|

市場調查報告書

商品編碼

1718485

智慧商業建築聯網平台市場(2025-2030)-物聯網市場規模與競爭格局IoT Platforms in Smart Commercial Buildings 2025 to 2030 - Total IoT Market Sizing & Competitive Landscape |

||||||

探索智慧建築中的物聯網平台生態系統:2030 年完整市場分析

隨著商業大樓轉變為響應式、數據驅動的環境,物聯網平台正在成為將先前脫節的系統連接到統一網路的關鍵編排層。這份綜合報告揭示了全球樓宇物聯網市場到 2030 年將如何成長到 1,010 億美元,並重塑辦公室、零售、飯店和資料中心的房地產營運。

我們的分析清楚地展現了碎片化的物聯網平台生態系統,並研究了領先供應商到 2030 年的架構演進、競爭定位和策略路線圖。透過對三種情境的詳細市場預測和針對不同利害關係人群體量身定制的可行建議,本報告提供了利用新興技術並將技術投資與可衡量的業務成果聯繫起來所需的策略情報。

本研究包括三電子錶格和一個包含高解析度圖形和圖表的簡報文件。本報告是我們 2025 年物聯網報告系列的第二份,第一份是關於物聯網設備的。該研究是我們 2025 年企業訂閱服務報告的一部分。

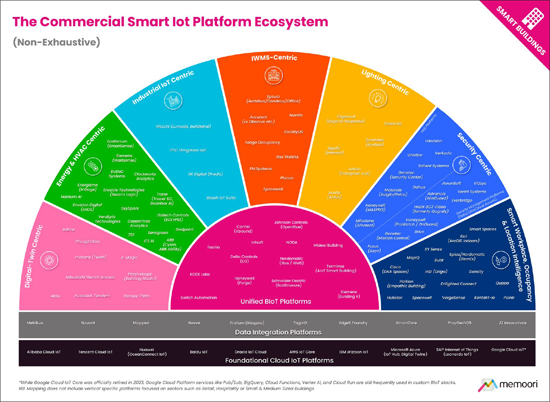

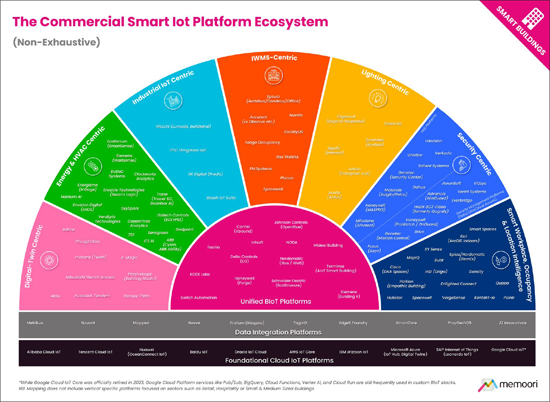

為了幫助您駕馭分散且快速發展的 BIoT 平台解決方案市場,本報告提供了兩個關鍵資源:物聯網平台生態系統的高階映射(見上文)和附錄 A 中的結構化平台比較。雖然我們對市場進行了廣泛而系統的研究,但需要注意的是,生態系統地圖並非旨在列出所有供應商。

在此映射中,Memoori 將每個平台分類為最能反映其關鍵策略定位和平台能力的部分。

關於物聯網平台的熱門議題

- 評估物聯網平台時,組織應該尋找哪些關鍵功能? 尋找開放式架構來防止供應商鎖定、用於供應商中立整合的單獨資料層以及強大的安全協定。儘管各大供應商都在向統一平台邁進,但沒有一家供應商能夠提供涵蓋所有建築系統的綜合解決方案。組織應優先考慮互通性和模組化方法,以允許最佳解決方案有效地協同工作。

- 除了行銷炒作之外,人工智慧如何改變建築運作?人工智慧正在三個明確的領域從理論轉向實踐:包括能夠主動調整暖通空調的操作預測、比傳統方法提前幾天識別設備故障的故障檢測演算法,以及可將消耗降低 15-25% 的自主能源優化。像BrainBox AI這樣的公司已經被收購。然而,市場仍然存在著兩種類型:純人工智慧驅動的平台和僅以 "人工智慧" 為幌子提供基於規則的自動化的平台。

- 最近的併購交易揭示了競爭格局的哪些面向? 2023 年及以後計劃進行的 168 億美元併購交易表明,傳統原始設備製造商 (OEM) 將數位平台定位為其未來收入模式的核心。 特靈和施耐德電機等企業買家正在引領收購,將投資重點放在符合永續發展趨勢的資本充足平台上。為了與整合平台競爭,小型供應商被迫透過專門的功能和不同的商業模式來實現差異化。

