|

市場調查報告書

商品編碼

1244373

全球超聲凝膠市場——增長、趨勢、COVID-19 的影響和預測 (2023-2028)Ultrasound Gel Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球超聲凝膠市場預計將以 3.9% 的複合年增長率增長。

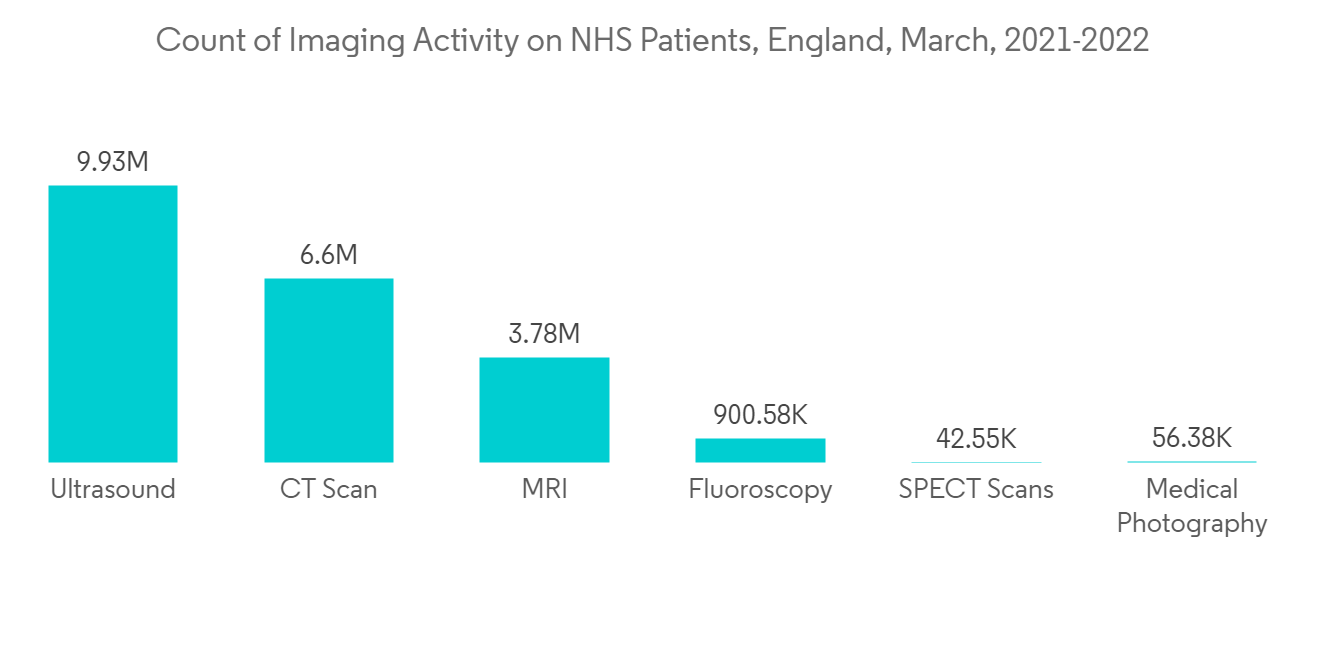

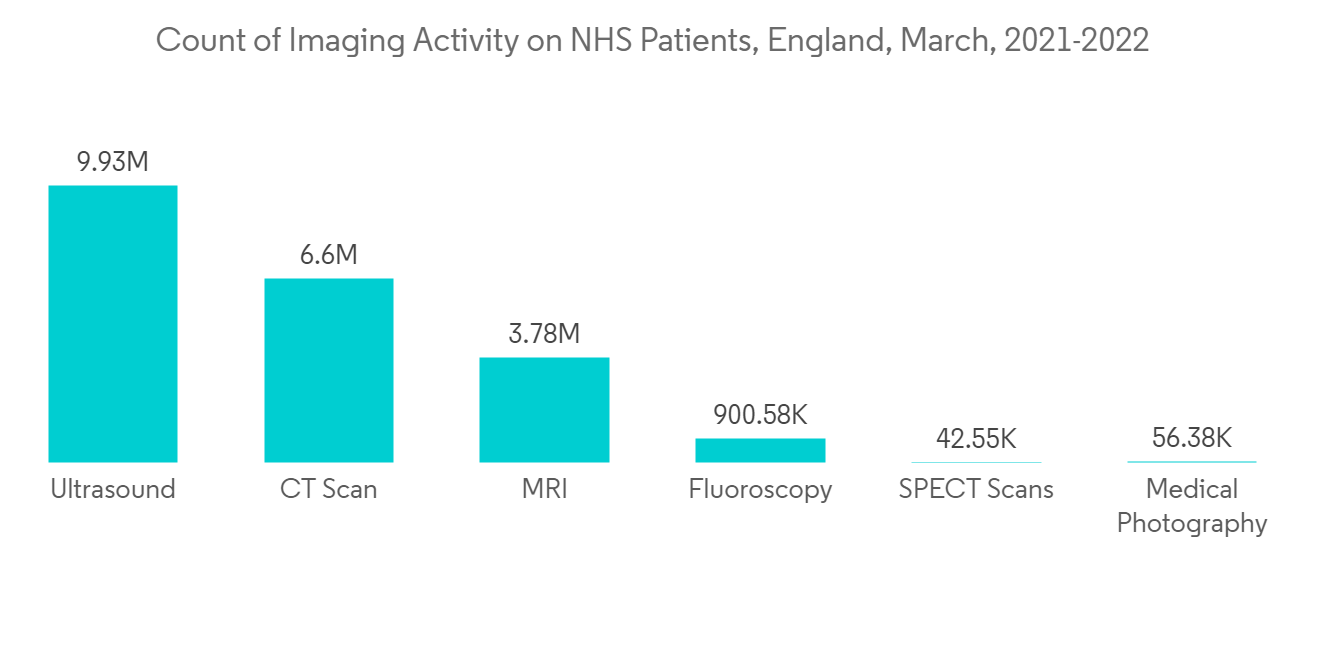

COVID-19 對超聲凝膠市場的早期影響是由於取消了包括超聲診斷在內的選擇性程序而產生的負面影響。 例如,2021 年 4 月發表在 Nature Public Health Emergency Collection 上的一篇論文報告說,COVID-19 期間在放射科進行的急診超聲檢查減少了 58%。。 然而,市場是由超聲波主要用於監測 COVID-19 患者的呼吸活動所推動的。 例如,在2021年3月發表於NCBI的另一篇論文中,使用肺部超聲評估COVID-19患者是一種低成本、無輻射、實用、易於消毒的儀器。據說它受到鼓勵 超聲也促進了 SARS-CoV-2 肺損傷的結構評估。 由於越來越多的超聲手術和超聲凝膠的新配方,預計未來幾年超聲凝膠市場將增長。

