|

市場調查報告書

商品編碼

1272698

生物植入物市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Bio-implants Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,生物植入物市場預計將以 8% 的複合年增長率增長。

COVID-19 大流行不僅對感染 COVID-19 的患者產生了重大影響,而且對其他患者也產生了重大影響,導致植入手術被取消以管理和確保資源,並且許多影響了該國的醫療保健系統因為醫院缺乏專家來協助這些手術。 例如,根據美國國家醫學圖書館 2021 年 10 月在全球範圍內發表的一項研究,普外科住院人數下降了 42.8%。 因此,在 COVID-19 大流行期間外科手術的減少影響了市場的增長。 然而,推遲的手術在全球範圍內恢復,推動了大流行後時期的市場增長。 因此,預計在預測期內進行的外科手術和手術數量將推動生物植入物市場的發展。

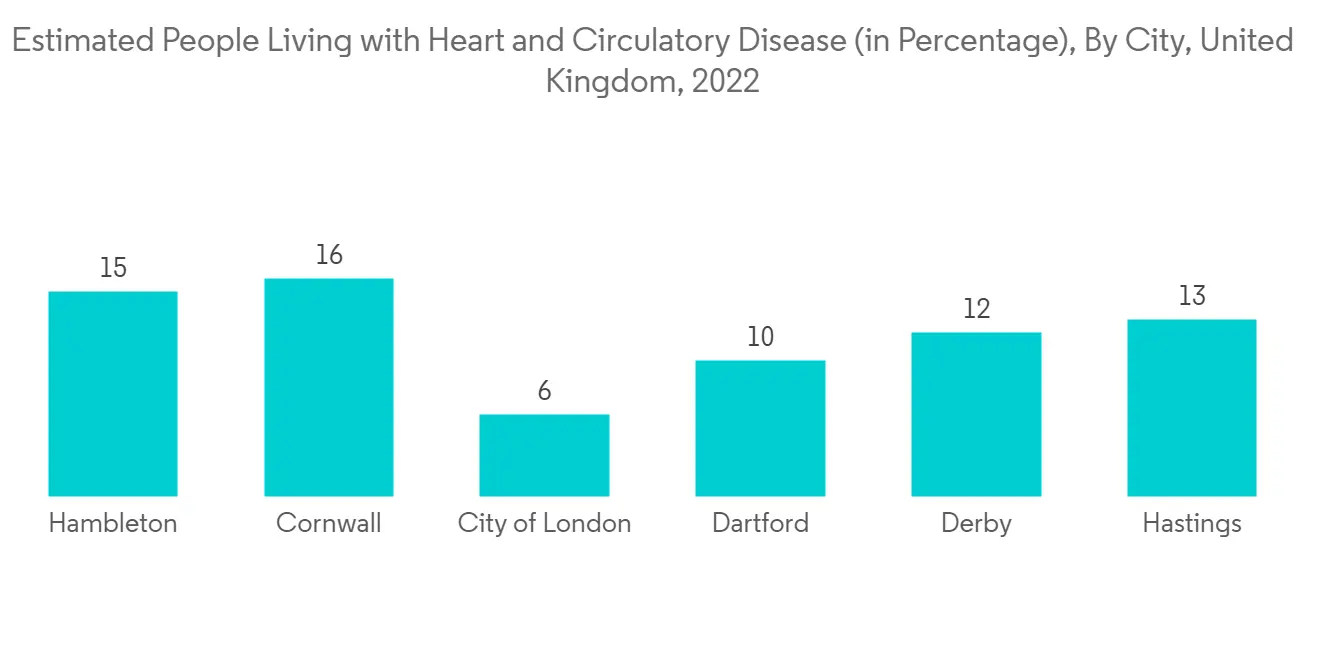

