|

市場調查報告書

商品編碼

1689830

物聯網保險-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)IoT Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

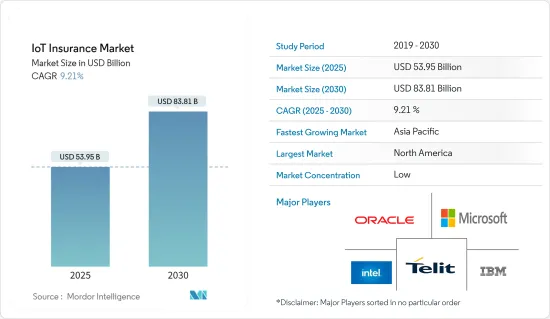

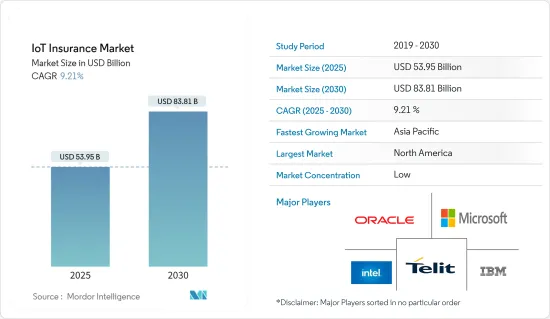

預計 2025 年物聯網保險市場規模為 539.5 億美元,到 2030 年將達到 838.1 億美元,預測期間(2025-2030 年)的複合年成長率為 9.21%。

物聯網在降低保費和風險相關成本方面的應用日益廣泛,加上創新的保險模式,正在推動保險業的成長,這將進一步促進所研究的市場成長。

關鍵亮點

- 資料分析、巨量資料、感測器和機器學習技術的成長正在推動市場進一步成長。由於智慧電網預計將主導整個能源產業,物聯網公共產業預計將在預測期內獲得發展動力。

- 此外,由於智慧型手錶、智慧型手機和健身追蹤器等網路醫療設備的快速普及,預計全球人壽和健康保險市場在預測期內將顯著成長。

- 保險領域擴大採用機器學習和人工智慧等最尖端科技,這可能有利於全球物聯網保險市場的成長。

- 然而,對客戶個人資訊安全和隱私的擔憂,以及對員工熟練使用物聯網設備的需求,限制了物聯網保險業務的成長。

- 預計 COVID-19 將對物聯網保險領域的擴張產生積極影響。隨著保險提供者擴大採用數位技術來收集客戶資料以進行索賠管理。為了向客戶提供 COVID-19 保險服務,物聯網技術將在當前 COVID-19 疫情期間透過行動電話、穿戴式裝置和感測器安全地收集患者健康資訊,為保險業提供協助。

物聯網(IoT)保險市場的趨勢

零售和商業部門預計將佔很大佔有率

- 數位顛覆預計將影響商業保險公司,該產業正準備迎接重大轉型。物聯網技術有望成為各種新措施的核心。保險公司正在使用物聯網資料來評估客戶、降低保費並提供即時警報。

- 商用財產保險公司可能會看到與客戶重建關係的多個機會。物聯網和雲端運算等技術進步正在顯著創造大量資料,這些數據可用於為商用客戶提供價值,主要是透過建立更緊密的夥伴關係和新的收益來源。

- 近年來全球電子商務市場的快速成長帶動了零售業的顯著成長。因此,零售商正在使用物聯網解決方案來改善客戶體驗和業務效率,以獲得競爭優勢。因此,客戶對改善購物體驗的需求、對智慧付款解決方案的接受度不斷提高以及基於物聯網的感測器和連接成本的下降是影響調查領域採用物聯網技術的關鍵促進因素。

- 物聯網在實現流程自動化和提高零售設施營運效率方面發揮著重要作用。這些包括能源效率、安全和監控、庫存和供應鏈最佳化、勞動力管理等等。此外,物聯網也在生鮮食品和藥品的低溫運輸監控領域發展其能力。

