|

市場調查報告書

商品編碼

1248847

郵政服務市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Postal Services Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,郵政服務市場預計將以 1% 左右的複合年增長率增長。

COVID-19 的傳播迫使各國關閉公共活動,改變了政府、企業和人們對郵政系統的看法。 隨著越來越多的人被要求呆在家裡以阻止病毒傳播,郵政服務越來越被認為是重要的服務提供商。

主要亮點

- COVID-19 大流行在 2020 年抑制了郵政服務市場,因為政府封鎖並限制人員和貨物的流動以遏制感染的傳播。 大流行已將行業增長從郵政收入推向包裹。 根據國際郵政公司 (IPC) 的數據,2020 年包裹收入增加了 193 億歐元(217 億美元),而郵政收入減少了 61 億歐元(68□□ 億美元)。

- 近年來,郵政服務行業受到互聯網和數字行業的衝擊。 隨著向在線通信的轉變,傳統的核心郵政遞送業務正在衰退。 同時,行業也面臨著快速增長的電商包裹市場的激烈競爭。 因此,郵政和郵政業務正從國有壟斷向多元化經營的商業企業轉變。

- 目前,世界頂級郵政公司包括美國郵政 (USPS)、德國郵政 DHL(德國)、法國郵政和日本郵政。

- 對郵政和郵寄服務的需求取決於交易量和公司的直接營銷支出。 此外,個別公司的盈利能力取決於其營運效率。

- 最大的郵政和郵寄市場包括中國、美國、英國、法國、德國和意大利。 高增長市場包括加拿大、印度、葡萄牙和新加坡。

- 2021 年,全球郵政和快遞活動的主要市場是德國、英國、法國、意大利和荷蘭。 展望未來,數據分析的引入、技術發展以及自動駕駛和電動汽車的使用可能會對市場產生積極影響。 未來,勞動力短缺等因素將阻礙郵政服務市場的增長。

郵政服務市場趨勢

電子商務擴展郵政服務的可能性

電子商務對郵政業務來說是一個巨大的機遇。 消費者越來越習慣於從新興的電子商務平台在線訂購產品,而傳統的實體店也正在轉向數字環境。 隨著在線銷售的興起,電子商務運營商□□正在尋求具有成本效益的渠道來交付和收集所購買的商品。 在這方面,擁有全國網絡和最後一英裡交付經驗的郵政運營商正在成為有效的合作夥伴。 例如,在肯尼亞,在線市場 Jumia 和肯尼亞郵政服務合作,允許客戶在最近的郵局領取他們購買的 Jumia。

但是,世界各地的許多郵政運營商都沒有做好充分利用電子商務增長的準備。 B2C 電子商務在全球範圍內呈現 17% 的增長率,而郵政公司的包裹量增長不到 5%。 部分問題在於,在表現不佳的郵政運營商中,數字技術作為核心業務和創新驅動力的採用率較低。 凡是採用數字技術的地方,創新都將不可避免地發生。 例如,肯尼亞郵政推出了mPost,將每一部手機都變成了一個官方郵政地址,讓信件和包裹在全國任何地方都可以訪問。

英國使用無人機改善郵件投遞

COVID-19 疫情正在重新定義郵政和包裹行業對自主遞送系統的需求。

United Kindome Royal Mail 計劃在未來三年內推出 50 條新的“郵政無人機路線”,作為其增加使用交付無人機的一部分。 儘管需要航空管理局的許可,但與物流無人機運營商 Windracers 的合作將為農村地區提供更快、更實用的服務。 錫利島、設得蘭群島、奧克尼群島和赫布裡底群島將成為這項新服務的首批目的地。 皇家郵政計劃在未來三年內使用多達 200 架,最終超過 500 架無人機,為英國的每個地區提供服務。 皇家郵政在過去一年半中進行了四次無人機試驗,包括在蘇格蘭的馬爾島、康沃爾海岸的錫利島以及奧克尼群島的柯克沃爾和北羅納德賽。 新服務的試飛在勒威克的廷沃爾機場和安斯特之間進行,單程距離為 50 英裡。 信件和包裹隨後由附近的郵遞員和婦女使用這次採用的無人機運送。 無人機每天可以在島嶼之間往返兩次,最多可攜帶 100 公斤的郵件。