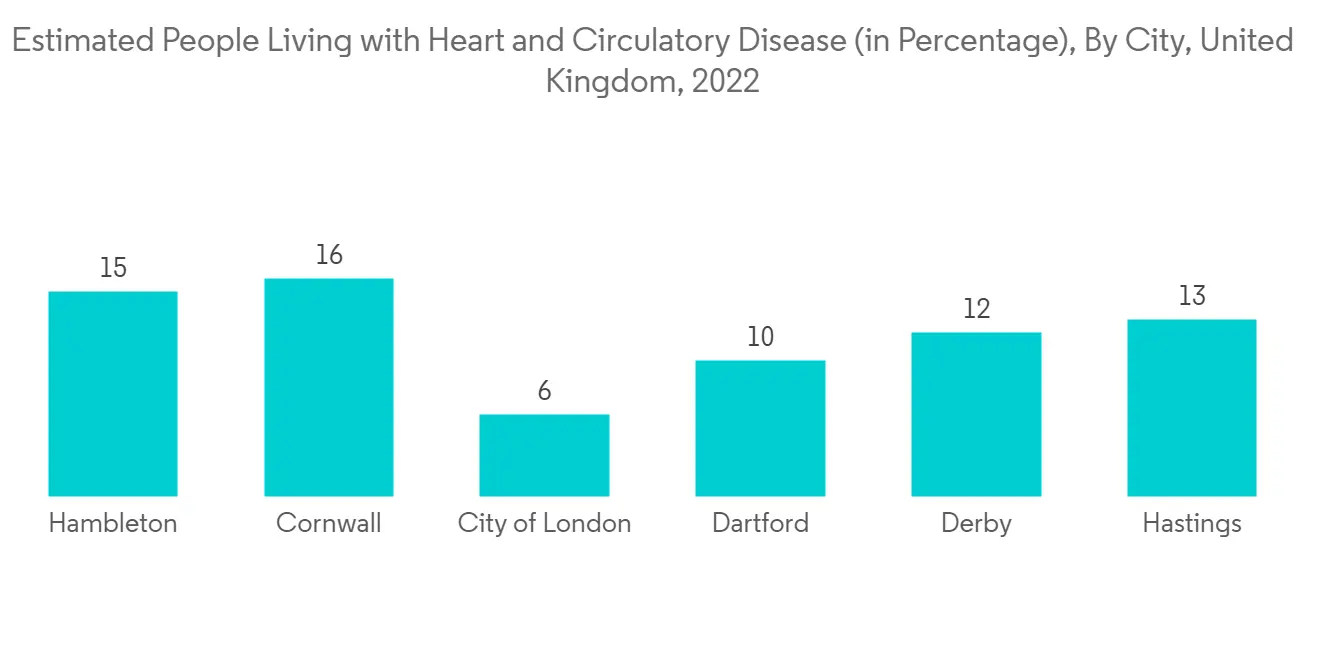

生物植入物市場的主要驅動因素是慢性病和生活方式疾病負擔的增加以及對微創手術的日益偏好。 生物植入物有助於在肥胖、感染和肌肉骨骼疾病等情況下更好地控制和特定藥物輸送。 例如,生物植入物可向骨骼系統提供獨特且特異性的藥物輸送。 據《骨科外科》2021年1月發表的一篇論文顯示,北京社區中年人群腰椎峽部裂總患病率為17.26%(男性15.98%,女性18.80%)。 據說女性60歲以後更容易患腰椎病。 此外,根據英國心臟基金會2022年公佈的“UK Factsheet January 2022”,2021年日本將有約760萬人患有心臟和循環系統疾病,其中男性約400萬人,女性約360萬人。心臟和循環系統疾病。 因此,患者中心髒病和循環系統疾病的高患病率導致了對更多植入手術和住院治療的需求。

此外,預計在預測期內,增加產品發布也將推動市場增長。 2021年2月,美敦力推出了TYRX可吸收抗菌包膜——一種可吸收的一次性抗菌包膜,旨在穩定心臟植入式電子設備或植入式神經刺激器。

