|

市場調查報告書

商品編碼

1237842

口腔睡眠呼吸暫停市場——增長、趨勢、COVID-19 的影響和預測 (2023-2028)Oral Sleep Apnea Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,口腔睡眠呼吸暫停市場的複合年增長率預計為 14.1%。

最初,COVID-19 大流行對口腔睡眠呼吸暫停市場產生了重大影響。 在 COVID-19 爆發後,口腔睡眠呼吸暫停市場經歷了高速增長。 這主要是由於感染 COVID-19 的患者呼吸衰竭的風險增加。 為了管理呼吸問題,已使用口腔睡眠設備(例如下頜前移設備)為 COVID-19 患者提供呼吸支持。 美國牙科睡眠協會建議在大流行期間使用口腔睡眠設備作為患者睡眠呼吸暫停的一線療法。 根據美國睡眠醫學會的說法,口服睡眠呼吸暫停設備可作為侵入性和易感染的氣道正壓通氣 (PAP) 設備的替代療法。

COVID-19 大流行和封鎖使患者很難去看醫生、去醫院和去睡眠診所。 然而,在 COVID-19 期間,遠程醫療有助於更深入地滲透口服睡眠呼吸暫停藥物。 臨床醫生已迅速將遠程醫療納入他們的實踐中,並且可以有效地諮詢多個患者。 在 Sleep Medicine 2022 上發表的一項研究中,BlueSleep 中心於 2020 年 3 月在大流行期間遠程諮詢了 10,171 多名睡眠呼吸暫停患者。

分析表明,在後大流行時代,對口服睡眠呼吸暫停藥物的需求預計將穩步增長。 多個市場進入者表示,自 COVID-19 大流行以來,口腔睡眠設備的銷量有所增加。 例如,2021 年 12 月,SomnoMed 表示 2022 年上半年的銷售額增長了 10%。 我們預計 2022 財年將增長 15%。 此外,Oventus Medical 報告稱,從 2020 年到 2021 年,口腔睡眠設備的銷量增長了一倍以上。 因此,隨著設備和藥品銷量的增長,預計該市場將進一步穩步增長。

此外,睡眠呼吸暫停綜合症患病率的上升和老年人口的迅速增加,與睡眠呼吸暫停綜合症相關的基礎疾病的發病率不斷增加,以及未來設備的技術進步預計將在未來幾年繼續進行。預計將推動市場的增長

根據 2022 年發表在美國胸科學會雜誌上的一項研究,阻塞性睡眠呼吸暫停 (OSA) 的全球患病率超過 22.6%。 此外,不斷增長的老年人口對口服睡眠呼吸暫停藥物和設備的需求產生了重大影響,因為老年人患這種疾病的風險更高。 例如,根據國家醫學圖書館發表的一項研究,到 2022 年 6 月,全球約有 10 億人患有阻塞性睡眠呼吸暫停 (OSA),其中 4.25 億人年齡在 30-69 歲之間。估計有 10,000 人患有中度至嚴重的 OSA。 此外,患病率在 50 歲以後隨著年齡的增長而增加,並且這種情況在全世界影響著與男性一樣多的女性。 此外,世界衛生組織預測,到 2030 年,六分之一的人將超過 60 歲。 因此,易患睡眠呼吸暫停的老年人口增加可能會增加對口服睡眠呼吸暫停設備和藥物的需求,從而推動市場增長。

此外,2022 年 6 月的睡眠健康組織指出,肥胖的醫學合併症會增加發生睡眠呼吸暫停的風險。 高度肥胖會導致氣道阻塞、肺活量降低以及睡眠時喉嚨塌陷導致的呼吸困難。

此外,一些市場參與者已獲得監管部門的批准,並正在推出先進的口服睡眠呼吸暫停產品,這將推動市場增長。 例如,2022 年 10 月,Airway Management 推出了 flexTAP,這是一種可定制的口腔睡眠設備,專門用於治療打鼾和輕度至中度阻塞性睡眠呼吸暫停患者。 該設備將獲得專利的 Vertex 技術與 flexTAP Mouth Shield 舒適配件相結合,有助於鼻腔呼吸並優化唾液分泌不足或分泌過多。 2021 年 2 月,Oventus Medical 在直接面向消費者的模式和虛擬實驗室中推出了 O2Vent Optima 口腔睡眠設備。 該公司提供與口腔睡眠呼吸暫停設備相關的遠程醫療服務。

