|

市場調查報告書

商品編碼

1273371

棘突間間隔器市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Interspinous Spacers Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,棘突間墊片市場預計將以 5.4% 的複合年增長率增長。

COVID-19 大流行最初對棘突間墊片市場產生了負面影響。 由於沒有藥物或疫苗,傳染性病毒感染突然爆發並導致全球封鎖。 非 COVID 治療,如手術和非緊急醫療護理,已被暫時推遲或取消。 該病毒的風險也減少了因非 COVID 問題而去醫院就診的患者數量。 脊柱手術中使用的椎間墊片也受到 COVID-19 限制的不利影響。 2021 年 12 月發表在《骨科創傷雜誌》上的一項研究發現,在 COVID-19 封鎖的早期階段,來自英國急診科的急性脊柱轉診減少了 20% 以上。 2021 年 7 月發表在《脊柱雜誌》上的一項研究稱,他們的研究發現,超過三分之一的擇期脊柱手術因 COVID-19 而被取消。

然而,在大流行後隨著封鎖的解除和非 COVID、非緊急治療、手術和程序的恢復,棘突間市場有望恢復前的增長速度大流行時期。 2021 年美國骨科醫師學會宣布,美國因 COVID-19 而推遲的非緊急骨科手術已在全國范圍內恢復。 因此,COVID-19 爆發對之前的市場增長產生了負面影響。 此外,由於選擇性脊柱手術和恢復治療,全球椎間墊片的使用逐漸增加,預計該市場將進一步穩步增長。

