|

市場調查報告書

商品編碼

1872363

全球實體門禁控制市場(2025-2030)-硬體、軟體和身分驗證The Physical Access Control Business 2025 to 2030 - Hardware, Software & Credentials Market Analysis |

||||||

實體門禁控制系統 (PACS) 正從獨立的門禁安全系統向軟體定義平台演進,這些平台由雲端架構、行動身分驗證和人工智慧 (AI) 驅動,是智慧建築營運的核心。這正在改變企業保護設施、管理身分和優化工作場所體驗的方式,為從製造商到系統整合商的所有利害關係人創造策略機會和競爭風險。

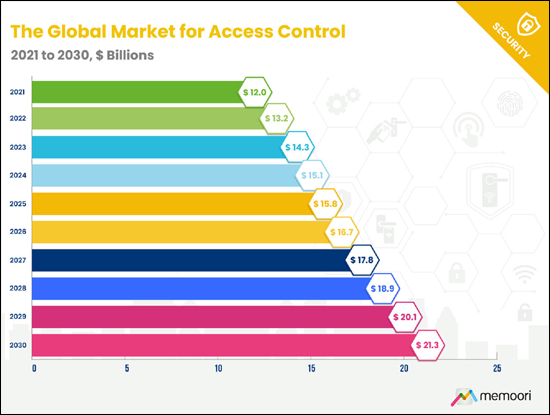

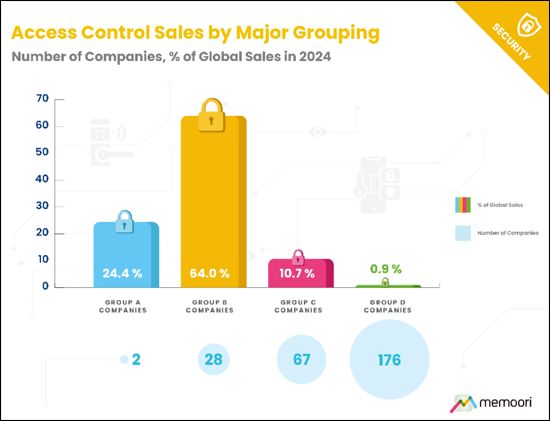

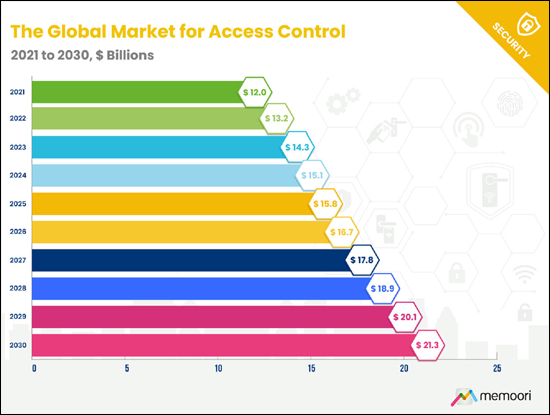

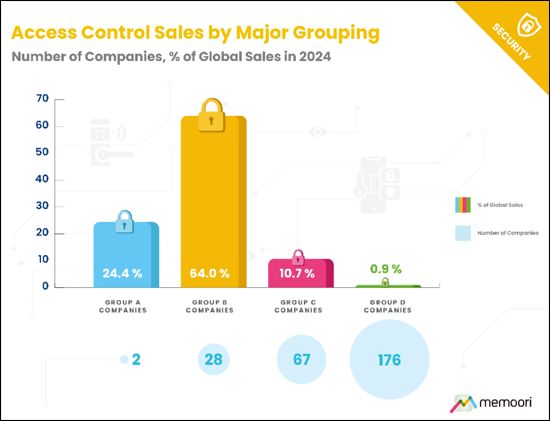

- 全球門禁控制市場規模預計將在 2024 年達到 151 億美元,到 2030 年達到 213 億美元,複合年增長率 (CAGR) 為 5.94%。 A 類公司(營收超過 10 億美元)約佔全球營收的 24.4%。 B 類公司(營收在 1 億美元至 10 億美元之間)包括28 家公司,平均營收為 3.27 億美元,佔全球銷售額的 64%。