郵政服務行業概覽

該行業相當分散。 大公司具有廣泛的基礎設施和服務多樣性的優勢。 較小的公司通過提高專業化來競爭。 在大多數國家,政府擁有的郵政服務佔據了大部分市場。 這些政府郵局通常壟斷郵件投遞,但面臨來自私營包裹投遞公司的激烈競爭。 相互競爭的運營商結成夥伴關係以利用彼此的優勢。 例如,主要的快遞公司聯邦快遞 (FedEx) 和聯合包裹服務 (UPS) 將部分住宅遞送外包給美國郵政服務 (USPS),後者又將空運外包給 FedEx 和 UPS。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 當前市場情況

- 市場驅動因素

- 市場製約因素

- 市場機器

- 波特的五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈/供應鏈分析

- 關於 COVID-19 對市場的影響

第 5 章市場細分

- 按類型

- 快遞郵政服務

- 標準郵政服務

- 按項目

- 來信

- 包裹

- 按目的地

- 國內航班

- 國際航班

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 世界其他地區

- 拉丁美洲

- 中東和非洲

- 北美

第六章競爭格局

- 市場集中度概述

- 公司簡介

- United States Postal Services

- Deutsche Post DHL

- Le Groupe La Poste

- Royal Mail Group

- Japan Post

- Swiss Post

- Post NL

- Poczta Polska

- The Singapore Post

- The Australian Post AG

- China Post*

第七章期貨市場

第8章附錄

The postal services market is estimated to register a CAGR of approximately 1% during the forecast period. The spreading of COVID-19 has forced nations to suspend public activities, changing how governments, corporations, and people see the postal system. When more people are required to stay at home to stop the virus from spreading, posts are becoming more and more recognized as crucial service providers.

Key Highlights

- The COVID-19 outbreak restrained the postal services market in 2020 as governments imposed lockdowns and restricted the movement of people and goods to contain the transmission. The pandemic drove industry growth away from mail revenue and toward parcels. According to the International Post Corporation (IPC), the parcel revenue rose by EUR 19.3 billion (USD 21.7 billion), while mail revenue fell by EUR 6.1 billion (USD 6.8 billion) in 2020.

- Over recent years, the postal service industry has suffered disruptions from the internet and digital industries. The traditional core mail delivery business is declining as communications move online. Meanwhile, the industry also faces fierce competition in the rapidly growing e-commerce parcel market. As a result, postal and mailing businesses are shifting from state-owned monopolies to commercial companies with diversified portfolios.

- Currently, some of the top postal service companies across the world include the US Postal Service (USPS), Deutsche Post DHL (Germany), La Poste (France), and Japan Post.

- The demand for postal and mailing services depends on transaction volume and corporate spending on direct marketing. The profitability of individual companies depends on the efficiency of their operations.

- Some of the largest postal and mailing markets are China, the United States, the United Kingdom, France, Germany, and Italy. High-growth markets include Canada, India, Portugal, and Singapore.

- In 2021, the leading markets for postal and courier activities worldwide were Germany, the United Kingdom, France, Italy, and the Netherlands. In the future, the adoption of data analytics, technology development, and the use of automated and electric vehicles may positively impact the market. Factors that could hinder the growth of the postal services market in the future include workforce shortage, etc.

