|

市場調查報告書

商品編碼

1237846

自動駕駛汽車市場中的傳感器融合——COVID-19 的增長、趨勢、影響和預測 (2023-2028)Sensor Fusion Market In Autonomous Vehicles - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,自動駕駛汽車的傳感器融合市場預計將以 19.6% 的複合年增長率增長。 在自動駕駛汽車中加入高級功能(例如高級駕駛員輔助系統 (ADAS)、新型雷達系統、攝像頭、激光雷達和 GNSS 傳感器)的趨勢日益增長,這就需要能夠快速、安全地感知和響應變量的靈活系統。也是推動自動駕駛汽車中傳感器融合增長的主要因素之一。

主要亮點

- 解決傳感器之間的差異、同步傳感器、預測物體的未來位置以及滿足自動駕駛的安全要求是傳感器融合在自動駕駛汽車應用中的一些關鍵目標。 根據世界經濟論壇的數據,到 2035 年,預計每年將售出超過 1200 萬輛全自動駕駛汽車。 據稱,自動駕駛汽車佔全球汽車市場的 25%。 據Intel稱,一輛自動駕駛汽車平均每天可以產生 4 TB 的數據。 Sense Fusion 解決方案可以在實時利用大量數據方面發揮關鍵作用。

- 隨著 ADAS 發展的進步和 GPS-IMU(慣性測量單元)融合原理的利用,可以消除絕對位置測量間隔中估計誤差的累積。 Tesla的自動駕駛功能“Autopilot”是 ADAS 的一個例子,它實現了諸如根據前置攝像頭和傳感器收集的數據確定準確位置以及將車輛中心保持在高速公路車道內等功能。

- 汽車製造商與軟件公司之間的合作是市場上的普遍趨勢。 例如,2021年4月,提供激光雷達傳感器的RoboSense將與提供智能汽車操作系統和解決方案的Banma Network以及中國領先的robo-taxi運營商AutoX合作,為汽車提供高水平的自動駕駛服務。智能汽車,我們簽約合作搭建平台。 建立合作夥伴關係的主要目標是通過人工智能功能、硬件和軟件的融合,促進智能駕駛艙和自動駕駛系統的集成。

- 全球範圍內嚴格的政府法規也在推動所研究市場的產品需求。 例如,Euro NCAP(歐洲新車評估計劃)要求引入至少一種駕駛輔助系統。 日本、美國等國家在國內NCAP法規中也採用了類似的標準。

- 自動駕駛技術中日益增加的安全問題不僅限制了自動駕駛汽車的採用,而且可能會影響傳感器融合解決方案的可信度。 標準化是阻礙傳感器融合系統發展的因素之一。 如果沒有全球標準,設備和 IC 的複雜性預計將呈指數級增長。

- COVID-19 的爆發正在加劇其對全球汽車行業的影響。 隨著戶外活動減少,對汽車的需求大幅下降,主要是在大流行的早期階段。 此外,汽車零部件供應減少和生產設施關閉導致汽車製造商的營運資金減少,導致新技術投資的延遲和減少。 然而,隨著汽車行業從大流行中復蘇,傳感器融合解決方案提供商也迎來了新的機遇。

自動駕駛汽車傳感器融合的市場趨勢

乘□□用車佔據較大市場份額

- 由於對具有高級功能的汽車的需求不斷增長,乘用車製造商對開發自動駕駛汽車的興趣與日俱增。 汽車製造商、科技公司和研究人員一直致力於進一步開發自動駕駛汽車背後的技術。 由於這些車輛配備了多個收集大量數據的傳感器,因此傳感器融合已成為使供應商能夠智能地使用傳感器數據的理想解決方案。

