|

市場調查報告書

商品編碼

1445938

MOOC - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)MOOC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

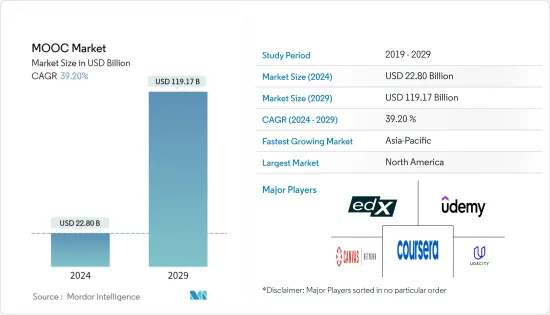

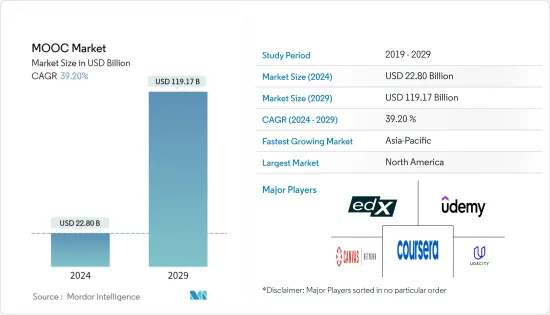

MOOC 市場規模預計到 2024 年將達到 228 億美元,預計到 2029 年將達到 1191.7 億美元,在預測期內(2024-2029 年)CAGR為 39.20%。

數位化趨勢的不斷發展、智慧型手機普及率的不斷提高、網際網路的靈活訪問,加上對具有成本效益的教育平台的需求不斷成長,正在促進大規模開放線上課程市場的成長。

主要亮點

- 資訊和通訊科技的進步迫使教育者和學習者超越時間、空間和環境的限制。雖然傳統的課堂教育一直是一種眾所周知的學習系統,但課堂外的教育,尤其是透過大規模開放式線上課程(MOOC)等技術增強的教育,在過去幾年中取得了顯著成長。

- 由於成本低廉且缺乏資格要求,慕課在知識尋求者中獲得了巨大的吸引力。此外,這些課程可以透過獲得新的定性知識和專業知識並增強他們的前景來支持人們轉變職業生涯。預計這些因素將在未來幾年進一步推動市場。

- 此外,向數位學習的轉變加速了龐大的開放線上課程市場的成長。如今,世界各地的學生都已經習慣了線上學習方式,這使得他們的抵觸情緒降低,從而增加了對 MOOC 市場的需求。

- 此外,各國政府都在敦促大學和學校採用和推廣大規模開放線上課程(MOOC),以便為學生提供最大的利益;這反過來又會推動對 MOOC 的需求。

- 例如,今年6月,大學教育資助委員會(UGC)要求所有大學允許學生將他們在SWAYAM平台上學習的課程的學分轉移到他們的學術記錄中。還要求大學共同努力,透過SWAYAM平台採用和推廣大規模開放線上課程(MOOC),以便學生能夠充分利用它們。

COVID-19 的爆發和許多國家的封鎖增加了對 MOOC 的需求,世界各地的學生都採用數位學習平台。自疫情以來,大規模的線上開放課程也大幅增加了入學人數。例如,提供 MOOC 的線上平台 Coursera 的註冊人數從 3 月中旬到 4 月中旬與去年同期相比猛增約 640%,從約 160 萬人增至 1,030 萬人。此外,另一家 MOOC 供應商 Udemy 的註冊人數在 2 月至 3 月期間增加了 400% 以上。

大規模開放式線上課程 (MOOC) 市場趨勢

科技主體預計持有主要股份

- 技術領域是所考慮的市場中最發達的領域之一。大多數人都加入這些類別,因為這些類別最容易貨幣化。此外,各行業也擴大採用資料分析和人工智慧等最新技術,進一步擴大了預測期內研究領域的範圍。

