|

市場調查報告書

商品編碼

1237835

高通量過程開發市場——增長、趨勢和預測 (2023-2028)High Throughput Process Development Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,高通量工藝開發市場預計將以 14.4% 的複合年增長率增長。

由於全球研發活動中斷,COVID-19 大流行對其前身的高通量工藝開發 (HTPD) 市場產生了重大影響。 隨著大流行的持續惡化,我們加快了針對 SARS-CoV-2 病毒的疫苗和藥物開發進程。 根據 HTPD 精準醫學綜合解決方案提供商 BGI Genomics 2022 年 11 月的更新,隨著大流行的爆發,貝爾格萊德大學分子遺傳工程研究所 (IMGGE) 立即擴大了其在分子診斷方面的專業知識。報價。 BGI與 IMGGE 的合作始於兩個永久性火眼實驗室的建設。 在宣布大流行大約 40 天後,第一個實驗室設立在塞爾維亞大學臨床中心的場地上。 在貝爾格萊德建立了兩個傳染病分子診斷國家實驗室之一。 到 2020 年 7 月,戰略性地位於塞爾維亞城市尼什的第二個國家實驗室開始運作,為該地區提供服務。 這些新興市場的發展為大流行期間的市場增長做出了貢獻。

即使在大流行後階段,市場也有望實現顯著增長。 例如,根據 Frontiers in Medical Technology 於 2022 年 9 月發表的一篇論文,自動化微流體技術可以提高 COVID-19 診斷測試的可及性,並加快高通量檢測技術的速度,尤其是對於 POC 測試。有相當大的保證 此外,使用為其他病原體製造的自動化微流體平台可以輕鬆進行 COVID-19 診斷。 因此,隨著全球預計會出現新型 SARS-CoV-2 毒株,市場有望在未來幾年獲得牽引力。

此外,與 HTPD 相關的好處,例如確定新藥目標的需求不斷增長、藥物發現和開發技術的進步、藥物研發成本上升、成本降低和流程效率,可能會在未來幾年市場發展的主要因素。

高通量篩選允許在相同條件下同時測試大量樣本。 此外,通過使用機器人功能,可以同時檢查數百或數千個樣品。 對於大樣本量,高通量工藝開發速度更快且成本更低,使其成為篩選新藥物靶標以進行藥物開發的便捷選擇。 高通量開髮帶來的這些好處預計將很快推動藥物發現過程中的市場增長,在該過程中需要篩選多種候選藥物。

此外,高通量測序技術將在 2020 年解碼 100 萬個人類基因組,從而徹底改變遺傳學和基因組學。 因此,製藥行業可以獲得需要進一步研究的廣泛治療靶點,從而推動了對高通量工藝開發的需求。

同樣,製藥行業的研發進展也有望促進市場增長。 針對中樞神經系統 (CNS) 的藥物歷來在阿爾茨海默病等神經退行性疾□□病的臨床試驗中顯示出高失敗率。 此外,體內篩選耗時且成本高昂的負擔仍然是臨床前研究的重要組成部分。 近年來,高通量技術使這些測試能夠滿足當前藥物開發步伐的需求。 例如,2021 年 6 月,法國阿圖瓦大學的科學家將獲得專利的 BBB 體外模型小型化,以實現自動化高通量化合物篩選。 我們使用機器人細胞接種、化驗測試和成像來自動化以前使用 12 孔格式手動完成的模型。 自動化提高了準確性並減少了研究人員運行分析所需的時間。 準確性大大提高,減少了研究人員運行檢測的時間。 最終,它使得在藥物發現的早期階段篩選更多化合物成為可能。