這份長達 152 頁、包含 18 幅圖表的報告提煉了所有關鍵事實並得出結論,以便您能夠準確瞭解哪些因素正在塑造商業智慧建築的未來。

- 可行的轉型路線圖:利用針對建築業主、平台供應商、設施經理和投資者的客製化策略建議來解決當前的採用障礙,並使您的組織能夠利用新的平台融合趨勢。

- 多重情境市場預測:透過三種經濟情境的詳細預測來應對前所未有的市場不確定性,並按技術類別、建築類型和地區細分到 2030 年的成長預測。

- 全面的供應商格局分析:我們使用專有的評估框架對87家平台供應商進行評估,該框架突破行銷宣傳,揭示他們在多系統整合、邊緣運算、安全協定和人工智慧實施成熟度方面的實際能力。

本報告提供了有價值的信息,幫助公司改善其策略規劃和考慮業務發展機會。

誰應該購買此報告?

對於建築業主、技術提供者和投資者來說,瞭解這種不斷變化的情況對於在日益複雜的市場中保持競爭優勢至關重要。

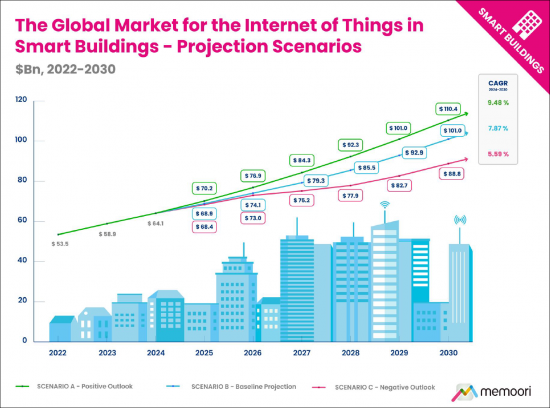

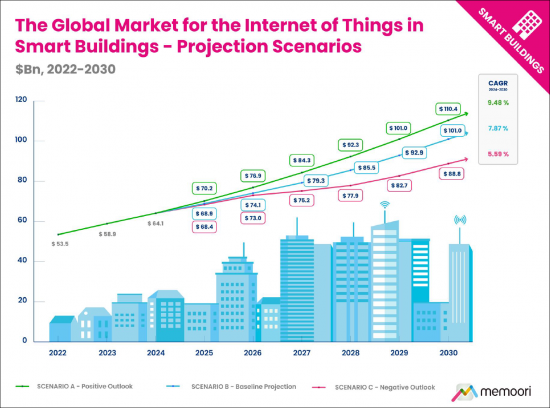

在基準情境下,全球建築物連網市場預計將從 2024 年的 641 億美元成長到 2030 年的 1,010 億美元(複合年增長率為 7.87%),遠低於 10-16% 的歷史成長率。鑑於前所未有的宏觀經濟不確定性,我們制定了三種不同的預測情境:正面展望(複合年增長率 9.48%)、基線預測(複合年增長率 7.87%)和負面展望(複合年增長率 5.59%)。數據整合、分析和軟體是規模最大、成長最快的類別(複合年增長率為 9.53%),這表明市場越來越關注軟體定義的價值,而不是硬體。

目錄

前言

執行摘要

第1章簡介

- 智慧商業建築物連網市場概覽

- 繪製 BIoT 供應鏈圖

- 物聯網解決方案的成熟度與市場發展

第2章影響BIoT市場的經濟與政策壓力

- 評估貿易戰的影響

- 中美貿易與技術摩擦

- 更廣泛的區域貿易和政策影響

- 評估更廣泛的技術市場的現狀

第3章市場規模評估與區域分析

- 市場預測情景

- 情境框架與假設

- 情境預測

- 全球市場細分

- 按硬體、軟體和服務劃分的市場

- 以建築類型劃分的市場

- 按應用程式細分的市場

- 區域預測與分析

- 北美

- 拉丁美洲

- 亞太地區

- 歐洲

- 中東和非洲

第4章 物聯網平台

- 物聯網平台在智慧商業建築中的作用

- BIoT 堆疊

第5章 物聯網平台生態系及競爭格局

- 繪製物聯網平台生態系圖

- 競爭格局評估

- 底層雲物聯網平台

- 資料整合平台

- 以數位孿生為中心的平台

- 以能源和暖通空調為中心的平台

- 以工業物聯網為中心的平台

- 以 IWMS 為中心的平台

- 以照明為中心的平台

- 以安全為中心的平台

- 智慧工作場所/佔用/位置智慧平台

- 整合的BIoT平台

- 產業特定平台

- 值得關注的平台趨勢

- 融合與整合的動態

- 邁向開放、模組化、可擴充的 BIoT 平台

- 不斷發展的計算模型

- 人工智慧、分析與自主控制

- 不斷發展的商業模式

- 風險管理

- 區域市場動態與市場分化

- 對利害關係人的建議

- 解決 BIoT 平台中的常見課題

- 評估平台成熟度的清單

- 針對不同利害關係人群體的策略建議

第6章 併購與投資趨勢

- 投資

- 合併與收購

Navigate the Smart Building IoT Platforms Ecosystem: Complete Market Analysis Through to 2030

As commercial buildings transform into responsive, data-driven environments, IoT platforms have emerged as the critical orchestration layer connecting previously isolated systems into unified networks. This comprehensive report reveals how the global Building IoT market will grow to $101 billion by 2030, reshaping property operations across offices, retail, hospitality, and data centers.

