|

市場調查報告書

商品編碼

1237857

BTX(苯甲苯二甲苯)市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Benzene-Toluene-Xylene (Btx) Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

全球 BTX(苯-甲苯-二甲苯)市場預計在預測期內的複合年增長率超過 3.5%。

COVID-19 對 2020 年的市場產生了負面影響。 但市場估計已達到疫情前水平,有望穩步增長。

主要亮點

- 苯和甲苯在各種化學應用中越來越重要,預計將在預測期內推動市場增長。

- 另一方面,BTX(苯甲苯二甲苯)的毒性預計會阻礙市場增長。

- 此外,越來越多地使用生物基 BTX(苯-甲苯-二甲苯)有望在未來幾年帶來市場機遇。

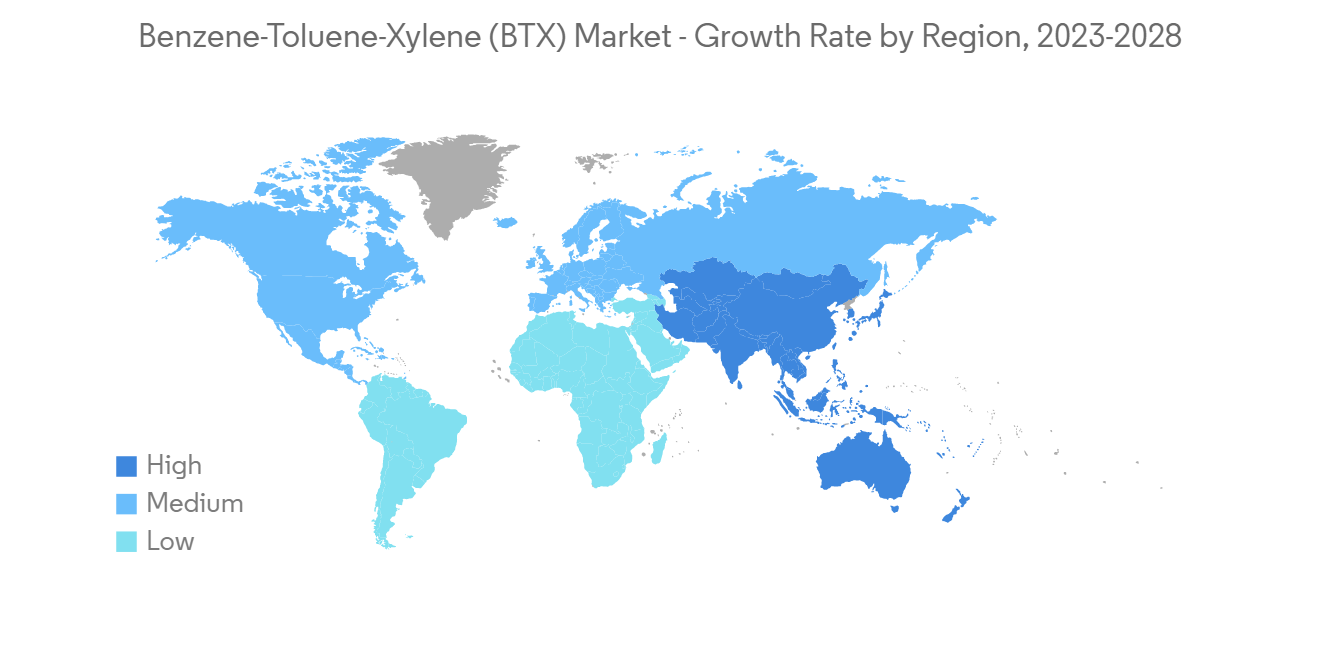

