|

市場調查報告書

商品編碼

1931749

全球環氧丙烷市場按應用、終端用戶產業、製造流程和地區分類-預測至2030年Propylene Oxide Market by Production Process (Chlorohydrin Process, Styrene Monomer Process), Application (Polyether Polyols, Propylene Glycol), End-use Industry (Automotive, Building & Construction), and Region - Global Forecast to 2030 |

||||||

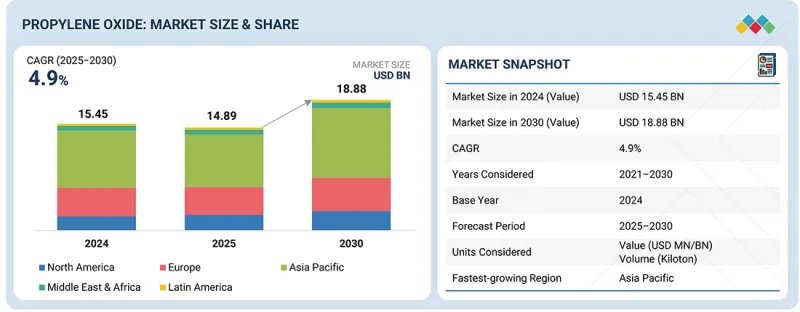

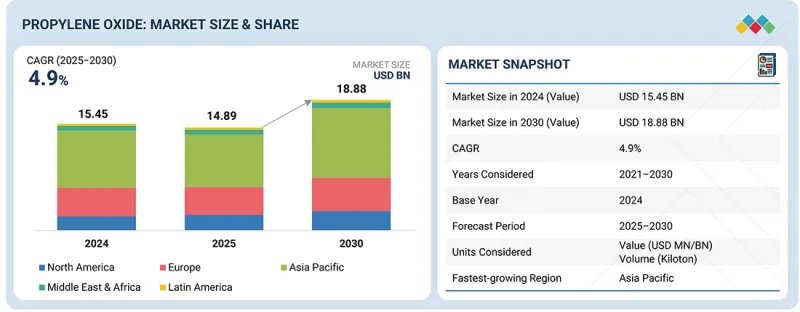

預計到 2025 年,環氧丙烷市場規模將達到 148.9 億美元,到 2030 年將達到 188.8 億美元,預測期內複合年成長率為 4.9%。

環氧丙烷市場的主要驅動力是其在泡沫生產中的應用,因為環氧丙烷在聚氨酯(以聚醚多元醇的形式)的生產中有著重要的應用,而聚氨酯又以硬質和軟質泡沫的形式存在,這直接刺激了環氧丙烷的生產。

| 調查範圍 | |

|---|---|

| 調查期 | 2022-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 價值(百萬美元/十億美元) 數量(千噸) |

| 部分 | 按應用、最終用途產業、製造流程和地區分類 |

| 目標區域 | 亞太地區、歐洲、北美、中東和非洲、南美 |

全球範圍內的都市化不斷加快,包括亞洲、北美和歐洲市場,這推動了輕質建築材料和高效隔熱材料的使用日益增多,而這主要是由於聚氨酯衍生物滿足了結構需求。

由於聚醚多元醇在以銷售量為導向的終端應用領域應用廣泛,且環氧丙烷消耗量最高,預計在預測期內,聚醚多元醇市場將佔據最大的市場佔有率。硬質和軟質聚氨酯泡棉廣泛應用於建築隔熱材料、汽車座椅和內裝、家具、寢具和包裝等領域,而這些泡棉主要由聚醚多元醇製成。聚醚多元醇泡沫的需求主要受建築計劃數量的激增、對節能建築需求的成長以及汽車(尤其是輕型車和電動汽車)產量的增加所驅動。此外,聚醚多元醇還具有優異的性能,例如柔軟性、強度和加工性,使其優於其他替代品。大規模連續生產確保了聚醚多元醇始終保持最大的市場佔有率,這也反過來支撐了環氧丙烷的高消耗量。

預計在預測期內,環氧丙烷市場汽車應用領域將以最顯著的速度成長,這主要得益於汽車產業對輕質高性能材料日益成長的需求。環氧丙烷基聚醚多元醇主要用於製造聚氨酯泡棉,這些泡沫可用於座椅、頭枕、扶手、簾式襯裡和行李箱襯裡等應用。乘客舒適度的提升以及向電動車的快速轉型是推動市場需求的主要因素,這促使汽車製造商使用輕量材料來提高電動車的效率和續航里程。開發中國家汽車產量的成長以及更嚴格的污染防治和燃油經濟性標準的實施也加速了聚氨酯零件的使用。此外,汽車內裝領域的顯著成長也是環氧丙烷市場成長的驅動力,而這又源自於人們對乘客舒適度的日益重視。

