|

市場調查報告書

商品編碼

1237839

氫氧化鎂市場 - 增長、趨勢、COVID-19 的影響和預測 (2023-2028)Magnesium Hydroxide Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計在預測期內,氫氧化鎂市場的複合年增長率將超過 7%。

在 COVID-19 疫情期間,由於全國范圍內的封鎖和嚴格的社會隔離規定,市場關閉,對各種化學產品的需求直線下降。 然而,由於製藥行業的需求不斷增加,預計該市場將穩步增長。

主要亮點

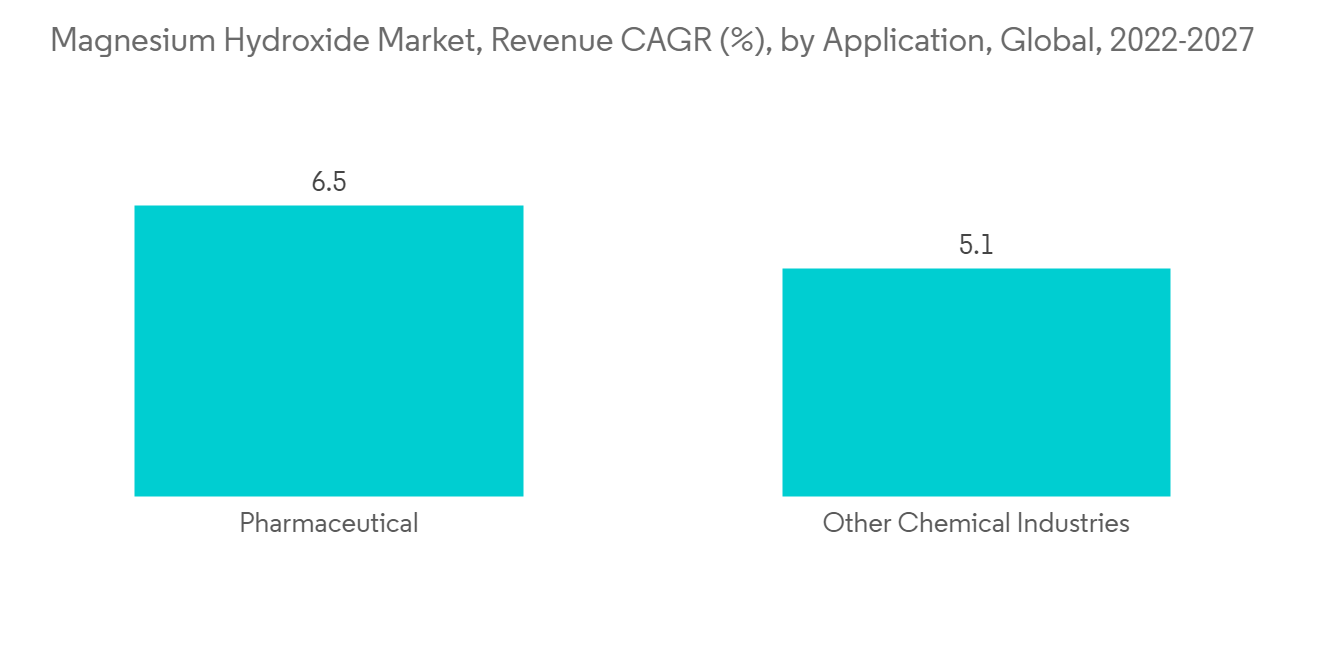

