|

市場調查報告書

商品編碼

1258789

維生素 D 檢測市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Vitamin D Testing Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,維生素 D 測試市場預計將以 5.1% 的複合年增長率增長。

COVID-19 大流行對 2020 年的維生素 D 檢測市場產生了重大影響。 在大流行期間,嚴格的家庭隔離方案、推遲的選擇性程序以及政府暗示的其他限制使人們難以進入醫療機構。 因此,包括維生素 D 測試在內的路由測試被推遲了。 例如,國家生物技術信息中心 (NCBI) 於 2022 年 9 月發表的一項名為“COVID-19 對兒童醫療中心實驗室利用的影響”的研究發現,在大流行期間,實驗室檢測估計減少了 84%。報導。 這主要是由於 SARS-COV-2 病毒的實驗室檢測量激增,這大大抵消了其他適應症的診斷檢測量,包括維生素 D 水平檢測。

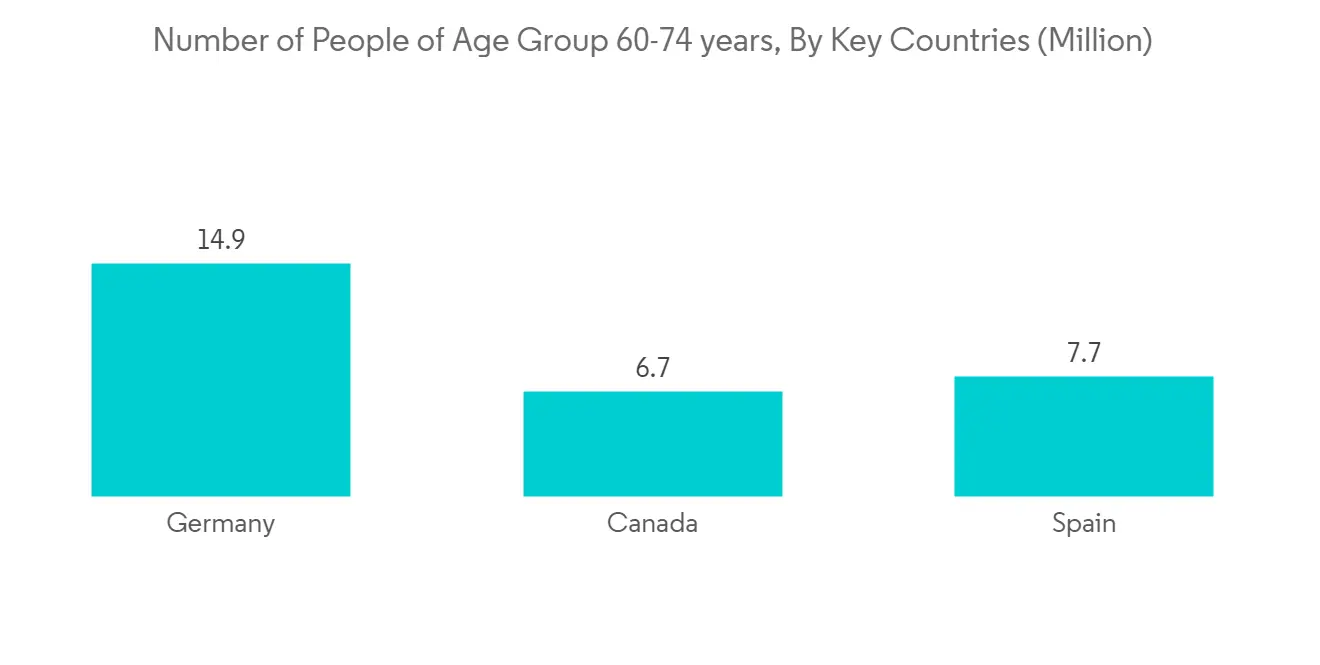

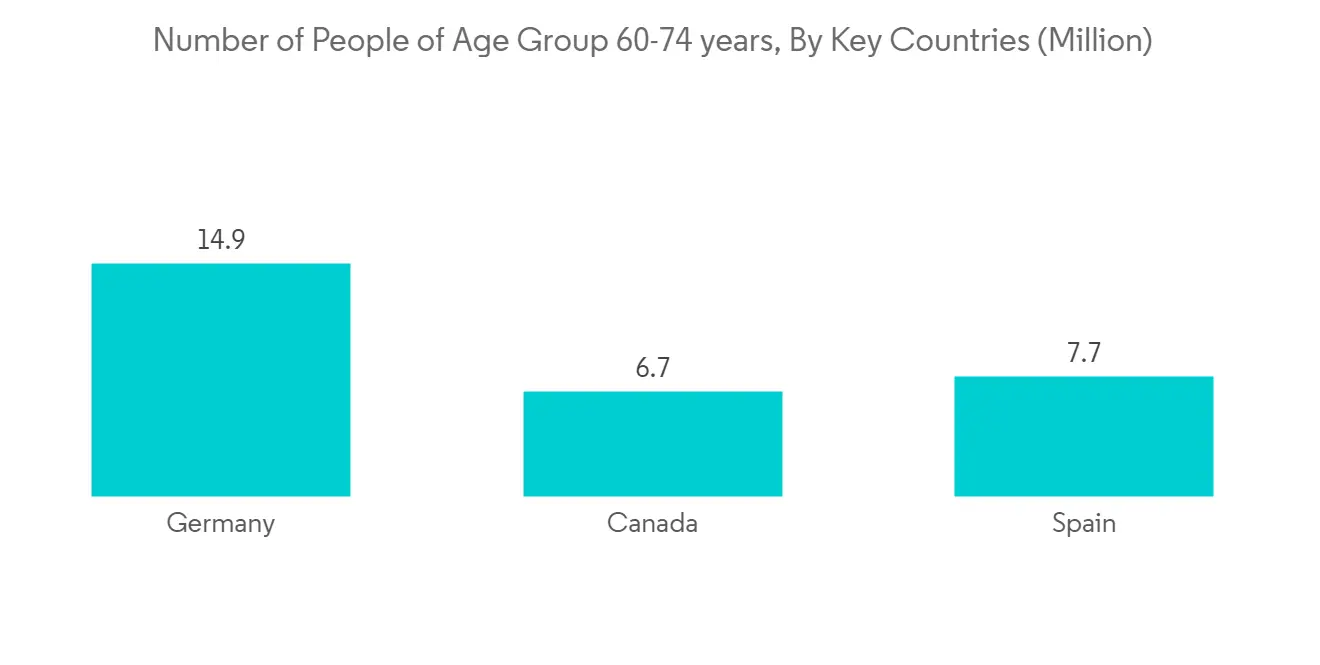