- 此外,技術部分主要包括與電腦科學相關的課程。 MOOC 的教學大綱是圍繞著公司和就業市場使用的最新技術和軟體設計的。 MOOC 在區塊鏈、人工智慧 (AI)、智慧城市、加密貨幣、資料科學、資料分析、統計、機器學習和網路安全等新興領域的招生人數有所增加。

- 據 Class Central 稱,迄今為止,在排名前 100 的線上課程中,技術課程所佔比例最高。過去幾年,科技領域註冊人數最多的一些課程包括 Python 互動式程式設計簡介(萊斯大學,透過 Coursera)、Python 入門(密西根大學,透過 Coursera)、機器學習(史丹佛大學,透過 Coursera) 、MATLAB 程式設計簡介(范德堡大學透過Coursera)、Elements of AI(赫爾辛基大學透過Independent)、分治、排序和搜尋以及隨機演算法(史丹佛大學透過Coursera)等。

- 此外,為了抓住技術領域不斷成長的機會,市場供應商必須不斷升級其課程並推出有關技術主題的新課程。例如,今年 6 月,東京工業大學推出了兩門新的大規模開放式線上課程(MOOC)。初學者程式設計:《電腦將棋基礎知識》和《超級智慧社會簡介》皆在 edX 平台上以日文提供,長度約為五週。在這門程式設計初學者的課程中,參與者將學習在 MATLAB 上使用電腦將棋進行編碼的基礎知識和各種技術。

- 此外,隨著對技術科目的需求成長,市場供應商不斷推出新課程以抓住機遇,從而推動技術領域的發展。例如,根據Persolkelly去年的一項調查,技術技能(50%)是亞太地區公司最需要的技能。銷售和業務開發技能緊隨其後,近一半的受訪者將其視為稀缺技能。

亞太地區預計將出現最高成長

由於工作和學習人口眾多,中國正在利用數位學習技術來提高教育公平、品質和效率。此外,中國政府的努力也進一步促進了慕課在中國的發展。例如,今年3月,中國教育部宣布了中國智慧教育計劃,並推出了涵蓋中國大陸所有MOOC平台的綜合網站Chinaooc。

- 此外,由於數位化、智慧型手機使用和網路普及率的不斷提高以及線上學習者數量的增加,印度和中國等亞太國家對大規模開放線上課程(MOOC)的需求日益成長。例如,根據加州 MOOC 平台 Coursera 去年的影響報告,印度是第二大學習者群體,擁有 13.6 億學習者,僅次於美國的 17.3 億學習者。

- 此外,隨著印尼網路教育學院、JMOOC、KMOOC、M-MOOC、XuetangX、ThaiMOOC 等國家 MOOC 入口網站的建立和運作,大規模開放式線上課程 (MOOC) 在亞太地區繼續獲得更大擴張的動力,以及印度的SWAYAM入口網站。

- 此外,在印度、澳洲和許多其他亞洲國家,大規模開放式線上課程(MOOC)正在成為教育系統的一部分,預計這將在未來幾年推動市場發展。例如,今年2月,雪梨大學宣布將首次與2U合作提供線上研究生學位課程。此次合作將帶來四個線上研究生學位,首先是數據科學碩士和專案與計劃管理碩士,課程將於明年 2 月開始。

大規模開放式線上課程 (MOOC) 產業概況

MOOC 市場競爭適中,由一些重要參與者組成。從市場佔有率來看,目前一些主要參與者佔據市場主導地位。然而,隨著創新教育平台的發展,新參與者正在增加其市場佔有率並擴大其在新興經濟體的業務足跡。

2022年12月,數位學習平台FutureLearn被Global University Systems (GUS)收購。該交易將使總部位於荷蘭的GUS 能夠為FutureLearn 提供其專有的人工智慧職業管理解決方案,從而擴大FutureLearn 的產品範圍,透過將學習者與內容、認證、指導和職業機會聯繫起來,提供全面的職業發展。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- COVID-19 對市場影響的評估

第 5 章:市場動態

- 市場促進因素

- 對具有成本效益的教育平台的需求

- 全球培訓的需求不斷增加

- 市場限制

- 課程完成率低

- 糟糕的討論論壇和指導

- 市場機會

第 6 章:市場區隔

- 依類型

- 慕課

- 慕課

- 依學科類型

- 科技

- 商業

- 科學

- 其他科目類型

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 印度

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Coursera Inc.