因此,由於上述因素,預計該市場在分析期內將增長。 然而,口腔睡眠呼吸暫停設備的高成本和嚴格的法規可能會阻礙市場增長。

口腔睡眠呼吸暫停的市場趨勢

下頜前移裝置事業部有望實現顯著增長

下頜前突裝置 (MAD) 是一種口腔睡眠呼吸暫停裝置,可調節下巴以擴大氣道並在睡眠期間輔助呼吸。 該設備是 PAP 設備的非侵入性替代品,可有效治療輕度至中度睡眠呼吸暫停。 它是對 PAP 設備感到不適的輕度至中度睡眠呼吸暫停患者的主要治療方法。 MAD 設備提供定制的靈活性和所需的問題管理。 一些研究出版物表明,從長遠來看,MAD 可有效控制睡眠呼吸暫停。 例如,2022 年發表在《顱下頜骨與睡眠實踐雜誌》上的一項研究強調了 MAD 治療輕度至重度睡眠呼吸暫停的功效。 這些設備在減少呼吸暫停低通氣指數 (AHI) 和睡眠呼吸暫停相關症狀(如打鼾、白天過度疲勞和睡眠不安)方面顯示出良好效果。

此外,下頜前突裝置的幾項重大發展進一步推動了市場增長。 例如,2022 年 7 月,Glidewell 推出了下頜前移裝置“Silent Nite Sleep Appliance with Glidewell Hinge”。 該設備是牙醫用來治療打鼾和阻塞性睡眠呼吸暫停的 Silent Nite 品牌的延伸。 此外,2021 年 9 月,Vivos Therapeutics , Inc .獲得了 USFDA 510(k) 的市場許可,用於其改良的下頜重新定位夜間矯治器(mmRNA)。