由於苯乙烯單體法與苯乙烯生產緊密相關,且全球產能規模龐大,預計在預測期內,苯乙烯單體法將佔據環氧丙烷市場最大的佔有率。苯乙烯單體法能夠同時生產環氧丙烷和苯乙烯單體,使企業能夠實現規模經濟、高效率和最優成本。由於消費品、建築和包裝等產業對苯乙烯的需求穩定,主要企業很可能採用此製程。鑑於製程升級和改造需要大量資本投入,許多現有工廠尚未放棄苯乙烯單體法。此製程的優勢在於其可靠性高、產能充足,且與苯乙烯需求相匹配,從而能夠維持環氧丙烷整體生產的大規模產量。

本報告主要參與者概述:

環氧丙烷市場的主要參與企業包括陶氏化學(美國)、利安德巴塞爾工業控股有限公司(荷蘭)、殼牌(荷蘭)、Indorama Ventures Public Company Limited(泰國)和沙烏地阿拉伯基礎工業公司(沙烏地阿拉伯)等。這些公司正在採取各種策略,例如簽署協議、成立合資企業和拓展業務,以提高其市場佔有率和業務收入。

調查範圍

本報告根據製造流程、應用、最終用途產業和地區對環氧丙烷市場進行細分,預測市場規模,對主要參與企業進行策略分析,全面分析其市場佔有率和核心競爭優勢,並追蹤和分析市場中的競爭發展,如擴張、協議和收購。

購買本報告的理由

本報告旨在透過提供丙烯氧化物市場及其細分市場最準確的收入估計值,為市場領導和新參與企業提供幫助。此外,本報告還將幫助相關人員深入了解市場競爭格局,獲取寶貴資訊以鞏固其業務地位,並制定有效的打入市場策略。報告還概述了市場趨勢,並提供了關鍵市場促進因素、限制、挑戰和機會的資訊。

本報告深入分析了以下內容:

- 關鍵促進因素(聚氨酯製造對聚醚多元醇的需求不斷成長,其他終端用戶行業的需求不斷成長)、限制因素(環氧丙烷的健康危害分類和毒性,職業安全和合規性限制)、機遇(清潔生產技術的開發和應用,新興市場的擴張原料和石油保健行業的新興應用)以及挑戰環氧聚氨酯泡棉

- 產品開發/創新:對環氧丙烷市場即將出現的技術趨勢和研發活動進行詳細分析

- 市場發展:關於盈利市場的全面資訊:該報告分析了各個地區的環氧丙烷市場。

- 市場多元化:關於環氧丙烷市場的新產品、類型、未開發地區、近期趨勢和投資的全面訊息

- 競爭格局分析:對環氧丙烷市場主要企業的市場佔有率、成長策略和產品供應進行詳細評估,包括陶氏化學(美國)、利安德巴塞爾工業控股有限公司(荷蘭)、殼牌(荷蘭)、Indorama Ventures Public Company Limited(泰國)和沙烏地基礎工業公司(沙烏地阿拉伯)。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 新的經營模式和生態系統變化

- 1/2/3級參與企業的策略舉措

第5章 產業趨勢

- 波特五力分析

- 宏觀經濟展望

- 價值鏈分析

- 生態系分析

- 定價分析

- 貿易分析

- 2025-2026 年主要會議和活動

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 案例研究分析

- 2025年美國關稅對環氧丙烷市場的影響

第6章:技術進步、人工智慧的影響、專利、創新與未來應用

- 關鍵新興技術

- 互補技術

- 鄰近技術

- 專利分析

- 未來應用

- 人工智慧/新一代人工智慧對環氧丙烷市場的影響

第7章永續性和監管環境

- 地方法規和合規性

- 對永續性的承諾

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第8章:顧客狀況與購買行為

- 決策流程

- 買方相關人員和採購評估標準

- 招募障礙和內部挑戰

- 各個終端用戶產業尚未滿足的需求

- 市場盈利

第9章 環氧丙烷市場(依應用領域分類)