此外,新產品的發布也促進了市場的增長。 例如,2021 年 4 月,Thermo Fisher Scientific 的高通量集成 COVID-19 測試套件獲得了 USFDA 的批准。 同樣,在 2022 年 11 月,Roche的 COBAS MPXV 高通量測試獲得了 FDA 的 EUA,用於檢測 mpox。 患者可以通過這種高通量解決方案快速獲得預期結果,盡快接受適當的治療,而無需進行不必要的額外檢測或隔離。 2021 年 12 月,Becton, Dickinson, and Company 的 COR 系統得到增強,增加了用於傳染病高通量分子檢測的新 MX 儀器。

因此,由於上述因素,預計所研究的市場在預測期內將出現顯著增長。 然而,高技術成本和薄弱的基礎設施可能會阻礙市場增長。

高通量工藝開發市場趨勢

生物製藥和生物技術公司有望顯著增長

在最終用戶方面,預計生物製藥和生物技術公司將在分析期間實現顯著增長。 這主要是由於公司研發活動和支出的增加以及為藥物發現確定新藥物靶點的需求不斷增長。

此外,推動該細分市場增長的主要因素是這些公司大量採用高通量工藝開發、引入更新和更先進的平台、藥物開發領域的技術進步以及主要參與者在市場上。它是由戰略發展的增長 例如,2022 年 11 月,高通量單細胞 DNA 和多組學分析領域的先驅 Mission Bio Inc. 表示,AVROBIO 用於溶□體疾病的管道部署了一種單細胞轉導測定。 使用 Mission Bio 的 Tapestri 平台,兩家公司共同開發了一種準確且可重複的檢測方法,用於測量數千個細胞樣本中轉導細胞的百分比。 在第 4 屆基因治療分析與開發 (GTAD) 峰會上,AVROBIO 展示了使用該測定法評估通過慢病毒載體自製的基因工程藥物的轉導率的結果。

同樣,2022 年 6 月,英國創新機構 Innovate UK 向 Orbit Discovery Ltd. 授予了 Smart 贈款。 這家私人控股的生物製藥公司專門使用專有的親和力和基於細胞的功能篩選平台來識別□治療候選藥物。 這筆撥款總額為 472,000 英鎊(約合 579,474 美元),將促進基於液滴的微流體技術在基於細胞的功能篩選中的應用,顯著提高 Orbit □展示平台的容量和吞吐量。我們計劃對其進行改進。 這種高通量篩選平台針對多膜蛋白,如 G 蛋白偶聯受體,這些蛋白在相關生物學重要領域難以作為治療靶點。

2022 年 7 月,為生物技術和生命科學行業提供最先進的多孔塑料材料和微孔板技術的製造商和開發商 PolveaScience 宣布推出 eGecko。 這種自動化條形碼貼標系統提供了最佳的高通量解決方案,可將條形碼標籤準確地貼在培養皿的板和架上。

此類發展有助於預測期內生物製藥和生物技術公司的增長。

北美有望顯著增長

北美的特點是可以輕鬆獲得技術先進的產品、慢性病患病率增加、研發活動支出增加、該地區有領先公司以及完善的醫療保健基礎設施。預計它將主導市場,因為等各種因素。

根據加拿大癌症協會 2022 年 5 月發表的一篇文章,到 2022 年底,估計將有 3,200 名加拿大人被診斷出患有腦癌和脊髓癌,其中包括 1,850 名男性和 1,350 名女性。 此外,如上述來源所述,每天有 27 名加拿大人被診斷出患有腦瘤。 估計有 55,000 名加拿大人患有腦瘤。 人群中腦腫瘤的高患病率強調了對創新療法的需求。 這導致對藥物發現和開發的需求增加,推動生物製藥公司採用高通量工藝開發。

此外,本地公司的戰略舉措正在推動市場的增長。 例如,2022 年 9 月,Arsenal Biosciences, Inc. 與 Genentech 合作。 Genentech 將引入 ArsenalBio 的專有技術,用於 T 細胞的高通量工藝開發和工程,以確定基於 T 細胞的療法中的關鍵成功迴路。 這一發現過程將通過融合自動化、大規模基因組工程和人工智能算法,幫助並加速下一代細胞療法的設計、構建和測試。

