|

市場調查報告書

商品編碼

1273309

鑽孔機市場——增長、趨勢、COVID-19 的影響、預測 (2023-2028)Drilling Machines Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

今年鑽機市場規模預計為 225.2 億美元,在預測期內以超過 4% 的複合年增長率增長。

主要亮點

- 根據台灣機床及配件製造商協會 (TMBA) 的數據,2022 年台灣機床製造商的出口總額將達到 30.23 億美元,同比增長 8.6%。 2021年,中國、德國和日本將成為全球機床行業的強國。 那一年,中國占全球機床產量的31%,而德國和日本各佔13%。 德國製造商 VDW 報告稱,2022 年第二季度機床新訂單同比增長 24%,2022 年上半年同比增長 34%。 作為參考,2022年上半年美國機床訂單同比增長13.1%。 德國機床製造商的國內訂單在 2022 年上半年增長了 35%,而同期國外訂單增長了 33%。

- 全球挖掘機行業從 2021 年第一季度開始緩慢復甦,當時封鎖限制有所放鬆,工廠和國際貿易獲准重新開放。 汽車工業是機床市場的主要終端用戶領域之一。 由於與 COVID-19 病毒爆發相關的必要停工,汽車生產已顯著放緩。

- 市場的增長主要是由汽車、航空航天等多個最終用戶行業不斷增長的需求推動的。 此外,對金屬加工產品的需求增加、重工業設備的開發、製造工藝的進步以及最新技術的採用也在推動市場。 另一個驅動力是多功能材料去除機的開發,它將不同的切削設備(例如銑削和鑽孔)組合在一台機器中。

- 鑽床市場是機床市場的一個子部分,機床市場的增長預示著所研究的市場是個好兆頭。 中國是世界機床市場的領導者。 在全球範圍內,與成型技術相比,機床行業在產量中佔有很大份額。 機床切削事業部由車床、鑽床、鏜床、銑床等組成。

- 此外,製造機械的進步和政府在機床行業的舉措正在為市場創造有利可圖的增長機會。 大型機加工製造需要為管件等連接件鑽精密孔,建築和製造行業的需求不斷增加,預計未來重型設備領域將佔據市場主導地位。 然而,原材料價格的波動和製造業熟練勞動力的短缺阻礙了全球鑽機市場的增長。