預計北美將佔據主要佔有率

- 北美被視為物聯網保險市場的關鍵地區之一,因為全部區域物聯網的認知不斷提高且採用速度加快。包括 Liberty Mutual、Progressive 和 State Farm 在內的許多公司都在該地區利用物聯網技術來簡化風險評估。

- 美國大型保險公司 John Hancock 是首批利用穿戴式裝置優勢的公司之一,該公司與 Vitality 合作,向客戶免費提供 Fitbit 設備,以追蹤他們的健康狀況並降低索賠風險。此外,美國被認為是向各保險公司提供物聯網解決方案的領先公司的總部。

- 此外,物聯網 (IoT) 的早期採用和該地區強大的勞動力等因素預計將推動區域市場的成長。

- 推動全部區域採用物聯網保險解決方案的關鍵因素包括保險業的擴張、創造性保險模式的創建以及擴大使用物聯網技術來降低保費和風險相關成本。

物聯網(IoT)保險業概覽

物聯網保險市場競爭激烈,公司規模從大到小,不僅在國內市場競爭,而且在全球市場上競爭。由於科技巨頭眾多,市場顯得割裂。 IBM 公司、微軟公司、英特爾公司、SAP SE 等都是市場參與企業的主要例子。

- 2022 年 7 月 - SAP 和 NTT 資料宣布推出聯合創新解決方案“Connected Product”,用於追蹤易碎和敏感貨物運輸並簡化保險程序。透過實現端到端、即時的貨運狀態監控,該解決方案能夠監控可能影響貨運的所有變量,並且如果貨運未在某些預定義條件下運輸,則能夠自動觸發和執行保險政策。 SAP Business Network for Logistics 讓運輸保險更易於管理,並提高了每個相關人員的責任制。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 保險業發展與保險模式創新同步

- 擴大物聯網的使用以降低保險費和風險相關成本

- 市場限制

- 收集資料帶來高隱私風險

第6章市場區隔

- 按最終用戶產業

- 零售/商業

- 住宅(智慧家庭)

- 車

- 產業

- 醫療保健

- 其他終端用戶產業(公共基礎設施、物流、航運)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- Oracle Corporation

- Telit Communications PLC

- Synechron Inc.

- Verisk Analytics Inc.

- Accenture PLC

- Aeris Group

- Concirrus Ltd

- Allerin Pvt. Ltd

- ForMotiv LLC

- Wipro Corporation

- Webfleet Solutions BV(Bridgestone Corp.)

第8章投資分析

第9章:市場的未來

The IoT Insurance Market size is estimated at USD 53.95 billion in 2025, and is expected to reach USD 83.81 billion by 2030, at a CAGR of 9.21% during the forecast period (2025-2030).

The growth of the insurance sector in parallel with innovative insurance models, with the growing usage of IoT to reduce premium and risk-related costs, further expand the studied market growth.

Key Highlights

- Growth in data analytics, Big Data, sensors, and machine learning technologies further expands the studied market's growth. With smart grids envisioned to take over the entire energy industry, IoT utilities are expected to gain traction over the forecast period.

- Additionally, the global market for life and health insurance is predicted to grow significantly during the forecast period due to the rapid uptake of internet-connected medical devices like smartwatches, smartphones, and fitness trackers that are constantly used to gather user data and monitor their behavior or lifestyle.

- Increasing adoption of cutting-edge technologies in the insurance sector, such as machine learning and artificial intelligence, would present lucrative potential for the growth of the worldwide IoT insurance market.

- However, concerns about the security and privacy of customers' personal information and a need for worker proficiency with IoT devices limit the growth of the IoT insurance business.

- COVID-19 is anticipated to have a favorable effect on the expansion of the IoT insurance sector. This is due to an increase in insurance provider businesses' embrace of digital technologies to collect client data for claim management. To provide COVID-19 insurance services to clients, IoT technology assists the insurance sector during the current COVID-19 outbreak by securely collecting patient health information via mobile phones, wearable devices, and sensors.

Internet of Things (IoT) Insurance Market Trends

Retail and Commercial is Expected to Hold Significant Share

- Digital disruptions are expected to impact commercial insurers, as the industry has been preparing to witness some significant transformation. IoT technology is expected to be at the core of various new initiatives. Insurance firms are trying to utilize IoT data to assess customers, reduce premiums, and provide real-time warnings.