例如,根據 Informa UK Limited 於 2022 年 1 月發表的一篇文章,據報導,全球每年報告有 890 萬例因骨質疏鬆症導致的骨折。 此外,根據哈雷街頭髮移植診所在 2022 年 11 月發表的一項研究,據報導英國有 1540 萬人患有頭髮稀疏問題。 這些相關疾病增加了檢測體內維生素 D 水平的需求。 這反過來又增加了全球對多種維生素 D 檢測試劑盒的需求,推動了市場增長。 與此同時,用於快速檢測的先進產品的推出以及大公司採用的幾種增長戰略提高了公眾對維生素 D 檢測試劑盒的採用率。

例如,2022 年 11 月,2San 宣布了一種用於家庭檢測的維生素 D 快速檢測試劑盒,可在 10 分鐘內提供結果。 2San 是世界領先的一流醫療設備、套件和感染控制系統的製造商和分銷商之一。 公司在英國、澳大利亞、美國、加拿大等地擁有強大的供應鍊網絡。 同樣在 2022 年 1 月,遠程醫療和醫療設備公司 Empower Clinics Inc. 的子公司 MediSure Canada 從加拿大衛生部獲得了 MediSure 維生素 D 快速檢測的商業權利。 這使公司能夠在研究期間滿足對維生素 D 快速檢測試劑盒不斷增長的需求。 與此同時,政府和私人團體對維生素 D 缺乏症的認識不斷提高,向公眾傳播了有關維生素 D 營養價值的知識,並提高了維生素 D 檢測率。