鑽床市場趨勢

汽車行業對鑽孔機的需求增加

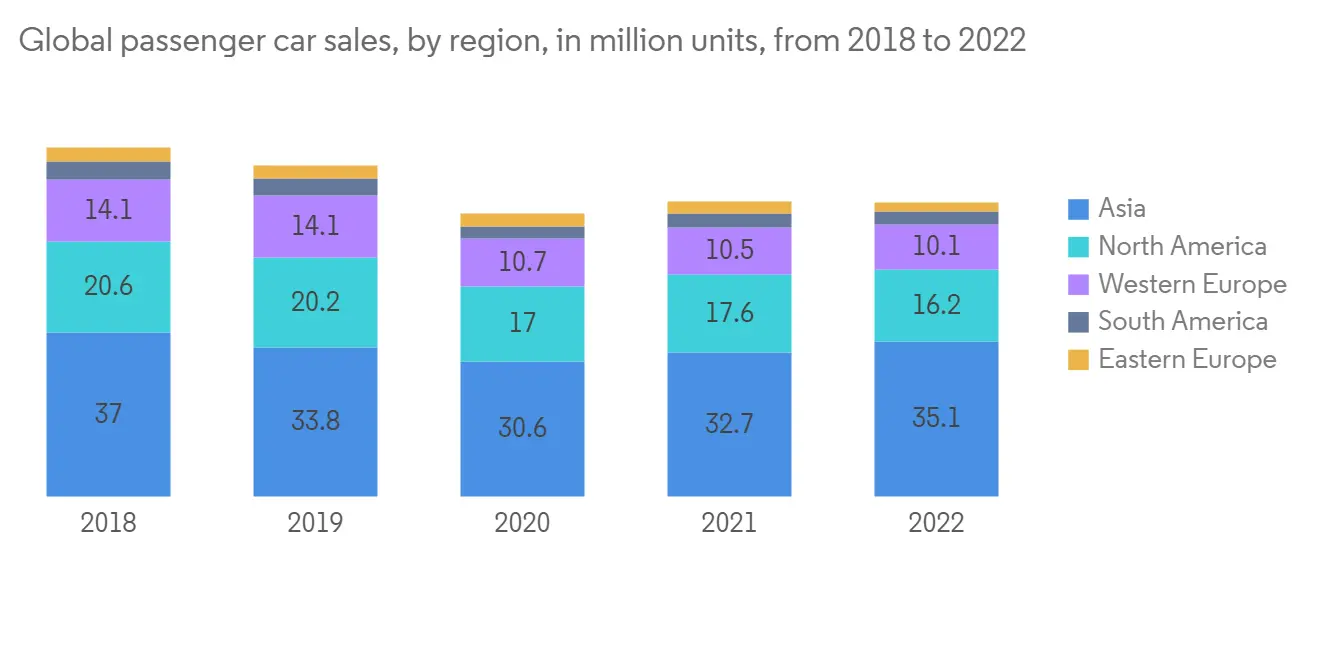

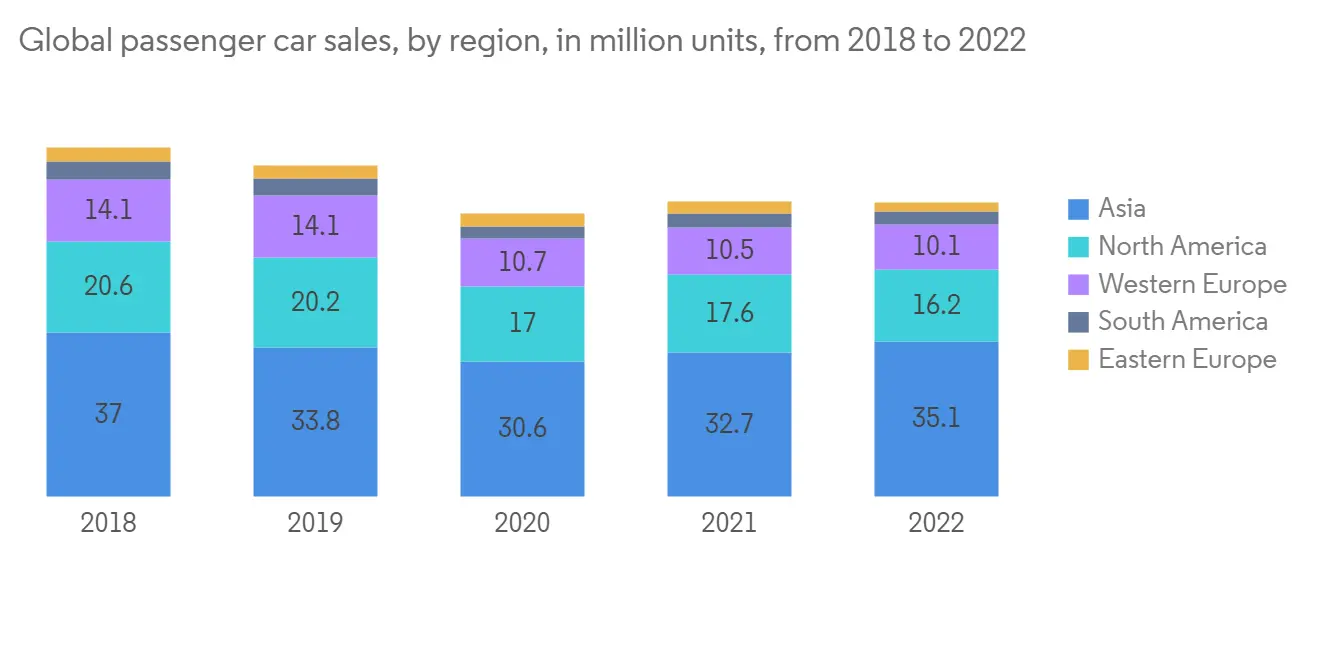

推動鑽孔機增長的主要因素是汽車行業不斷增長的需求。 然而,從 2020 年開始,由於 COVID-19 大流行,全球汽車行業面臨需求減少和停產的局面。 據業內人士透露,全球生產的輕型汽車數量可觀,未來只會繼續增加。 就產量而言,預計亞太地區的增長率最高,其次是北美。 預計這種情況將產生對鑽孔機和與製造過程相關的其他相關機械的需求。

為了滿足這些汽車製造、經濟和環境/監管趨勢,市場要求在機床和工具中進行車削和鑽孔方面的創新。 例如,Ultra T-A 和 Stealth Drill 技術已將低壓機器的性能顯著提高到與現代高壓冷卻劑機器相同的水平。 一個刀片可鑽約1200個孔,是舊技術的3至6倍。

目前,由於世界各地人們的可支配收入不斷增加,汽車行業正在強勁增長。 這種收入的增加將進一步提高世界人口的消費能力。 因此,汽車行業的顯著增長預計很快將為鑽機市場的需求鋪平道路。 這些機器在汽車工業中的使用率越來越高。 這些鑽床通常用於製造車架、汽車等的各種鑽孔作業。 此外,預計鑽孔將在汽車行業的製造設備中發揮重要作用。 所有汽車的製造過程中都會鑽出數百個孔,包括凸輪軸、安全氣囊推進劑、發動機缸體和傳動軸。