此外,中國首家DNA高通量合成技術公司Dynegene Technologies亮相第二屆美國人類遺傳學大會(ASHG)。 公司表示,Dynegene Technologies的高通量DNA合成技術未來將進入美國市場,為海外用戶提供高品質、高性價比的產品和服務。 它將大力支持合成生物學、生物醫學工具和分子診斷材料等領域。 預計此類開發將加速為多個最終用戶使用高通量工藝開發。 由於這些發展,預計北美地區在預測期內將出現顯著增長。

高通量工藝開發市場競爭對手分析

由於在全球和區域運營的公司的存在,高通量工藝開發市場正在經歷一些整合和競爭。 競賽其中包括Danaher Corporation、General Electric Company(GE Healthcare)、Thermo Fisher Scientific Inc.、Merck Millipore Limited、Agilent Technologies, Inc、Bio-Rad Laboratories, Inc、Eppendorf SE, Perkinelmer, Inc、Sartorius Stedim Biotech GmbH、Tecan Group AG,以及包括分析多家知名的國際和本地公司擁有市場份額,例如 Tecan Group AG。

其他福利。

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 啟動針對新藥物靶標的研發活動

- 降低生物製藥和生物技術公司製造成本的壓力越來越大

- 市場製約因素

- 先進技術的高成本和缺乏足夠的基礎設施

- 產業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(按價值劃分的市場規模)

- 按產品/服務類型

- 消耗品

- 儀器

- 服務詳情

- 軟件

- 按技術

- 色譜法

- 紫外-可見光譜

- 其他技術

- 最終用戶

- 生物製藥和生物技術公司

- 委託研究機構

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Danaher Corporation

- General Electric Company(GE Healthcare)

- Thermo Fisher Scientific Inc.

- Merck

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Eppendorf SE

- Perkinelmer, Inc.

- Sartorius Stedim Biotech GmbH

- Tecan Group AG

第七章市場機會與未來趨勢

The high throughput process development market is expected to register a CAGR of 14.4% over the forecast period.

In its preliminary phase, the COVID-19 pandemic significantly impacted the high throughput process development (HTPD) market due to disruptions in research and development activities worldwide. As the pandemic continued worsening, it accelerated the vaccine and drug development process against the SARS-CoV-2 virus. As per the November 2022 update by BGI Genomics, an integrated solutions provider of precision medicine with the use of HTPD, upon the onset of the pandemic, the Institute of Molecular Genetic and Genetic Engineering (IMGGE) at the University of Belgrade immediately announced offering its expertise in molecular diagnostic methods. A partnership between BGI and IMGGE commenced with the construction of two permanent Huoyan laboratories. The first laboratory was established on the premises of the University Clinical Center of Serbia approximately 40 days after the pandemic was publicly disclosed. One of the two national laboratories for molecular diagnostics of infectious agents was established in Belgrade. By July 2020, the second National Laboratory, strategically positioned in the Serbian city of Nis to serve the region, was operational. Such developments contributed to the market's growth amid the pandemic.

In the post-pandemic phase, the market is expected to witness significant growth. For instance, as per the article published in September 2022 by Frontiers in Medical Technology, automated microfluidic technologies have considerable assurance for improving COVID-19 diagnostic test accessibility and speeding up high throughput detection techniques, specifically for POC testing. Additionally, COVID-19 diagnosis can easily be performed using the automated microfluidic platforms created for other pathogens. Thus, per the analysis, with the anticipated emergence of newer SARS-CoV-2 strains globally, the market is predicted to gain traction over the coming years.

