|

市場調查報告書

商品編碼

1641986

全球 VoLTE -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Global VoLTE - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

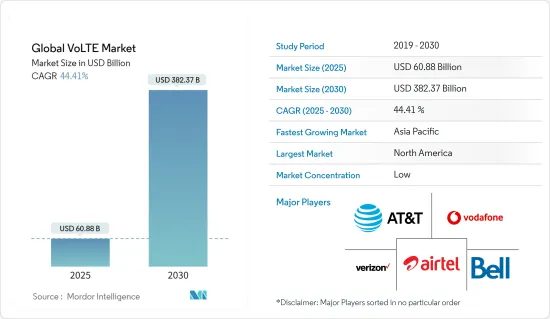

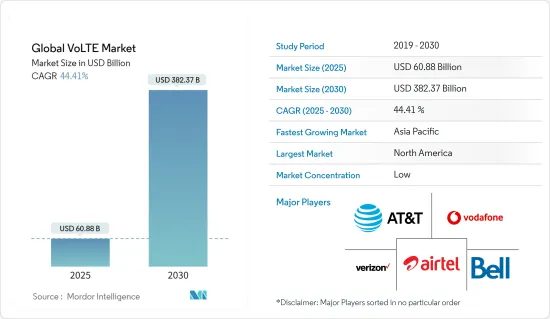

預計 2025 年全球 VoLTE 市場規模為 608.8 億美元,到 2030 年將達到 3,823.7 億美元,預測期內(2025-2030 年)的複合年成長率為 44.41%。

LTE 語音 (VoLTE) 使通訊業者能夠提供一組新的基於標準的服務,稱為富通訊服務。這些服務包括視訊通話、檔案傳輸、即時語言翻譯、視訊語音郵件、即時通訊軟體等。預測期內,高速網路使用量的增加預計將推動 VoLTE 市場的發展。

關鍵亮點

- 這項技術使網路營運商能夠提供高品質的語音、訊息和視訊服務。此外,提高頻譜效率將使營運商能夠使用更小的資料包透過資料網路傳輸語音服務,從而降低維護和營運成本。此外,該技術使營運商能夠充分利用其 IMS 基礎設施並最大限度地提高頻譜效率,從而提高其當前語音服務的價值。由於 RCS 技術,富通訊服務等服務正在實現新標準,這些服務提供視訊、語音郵件、即時通訊、即時語言翻譯和視訊通話。與競爭對手的 VoIP 程序相比,Rich Communication 功能可減少 VoLTE 通話連線時間並延長電池壽命。

- 對更好的語音和視訊品質以及更快的網路速度的需求不斷成長,推動了 VoLTE 服務的採用。對高速資料日益成長的需求推動了通訊業者之間的競爭加劇,以提供速度最快、覆蓋範圍最廣的行動寬頻。

- VoLTE 的優點在於,由於媒體/頻道上的資料傳輸速度更快,因此可以提供比 2G 或 3G 連接更好的通話品質。語音通話具有高清質量,透過切換到 VoLTE,您可以享受更豐富的體驗和更快、更可靠、功能更齊全的服務。如果沒有支援核心網路元素和網路整個生命週期開發的測試和監控解決方案,這樣的發展是不可能實現的。

- VoLTE不僅僅是一項4G技術。從 5G 開始,語音將不再有 CSFB,而營運商提供的未來語音服務將依賴 IMS 技術,這是唯一的標準化選項。未來五年內5G網路的推出將推動VoLTE的推出,從而實現Vo5G服務的推出。 GSMA預測,到2025年,約有400家業者將供應商使用VoLTE服務。

- 然而,新冠肺炎疫情已影響到經濟各領域的市場,智慧型手機也不例外。由於社會隔離影響消費者使用行動電話的頻率和目的,智慧型手機產業的生產正在中斷,使用模式也發生了重大變化。這導致疫情期間智慧型手機的普及率較低。受疫情影響,預計 2020 年行動服務年收入將較 2019 年下降 4.1%。

LTE 語音 (VoLTE) 市場趨勢

高速網路需求的不斷成長將推動 LTE 語音 (VoLTE) 市場的發展

- 據思科系統公司稱,2020 年的平均速度將比 2019 年提高 40% 以上,達到 50.8Mbps。預計到 2021 年將達到 58.9Mbps,比 2020 年再成長 16%。 LTE 語音 (VoLTE) 是一種透過 4G LTE 網路路由語音流量和傳輸資料的數位分組技術。該語音服務已成為智慧型手機、資料終端、物聯網 (IoT) 設備和穿戴式裝置等設備高速無線通訊的業界標準。