例如,2022 年 1 月,Horlicks Women's Plus 與 Apollo Clinic 合作,以提高女性對骨骼健康的認識。 該宣傳活動為印度欽奈阿波羅診所的 30 多歲女性提供免費維生素 D 檢測。 2022 年 5 月,英國政府還召開了一次會議,徵求有關提高英國維生素 D 水平的意見。 本次電話會議的主要目的是提高公眾對維生素 D 的認識,並通過飲食和膳食補充劑提高維生素 D 水平。 因此,普通大眾對維生素 D 檢測的需求和採用率猛增,推動了整體市場增長。

因此,上述因素幫助市場在研究期間顯著增長。 然而,某些明顯的優勢,例如由於缺乏檢測試劑盒的驗證而導致的體內維生素 D 水平的錯誤檢測,預計會阻礙市場增長。

維生素 D 測試市場趨勢

25-羥基維生素 D 測試有望在研究期間主導市場

25-羥基維生素 D 測試被認為是檢測人體維生素 D 水平的最準確方法。 根據西奈山伊坎醫學院 2022 年 4 月發表的一篇文章,25-羥基維生素 D 測試被認為是確定體內維生素 D 水平的最準確方法。 此外,Healthline Media 於 2022 年 1 月發表的一篇文章指出,25 羥基維生素 D 的含量是檢測骨質疏鬆症和佝僂病的重要指標。

此外,某些優勢(例如 25OH 維生素 D 的保質期比 1,25 二羥基維生素 D 更長)有望在研究期間推動該細分市場的採用。 例如,根據 NCBI 2022 年 9 月的一篇文章,由於 25-羥基維生素 D 的半衰期長達兩週,因此據報導主要推薦用於檢測維生素 D 水平。

除此之外,增加久坐不動的生活方式、減少暴露在陽光下以及減少綠葉蔬菜和水果的攝入會降低人體內維生素 D 的含量。 例如,HealthifyMe 於 2022 年 6 月發表的一篇文章將陽光照射不足歸因於幾個因素,其中包括維生素 D 缺乏症的主要原因。 此外,根據 Informa UK Limited 於 2020 年在印度進行的一項橫斷面研究,據報導,肥胖患者維生素 D 缺乏症的患病率約為 65.5%。 因此,在研究期間,患有維生素 D 缺乏症的患者人數增加,並且採用 25-羥基維生素 D 檢測的人數增加。

此外,用於 25-羥基維生素 D 檢測的廣泛產品組合增加了醫生和公眾對該檢測試劑盒和檢測技術的採用。 例如,2020 年 3 月,Thermo Fisher Scientific Inc. 宣佈在美國推出用於 25-羥基維生素 D 測定測試的 Cascadion SM 臨床分析儀。

