|

市場調查報告書

商品編碼

1244372

全球電子聽診器市場——增長、趨勢、COVID-19 的影響和預測 (2023-2028)Electronic Stethoscope Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球電子聽診器市場預計將以 5.1% 的複合年增長率增長。

COVID-19 疫情期間對市場增長產生了重大影響。 COVID-19 疫情增加了對電子聽診器的需求。 例如,電子聽診器 Thinklabs One 於 2020 年 5 月推出,以幫助在大流行期間保護醫護人員的安全。 肺部聽診通常是用於確定肺部是否感染了 COVID-19 的第一個程序,因此聽診器通常在從醫生到醫院和家庭護理提供者的最終用戶中使用。 這引發了聽診器市場的突然飆升,為市場參與者創造了很多前景。 此外,自 COVID-19 以來,全球限制有所放鬆,疾病篩查服務已恢復,因此在當前情況下,市場增長穩定。

電子聽診器的特性,例如聲音的可變放大、較少的噪聲干擾以及捕獲信號以進行可視化和存儲的能力,為電子聽診器市場的巨大增長提供了有利可圖的機會。

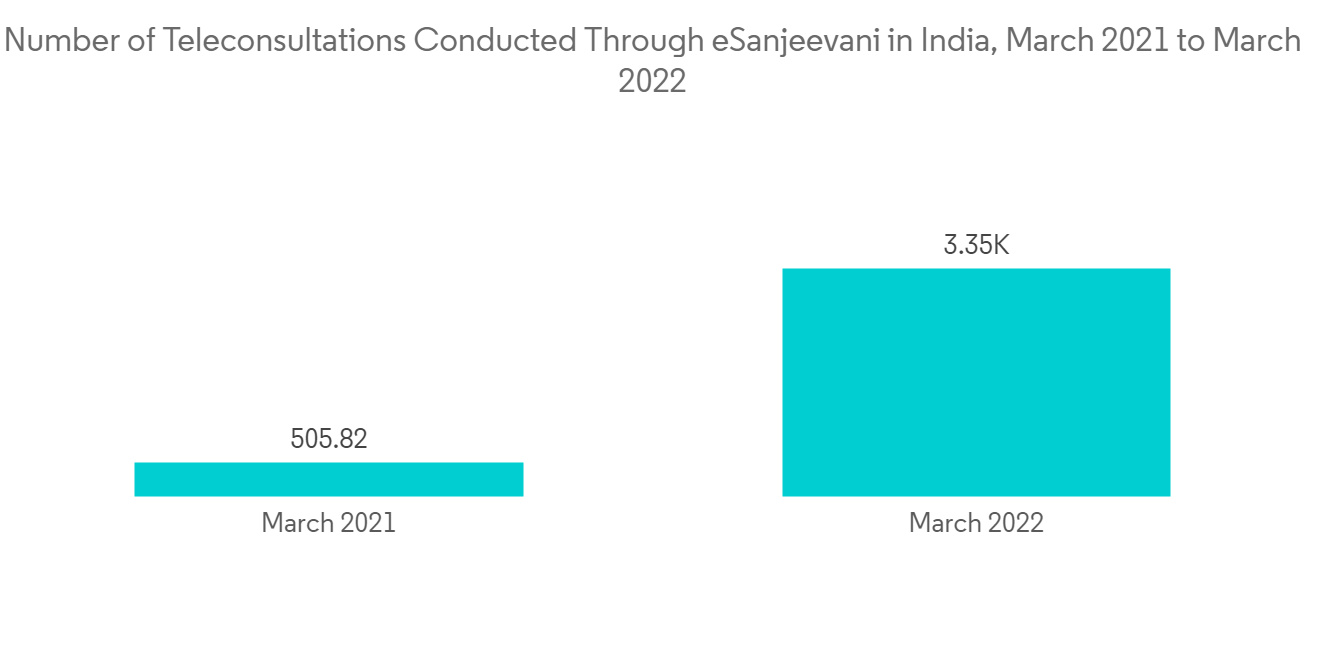

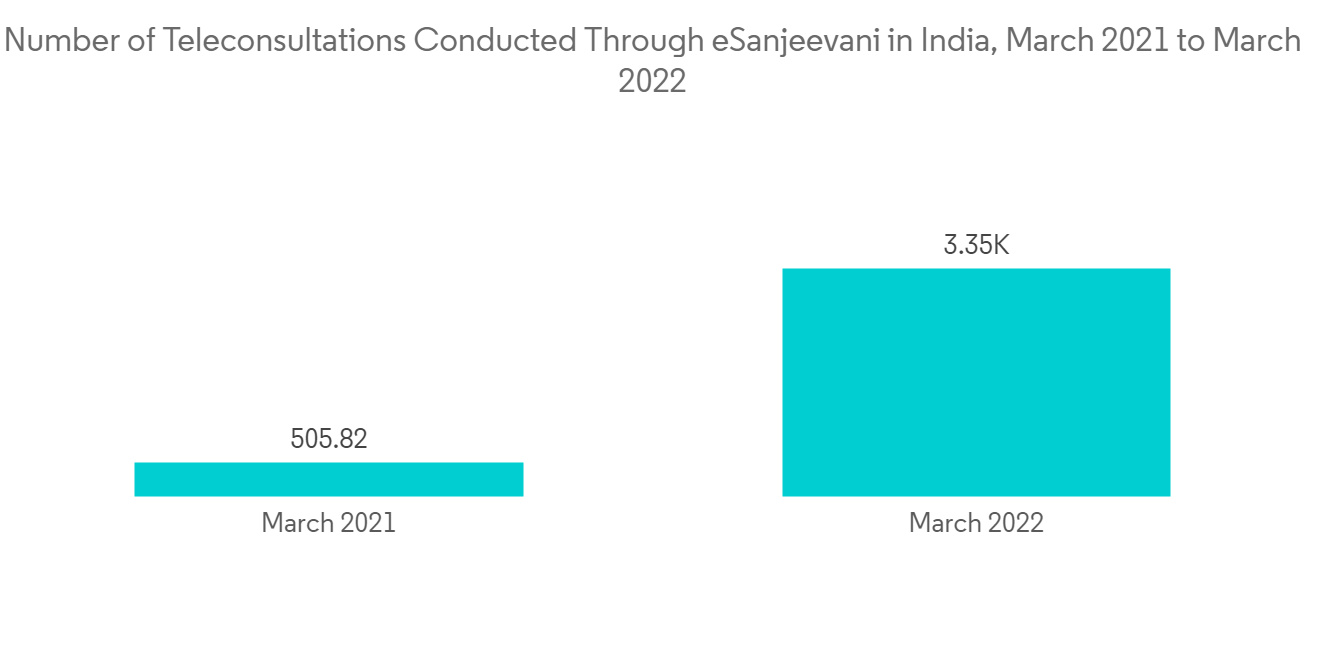

全球老年人口的增加、心血管和肺部疾病的高患病率、遠程醫療需求的增長以及先進醫療設備的技術進步是推動全球電子聽診器市場增長的主要因素。它是一個因素。 根據聯合國經濟和社會事務部在其人口報告中公佈的數據:根據2022年發布的《世界人口展望》,預計世界65歲及以上人口將從2022年的7.71億增長到2050年的7.71億增加到16億。 不斷增長的老年人口產生了對電子聽診器的需求。 老年人口是各種慢性病的高危人群,因此為這一人群配備電子聽診器成為必需品。

此外,根據 2022 年 2 月更新的 CDC 數據,到 2020 年,美國接受醫生或其他醫療保健提供者就診的成年人比例為 83.4%。 美國有 8.604 億人次就診,其中 51.2% 就診於初級保健醫生。 因此,患者平均看醫生次數的增加也有望在預測期內推動市場。

此外,2021 年 11 月,全球醫療保健社區的技術合作夥伴 eMurmur 將在美國推出世界上第一個用於高級數字聽診(聽診器技術)的開放軟件平台。它正在銷售中。 此類發布也促進了市場的增長。