- 聚醚多元醇

- 丙二醇

- 乙二醇醚

- 其他

第10章 環氧丙烷市場(依終端用途產業分類)

- 車

- 建築/施工

- 化學品和製藥

- 紡織品和家具

- 包裝

- 電子學

- 其他

第11章 環氧丙烷市場(依生產流程分類)

- 氯水法

- 苯乙烯單體工藝

- 待定聯合生產流程

- 過氧化氫工藝

- 基於異丙苯的工藝

第12章 環氧丙烷市場(按地區分類)

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 泰國

- 澳洲

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 荷蘭

- 俄羅斯

- 其他

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 海灣合作理事會其他成員國

- 南非

- 其他

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他

第13章 競爭格局

- 主要參與企業的策略/優勢

- 2024年收入分析

- 2024年市佔率分析

- 品牌/產品對比

- 估值和財務指標

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第14章:公司簡介

- 主要參與企業

- DOW

- LYONDELLBASELL INDUSTRIES HOLDINGS BV

- SHELL

- BASF

- AGC INC.

- REPSOL

- TOKUYAMA CORPORATION

- SUMITOMO CHEMICAL CO., LTD.

- SKC

- EVONIK

- SABIC

- BALCHEM CORP.

- INDORAMA VENTURES PUBLIC COMPANY LIMITED

- TOKYO CHEMICAL INDUSTRY CO., LTD.

- 其他公司

- PCC SE

- WANHUA

- OLTCHIM SA

- WUDI XINYUE CHEMICAL

- S-OIL CORPORATION

- BEFAR GROUP CO., LTD.

- CNOOC SHELL PETROCHEMICALS CO., LTD.

第15章調查方法

第16章附錄

The propylene oxide market is projected to grow from USD 14.89 billion in 2025 to USD 18.88 billion by 2030, at a CAGR of 4.9% during the forecast period. The prime driving force in the propylene oxide market, given the substance's vital use in the production of polyurethane in the form of polyether polyols in rigid and flexible foams, is propylene oxide's use in the production of foams, which directly stimulates the volume of propylene oxide production.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) Volume (Kiloton) |

| Segments | Production Process, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

The increasing rate of urbanization in the world, including the Asian, North American, and European markets, is increasing the use of lightweight building structure material, in addition to efficient thermal insulation. The principal driving force is often regarded as the structural pull provided by derivatives of polyurethane.

"By application, the polyether polyols segment is estimated to account for the largest share, in terms of volume, during the forecast period."

The polyether polyols market is expected to account for the largest volume share during the forecasted period due to its wide usage in volume-driven end-use applications and its highest consumption of propylene oxide. Rigid and flexible polyurethane foams, which are widely used in building insulation, car seats, and interior trims, furniture, bedding, and packaging, respectively, are mainly produced using polyether polyols. The demand for polyether polyol foam is being largely stimulated by the rising demand due to the fast-growing number of construction projects, the increasing demand for energy-efficient buildings, and the rising production levels of automobiles, particularly lightweight and electric cars. Additionally, polyether polyols offer an edge over alternatives because of their superior properties, including flexibility, strength, and ease of processing. The polyether polyols continuously hold the highest volume market due to large and continuous production, which in turn supports high use levels of propylene oxide.

"By end-use industry, the automotive segment is estimated to be the fastest-growing segment of the propylene oxide market during the forecast period."

The automotive application segment of the propylene oxide market is expected to grow at the most prominent pace through the forecast period due to the growing use of lightweight and high-performance materials in the car industry, propylene oxide-based polyether polyols are primarily used to make polyurethane foams intended for applications related to the creation of seating, head rests, arm rests, and curtain and trunk linings with a focus on promoting passenger comfort, safety, and noise reduction capabilities within a vehicle. Further driving the demand is the rampant shift toward the use of electric cars, with car manufacturers exemplifying the use of lightweight materials to boost the efficiency and range of electric cars. The rising use of polyurethane parts is also gaining impetus with the growing production volumes of autos within developing countries and more stringent pollution and fuel economy norms. The propylene oxide market is also being driven by the marked growth trajectory illustrated by the car interior sector, with more focus on passenger comfort.

"By production process, the styrene monomer process segment is estimated to hold the largest share, in terms of volume, during the forecast period."