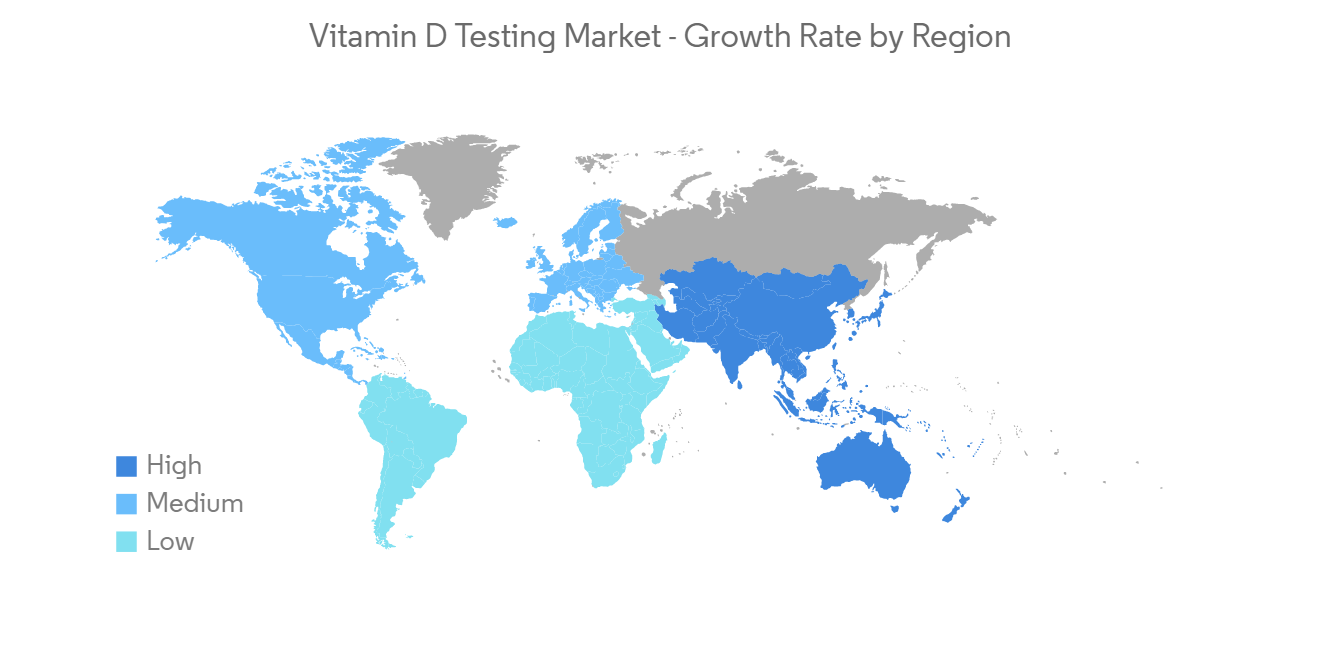

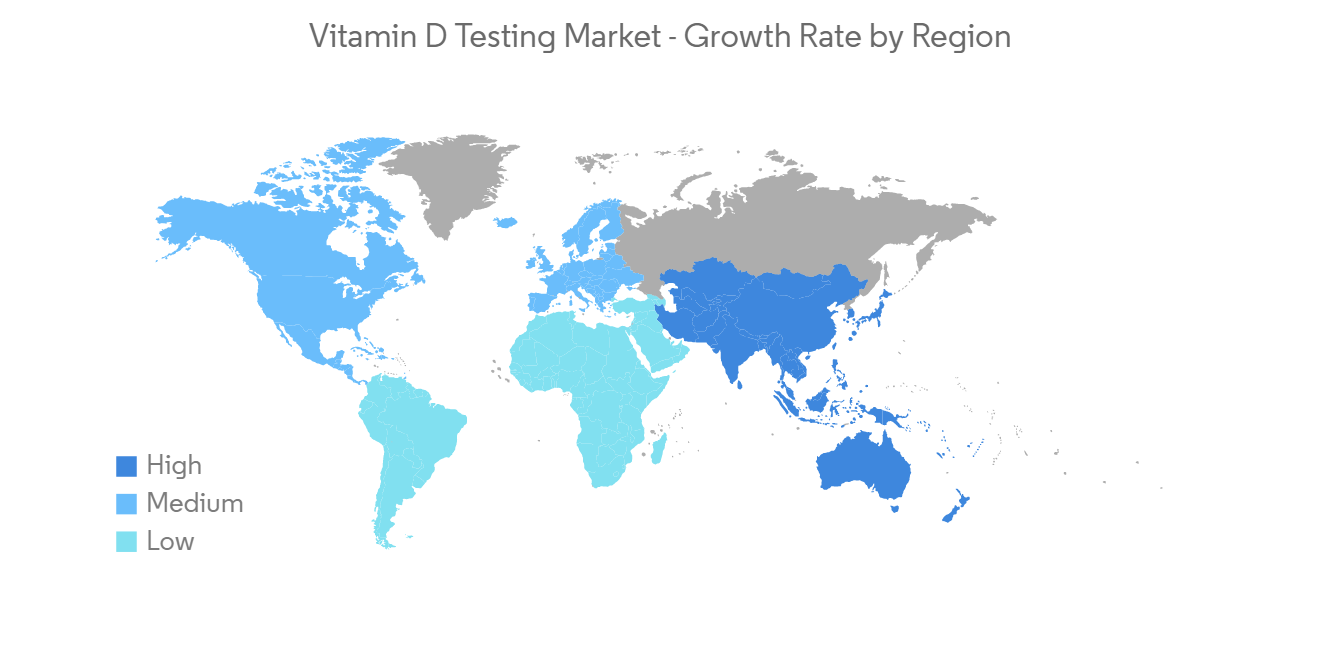

北美有望主導維生素 D 檢測市場

預計將主導北美市場的關鍵因素包括維生素 D 缺乏症患病率的上升以及美國 FDA 批准的維生素 D 檢測試劑盒產品數量的增加。 例如,根據克利夫蘭診所 2022 年 8 月發布的數據,估計美國有 35% 的成年人患有維生素 D 缺乏症。 這將增加該地區對診斷試劑盒的需求和採用,並在研究期間推動該地區的增長。

此外,一些組織正在美國開展宣傳活動,以提高人們對維生素 D 營養價值的認識。 例如,2020 年 8 月,有機與天然健康協會發起了一項教育活動,以提高人們對維生素 D 的健康益處的認識。 這增加了普通人群對維生素 D 檢測的需求和採用,隨後支持了該地區市場的增長。

除此之外,針對某些維生素 D 檢測的優惠報銷政策以及公眾對維生素 D 檢測的認識不斷提高,有望顯著提高維生素 D 檢測的採用率。我正在展示 根據 2022 年 4 月的 UnitedHealthcare Medicantage 政策指南,如果您的維生素 D 水平低於 20 ng/dl 或高於 60 ng/dl,您將在美國報銷某些費用。

因此,由於上述因素,預計北美地區在預測期內將引領地區份額。

維生素 D 檢測行業概況

維生素 D 檢測市場本質上是整合的,一些主要參與者主導著市場份額。 競爭格局包括對具有市場份額的知名國際和本地公司的分析。 F. Hoffmann-La Roche Ltd、DiaSorin S.p.A.、Abbott、bioMerieux SA、Siemens Healthcare GmbH、Beckman Coulter, Inc. Quest Diagnostics Incorporated、Quidel Corporation、Thermo Fisher Scientific Inc. Tosoh Bioscience, Inc、Qualigen Therapeutics Inc. 包含。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 維生素 D 缺乏症增加

- 維生素D檢測設備技術進展

- 提高營利性和非營利性組織對維生素 D 缺乏症的認識

- 市場製約因素

- 與維生素 D 檢測相關的高成本

- 波特的五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(按價值劃分的市場規模)

- 按測試類型

- 25-羥基維生素 D 測試

- 1,25 二羥基維生素 D 測試

- 最終用戶

- 醫院和診所

- 診斷實驗室

- 其他最終用戶

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- F. Hoffmann-La Roche Ltd.

- bioMerieux SA

- Beckman Coulter, Inc.

- DiaSorin S.p.A.

- Siemens Healthcare GmbH

- Quest Diagnostics Incorporated

- Abbott

- Quidel Corporation

- Thermo Fisher Scientific Inc.

- Tosoh Bioscience, Inc.

- QUALIGEN THERAPEUTICS, INC.

第七章市場機會與未來趨勢

The Vitamin D Testing Market is expected to register a CAGR of 5.1% over the forecast period.