因此,由於功效、產品發布和監管批准等上述因素,預計下頜前移裝置部分在預測期內將呈現顯著增長。

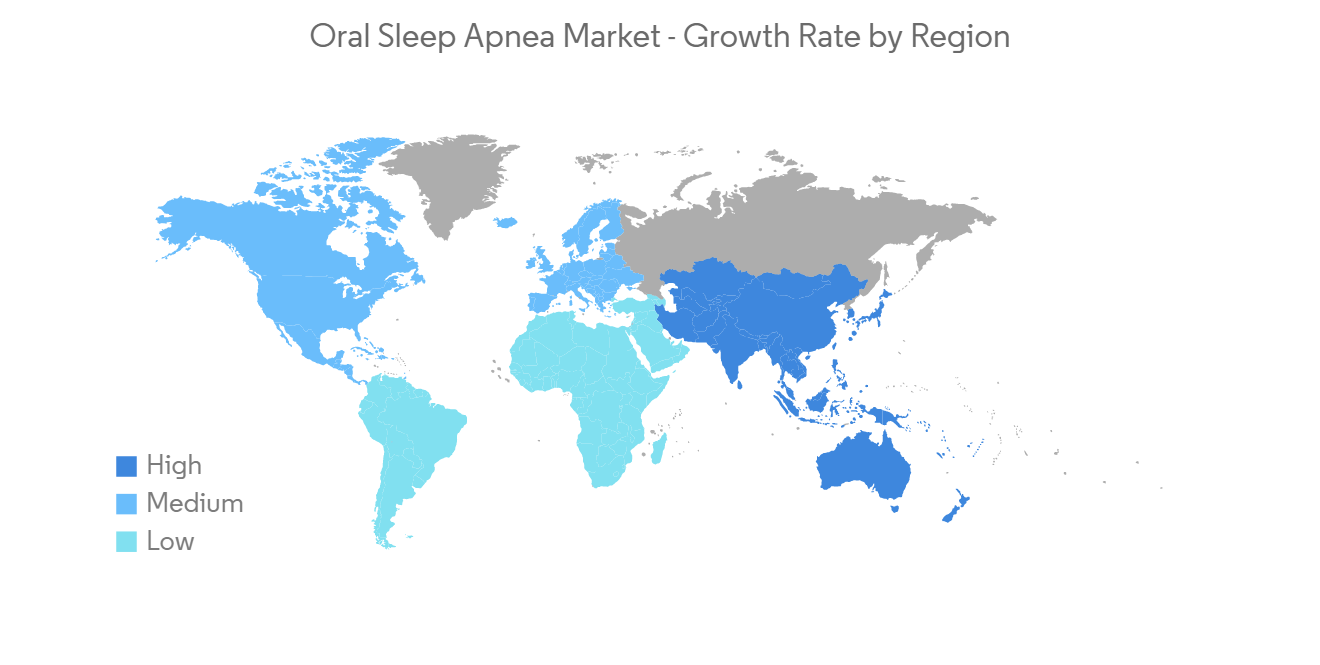

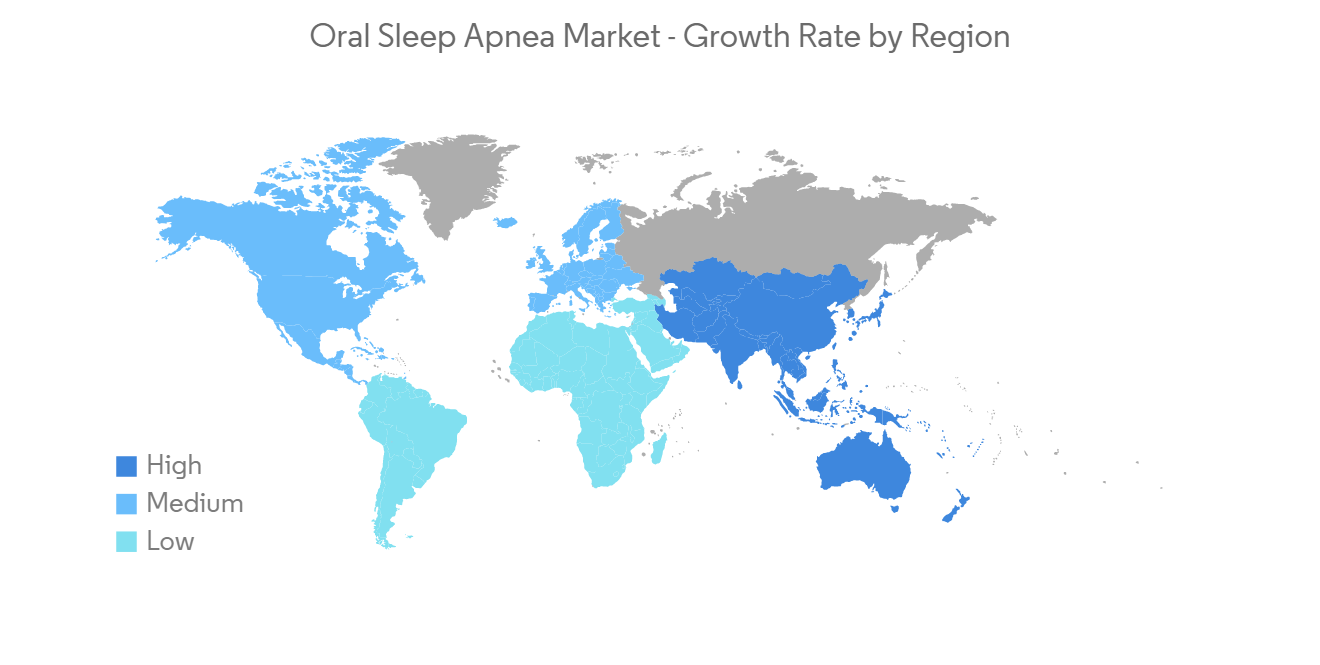

北美有望主導口腔睡眠呼吸暫停市場

由於睡眠呼吸暫停的高患病率、龐大的老年人口和先進的醫療基礎設施等關鍵因素,預計北美將主導口腔睡眠呼吸暫停市場。 主要製造商的存在和美國日益流行也是市場擴張的主要原因之一。 根據 AHA 2021,美國超過 17% 的中年女性和 34% 的中年男性符合阻塞性睡眠呼吸暫停的診斷標準。 此外,肥胖的高負擔也有望對市場增長產生積極影響。 例如,根據睡眠呼吸暫停組織的數據,到 2021 年,將有超過 3000 萬美國人患有睡眠呼吸暫停,而 80% 的中度至重度睡眠呼吸暫停病例未被確診。 這種情況每年影響超過 20% 的肥胖人群。

