|

市場調查報告書

商品編碼

1273415

無創呼吸機市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Non-invasive Ventilators Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,無創通氣 (NIV) 市場的複合年增長率預計為 5.9%。

COVID-19 大流行的爆發對研究市場產生了重大影響。 突然爆發的大流行最初對市場產生了短期的負面影響,因為到醫院和診所就診的患者減少了。 然而,在大流行後期,COVID-19 患者和其他慢性呼吸道疾病患者對 NIV 的需求增加,市場出現顯著增長。 根據 2021 年 3 月發表在《臨床呼吸雜誌》上的研究結果,NIV 與持續氣道正壓通氣 (CPAP) 一起被廣泛用於治療中度至重度急性呼吸衰竭 (ARF) 患者。 此外,在一項針對中度至重度 COVID-19 感染患者的研究中,NIV 在總研究人群中的成功率為 48%,NIV 後重症監護病房 (ICU) 潛伏患者的存活率為 57%。得出的結論是,它已經被證實。 因此,目標患者的高生存率增加了對 NIV 的需求。 這對市場增長做出了重大貢獻,預計在預測期內將繼續增長。

預計在預測期內,呼吸系統疾病患者數量的增加和對非侵入性手術的需求激增等因素將推動市場增長。 此外,與各種類型的無創 (NIV) 呼吸機相關的優勢也是增加設備採用和推動市場增長的因素。

慢性呼吸道疾病會影響呼吸道和肺部的其他部位。 呼吸道症狀是初級保健中心就診的主要原因之一。 主要可預防的慢性呼吸道疾病包括哮喘、慢性阻塞性肺疾病(COPD)、過敏性鼻炎、睡眠呼吸暫停和結核病(主要是耐多藥結核病)。 這些患者需要機械通氣以獲得更好的結果。 根據 2022 年 6 月發表在 NCBI 上的一篇文章,無創正壓通氣可在正壓下為肺部充氧,無需氣管插管,可用於急性和慢性呼吸衰竭。

此外,正如 2022 年 6 月在 LLICM 上發表的一篇論文所述,NIV 已成功用於術後低氧血症。 此外,面罩 NIV 已被證明可以改善氣體交換,減少呼吸問題,並改善患有慢性阻塞性肺病 (COPD)、因肥胖引起的換氣過度呼吸衰竭和心源性肺水腫的患者的臨床結果。已知可以改善 因此,該系統的相關優勢正在增加這些設備的採用,這有望推動市場的增長。