基於這些關鍵因素,電子聽診器市場有望在預測期內激增。 然而,與其他電子設備的干擾和設備的高成本預計將限制預測期內的市場增長。

電子聽診器市場趨勢

預計在預測期內,電子聽診器市場將以無線傳輸方式為主

藍牙技術的進步為無線聽診器的創新鋪平了道路。 它允許醫療保健提供者在沒有身體接觸的情況下聽到病人的聲音。 無線聽診器可幫助醫生以非接觸方式評估患者,從而保護他們免受各種傳染源的侵害。 近年來,隨著對遠程醫療的需求不斷增長,無線電子聽診器正在幫助醫療保健提供商實時分析和共享世界各地的聽診結果。 由於這些原因,預計在預測期內,無線傳輸系統的電子聽診器市場將出現巨大增長。

在預測期內,產品發布的增加預計也將有助於所研究細分市場的增長。 例如,2021 年 6 月,3M Littmann 聽診器和 Eko 在英國和愛爾蘭推出了 3M Littmann CORE 數字聽診器。 此類技術先進的產品在全球範圍內的出現將有助於該細分市場的增長。

此外,2021 年 8 月,Caregility 和 Eko 宣佈建立綜合合作夥伴關係。 Caregility 的雲平台與 Eko 的智能聽診器和軟件無縫集成,使 Caregility 的 iConsult 應用程序的用戶可以在虛擬體檢期間對患者進行高質量的聽診(心、肺和其他身體聲音)。