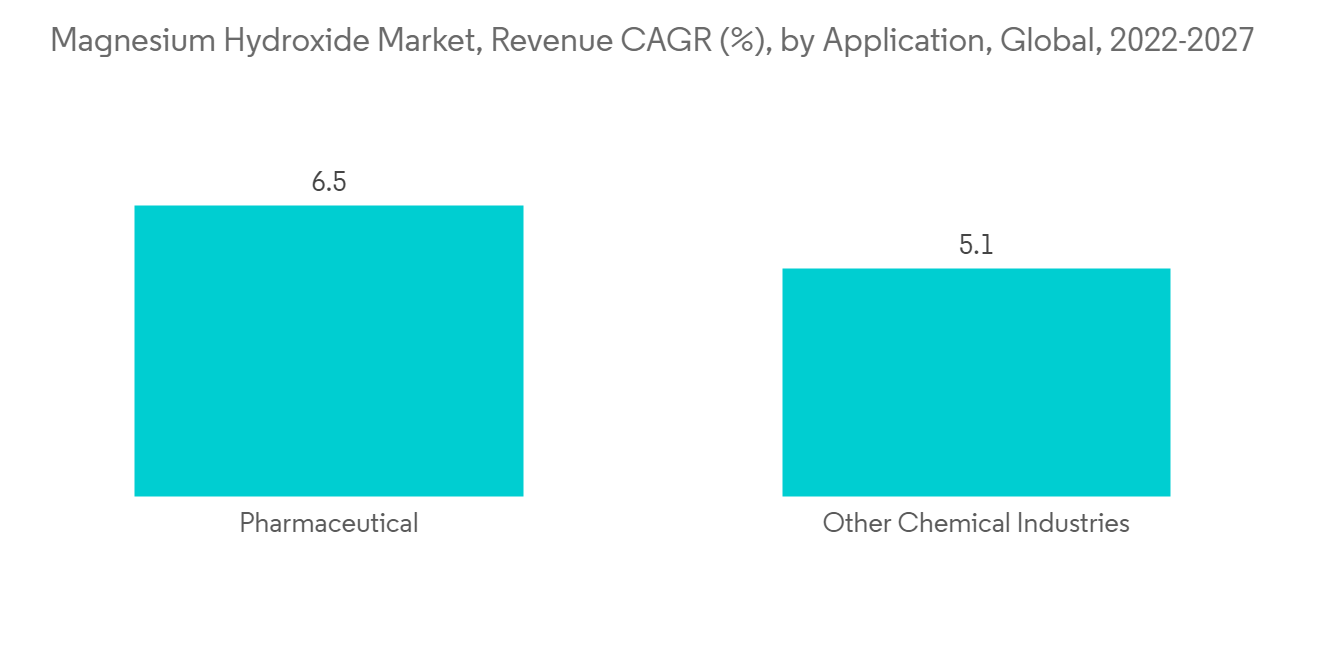

- 推動市場發展的主要因素是對醫藥、工業化學品、中間體等的需求。

- 氫氧化鈉和氫氧化鈣等鹼性大宗化學品的供應阻礙了市場增長。

- 對廢水處理化學品的需求不斷增長是一個重大的市場機遇。

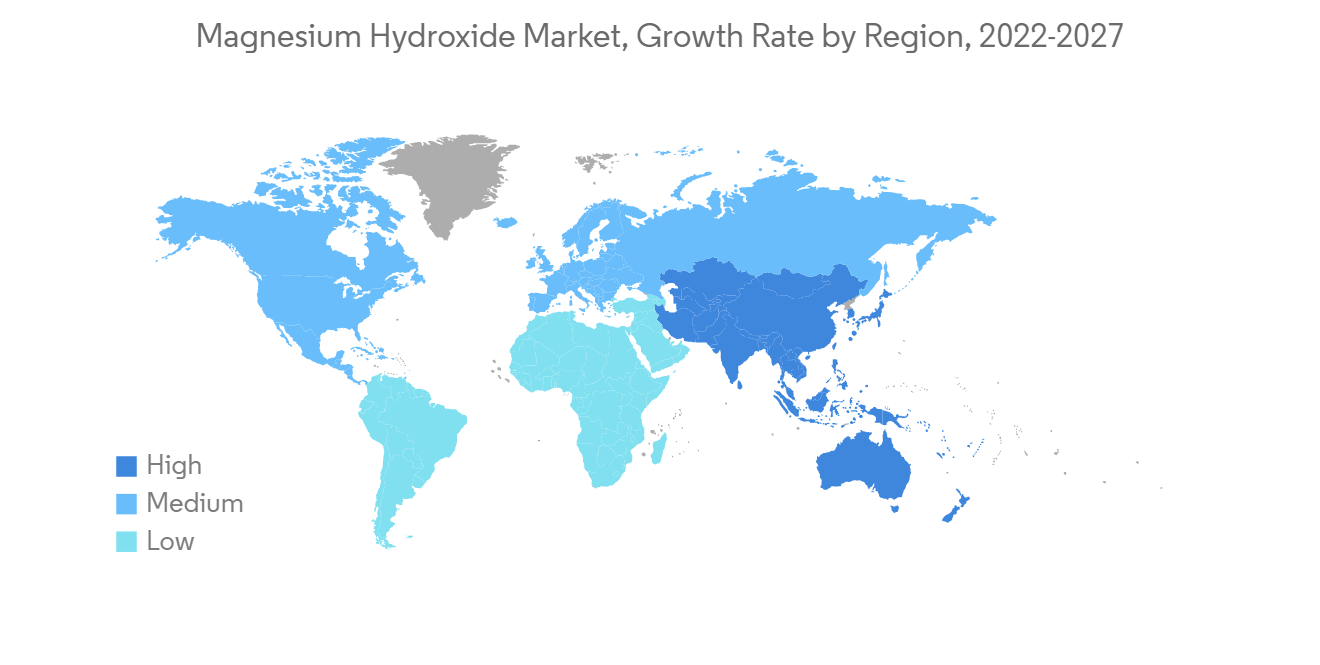

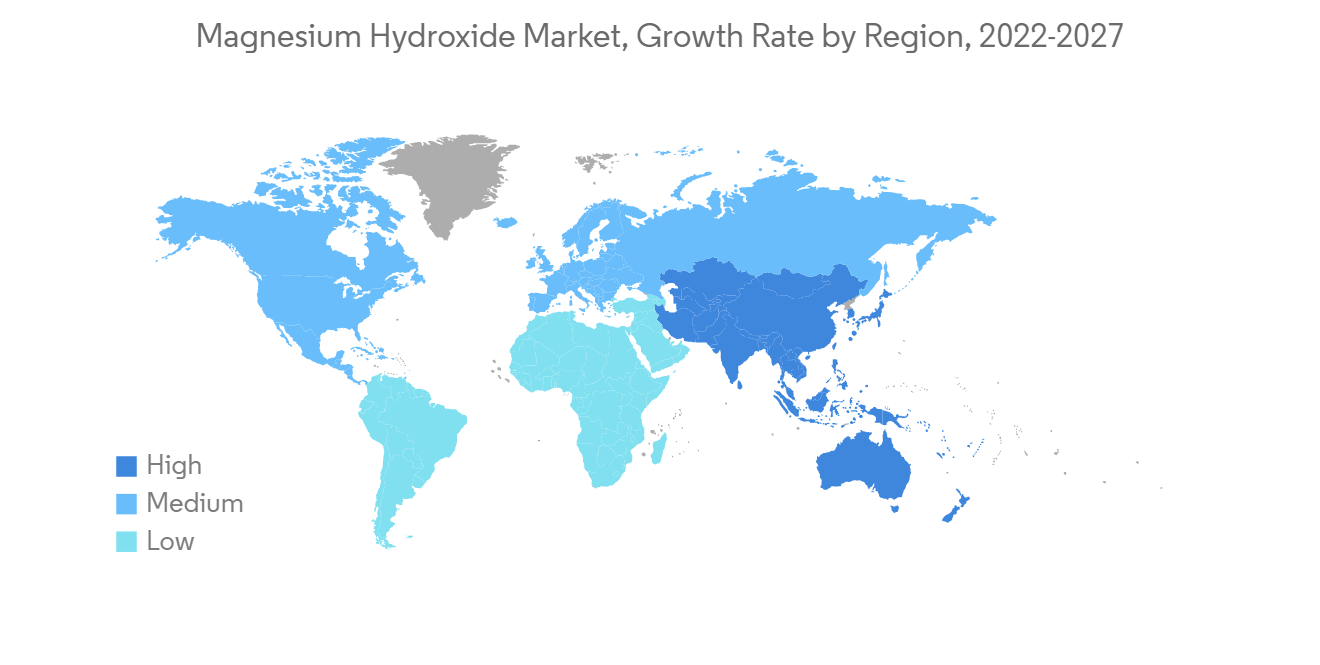

- 亞太地區主導著全球市場,其中中國和印度的消費最為突出。

氫氧化鎂市場趨勢

工業製造需求增加

- 氫氧化鎂通常用於工業製造設備中的脫硫和廢水處理。 此外,氫氧化鎂在醫藥領域主要用作抗酸劑。

- 氫氧化鎂還用於石油化工、電子塗料等。

- 全球工業部門的擴張預計會增加對氫氧化鎂的需求,氫氧化鎂可提供廢水處理和脫硫作用,並可提高工業過程的性能和效率。

- 亞太地區持續的經濟實力以及由此產生的對基礎設施、機械和製造設備不斷增長的需求將推動該地區對工業化學品的需求。 此外,由於生產設施的擴張和投資的增加,鋼鐵、化工、石油和天然氣、製造和建築等最終用戶行業有望出現新的商機。

- 越來越多的全球公司正在將其生產基地轉移到其他亞太國家/地區,例如台灣、印度、馬來西亞、菲律賓、泰國、新加坡和印度尼西亞。 這些國家在各個領域都獲得了外國直接投資(FDI),並在製造業方面享有盛譽。 此外,各國政府的政策也吸引了外國玩家,促進了工廠的建立。

