|

市場調查報告書

商品編碼

1237836

IT 設備市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)IT Device Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,IT 設備市場預計將以 2.4% 的複合年增長率增長。

由於對移動設備的需求增加,預計該市場在預測期內將會增長。 在 COVID-19 流行期間,隨著企業和消費者需要更大的靈活性和移動性,對 PC 的需求增加了。

主要亮點

- 在過去幾年中,隨著全球個人消費的擴大,對手機的需求也在增加。 值得一提的是,智能手機的需求在機型和市場規模上不斷擴大。 去年,預計 40% 的人將擁有智能手機。 據愛立信稱,全球智能手機用戶數量已超過 60 億,預計未來幾年將增長數億。 中國、印度和美國是智能手機用戶最多的前三個國家。

- 此外,筆記本電腦的銷量在美國和中國等主要國家/地區不斷擴大。 主要筆記本電腦製造商報告說,自 COVID-19 大流行以來,PC 銷量有所增加。 隨著圖形、連接性、重量、便攜性等方面的不斷更新,對最先進設備的需求始終是意料之中的。

- 但是,由於對筆記本電腦的需求增加,全球個人電腦銷量正在萎縮。 由於在家工作和社會疏遠規範,大流行後對個人電腦的需求也有所增加。 但是現在一切都恢復正常了,人們已經回到了他們的辦公室和設施中。 因此,對個人電腦的需求正在放緩。 此外,預計全球 PC 銷量在預測期內將進一步萎縮。

- 中國在全球 IT 設備市場處於領先地位,其次是美國、日本和印度。 去年,中國在手機領域的銷售額最高。 根據 GSMA 移動智庫的數據,今年早些時候,中國擁有 16.3 億手機連接。 今年第二財季,榮耀和vivo的智能手機市場份額最高。

- 在 COVID-19 疫情期間,全球對個人電腦、筆記本電腦和手機等 IT 設備的需求有所增加。 需求的增加主要是由於全球社會距離和在家工作的規定導致對網絡設備的需求增加。 然而,法規的逐步取消以及辦公室和設施的重新開放減少了對 PC 的需求。 在 COVID-19 之後,對手機,尤其是智能手機的需求預計將保持穩定。

IT 設備市場趨勢

移動領域的堅實貢獻

- 在中國、印度等人口密度較高的國家,智能手機普及率仍在70%左右,智能手機市場還有很大的發展空間。 儘管銷量一直低迷,但由於智能手機平均售價的上漲,全球智能手機市場的銷量在過去幾年有所增長。

- 手機市場廣闊並將繼續增長,可能會影響許多市場。 改善無線連接有助於將物聯網、人工智能、增強現實和雲計算等尖端技術集成到移動設備中。 因此,市場正在迅速將需求從傳統無線電話轉移到這些支持物聯網的設備。

- 世界各地的人們現在都可以訪問現在非常重要的移動網絡背後的連接。 根據 GSMA 報告,去年全球有 42 億移動互聯網用戶。 到 2025 年,這一數字預計將增長到 50 億。 對互聯網用戶不斷增長的需求推動了全球智能手機市場的發展。

- 根據今年的移動經濟報告,去年獨立移動用戶數量為 53 億,預計到 2025 年底將增至 57 億。 此外,全球 SIM 連接數量預計將從去年的 83 億大幅增長到 2025 年的 88 億。 特別是,全球智能手機普及率預計將從去年的 75% 提高到 2025 年的 84%。

- GSMA 報告預測,到 2025 年全球將有 20 億個 5G 連接,超過目前的 10 億個連接。 5G 也已成為智能手機行業的重要存在,並有望改變我們今天使用智能手機的方式。 過去幾個季度,全球具有 5G 功能的設備出貨量顯著增長。