此外,主要參與者的戰略開發是推動口腔睡眠呼吸暫停綜合徵市場增長的主要因素之一。 例如,2022 年 5 月,ProSomnus Holdings Inc. 和 Lakeshore Acquisition 根據最終的企業合併協議合併成立了 ProSomnus, Inc.。 該交易有望加速 ProSomnus 口腔矯治器治療設備的開發和商業化。

2022 年 10 月,Panthera Dental 與 MK1 Dental-Attachment GmbH 簽署了獨家經銷協議,以擴大其在美國和加拿大的口腔睡眠呼吸暫停和牙科產品供應。 2022 年 5 月,Panthera Dental 宣布將與 Medit Corp.合作創建全數字化工作流程,通過集成的數字化工作流程提供世界一流的個性化打鼾和阻塞性睡眠呼吸暫停管理。 此外,該地區的這些持續發展預計將推動市場增長。

因此,由於上述因素,預計北美地區的研究市場將出現增長。

口腔睡眠呼吸暫停市場競爭對手分析

口服睡眠呼吸暫停藥市場因其性質而適度整合,多家公司在全球和區域開展業務。 競爭格局包括 SomnoMed、Whole You、Panthera Dental、ProSomnus Sleep Technologies、Oventus Medical、ResMed、DynaFlex、Airway Management、OravanOSA、Myerson LLC、MPowrx Health & Wellness、Vivos Therapeutics, Inc、Glidewell、Teva Pharmaceutical Industries Ltd、Axsome Therapeutics還有一些在全球和區域公司中佔有市場份額的知名分析公司,例如 , Inc.

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 睡眠呼吸暫停綜合徵患病率上升,老年人口增加

- 睡眠呼吸暫停綜合徵的基礎疾病正在增加

- 未來的技術創新

- 市場製約因素

- 口腔內睡眠設備的高成本和嚴格的監管政策

- 產業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(按價值劃分的市場規模)

- 按產品類型

- 設備

- 下頜前突裝置

- 舌苔預防裝置

- 快速擴大上頜骨

- 口腔醫學

- 設備

- 按購買類型

- 醫生開具的/定制的口腔器具和藥物

- 在線 OTC 口腔器械和藥物

- 最終用戶

- 醫院

- 家庭護理場所/個人

- 藥店

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- SomnoMed

- Whole You

- Panthera Dental

- ProSomnus Sleep Technologies

- Oventus Medical

- ResMed

- DynaFlex

- Airway Management

- OravanOSA

- Myerson LLC

- MPowrx Health & Wellness

- Glidewell

- Vivos Therapeutics, Inc.

- Teva Pharmaceutical Industries Ltd

- Axsome Therapeutics, Inc.

第7章 市場機會與今後動向

The oral sleep apnea market is expected to register a CAGR of 14.1% over the forecast period.

Initially, the COVID-19 pandemic substantially impacted the oral sleep apnea market. With the outbreak of COVID-19, the oral sleep apnea market experienced a hike in growth. It was primarily due to the elevated risk of respiratory failure in the COVID-19-infected patients. For the management of respiratory issues, oral sleep devices, such as mandibular advancement devices, were utilized to provide respiratory support to COVID-19 patients. The American Academy of Dental Sleep Medicine recommended using oral sleep appliances as the first-line therapy for sleep apnea in patients amid the pandemic. According to the American Academy of Sleep Medicine, oral sleep apnea devices work as an alternative therapy to invasive and infection-prone positive airway pressure (PAP) devices.

The massive spread of COVID-19 and the imposition of lockdown made it challenging for patients to visit their physicians, hospitals, or sleep clinics. However, telemedicine helped with the deeper penetration of oral sleep apnea therapies during COVID-19. Clinicians quickly adapted to telemedicine for their clinical practices, which helped them consult with several patients effectively. In a study published in Sleep Medicine 2022, over 10,171 sleep apnea patients were tele-consulted by the BlueSleep Center in March 2020 during the pandemic.