但是,與呼吸機相關的並發症和副作用(例如感染肺炎的風險)可能會降低產品採用率並阻礙市場增長。

無創通氣的市場趨勢

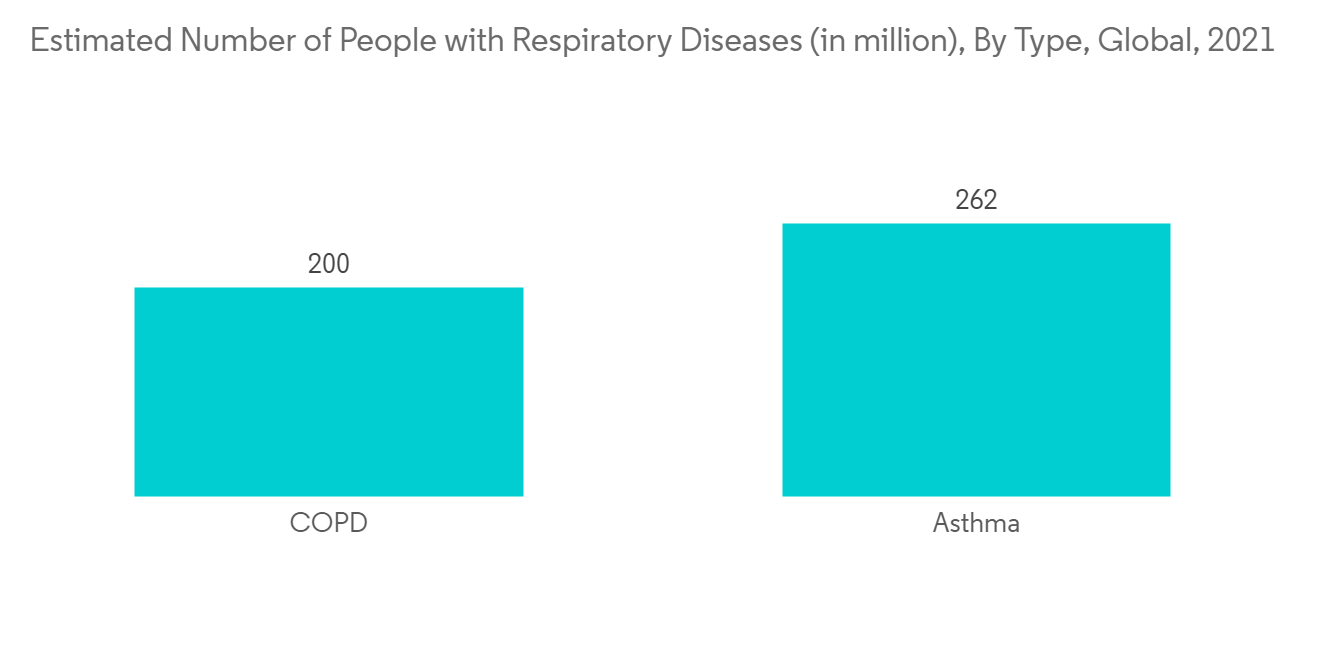

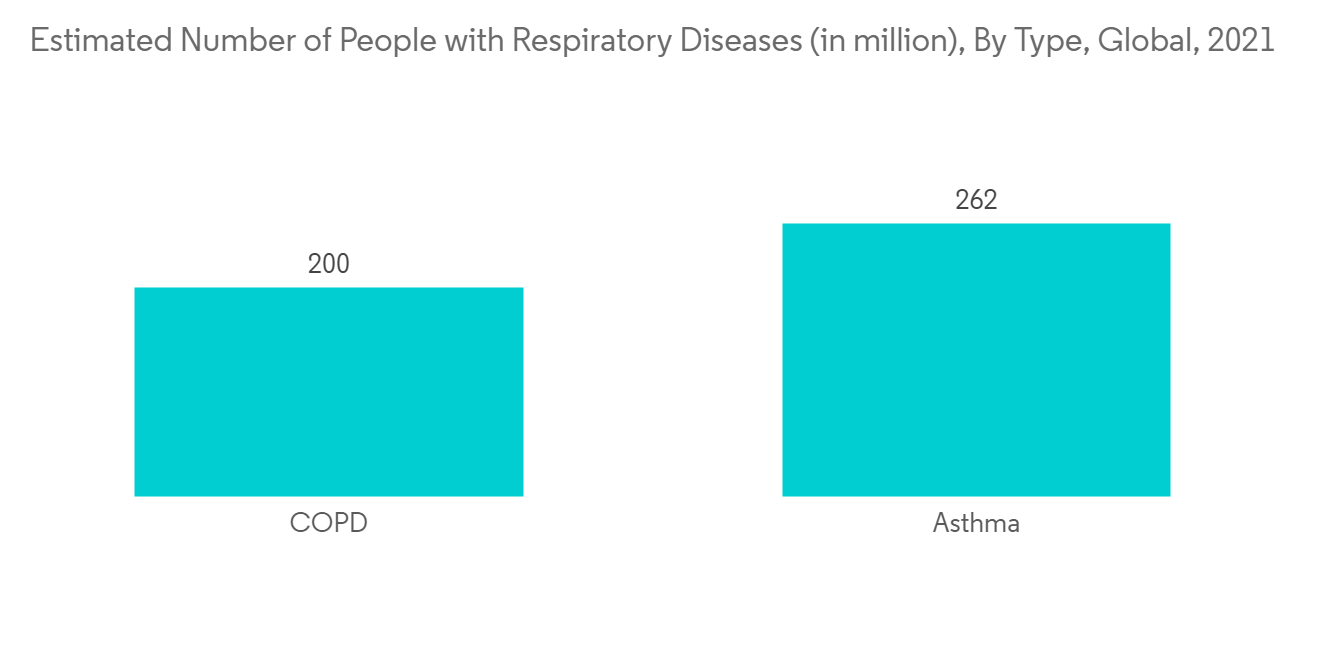

COPD 和哮喘預計在預測期內將顯著增長

慢性阻塞性肺病是一種危及生命的進行性肺部疾病,會導致呼吸急促(最初是在用力時)並且容易惡化。 此外,嚴重的病例可能會增加長期緊急治療的需要。 此外,哮喘是在受試者中發現的最常見但複雜的異質性炎症性氣道疾病之一。 因此,預計哮喘和慢性阻塞性肺病等呼吸急症的大量發生將增加 NIV 的應用並加速該細分市場的增長。