- 歐洲擁有許多大型塗料工業,以德國、法國、意大利和西班牙等四個主要經濟區為中心。 由於該地區有幾家老牌公司,工業塗料領域預計將在預測期內擴大。 工業發展預計將有利於工業部門對氫氧化鎂的需求,以提高工業設備和其他機械的性能。

- 由於結構改革取得進展,預計中東和非洲對工業化學品的需求強勁。 同樣在沙特阿拉伯,“2030 年願景”和隨之而來的國家轉型計劃 (NTP) 的公佈、對醫療保健和教育等各個領域的投資增加預計將在預測期內推動對氫氧化鎂的需求。看來。

- 因此,上述因素預計將影響工業化學品的市場需求。

亞太地區主導市場

- 在亞太地區,中國的實際 GDP 將在 2020 年和 2021 年分別增長 2.2% 和 8.1%,這主要是受疫情後消費支出複甦的推動。

- 中國在過去五年中對公立醫院的投入翻了一番,達到 380 億美元。 它還旨在到 2030 年將醫療保健行業的規模擴大一倍以上,達到 2.3 萬億美元。

- 此外,中國政府出台了支持和鼓勵國內醫療器械創新的政策,為市場研究提供了機會。 “中國製造2025”倡議將提高行業效率、產品質量和品牌美譽度,促進國內製藥企業發展,增強競爭力。

- 中國是世界第二大醫療保健市場。 但是,該國從發達國家進口技術高端的植入物。 該國的公立醫院是該國醫療設備的主要消費者。 2021年公共醫療衛生支出1.92萬億元。

- 根據國際貨幣基金組織 (IMF) 的預測,印度的 GDP 到 2021 年將增長 8.9%。 該國正在恢復工業活動,預計將在預測期的下半年成為經濟增長的引擎。 2022年GDP有望達到8.2%。

- 在印度,2021 年底,英聯邦衛生部長宣布了印度政府改善該國醫療設施的多項計劃。 政府計劃在未來六年內在該國的醫療保健領域投資 6418 億盧比。 政府計劃加強現有的“國家衛生使命”,以發展初級、二級和三級衛生系統以及檢測和治療新出現疾病的機構能力。

- 由於 COVID-19 流行病,各種藥品的需求不斷增加,預計將在預測期內推動醫用彈性體市場。

氫氧化鎂市場競爭者分析

氫氧化鎂市場具有分散性,由少數知名企業和許多本地企業主導。 市場上的主要參與者包括 Elementis PLC、Kyowa Chemical Industry、NikoMag、Premier Magnesia 和 Israel Chemicals Ltd 等公司。

其他福利。

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 調查範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 司機

- 工業製造的需求增加

- 製藥行業的需求不斷增長

- 約束因素

- 處理其他鹼性散裝化學品

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 用法

- 工業製造

- 醫藥行業

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要參與者採用的策略

- 公司簡介

- Elementis

- Huber Engineered Materials

- Israel Chemicals Ltd

- Konoshima Chemical Co. Ltd

- Kyowa Chemical Industry Co. Ltd

- Lehmann&Voss&Co

- Martin Marietta Magnesia Specialti

- NikoMag

- Xinyang Minerals Group

- Ube Industries Ltd

- PremierMagnesia LLC

- Tateho Chemical Industries Co. Ltd

第七章市場機會與未來趨勢

- 在一些經濟體中,人們對實現絕對廢水處理越來越感興趣

- 其他機會

The magnesium hydroxide market is expected to register a CAGR of more than 7% during the forecast period.

During the COVID-19 pandemic period, the demand for different chemical products reduced drastically because of the nationwide lockdown and stringent social distancing mandate, which caused the closure of markets. However, the market is expected to grow steadily owing to increasing demand from the pharmaceutical industry.

Key Highlights

- The primary factor driving the market is the demand for pharmaceuticals, industrial chemicals, and intermediaries.

- The availability of alkaline bulk chemicals such as sodium and calcium hydroxide will hinder market growth.

- The increasing demand for wastewater treatment chemicals is the key market opportunity.

- Asia-Pacific dominated the global market, with the most significant consumption in China and India.

Magnesium Hydroxide Market Trends

Increase in Demand from Industrial Manufacturing Industry

- Magnesium hydroxide is significantly used in desulphurization and wastewater treatment in industrial manufacturing units. Furthermore, magnesium hydroxide is majorly used as an antacid in the pharmaceutical segment.

- Magnesium hydroxide is also used in petrochemicals, electronic coatings, and others.