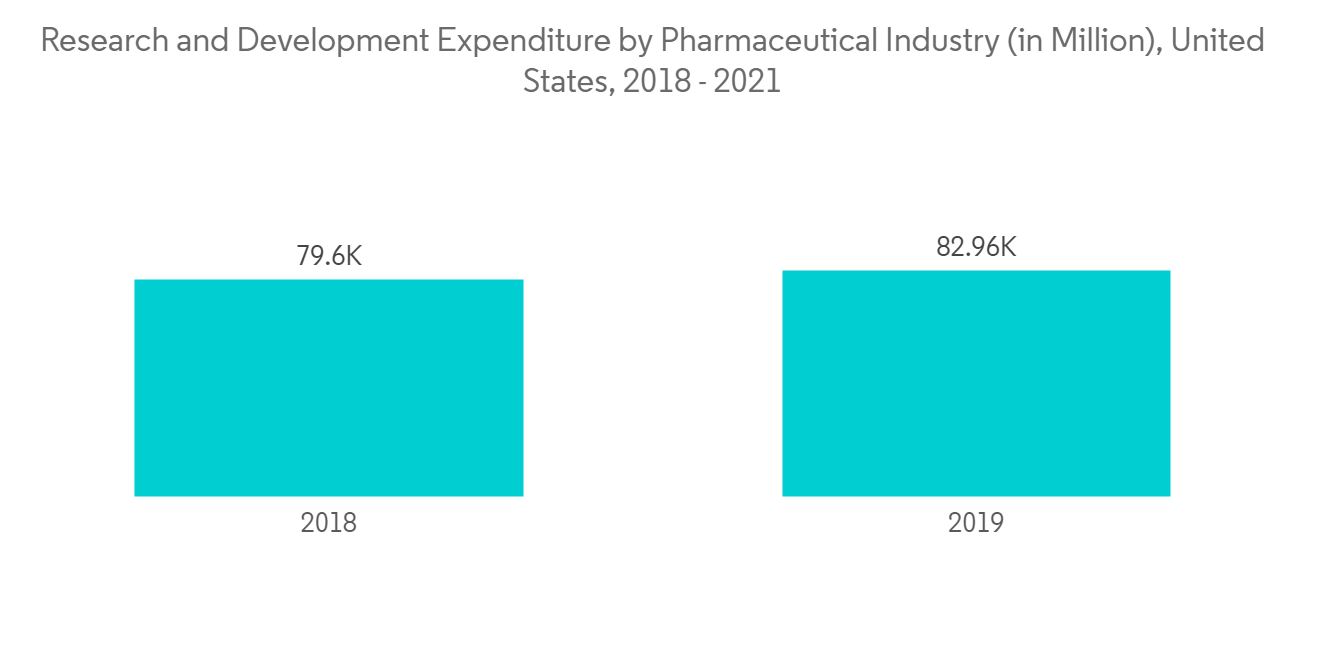

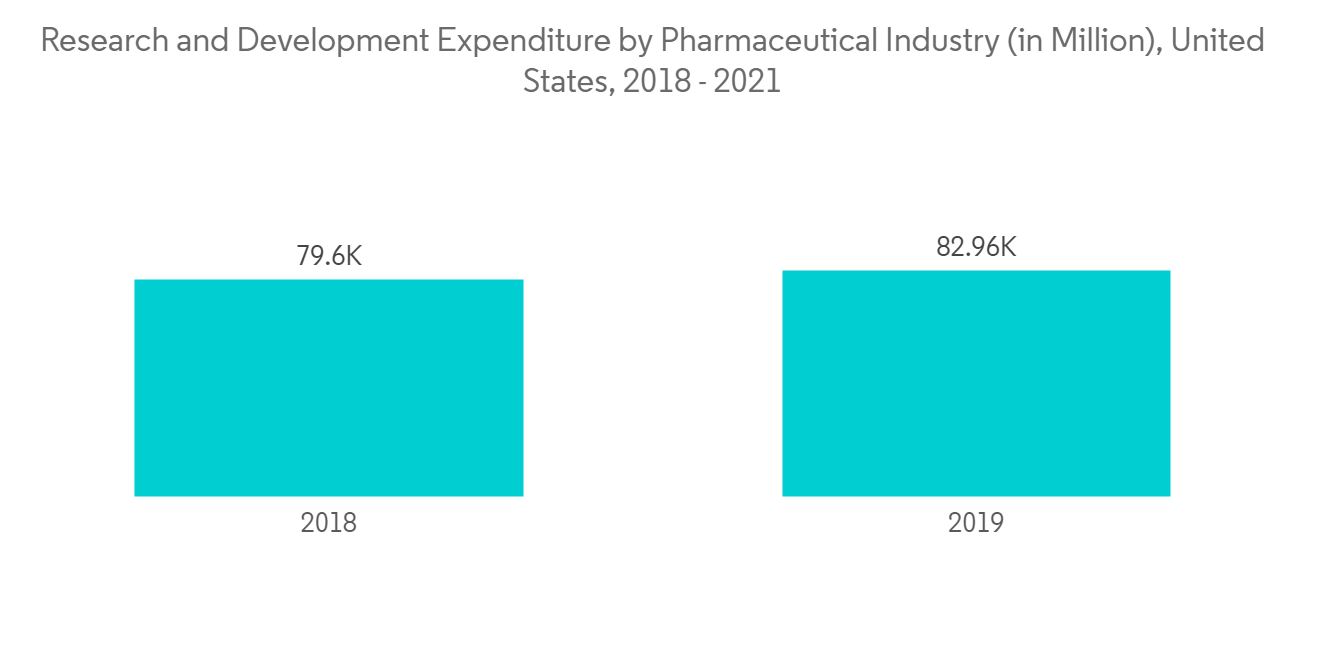

Additionally, the growing need for identifying new drug targets, advancements in drug discovery and development technology, an increase in pharmaceutical research and development expenditure, and the benefits associated with HTPD in terms of cost reduction and process efficiency are major factors driving market growth in the coming years.

With high throughput screening, numerous samples can be examined simultaneously under the same circumstances. In addition, with robotic capabilities, hundreds and thousands of samples could be examined at once. The high throughput process development is speedier and more affordable for large sample sizes, making it a convenient option for screening newer drug targets for drug development. Such advantages offered by high throughput process development in the drug discovery process, where several potential drug candidates need to be screened, are expected to boost the market's growth shortly.

Moreover, a million human genomes were sequenced in 2020 due to high throughput sequencing technologies, revolutionizing genetics and genomics. As a result, the pharmaceutical industry now has access to a wide range of prospective therapeutic targets that demand additional investigation, driving the demand for high throughput process development.

Likewise, growing research and development in the pharmaceutical industry will contribute to the market's growth. For clinical trials of neurodegenerative diseases like Alzheimer's, drugs that target the central nervous system (CNS) have a historically high failure rate. Also, time consumption and costliness of in-vivo screening remain essential components of preclinical testing. High throughput technologies have recently made it possible for these tests better to meet the demands of the current pharmacological development pace. For instance, in June 2021, scientists from the University of Artois in France miniaturized a patented BBB in-vitro model, enabling automated high throughput compound screening. Robotic cell seeding, assay testing, and imaging were used to automate the model, which had previously been carried out manually using a 12-well format. Automation improved accuracy and decreased the time needed for assay execution by researchers. It significantly increased precision and reduced the time spent by researchers performing assays. Ultimately, this allowed more compounds to be screened in the early stages of drug discovery.

Furthermore, new product launches are contributing to the market's growth. For instance, in April 2021, Thermo Fisher Scientific received USFDA approval for high throughput and integrated COVID-19 Test Kit. Likewise, in November 2022, the FDA granted a EUA for Roche's COBAS MPXV high throughput test to detect mpox. Patients could immediately achieve the desired results with this high throughput solution in order to receive the right care as quickly as possible without being compelled to undergo needless additional testing or isolation. In December 2021, Becton, Dickinson, and Company's COR System was enhanced by adding a new MX instrument for high throughput molecular testing for infectious diseases.