因此,在預測期內,所研究細分市場的增長預計將受到上述因素的推動。

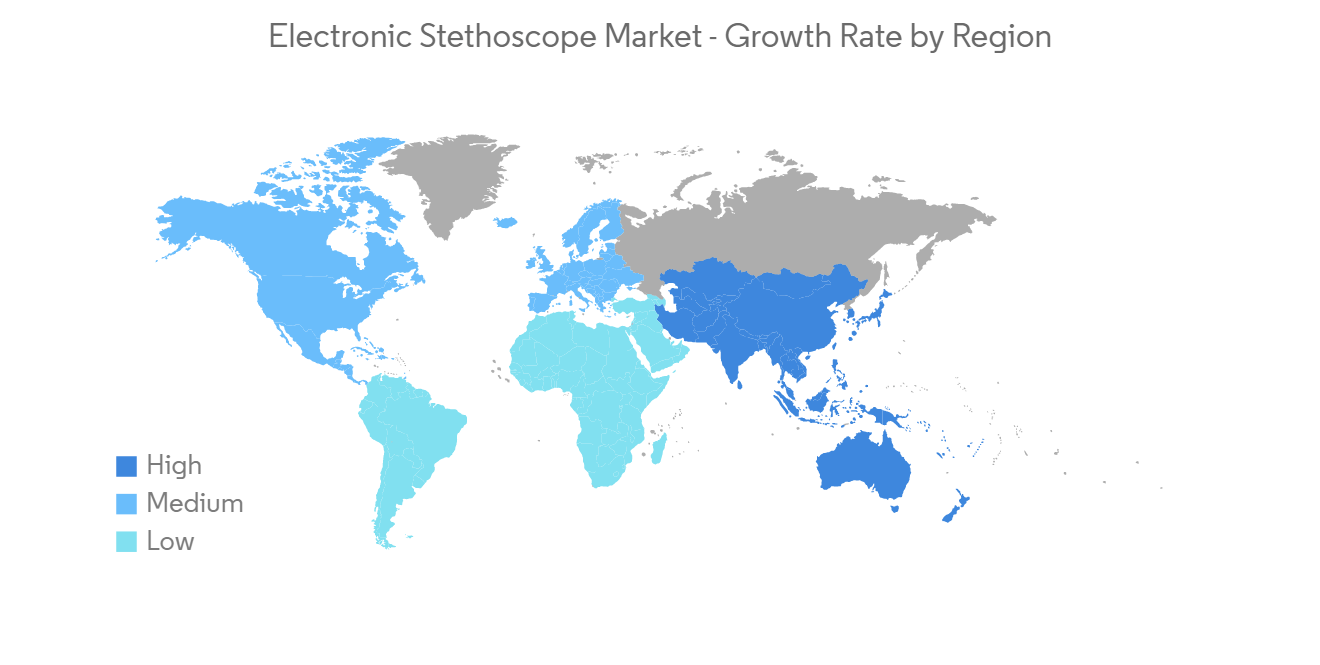

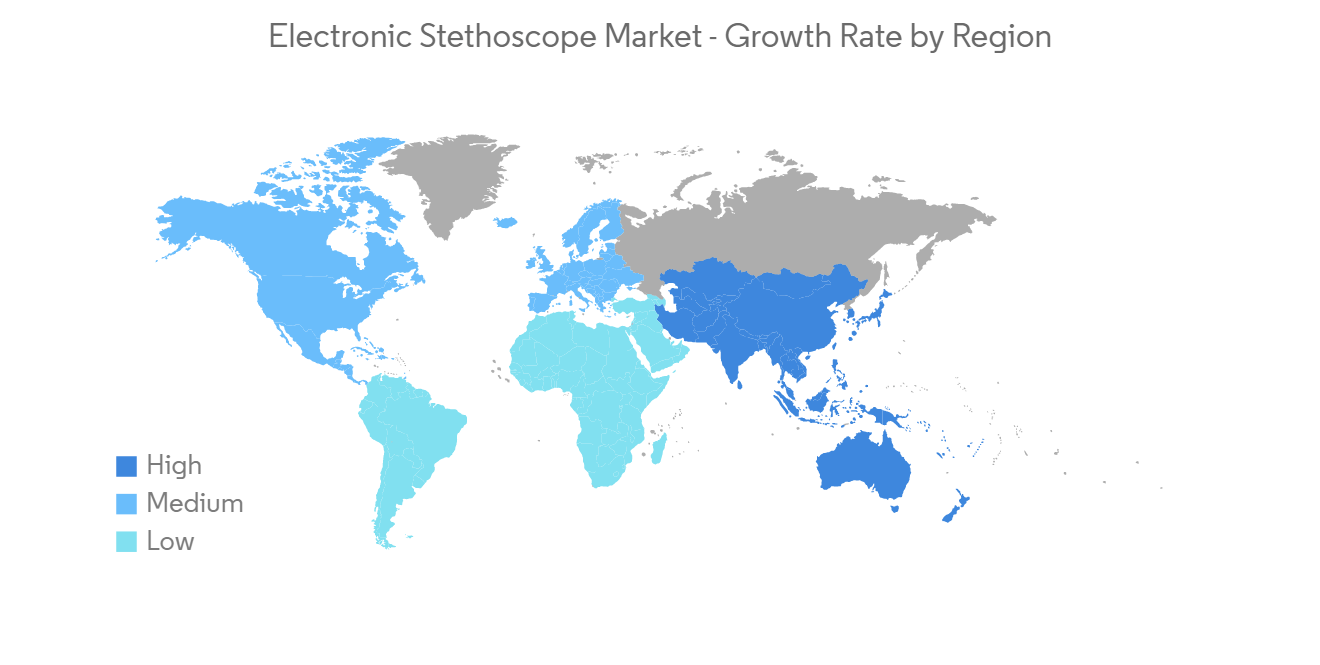

預測期內,北美電子聽診器市場有望實現健康增長

推動北美電子聽診器市場增長的主要因素是老年人口的增加、心肺病等慢性病的高患病率、大多數主要參與者的存在以及高水平的推進技術。招聘。

根據美國疾病預防控制中心 (CDC) 上次更新於 2022 年 7 月的數據,冠心病是最常見的心髒病類型。 到 2020 年,估計將影響美國約 2.01 億 20 歲以上的成年人。 此外,根據 CDC 數據,每 40 秒就有一人心髒病發作,美國每年有近 805,000 人心髒病發作。 這表明對治療慢性病的醫學專業知識和醫療設備的需求不斷增長。

此外,該地區不斷增長的老年人口也推動了市場的增長。 例如,根據加拿大統計局 2021 年的人口普查,65 歲及以上的人口大約有 7,021,430 人,其中男性 3,224,680 人,女性 3,796,750 人。 由於老齡化社會容易感染各種疾病,因此健康檢查必不可少,這推動了醫療機構對聽診器的需求。

此外,預計主要市場參與者的合作夥伴關係、併購等各種關鍵戰略將提振該地區的市場。 例如,2022 年 4 月,Sanolla 向 FDA 推出了一款支持 AI 的低頻聽診器 VoqX,供美國臨床使用。 同樣,2021 年 6 月,HD Medical 推出了 HD Steth。 HD Medical 最近將 Stethoscope.com 作為其在美國的主要在線分銷合作夥伴。 此外,完善的醫療保健基礎設施的存在也極大地推動了整個區域市場的增長。