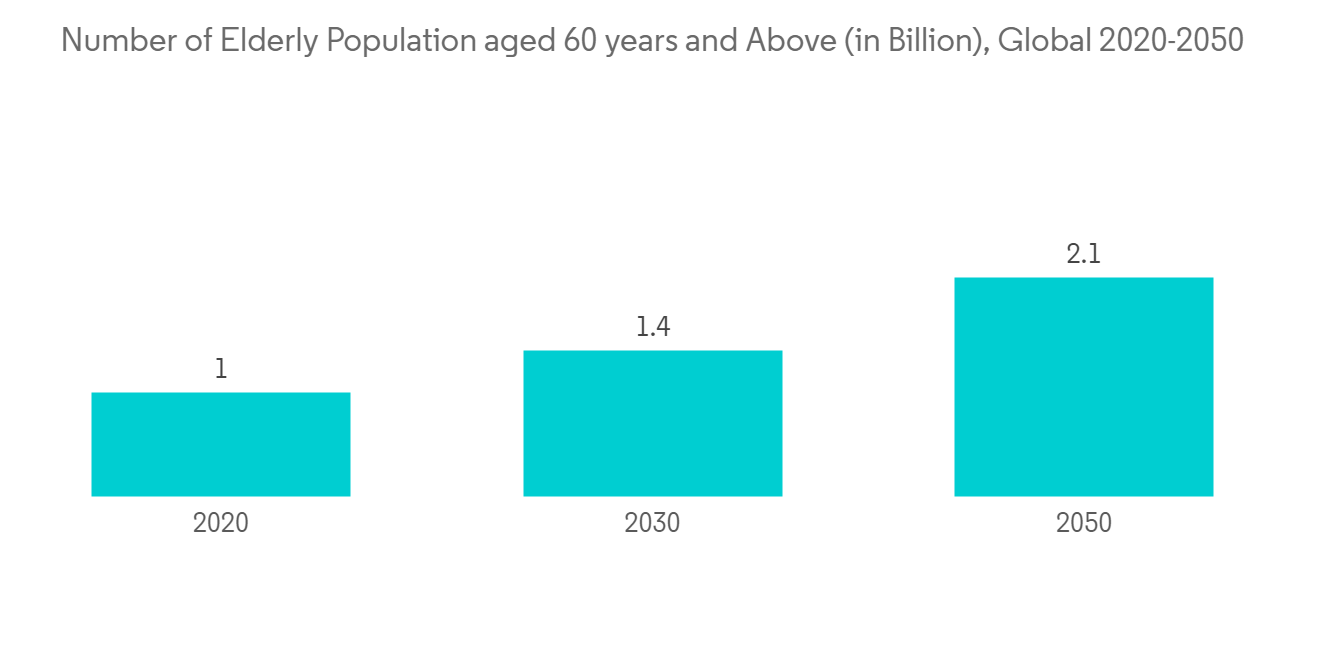

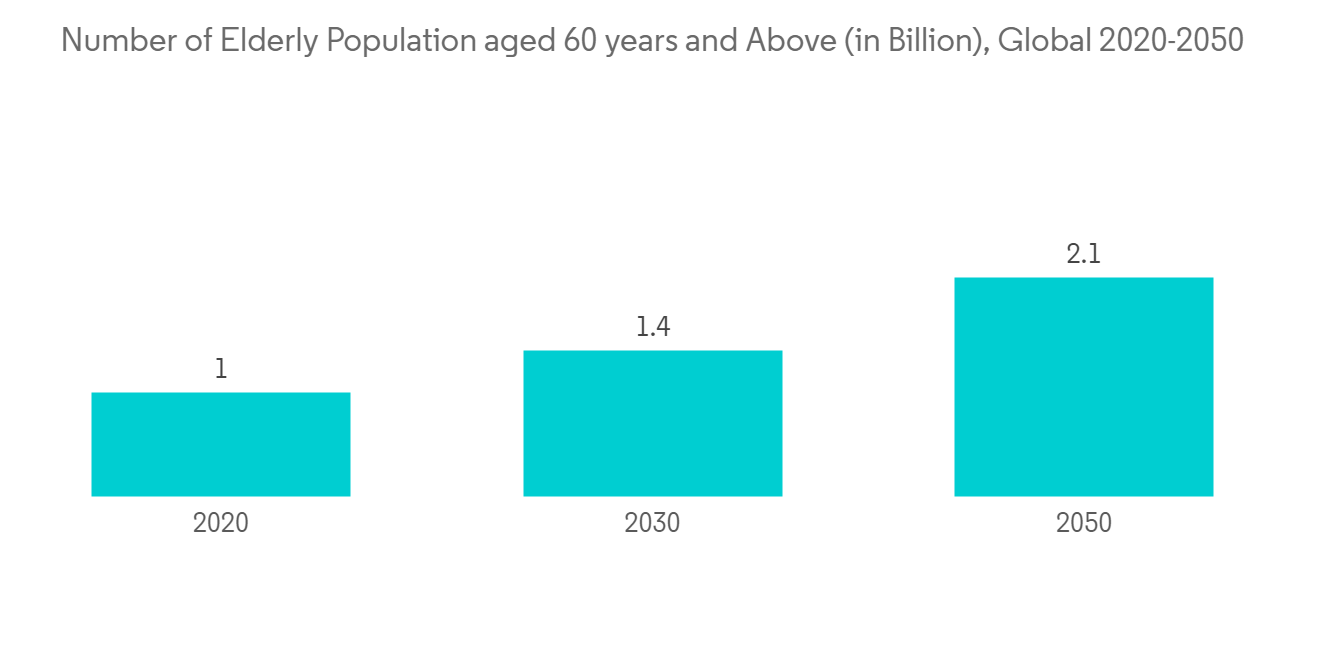

此外,椎間墊片在老年人群中的發生率更高。 全球老年人口正在增加,對椎管狹窄微創手術的需求不斷增長,促進了這一市場的增長。 根據 2020 年世界衛生組織 (WHO) 的一份報告,到 2030 年,地球上將有六分之一的人超過 60 歲。 預計 60 歲及以上的人口將從 2020 年的 10 億增長到 2050 年的 14 億。 到 2050 年,世界 60 歲以上人口將翻一番,達到 21 億。 2020 年至 2050 年間,80 歲及以上的人口數量預計將增加兩倍,達到 4.26 億。

此外,該領域的技術進步日新月異,椎間墊片的需求量也越來越大。 然而,與椎間墊片相關的彙編正在抑制整個市場的增長,尤其是在老年人群中。 因此,由於上述因素,預計該市場在分析期內將出現增長。 然而,與腰椎融合手術相關的並發症可能會阻礙市場增長。