因此,由於這些產品的使用越來越多,預計未來幾年鑽孔機市場將快速增長。

亞太地區主導挖掘機市場

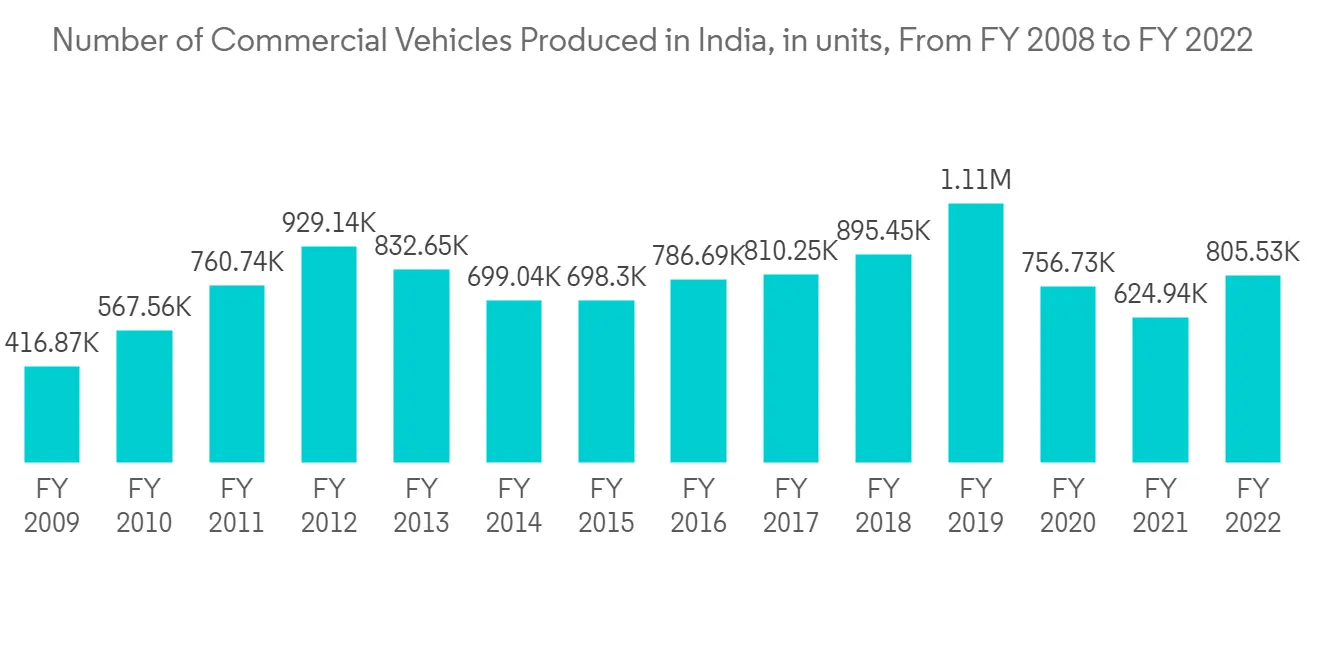

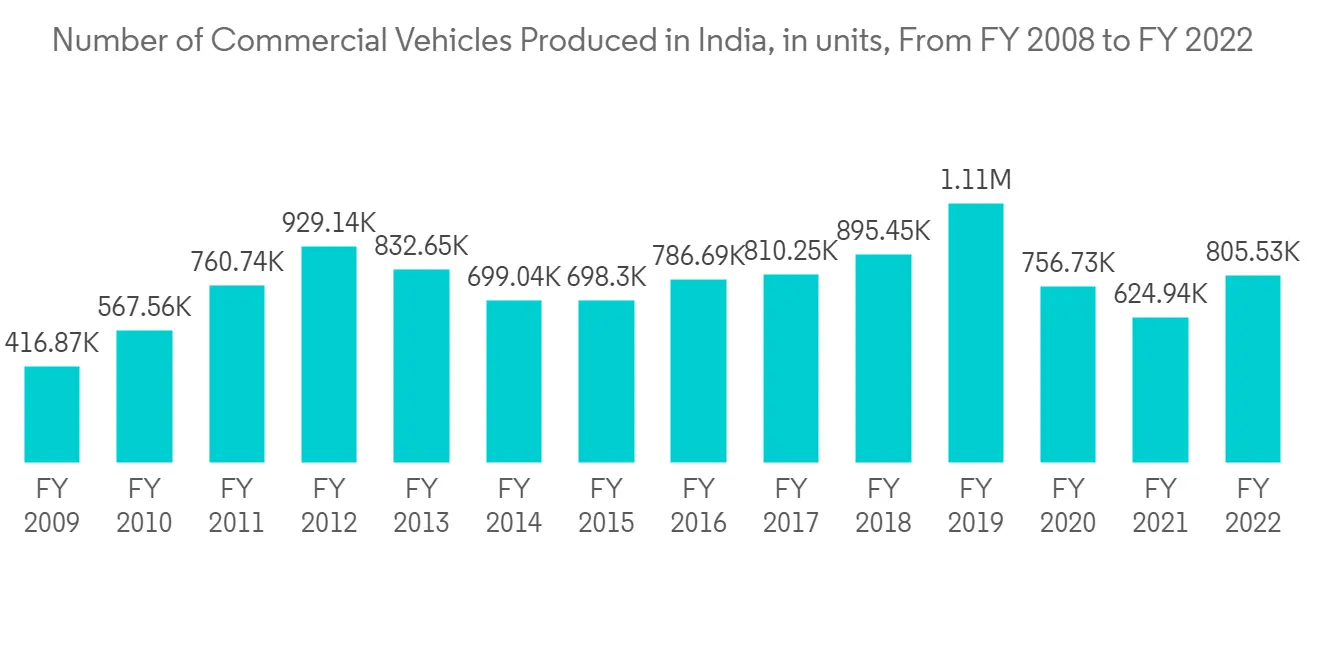

根據分析,亞太地區 (APAC) 預計在本次研究的市場中佔據最高的市場份額。 該地區擁有最多的製造工廠和最高的挖掘機滲透率。 由於其龐大的製造業,中國有望成為該地區的主要參與者。 此外,汽車是中國的支柱產業之一,仍然是全球最大的汽車市場。 2022年4月,中國商用車產量約21萬輛,乘用車產量約99.6萬輛。 當月,全行業共生產120萬台,環比下降46.2%,同比下降46.1%。