根據 2022 年 9 月發表在《美國呼吸與重症監護醫學雜誌》上的一篇論文,全球每年有近十分之一的人患有慢性阻塞性肺病。 而根據慢性阻塞性肺病全球倡議組織在2022年世界肺日發布的數據,上一年估計有近2億人患上COPD,哮喘每年影響約2.62億人,是常見的呼吸系統疾病之一。 多項研究表明,NIV 對患有哮喘和慢性阻塞性肺病的人群具有更多積極益處。 因此,疾病的高負擔預計會產生對 NIV 採用的需求,從而推動該領域的增長。

此外,根據 2022 年 5 月發表在美國轉化研究雜誌 (AJTR) 上的一篇論文,異丙托溴銨與無創通氣相結合可有效治療慢性阻塞性肺病和呼吸衰竭患者。 該系統可顯著改善循環炎症,改善患者肺功能和血氣濃度,取得更大療效。 因此,該系統的這些優勢有望在預測期內推動該細分市場的增長。 因此,該系統在治療 COPD 患者方面的優勢和應用有望在參與者之間創造競爭力,並有助於該領域的增長。

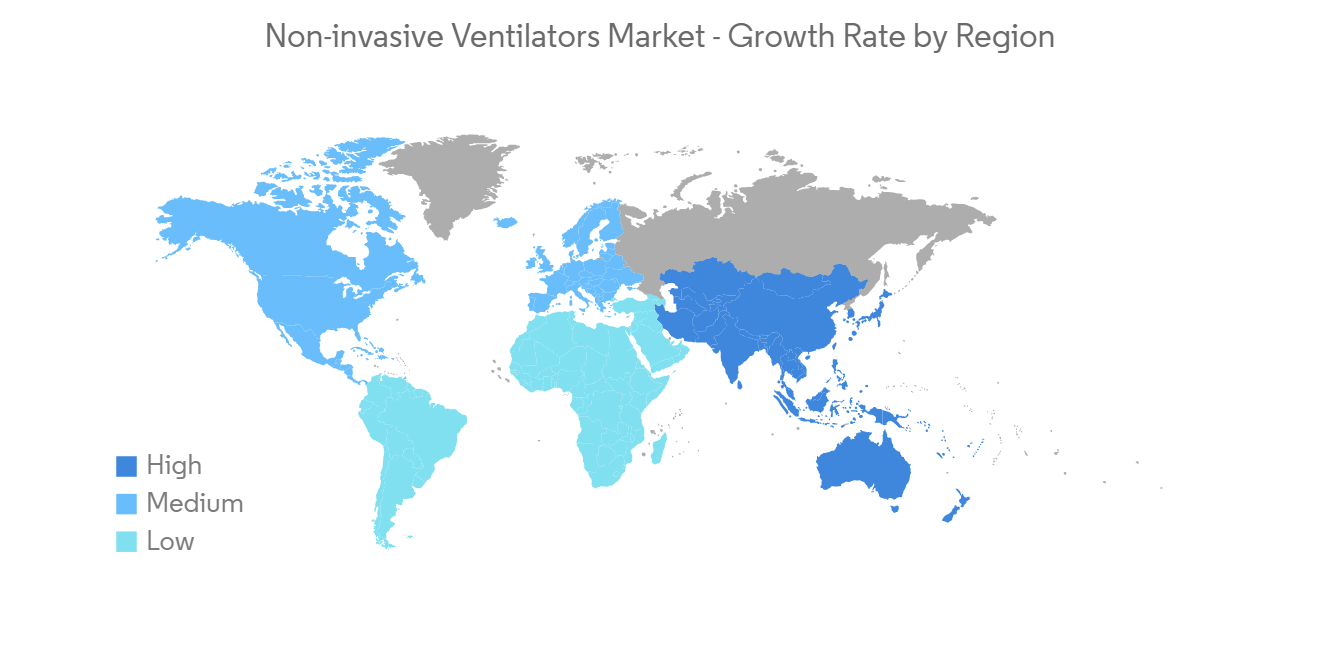

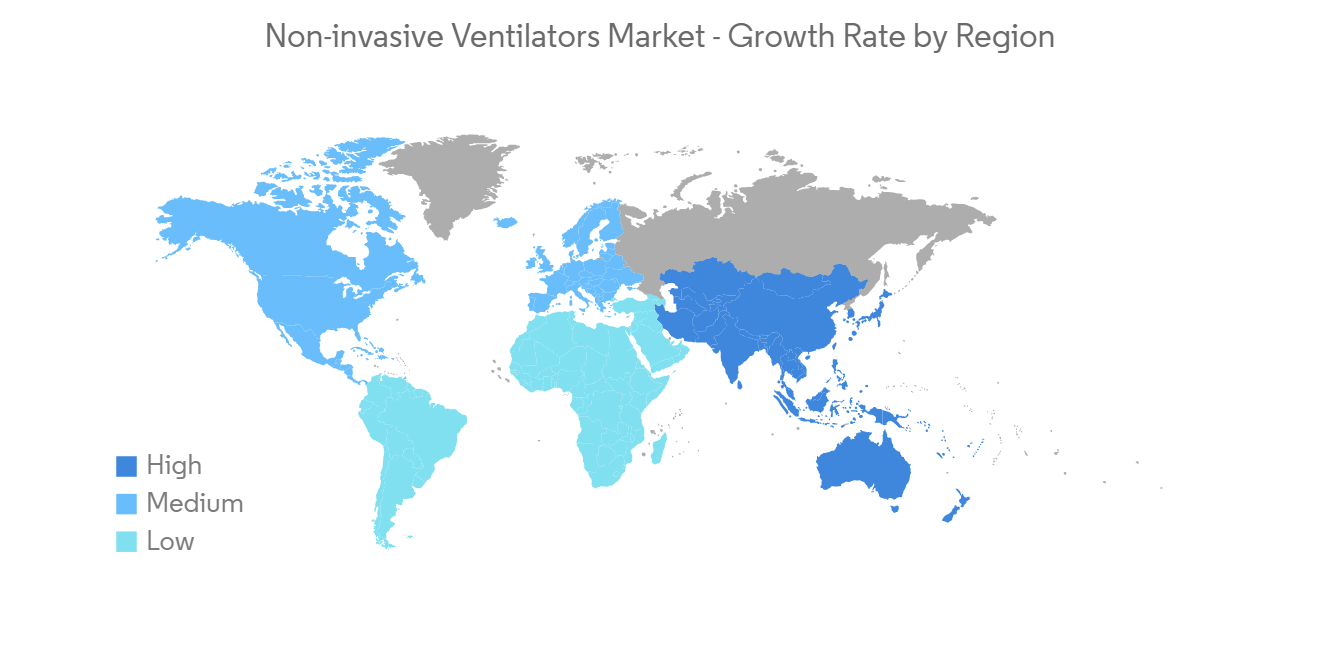

預計在預測期內北美將佔據主要市場份額

預計北美將佔據很大的市場份額,並且預計在預測期內其增長將繼續。 推動該地區市場增長的主要因素是各種呼吸系統疾病的流行和產品批准數量的增加。