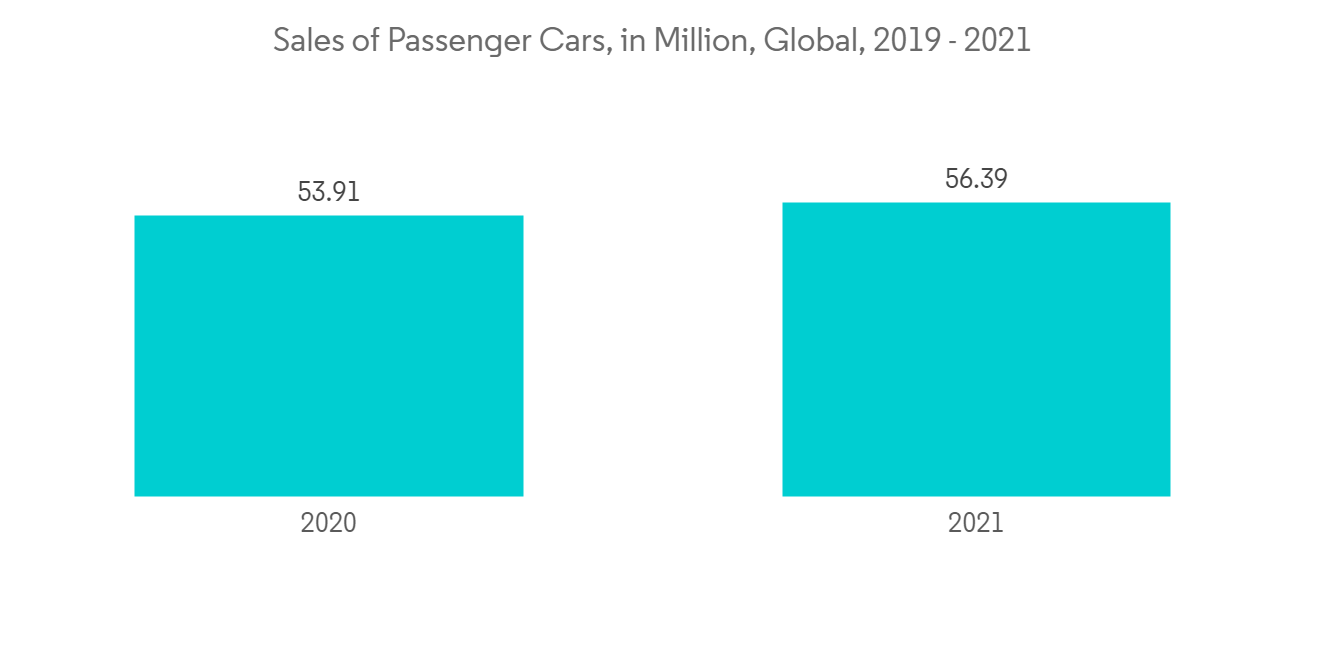

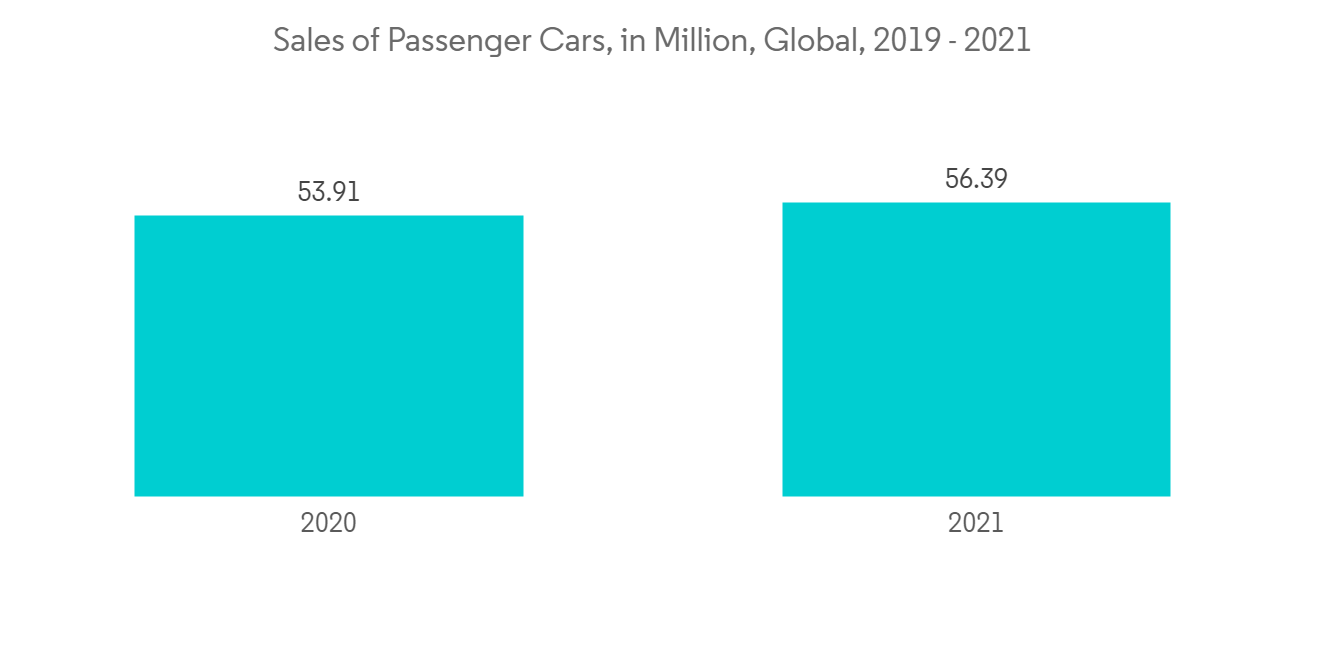

- 近年來,售出的乘用車數量一直在上升。 雖然大流行影響了增長,但影響是短期的,預計將推動未來幾年的增長。 例如,根據 OICA 的數據,2021 年乘用車銷量將從 2020 年的 5390 萬輛增加到 5640 萬輛。 預計這些發展將成為所研究市場增長的重要驅動力。

- 自動駕駛汽車的一個關鍵方面是路徑規劃。 傳感器融合通過整合傳感器讀數以準確了解車輛狀態並預測周圍物體的軌跡,發揮著關鍵作用。 因此,隨著自動駕駛乘用車銷量的增加,預計未來的採用率將會增加。

- 此外,自動緊急制動 (AEB) 是一種增強型主動安全系統,可幫助協調員避免或減輕與其他車輛或弱勢道路使用者的碰撞。 通常需要多個傳感器來進行準確、可靠和穩健的檢測,同時最大限度地減少誤報。 隨著安全成為汽車行業,尤其是乘用車領域日益重要的問題,AEB 系統的日益普及預計將對傳感器融合系統的需求產生積極影響。