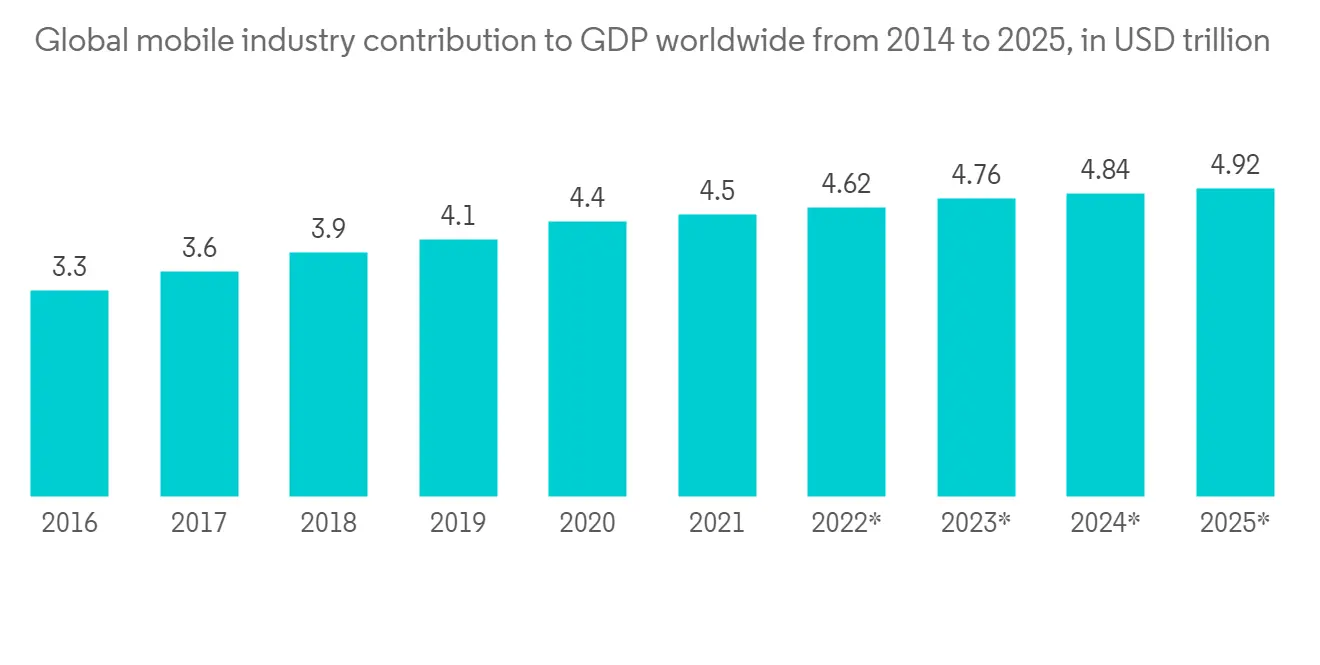

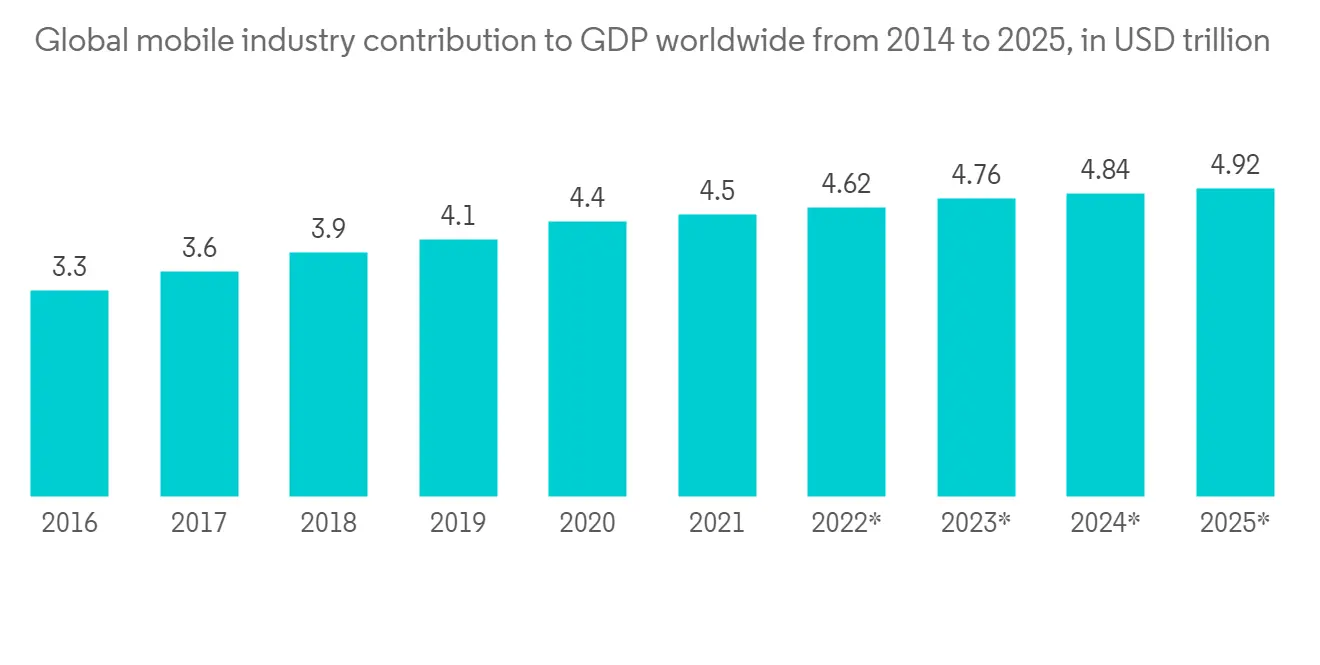

- 根據 GSMA 的數據,移動行業去年為全球 GDP 貢獻了 4.5 萬億美元,佔全球 GDP 的 5%。 據預測,到 2025 年,移動行業預計將貢獻 4.9 萬億美元。

亞太地區佔很大份額

- 亞太地區人口稠密地區預計在預測期內對 IT 設備的需求會增加。 這種增長主要是由於互聯網使用量的增加、可支配收入的增加、消費者對尖端□□技術出現的意識增強,以及最重要的是該地區人口的增長。 這些因素正在推動市場擴張。

- 亞太地區經濟繼續從移動生態系統中獲益匪淺,該生態系統目前佔該地區 GDP 的 5% 和 7700 億美元的額外經濟價值。 據 GSMA 稱,亞太地區的獨立移動用戶數量預計將從去年的 16 億 (59%) 增長到 2025 年的 18 億 (62%)。 該地區的移動互聯網用戶數量預計也將從去年的 12 億 (44%) 激增至 2025 年的 15 億 (52%)。 由於移動互聯網用戶的增加,未來對智能手機的需求預計會增加。