- 預計到 2030 年,亞太地區將超越歐洲,成為全球第二大市場。與成熟市場以翻新改造為推動力不同,亞太地區的成長將主要由辦公大樓、物流設施、製造設施和政府設施的新建項目所推動。

- 從 2023 年 9 月到 2025 年 9 月,共完成 16 筆交易,總價值達 79 億美元,其中以霍尼韋爾以 49.5 億美元收購開利門禁業務最為引人注目。

- 隨著經常性軟體收入、託管服務和雲端訂閱取代傳統的硬體利潤率,價值獲取方式正在發生巨大轉變。

- 行動身分驗證正在徹底改變組織授予、管理和撤銷存取權限的方式。 市場正從專有應用程式驗證轉向直接內建於 Apple Wallet 和 Google Wallet 的錢包原生身分驗證。這使得用戶無需解鎖裝置即可實現輕觸進入體驗,並預設支援生物辨識身份驗證。

創投對門禁控制平台的投資已從 2021 年的高峰大幅下降。 2023 年 9 月至 2025 年 9 月期間,該領域已揭露的融資額超過 3.26 億美元,共達成 12 筆投資交易,資金主要集中在整合雲端平台。 Verkada 以 45 億美元的估值完成了 2 億美元的 E 輪融資,而 Rhombus Systems 則完成了 4,500 萬美元的 C 輪融資。這表明投資者對那些將門禁控制、視訊監控和環境感測器整合到單一管理平台的公司持續充滿信心。

策略聯盟作為創新結構性推動因素,其重要性日益凸顯。身分驗證供應商、智慧型手機製造商和雲端平台供應商之間的合作正在加速行動身分驗證的普及,並使多供應商生態系統走向標準化。

本報告考察了全球實體門禁控制市場,並分析了273家公司的績效、產品組合和策略定位。

目錄

前言

摘要整理

第一章:門禁控制業務結構與形成

- 門禁控制市場結構

- 公司分類與市佔率

- 門禁控制市場價值鏈

- 銷售與通路

- 定價、總擁有成本與生命週期經濟學

第二章 門禁管制市場

- 門禁管制市場發展歷程

- 市場動態、投資與採用趨勢

- 市場管理

- 採用訊號與預算展望

- 投資重點

- 買方行為、採購與風險

- 市場規模與成長預測

- 市場規模與趨勢:依地區劃分

- 北美

- 拉丁美洲和加勒比海地區

- 亞太地區

- 歐洲

- 中東和非洲

- 市場規模與趨勢:依產業劃分

- 辦公

- 政府

- 教育

- 製造和物流

- 醫療保健

- 零售

- 交通運輸

- 飯店與餐飲服務

- 資料中心

- 娛樂和休閒

- 硬體

- 電子鎖、無線鎖、智慧鎖

- 讀卡機、掃描器、鍵盤

- 控制面板、伺服器

- 身份驗證

- 依認證類型劃分的市場規模

- 身份驗證比較分析類型

- 磁條卡

- 近距離卡

- 智慧卡

- 行動錢包認證

- 生物辨識認證

- 條碼/二維碼

- 軟體

- 以部署方式劃分的軟體市場

- 專用門禁軟體

- 整合安全解決方案

- PIAM(實體身分和存取管理)

- 相關軟體領域

第三章 IP、物聯網與互通性

- IP 與物聯網的融合

- 開放標準倡議

- 物聯網成長與應用趨勢

- IP 和物聯網的優勢

- IP 與物聯網應用面臨的挑戰

- 用於門禁控制的邊緣處理

- API、SDK 的興起以及平台生態系統

第四章:雲端與存取控制即服務 (ACaaS)