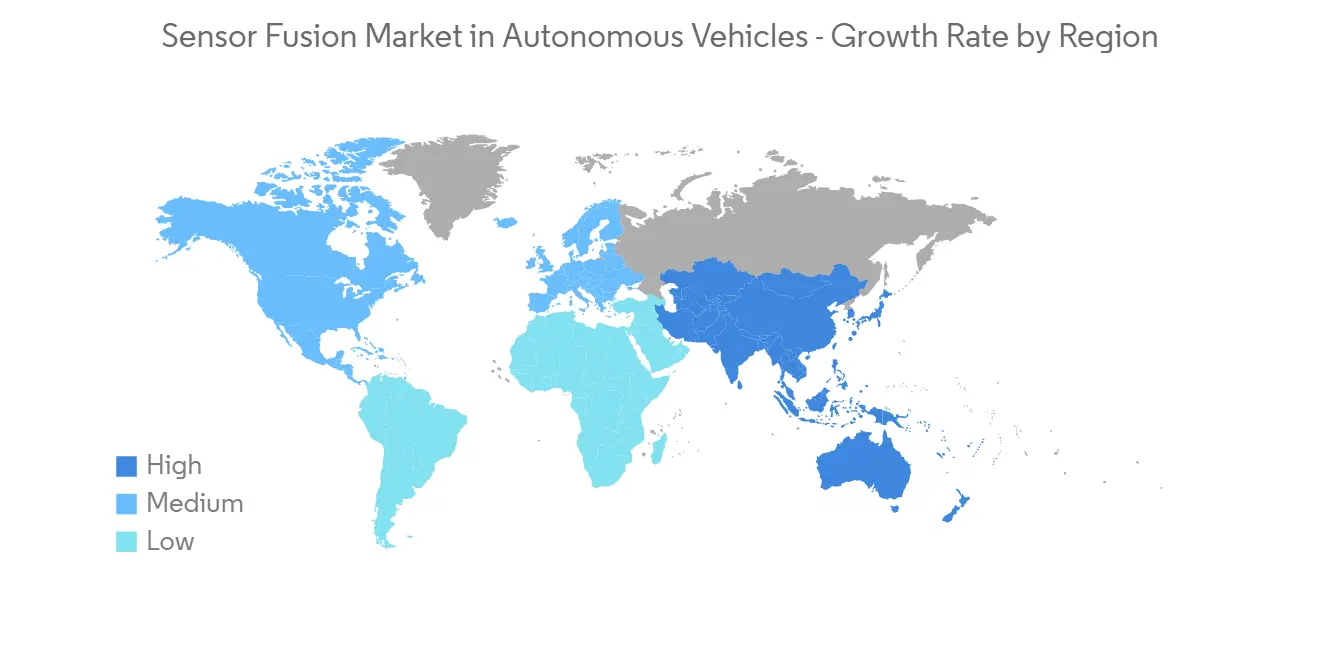

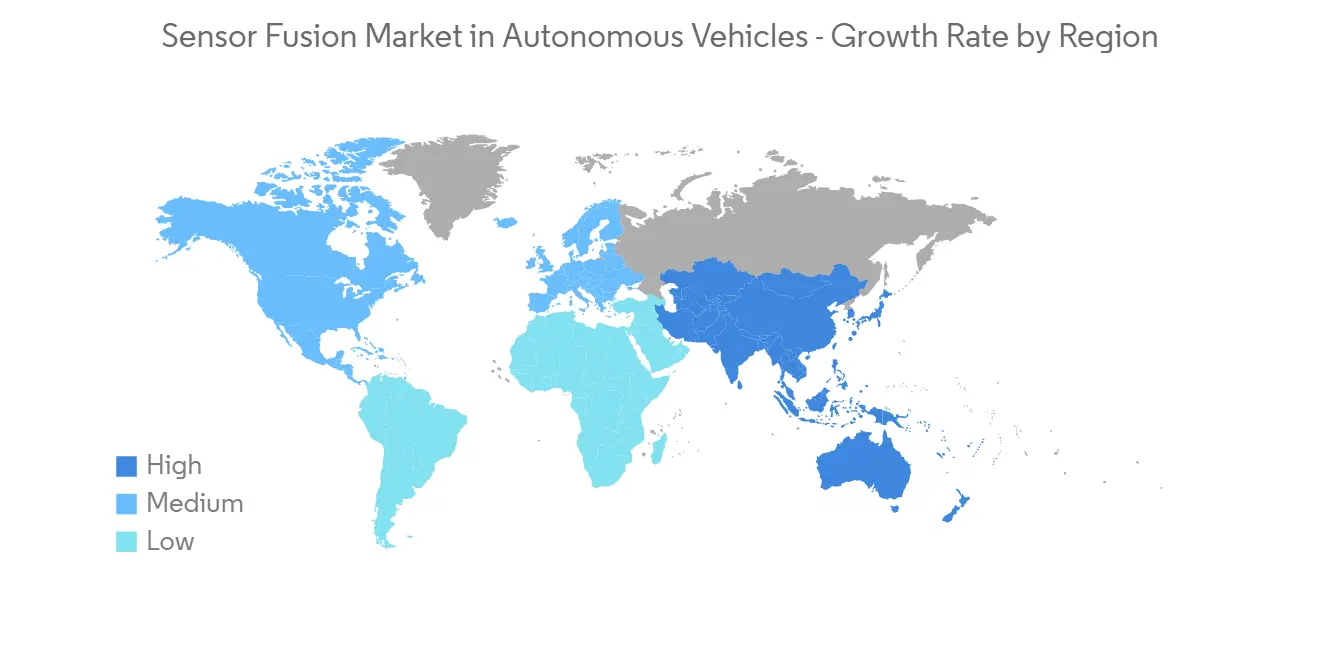

北美市場份額大

- 北美是世界領先的汽車生產基地之一。 該地區的經濟增長正在影響乘用車和商用車的銷售。 美國是北美地區汽車製造大國之一,不僅國內消費大,而且是全球汽車出口大國。 例如,根據美國國際貿易委員會的數據,2021年輕型車出口數量將達到16.1935億輛。