椎間墊片的市場趨勢

腰椎管狹窄段有望主導市場

腰椎管狹窄症是一種椎管變窄並壓迫從下背部到腿部的神經的疾病。 由於發育原因,腰椎管狹窄症可能在年輕人中發生,但它通常是一種退行性疾病,發生在60歲及以上的人群中。 腰椎管狹窄症的高患病率及其管理技術的進步正在推動這一領域的增長。 據 JAMA Patient Page 報導,截至 2022 年 5 月,美國將有超過 11% 的老年人患有腰椎管狹窄症。 根據 2022 年 4 月發表在《疼痛研究雜誌》(Journal of Pain Research) 上的一項研究,椎間墊片已被用於通過減輕疼痛、改善活動能力和減少阿片類藥物使用來治療腰椎管狹窄症的臨床研究,並且作為一項科學研究得到了高度研究。 本研究建議使用椎間墊片治療輕度至中度椎管狹窄。

市場參與者獲得了用於治療腰椎管狹窄症的先進產品的批准。 例如,2022 年 7 月,Aurora Spine Corporation 獲得了 FDA 批准用於治療腰椎管狹窄症的 ZIP 系列 MIS 植入物。 ZIP Implant Spacer 是無螺絲和微創的,與傳統手術和其他介入手術相比具有優勢。