換句話說,由於上述原因,未來幾年市場可能會增長。

電子聽診器行業概況

電子聽診器市場適度整合,少數廠商主導市場。 大公司正在採取戰略舉措,例如收購和合作協議,以加強其市場地位。 3M 和美國診斷公司是市場上的兩個主要參與者。 Cardionics、Contec Medical Systems、ThinkLabs Medical LLC、eKuore、Hill-Rom Services、Meditech Equipment。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 心血管和呼吸系統疾病患病率高

- 電子聽診器的新技術進展

- 對遠程諮詢的需求不斷增長

- 市場製約因素

- 設備成本高

- 干擾其他電子設備

- 波特的五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(金額 - 百萬美元)

- 按產品分類

- 帶放大器的電子聽診器

- 數字電子聽診器

- 按技術

- 胸片集成系統

- 無線傳輸系統

- 帶集成接收器的耳機系統

- 最終用戶

- 醫院和診所

- 門診手術中心

- 其他

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 世界其他地方

- 北美

第六章競爭格局

- 公司簡介

- 3M

- American Diagnostic Corporation

- Cardionics

- AD Instruments

- Contec Medical Systems Co., Ltd.

- Thinklabs Medical LLC.

- eKuore

- HD Medical

- Meditech Equipment Co., Ltd.

- Eko

第7章 市場機會與今後動向

The electronic stethoscope market studied is expected to grow with an anticipated CAGR of 5.1% during the forecast period.

COVID-19 had a significant impact on the growth of the market during the pandemic period. The COVID-19 outbreak increased the demand for electronic stethoscopes. For instance, Thinklabs One, an electronic stethoscope, was launched in May 2020 to keep healthcare professionals safe during the pandemic. Because auscultation of the lungs was generally the first procedure used to determine whether the lungs were infected with COVID-19 or not, there has been an increase in demand for stethoscopes among end-users ranging from physicians to hospitals or home care providers.This triggered a sudden surge in the market for stethoscopes, creating numerous prospects for market players. In addition, the market growth is stabilizing in the current scenario after COVID-19 as the worldwide restrictions have eased and the disease screening services have been resumed.

The features of the electronic stethoscope, such as variable amplification of sound, minimal interference from noise, and the ability to capture signals for visualization and storage, have provided a lucrative opportunity for the tremendous growth of the electronic stethoscope market.

The increase in the global geriatric population, the high prevalence of cardiovascular and pulmonary diseases, rising demand for teleconsultation, and advancements in the technology for sophisticated medical devices are the major drivers of the growth of the global electronic stethoscope market. According to the data published by the United Nations Department of Economic and Social Affairs in its Population Report: World Population Prospects published in 2022, the global population aged 65 years or older is projected to rise from 771 million in 2022 to 1.6 billion in 2050. Such a rising geriatric population creates the need for an electronic stethoscope, as the geriatric population is at high risk of various chronic diseases that would require an electronic stethoscope for this population.

Moreover, according to CDC data updated in February 2022, the percentage of adults who had a visit with a doctor or other health care professional in the United States was 83.4% in 2020. The number of visits in the United States was 860.4 million, and the percentage of visits made to primary care physicians was 51.2%. Therefore, the increase in average patient visits to physicians is also expected to drive the market during the forecast period.

Furthermore, in November 2021, eMurmur, a technology partner to the global healthcare community, launched the world's first open software platform for advanced digital auscultation (stethoscope technology) available in the United States. Such launches also propel the growth of the market.

Given these key factors, the electronic stethoscope market is anticipated to surge over the forecast period. However, interference with other electronic devices and the high cost of devices are expected to restrain the growth of the market during the forecast period.