- 該地區還是採用支持 ADAS 的車輛和自動駕駛交通解決方案的先驅之一。 根據德意志銀行的數據,預計 2021 年美國 ADAS 單位產量將達到 1845 萬輛。 ADAS(高級駕駛輔助系統)可以支持自適應巡航控制(ACC)、自動緊急制動(AEB)、車道偏離、盲點檢測、360度二次環視等,ADAS系統的設計中使用了很多傳感器。這些趨勢預計將推動該國對傳感器融合解決方案的需求,因為它們正在使用中。

- 根據 ITA 的數據,加拿大是北美第二大汽車市場,進口汽車約佔新車市場的四分之三。 2021年乘用車進口額將增長約26%(同比)至278億美元。 該國對自動駕駛汽車的接受度正在顯著提高,促使汽車製造商加大投資力度。 例如,Tesla、Uber、Toyota、BMW、General Motors、Nissan等技術和汽車公司都在競相為加拿大消費者開發自動駕駛汽車。

- 此外,依靠一系列強大的先進傳感技術(包括多個 LiDAR)來安全地在復雜的城市環境中行駛的 Robotaxis 還不成熟。 儘管如此,Waymo、Cruise 和 Uber 仍在美國大力投資和運營實驗車輛,有望創造未來機會。

自動駕駛汽車傳感器融合市場的競爭對手分析

自動駕駛汽車的傳感器融合市場是一個競爭鬆散的市場,擁有博世、STMicroelectronics 和 NXP Semiconductors NV 等大型企業,以及專注於該技術的新進入者。 供應商正越來越多地努力使這項技術為未來的自動駕駛汽車做好準備並使其價格合理。

2022 年 10 月 - 美國領先的汽車傳感器解決方案提供商 Microvision 在布魯塞爾舉行的 AutoSens 2022 展會上推出了動態視圖激光雷達系統“MAVIN DR”。 MAVIN DR 激光雷達系統具有動態視野。 它提供高分辨率和低延遲,使新 ADAS 安全功能的設計人員能夠實現原始設備製造商所需的正確高速公路駕駛功能。

2022 年 4 月 - Volkswagen Group的軟件公司 CARIAD 收購了傳感器數據融合公司 Intenta GmbH 的汽車部門。 此次收購符合公司的戰略,即顯著擴大其在軟件和硬件開發領域的垂直價值創造,實現關鍵軟件組件的內部開發,並深化關鍵開發領域的附加值。這是一回事。

其他福利。

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 研究假設和市場定義

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 產業吸引力 - 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭強度

- 替代品的威脅

- 工業價值鏈分析

- 技術快照

- 關於 COVID-19 對市場的影響

第 5 章市場動態

- 市場驅動因素

- 對自動駕駛汽車的需求不斷增長

- 高效的實時數據處理和數據共享能力推動需求

- 市場製約因素

- 傳感器融合技術缺乏標準化

第 6 章主要市場趨勢

- 主要專利和研究活動

- 主要用途和新用途

- 自適應巡航控制 (ACC)

- 自動緊急制動 (AEB)

- 電子穩定性控制 (ESC)

- 前方碰撞警告 (FCW)

- 其他用途

第 7 章市場細分

- 車輛類型

- 乘用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

- 其他自動駕駛車輛

- 按地區

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/阿胡島利卡地區

第八章競爭格局

- 公司簡介

- Robert Bosch GmbH

- Microchip Technology Inc.

- Infineon Technologies AG

- BASELABS GmbH

- NXP Semiconductor

- STMicroelectronics NV

- Aimotive kft

- Kionix Inc(Rohm Co. Ltd)

- TDK Corporation

- CEVA Inc.