Postal Services Market Trends

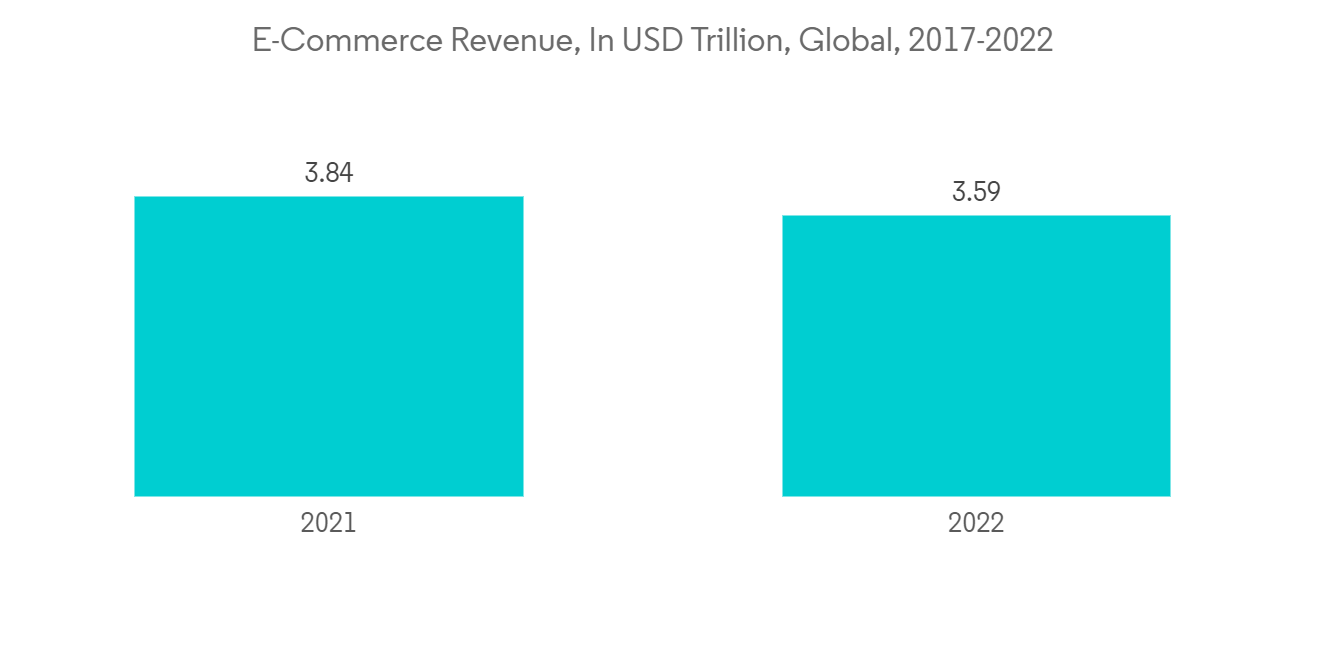

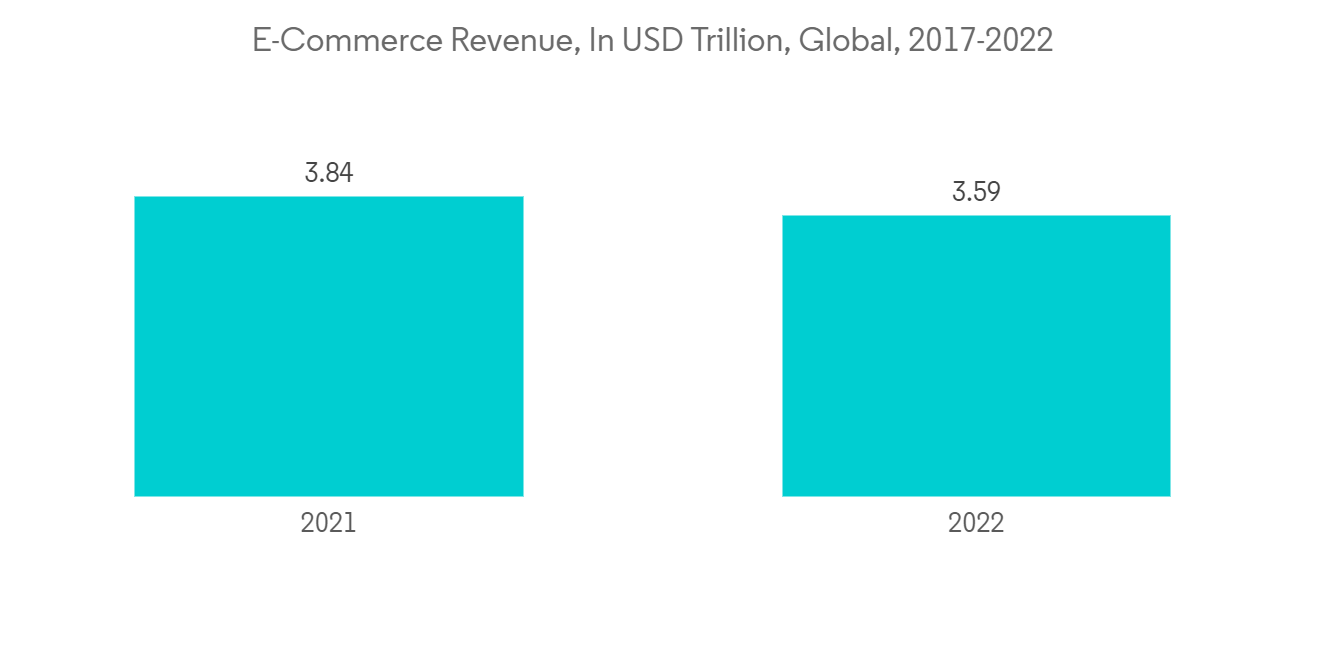

E-commerce Opens Opportunities for Postal Services

E-commerce represents a tremendous opportunity for postal services as consumers become increasingly comfortable ordering items online from emerging e-commerce platforms, and traditional brick-and-mortar outlets are also transitioning to digital environments. As the volume of online sales increases, e-commerce providers are seeking cost-effective channels for the delivery and collection of purchased items. Postal services, with their long-established national networks and experience in last-mile delivery, are emerging as effective partners in this regard. In Kenya, for example, a partnership between online marketplace Jumia and the Postal Corporation of Kenya enables online shoppers to collect items they purchase on Jumia from their nearest post office.