Therefore, the studied market is expected to witness significant growth over the forecast period owing to the above-mentioned factors. However, the high cost of technology and the lack of infrastructure may impede the market's growth.

High Throughput Process Development Market Trends

Biopharmaceutical & Biotechnology Companies Segment Expected to Witness Significant Growth

The biopharmaceutical & biotechnology companies segment by the end-user is expected to witness significant growth over the analysis period. This is primarily attributed to the increase in R&D activities and spending by the companies and the emerging need to identify new drug targets for drug discovery.

Furthermore, significant factors augmenting the segment growth are a surge in the adoption of high throughput process development in these companies, the introduction of newer and advanced platforms, technological advancements in the fields of drug development, and growth in strategic developments by key players within the market. For instance, in November 2022, Mission Bio Inc., a pioneer in high-throughput single-cell DNA and multi-omics analysis, stated that AVROBIO's pipeline for lysosomal disorders deployed one single-cell transduction assay. Using Mission Bio's Tapestri Platform, the two firms worked together to create a precise, reproducible assay for measuring the proportion of transduced cells in samples made up of thousands of cells. At the 4th Annual Gene Therapy Analytical Development (GTAD) Summit, AVROBIO presented results on using this test to estimate the percentage transduction in autologous, lentiviral vector-mediated, genetically modified drug products.

Likewise, in June 2022, the United Kingdom's innovation agency, Innovate UK, gave a Smart grant to Orbit Discovery Ltd. This privately held biopharmaceutical firm specializes in identifying candidate peptide therapies using unique affinity and cell-based functional screening platforms. The funding, which has a total value of GBP 472,000 (~USD 579,474), will make it easier to use droplet-based microfluidics for cell-based functional screening and considerably increase the capacity and throughput of Orbit's peptide display platform. The high-throughput screening platform will target multi-membrane-spanning proteins such as G-protein-coupled receptors as difficult-to-access therapeutic targets in important biologically relevant areas.

In July 2022, Porvair Sciences, a manufacturer and developer of cutting-edge porous plastic materials and microplate technologies for the biotechnology and life science industries, introduced eGecko. This automated barcode application system offers the best high-throughput solution for accurately applying barcode labels onto racks of plates and petri dishes.

Such developments are contributing to the biopharmaceutical and biotechnology companies' growth over the forecast period.