第九章投資分析

第十章市場展望

The sensor fusion market in autonomous vehicles is expected to grow by registering a CAGR of 19.6% during the forecast period. The growing trend of including advanced functionalities in autonomous vehicles, such as advanced driver assistance systems (ADAS), new radar systems, cameras, lidar, and GNSS sensors enhanced the requirements of flexible systems to quickly and safely detect the variables and respond, which is also among the significant factors driving the growth of sensor fusion in the autonomous vehicle sector.

Key Highlights

- Resolving contradictions between sensors, synchronizing sensors, predicting the future positions of objects, and achieving automated driving safety requirements are some of the primary objectives of sensor fusion in an autonomous vehicle application. According to the World Economic Forum, more than 12 million fully autonomous cars are expected to be sold annually by 2035. Autonomous vehicles will account for 25% of the global automotive market. According to Intel, a single autonomous vehicle can generate an average of 4 terabytes of data per day. Sens fusion solutions can play a significant role in utilizing this massive data in real time.

- The growing development in ADAS and increasing utilization of the principle of GPS-IMU (Inertial Measurement Unit) fusion helps solve accumulated errors of dead reckoning in intervals with absolute position readings. Tesla's Autopilot automated driving feature is an example of an ADAS that can perform functions such as keeping the vehicle center in a highway lane by determining its precise position from data collected from a forward-facing camera and sensors.

- Collaboration between automotive and software companies is a common trend in the market. For instance, in April 2021, RoboSense, a lidar sensor provider, formed a partnership with Banma Network Technology, an intelligent automobile operating system and solution provider, and AutoX, China's leading robotaxi operator, to build a high-level autonomous driving platform for intelligent vehicles. The partnership was established primarily to promote the integration of intelligent cockpits with autonomous driving systems through the fusion of AI Capabilities, hardware, and software.

- Stringent government regulations globally also fuel the demand for the products in the market studied. For instance, Euro NCAP (European New Car Assessment Program) mandates the deployment of at least one driver assistance system. Countries like Japan and the United States also adopt similar criteria in their national NCAP rules.

- The growing safety issue of autonomous technology can not only limit the adoption of autonomous vehicles but could claim the authenticity of sensor fusion solutions. Standardization is one of the factors hindering the evolution of sensor fusion systems. Without global standards, the level of complexity of devices and ICs is expected to increase exponentially.

- The COVID-19 outbreak increasingly affected the automotive sector globally. Due to reduced outdoor activities, the demand for automobiles declined significantly, primarily during the initial phase of the pandemic. Furthermore, the reduced supply of automotive parts and shutdown of production facilities fell the working capital of automobile manufacturers, resulting in a delay or reduction in investments in new technologies. However, with the automotive sector recovering from the pandemic, new opportunities are on the horizon for sensor fusion solution providers.

Autonomous Vehicles Sensor Fusion Market Trends

Passenger Cars to Hold a Significant Market Share

- There is an increasing interest among passenger car makers in developing autonomous cars, owing to the growing demand for vehicles with premium features. Car manufacturers, technology companies, and researchers are continuously working on further developing the technologies behind the autonomous car. As these vehicles include multiple sensors that gather massive amounts of data, sensor fusion emerged as an ideal solution to enable vendors to use the sensor data intelligently.

- Recent years have witnessed an upward growth trend in passenger vehicle sales. Although the pandemic affected the growth, the impact is more in the short term, which is expected to gain traction in the next few years. For instance, according to OICA, in 2021, sales of passenger cars increased to 56.4 million units from 53.9 million in 2020. Such trends are expected to act as a significant driving factor for the growth of the studied market.

- One crucial aspect of autonomous vehicles is path planning. Sensor fusion plays an essential role here by integrating the sensor readings to construct a precise picture of the vehicle's state and predict the trajectories of the surrounding objects. Hence, the adoption would increase with the increase in passenger car sales, which are autonomous in the coming times.

- Furthermore, Autonomous Emergency Braking (AEB) is an enhanced active safety system that helps drivers avoid or mitigate collisions with other vehicles or vulnerable road users. Multiple sensors are often needed for accurate, reliable, and robust detections while minimizing false positives. With safety becoming an increasingly important issue in the automotive industry, especially in the passenger vehicle segment, the increasing adoption of AEB systems is expected to impact the demand for sensor fusion systems positively.