Our analysis provides clarity on the fragmented IoT platforms ecosystem, examining the architectural evolution, competitive positioning, and strategic roadmaps of key vendors through to 2030. With detailed market forecasts across three scenarios and actionable recommendations tailored to different stakeholder groups, this report delivers the strategic intelligence needed to capitalize on emerging technologies and align technology investments with measurable business outcomes.

The research includes 3 spreadsheets AND a presentation file with high-resolution versions of the charts. It is the 2nd in our 2025 series of IoT reports, with the 1st on IoT Devices. The research is included in our 2025 Enterprise Subscription Service.

To help navigate the fragmented and rapidly evolving market for BIoT platform solutions, this report provides two key resources: a high-level mapping of the IoT platform ecosystem (see above) and a structured platform comparison presented in Appendix A. While we conducted a broad and systematic survey of the market, it is important to note that the Ecosystem Map is not intended to include every single vendor.

It should also be noted that many vendors could arguably fit into multiple segments, depending on how their portfolios and go-to-market strategies are interpreted. For the purposes of this mapping, Memoori has placed each platform into the segment that we assess best reflects its primary strategic positioning and platform functionality.

KEY QUESTIONS ADDRESSED ABOUT IOT PLATFORMS:

- What key capabilities should organizations look for when evaluating IoT platforms? Look for open architectures to prevent vendor lock-in, independent data layers for vendor-neutral integration, and robust security protocols. Despite the trend toward unified platforms from major vendors, no single provider offers comprehensive solutions across all building systems. Organizations should prioritize interoperability and modular approaches that allow best-of-breed solutions to work together effectively.

- How is AI transforming building operations beyond the marketing hype? AI is moving from theory to practice in three obvious areas: occupancy prediction that enables proactive HVAC adjustments, fault detection algorithms that identify equipment failures days before traditional methods, and autonomous energy optimization that reduces consumption by 15-25%. Companies like BrainBox AI are being acquired specifically for these capabilities. However, the market remains fragmented between genuinely AI-driven platforms and those merely offering rule-based automation rebranded as "artificial intelligence."

- What does recent M&A activity reveal about the competitive landscape? The $16.8 billion in M&A transactions since 2023 shows traditional OEMs positioning digital platforms at the center of future revenue models. Corporate buyers like Trane and Schneider Electric are dominating acquisitions, while investment is concentrating among well-capitalized platforms aligned with sustainability trends. Smaller vendors face growing pressure to differentiate through specialized functionality or different business models to compete against integrated platforms.

WITHIN ITS 152 PAGES AND 18 CHARTS AND TABLES, THE REPORT FILTERS OUT ALL THE KEY FACTS AND DRAWS CONCLUSIONS, SO YOU CAN UNDERSTAND EXACTLY WHAT IS SHAPING THE FUTURE OF COMMERCIAL SMART BUILDINGS.

- Actionable Transformation Roadmaps: Leverage tailored strategic recommendations for building owners, platform vendors, facility managers, and investors that address immediate adoption barriers while positioning organizations to capitalize on emerging platform convergence trends.

- Multi-Scenario Market Forecasts: Navigate unprecedented market uncertainty with detailed projections across three economic scenarios, breaking down growth expectations by technology category, building type, and geographic region through 2030.

- Comprehensive Vendor Landscape Analysis: Evaluate 87 platform providers using our proprietary assessment framework that cuts through marketing claims to reveal actual capabilities in multi-system integration, edge computing, security protocols, and AI implementation maturity.

This report provides valuable information to companies so they can improve their strategic planning exercises AND look at the potential for developing their business.

WHO SHOULD BUY THIS REPORT?

For building owners, technology providers, and investors, understanding this evolving landscape has become essential for maintaining a competitive advantage in an increasingly complex market.

The report projects the global Building IoT market will grow from $64.1 billion in 2024 to $101.0 billion by 2030 (7.87% CAGR) under our baseline scenario, significantly lower than historical growth rates of 10-16%. We've developed three distinct projection scenarios to account for unprecedented macroeconomic uncertainty: Positive Outlook (9.48% CAGR), Baseline Projection (7.87% CAGR), and Negative Outlook (5.59% CAGR). Data Integration, Analytics & Software represents the largest and fastest-growing category (9.53% CAGR), indicating a market increasingly focused on software-defined value rather than hardware.