The styrene monomer process is estimated to account for the largest volume share within the propylene oxide market during the forecast period due to its strong link with styrene manufacture and its large worldwide capacity. By aiding the simultaneous manufacture of propylene oxide and styrene monomer, the SM process allows companies to leverage economies of scale, high efficiency, and optimal costs. Large players often resort to this process, which relies on the well-known demand for styrene from various consumer products, construction, and packaging sectors. Assuming the large capital expenditure requirements involved with upgrading or changing processes, most old facilities have yet to shift from the styrene monomer process. To its credit, the process holds large-scale volumes within collective propylene oxide manufacture due to its well-proven reliability, capabilities, and matching demand within the styrene segment.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 30%, Tier 2 - 35%, and Tier 3 - 35%

- By Designation: C-level Executives - 30%, Directors - 60%, and Others - 10%

- By Region: North America - 30%, Asia Pacific - 15%, Europe - 40%, Middle East & Africa - 10%, and South America - 5%

Dow (US), LyondellBasell Industries Holdings B.V. (Netherlands), Shell (Netherlands), Indorama Ventures Public Company Limited (Thailand), and SABIC (Saudi Arabia) are among the key players in the propylene oxide market. These players have adopted various strategies, including agreements, joint ventures, and expansions, to increase their market share and business revenue.

Research Coverage

The report defines segments and projects the size of the propylene oxide market based on production process, application, end-use industry, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as expansions, agreements, and acquisitions undertaken by them in the market.

Reasons to Buy the Report

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the propylene oxide market and its segments. This report is also expected to help stakeholders gain a deeper understanding of the market's competitive landscape, acquire valuable insights to enhance their business positions, and develop effective go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of critical drivers (rising demand for polyether polyols for the production of polyurethanes, growing demand from other end use industries), restraints (health hazard classification and toxic nature of propylene oxide, occupational safety and compliance constraints), opportunities (development and adoption of cleaner production technologies, expanding opportunities in developing markets, emerging applications in healthcare industry), and challenges (price volatility of raw materials, use of bio-based feedstock for polyurethane foam instead of petroleum) influencing the growth of the propylene oxide market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the propylene oxide market

- Market Development: Comprehensive information about lucrative markets: the report analyzes the propylene oxide market across varied regions

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the propylene oxide market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Dow (US), LyondellBasell Industries Holdings B.V. (Netherlands), Shell (Netherlands), Indorama Ventures Public Company Limited (Thailand), SABIC (Saudi Arabia), and others are the key players in the propylene oxide market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PROPYLENE OXIDE MARKET

- 3.2 PROPYLENE OXIDE MARKET, BY TYPE AND REGION

- 3.3 PROPYLENE OXIDE MARKET, BY PRODUCTION PROCESS

- 3.4 PROPYLENE OXIDE MARKET, BY END-USE INDUSTRY

- 3.5 PROPYLENE OXIDE MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising demand for polyether polyols for production of polyurethanes

- 4.2.1.2 Growing demand from automotive and building & construction industries

- 4.2.2 RESTRAINTS

- 4.2.2.1 Health hazard classification and toxic nature of propylene oxide

- 4.2.2.2 Occupational safety and compliance constraints

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Development and adoption of cleaner production technologies

- 4.2.3.2 Expanding opportunities in developing markets

- 4.2.3.3 Emerging applications in healthcare industry

- 4.2.4 CHALLENGES

- 4.2.4.1 Price volatility of raw materials

- 4.2.4.2 Use of bio-based feedstock for polyurethane foam instead of petroleum

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN PROPYLENE OXIDE MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 OIL & GAS INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.2.5 TRENDS IN MANUFACTURING INDUSTRY

- 5.2.6 TRENDS IN GLOBAL ELECTRONICS INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5.2 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2025 (USD/TON)

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 291020)

- 5.6.2 EXPORT SCENARIO (HS CODE 291020)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HEALTH CLASSIFICATION DRIVING RISK MANAGEMENT IN PROPYLENE OXIDE MARKET

- 5.10.2 LOW TEMPERATURE DIRECT OXIDATION OF PROPANE TO PROPYLENE OXIDE USING SUPPORTED SUBNANOMETER CU CLUSTERS

- 5.10.3 GREEN SYNTHESIS OF PROPYLENE OXIDE DIRECTLY FROM PROPANE

- 5.11 IMPACT OF 2025 US TARIFF ON PROPYLENE OXIDE MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 CHLOROHYDRIN PROCESS (CHPO)

- 6.1.2 ETHYLBENZENE HYDROPEROXIDE WITH STYRENE CO-PRODUCT (SMPO/POSM)