由於運營成本較低,該地區的經濟吸引了來自較大製造基地和國家/地區的公司。 近年來,中國收緊了監管,提高了工資,併計劃轉向附加值更高的製造業,導致運營成本更高。 因此,企業正在尋找東盟地區的低價值生產網絡來取代中國以前的角色,這些地區也很大程度上融入了全球製造業價值鏈。 分析認為,鑽機製造商將需要服務於新興製造業以增加銷量,並調整銷售渠道以專注於成長型市場。

快速城市化、工業化、高可支配收入以及與技術進步相關的研發活動增加是預計推動亞太地區鑽機需求的一些因素。

挖掘機行業概況

本報告涵蓋了挖掘機市場上的主要國際參與者。 市場具有高度分散的性質,大公司佔據了很大的市場份額。

幾家領先的公司攜手合作,以產生新想法、發展業務、贏得獎項等,以改進產品並保持市場競爭力。

鑽床市場的主要參與者包括 DMG MORI、Dalian Machine Tool Corporation、Shenyang Machine Tool Corp. Ltd.、Shenyang Machine Tool Corp. (SMTCL)、ERNST LENZ Maschinenbau GmbH 和 Fehlmann AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

- 調查框架

- 二次調查

- 初步調查

- 數據三角測量和洞察生成

- 項目流程和結構

- 參與框架

第 3 章執行摘要

第 4 章市場動態和洞察

- 當前市場情況

- 技術趨勢

- 工業價值鏈分析

- 世界製造業(概況、趨勢、研發、關鍵統計數據等)

- 針對製造業的主要政府法規和舉措

- 金屬加工行業概況(概述、關鍵指標、發展等)

- 對便攜式鑽孔機及其最新趨勢的見解

- 鑽具聚焦(概述、不同類型、進展等)

- COVID-19 對市場的影響

- 市場動態

- 市場驅動因素

- 市場製約因素/挑戰

- 市場機會

- 產業吸引力 - 波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按類型

- 靈敏鑽孔機

- 立式鑽床

- 搖臂鑽床

- 多頭鑽床

- 多軸鑽床

- 深孔鑽床

- 其他類型

- 最終用戶

- 製造業和工業機械製造

- 航空航天

- 重型機械

- 汽車

- 能源行業

- 軍事/國防

- 石油和天然氣行業

- 其他最終用戶

- 按地區

- 北美

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

第六章競爭格局

- 公司簡介

- DMG MORI

- Dalian Machine Tool Corporation

- Shenyang Machine Tool Corp Ltd(SMTCL)

- ERNST LENZ Maschinenbau GmbH

- Fehlmann AG

- Gate Machinery International Limited

- Hsin Geeli Hardware Enterprise

- Kaufman Mfg. Co

- LTF SpA

- Minitool, Inc.

- Roku-Roku Co, Ltd

- Scantool Group

- Taiwan Winnerstech Machinery Co, Ltd

- Tongtai Machine & Tool Co, Ltd*

第七章市場機會與未來趨勢

第8章附錄

- GDP 分佈(按活動)- 主要國家

- 對資本流動的見解 - 主要國家

- 經濟統計製造業,對經濟的貢獻(主要國家)

- 世界製造業統計數據

The size of Drilling Machines market is USD 22.52 billion in the current year and is anticipated to register a CAGR of over 4% during the forecast period

Key Highlights

- Taiwan-based machine tool makers recorded a total export value of USD 3.023 billion in 2022, increasing 8.6% on year, according to Taiwan Machine Tool & Accessory Builders' Association (TMBA). In 2021, China, Germany, and Japan were the powerhouses of machine tool industry worldwide. That year, China accounted for 31 percent of the world's machine tool production, while Germany and Japan each accounted for 13 percent. German manufacturers, VDW reported that new orders for machine tools increased 24% year-over-year during the second quarter of 2022, and 34% year-over-year for the first six months of 2022. For comparison, the U.S. machine tool orders rose 13.1% year-over-year during the first half of 2022. German machine-tool manufacturers' domestic orders from rose 35% during the first half of 2022, while foreign orders rose 33% during that time.