The COVID-19 pandemicmoderately impacted the Vitamin D Testing Market in 2020. Stringent lockdown scenarios at home restrictions, postponement of elective procedures, and other restrictions implied by the government during the pandemic resulted in difficulties while accessing healthcare facilities. This subsequently delayed the routing testing procedures, including the vitamin D test. For instance, in a study, "The Impact of COVID-19 on Laboratory Test Utilization at a Pediatric Medical Center", published by the National Center for Biotechnology Information (NCBI) in September 2022, it was reported that an estimated 84% decrease in lab tests was observed during the pandemic. This was primarily owing to a surge in the lab test volume for the SARS-COV-2 virus, which dramatically offset the diagnostic testing volume for other indications, including the test for vitamin D level.

However, the increasing prevalence of several vitamin D deficiency-associated diseases such as osteoporosis, hair loss, excessive fatigue, and others are augmenting the demand for diagnostic testing of vitamin D. For instance, according to an article published by Informa UK Limited in January 2022, it was reported that globally 8.9 million fractures were reported in each year due to osteoporosis. Also, according to a study published by Harley Street Hair Transplant Clinics in November 2022, it was reported that 15.4 million people in the United Kingdom are suffering from hair loss. These associated disorders are increasing the demand to detect vitamin D levels in the body. This, in turn, is increasing the demand for several vitamin D testing kits globally and fostering the market's growth.

Along with this, the introduction of advanced products for rapid testing and the adoption of several growth strategies adopted by the key players are rising the adoption rate of vitamin D test kits among the common people. For instance, in November 2022, 2San introduced vitamin D rapid test kits for home testing, which offer results within 10 minutes. 2San is one of the leading global manufacturers and distributors of best-in-class medical devices, kits, and infection control systems across the globe. The company has a robust supply chain network in the United Kingdom, Australia, the United States, Canada, and others. Also, in January 2022, MediSure Canada, a subsidiary of Empower Clinics Inc., a telemedicine and medical device company, received the commercialization right from Health Canada for Medisure Vitamin D Rapid Test. This helped the company to cater to the rising demand for vitamin D rapid test kits during the study period. This is augmenting the preference for home test kits and subsequently resulting in the higher adoption of vitamin D tests.

Along with this, rising initiatives for awareness of vitamin D deficiency by the government and private organization is increasing the knowledge of the nutritious value of vitamin D among common people, which in turn increase the rate of vitamin D testing procedures. For instance, in January 2022, Horlicks Women's Plus partnered with Apollo Clinic to improve bone health awareness among women. In this awareness campaign, they offered free vitamin D tests for women of age group 30 years across Apollo clinics in Chennai, India. Also, the government of England arranged a conference in May 2022 to seek views on improving vitamin D levels among the England population. The main objective of this conference call was to improve population awareness of vitamin D, improving vitamin D levels through diet and dietary supplements. This is alternatively surging the demand and adoption of vitamin D tests among the general population and resulting in the market's overall growth.

Therefore, the aforementioned factors have been instrumental in the substantial growth of the market during the study period. However, certain distinct advantages, including false detection of vitamin D level in the body due to lack of validation of the testing kits, is anticipated to hinder the market growth.

Vitamin D Testing Market Trends

25-Hydroxy Vitamin D Test is Anticipated to Dominate the Market During the Study Period

25-hydroxy vitamin D test is considered the most accurate way to detect the level of vitamin D in a person. According to an article published by Icahn School of Medicine at Mount Sinai in April 2022, it was stated that 25-hydroxy vitamin D test is considered the most precise way to determine the vitamin D level in the body. Also, according to an article published by Healthline Media in January 2022, it was stated that the amount of 25 OH vitamin D is an important indicator to detect osteoporosis and rickets.

Additionally, certain benefits, including longer shelf life of 25 OH vitamin D over 1,25 dihydroxy vitamin D, are poised to fuel the adoption of this segment during the study period. For instance, according to an article by NCBI in September 2022, it was reported that owing to the extended half-life of 2 weeks for 25-hydroxy vitamin D, it is mostly recommended for the detection of vitamin D levels in the body as opposed to 1,25 dihydroxy vitamin D, which has a half-life of fewer than 4 hours.