Electronic Stethoscope Market Trends

The Wireless Transmission System is Expected to Occupy a Significant Share in the Electronic Stethoscope Market Over the Forecast Period

The progression of Bluetooth technology has paved the way for the innovation of wireless stethoscopes. This helps healthcare providers listen to patients without any physical contact. The wireless electronic stethoscopes assist physicians in the contactless evaluation of patients, thereby protecting themselves from various infectious pathogens. With the increasing demand for teleconsultation services in recent years, wireless electronic stethoscopes help healthcare providers analyze and share auscultations across the globe in real-time. Given these factors, the wireless transmission system-based electronic stethoscope market is expected to grow tremendously over the forecast period.

Also, the increasing number of product launches is expected to contribute to the growth of the studied segment during the forecast period. For instance, in June 2021, 3M Littmann stethoscopes and Eko launched the 3M Littmann CORE digital stethoscope in the United Kingdom and Ireland. When these kinds of technologically advanced products come out all over the world, they help the market segment grow.

Moreover, in August 2021, Caregility and Eko announced an integration partnership. Caregility's cloud platform now seamlessly integrates with Eko's smart stethoscopes and software, enabling users of Caregility's iConsult application to perform high-quality auscultation (heart, lung, and other body sounds) on patients during a virtual physical exam.

Thus, the growth of the studied segment is likely to be driven by the above factors during the forecast period.

North America is Anticipated to Witness a Healthy Growth in Electronic Stethoscope Market Over the Forecast Period

The major factors driving the growth of the Electronic Stethoscope Market in North America are the increasing geriatric population, the high prevalence of chronic illnesses such as cardiac and pulmonary diseases, the existence of most of the major players, and the high adoption of advancing technology.

According to data from the CDC that was last updated in July 2022, coronary heart disease is the most common type of heart disease. In 2020, it will affect about 20,1 million 20-year-old and older adults in the United States. Additionally, as per the CDC data, every 40 seconds someone suffers from a heart attack, and nearly 805,000 people in the United States have a heart attack every year. This shows that there is a rising demand for medical expertise and devices to combat chronic diseases.

The growing geriatric population in the region is also propelling the growth of the market. For instance, as per the Statistics Canada 2021 census, there were around 7,021,430 people aged 65 years or above, out of which 3,224,680 were males and 3,796,750 were females. As the aging population is most vulnerable to various diseases, a health check-up has become mandatory, thereby driving the demand for stethoscopes across healthcare settings.

Furthermore, various key strategies by the key market players, such as partnerships, mergers, and acquisitions, are expected to boost the market in the region. For instance, in April 2022, Sanolla launched the AI-ready VoqX infrasound stethoscope with the FDA for clinical usage in the United States. Similarly, in June 2021, HD Medical launched HD Steth. HD Medical recently introduced Stethoscope.com as a key online distribution partner in the United States. Furthermore, the presence of well-established healthcare infrastructure is also fueling the growth of the overall regional market to a large extent.

So, because of the things listed above, the market is likely to grow over the next few years.

Electronic Stethoscope Industry Overview

The electronic stethoscope market is moderately consolidated, with a few players dominating the market. The key players are taking strategic initiatives, such as acquisitions and partnership agreements, to strengthen their position in the market. 3M and American Diagnostic Corporation are two of the market's major players. Cardionics, Contec Medical Systems Co., Ltd., ThinkLabs Medical LLC, eKuore, Hill-Rom Services, and Meditech Equipment Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence of Cardiovascular and Pulmonary Diseases

- 4.2.2 Advancements in New Technology of Electronic Stethoscope

- 4.2.3 Rising Demand for Teleconsultation

- 4.3 Market Restraints

- 4.3.1 High Cost of Device

- 4.3.2 Interference with Other Electronic Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Amplified Electronic Stethoscopes

- 5.1.2 Digital Electronic Stethoscopes

- 5.2 By Technology

- 5.2.1 Integrated Chest-Piece System

- 5.2.2 Wireless Transmission System

- 5.2.3 Integrated Receiver Head-Piece System

- 5.3 By End User

- 5.3.1 Hospitals and Clinics

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 American Diagnostic Corporation

- 6.1.3 Cardionics

- 6.1.4 AD Instruments

- 6.1.5 Contec Medical Systems Co., Ltd.

- 6.1.6 Thinklabs Medical LLC.

- 6.1.7 eKuore

- 6.1.8 HD Medical

- 6.1.9 Meditech Equipment Co., Ltd.

- 6.1.10 Eko