As per the analysis, the demand for oral sleep apnea therapies is expected to grow at a stable pace in the post-pandemic era. Several market participants have stated that sales of oral sleep devices have increased since the COVID-19 pandemic. For instance, in December 2021, SomnoMed stated that its revenue increased by 10% in the first half of the financial year 2022. It forecasted an estimated growth rate of 15% in the financial year 2022. Furthermore, Oventus Medical reported that the sales of oral sleep appliances had more than doubled between 2020 and 2021. Thus, with such an increase in the sales of devices as well as drugs, the market is expected to grow further at a stable pace.

Further, the rising prevalence of sleep apnea and an upsurge in the geriatric population, growing incidences of the underlying conditions associated with sleep apnea, and upcoming technological advancements in devices are likely to boost the market's growth over the coming years.

According to a study published in the Journal of the American Thoracic Society in 2022, obstructive sleep apnea (OSA) has a global prevalence of over 22.6%. Moreover, the enlarging geriatric population has a major impact on the demand for oral sleep apnea drugs and devices, as aged individuals have a high risk of developing this condition. For instance, according to a study published in the National Library of Medicine, in June 2022, nearly 1 billion people worldwide suffer from obstructive sleep apnea (OSA), with 425 million adults aged 30-69 having moderate-to-severe OSA. The study further states that when people reach 50 years or older, the prevalence increases with age, and the condition affects just as many women as men worldwide. Furthermore, the WHO predicts that by 2030, one out of every six people will be 60 years of age or older. Thus, a growing aging population more vulnerable to this condition will likely augment the demand for oral sleep apnea devices and drugs, propelling the market's growth.

In addition, the Sleep Health Organization in June 2022 stated that the medical comorbidity of obesity increases the risk of developing sleep apnea. The high body mass index causes difficulty breathing by obstructing the airway, reducing lung capacity, and causing throat collapse during sleep.

Additionally, several market players have received regulatory approvals and launched advanced oral sleep apnea products, which will propel the market's growth. For instance, in October 2022, Airway Management launched its customizable oral sleep appliance, flexTAP, dedicated to treating patients with snoring conditions and mild to moderate obstructive sleep apnea. The device combines patented Vertex Technology with the flexTAP Mouth Shield comfort accessory, which aids in nasal breathing and optimizes under or over-secretion of saliva. In February 2021, Oventus Medical launched its oral sleep appliance, O2Vent Optima, under its direct-to-consumer model and virtual lab. The company offers telehealth services associated with the oral sleep apnea device.

Therefore, owing to the aforementioned factors, it is anticipated that the studied market will witness growth over the analysis period. However, the high cost of oral sleep appliances and stringent regulatory policies will likely impede the market growth.

Oral Sleep Apnea Market Trends

Mandibular Advancement Devices Segment Expected to Witness Significant Growth

Mandibular advancement devices (MAD) are oral sleep apnea devices that adjust the jaw to expand the airways and assist in breathing during sleep. These devices are a non-invasive alternative to PAP devices and effectively treat mild to moderate sleep apnea. They are the primary treatment for sleep apnea, with mild to moderate severity in patients who feel uneasy with PAP devices. MAD devices offer the flexibility of being custom-made and offer desirable management of the problem. Several research publications have indicated the effectiveness of MADs in managing sleep apnea over the long term. For instance, a study published in the Journal of Craniomandibular & Sleep Practice in 2022 underlined the efficacy of MADs for managing mild to severe sleep apnea. These devices have shown positive results in reducing the apnea-hypopnea index (AHI) and sleep apnea-related symptoms, such as snoring, excessive daytime exhaustion, and unrefreshing sleep.

In addition, some key developments in mandibular advancement devices have further bolstered the market's growth. For instance, in July 2022, Glidewell launched its mandibular advancement device, the Silent Nite Sleep Appliance with Glidewell Hinge. The device is an extension of the Silent Nite brand, which dentists use to treat snoring and obstructive sleep apnea. Further, in September 2021, Vivos Therapeutics, Inc. received the USFDA's 510(k) market clearance for its mmRNA (modified mandibular repositioning nighttime appliance) oral appliance.