- edX Inc. (2U)

- Udacity Inc.

- Udemy Inc.

- Canvas Networks Inc.

- FutureLearn Ltd (Global University Systems)

- openSAP (SAP SE)

- 360training.com Inc.

- Iversity Inc. (Springer Nature)

- Miriadax (Telefonica Learning Services SLU)

- Blackboard Inc. (Providence Equity Partners)

第 8 章:投資分析

第 9 章:市場的未來

The MOOC Market size is estimated at USD 22.80 billion in 2024, and is expected to reach USD 119.17 billion by 2029, growing at a CAGR of 39.20% during the forecast period (2024-2029).

The growing trend of digitalization, increasing penetration of smartphones, and the flexible accessibility of the internet, coupled with growing demand for cost-effective education platforms, are fostering the growth of the massive open online course market.

Key Highlights

- The advancements in information and communication technologies are forcing educators and learners to move past time, space, and environmental constraints. While traditional classroom education has been a well-known learning system, education outside the classrooms, especially the one enhanced through technologies such as massive open online courses (MOOCs), has gained significant growth over the past few years.

- MOOCs are gaining significant traction among knowledge seekers owing to their low cost and lack of eligibility requirements. Additionally, these courses can support people in transitioning their careers by acquiring new qualitative knowledge and expertise and enhancing their prospects. Such factors are further expected to drive the market in the coming years.

- Moreover, the shift toward digital learning has accelerated the growth of the massive open online course market. Students all over the world are now used to online ways of learning, which has made them less resistant and increased the demand for the MOOC market.

- Further, governments across countries are urging universities and schools to adopt and promote Massive Open Online Courses (MOOCs) in order to provide maximum benefits to the students; this, in turn, would drive the demand for MOOCs.

- In June of this year, for example, the University Grants Commission (UGC) asked all universities to let students transfer credit for courses they took on the Study Webs of Active Learning for Young Aspiring Minds (SWAYAM) platform to their academic records.The UGC also asked universities to work together to adopt and promote Massive Open Online Courses (MOOCs) through the SWAYAM platform so that students could get the most out of them.

The COVID-19 outbreak and lockdown in many countries surged the demand for MOOCs, with students worldwide adopting digital learning platforms. The massive open online courses have also significantly increased enrolment since the pandemic. For instance, the enrolment in Coursera, an online platform offering MOOCs, skyrocketed by around 640% from mid-March to mid-April compared to the same period in the previous year, growing from around 1.6 million to 10.3 million. Moreover, the enrolment at Udemy, which is another MOOC provider, grew by more than 400% between February and March.

Massive Open Online Course (MOOC) Market Trends

Technology Subject is expected to hold Major Share

- The technology segment is one of the most developed in the market under consideration.Most people are enrolling in these categories, as these are the easiest to monetize. Additionally, the growing adoption of the latest technologies, like data analytics and AI, across various industries further expands the scope of the studied segment over the forecast period.

- Further, the technology segment mainly consists of courses related to computer science. The syllabus of MOOCs is designed around the latest technologies and software used in companies and on the job market. MOOCs see more enrollments in emerging areas like Blockchain, Artificial Intelligence (AI), smart cities, cryptocurrency, data science, data analytics, statistics, machine learning, and cybersecurity.

- According to Class Central, among the top 100 online courses until now, technology holds the most significant number. Some of the most enrolled courses in the technology segments in the last few years are Introduction to Interactive Programming in Python (Rice University via Coursera), Getting Started with Python (the University of Michigan via Coursera), Machine Learning (Stanford University via Coursera), Introduction to Programming with MATLAB (Vanderbilt University via Coursera), Elements of AI (the University of Helsinki via Independent), and Divide and Conquer, Sorting and Searching, and Randomized Algorithms (Stanford University via Coursera), among others.