此外,越來越多的超聲手術、技術進步和超聲凝膠製備的進步正在有效地推動所研究市場的增長。 此外,在各種治療方式中增加超聲波的使用也可能促進市場增長。 例如,2022 年 4 月發表在 Journal of Material Chemistry B 上的一篇論文描述了超聲響應水凝膠的優勢。 超聲響應水凝膠已用於超聲成像、按需藥物輸送和形狀記憶等應用。 因此,超聲凝膠等進步有望增加需求,從而促進市場增長。

經過改進的超聲凝膠無味、無色、不含甘油和甲醛。 已經對超聲凝膠進行了大量研究,以改進其配方並提高其效率。 例如,2022 年 1 月發表在 MDPI 雜誌上的一篇文章使用蘆薈凝膠等高度可生物降解的天然成分製備了一種替代超聲凝膠配方。 蘆薈凝膠對皮膚有抗炎作用。 蘆薈還具有皮膚抗炎特性,使用它的配方具有低過敏性,對皮膚敏感的患者來說是安全的。 因此,超聲凝膠製備中的此類改進將增加對產品的需求,從而促進市場增長。

此外,主要市場參與者的技術進步、產品批准、發布和合作夥伴關係預計將推動市場增長。 例如,2021 年 2 月,挪威初創公司 SonoClear AS 的新型聲學耦合液“SonoClear”在臨床試驗中註冊,以評估其性能和安全性。 這種耦合液可以模擬自然腦電波。 此類臨床試驗的開展有望推動對創新超聲凝膠的需求並推動市場增長。