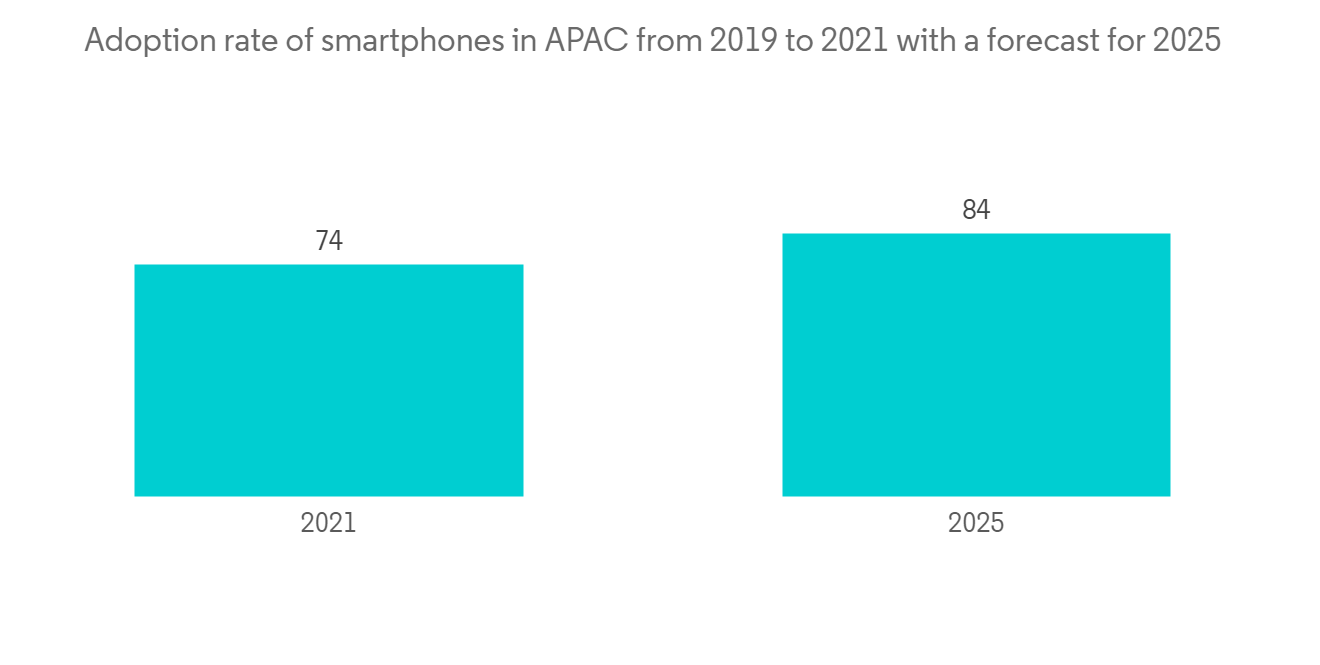

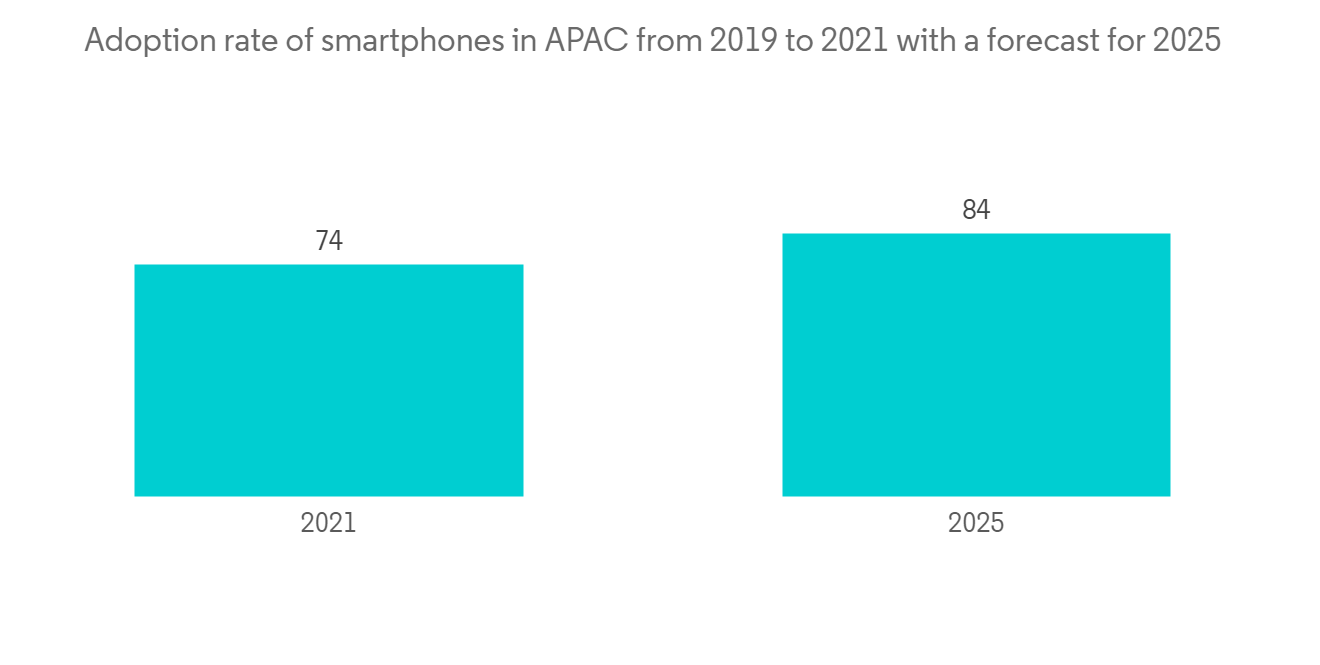

- 此外,根據 GSMA 報告,到 2025 年,亞太地區的智能手機普及率預計將從上一年的 74% 上升至 84%。 從 2020 年到 2025 年,預計全球將新增 5 億用戶,僅在亞太地區就貢獻了約 1.88 億新增用戶。 然而,該地區人們在使用移動互聯網連接方面存在很大差異,智能手機的普及還有進一步增長的空間。

