施建設,以建設新的醫院和醫療保健中心,並對現有醫院和醫療保健中心進行升級。我計劃投資更多。 此外,“墨西哥社會保障醫院(IMSS)”分享了到2024年投資6.772億美元建設111家新醫院的計劃。 預計這將推動所研究市場的增長。 預計這些投資將為醫院和診所的手術和手術托盤提供新的機會,推動該國整體市場的增長。

因此,隨著北美疾病負擔的增加以及政府正在採取措施改善醫療保健基礎設施,預計北美研究市場將在預測期內增長。

手術和手術托盤行業概覽

手術和手術托盤市場競爭適中,由幾家大型企業組成。 目前主導市場的公司包括 Molnlycke Health Care、Becton、Dickinson 和 Company、CPT Medical, Inc、Owens & Minor, Inc、Cardinal Health、Merit Medical Systems、Teleflex Incorporated、3M 和 B. Braun Melsungen AG。有公司例如

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 手術次數增加

- 減少採購時間和成本

- 市場製約因素

- 缺乏標準化

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分(基於價值的市場規模)

- 按產品分類

- 血管造影

- 手術室

- 眼科

- 其他

- 最終用戶

- 醫院

- 醫務室

- 門診手術中心

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Molnlycke Health Care

- Becton, Dickinson and Company

- CPT Medical, Inc.

- Owens & Minor, Inc

- Cardinal Health

- Merit Medical Systems

- Teleflex Incorporated

- 3M

- B. Braun Melsungen AG

- Baxter

- Boston Scientific Company

- Medline Industries Inc

第七章市場機會與未來趨勢

The procedure trays market is expected to register a CAGR of 7.5% during the forecast period.

COVID-19 had a significant impact on the growth of the market during the pandemic period. This is due to the rising demand for medical procedure trays to perform surgeries and reduce the spread of infection. The study published in the National Library of Medicine in February 2022 stated that the surgical services were temporarily shut down during the initial COVID-19 surge, but the healthcare system continues to offer safe care for thoracic surgery patients, especially those with oncologic reasons. Additionally, according to the research study published in December 2021 by Avia S. Mattingly et al., in the United States, there was a 48.0% decrease in total surgical procedure volume immediately after the March 2020 recommendation to cancel elective surgical procedures. However, the number of surgeries increased after the initial decline during the pandemic, and it is expected that the studied market will bounce back to its full potential in the coming years.

The growth of the market is attributed to an increasing number of surgeries, a decrease in procurement time and costs, and favorable government regulations for the prevention and control of healthcare-associated infections. According to the OECD statistics updated in August 2022, the number of surgeries (in thousand) performed in some European countries such as Portugal, Denmark, Ireland, and Norway in 2021 include 94.87, 49.33, 32.84, and 21.5. Such a huge number of surgeries in developed European countries will lead to increased adoption of procedural trays during the surgeries, driving the growth of the procedure trays market over the forecast period.

Furthermore, the increasing healthcare expenditure along with investment in new hospitals and clinics along with the expansion of existing ones are expected to boost growth in the studied segment over the forecast period. For instance, in March 2021, the Ontario government, a Canadian province, invested USD 41.8 million in the new Grey Bruce Health Services Markdale Hospital for expansion and other activities like the purchase of instruments which is expected to have a positive impact on the growth, of the market. Thus, such increasing investments in hospitals are expected to increase the procedural capacity, which is expected to increase the market growth for procedural trays over the forecast period.

However, a lack of standardization is expected to restrain the growth of the market over the forecast period.

Procedure Trays Market Trends

Ambulatory Surgical Centres Segment is Expected to Hold a Significant Market Share Over the Forecast Period

Ambulatory Care Centers (ACCs) or Ambulatory Surgical Centers (ASCs) are modern medical facilities providing same-day surgical care, including diagnostic and preventive procedures. They are also known as outpatient surgical centers where procedures do not require hospital admissions, and rising demand for ASC services in the country is expected to drive growth in the studied segment. In addition, the growing number of ASCs worldwide will result in the high adoption of procedure trays as these are cost-effective and time-saving.