因此,預計該市場在預測期內將穩定增長。 然而,生物植入物的高成本和不利的報銷政策預計將抑制市場增長。

生物植入物市場趨勢

在預測期內,心血管植入物部分預計將佔據生物植入物市場的很大份額。

用於心臟修復的生物植入物需要功能性血管生成和神經支配,以便與周圍的心肌適當整合。 具有乾細胞細胞外囊泡的生物植入物可改善急性心肌梗死後的心臟功能。 推動市場細分增長的主要因素是全球心血管疾病患病率上升。 此外,全球老齡化人口正在顯著增加,預計在預測期內將為市場帶來更多機會。 例如,根據美國心臟協會2021年發表的一篇文章,美國每年約有4萬名兒童接受先天性心臟手術。 心血管疾病患病率的增加,增加了對早期診斷和治療的需求,預計將在預測期內推動介入心髒病學手術的增長。 它將推動心血管植入物領域的增長。 大多數患者選擇心臟手術,但生物植入物可用於治療多種心血管疾病。

產品發布的增加預計也將在預測期內推動所研究細分市場的增長。 例如,2022 年 5 月,Impulse Dynamics 推出了 Optimizer Smart Mini。 它是一種具有心力衰竭監測功能的可充電電池,可為提供者提供重要的臨床見解,以幫助管理心力衰竭患者。