呼吸系統疾病是該地區醫療保健負擔的主要原因之一,而哮喘是影響許多美國人生活質量的主要疾病之一。 根據美國過敏、哮喘和免疫學會 (ACAAI) 組織 2023 年 1 月的更新,美國每年有 439,000 例與哮喘相關的住院治療和近 130 萬例哮喘就診。 此外,如上所述,該國每年與哮喘相關的經濟成本為 560 億美元。

此外,根據 Lung Canada 組織 2023 年 1 月的更新,加拿大是哮喘患病率和發病率最高的國家,每年約有 270 萬加拿大人患有哮喘。 此外,如上述來源所述,哮喘和兒童住院是與工作時間損失和缺勤相關的第三大最重要因素。 預計此類疾病的高患病率將增加對 NIV 的需求並推動該地區的市場增長。

無創呼吸機行業概況

全球無創呼吸機市場競爭激烈,由許多大型企業組成。 主要參與者正專注於推出新產品並擴大其產品組合。 全球和區域參與者專注於戰略活動,例如夥伴關係、協作和收購。 全球市場的一些公司有ResMed Inc.、Teleflex Incorporated、Hamilton Bonaduz AG、HEYER Medical AG、Koninklijke Philips N.V.等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 呼吸系統疾病的患病率增加