因此,由於上述因素(如高患病率和先進技術),預計腰椎管狹窄領域在預測期內將出現顯著增長。

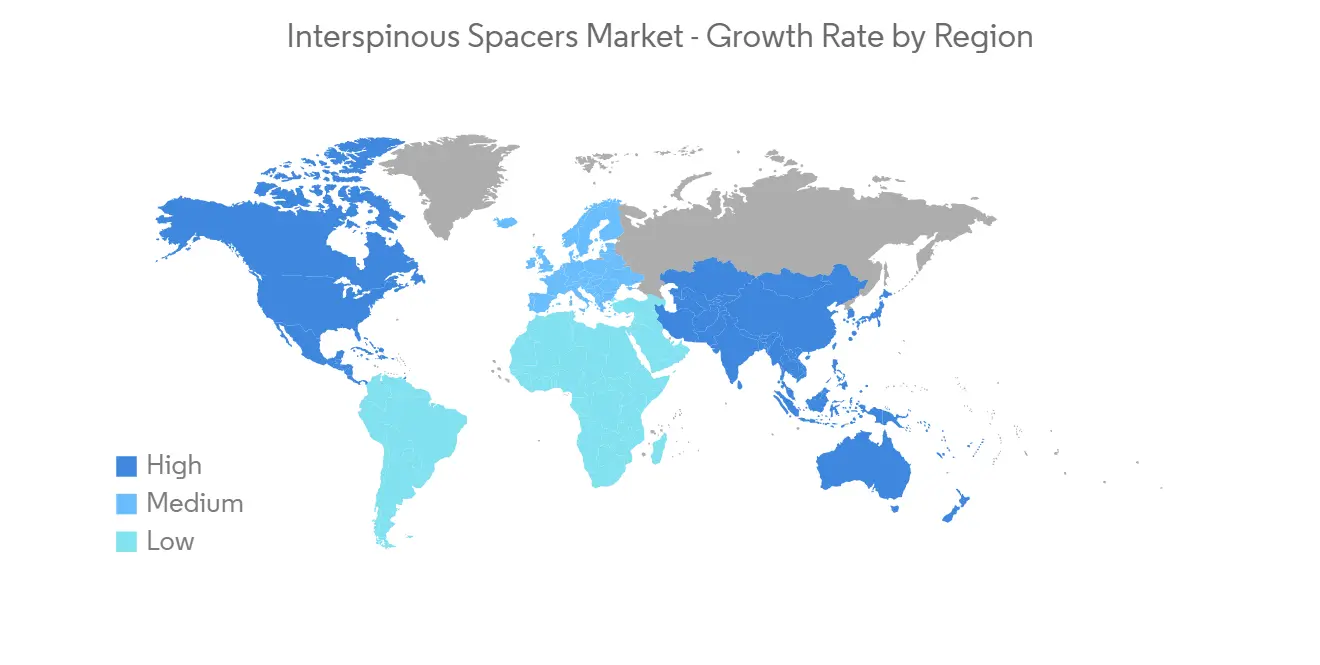

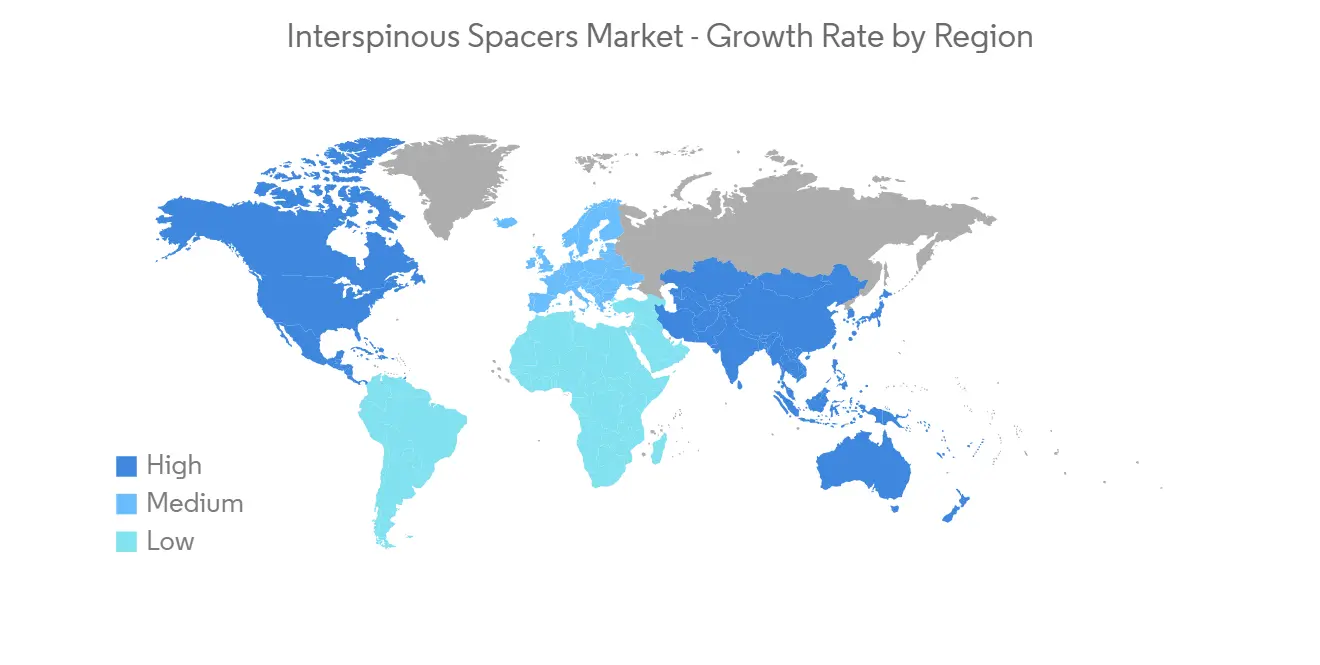

北美有望主導棘突間隔器市場

由於人口老齡化程度高和醫療保健支出高等因素,預計北美將主導該市場。 該地區的老齡化人口正在增加,並且容易患椎管狹窄,推動了該地區的市場增長。 根據加拿大統計局的數據,在2022年4月的2021年人口普查中,加拿大85歲及以上的人口估計超過861,000人,佔總人口的2.3%以上,2001年的人口基數可以看到多年來翻了一番。 85+年齡段在2021年增長最快,2016-2021年增長率達到16%。 然而,該地區也擁有完善的醫療保健系統,並為此投入了大量資金進行研發。 因此,世界上大部分的治療方法都可以在該地區獲得。 根據研究組合在線報告工具 (RePORT),2022 年 5 月,2021 年在創傷性頭部和脊柱損傷研究/疾病領域的支出超過 1.85 億美元。 預計這一支出將在 2022 年增至 3.25 億美元,並在 2023 年進一步增至 3.37 億美元。 根據加拿大健康信息研究所 (CIHI) 的數據,2022 年 11 月,加拿大在醫療保健方面的支出超過 3.31 億加元(每個加拿大人 8,563 加元)。 因此,所有這些因素幫助許多全球參與者在該地區開展業務。 因此,市場已經發展壯大,並有望在未來發展。 因此,由於上述因素,預計北美地區的市場將會增長。