因此,由於上述所有因素,預計所研究的細分市場在預測期內將呈現高增長。

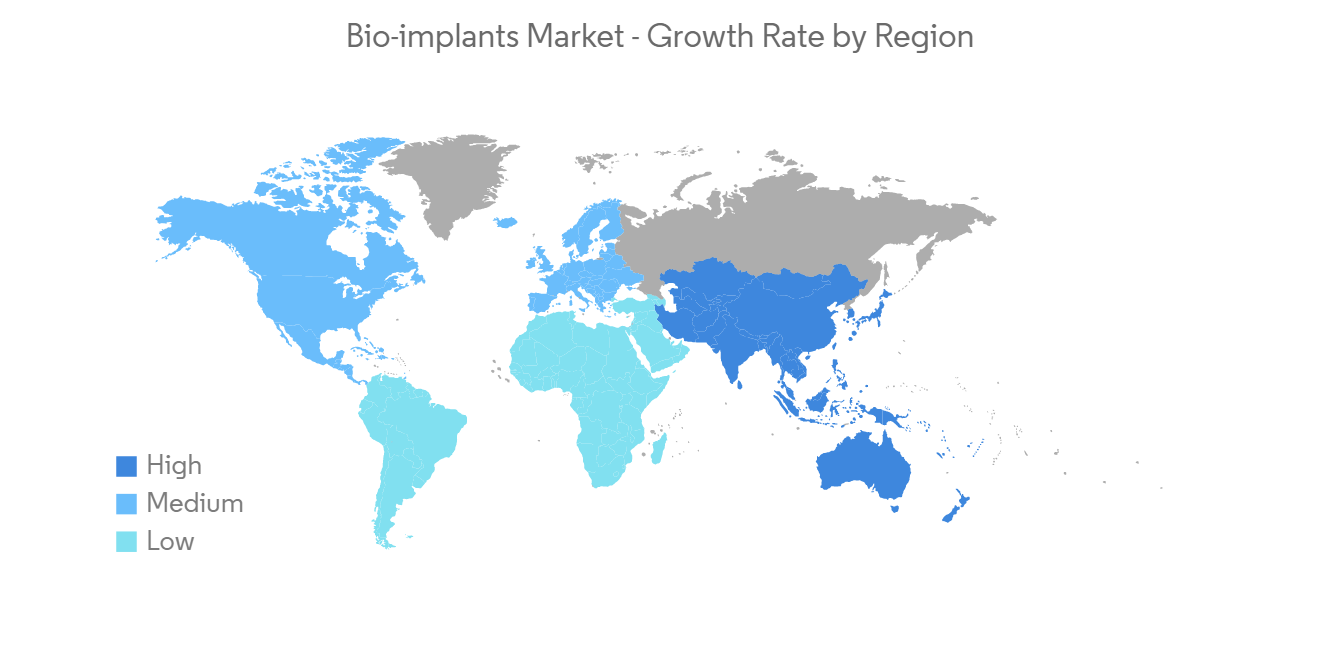

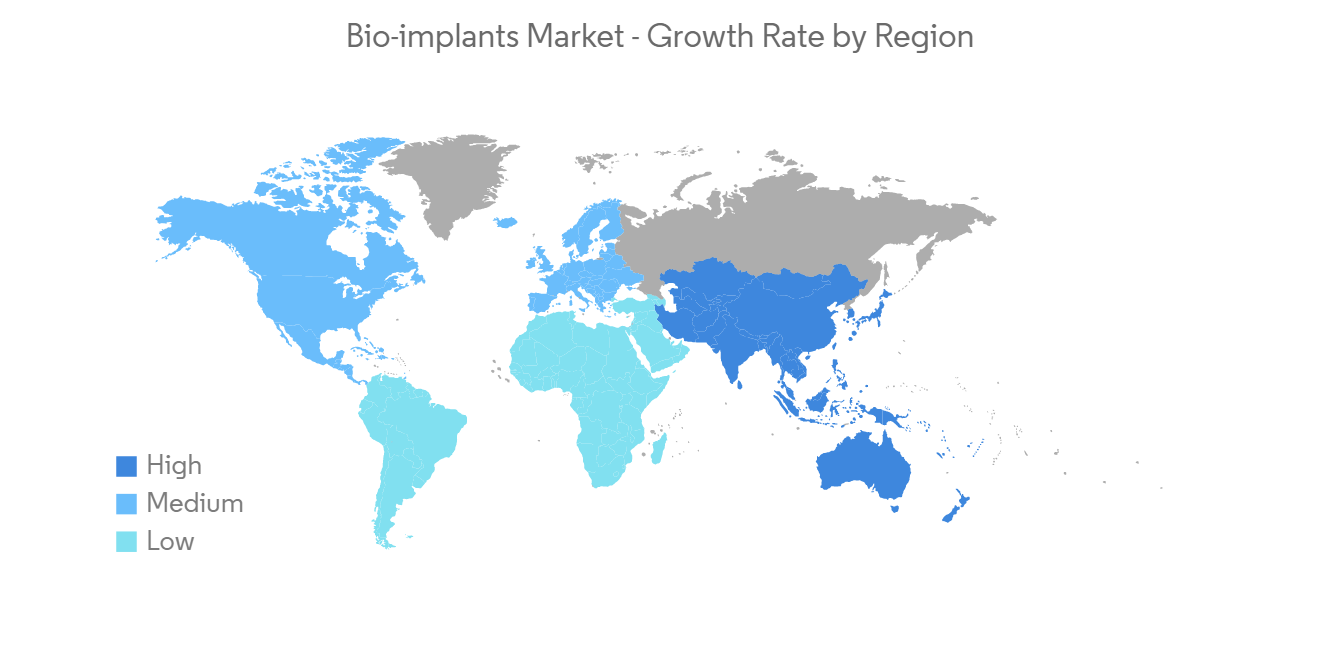

北美生物植入市場有望顯著增長

北美在生物植入市場中佔有很大份額,預計在預測期內將呈現類似趨勢,不會出現重大波動。 推動市場增長的主要因素是慢性病的日益流行和更好的醫療保健基礎設施的存在。 根據美國疾病控制與預防中心 (CDC) 2022 年 7 月更新的數據,冠心病是最常見的心髒病,在美國影響著大約 2010 萬 20 歲及以上的成年人。我也患有同樣的疾病。 此外,CDC 數據表明,每 40 秒就有一人心髒病發作,美國每年有近 805,000 人心髒病發作。 慢性病患者數量的增加預計將增加對整個生物植入物市場的需求。 因此,由於上述所有因素,預計市場在預測期內將呈現高增長率。

此外,根據醫療保險和醫療補助服務中心的數據,從 2019 年到 2028 年,國家醫療保健支出預計將以 5.4% 的複合年增長率增長,到 2028 年將達到 6.2 萬億美元。. 預計 2019 年至 2028 年全國衛生支出的增長速度將比年均 GDP 快 1.1 個百分點,因此衛生在經濟中的份額預計將在 2028 年增長 19.7%。 因此,預計不斷增加的醫療成本將為生物植入物創造發展機會並推動市場增長。