- 慢性病患者人數增加,重症監護住院人數增加

- 市場製約因素

- 呼吸機相關性肺炎的風險

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分(基於價值的市場規模)

- 按產品分類

- 無創正壓通氣 (PPV)

- 雙水平氣道正壓 (BiPAP)

- 常規氣道正壓呼吸器 (CPAP)

- 自動滴定(調整)氣道正壓呼吸機 (APAP)

- 負壓通氣 (NPV)

- 無創正壓通氣 (PPV)

- 通過使用

- COPD 和支氣管哮喘

- 呼吸窘迫綜合徵

- 其他

- 最終用戶

- 醫院和診所

- 門診手術中心

- 其他

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- ResMed Inc.

- Teleflex Incorporated

- Hamilton Bonaduz AG

- heyer medical AG

- Koninklijke Philips N.V.

- Airon Corporation

- Fisher & Paykel Healthcare

- Mindray Medical International Limited

- Phoenix Medical Systems Pvt. Ltd.

- Smiths Medical, Inc.

- Dragerwerk AG & Co. KGaA

- Getinge AB

第7章 市場機會與將來動向

The non-invasive ventilators (NIV) market is expected to register a CAGR of 5.9% over the forecast period.

The onset of the COVID-19 pandemic had a significant impact on the market studied. Due to the sudden onset of the pandemic, a short-term negative impact was initially seen on the market, owing to the decreased patient visits to hospitals and clinics. However, the market witnessed immense growth in the later phases of the pandemic due to increased demand for NIV for COVID-19 patients and other chronic respiratory disease patients. As per a research study published in the Clinical Respiratory Journal in March 2021, along with continuous positive airway pressure (CPAP), NIV was widely used to treat patients with moderate to severe acute respiratory failure (ARF). Also, the researchers concluded that when a group of patients with moderate to severe COVID-19 infection were studied, NIV was successful in 48% of the total studied population, and a 57% survival rate was seen among the patients in the intensive care unit (ICU) incubation after NIV. Thus, due to the high survival rate among the target patients, the demand for the NIVs increased. This significantly contributed to the market's growth and is further expected to continue its growth trend during the forecast period.

Factors such as increasing cases of respiratory disorders and a rapid increase in demand for non-invasive procedures are anticipated to fuel the market growth during the forecast period. In addition, advantages associated with various types of non-invasive (NIV) ventilators are other factors associated with the increasing adoption of the devices and garnering the market's growth.

Chronic respiratory diseases affect the airways and other parts of the lungs. Respiratory symptoms are among the major causes of consultation with doctors and physicians in primary healthcare centers. Some of the major preventable chronic respiratory disorders are asthma, chronic obstructive pulmonary disease (COPD), allergic rhinitis, sleep apnea, and tuberculosis (principally, multi-drug resistant tuberculosis). These patients require ventilation for a better outcome. According to an article published in NCBI in June 2022, non-invasive positive pressure ventilation delivers oxygen into the lungs via positive pressure without the need for endotracheal intubation and is used in both acute and chronic respiratory failure.

In addition, as per an article published in the LLICM in June 2022, in post-operative hypoxemia, NIV has been successfully used. In addition, facemask NIV is known to improve gas exchange, reduce breathing issues and improve clinical outcomes in patients with hypercapnic respiratory failure due to chronic obstructive pulmonary disease (COPD), obesity-hypoventilation, and in patients with cardiogenic pulmonary edema. Thus, due to the associated benefits of the systems, the adoption of these devices is increasing and expected to fuel the growth of the market.

However, complications and side effects associated with ventilators, such as the risk of being affected with pneumonia, might lower the adoption of the products, hindering the market's growth.

Non-invasive Ventilators Market Trends

COPD and Asthma is Expected to Witness Significant Growth During the Forecast Period

COPD is a progressive life-threatening lung disease that causes breathlessness (initially with exertion) and predisposes to exacerbations. Moreover, serious illness may lead to an increasing need for emergency treatment for prolonged periods. In addition, asthma is one of the most common but complex heterogeneous inflammatory airway disorders seen among the target population. Thus, due to a high number of respiratory emergencies such as asthma and COPD, the application of NIV is expected to increase, thereby accelerating segmental growth.