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 TERT-BUTYL ALCOHOL CO PRODUCT PROCESS (TBA ROUTE)

- 6.2.2 EPOXIDATION WITH HYDROGEN PEROXIDE (HPPO)

- 6.2.3 CUMENE HYDROPEROXIDE (CHP) PROCESS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 GREEN SYNTHESIS OF PROPYLENE OXIDE DIRECTLY FROM PROPANE

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 INSIGHTS

- 6.4.5 LEGAL STATUS OF PATENTS

- 6.4.6 JURISDICTION ANALYSIS

- 6.4.7 TOP APPLICANTS

- 6.4.8 LIST OF MAJOR PATENTS

- 6.5 FUTURE APPLICATIONS

- 6.5.1 POLYURETHANE SYSTEMS: HIGH PERFORMANCE FOAMS AND ELASTOMERS FOR CONSTRUCTION, AUTOMOTIVE, AND INDUSTRIAL APPLICATIONS

- 6.5.2 ELECTRIC VEHICLE & BATTERY SAFETY MATERIALS: ADVANCED FOAMS AND ELASTOMERS FOR BATTERY THERMAL MANAGEMENT AND FIRE PROTECTION

- 6.5.3 SUSTAINABLE CONSUMER & PHARMA INGREDIENTS: BIOCOMPATIBLE PROPYLENE GLYCOL DERIVATIVES REPLACING HIGHER TOXICITY ALTERNATIVES

- 6.5.4 ENERGY EFFICIENT BUILDING MATERIALS: ADVANCED INSULATION SYSTEMS SUPPORTING GLOBAL ENERGY EFFICIENCY STANDARDS

- 6.5.5 SPECIALTY CHEMICALS & COATINGS: HIGH PURITY SOLVENTS AND INTERMEDIATES FOR ELECTRONICS, COATINGS, AND ADVANCED MATERIALS

- 6.6 IMPACT OF AI/GEN AI ON PROPYLENE OXIDE MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES: COMPANIES/INSTITUTIONS USE CASES

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN PROPYLENE OXIDE MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN PROPYLENE OXIDE MARKET

- 6.6.6 SUCCESS STORIES AND REAL WORLD APPLICATIONS

- 6.6.6.1 BASF: AI-enabled optimization in propylene oxide production

- 6.6.6.2 Dow: Artificial intelligence readiness in large-scale propylene oxide manufacturing

- 6.6.6.3 LyondellBasell: Artificial intelligence integration supporting propylene oxide and PO/SM operations

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO APPLICATIONS OF PROPYLENE OXIDE

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 PROPYLENE OXIDE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 POLYETHER POLYOLS

- 9.2.1 INCREASED CONSUMPTION IN POLYURETHANE INDUSTRY TO DRIVE MARKET

- 9.3 PROPYLENE GLYCOLS

- 9.3.1 RISING DEMAND FOR PETROLEUM-BASED PROPYLENE GLYCOL BOOSTING MARKET

- 9.4 GLYCOL ETHERS

- 9.4.1 BROAD ADOPTION IN TEXTILES, AUTOMOTIVE, PHARMACEUTICALS, AND CHEMICAL SECTORS DRIVING MARKET EXPANSION

- 9.5 OTHER APPLICATIONS

10 PROPYLENE OXIDE MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE

- 10.2.1 STRONG GROWTH OF AUTOMOTIVE INDUSTRY TO DRIVE DEMAND

- 10.3 BUILDING & CONSTRUCTION

- 10.3.1 HIGH DEMAND FOR UNSATURATED POLYESTER RESINS TO DRIVE MARKET GROWTH

- 10.4 CHEMICAL & PHARMACEUTICAL

- 10.4.1 DEMAND FOR SOLVENTS AND COUPLING AGENTS IN PAINTS TO SUPPORT MARKET GROWTH

- 10.5 TEXTILE & FURNISHING

- 10.5.1 RISING ADOPTION IN MANUFACTURE OF SYNTHETIC FIBERS AND SPECIALIZED COATINGS TO BOOST GROWTH

- 10.6 PACKAGING

- 10.6.1 RISING DEMAND FOR LIGHTWEIGHT, DURABLE, AND IMPACT-RESISTANT PACKAGING SOLUTIONS STRENGTHENING ADOPTION

- 10.7 ELECTRONICS

- 10.7.1 EXPANDING ELECTRONICS MANUFACTURING AND MAINTENANCE ACTIVITIES INCREASING CONSUMPTION OF PROPYLENE GLYCOL ETHERS