因此,由於超聲凝膠的進步和產品發布的增加,預計該市場在分析期間將會增長。 然而,使用其他替代產品可能會阻礙市場增長。

超聲凝膠市場趨勢

無菌超聲凝膠部分預計在預測期內增長

滅菌超聲凝膠用於體外受精手術和陰道/宮內檢查的超聲檢查和活檢採集過程。 在超聲檢查過程中防止感染和微生物傳播的最佳方法之一是使用無菌超聲凝膠。

無菌凝膠比其他類型的凝膠佔有更大的市場份額。 美國健康與安全管理局已發布 2022 年 5 月指南,以確保僅使用未打開的小袋或標有“無菌”標籤的容器。 預計此類法規的頒布將對該行業在分析期間的增長產生積極影響。 此外,需要超聲進行更好診斷的疾病的增加將進一步推動對超聲凝膠的需求。 例如,根據美國慢性病專業協會 2022 年慢性病預防評論,近 60% 的成年美國人至少患有一種慢性病。 糖尿病、癌症和心血管疾病等慢性病是美國的主要健康問題。 超聲成像主要用於診斷慢性病,預計將在預測期內促進該領域的增長。

此外,預計在預測期內,旨在增加無菌超聲凝膠可用性的產品發布、合作和夥伴關係將推動市場增長。 例如,2021年1月,以銀納米技術為動力的保健品醫療品牌Nanocare推出了一款無菌超聲凝膠。 這種超聲凝膠具有粘性,可以消散和減少激光設備產生的熱量。