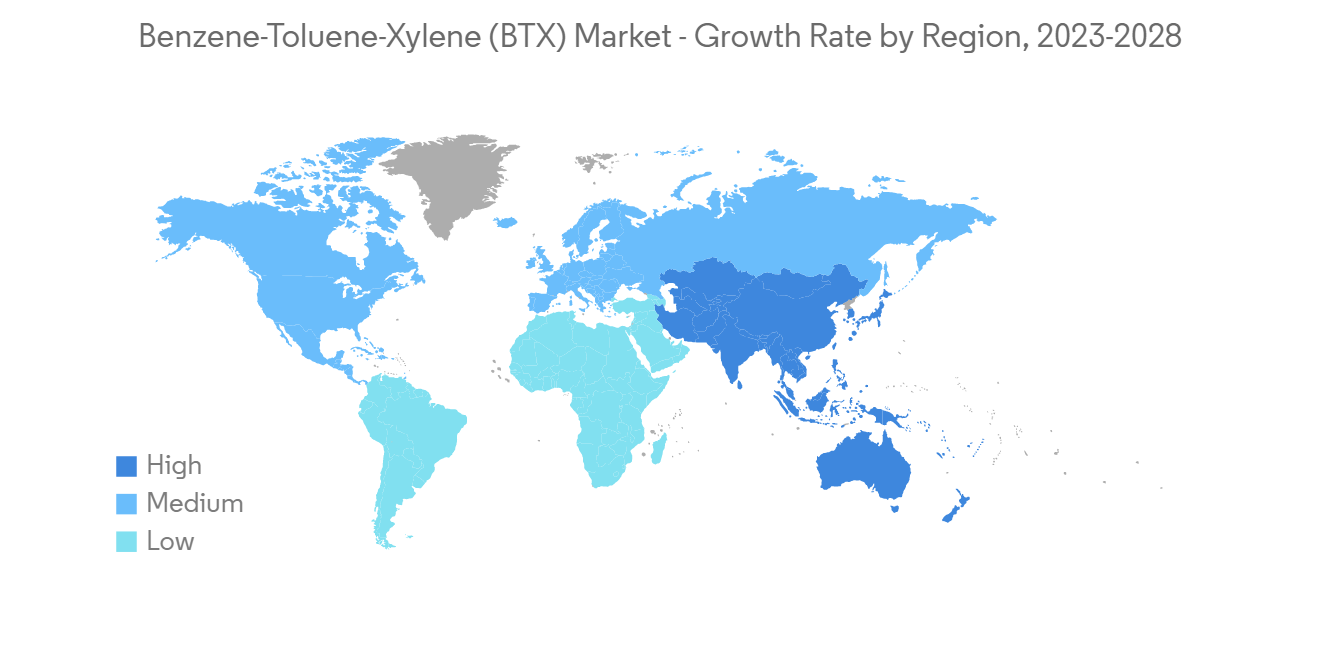

- 由於印度、中國和日本等主要國家/地區的市場發展,預計亞太地區在預測期內將主導市場。

BTX(苯-甲苯-二甲苯)市場趨勢

乙苯主導苯應用領域

- 乙苯是通過苯與乙烯的酸催化烷基化得到的。 乙苯(EB)是生產苯乙烯的重要中間體,通過乙苯催化脫氫生成氫氣和苯乙烯。

- 乙苯作為抗爆劑添加到汽油中,以減少發動機爆震並提高辛烷值。 乙苯也大量存在於其他製成品中,例如殺蟲劑、醋酸纖維素、合成橡膠、油漆和油墨。

- 苯乙烯主要用於生產聚苯乙烯、丙烯□-丁二烯-苯乙烯 (ABS) 樹脂、苯乙烯-丙烯□ (SAN) 樹脂、苯乙烯-丁二烯彈性體、乳膠和不飽和聚酯樹脂等聚合物。

- 苯乙烯行業的主要市場包括包裝、電氣和電子設備、建築、汽車和消費品。 根據中國汽車工業協會的數據,2022 年 12 月中國新能源汽車產量同比增長 96.9%。 因此,它對市場產生了積極的影響。