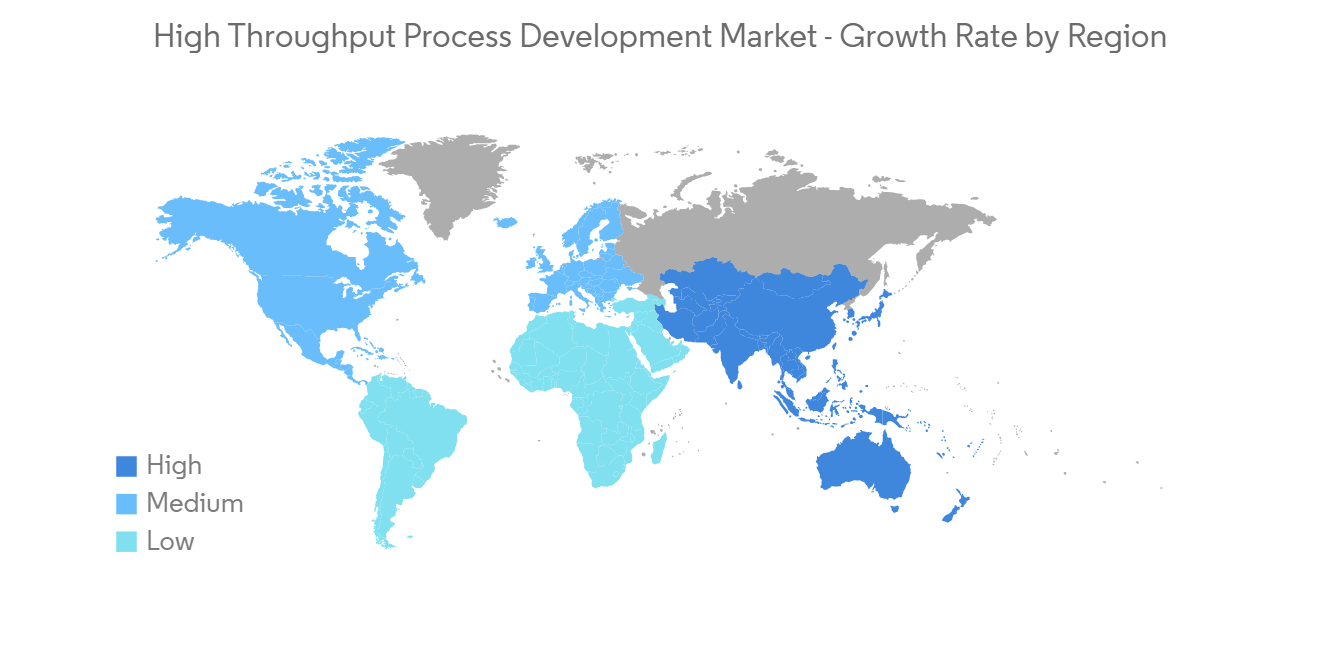

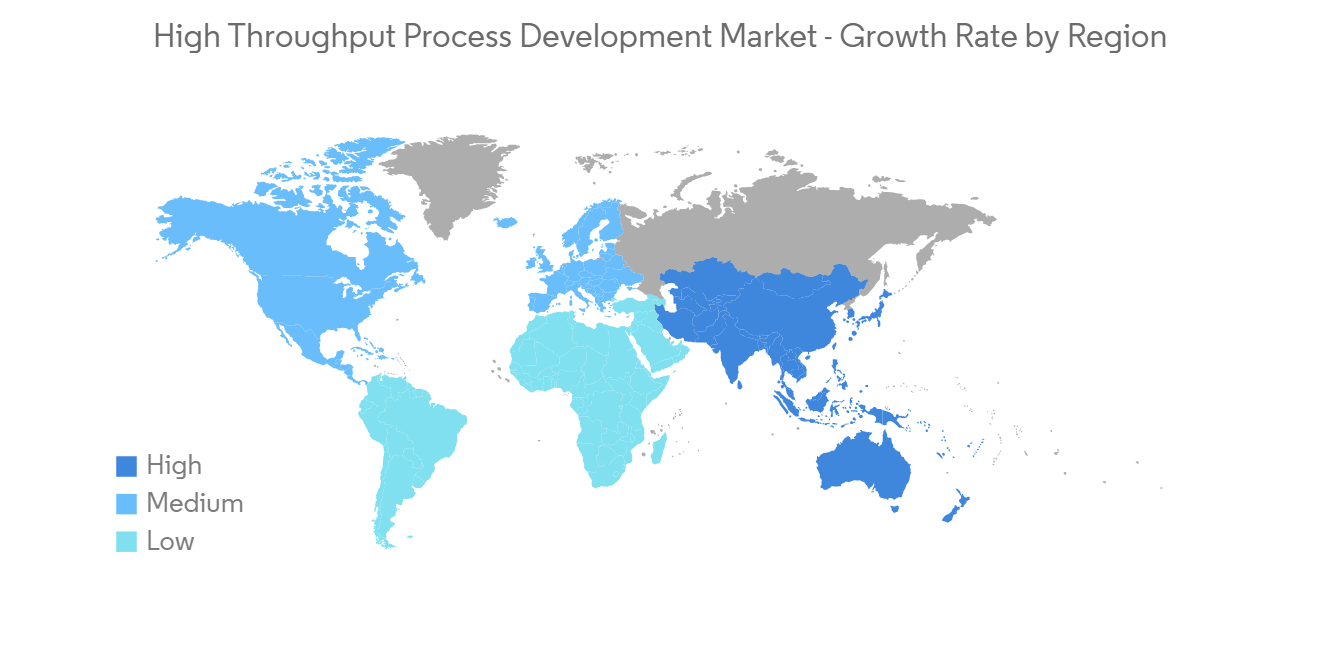

North America Expected to Witness Significant Growth

North America is expected to dominate the market owing to various factors, such as the easy availability of technologically advanced products, the growth in the prevalence of chronic diseases, higher spending on research and development activities, the presence of prominent players in the region, and well-established healthcare infrastructure.

According to the article published by the Canadian Cancer Society in May 2022, an estimated 3,200 Canadians will be diagnosed with brain and spinal cord cancer by the end of 2022, including 1,850 men and 1,350 women. In addition, as per the source above, 27 Canadians are diagnosed with brain tumors every day. It is estimated that 55,000 Canadians are surviving with brain tumors. The high prevalence of brain tumors among the target population underlines the need for innovative therapies. This drives demand for new drug discovery and development, in turn boosting the adoption of high throughput process development among biopharmaceutical companies.

Furthermore, strategic initiatives by the regional companies augment the market's growth. For instance, in September 2022, Arsenal Biosciences, Inc. collaborated with Genentech. Genentech will deploy ArsenalBio's proprietary technology for high throughput process development and engineering of T-cells to identify critical success circuits in T-cell-based therapies. This discovery process employs the convergence of automation, large-scale genome engineering, and artificial intelligence algorithms to aid and advance the design, building, and testing of next-generation cell therapies for cancer.

In addition, Dynegene Technologies, with the first DNA high throughput synthesis expertise in China, was featured at the 2nd American Annual Conference of Human Genetics (ASHG). The company stated that the high throughput DNA synthesis technology of Dynegene Technologies would enter the United States market in the future to deliver overseas users high-quality, cost-effective