- 自 2017 年 11 月以來,中國第八次成為世界上最快的超級計算機的第一擁有者。 這是因為最新一期的世界超級計算機500強榜單中包括了186台中國超級計算機,約佔總榜單的40%。 到 2025 年,中國政府可能擁有多達 10 台百億億級超級計算機。 由於對處理能力的需求不斷增長,超級計算機近年來發展迅速。

- 隨著加強筆記本電腦製造和降低備件進口關稅等政府舉措的增加,預計中國和印度等國家/地區將推動市場擴張。 技術進步和趨勢、快速更新的需求以及對新技術的響應能力也在推動亞太地區筆記本電腦市場的發展。

IT 設備市場競爭者分析

IT 設備市場目前高度分散,因為它由許多參與者組成。 市場上的主要參與者不斷努力帶來進步。 幾家知名公司正在建立合作夥伴關係並擴大其在新興市場的全球足跡,以鞏固其市場地位。 該市場的主要參與者包括Dell Inc.、Lenovo Group Ltd.、Apple Inc.、Samsung Electronics、Microsoft Corporation。

2022 年 11 月,Microsoft 發布了新的 Surface 設備,這些設備將引領 Windows PC 計算的下一階段。 從推出新的 Surface 產品開始,Microsoft 的頂級功能已整合到一個小工具中,每個人都可以參與、聽到、看到並創造性地表達自己。

2022 年 10 月,先進內存技術的市場領導者Samsung電子宣布,其最新的 LPDDR5X DRAM 具有業界領先的每秒 8.5 吉比特 (Gbps) 的性能,已獲准用於驍龍移動平台。 Samsung在 3 月份突破了此前 7.5Gbps 的最高速度,再次彰顯其在內存行業的霸主地位。

其他福利。

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 產業吸引力 - 波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估 COVID-19 對 IT 設備行業的影響

第 5 章市場動態

- 市場驅動因素

- 對 5G 兼容移動設備的需求不斷擴大

- 移動寬帶的普及仍在繼續

- 亞太地區的技術進步

- 市場製約因素

- 對台式電腦的需求減少

第 6 章市場細分

- 按類型

- 電腦

- 筆記本電腦

- 台式電腦

- 平板設備

- 電話

- 固定電話

- 智能手機

- 功能手機

- 電腦

- 按地區

- 北美

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 澳大利亞

- 中國

- 印度

- 日本

- 印度尼西亞

- 馬來西亞

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 哥倫比亞

- 其他拉丁美洲地區

- 中東和非洲

- 沙特阿拉伯

- 阿拉伯聯合酋長國

- 卡塔爾

- 科威特

- 南非

- 埃及

- 尼日利亞

- 其他中東和非洲地區

- 北美

第七章競爭格局

- 公司簡介

- Lenovo Group Limited

- Dell Inc.

- Acer Inc.

- ASUSTek Computer Inc.

- Microsoft Corporation

- Razer Inc.

- Micro-Star International Co.

- Toshiba Corporation

- Samsung Electronics Co., Ltd

- Apple Inc.

- Honor Technology, Inc.

- Xiaomi Corporation

- Nokia Corp

- LG Corporation

- Vivo Communication Technology Co., Ltd

- Realme Mobile Telecommunications Corp. Ltd

第八章投資分析

第9章未來趨勢

The IT device market is expected to grow at a CAGR of 2.4% during the forecast period. The market is expected to witness growth in the forecast period owing to the higher demand for mobile devices. During the COVID-19 epidemic, there was an increase in demand for PCs due to businesses' and consumers' growing flexibility and mobility requirements.

Key Highlights

- The demand for mobile phones has been growing over the past several years as consumer spending has increased globally. Notably, the smartphone demand has been continuously expanding in terms of models and market size. It was projected that 40% of people owned a smartphone last year. According to Ericsson, the number of smartphone subscribers globally has surpassed six billion and is projected to increase by several hundred million more over the next several years. China, India, and the United States are the top three nations with the most smartphone users.