- From the first quarter of 2021, when lockdown restrictions were eased and factories and international trade were allowed to start up again, the global drilling machines industry slowly got back on its feet. The automobile industry is one of the major end-user segments of the machine tool market. Vehicle production slowed considerably as a result of the required shutdown following the outbreak of the COVID-19 virus.

- The growth of the market is primarily driven by the increasing demand from several end-user industries, such as automotive, aerospace, and others, across the world. Furthermore, the market is also driven by the growing demand for fabricated metal products, the development of heavy industrial equipment, advancements in manufacturing processes, and the adoption of the latest technologies. Moreover, the development of multi-purpose material removal machines, which consist of different cutting equipment in a single machine (like milling, drilling, etc.), has gained traction.

- The drilling machines market is a sub-segment of the machine tools market; the growth of the machine tool market is a positive sign for the market studied. China is the global leader in the machine tool market. Worldwide, the machine tooling sector represented a major share in terms of production volume when compared to forming technology. The machine tool cutting sector comprises lathes, drilling machines, boring machines, milling machines, etc.

- In addition, advancements in manufacturing machinery and government initiatives in the machine tool industry provide lucrative growth opportunities for the market. The heavy equipment segment is projected to dominate the market in the future due to an increase in demand for this equipment in the construction and manufacturing industries, where large-scale machined manufacturing requires precisely drilled holes for fittings and other connections. However, fluctuations in the prices of raw materials and a lack of skilled labor in the manufacturing sector hinder the growth of the drilling machine market globally.

Drilling Machines Market Trends

Rise in Demand for Drilling Machines in the Automotive Industry

The major factor boosting the growth of drilling machines is the increasing demand from the automotive industry. But since 2020, the global automotive sector has faced decreased demand and production halts resulting from the COVID-19 pandemic. According to industry sources, global light vehicle production units have been remarkable, and they only continue to grow. APAC is expected to register the highest growth rates in terms of production volumes, followed by North America. This scenario is expected to create demand for the drilling machines and other related machines associated with the manufacturing process.

In response to these automobile manufacturing, economic, and environmental/regulatory trends, the market is looking for innovations in turning and drilling, both machines and tooling. For instance, the Ultra T-A and Stealth Drill technologies enabled the low-pressure machines to perform dramatically better, on par with modern high-pressure coolant machines. Each insert can drill about 1200 holes, which is 3-6 times more than the old technology.

At present, there has been significant growth in the automotive industry because of the rising disposable income of people around the world. This rising income further improves the spending capacity of the global population. Thus, a noticeable growth in the automotive industry is predicted to create demand avenues in the drilling machine market shortly. These machines are used at an increased rate in the automotive industry. These drilling machines are commonly used for different drilling operations to fabricate automotive frames, cars, and others. Further, hole drilling is predicted to play a vital role in the manufacturing unit of the automotive industry. Hundreds of holes are drilled during the manufacturing of every vehicle, such as for camshafts, airbag propellants, engine blocks, transmission shafts, and many others.

So, based on how these products are being used more and more, the drilling machine market is expected to grow quickly over the next few years.

Asia-Pacific to Dominate the Drilling Machines Market

According to analysis, Asia-Pacific (APAC) is estimated to hold the highest market share in the current market studied. The region has the highest number of manufacturing plants, where the adoption of drilling machines is substantial. China is expected to be the major country in the region owing to its vast manufacturing sector. Additionally, automotive is one of China's pillar industries, and it continues to be the largest vehicle market in the world. In April 2022, around 210,000 commercial vehicles and 996,000 passenger cars were produced in China. During the month, the industry produced a total of 1.2 million vehicles, a decrease of 46.2 percent from the previous month and 46.1 percent year-over-year.