However, many global postal services organizations are not equipped to take advantage of this growth in e-commerce. While B2C eCommerce is growing at a global rate of 17%, parcel volumes among postal services organizations have been growing at less than 5%. Part of the issue is the low adoption of digital technologies as core business and innovation drivers among low-performing postal services organizations. Where digital adoption is high, innovations inevitably emerge. The launch of mPost by Kenya's postal services, for example, has turned every mobile phone into a formal postal address, enabling people to access letters and parcels from anywhere in the country.

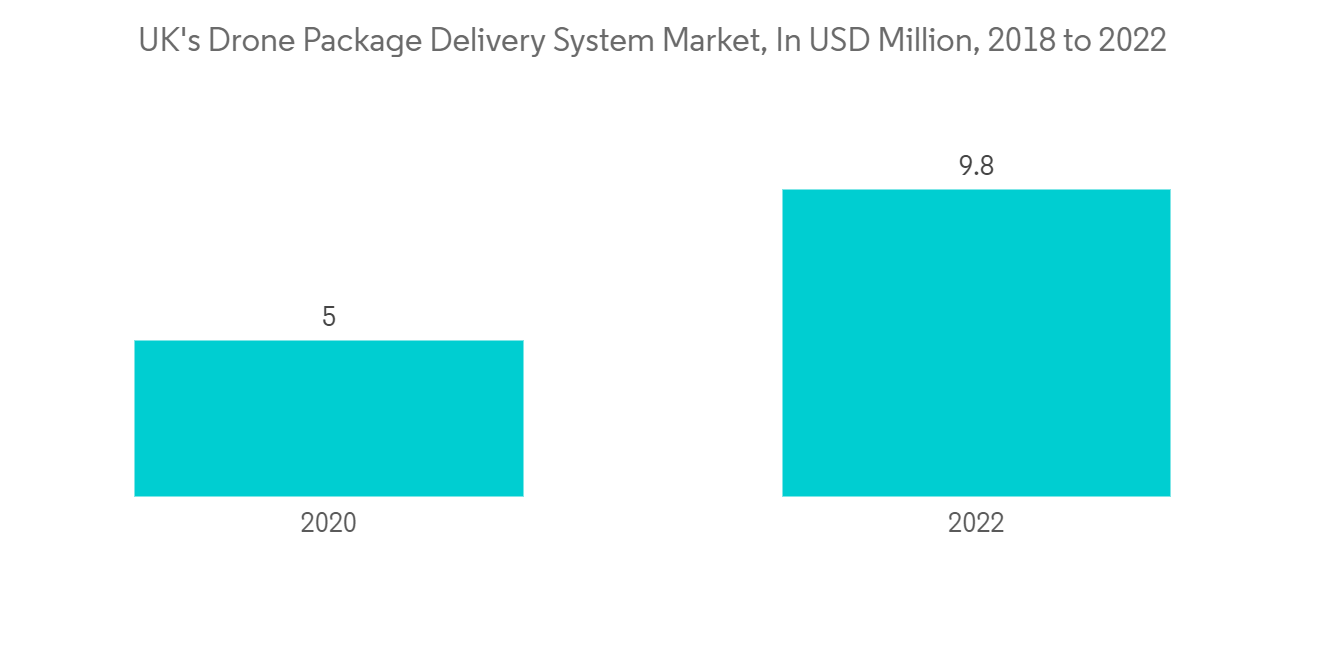

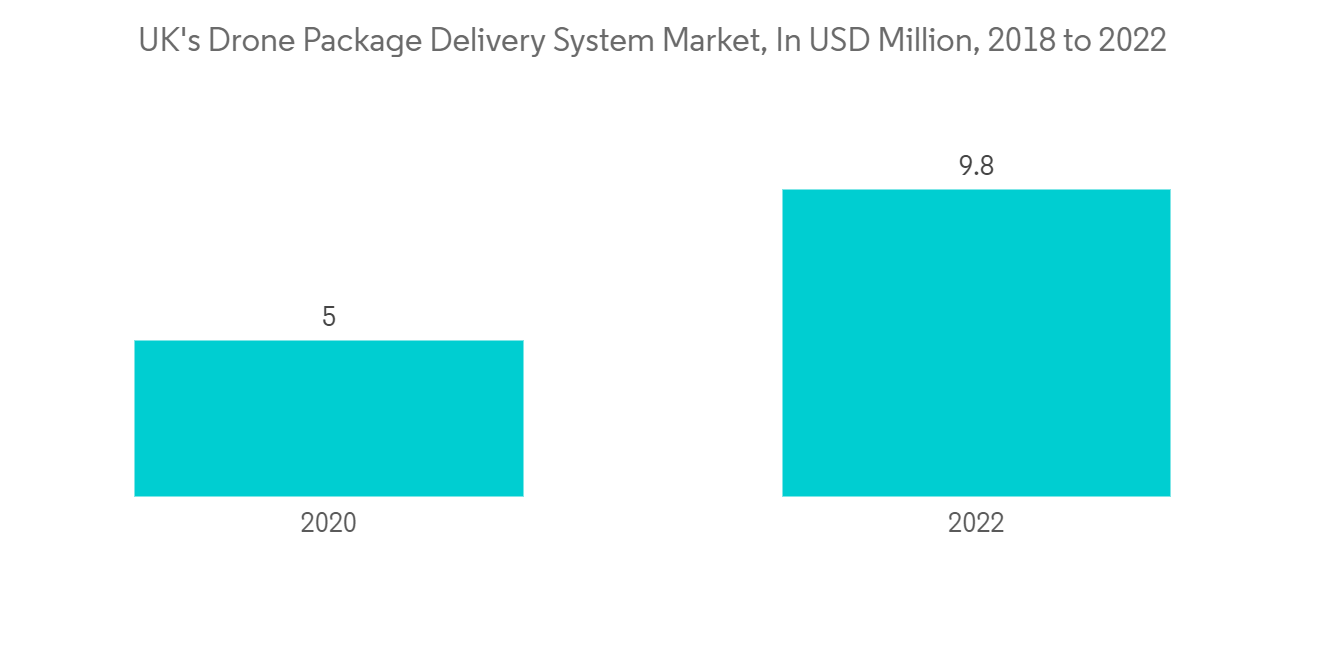

United Kingdom Boost the Postal Delivery Service by Drones

The COVID-19 epidemic is redefining how much the post and parcel sector needs autonomous delivery systems.

United Kindom: In the coming three years, Royal Mail will establish 50 new "postal drone routes" as part of its increased usage of drones for delivery. The move, which is subject to Civil Aviation Authority permission, would give rural communities speedier and more practical services thanks to cooperation with the logistics drone business Windracers. The Isles of Scilly, Shetland Islands, Orkney Islands, and the Hebrides are among the initial destinations for the new service. For the next three years, Royal Mail said it plans to utilize up to 200 drones, and eventually more than 500, to service every part of the UK. Four drone tests have been carried out by Royal Mail over the past 18 months, including flights over the Scottish Isle of Mull, the Isles of Scilly off the coast of Cornwall, and the Orkney Islands' Kirkwall and North Ronaldsay. Between Tingwall Airport in Lerwick and