- Further, to capture the growing opportunity in the technology segment, market vendors must continuously upgrade their courses and launch new courses on technology subjects. For instance, in June this year, Tokyo Tech launched two new massive open online courses (MOOCs). Programming for beginners: Learning Basics with Computers Shogi and Introduction to the Super Smart Society, both available in Japanese on the edX platform, are approximately five weeks long. During this course for beginners in programming, participants learn the basics and various techniques of coding with computer Shogi on MATLAB.

- Further, as the demand for technology subjects grows, market vendors continuously launch new courses to capture the opportunity, thus driving the technology segment. For instance, according to a survey from Persolkelly last year, technology skills (50%) were the most in-demand skills among Asia-Pacific companies. Sales and business development skills were a close second, with nearly half of the respondents selecting them as an in-demand skill.

Asia-Pacific is Expected to Witness Highest Growth

Due to the large working and studying population, China is using digital learning technology to enhance education equity, quality, and efficiency. Moreover, government efforts in the country are further fostering the growth of MOOCs in China. In March of this year, for example, China's Ministry of Education announced the Smart Education of China initiative and launched the comprehensive website Chinaooc, which includes all MOOC platforms in mainland China.

- Moreover, Asia-Pacific countries such as India and China are witnessing significant demand for massive open online courses (MOOC) owing to the increasing digitization, smartphone use, and internet penetration coupled with an increasing number of online learners. For instance, according to the California-based MOOC platform Coursera's Impact Report from last year, India is home to the second largest group of learners, with 1.36 crore learners, after the USA, which has 1.73 crore learners.

- Further, massive open online courses (MOOCs) continue to gain momentum towards greater expansion in the Asia and Pacific region with the establishment and functioning of national MOOC portals, such as Indonesia's Cyber Education Institute, JMOOCs, KMOOCs, M-MOOCs, XuetangX, ThaiMOOC, and India's SWAYAM portal.

- Additionally, in countries like India, Australia, and many other Asian countries, Massive Open Online Courses (MOOCs) are becoming a part of the education system, which is expected to boost the market in the coming years. For instance, in February this year, The University of Sydney announced that it would offer postgraduate degree programs online for the first time in partnership with 2U. The collaboration will bring four postgraduate degrees online, beginning with a Master of Data Science and a Master of Project and Program Management, with classes beginning in February next year.

Massive Open Online Course (MOOC) Industry Overview

The MOOC market is moderately competitive and consists of a few significant players. In terms of market share, some of the major players currently dominate the market. However, with the growth of the innovative educational platform, new players are increasing their market presence and expanding their business footprint across emerging economies.

In December 2022, the digital learning platform FutureLearn was acquired by Global University Systems (GUS). The deal will allow Netherlands-based GUS to provide FutureLearn with access to its proprietary AI-powered career management solution, widening FutureLearn's offering to provide fully-fledged career advancement by linking learners with content, accreditation, mentorship, and career opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Cost Effective Education Platforms

- 5.1.2 Increasing Requirement of Global Training

- 5.2 Market Restraints

- 5.2.1 Low Course Completion Rate

- 5.2.2 Poor Discussion Forum and Mentoring

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 cMOOC

- 6.1.2 xMOOC

- 6.2 By Subject Type

- 6.2.1 Technology

- 6.2.2 Business

- 6.2.3 Science

- 6.2.4 Other Subject Types

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Germany

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 South Korea

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coursera Inc.

- 7.1.2 edX Inc. (2U)

- 7.1.3 Udacity Inc.

- 7.1.4 Udemy Inc.

- 7.1.5 Canvas Networks Inc.

- 7.1.6 FutureLearn Ltd (Global University Systems)

- 7.1.7 openSAP (SAP SE)

- 7.1.8 360training.com Inc.

- 7.1.9 Iversity Inc. (Springer Nature)

- 7.1.10 Miriadax (Telefonica Learning Services S.L.U.)

- 7.1.11 Blackboard Inc. (Providence Equity Partners)