Therefore, owing to the abovementioned factors, such as efficacy, product launches, and regulatory approvals, the mandibular advancement devices segment is expected to witness significant growth over the forecast period.

North America Expected to Dominate the Oral Sleep Apnea Market

North America is expected to dominate the oral sleep apnea market owing to crucial factors, such as the high prevalence of sleep apnea, the vast geriatric population, and the advanced healthcare infrastructure. The presence of key manufacturers in the United States, as well as the increasing prevalence of the condition, are two of the primary reasons for market expansion. According to the AHA 2021, over 17% of middle-aged females and 34% of middle-aged men met the diagnostic criteria for obstructive sleep apnea in the United States. Furthermore, the high burden of obesity is expected to positively impact the market's growth. For instance, according to the Sleep Apnea Organization, in 2021, more than 30 million Americans suffered from sleep apnea, and 80% of moderate-to-severe sleep apnea cases were undiagnosed. The condition affects more than 20% of obese people every year.

Moreover, strategic developments by the leading players are one of the major factors driving the growth of the oral sleep apnea market. For instance, in May 2022, ProSomnus Holdings Inc. and Lakeshore Acquisition merged under the definitive business combination agreement to become ProSomnus, Inc. The deal is expected to accelerate the development and commercialization of ProSomnus' oral appliance therapy devices.

In October 2022, Panthera Dental signed an exclusive distribution agreement with MK1 Dental-Attachment GmbH to expand the oral sleep apnea and dental products offering in the United States and Canada. In May 2022, Panthera Dental, in collaboration with Medit Corp., announced the creation of a completely digital workflow to provide world-class custom-made snoring and obstructive sleep apnea management through an integrated digital workflow. Further, these continuous developments in the region are anticipated to drive the growth of the market.

Therefore, owing to the aforesaid factors, the growth of the studied market is anticipated in the North American region.

Oral Sleep Apnea Market Competitor Analysis

The oral sleep apnea market is moderately consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of some international and local companies that hold market shares and are well known, including SomnoMed, Whole You, Panthera Dental, ProSomnus Sleep Technologies, Oventus Medical, ResMed, DynaFlex, Airway Management, OravanOSA, Myerson LLC, MPowrx Health & Wellness, Vivos Therapeutics, Inc., Glidewell, Teva Pharmaceutical Industries Ltd, and Axsome Therapeutics, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Sleep Apnea and Upsurge in Geriatric Population

- 4.2.2 Growing Incidences of the Underlying Conditions Associated with Sleep Apnea

- 4.2.3 Upcoming Technological Advancements

- 4.3 Market Restraints

- 4.3.1 High Cost of the Oral Sleep Appliances and Stringent Regulatory Policies

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Devices

- 5.1.1.1 Mandibular Advancement Devices

- 5.1.1.2 Tongue-retaining Devices

- 5.1.1.3 Rapid Maxillary Expansion

- 5.1.2 Oral Drugs

- 5.1.1 Devices

- 5.2 By Purchase Type

- 5.2.1 Physician-prescribed/Customized Oral Appliances and Drugs

- 5.2.2 Online OTC Oral Appliances and Drugs

- 5.3 By End-user

- 5.3.1 Hospital

- 5.3.2 Home Care Settings/Individual

- 5.3.3 Pharmacies

- 5.3.4 Other End-users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SomnoMed

- 6.1.2 Whole You

- 6.1.3 Panthera Dental

- 6.1.4 ProSomnus Sleep Technologies

- 6.1.5 Oventus Medical

- 6.1.6 ResMed

- 6.1.7 DynaFlex

- 6.1.8 Airway Management

- 6.1.9 OravanOSA

- 6.1.10 Myerson LLC

- 6.1.11 MPowrx Health & Wellness

- 6.1.12 Glidewell

- 6.1.13 Vivos Therapeutics, Inc.

- 6.1.14 Teva Pharmaceutical Industries Ltd

- 6.1.15 Axsome Therapeutics, Inc.