The economies in this region have low operating costs, which attract businesses from larger manufacturing bases and countries. In recent times, China has seen tighter regulations and rising wages, which have led to an increase in operating costs as it plans to shift toward higher-value manufacturing. Hence, to replace the role that China once used to play, companies are looking to the ASEAN region for lower-value production networks, which have also been largely integrated into global manufacturing value chains. As per the analysis, drilling machine manufacturers should align their distribution channels to focus on the growing markets by serving the emerging manufacturing sectors to increase their sales.

Rapid urbanization, industrialization, high disposable income, and increased R&D activities associated with technological advancement are some of the factors expected to fuel demand for drilling machines in the Asia-Pacific region.

Drilling Machines Industry Overview

The report covers major international players operating in the drilling machine market. The market is highly fragmented in nature, with large companies claiming significant market share.

Several key players work together, come up with new ideas, grow their businesses, win awards, and do other things to improve their products and stay competitive in the market.

Some of the key players in the drilling machines market are DMG MORI, Dalian Machine Tool Corporation, Shenyang Machine Tool Corp. Ltd. (SMTCL), ERNST LENZ Maschinenbau GmbH, Fehlmann AG, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

- 2.5 Project Process And Structure

- 2.6 Engagement Frameworks

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Global Manufacturing Sector (Overview, Trends, R&D, Key Statistics, etc.)

- 4.5 Key Government Regulations and Initiatives for Manufacturing Sector

- 4.6 Metal Working Industry Snapshot (Overview, Key Metrics, Developments, etc.)

- 4.7 Insights on Portable Drilling Machines and its Latest Developments

- 4.8 Spotlight on Drilling Tools (Overview, Different Types, Advancements, etc.)

- 4.9 Impact of COVID-19 on the Market

- 4.10 Market Dynamics

- 4.10.1 Market Drivers

- 4.10.2 Market Restraints/Challenges

- 4.10.3 Market Opportunities

- 4.11 Industry Attractiveness - Porter's Five Forces Analysis

- 4.11.1 Threat of New Entrants

- 4.11.2 Bargaining Power of Buyers/Consumers

- 4.11.3 Bargaining Power of Suppliers

- 4.11.4 Threat of Substitute Products

- 4.11.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Sensitive Drilling Machine

- 5.1.2 Upright Drilling Machine

- 5.1.3 Radial Drilling Machine

- 5.1.4 Gang Drilling Machine

- 5.1.5 Multiple Spindle Drilling Machine

- 5.1.6 Deep Hole Drilling Machine

- 5.1.7 Other Types

- 5.2 By End-user

- 5.2.1 Fabrication and Industrial Machinery Manufacturing

- 5.2.2 Aerospace

- 5.2.3 Heavy Equipment

- 5.2.4 Automotive

- 5.2.5 Energy Industry

- 5.2.6 Military & Defense

- 5.2.7 Oil & Gas

- 5.2.8 Other End-Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.5 Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 DMG MORI

- 6.2.2 Dalian Machine Tool Corporation

- 6.2.3 Shenyang Machine Tool Corp Ltd (SMTCL)

- 6.2.4 ERNST LENZ Maschinenbau GmbH

- 6.2.5 Fehlmann AG

- 6.2.6 Gate Machinery International Limited

- 6.2.7 Hsin Geeli Hardware Enterprise

- 6.2.8 Kaufman Mfg. Co

- 6.2.9 LTF SpA

- 6.2.10 Minitool, Inc.

- 6.2.11 Roku-Roku Co, Ltd

- 6.2.12 Scantool Group

- 6.2.13 Taiwan Winnerstech Machinery Co, Ltd

- 6.2.14 Tongtai Machine & Tool Co, Ltd*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution, by Activity-Key Countries

- 8.2 Insights on Capital Flows-Key Countries

- 8.3 Economic Statistics Manufacturing Sector, Contribution to Economy (Key Countries)

- 8.4 Global Manufacturing Industry Statistics