因此,由於無菌超聲凝膠的進步、產品發布的增加以及需要超聲的慢性疾病的增加,預計所研究的市場在分析期間會出現增長。

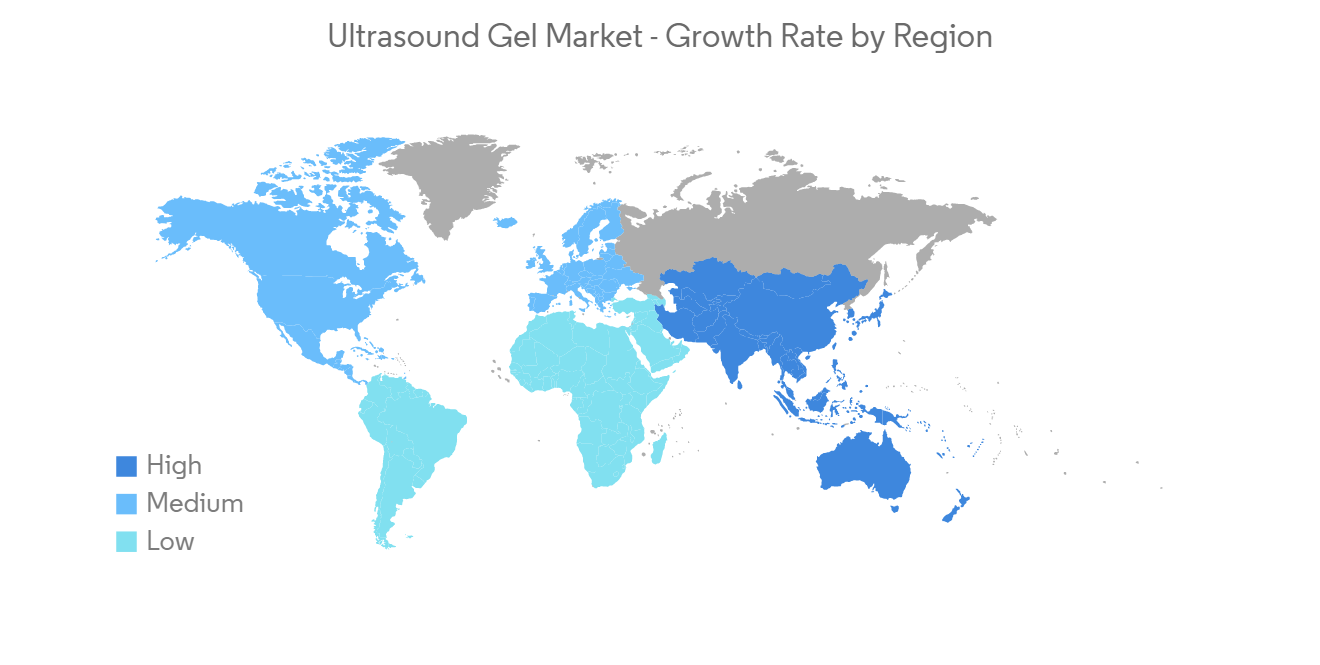

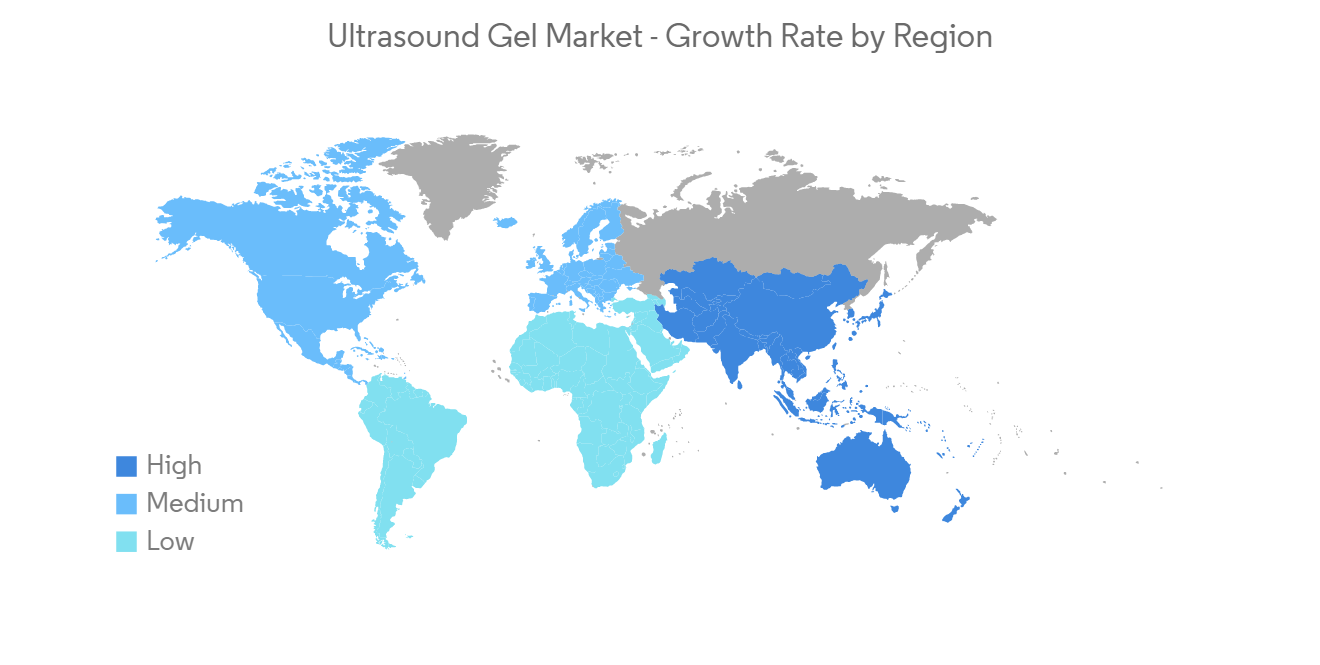

在預測期內,預計北美將主導超聲凝膠市場。

預計北美市場的增長將受到多種因素的推動,例如需要超聲檢查的慢性病患病率上升、超聲凝膠技術不斷進步,以及行業參與者在該地區的強大影響力。預計。

預計慢性病的高患病率將推動超聲凝膠在同一地區的增長。 由於超聲對於慢性疾病的診斷是必不可少的,因此預計將促進超聲凝膠的使用,使診斷更加順利。 比如美國的慢性腎病,2021年估計超過七分之一的人,也就是美國15%的成年人,也就是3700萬人患有CKD。 腎臟疾病,如慢性腎病和腎癌,可以通過適當的超聲檢查來診斷,因此需要超聲凝膠,這有望促進該研究地區的市場增長。

此外,意識的提高、對各種診斷方法的需求不斷增加以及各種醫療機構的批准預計將推動該地區的市場增長。 例如,2021 年 3 月,美國醫學超聲學會 (AIUM) 重新批准了清潔和準備外部和內部超聲探頭以及安全處理和使用偶聯凝膠的指南。 這種批准有望提高超聲凝膠在該地區的實用性。