North America to Retain a Significant Market Share

- North America is among the largest automotive manufacturing hubs in the world. The economic growth of the region posed an impact on the sale of passenger cars and commercial vehicles. The United States is among the leading automobile manufacturers in the North American region; apart from high domestic consumption, the country also exports automobiles globally. For instance, according to the US International Trade Commission, the export volume of light vehicles reached 1,619.35 thousand units in 2021.

- The region is also among the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. According to Deutsche Bank, the US ADAS unit production volume was forecasted to reach 18.45 million by 2021. ADAS (advanced driver-assistance systems) is capable of supporting adaptive cruise control (ACC), automatic emergency braking (AEB), lane departure, blind-spot detection, 360° surround view, etc., as a lot of sensors are used in designing the ADAS systems, such trends are expected to drive the demand for sensor fusion solutions in the country.

- According to ITA, Canada is the second largest automotive market in the North American region, where imports represent about three-quarters of the new vehicles market. In 2021, the import value of passenger vehicles increased by about 26% (compared to the last year) to USD 27.8 billion. The country's acceptance of autonomous cars is growing significantly, encouraging automobile manufacturers to increase their investment. For instance, tech and motor companies like Tesla, Uber, Toyota, BMW, GM, and Nissan are all in the race to develop autonomous vehicles for Canadian consumers.

- Furthermore, Robotaxis (relying on a powerful array of advanced sensing technologies that include multiple LiDARs to maneuver complex urban environments safely) is not quite here. Still, Waymo, Cruise, and Uber are investing heavily in and operating experimental fleets in the United States, which is expected to create future opportunities.

Autonomous Vehicles Sensor Fusion Market Competitor Analysis

The Sensor Fusion Market in Autonomous Vehicles is moderately competitive, owing to the mixed presence of both large-scale companies, such as Bosch, STMicroelectronics, and NXP Semiconductors NV, as new players specifically focused on this technology. The vendors are increasingly focusing on developing the technology to prepare it for future autonomous vehicles and make it affordable.

October 2022 - MicroVision, a leading American automotive sensor solution provider, unveiled MAVIN DR, a dynamic view lidar system, at the AutoSens 2022 Show in Brussels. The MAVIN DR lidar system features a dynamic field of view. It delivers high resolution with low latency, enabling new ADAS safety feature designers to achieve the proper highway-pilot functionality that OEMs demand.

April 2022 - CARIAD, the Volkswagen Group's software company, acquired the automotive division of Intenta GmbH, which works in sensor data fusion. The acquisition is in line with the company's strategy to massively increase its vertical value creation in software and hardware development to enable itself to develop critical software components in-house and increase the depth of value added in key development areas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Autonomous Vehicles

- 5.1.2 Efficient Real Time Data Processing and Data Sharing Capabilities to Drive the Demand

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization in Sensor Fusion Technology

6 KEY MARKET TRENDS

- 6.1 Key Patents and Research Activities

- 6.2 Major and Emerging Applications

- 6.2.1 Adaptive Cruise Control (ACC)

- 6.2.2 Autonomous Emergency Braking (AEB)

- 6.2.3 Electronic stability control (ESC)

- 6.2.4 Forward Collision Warning (FCW)

- 6.2.5 Other Applications

7 MARKET SEGMENTATION

- 7.1 By Types of Vehicle

- 7.1.1 Passenger Cars

- 7.1.2 Light Commercial Vehicle (LCV)

- 7.1.3 Heavy Commercial Vehicle (HCV)

- 7.1.4 Other Autonomous Vehicles

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East & Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Robert Bosch GmbH

- 8.1.2 Microchip Technology Inc.

- 8.1.3 Infineon Technologies AG

- 8.1.4 BASELABS GmbH

- 8.1.5 NXP Semiconductor

- 8.1.6 STMicroelectronics NV

- 8.1.7 Aimotive kft

- 8.1.8 Kionix Inc (Rohm Co. Ltd)

- 8.1.9 TDK Corporation

- 8.1.10 CEVA Inc.