棘間墊片行業概況

棘突間墊片市場由幾家在全球和區域運營的公司適度整合。 競爭格局包括 Life Spine, Inc.、Boston Scientific、Globus Medical, Inc.、ATEC Spine, Inc.、Veritas Health, LLC、Johnson & Johnson、Surgalign Spine Technologies、Aurora Spine, Inc。它還包括對知名公司的分析那佔

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 對微創解決方案的需求不斷增長

- 老年人口增加

- 棘間間隔物的研究與技術進步

- 市場製約因素

- 與腰椎融合手術相關的並發症

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分(基於價值的市場規模)

- 按類型

- 靜態(不可壓縮)墊片

- 動態(可壓縮)墊片

- 通過使用

- 腰椎管狹窄症

- 退行性椎間盤疾病

- 其他

- 最終用戶

- 醫院

- 骨科診所

- 門診手術中心

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Life Spine, Inc.

- Boston Scientific

- Globus Medical, Inc.

- ATEC Spine, Inc

- Stryker

- Johnson & Johnson

- Surgalign Spine Technologies, Inc.

- Aurora Spine, Inc.

第七章市場機會與未來趨勢

The Interspinous Spacers market is expected to register a CAGR of 5.4% over the forecast period.

The COVID-19 pandemic has had an adverse impact on the Interspinous Spacers market initially. The sudden outbreak of the contagious viral infection and the absence of any medication or vaccine led to a lockdown globally. The non-COVID treatment, such as surgical interventions and non-urgent medical treatment, was temporarily postponed or canceled. Also, the risk of the virus reduced the number of patients visiting the hospital for non-COVID issues. The interspinous spacers are used in spinal surgeries, which was also adversely impacted by the COVID-19 restrictions. According to a study published in the Journal of Orthopaedic Trauma in December 2021, there was a reduction of over 20% in acute spinal referrals from UK emergency departments during the COVID-19 lockdown initial phase. A study published in the Spine Journal in July 2021 stated that over one-third of elective spine, surgeries were canceled, as per their study, due to COVID-19.

However, in the post-pandemic with the lifting of the lockdown and the resumption of the non-COVID, non-urgent treatment, surgeries, and procedures, the interspinous space market is expected to regain its growth pace as it was in the pre-pandemic period. American Academy of Orthopaedic Surgeons in 2021 stated that the non-essential orthopedic surgeries which were postponed in the United States due to COVID-19 had been resumed across the country. Thus, the COVID-19 outbreak has adversely impacted the market's growth in its preliminary phase. Moreover, the market is expected to grow further at a stable pace with the resumption of elective spine surgeries and treatment, which would gradually increase the use of interspinous spacers globally.

Further, the interspinous spacer has a higher occurrence in the geriatric population. As the geriatric population is increasing globally, and there is an increasing demand for minimally invasive procedures for spinal stenosis that has helped in the growth of this market. According to the World Health Organization report (WHO) report in 2020, by 2030, 1 out of every six people on the planet will be 60 years old or older. The number of people aged 60 and up is expected to rise from 1 billion in 2020 to 1.4 billion by 2050. By 2050, the global population of people aged 60 and above will double to reach 2.1 billion. Between 2020 and 2050, the number of people aged 80 and above is expected to triple, reaching 426 million.

In addition, there are also increasing technological advancements seen in this field; therefore, the demand for interspinous spacers is increasing. However, compilations related to the interspinous spacer, especially in the older population, have been restraining the overall growth of the market. Therefore, owing to the aforementioned factors, the studied market is anticipated to witness growth over the analysis period. However, the complications associated with lumbar spinal fusion are likely to impede the market growth.