products and services. It will provide robust support for synthetic biology, biomedical tools, molecular diagnostic materials, and other fields. Such developments are meant to speed up the use of high throughput process development across several end-users. Thus, owing to such developments, the North American region is expected to witness significant growth over the forecast period.

High Throughput Process Development Market Competitor Analysis

The high throughput process development market is slightly consolidated and competitive due to the presence of companies operating globally and regionally. The competitive landscape includes an analysis of a few international as well as local companies that hold market shares and are well known, such as Danaher Corporation, General Electric Company (GE Healthcare), Thermo Fisher Scientific Inc., Merck Millipore Limited, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Eppendorf SE, Perkinelmer, Inc., Sartorius Stedim Biotech GmbH, and Tecan Group AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Research and Development Activities for Newer Drug Targets

- 4.2.2 Growth in Pressure to Lower the Manufacturing Costs in Biopharmaceutical and Biotechnology Companies

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Technologies and Lack of Adequate Infrastructure

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product and Services Type

- 5.1.1 Consumables

- 5.1.2 Instruments

- 5.1.3 Services

- 5.1.4 Software

- 5.2 By Technology

- 5.2.1 Chromatography

- 5.2.2 Ultraviolet-visible Spectroscopy

- 5.2.3 Other Technologies

- 5.3 By End-user

- 5.3.1 Biopharmaceutical and Biotechnology Companies

- 5.3.2 Contract Research Organizations

- 5.3.3 Other End-users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Danaher Corporation

- 6.1.2 General Electric Company (GE Healthcare)

- 6.1.3 Thermo Fisher Scientific Inc.

- 6.1.4 Merck

- 6.1.5 Agilent Technologies, Inc.

- 6.1.6 Bio-Rad Laboratories, Inc.

- 6.1.7 Eppendorf SE

- 6.1.8 Perkinelmer, Inc.

- 6.1.9 Sartorius Stedim Biotech GmbH

- 6.1.10 Tecan Group AG