- Commercial property insurers are expected to witness multiple opportunities to redraw their relationships with their clients. Technological advancements, such as IoT and cloud, are significantly creating vast amounts of data that can be used to deliver value to commercial customers, primarily enabling closer partnerships and new sources of revenue.

- Due mainly to the rapid rise of the global e-commerce market over the past few years, the retail sector has also seen enormous growth. As a result, retailers use IoT solutions to boost the customer experience and operational efficiency to gain a competitive edge. As a result, the need from customers for an improved shopping experience, the growing acceptance of smart payment solutions, and the declining cost of IoT-based sensors and connectivity are some of the key drivers influencing the adoption of IoT technology in the researched segment.

- IoT has been significantly contributing to process automation and improving the operational effectiveness of retail establishments. It offers energy efficiency, security and surveillance, inventory and supply chain optimization, and labor management. Additionally, IoT is developing its capabilities in the area of cold chain monitoring for perishable food and pharmaceutical products.

North America is Expected to Hold Major Share

- North America is regarded as one of the significant regions for the IoT insurance market due to the growing awareness and the faster adoption of IoT across the region. Many companies, such as Liberty Mutual, Progressive, and State Farm, are leveraging the region's IoT technologies to enhance their risk assessment efficiency.

- John Hancock, a major insurance company in the United States, was one of the first to utilize the power of wearable devices by partnering with Vitality, distributing free Fitbits to customers, and tracking their well-being, making them less at risk of filing a claim. Moreover, the United States is regarded as the headquarters of some major players who offer their IoT solutions for various insurance companies.

- Additionally, it is projected that factors like the early adoption of the web of things (IoT) and a robust regional labor force will accelerate the regional market's growth.

- Some key factors driving the adoption of IoT insurance solutions across the region include the expansion of the insurance industry, the creation of creative insurance models, and the expanding use of IoT technology to lower premium and risk-related expenses.

Internet of Things (IoT) Insurance Industry Overview

The IoT insurance market is highly competitive, due to the market's large and small businesses' existence, which allows them to compete on both domestic and global marketplaces. Due to the presence of so many technology behemoths, the market seems to be fragmented. IBM Corporation, Microsoft Corporation, Intel Corporation, and SAP SE are a few of the market's main participants.

- July 2022 - SAP and NTT DATA announced Co-Innovation Solution Connected Product to Track Fragile and Sensitive Cargo Shipments and Facilitate Insurance Procedures, where By enabling end-to-end, real-time monitoring of the transportation conditions, the solution can monitor all variables that could affect a shipment, and automatically trigger and execute insurance policies if goods are not transported under certain pre-defined conditions. Utilizing SAP Business Network for Logistics helps improve accountability for each stakeholder and makes transport insurance management easier.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Insurance Sector in Parallel with Innovative Insurance Models

- 5.1.2 Growing Usage of IoT to Reduce the Premium and Risk-related Costs

- 5.2 Market Restraint

- 5.2.1 High Risk for Privacy from the Collected Data

6 MARKET SEGMENTATION

- 6.1 By End-User Industry

- 6.1.1 Retail and Commercial

- 6.1.2 Residential (Smart homes)

- 6.1.3 Automotive

- 6.1.4 Industrial

- 6.1.5 Healthcare

- 6.1.6 Other End-user Industries (Public Infrastructure, Logistics and Navigation)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Intel Corporation

- 7.1.4 Oracle Corporation

- 7.1.5 Telit Communications PLC

- 7.1.6 Synechron Inc.

- 7.1.7 Verisk Analytics Inc.

- 7.1.8 Accenture PLC

- 7.1.9 Aeris Group

- 7.1.10 Concirrus Ltd

- 7.1.11 Allerin Pvt. Ltd

- 7.1.12 ForMotiv LLC

- 7.1.13 Wipro Corporation

- 7.1.14 Webfleet Solutions BV (Bridgestone Corp.)