- 雲端存取控制架構

- 雲和 ACaaS 的採用趨勢和預測

- 基於雲端的存取控制的優勢和挑戰

- ACaaS 競爭格局與商業模式

第五章:存取控制中的人工智慧與機器學習

- 存取控制中的人工智慧創新與應用

- 人工智慧採用趨勢

- 主要採用挑戰和障礙

- 資料隱私與倫理考量

第六章:行動存取控制

- 行動存取控制技術與身分驗證

- 行動採用趨勢與市場動態

- 行動存取控制的競爭格局

第七章:生物辨識身份驗證

- 生物辨識身分驗證技術及模式

- 生物辨識身分驗證應用趨勢

- 生物辨識身分驗證相關挑戰

- 監管、法律及隱私權考量

- 生物辨識身分驗證競爭格局

第八章:多因素身份驗證與多技術領先者

- 多因素身份驗證

- 多技術領先者

- 挑戰與不足

第九章:系統整合與融合趨勢

- 實體安全與邏輯安全的融合

- 視訊門禁整合

- 樓宇管理系統整合

第十章:供應鏈與製造趨勢

- 供應鏈營運狀況

- 地緣政治對供應的影響

- 區域化與本土化趨勢

第11章:商業建築與房地產市場

- 商業不動產與建築市場對門禁管制需求的影響

- 值得關注的房地產趨勢

- 商業建築展望

第12章:技能、人才與勞動力

- 主要趨勢與挑戰

- 新興機遇

第13章:網路安全與資料隱私

- 整合系統對網路安全的影響

- 威脅情勢與主要漏洞

- 監理因素

- 網路安全最佳實踐風險緩解

第十四章 永續性

- 永續性作為投資推動因素

- 使門禁系統更具永續性

- 面向永續性的門禁控制

- 標準、認證與買家期望

第十五章:併購

- 過往併購市場動態

- 最新併購交易

- 併購趨勢及影響

第十六章:策略聯盟

- 過往策略聯盟及市場動態

- 最新策略聯盟(2023年9月至2025年9月)

- 策略聯盟趨勢及影響

第十七章:投資趨勢

- 過往投資交易及市場動態

- 最新投資交易

- 投資趨勢及影響力

This report is an in-depth study providing a detailed market analysis of access control, with a specific focus on revenues generated by hardware, software & credentials.

Physical access control (PACS) is evolving from standalone door security into a software-defined platform at the center of smart building operations, with cloud architectures, mobile credentials, and artificial intelligence reshaping how organizations secure facilities, manage identities, and optimize workplace experiences, creating both strategic opportunities and competitive risks for everyone from manufacturers to systems integrators.

It is the second instalment of a two-part series covering Physical Security Technology. Part 1, covering Video Surveillance, was published in Q3 2025. Both these reports are included in Memoori's 2025 Premium Subscription Service.

Key Questions Addressed:

- What is the size and structure of the global access control market in 2025? The market reached $15.1 billion in 2024 and will grow to $21.3 billion by 2030 at a 5.94 percent CAGR. Group A companies (those with over $1 billion in revenues), together represent approximately 24.4 percent of global revenues. Group B (those with between $100 million and $1 billion) encompasses 28 companies with average revenues of $327 million, collectively accounting for 64 percent of global revenues.

- Which region offers the strongest growth opportunity through 2030? Asia Pacific will overtake Europe as the second-largest market by 2030. Unlike mature markets driven by retrofits, Asia Pacific growth comes from new construction across offices, logistics, manufacturing, and government facilities.

- How is M&A reshaping and consolidating the industry? 16 transactions totaling $7.9 billion were completed between September 2023 and September 2025, led by Honeywell's $4.95 billion acquisition of Carrier's access control business.

Within its 238 Pages and 13 Charts, This report presents all the key facts and draws conclusions, so you can understand what is shaping the future of the access control industry:

- Our comprehensive analysis of the global access control market is structured around 3 core revenue categories: hardware (electronic locks, readers, control panels, and supporting infrastructure), credentials (cards, mobile, biometrics, and alternative formats), and software (on-premises and cloud-based platforms). Our methodology evaluates 273 active companies worldwide, classifying vendors into four groups based on 2024 revenues and analyzing their financial performance, product portfolios, and strategic positioning.

- Value capture is shifting dramatically as recurring software revenue, managed services, and cloud subscriptions displace traditional hardware margins. This report maps these dynamics across vendor groups and identifies where profits are concentrating as the industry transitions from product sales to platform economics.