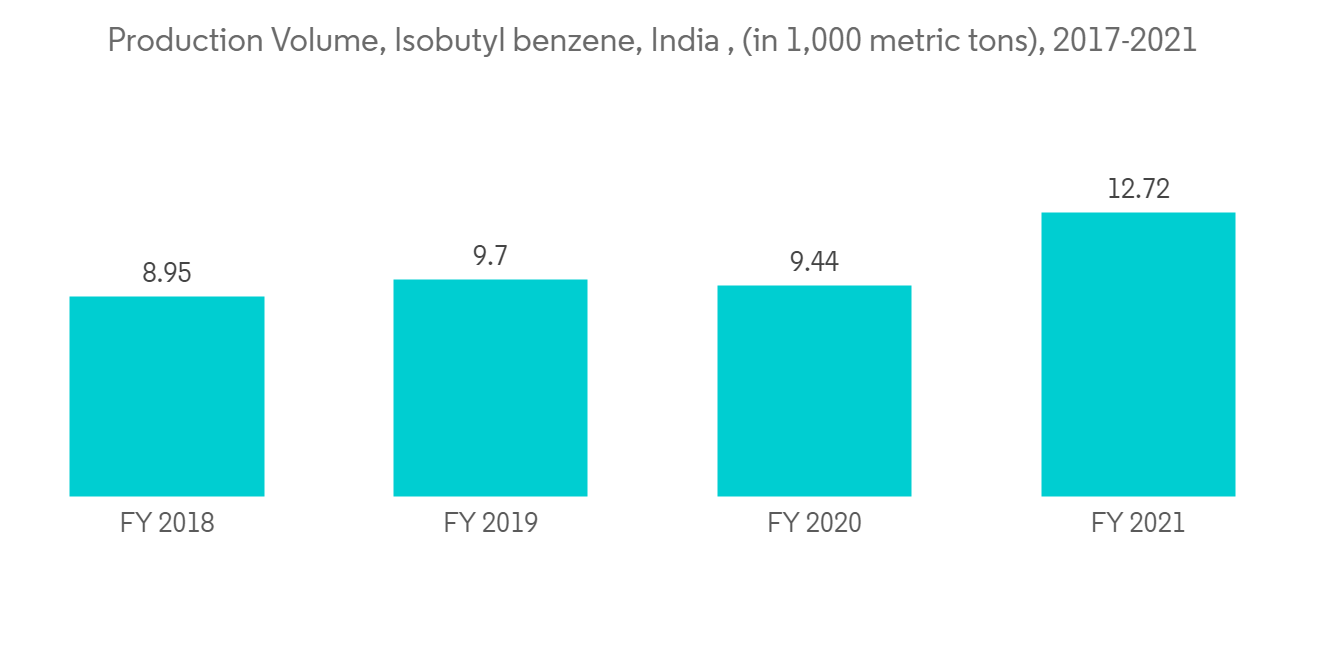

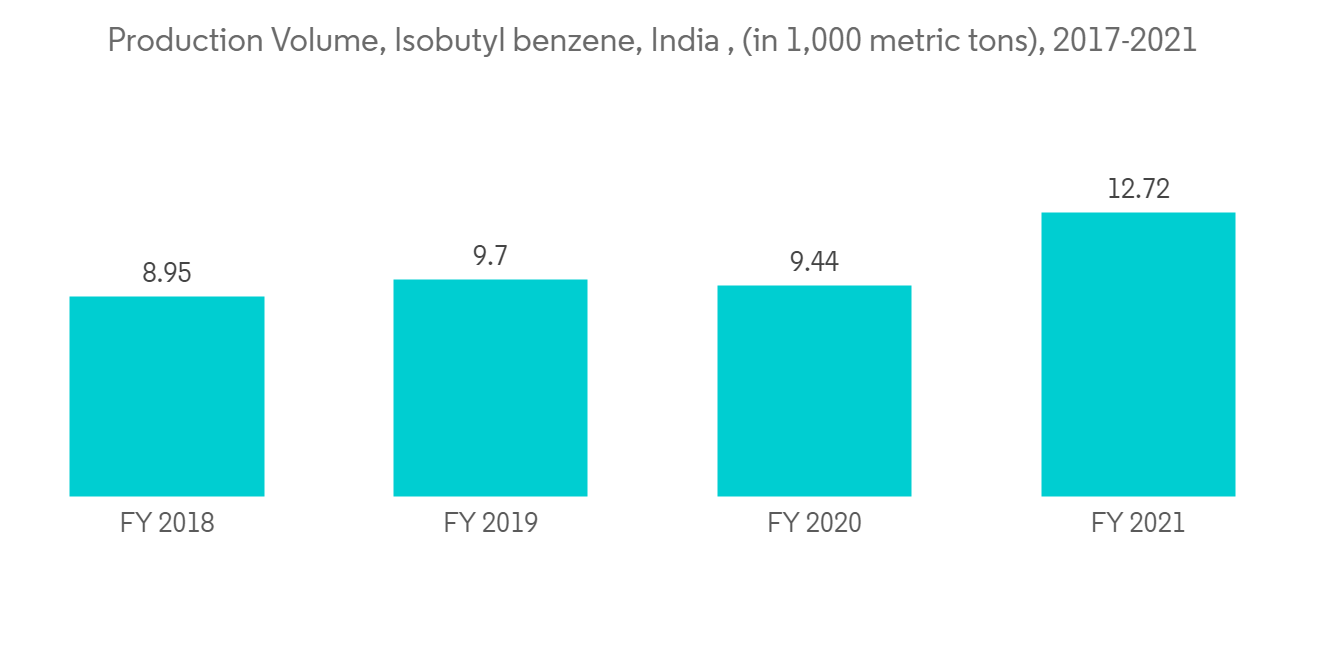

- 2021 財年,印度的異丁苯產量約為 12,720 公噸,比 2021 年增長 35%。

- 此外,印度是世界領先的化學工業之一,每年生產 80,000 多種化學產品。

- 因此,預計上述所有因素都會對預測期內的市場增長產生重大影響。

亞太地區主導市場

- 亞太地區在整個市場中所佔份額最大,預計在市場估計和預測期內是增長最快的地區。

- 在亞太地區,苯和甲苯在各種化學應用中的重要性與日俱增,二甲苯作為溶劑和單體的使用也在不斷增加,這推動了所研究市場的增長。

- 二甲苯是 BTX 的一種成分。 二甲苯的大部分用作溶劑,其次是單體(主要用於塑料和聚合物)。 其強溶劑性能用於印刷、橡膠和皮革加工。

- 中國是世界上最大的塑料生產國,約佔全球產量的三分之一。 據中國國家統計局數據,2021年全國塑料製品產量為8000萬噸,同比增長5.27%,將拉動市場增長。

- 根據 IBEF 的數據,從 2022 年 4 月到 2022 年 9 月,印度的塑料出口總額為 63.8 億美元。 因此,它在預測期內為市場帶來了正利潤。

- 此外,印度最大的出口類別是塑料原材料,佔 2021-2022 年出口總值的 30.7%,比上一年增長 26.5%。

- 鑑於上述所有因素,該地區的 BTX 市場預計在預測期內將顯著增長。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 司機

- 苯和甲苯在化學應用中的重要性與日俱增

- 擴大使用二甲苯作為溶劑和單體

- 約束因素

- 關於 BTX(苯-甲苯-二甲苯)的有害影響

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章市場細分(市場規模(基於數量)

- 類型

- 苯

- 甲苯

- 二甲苯

- 正交

- 元

- 段

- 產品 - 按應用

- 使用苯

- 乙苯

- 環己烷

- 烷基苯

- 庫門

- 硝基苯

- 其他用途

- 應用中的甲苯

- 油漆和塗料

- 粘合劑/油墨

- 炸藥

- 化學工業

- 其他用途

- 應用二甲苯

- 溶劑

- 單體

- 其他用途

- 使用苯

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要參與者採用的策略

- 公司簡介

- BASF SE

- Chevron Phillips Chemical Company LLC

- CNOOC Ltd

- Dow

- Exxon Mobil Corporation

- INEOS

- IRPC Public Company Limited

- JX Nippon Oil & Gas Exploration Corporation

- MITSUBISHI GAS CHEMICAL COMPANY, INC

- OCI COMPANY Ltd.