增加產品發布預計也將在預測期內推動市場增長。 例如,2022年6月,ZimVie在美國推出了美國食品和藥物管理局批准的T3 pro tampered implant和Encode emergence healing Abutment。

因此,預計上述因素將推動該地區預測期內的市場增長。

生物植入行業概況

生物植入市場本質上是整合的,因為在該市場運營的公司數量很少。 競爭格局分析了具有市場份額的知名國際和本地參與者,包括 Implantate AG、Abbott、Bausch & Lomb Incorporated、BIOTRONIK Inc.、Edwards Lifesciences Corporation、LifeNet Health、MiMedx、Smith & Nephew PLC 和 Zimmer Biomet。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 慢性病和生活方式相關疾病的負擔增加

- 越來越喜歡微創手術

- 市場製約因素

- 生物植入物的高成本

- 不利的報銷政策

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分(基於價值的市場規模 - 百萬美元)

- 按生物植入物類型

- 心血管植入物

- 脊柱植入物

- 骨科植入物

- 種植牙

- 眼科植入物

- 其他植入物

- 按材料

- 生物材料金屬和合金

- 高分子材料

- 其他材料

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- aap Implantate AG

- Abbott Laboratories

- Bausch & Lomb Incorporated

- BIOTRONIK Inc.

- Edwards Lifesciences Corporation

- LifeNet Health

- MiMeDX

- Smith & Nephew PLC

- Zimmer Biomet

- Boston Scientific Corporation

- Stryker Corporation

- Endo International Plc

第7章 市場機會將來動向

The Bio-implants market is expected to register a CAGR of 8% over the forecast period.

The Covid-19 pandemic had an effect on the country's healthcare systems with significant impacts not only on the patients infected with COVID-19 but on others as well, which resulted in the cancellation of implant surgeries to manage and reserve the resources and many hospitals were facing a shortage of professionals to assist these surgeries. For instance, according to the study published in October 2021, by the National Library of Medicine globally, there has been a 42.8% decrease in general surgery admissions. Thus, the reduction in surgical procedures during the COVID-19 pandemic affected the market's growth. However, the postponed surgeries resumed worldwide, driving the market's growth during the post-pandemic period. Hence, the high number of surgical procedures and operations being performed is expected to boost the development of the bio-implant market during the forecast period.

The bio-implants market is primarily driven by the increasing burden of chronic diseases and lifestyle disorders and the rising preference toward minimally invasive surgeries. Bio-implants help in better management and specific drug delivery in conditions such as obesity, infections, and musculoskeletal disorders. For instance, bio-implants provide a unique and specific drug delivery for the skeletal system. According to an article published by Orthopaedic Surgery in January 2021, the total prevalence of lumbar spondylolisthesis in the middle-aged people of the Beijing community was 17.26% (15.98% in males and 18.80% in females). Women are more likely to suffer from lumbar spondylolisthesis after 60 years old. Furthermore, the "UK Factsheet January 2022" published in 2022 by British Heart Foundation shows that around 7.6 million people live with heart and circulatory diseases, and nearly 4 million males and 3.6 million females live with heart and circulatory diseases in the country in 2021. This highly prevalent heart and circulatory disease among patients generate demand for more implant procedures and hospital admissions.

Additionally, the increasing product launches are expected to drive the growth of the market during the forecast period. In February 2021, Medtronic launched TYRX absorbable Antibacterial Envelope- an absorbable, single-use antibacterial envelope designed to stabilize a cardiac implantable electronic device or implanted neurostimulator.

Hence, the market studied is expected to witness steady growth over the forecast period. However, the high cost of bio-implants and unfavorable reimbursement policies are expected to restrain the growth of the market.

Bio-implants Market Trends

Cardiovascular Implants Segment is Expected to Hold the Large Share in the Bio-Implant Market Over the Forecast Period.