因此,由於需要超聲檢查的慢性病增加以及產品發布的增加,預計北美在分析期間的監測市場將出現增長。

超聲凝膠行業概況

超聲凝膠市場因其性質而分散,許多公司不僅在全球範圍內開展業務,而且在區域範圍內開展業務。 競爭格局包括對幾家具有市場份額的知名國際和本地公司的分析。 主要公司包括 Compass Health Brands、Eco-Med Pharmaceutical Inc.、National Therapy Products Inc.、HR Pharmaceuticals Inc.、OJI Group (TELE-PAPER (M) SDN BHD)、Sonogel Vertriebs GmbH、Parker Laboratories Inc.、Scrip Inc、 Besmed Health Business Corporation、Medline Industries、LP、Ultragel Hungary 2000 Kft。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 超聲診斷程序的數量增加

- 超聲凝膠配方的進展

- 市場製約因素

- 使用其他替代方案

- 波特五力

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(金額 - 百萬美元)

- 按產品類型

- 非無菌

- 已消毒

- 最終用戶

- 醫院和診所

- 診斷中心

- 其他最終用戶

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Compass Health Brands

- National Therapy Products Inc.

- HR Pharmaceiuticals Inc.

- OJI Group(TELE-PAPER(M)SDN BHD)

- Sonogel Vertriebs GmbH

- Parker Laboratories Inc.

- Scrip Inc.

- Besmed Health Business Corp.

- Medline Industries, LP

- Ultragel Hungary 2000 Kft.

第7章 市場機會與今後動向

The ultrasound gel market is projected to register a CAGR of 3.9% during the forecast period.

The impact of COVID-19 in its initial phase in the ultrasound gel market was adverse owing to cancellations of elective procedures, including ultrasound diagnosis. For instance, an article published in Nature Public Health Emergency Collection in April 2021 stated that a 58% decrease in emergency department ultrasounds performed by the radiology department was reported during the COVID-19 period. However, the market gained traction as the ultrasound was majorly used in monitoring respiratory activity in COVID-19 patients. For instance, another article published in the NCBI in March 2021 stated use of lung ultrasound in the evaluation of patients with COVID-19 was encouraged because of its low cost, radiation-free, practical method of use, with easy-to-sanitize equipment. The ultrasound facilitated the structural evaluation of lung damage brought on by SARS-CoV-2. The ultrasound gel market is anticipated to witness growth in the coming years due to the rise in the growing number of ultrasound procedures and ultrasound gels with new formulations.

In addition, the growing number of ultrasound procedures, technological advancements, and advancements in ultrasound gel preparation are effectively driving the growth of the studied market. The increased usage of ultrasound in different therapy also likely to boost the market growth. For instance, an article published in April 2022 in the Journal of Material Chemistry B explained the advantages of ultrasound-responsive hydrogel. The ultrasound-responsive hydrogels are used in the applications of ultrasound imaging, on-demand drug delivery, and shape memory. Thus, advancements like ultrasound gel are anticipated to increase the demand, thereby boosting market growth.

Improvements in ultrasound gels to make them odorless, colorless, glycerin-free, and formaldehyde-free. A lot of studies are carried out in ultrasound gel to improve the formula and increase efficiency. For instance, as per the article published in January 2022 in the MDPI journal, an alternative ultrasound gel formulation was prepared using biodegradable and natural ingredients such as aloe vera gel. Aloe vera gel has an anti-inflammatory effect on the skin. The formulation prepared with it is safe for patients with sensitive skin due to its hypoallergenic characteristics. Hence, such improvements included in the preparation of ultrasound gel increase the demand for the products and thereby boosting the market growth.

Moreover, technological advancements, product approvals, launches, and partnerships by key market players are likely to drive market growth. For instance, in February 2021, a new acoustic coupling fluid, SonoClear, from a Norway-based start-up, SonoClear AS, was registered for clinical trials to assess its performance and safety. This coupling fluid can mimic natural brain waves. Such clinical trial developments are projected to boost the demand for innovative ultrasound gel and propel market growth.

Therefore, owing to the increase in advancements in ultrasound gel and the rise in product launches, the studied market is anticipated to witness growth over the analysis period. However, the use of other alternative products is likely to impede the market's growth.

Ultrasound Gel Market Trends

Sterile Ultrasound Gels Segment is Expected to Witness Growth Over the Forecast Period

Sterile ultrasound gel is used for ultrasonography and biopsy sampling processes in in-vitro fertilization surgeries and vaginal and intrauterine examinations. One of the best ways to prevent infection and the spread of microorganisms during an ultrasound procedure is to use sterile ultrasound gel.