- 2022 年 6 月:拜登政府週四宣布,將撥款超過 4 億美元的貸款和津貼,用於促進農村地區的高速網路舉措。這筆資金預計將使11個州的約31,000名個人和企業受益。預計此類政府措施將推動研究市場的發展。

- 此外,2022 年 6 月,印度總理表示,政府正在尋求將高速網路覆蓋所有地區,並提案其他人在印度投資並挖掘數位科技領域的潛力。他們將當前的時代稱為科技時代。他們強調了疫情期間所看到的科技效益,並表示進一步增加對創新和技術的投入非常重要。

- 5G,稱為增強行動寬頻(eMBB),有望為行動網路用戶提供更快的通訊和高密度或高行動環境中更好的體驗。 5G將支援虛擬實境(VR)、擴增實境(AR)和應用程式等高頻寬服務。 5G將實現大量基於機器的通訊(mMTC),實現構成物聯網(IoT)的數百萬個聯網設備的連接。

- 由於 5G 服務的綜合性,預計連接將為頻譜增加多層複雜性。 5G發展的一大挑戰是可用頻段數量有限。 5G 的頻寬要求意味著更高的頻段對於提供更快、更高品質的連線至關重要。

亞太地區佔較大市場佔有率

- 到2025年,亞太地區將新增3.7億個行動用戶。愛立信表示,預計到 2024 年,亞太地區仍將佔據 VoLTE 用戶的大部分佔有率。亞太地區訂閱量為 3,480,080,000,其次是歐洲,訂閱量為 949,810,000。

- 此外,整個行動產業對經濟和社會發展做出了重大貢獻,2018年貢獻了GDP的5.3%,預計到2023年將超過1.9兆美元。

- 此外,韓國、日本和澳洲等許多新興市場都渴望成為5G世界領導者,因為他們對在5G網路上運行的新型創新服務和連網型設備的潛力感到興奮。中東和非洲的其他國家則更加謹慎。在許多新興國家,4G將在下一個十年中期繼續成為主流,預計到2025年將佔據70%的連接佔有率。

- 根據GSMA預測,2025年,全球將新增近2億用戶,總用戶數將達到18億人(佔總人口的62%)。大部分成長將來自南亞,到 2025 年,印度將佔所有新增用戶的一半以上。到2025年,該地區將有超過3.33億人首次使用行動網際網路,整體普及率將達到52%。

- 亞太地區也擁有最多的VoLTE營運商和用戶。沃達豐、Airtel、Reliance Jio、Digi、U Mobile、Yes 4G 和 Dialog 等行動網路供應商正在進軍 VoLTE 技術。他們正在投資這項技術以提供更好的服務。預計這些因素將在未來幾年推動該地理區域的成長。

LTE 語音 (VoLTE) 產業概覽

長期演進語音 (VoLTE) 市場本質上是分散的,由眾多全球和地區參與企業組成。這些參與企業致力於擴大其在世界各地的基本客群。這些供應商正專注於研發投資,推出新的解決方案、策略聯盟以及其他有機和無機成長策略,以在預測期內獲得競爭優勢。

- 2022 年 6 月 – Pixel 設備將能夠在各種網路上透過 VoLTE 漫遊。透過在其 Pixel 手機上啟用 VoLTE 漫遊,Google旨在避免消費者在美國通訊業者逐步淘汰 3G 網路後可能面臨的連接問題。

- 2022 年 5 月-Reliance Jio 開始對 4G 長期演進語音 (VoLTE) 和 5G 新無線語音 (VoNR) 進行相容性測試,以擴展其功能。 5G核心已在該公司增強型4G VoLTE網路上推出。該公司現在可以測試 5G VoNR 和 4G VoLTE 是否可以協同工作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 市場促進因素

- 對高速網際網路和優質服務的需求日益增加

- 快速都市化導致政府部門複雜化

- 市場限制

- 低度開發國家缺乏認知,採用緩慢

第 5 章 Volte 的發布國家

第6章 COVID-19 對 LTE 語音 (Volte) 市場的影響

第 7 章 技術簡介

- IP 語音多媒體子系統 (VOIMS)

- 電路交換回退(CSFB)

- 雙無線電/通訊語音和 LTE (SVLTE)

- 透過非專利存取網路 (VOLGA) 實現 LTE 語音

- 單一無線電語音呼叫連續性 (SRVCC)

第 8 章 各國電壓連接/滲透率細分

- 美國

- 加拿大

- 英國

- 德國

- 中國

- 日本

- 韓國

第9章市場區隔

- 按最終用戶產業

- 企業

- 商業的

- 政府

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第10章 競爭格局

- 公司簡介

- AT&T Inc.