Bioimplants for cardiac repair require functional vascularization and innervation for proper integration with the surrounding myocardium. Bioimplants with extra-cellular vesicles from stem cells improve cardiac function after an acute myocardial heart attack. The primary factor driving the market segment's growth is the rising prevalence of cardiovascular diseases worldwide. Moreover, there is an evident rise in the geriatric population globally, which is expected to create more opportunities for the market over the forecast period. For instance, as per the article published by the American Heart Association in 2021, Approximately 40,000 children undergo congenital heart surgery in the United States each year. Such increasing prevalence of cardiovascular diseases, which led to an increasing need for early diagnosis and treatment, is expected to drive the growth of interventional cardiology procedures during the forecast period. It will drive growth in the cardiovascular implants segment. Most patients opt for heart surgery, and bioimplants can be used to treat various cardiovascular diseases.

Also, the increasing product launches are expected to drive the growth of the studied segment during the forecast period. For instance, in May 2022, Impulse Dynamics launched an optimizer smart mini. It is a rechargeable battery with heart failure monitoring that provides important clinical insights to providers to assist in managing their patients with heart failure.

Thus, owing to all the above-mentioned factors, the studied segment is expected to witness high growth over the forecast period.

North America is Expected to show a Significant Growth in the Bio-implants Market

North America is found to hold a significant share of the bio-implants market and is expected to show a similar trend over the forecast period without significant fluctuations. The major factors driving the growth of the market are the increasing prevalence of chronic diseases and the presence of better healthcare infrastructure. The Centers for Disease Control and Prevention (CDC) data updated in July 2022 shows that coronary heart disease is the most common type of heart disease, and approximately 20.1 million adults of age 20 and older have the disease in the United States. Additionally, as per the CDC data, every 40 seconds, someone suffers from a heart attack, and nearly 805,000 people in the United States have a heart attack every year. The rising number of cases of chronic diseases is expected to increase the overall demand in the bio-implants market. Thus, owing to all the above-mentioned factors, the market is expected to witness a high growth rate over the forecast period.

Additionally, as per the Centers for Medicare and Medicaid Services, national health spending was projected to grow at an average annual rate of 5.4% from 2019-2028 and reach USD 6.2 trillion by 2028. As national health expenditure is projected to grow 1.1% points faster than the average yearly GDP over 2019-2028, the health share of the economy is projected to rise by 19.7% in 2028. Thus, the increasing healthcare spending is anticipated to create opportunities for developing bioimplants, thereby propelling market growth.

Also, the increasing product launches are expected to drive the market's growth during the forecast period. For instance, In June 2022, ZimVie launched the United States Food and Drug Administration clearing T3 pro tampered implant and Encode emergence healing Abutment in the United States.

Thus, the above-mentioned factors are expected to drive the market's growth during this region's forecast period.

Bio-implants Industry Overview

The bio-implants market is consolidated in nature due to the presence of few companies operating. The competitive landscape includes analyzing a few well-known international and local companies that hold market shares and are famous, including Implantate AG, Abbott, Bausch & Lomb Incorporated, BIOTRONIK Inc., Edwards Lifesciences Corporation, LifeNet Health, MiMedx, Smith & Nephew PLC, and Zimmer Biomet, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Chronic Diseases and Lifestyle Disorders

- 4.2.2 Rising Preference toward Minimally Invasive Surgeries

- 4.3 Market Restraints

- 4.3.1 High Cost of Bio-implants

- 4.3.2 Unfavorable Reimbursement Policies

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type of Bio-implants

- 5.1.1 Cardiovascular Implants

- 5.1.2 Spinal implants

- 5.1.3 Orthopedic Implants

- 5.1.4 Dental Implants

- 5.1.5 Ophthalmic Implants

- 5.1.6 Other Implants

- 5.2 By Material

- 5.2.1 Biomaterial Metal and Alloys

- 5.2.2 Polymers

- 5.2.3 Other Materials

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 aap Implantate AG

- 6.1.2 Abbott Laboratories

- 6.1.3 Bausch & Lomb Incorporated

- 6.1.4 BIOTRONIK Inc.

- 6.1.5 Edwards Lifesciences Corporation

- 6.1.6 LifeNet Health

- 6.1.7 MiMeDX

- 6.1.8 Smith & Nephew PLC

- 6.1.9 Zimmer Biomet

- 6.1.10 Boston Scientific Corporation

- 6.1.11 Stryker Corporation

- 6.1.12 Endo International Plc