Table of Contents

Preface

Executive Summary

1. Introduction

- 1.1. Overview of the IoT Market in Smart Commercial Buildings

- 1.2. Mapping the BIoT Supply Chain

- 1.3. IoT Solution Maturity and Market Evolution

2. Economic and Policy Pressures Impacting BIoT Markets

- 2.1. Evaluating the Impact of the Trade War

- 2.1.1. US-China Trade and Technology Tensions

- 2.1.2. Broader Regional Trade and Policy Impacts

- 2.2. Evaluating the State of Broader Technology Markets

3. Market Sizing & Regional Analysis

- 3.1. Market Projection Scenarios

- 3.1.1. Scenario Framework and Assumptions

- 3.1.2. Scenario Forecasts

- 3.2. Global Market Breakdowns

- 3.2.1. Market Breakdown by Hardware, Software & Services

- 3.2.2. Market Breakdown by Building Vertical

- 3.2.3. Market Breakdown by Application

- 3.3. Regional Forecasts & Analysis

- 3.3.1. North America

- 3.3.2. Latin America

- 3.3.3. Asia Pacific

- 3.3.4. Europe

- 3.3.5. Middle East & Africa

4. IoT Platforms

- 4.1. The Role of IoT Platforms in Smart Commercial Buildings

- 4.2. The BIoT Stack

5. The IoT Platform Ecosystem & Competitive Landscape

- 5.1. Mapping the IoT Platform Ecosystem

- 5.2. Evaluating the Competitive Landscape

- 5.2.1. Foundational Cloud IoT Platforms

- 5.2.2. Data Integration Platforms

- 5.2.3. Digital Twin-Centric Platforms

- 5.2.4. Energy & HVAC-Centric Platforms

- 5.2.5. Industrial IoT-Centric Platforms

- 5.2.6. IWMS-Centric Platforms

- 5.2.7. Lighting-Centric Platforms

- 5.2.8. Security-Centric Platforms

- 5.2.9. Smart Workplace / Occupancy / Location Intelligence Platforms

- 5.2.10. Unified BIoT Platforms

- 5.2.11. Vertical Specific Platforms

- 5.3. Notable Platform Trends

- 5.3.1. Convergence and Integration Dynamics

- 5.3.2. A Shift Towards Open, Modular, and Scalable BIoT Platforms

- 5.3.3. Evolving Computational Models

- 5.3.4. AI, Analytics, and Autonomous Control

- 5.3.5. Evolving Business Models

- 5.3.6. Risk Management

- 5.3.7. Regional Market Dynamics & Market Bifurcation

- 5.4. Recommendations for Stakeholders

- 5.4.1. Navigating Common Challenges in BIoT Platforms

- 5.4.2. A Checklist for Evaluating Platform Maturity

- 5.4.3. Strategic Recommendations by Stakeholder Group

6. M&A & Investment Trends

- 6.1. Investments

- 6.1.1. Notable Investment Trends

- 6.2. Mergers & Acquisitions

- 6.2.1. Notable M&A Trends

List of Charts and Figures

- Fig 1.1: The Internet of Things in Smart Commercial Buildings 2025 v6.0

- Fig 1.2: The BIoT Supply Chain

- Fig 1.3: BIoT Solution Maturity

- Fig 2.1: US/China Trade Barriers - A Timeline - 2018 to Present

- Fig 3.1: The Global Market for the Internet of Things in Smart Building - Projection Scenarios to 2030

- Fig 3.2: The Global Market for the Internet of Things in Smart Building, Breakdown by Hardware, Software & Services 2024

- Fig 3.3: Market Breakdown by Hardware, Software & Services, Breakdown by Category 2024

- Fig 3.4: The Internet of Things in Smart Commercial Buildings Market by Vertical 2024

- Fig 3.5: The Internet of Things in Smart Commercial Buildings Market by Application 2024

- Fig 3.6: Regional Growth Indicators

- Fig 3.7: The Internet of Things in Smart Commercial Buildings Market by Region 2024

- Fig 3.8: The Market for the Internet of Things in Smart Commercial Buildings North America 2024

- Fig 3.9: The Market for the Internet of Things in Smart Commercial Buildings Latin America 2024

- Fig 3.10: The Market for the Internet of Things in Smart Commercial Buildings Asia Pacific 2024

- Fig 3.11: The Market for the Internet of Things in Smart Commercial Buildings Europe 2024

- Fig 3.12: The Market for the Internet of Things in Smart Commercial Buildings Middle East & Africa 2024

- Fig 4.1: Typical IoT Platform Functionality

- Fig 5.1: The Commercial Smart IoT Platform Ecosystem

- Appendix A - BIoT Platform Comparison Matrix

- Appendix B - M&A & Investments Summary