According to an article published in the American Journal of Respiratory and Critical Care Medicine in September 2022, nearly 1 in 10 people are affected by COPD every year globally. In addition, as per the data published by the Global Initiative for Chronic Obstructive Lung Disease on World Lung Day 2022, nearly an estimated 200 million people had COPD in the previous year, and asthma is one of the most common respiratory diseases which affects approximately 262 million people annually. Various research suggests that NIV has more positive benefits for populations with asthma and COPD. Thus, the high burden of diseases is anticipated to create demand for the adoption of NIV and fuel the segment growth.

Additionally, according to an article published in the American Journal of Translational Research (AJTR) in May 2022, ipratropium bromide combined with non-invasive ventilation is effective in the treatment of patients with COPD and respiratory failure. The systems can significantly ameliorate circulatory inflammation and improve the pulmonary function and blood gas levels of patients and provide higher treatment efficacy. Thus, these benefits of the systems are anticipated to fuel the segment growth over the forecast period. Therefore, the advantages of the systems and applications in treating COPD patients are anticipated to create competitiveness among the players and contribute to the segment's growth.

North America is Expected to Hold a Significant Share of the Market Over the Forecast Period

North America is expected to hold a major share of the market, and it is predicted to continue its growth over the forecast period. The major factors fuelling the market growth in the region are the increasing prevalence of various respiratory diseases and the growing number of product approvals.

Respiratory disease is one of the major causes of healthcare burden in the region, and asthma is one of the major diseases that affect the quality of life for most Americans. According to the January 2023 update by the American College of Allergy, Asthma & Immunology (ACAAI) organization, the annual hospitalization related to asthma is 439,000, and asthma accounts for nearly 1.3 million emergency room visits annually in the United States. In addition, as per the source above, the economic cost related to asthma is USD 56,000 million annually in the country.

Additionally, as per the January 2023 update by the Lung Canada organization, the rate of prevalence and incidence of asthma is among the highest in Canada, and about 2.7 million Canadians live with asthma every year. Also, as per the source above, asthma is the third crucial factor related to work time lost and school absenteeism coupled with hospitalization for children. The high prevalence of the diseases is anticipated to increase demand for NIV, thereby driving market growth in the region.

Non-invasive Ventilators Industry Overview

The global non-invasive ventilators market is highly competitive and consists of a number of major players. The major companies are focused on new product launches and the expansion of their product portfolio. The global and regional players focus on strategic activities such as partnership, collaboration, and acquisition. A few companies in the global market are ResMed Inc., Teleflex Incorporated, Hamilton Bonaduz AG, HEYER Medical AG, and Koninklijke Philips N.V., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Prevalence of Respiratory Disorders

- 4.2.2 High Incidences of Chronic Conditions and Increasing Intensive Care Admissions

- 4.3 Market Restraints

- 4.3.1 Risk of Ventilator-Associated Pneumonia

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Non-invasive Positive-pressure Ventilator (PPV)

- 5.1.1.1 Bi-level Positive Airway Pressure Ventilator (BiPAP)

- 5.1.1.2 Constant Positive Airway Pressure Ventilator (CPAP)

- 5.1.1.3 Autotitrating (Adjustable) Positive Airway Pressure Ventilator (APAP)

- 5.1.2 Non-invasive Negative Pressure Ventilator (NPV)

- 5.1.1 Non-invasive Positive-pressure Ventilator (PPV)

- 5.2 By Application

- 5.2.1 COPD and Asthma

- 5.2.2 Respiratory Distress Syndrome

- 5.2.3 Others

- 5.3 End Users

- 5.3.1 Hospitals and Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ResMed Inc.

- 6.1.2 Teleflex Incorporated

- 6.1.3 Hamilton Bonaduz AG

- 6.1.4 heyer medical AG

- 6.1.5 Koninklijke Philips N.V.

- 6.1.6 Airon Corporation

- 6.1.7 Fisher & Paykel Healthcare

- 6.1.8 Mindray Medical International Limited

- 6.1.9 Phoenix Medical Systems Pvt. Ltd.

- 6.1.10 Smiths Medical, Inc.

- 6.1.11 Dragerwerk AG & Co. KGaA

- 6.1.12 Getinge AB