- Mobile credentials represent a significant transformation in how organizations provision, manage, and revoke access rights. The market is shifting from proprietary app-based credentials toward wallet-native credentials embedded directly in Apple Wallet and Google Wallet, enabling tap-to-enter experiences without unlocking devices and supporting biometric authentication by default. This report analyzes adoption patterns across vertical markets, quantifies infrastructure investment requirements, and evaluates competing standards.

This report provides valuable information into how physical security companies can develop their business strategy through mergers, acquisitions, and alliances.

Venture capital investment in access control platforms declined sharply from peak inflows in 2021. Between September 2023 and September 2025, 12 investment deals directed well over $326 million in disclosed funding into the sector, with capital concentrating around unified cloud platforms. Verkada secured $200 million in Series E funding at a $4.5 billion valuation, while Rhombus Systems raised a $45 million Series C round, demonstrating continued investor confidence in companies integrating access control, video surveillance, and environmental sensors into single management platforms.

Strategic partnerships have become important as structural enablers of innovation, with alliances between credential providers, smartphone manufacturers, and cloud platform vendors accelerating mobile credential adoption and normalizing multi-vendor ecosystems.

The report documents funding rounds, analyzes which technologies and business models are attracting capital, maps strategic alliances shaping interoperability standards, and identifies which vendor partnerships deliver genuine integration versus marketing announcements, critical intelligence for buyers evaluating platform longevity and ecosystem risk.

Who Should Buy This Report?

The information in this report will be of value to all those engaged in managing, operating, and investing in electronic security technology companies (and their advisors) around the world. In particular, those wishing to acquire, merge or sell companies will find its contents particularly useful.

Table of Contents

Preface

Executive Summary

1. The Structure & Shape of the Access Control Business

- 1.1. Access Control Market Structure

- 1.2. Company Classifications & Market Share

- 1.3. Access Control Market Value Chain

- 1.4. Sales & Distribution Channels

- 1.5. Pricing, TCO and Lifecycle Economics

2. The Access Control Market

- 2.1. The Evolution of the Access Control Market

- 2.2. Market Dynamics, Investment & Adoption Trends

- 2.2.1. Market Operating Conditions

- 2.2.2. Adoption Signals and Budget Outlook

- 2.2.3. Investment Priorities

- 2.2.4. Buyer Behavior, Procurement and Risk

- 2.3. Market Size & Growth Forecasts

- 2.4. Market Size & Trends by Region

- 2.4.1. North America

- 2.4.2. Latin America & The Caribbean

- 2.4.3. Asia Pacific

- 2.4.4. Europe

- 2.4.5. Middle East & Africa

- 2.5. Market Size & Trends by Vertical

- 2.5.1. Offices

- 2.5.2. Government

- 2.5.3. Education

- 2.5.4. Manufacturing & Logistics

- 2.5.5. Healthcare

- 2.5.6. Retail

- 2.5.7. Transport

- 2.5.8. Hospitality & Food Services

- 2.5.9. Datacenters

- 2.5.10. Entertainment / Leisure

- 2.6. Hardware

- 2.6.1. Electronic, Wireless & Smart Locks

- 2.6.2. Readers, Scanners & Keypads

- 2.6.3. Control Panels and Servers

- 2.7. Credentials

- 2.7.1. Market Size by Credential

- 2.7.2. Comparative Analysis of Credential Types

- 2.7.3. Magnetic Stripe Cards

- 2.7.4. Proximity Cards

- 2.7.5. Smart Cards

- 2.7.6. Mobile-Wallet Credentials

- 2.7.7. Biometrics

- 2.7.8. Barcodes/QR Codes

- 2.8. Software

- 2.8.1. Software Market by Deployment Method

- 2.8.2. Dedicated Access Control Software

- 2.8.3. Unified Security Solutions

- 2.8.4. PIAM (Physical Identity and Access Management)