The increasing prevalence of chronic diseases such as cardiovascular diseases is expected to propel the growth of the market segment. For instance, as per the study published by the BHF in 2022, around 7.6 million people will be living with cardiovascular disease in the United Kingdom in 2021. Also, the article published by the American Heart Association in 2021, approximately 40,000 children undergo congenital heart surgery in the United States each year. Such an increasing number of cardiovascular surgeries leading to the extensive usage of procedural trays, thereby contributing to the growth of the studied segment during the forecast period.

Furthermore, increasing investment in ASCs is another factor in segment growth. For instance, in May 2021, Arizona-based Joel Rainwater launched a flagship Comprehensive Surgical Care center in Gilbert, Arizona, that includes three operating rooms equipped with advanced imaging systems. The company is backed by USD 125 million in funding from an investor and plans to open 20 locations in the next two years. Similarly, in April 2021, a super-hybrid ambulatory surgical center was opened in Southern California, which offers the most comprehensive outpatient vascular surgical services within Orange County and represents a transformative vision for the future of ambulatory surgery. Thus, the increasing prevalence of chronic diseases coupled with the increasing investment in ASCs is expected to increase segmental growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share in the global procedure trays market due to the rising number of surgical procedures, growing research and development expenditure, rising patient preference for minimally invasive procedures, and technological advancements Centers for Disease Control and Prevention (CDC) data updated in July 2022 shows that coronary heart disease is the most common type of heart disease, and approximately 20.1 million adults of age 20 and older have the disease in the United States. Additionally, the rise in investments in hospital infrastructure in the United States is predicted to contribute to the market growth over the analysis period. For instance, in May 2022, the Healthcare Information and Management Systems Society (HIMSS) recommended a total investment of nearly USD 36.7 billion for more than ten years to modernize State, Territorial, Local, and Tribal (STLT) public health infrastructures to ensure readiness for ongoing and emerging public health emergencies. Such investment plans for public health infrastructure development are anticipated to create opportunities for procedural trays, driving the studied market growth over the forecast period.

Furthermore, the government of Canada focuses more on healthcare investments to ensure accessible, public, high-quality healthcare. In March 2022, the federal government introduced Bill C-17 in the House of Commons, providing USD 2 billion in additional healthcare funding to clear 700,000 surgeries and other medical procedures delayed by the Covid-19 pandemic and support thousands of additional surgeries. These increases in surgeries are expected to create demand for the procedural trays used during the surgeries for assistance and ease. Thereby driving the studied market growth.

Similarly, in April 2022, the Jalisco government, Mexico, planned to invest more than USD 301.5 million in healthcare infrastructure over the next three years to build new hospitals and healthcare centers and upgrade existing ones. Additionally, the "Mexican Social Security Institute (IMSS)" shared plans to invest USD 677.2 million to build 111 new hospitals by 2024. This is expected to drive the studied market growth. These investments are predicted to provide a new opportunity for procedural trays in hospital and clinic settings, bolstering the overall market growth in the country.

Thus, owing to the growing burden of diseases and initiatives taken by the government to improve healthcare infrastructure, the studied market in North America is expected to project growth over the forecast period.

Procedure Trays Industry Overview

The procedure trays market is moderately competitive and consists of several major players. Some of the companies which are currently dominating the market are Molnlycke Health Care, Becton, Dickinson, and Company, CPT Medical, Inc., Owens & Minor, Inc, Cardinal Health, Merit Medical Systems, Teleflex Incorporated, 3M, and B. Braun Melsungen AG among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Surgeries

- 4.2.2 Decrease in Procurement time and Costs

- 4.3 Market Restraints

- 4.3.1 Lack of Standardization

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Angiography

- 5.1.2 Operating Room

- 5.1.3 Ophthalmology

- 5.1.4 Others

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Clinics

- 5.2.3 Ambulatory Surgical Centres

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Molnlycke Health Care

- 6.1.2 Becton, Dickinson and Company

- 6.1.3 CPT Medical, Inc.

- 6.1.4 Owens & Minor, Inc

- 6.1.5 Cardinal Health

- 6.1.6 Merit Medical Systems

- 6.1.7 Teleflex Incorporated

- 6.1.8 3M

- 6.1.9 B. Braun Melsungen AG

- 6.1.10 Baxter

- 6.1.11 Boston Scientific Company

- 6.1.12 Medline Industries Inc