- The expansion of the industrial sector across the world is likely to boost the demand for magnesium hydroxide to offer wastewater treatment and desulphurization and improve the performance and efficiency of industrial processes.

- Asia-Pacific region's continuing economic strength and corresponding increasing need for infrastructure, machinery, manufacturing units, and others are likely to propel the demand for industrial chemicals in the region. In addition, expanding production units and increasing investments in the area are expected to offer newer opportunities in the end-user industries such as iron and steel, chemical, oil and gas, manufacturing, construction, and others.

- A growing number of global companies are moving production to other Asian-Pacific countries, such as Taiwan, India, Malaysia, Philippines, Thailand, Singapore, and Indonesia. These countries have gained a reputation for manufacturing, with foreign direct investment (FDI) in various sectors. In addition, the government policies in the countries attract foreign players and facilitate the setup of plants.

- Europe is home to many large paint industries, with the four largest mainland economies, including Germany, France, Italy, and Spain. The presence of several well-established players in the region is projected to expand the industrial coatings segment over the forecast period. Development of the industrial sector is anticipated to benefit the demand for magnesium hydroxide in the industrial sector to enhance the performance of industrial equipment and other machinery.

- The Middle East and Africa are anticipated to witness strong demand for industrial chemicals due to the region's increasing structural reforms. In addition, the announcement of Vision 2030, coupled with the associated National Transformation Plan (NTP), and increased investments in various sectors, including healthcare and education in Saudi Arabia, are likely to propel the demand for magnesium hydroxide over the forecast period.

- Therefore, owing to the abovementioned factors, industrial chemicals are likely to affect the demand for the market.

Asia Pacific to Dominate the Market

- In the Asia-Pacific region, China's real GDP grew by 2.2% in 2020 and by 8.1% in 2021, largely driven by consumer spending rebound post-pandemic.

- China has doubled the amount, it had been pouring into public hospitals in the last five years, to USD 38 billion. It aims to raise the healthcare industry's value to USD 2.3 trillion by 2030, more than twice its size now.

- Furthermore, the Chinese government has started policies to support and encourage domestic medical device innovation providing opportunities for the market studied. The "Made in China 2025" initiative improves industry efficiency, product quality, and brand reputation, which will spur the development of domestic pharmaceutical manufacturers and will increase competitiveness.

- China is the second-largest healthcare market in the world. However, the country imports technologically high-end implants from advanced economies. The public hospitals in the country are leading consumers of medical devices in the country. In 2021, the public expenditure done on healthcare was Yuan 1.92 trillion.

- According to the International Monitory Fund (IMF) projections, the GDP of India grew by 8.9% by 2021. The country has resumed its industrial activities which are expected to drive economic growth during the latter part of the forecast period. The GDP for the year 2022 is expected to reach 8.2%.

- In India, in late 2021, the Union Health Minister announced various plans of the Indian government to improve healthcare facilities in the country. The government plans to invest INR 64,180 crore in healthcare sector over the next six years in the country. The government plans to strengthen the existing 'National Health Mission' by developing capacities of primary, secondary, and tertiary healthcare systems and institutions for detection and cure of new and emerging diseases.

- The increasing demand from various pharmaceuticals due to the COVID-19 outbreak is estimated to drive the market for medical elastomers during the forecast period.

Magnesium Hydroxide Market Competitor Analysis

The magnesium hydroxide market is fragmented in nature, with the dominance of a few prominent players and the existence of many local players. Some of the major players in the market include Elementis PLC, Kyowa Chemical Industry, NikoMag, Premier Magnesia, Israel Chemicals Ltd., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Industrial Manufacturing Industry

- 4.1.2 Growing Demand from Pharmaceutical Industry

- 4.2 Restraints

- 4.2.1 Availability of Other Alkaline Bulk Chemicals

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Industrial Manufacturing

- 5.1.2 Pharmaceutical Industry

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Elementis

- 6.4.2 Huber Engineered Materials

- 6.4.3 Israel Chemicals Ltd

- 6.4.4 Konoshima Chemical Co. Ltd

- 6.4.5 Kyowa Chemical Industry Co. Ltd

- 6.4.6 Lehmann&Voss&Co

- 6.4.7 Martin Marietta Magnesia Specialti

- 6.4.8 NikoMag

- 6.4.9 Xinyang Minerals Group

- 6.4.10 Ube Industries Ltd

- 6.4.11 PremierMagnesia LLC

- 6.4.12 Tateho Chemical Industries Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on Achieving Absolute Wastewater Treatment By Several Economies

- 7.2 Other Opportunities