- 2.8.5. Related Software Domains

3. IP, IoT, and Interoperability

- 3.1. The Convergence of IP and IoT

- 3.2. Open Standards Initiatives

- 3.3. IoT Growth & Adoption Trends

- 3.4. The Benefits of IP & IoT

- 3.5. IP and IoT Adoption Challenges

- 3.6. Edge Processing for Access Control

- 3.7. APIs, SDKs the Rise of Platform Ecosystems

4. The Cloud & ACaaS

- 4.1. Cloud Architectures in Access Control

- 4.2. Cloud & ACaaS Adoption Trends & Forecasts

- 4.3. Benefits & Challenges of Cloud-Based Access Control

- 4.4. ACaaS Competitive Landscape & Business Models

5. AI & Machine Learning in Access Control

- 5.1. AI Innovations & Applications for Access Control

- 5.2. AI Adoption Trends

- 5.3. Key Adoption Challenges & Barriers

- 5.4. Data Privacy & Ethical Considerations

6. Mobile Access Control

- 6.1. Mobile Access Control Technologies & Credentials

- 6.2. Mobile Adoption Trends & Market Dynamics

- 6.3. Mobile Access Control Competitive Landscape

7. Biometrics

- 7.1. Biometrics Technologies & Modalities

- 7.2. Biometric Adoption Trends

- 7.3. Biometrics Related Challenges

- 7.4. Regulatory, Legal & Privacy Considerations

- 7.5. Biometrics Competitive Landscape

8. Multifactor Authentication & Multi Technology Readers

- 8.1. Multifactor Authentication

- 8.2. Multi Technology Readers

- 8.3. Challenges and Drawbacks

9. Systems Integration & Convergence Trends

- 9.1. Physical-Logical Security Convergence

- 9.2. Video-Access Integration

- 9.3. Building Management Systems Integration

10. Supply Chain & Manufacturing Trends

- 10.1. Supply Chain Operating Conditions

- 10.2. Geopolitical Impacts on Supply

- 10.3. Regionalization and onshore trends

11. Commercial Construction & Real Estate Markets

- 11.1. Influence of CRE and Construction Markets on Access Control Demand

- 11.2. Notable Real Estate Trends

- 11.3. Commercial Construction Outlook

12. Skills, Talent & Labor

- 12.1. Key Trends & Challenges

- 12.2. Emerging Opportunities

13. Cybersecurity & Data Privacy

- 13.1. Cybersecurity Implications of Converged Systems

- 13.2. Threat Landscape & Notable Vulnerabilities

- 13.3. Regulatory Drivers

- 13.4. Best Practices for Cyber Risk Mitigation

14. Sustainability

- 14.1. Sustainability as an Investment Driver

- 14.2. Making Access Control Systems More Sustainable

- 14.3. Access Control as a Sustainability Enabler

- 14.4. Standards, Certifications, and Buyer Expectations

15. Mergers & Acquisitions

- 15.1. Historic M&A Market Dynamics

- 15.2. New M&A Deals

- 15.3. M&A Trends and Implications

16. Strategic Alliances

- 16.1. Historic Strategic Alliances and Market Dynamics

- 16.2. New Strategic Alliances (September 2023 to September 2025)

- 16.3. Strategic Alliance Trends and Implications

17. Investment Trends

- 17.1. Historic Investment Deals & Investment Market Dynamics

- 17.2. New Investment Deals

- 17.3. Investment Trends and Implications

List of Charts and Figures

- Fig 1.1: Access Control Market Structure

- Fig 1.2: Access Control Sales by Major Grouping, Number of Companies, % of Global Sales in 2024

- Fig 1.3: Market Share of Global Access Control Sales by Major Vendor 2024

- Fig 2.1: The Security Market Index (SMI)

- Fig 2.2: The Global Market for Access Control 2021 to 2030, $ Billions

- Fig 2.3: The Global Market for Access Control by Category 2021 to 2030, $ Billions

- Fig 2.4: Access Control Sales by Region 2024 & 2030, $ Billions

- Fig 2.5: Distribution of Access Control Sales by Building Type 2024, $ Billions

- Fig 2.6: The Global Market for Access Hardware by Sub-Category 2021 to 2030, $ Billions

- Fig 2.7: The Global Market for Access Control Credentials by Sub-Category 2021 to 2030, $ Billions

- Fig 2.8: The Global Market for Access Control Software, On-Premises vs Cloud Based 2021 to 2030, $ Billions

- Fig 11.1: Annual Change in Global Non-Residential Construction Sector Output

- Fig 11.2: Annual Change in Global Construction by Region