- PetroChina Company Limited

- Reliance Industries Limited

- Shell plc

- China Petrochemical Corporation

- SABIC

- S-OIL Corporation

- SK innovation Co., Ltd.

第七章市場機會與未來趨勢

- Bio BTX(苯-甲苯-二甲苯)

簡介目錄

Product Code: 72458

The Global Benzene-Toluene-Xylene (BTX) Market is projected to register a CAGR of more than 3.5% during the forecast period. COVID-19 negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and is expected to grow steadily.

Key Highlights

- The growing significance of benzene and toluene in various chemical applications is expected to fuel the market growth during the forecast period.

- On the flip side, the harmful effects of benzene-toluene-xylene (BTX) are expected to hinder the market's growth.

- Moreover, the increasing usage of bio-based Benzene-Toluene-Xylene (BTX) is expected to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market during the forecast period owing to its growing development in major countries such as India, China, and Japan.

Benzene-Toluene-Xylene (BTX) Market Trends

Ethylbenzene to Dominate the Benzene Application Segments

- Ethylbenzene is obtained through acid-catalyzed alkylation of benzene with ethylene. Ethylbenzene (EB) is the critical intermediate in the production of styrene, produced by the catalytic dehydrogenation of ethylbenzene, which gives hydrogen and styrene.