Interspinous Spacers Market Trends

Lumbar Spinal Stenosis Segment is Expected to Dominate the Market

Lumbar spinal stenosis is a narrowing of the spinal canal, compressing the nerves traveling through the lower back into the legs. While it may affect younger patients due to developmental causes, it is more often a degenerative condition that affects people who are typically aged 60 and older. The high prevalence and advancing technology of lumbar spinal stenosis and its management are boosting the growth of the segment. According to JAMA Patient Page, in May 2022, over 11% of elderly adults in the United States have the condition of Lumbar spinal stenosis. According to a study published in the Journal of Pain Research in April 2022, interspinous spacers are highly studied for clinical research and scientific studies for the management of lumbar spinal stenosis by reducing pain, improving mobility, and reduction in the use of opiates. The study has recommended the use of interspinous spacers for mild-to-moderate spinal lumbar stenosis.

The players in the market have received approval for their advanced products for the management of lumbar spinal stenosis. For instance, in July 2022, Aurora Spine Corporation received FDA clearance for its ZIP family of MIS implants for the management of lumbar spinal stenosis. The ZIP implant spacer has no screw and is minimally invasive, which bears an edge over traditional surgeries and other interventional procedures.

Therefore, the lumbar spinal stenosis segment is expected to witness significant growth over the forecast period due to the abovementioned factors, including its high prevalence and advancing technology.

North America is Expected to Dominate the Interspinous Spacers Market

North America is expected to dominate the market owing to factors such as the vast geriatric population and high healthcare expenditure. The geriatric population in the region is expanding and is susceptible to spinal stenosis; thus, the aging population drives the growth of the market in the region. According to Statistics Canada, in April 2022, over 861,000 people in Canada were estimated to be aged 85 and above in the 2021 Census, representing over 2.3% of the total population, which shows that the age group population base has doubled from 2001. The age group of 85 years and above was the fastest growing in 2021, with a growth rate of 16% from 2016 to 2021. However, the region also has well-developed healthcare systems and also spends huge amounts in research and development for the same. As a result, most of the global treatments are available in this region. According to the Research Portfolio Online Reporting Tools (RePORT), in May 2022, over USD 185 million had been spent on the research/ disease area of traumatic head and spine injury in 2021. This expenditure was estimated to increase to USD 325 million in 2022 and further to USD 337 million in 2023. According to the Canadian Institute for Health Information (CIHI), in November 2022, Canada spent over CAD 331 million on healthcare (CAD 8,563 per Canadian) in 2022. Hence all these factors have helped many global players to make their presence in this region. As a result, the market has grown and is also expected to grow in the future. Therefore, owing to the previously mentioned factors, the growth of the studied market is anticipated in the North America Region.

Interspinous Spacers Industry Overview

The interspinous spacers market is moderately consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of some international as well as local companies that hold market shares and are well known, including Life Spine, Inc., Boston Scientific, Globus Medical, Inc., ATEC Spine, Inc, Veritas Health, LLC., Johnson & Johnson, Surgalign Spine Technologies, Inc., Aurora Spine, Inc. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Minimally Invasive Solutions

- 4.2.2 Increasing Geriatric Population

- 4.2.3 Growth in Research and Technological Advancements in Interspinous Spacers

- 4.3 Market Restraints

- 4.3.1 Complications associated with Lumbar Spinal Fusion

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Static (Non-compressible Spacers)

- 5.1.2 Dynamic (Compressible Spacers)

- 5.2 By Application

- 5.2.1 Lumbar Spinal Stenosis

- 5.2.2 Degenerative Disc Diseases

- 5.2.3 Others

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Orthopedic Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Life Spine, Inc.

- 6.1.2 Boston Scientific

- 6.1.3 Globus Medical, Inc.

- 6.1.4 ATEC Spine, Inc

- 6.1.5 Stryker

- 6.1.6 Johnson & Johnson

- 6.1.7 Surgalign Spine Technologies, Inc.

- 6.1.8 Aurora Spine, Inc.