Unst, a 50-mile journey each way, test flights for the new service have been conducted. Letters and packages are subsequently carried by the neighborhood postman or lady using the drones employed in the study, which can carry up to 100kg of mail for two daily return trips between the islands.

Postal Services Industry Overview

The industry is moderately fragmented. Large companies have advantages in widespread infrastructure and diversity of services. Small companies compete by specializing. Most nations have a government-owned postal service that controls a major portion of the market there. These Government-owned postal agencies typically have a monopoly on mail delivery but face heavy competition from private package delivery companies. The competing entities form partnerships to capitalize on each other's strengths. For instance, major express delivery companies Federal Express (FedEx) and United Parcel Service (UPS) contract certain residential deliveries to the US Postal Service (USPS), while the USPS contracts air transportation out to FedEx and UPS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Market Opportunities

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Value Chain/Supply Chain Analysis

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Express Postal Services

- 5.1.2 Standard Postal Services

- 5.2 By Item

- 5.2.1 Letter

- 5.2.2 Parcel

- 5.3 By Destination

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Latin America

- 5.4.4.2 Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 United States Postal Services

- 6.2.2 Deutsche Post DHL

- 6.2.3 Le Groupe La Poste

- 6.2.4 Royal Mail Group

- 6.2.5 Japan Post

- 6.2.6 Swiss Post

- 6.2.7 Post NL

- 6.2.8 Poczta Polska

- 6.2.9 The Singapore Post

- 6.2.10 The Australian Post AG

- 6.2.11 China Post*