- Notably, laptop sales are escalating in major countries, such as the United States and China. Major laptop manufacturers have reported an increase in sales of computers following the COVID-19 pandemic. Due to the continuous updates of graphics, connectivity, weight, and portability, the demand for the latest technology device is always anticipated.

- However, the higher demand for laptops has caused personal computer sales to be contracted across the globe. Also, after the pandemic, due to the work-from-home and social distancing norms, there was an upswing in demand for PCs. However, with everything back to normal, people have returned to their offices and institutions. Thus, the need for personal computers has slowed. Also, further contraction is expected in PC sales worldwide for the forecast period.

- China is leading the global IT device market, followed by the United States, Japan, and India. China had the highest revenue in the phone segment for the last year. At the beginning of this year, China had 1.63 billion mobile phone connections, according to data from GSMA Intelligence. During the second financial quarter of this year, Honor and Vivo held the highest smartphone market share.

- During the COVID-19 pandemic, the global demand for IT devices like PCs, laptop tablets, and phones grew. The surged demand mainly backed this growth for networking devices owing to social distancing and work-from-home regulations worldwide. However, the demand for personal computers fell with the gradual withdrawal of restrictions and the reopening of offices and institutions. Notably, the demand for mobile phones, especially smartphones, is expected to stabilize during the post-COVID-19 period.

IT Device Market Trends

Robust Contribution from Mobile Segment

- In many densely populated nations, such as China and India, the smartphone penetration rate is still around 70%, giving the market for smartphones significant room for development. Despite stagnant unit sales over the past several years, the worldwide smartphone market's revenue has increased because the average selling price of smartphones has increased.

- The mobile phone market is vast and will likely keep expanding and influencing many more markets. The improvement of wireless connectivity makes it easier to integrate cutting-edge technologies like IoT, AI, AR, and cloud computing into mobile devices. Thereby, there is a rapid demand shift in the market for these IoT-enabled devices from traditional wireless phones.

- People worldwide now have access to connections on the back of a significant mobile network. According to a GSMA report, globally, there were 4.2 billion subscribers to mobile internet last year. This number is expected to grow to 5 billion by 2025. The increased demand for internet subscribers has escalated the market for smartphones across the globe.

- As per Mobile Economy's this year's report, the number of unique mobile subscribers as of last year was 5.3 billion, which is expected to grow to 5.7 billion by the end of 2025. Also, the global sim connection is expected to grow remarkably from 8.3 billion last year to 8.8 billion in 2025. Notably, the global smartphone penetration is anticipated to increase from 75% last year to 84% in 2025.

- The GSMA's report predicts that by 2025, there will be 2 billion 5G connections worldwide, surpassing the current level of 1 billion connections. In the smartphone industry, 5G has also become a significant player, and it is expected to change how people use their phones today. Over the past several quarters, the shipment of devices with 5G capabilities has grown significantly worldwide.

- According to GSMA, the mobile industry contributed USD 4.5 trillion to the global GDP last year, or 5% of the entire global GDP. According to the forecast, the mobile industry is expected to witness a contribution of USD 4.9 trillion by 2025.

Asia-Pacific Holds a Significant Share

- Densely populated countries of the Asia-Pacific are expected to witness rising demand for IT devices during the forecast period. This growth is mainly attributable to the increasing levels of internet use, more disposable incomes, greater consumer awareness of the advent of cutting-edge technology, and, most importantly, the expanding population in this region. Such factors are driving the market's expansion.

- The Asia-Pacific region's economy continues to benefit significantly from the mobile ecosystem, which now accounts for 5% of the regional GDP and USD 770 billion in additional economic value. According to GSMA, the expected number of unique mobile subscribers in the Asia-Pacific would increase from 1.6 billion or 59% last year to 1.8 billion or 62% in 2025. Also, the number of mobile internet users in the region is anticipated to surge from 1.2 billion or 44% last year to 1.5 billion or 52% in 2025. From the upswing of mobile internet users, it can be forecasted that the demand for smartphones will be observed for the upcoming period.