Apart from that, an increasingly sedentary lifestyle decreases exposure to sunlight, and a lower intake of green vegetables and fruits results in a reduced amount of vitamin D in the human body. For instance, according to an article published by HealthifyMe in June 2022, it was stated that several factors, including the primary reason for vitamin D deficiency, is attributed to lack of exposure to sunlight. Also, according to a cross-sectional study conducted in India and published by Informa UK Limited in 2020, it was reported that the prevalence of vitamin D deficiency was found to be around 65.5% among obese patients. This resulted in an increased patient pool suffering from vitamin D deficiency disorders which in turn increased the adoption of the 25-hydroxy vitamin D test during the study period.

In addition to that, a wide range of product availability for the 25-hydroxy vitamin D test is augmenting the adoption rate of this test kit and assay technology among physicians and the general population. For instance, in March 2020, Thermo Fisher Scientific Inc. announced the availability of the Cascadion SM Clinical Analyzer in the United States for 25-hydroxy vitamin D assay testing.

Therefore, the reasons mentioned above are the primary driving factors for the lion's share of the segment in the market during the study period.

North America is Anticipated to Dominate the Vitamin D Testing Market

North America is expected to dominate the market owing to primary factors, including the rising prevalence of vitamin D deficiency and the rising number of product approvals for vitamin D test kits by the U.S. FDA in the United States. For instance, according to data published by Cleveland Clinic in August 2022, an estimated 35% of adults in the United States suffer from vitamin D deficiency. This augments the demand and adoption of diagnostic kits in this region and alternatively fuels regional growth during the study period.

Additionally, to increase awareness of the nutritional value of vitamin D, several organizations are organizing awareness campaigns in the United States. For instance, in August 2020, the Organic & Natural Health Association initiated an educational campaign to enlighten the health benefits of vitamin D. This increased the demand and adoption of vitamin D testing among the general population and subsequently supported the growth of the market in this region.

Apart from that, the availability of favorable reimbursement policies for certain vitamin D tests and increasing awareness among the general population on vitamin D tests is poised to increase the adoption of vitamin D tests in a large proportion. According to UnitedHealthcare Medicare Advantage Policy Guideline in April 2022, it was stated that if the vitamin D level is less than 20 ng/dl or greater than 60 ng/dl, a certain amount of the expense will be reimbursed in the United States.

Therefore, owing to the above-mentioned factors, the North America region is anticipated to lead the regional share during the forecast period.

Vitamin D Testing Industry Overview

The Vitamin D Testing Market is consolidated in nature due to the presence of a few major players dominating the market shares. The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well known. include F. Hoffmann-La Roche Ltd, DiaSorin S.p.A., Abbott, bioMerieux SA, Siemens Healthcare GmbH, Beckman Coulter, Inc., Quest Diagnostics Incorporated, Quidel Corporation, Thermo Fisher Scientific Inc., Tosoh Bioscience, Inc., Qualigen Therapeutics Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Vitamin D Deficiency Diseases

- 4.2.2 Technological Advancement in the Vitamin D Testing Devices

- 4.2.3 Rising Awareness by the For Profit and Non-Profit Organisation for Vitamind D Deficiency

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with Vitamin D Testing

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Test Type

- 5.1.1 25-Hydroxy Vitamin D Test

- 5.1.2 1,25 Dihydroxy Vitamin D Test

- 5.2 By End-User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Diagnostics Labs

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 F. Hoffmann-La Roche Ltd.

- 6.1.2 bioMerieux SA

- 6.1.3 Beckman Coulter, Inc.

- 6.1.4 DiaSorin S.p.A.

- 6.1.5 Siemens Healthcare GmbH

- 6.1.6 Quest Diagnostics Incorporated

- 6.1.7 Abbott

- 6.1.8 Quidel Corporation

- 6.1.9 Thermo Fisher Scientific Inc.

- 6.1.10 Tosoh Bioscience, Inc.

- 6.1.11 QUALIGEN THERAPEUTICS, INC.