- Ethylbenzene is added to gasoline as an anti-knock agent to reduce engine knocking and increase the octane rating. Ethylbenzene is often found in other manufactured products, including pesticides, cellulose acetate, synthetic rubber, paints, and inks.

- Styrene is used primarily in polymer production for polystyrene, acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN) resins, styrene-butadiene elastomers, and latexes, and unsaturated polyester resins.

- The major styrene industry markets include packaging, electrical and electronic appliances, construction, automotive, and consumer products. According to the China Association of Automobile Manufacturing, the production of New Energy Vehicles in the country witnessed a year-on-year increase of 96.9% in December 2022. Hence, impacting the market positively.

- In the fiscal year 2021, India produced around 12,720 metric tons of isobutyl benzene, representing an increase of 35% compared to 2021.

- Moreover, India is one of the major chemical industries in the world, producing more than 80,000 chemical products annually.

- Therefore, all factors above are expected to significantly impact the market's growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the market studied, with the largest share of the total market volume, and is estimated to be the fastest-growing region during the forecast period.

- In the Asia-Pacific region, the growing significance of benzene and toluene in various chemical applications and the growing usage of xylene as solvents and monomers are driving the growth of the market studied.

- Xylene is a component of BTX. Xylene's majority share is used as a solvent, followed by monomers (mainly used in plastics and polymers). Its powerful solvent properties are used in printing, rubber, and leather processing.

- China is the world's largest plastics manufacturer, accounting for approximately one-third of worldwide production. According to the National Bureau of Statistics of China, the country produced 80 million metric tons of plastic products in 2021, an increase of 5.27 % compared to the previous year, which in turn is fueling the market growth.

- According to IBEF, in India, the total value of plastics exported between April and September 2022 was USD 6.38 billion. Thus benefiting the market positively during the forecast period.

- Further, the largest export category in India was plastic raw materials, which accounted for 30.7% of all exports in 2021-2022 and increased by 26.5% from the previous year.

- Owing to all the factors above, the market for BTX in the region is projected to grow significantly during the forecast period.

Benzene-Toluene-Xylene (BTX) Market Competitor Analysis

The global benzene toluene xylene (BTX) market is partially consolidated in nature. Some of the major players in the market include China Petrochemical Corporation, Exxon Mobil Corporation, SABIC, Reliance Industries Limited, and PetroChina Company Limited, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Significance of Benzene, Toluene in Various Chemical Applications

- 4.1.2 Growing Usage of Xylene as Solvents and Monomers

- 4.2 Restraints

- 4.2.1 Harmful Effects of Benzene-Toluene-Xylene (BTX)

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Benzene

- 5.1.2 Toluene

- 5.1.3 Xylene

- 5.1.3.1 Ortho

- 5.1.3.2 Meta

- 5.1.3.3 Para

- 5.2 Product - By Application

- 5.2.1 Benzene By Application

- 5.2.1.1 Ethylbenzene

- 5.2.1.2 Cyclohexane

- 5.2.1.3 Alkylbenzene

- 5.2.1.4 Cumene

- 5.2.1.5 Nitrobenzene

- 5.2.1.6 Other Applications

- 5.2.2 Toluene By Application

- 5.2.2.1 Paints and Coatings

- 5.2.2.2 Adhesives and Inks

- 5.2.2.3 Explosives

- 5.2.2.4 Chemical Industry

- 5.2.2.5 Other Applications

- 5.2.3 Xylene By Application

- 5.2.3.1 Solvent

- 5.2.3.2 Monomer

- 5.2.3.3 Other Applications

- 5.2.1 Benzene By Application

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Chevron Phillips Chemical Company LLC

- 6.4.3 CNOOC Ltd

- 6.4.4 Dow

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 INEOS

- 6.4.7 IRPC Public Company Limited

- 6.4.8 JX Nippon Oil & Gas Exploration Corporation

- 6.4.9 MITSUBISHI GAS CHEMICAL COMPANY, INC

- 6.4.10 OCI COMPANY Ltd.

- 6.4.11 PetroChina Company Limited

- 6.4.12 Reliance Industries Limited

- 6.4.13 Shell plc

- 6.4.14 China Petrochemical Corporation

- 6.4.15 SABIC

- 6.4.16 S-OIL Corporation

- 6.4.17 SK innovation Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Bio-based Benzene-Toluene-Xylene (BTX)

02-2729-4219

+886-2-2729-4219