- Additionally, as per the GSMA report, the smartphone adoption rate in the Asia-Pacific is expected to increase from 74% previous year to 84% in 2025. Also, from 2020 to 2025, there would be an expected addition of half a billion new mobile subscribers globally, which the Asia-Pacific alone would contribute to approximately 188 million additional subscribers. However, there is a substantial usage gap in the population's mobile internet connectivity in the region, which leaves scope for further growth in smartphone penetration.

- China is currently the No. 1 owner of the fastest supercomputers in the world for the eighth time since November 2017, owing to the inclusion of 186 Chinese supercomputers on the most recent list of the world's Top-500 supercomputers, which makes up about 40% of all those on the list. By 2025, the Chinese government may use up to 10 exascale supercomputers. Supercomputers have developed quickly in recent years due to the rising need for processing capacity.

- Encouragingly, through the projected period, countries like China and India are anticipated to propel market expansion on the back of increased government initiatives to enhance laptop manufacturing and lower import taxes on spare parts. Also, technological advancement and changing trends, the need for faster updates, and compatibility with emerging technologies are driving the laptop market in APAC.

IT Device Market Competitor Analysis

The IT Device market is highly fragmented as it currently consists of many players. Several key players in the market are in constant efforts to bring advancements. A few prominent companies are entering into collaborations and expanding their global footprints in developing regions to consolidate their positions in the market. The major players in this market include Dell Inc., Lenovo Group Limited, Apple Inc., Samsung Electronics Co., Ltd, and Microsoft Corporation.

In November 2022, Microsoft launched new Surface devices that ushered in the next phase of computing for Windows PCs. With the introduction of the new Surface products, Microsoft's top features are combined on a single gadget, allowing all users to participate, be heard, seen, and creatively express themselves.

In October 2022, Samsung Electronics Co., Ltd, the market leader in advanced memory technology, confirmed that the most recent LPDDR5X DRAM, which boasts the best performance in the industry at 8.5 gigabits per second (Gbps), has been approved for usage on Snapdragon mobile platforms. Samsung surpassed the previous maximum speed of 7.5Gbps in March, reiterating its dominance in the memory industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment Of The Impact Of COVID-19 On The IT Device Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for 5G Enabled Mobile Devices

- 5.1.2 Growing Mobile Broadband Penetration

- 5.1.3 Technology Advancement in the APAC Region

- 5.2 Market Restraints

- 5.2.1 Contracting Demand for Desktop Computers

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PC's

- 6.1.1.1 Laptops

- 6.1.1.2 Desktop PCs

- 6.1.1.3 Tablets

- 6.1.2 Phones

- 6.1.2.1 Landline Phones

- 6.1.2.2 Smartphones

- 6.1.2.3 Feature Phones

- 6.1.1 PC's

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 Australia

- 6.2.3.2 China

- 6.2.3.3 India

- 6.2.3.4 Japan

- 6.2.3.5 Indonesia

- 6.2.3.6 Malaysia

- 6.2.3.7 South Korea

- 6.2.3.8 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.4.4 Colombia

- 6.2.4.5 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 United Arab Emirates

- 6.2.5.3 Qatar

- 6.2.5.4 Kuwait

- 6.2.5.5 South Africa

- 6.2.5.6 Egypt

- 6.2.5.7 Nigeria

- 6.2.5.8 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lenovo Group Limited

- 7.1.2 Dell Inc.

- 7.1.3 Acer Inc.

- 7.1.4 ASUSTek Computer Inc.

- 7.1.5 Microsoft Corporation

- 7.1.6 Razer Inc.

- 7.1.7 Micro-Star International Co.

- 7.1.8 Toshiba Corporation

- 7.1.9 Samsung Electronics Co., Ltd

- 7.1.10 Apple Inc.

- 7.1.11 Honor Technology, Inc.

- 7.1.12 Xiaomi Corporation

- 7.1.13 Nokia Corp

- 7.1.14 LG Corporation

- 7.1.15 Vivo Communication Technology Co., Ltd

- 7.1.16 Realme Mobile Telecommunications Corp. Ltd