- Verizon Wireless

- SK Telecom Co. Ltd

- Bell Canada

- Vodafone Group PLC

- Reliance Jio Infocomm Limited

- Bharati Airtel Limited

- KT Corporation

- Orange SA

第11章 投資分析

第12章 投資分析:市場機會與未來趨勢

The Global VoLTE Market size is estimated at USD 60.88 billion in 2025, and is expected to reach USD 382.37 billion by 2030, at a CAGR of 44.41% during the forecast period (2025-2030).

Voice over LTE (VoLTE) enables wireless operators to deliver a new set of standards-based services called Rich Communications Services. These services include video calling, file transferring, real-time language translation, video voicemail, and instant messaging. The increase in the use of high-speed internet is expected to drive the VoLTE market in the forecast period.

Key Highlights

- Due to technology, network operators may now offer high-quality voice, message, and video services. Additionally, it allows for greater spectrum efficiency and will enable operators to send speech services across data networks in small packet sizes, which lowers maintenance and operational expenses. Additionally, the technology allows the operators to make the most of their IMS infrastructure and maximize spectrum efficiency, enhancing the value of their current voice services. The availability of new standards based on services like Rich Communication Services thanks to technology RCS offers video, voice mail, instant messaging, real-time language translation, and video calling. Compared to competing VoIP programs, the rich communication features shorten the time it takes for VoLTE calls to connect and increase battery life.

- The increasing demand for improved voice and video quality and high-speed internet is driving the adoption of VoLTE services. The growing demand for high-speed data increases competition among the operators for the best mobile broadband offering, with the highest speeds and the best coverage.

- The benefit of VoLTE is that the quality of the call is better than 2G and 3G connections because of the high data transfer rate over the medium/channel. The voice calls are HD quality and offer a much richer experience and fast, reliable, and richer services altogether to switch to VoLTE. Such development is impossible without testing and monitoring solutions supporting the development of core network elements and the networks throughout the entire lifecycle.

- VoLTE is more than just a 4G technology. Since there is no CSFB of voice from 5G, the future of operator-provided voice services rests on IMS technology as the only standardized option. VoLTE launches will be boosted by 5G network rollout over the next five years, allowing the launch of Vo5G services. By 2025, the GSMA predicts that approximately 400 operators will deliver commercial VoLTE services.

- However, the COVID-19 pandemic is impacting markets in every segment of the economy, and smartphones are no exception. The smartphone industry has seen production disruptions and substantial changes in usage patterns, as social isolation impacts how much consumers use their phones and their purpose for using smartphones. This has led to the low subscription of smartphones during a pandemic. As a result of the pandemic, the annual mobile services revenue is expected to drop by 4.1% by 2020 compared to 2019.

Voice Over LTE (VoLTE) Market Trends

Increasing Demand for High-Speed Internet is Driving the Voice Over LTE (VoLTE) Market

- According to Cisco Systems, In comparison to 2019, the average speed increased by over 40% to 50.8 Mbps in 2020. It is projected to reach 58.9 Mbps in 2021, up another 16% from 2020. Voice over LTE (VoLTE) is a digital packet technology that routes voice traffic and transmits data across 4G LTE networks. This voice service is the industry standard for high-speed wireless communications in gadgets like smartphones, data terminals, Internet of Things (IoT) devices, and wearables.

- In June 2022, The Biden administration announced Thursday that it would allocate more than USD 400 million in loans and grants to promote high-speed internet initiatives for rural regions. The cash is anticipated to benefit around 31,000 individuals and companies across 11 states. Such initiatives by the government will drive the studied market.

- Further, in June 2022, The prime minister of India suggested the rest of the world invest in India and take advantage of the potential in the digital and technology sectors by stating that the government is trying to bring high-speed internet to every community. They referred to the current era as one of technology. They emphasized the advantages of technology as seen during the epidemic, saying it is crucial to make even more investments in innovation and technology.

- 5G, characterized as Enhanced Mobile Broadband (eMBB), is expected to improve mobile internet users' higher speeds and experience in dense or high mobility environments. It will support high-bandwidth services such as Virtual Reality (VR), Augmented Reality (AR), and apps. 5G will enable Massive Machine-type Communications (mMTC) and will allow the connection of many connected devices, which comprise the Internet of Things (IoT).

- 5G connection is expected to add multiple layers of complexity to the spectrum due to the all-inclusive nature of services. Limited spectrum availability is a big challenge in the development of 5G. The bandwidths requirements of 5G mean a higher frequency spectrum would be fundamental in delivering high-speed, high-quality connectivity.