The sterile type of gel occupies a significant share of the market compared to other types of gel. The United Kingdom's Health Security Agency, in its May 2022 guidelines, stated to ensure that only unopened sachets and containers that are labeled as 'sterile' are used. The enactment of such regulations is expected to have a positive impact on the growth of the segment over the analysis period. Moreover, growth in the disease prevalence requiring ultrasound for a better diagnosis is likely to further boost the demand for ultrasound gels. For instance, according to the National Association of Chronic Disease Directors, 'Commentary on Chronic Disease Prevention in 2022', nearly 60% of adult Americans have at least one chronic disease. Chronic conditions like diabetes, cancer, and cardiovascular disease are the major health issues in the United States. The diagnosis of chronic diseases majorly employs ultrasound imaging, which is ultimately projected to boost the segment's growth during the forecast period.

Furthermore, product launches, collaborations, and partnerships to increase the availability of sterile ultrasound gel are expected to drive market growth over the forecast period. For instance, in January 2021, Nanocare, a medical brand with health protection products applying Silver Nanotechnology, launched a sterile ultrasonic gel. This ultrasound gel has viscosity to help disperse and reduce the heat generated by the laser device.

Therefore, owing to the increase in advancements in sterile ultrasound gel, the rise in product launches, and the increase in chronic diseases that require an ultrasound, the studied market is anticipated to witness growth over the analysis period.

North America is Expected to Dominate the Ultrasound Gel Market Over the Forecast Period

North America is expected to witness growth in the market owing to factors such as the rising prevalence of chronic diseases that require an ultrasound, increasing technological advancements in ultrasound gel, and the strong presence of industry players in the region.

The high prevalence of chronic diseases is projected to augment the growth of ultrasound gels in the region as the diagnosis of chronic diseases requires an ultrasound to a large extent, which is ultimately projected to boost the use of ultrasound gels for smoother diagnosis. For instance, according to the Chronic Kidney Disease in the United States, 2021, More than 1 in 7, that is 15% of US adults or 37 million people, were estimated to have CKD. Kidney diseases like chronic kidney disease kidney cancer can be diagnosed by proper ultrasound, and thereby requiring the ultrasound gel, which is anticipated to boost the market growth in the studied region.

Also, rising awareness, growing demand for various diagnostic procedures, and approvals by various healthcare institutions are expected to fuel the market growth in this region. For instance, in March 2021, the American Institute of Ultrasound in Medicine (AIUM) reapproved the guidelines for the cleaning and preparation of external and internal ultrasound probes, along with the safe handling and use of coupling gel. Such approvals are projected to boost the utility of ultrasound gels in the region.

Therefore, owing to the increase in chronic diseases that require an ultrasound, and the rise in product launches, North America is anticipated to witness growth in the studied market over the analysis period.

Ultrasound Gel Industry Overview

The ultrasound gel market is fragmented in nature due to the presence of many companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international and local companies that hold the market share and are well known. Some of the major players include Compass Health Brands, Eco-Med Pharmaceutical Inc., National Therapy Products Inc., HR Pharmaceuticals Inc., OJI Group (TELE-PAPER (M) SDN BHD), Sonogel Vertriebs GmbH, Parker Laboratories Inc., Scrip Inc., Besmed Health Business Corporation, Medline Industries, LP, and Ultragel Hungary 2000 Kft.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Number of Ultrasound Procedures

- 4.2.2 Advancements in Ultrasound Gels Preparations

- 4.3 Market Restraints

- 4.3.1 Use of Other Alternative Products

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Non-sterile

- 5.1.2 Sterile

- 5.2 By End User

- 5.2.1 Hospitals/Clinics

- 5.2.2 Diagnostic Centers

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Compass Health Brands

- 6.1.2 National Therapy Products Inc.

- 6.1.3 HR Pharmaceiuticals Inc.

- 6.1.4 OJI Group (TELE-PAPER (M) SDN BHD)

- 6.1.5 Sonogel Vertriebs GmbH

- 6.1.6 Parker Laboratories Inc.

- 6.1.7 Scrip Inc.

- 6.1.8 Besmed Health Business Corp.

- 6.1.9 Medline Industries, LP

- 6.1.10 Ultragel Hungary 2000 Kft.