Asia-Pacific to Account for Significant Market Share

- The Asia-pacific region will have 370 million new mobile subscribers by 2025. According to Ericsson, it is estimated that in 2024, Asia-Pacific will continue to dominate in the number of Voice over LTE subscriptions. In Asia-Pacific, the number of subscriptions is 3480.08 million, with a second spot taken up by Europe, with the number of subscriptions being 949.81 million.

- Further, the mobile industry as a whole contributes an extensive amount to economic and social development, generating 5.3% of GDP in 2018, and is expected to surpass 1.9 trillion US dollars by 2023 as countries increasingly benefit from the improvements in productivity and efficiency brought about by the increased take-up of mobile services.

- Further, many developed markets, such as South Korea, Japan, and Australia, are keen to be global leaders in 5G, with much about the potential of new innovative services and connected devices running on 5G networks. The rest of the region is more cautious. In many developing countries, 4G will still dominate the middle of the next decade, accounting for 70% of connections by 2025.

- According to the GSMA, almost 200 million new customers will be added by 2025, bringing the total number of subscribers to 1.8 billion (62% of the population). South Asia will account for a large portion of the growth, with India accounting for more than half of the new users by 2025. Over 333 million individuals in the region will use mobile internet for the first time by 2025, bringing the overall penetration rate to 52%.

- Also, Asia-Pacific has the highest number of VoLTE operators and subscribers. Mobile network providers such as Vodafone, Airtel, Reliance Jio, Digi, U Mobile, Yes 4G, and Dialog have ventured into VoLTE technology. They are investing in this technology to provide better service. These factors will drive the growth of this geographic segment in the coming years.

Voice Over LTE (VoLTE) Industry Overview

The voice over LTE (VoLTE) market is fragmented in nature and consists of a significant number of global and regional players. These players are focusing on expanding their customer base across the globe. These vendors are focusing on the research and development investment in introducing new solutions, strategic alliances, and other organic & inorganic growth strategies to earn a competitive edge over the forecast period.

- June 2022 - VoLTE roaming is made possible for Pixel handsets across various networks. Google intends to prevent any connectivity concerns consumers may see when U.S. carriers phase down their 3G networks by enabling supported VoLTE roaming on Pixel smartphones.

- May 2022 - Reliance Jio has begun testing the compatibility of 4G Voice over Long Term Evolution (VoLTE) and 5G Voice over New Radio (VoNR) to expand its capabilities. A 5G core has been put into the company's enhanced 4G VoLTE network. The business can now test if 5G VoNR and 4G VoLTE can work together.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Demand for High-speed Internet & Quality Services

- 4.4.2 Upgradation of Government Sectors due to Rapid Pace Urbanization

- 4.5 Market Restraints

- 4.5.1 Lack of Awareness and Slow Adoption in Under Developed Countries

5 VOLTE LAUNCHES BY COUNTRY

6 IMPACT OF COVID-19 ON THE VOICE OVER LTE (VOLTE) MARKET

7 TECHNOLOGY SNAPSHOT

- 7.1 Voice Over IP Multimedia Subsystem (VOIMS)

- 7.2 Circuit Switched Fall Back (CSFB)

- 7.3 Dual Radio/Simultaneous Voice and LTE (SVLTE)

- 7.4 Voice Over LTE Via Generic Access Network (VOLGA)

- 7.5 Single Radio Voice Call Continuity (SRVCC)

8 BREAKDOWN FOR VOLTECONNECTION/ PENETRATION BYCOUNTRY

- 8.1 United States

- 8.2 Canada

- 8.3 United Kingdom

- 8.4 Germany

- 8.5 China

- 8.6 Japan

- 8.7 South Korea

9 MARKET SEGMENTATION

- 9.1 By End-user Industry

- 9.1.1 Corporate

- 9.1.2 Commercial

- 9.1.3 Government

- 9.2 By Geography

- 9.2.1 North America

- 9.2.2 Europe

- 9.2.3 Asia

- 9.2.4 Australia and New Zealand

- 9.2.5 Latin America

- 9.2.6 Middle East and Africa

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 AT&T Inc.

- 10.1.2 Verizon Wireless

- 10.1.3 SK Telecom Co. Ltd

- 10.1.4 Bell Canada

- 10.1.5 Vodafone Group PLC

- 10.1.6 Reliance Jio Infocomm Limited

- 10.1.7 Bharati Airtel Limited

- 10.1.8 KT Corporation

- 10.1.9 Orange SA