- 10.8 OTHER END-USE INDUSTRIES

11 PROPYLENE OXIDE MARKET, BY PRODUCTION PROCESS

- 11.1 INTRODUCTION

- 11.2 CHLOROHYDRIN PROCESS

- 11.2.1 HIGHER EFFICIENCY AND SUSTAINABILITY SUPPORTING MARKET GROWTH

- 11.3 STYRENE MONOMER PROCESS

- 11.3.1 STYRENE MONOMER/PROPYLENE PRODUCTION PROCESS GAINING POPULARITY OWING TO ITS SUPERIOR ECONOMICS

- 11.4 TBA CO-PRODUCT PROCESS

- 11.4.1 HIGH YIELD EFFICIENCY AND LOWER ENVIRONMENTAL FOOTPRINT INCREASING ADOPTION

- 11.5 HYDROGEN PEROXIDE PROCESS

- 11.5.1 INCREASING DEMAND FOR CLEANER & COST-EFFECTIVE METHOD SUPPORTING MARKET GROWTH

- 11.6 CUMENE-BASED PROCESS

- 11.6.1 HIGH YIELD EFFICIENCY, LOW ENVIRONMENTAL FOOTPRINT, AND INTEGRATION WITH PHENOL MANUFACTURING TO ENHANCE MARKET GROWTH

12 PROPYLENE OXIDE MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Strong industrial expansion driving market growth

- 12.2.2 JAPAN

- 12.2.2.1 Growing automotive and construction industries to drive demand

- 12.2.3 INDIA

- 12.2.3.1 Strong growth of automotive sector to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Market characterized by shift toward sustainable production methods

- 12.2.5 THAILAND

- 12.2.5.1 Increasing construction activities to support market growth

- 12.2.6 AUSTRALIA

- 12.2.6.1 Push for development of energy-efficient buildings to support market growth

- 12.2.7 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Strong demand for propylene glycol to drive market growth

- 12.3.2 CANADA

- 12.3.2.1 Excellent manufacturing facilities and infrastructure to drive market growth

- 12.3.3 MEXICO

- 12.3.3.1 Free trade agreements with other countries to fuel market growth

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Growing automotive industry to increase consumption of propylene oxide

- 12.4.2 FRANCE

- 12.4.2.1 Presence of foreign investors to support market growth

- 12.4.3 UK

- 12.4.3.1 Preference for sustainable and high-quality propylene oxide to increase production

- 12.4.4 ITALY

- 12.4.4.1 Expanding automotive and construction industries to boost market

- 12.4.5 SPAIN

- 12.4.5.1 Growth in commercial construction sector to fuel demand

- 12.4.6 NETHERLANDS

- 12.4.6.1 Demand in polyether polyols applications to drive market growth

- 12.4.7 RUSSIA

- 12.4.7.1 Investment in unsaturated polyester resin and polyurethanes to drive market

- 12.4.8 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 SAUDI ARABIA

- 12.5.1.1 Initiatives to develop automotive sector to drive demand

- 12.5.2 UAE

- 12.5.2.1 Increasing infrastructure activities to support market growth

- 12.5.3 REST OF GCC

- 12.5.3.1 Increasing infrastructure activities to fuel market growth

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Increasing infrastructure projects and automotive manufacturing to drive market

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.5.1 SAUDI ARABIA

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Presence of strong automotive sector to drive market

- 12.6.2 ARGENTINA

- 12.6.2.1 Well-developed infrastructure to support market growth

- 12.6.3 CHILE

- 12.6.3.1 Expansion of automotive, building & construction, and chemical industries to drive market

- 12.6.4 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.4.1 DOW (US)

- 13.4.2 LYONDELLBASELL INDUSTRIES HOLDINGS B.V. (NETHERLANDS)

- 13.4.3 SHELL (UK)

- 13.4.4 INDORAMA VENTURES PUBLIC COMPANY LIMITED (THAILAND)

- 13.4.5 SABIC (SAUDI ARABIA)

- 13.5 BRAND/PRODUCT COMPARISON

- 13.5.1 DOW

- 13.5.2 LYONDELLBASELL

- 13.5.3 SHELL

- 13.5.4 BASF

- 13.5.5 AGC

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Production process footprint

- 13.7.5.4 Application footprint

- 13.7.5.5 End-use industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 EXPANSIONS

14 COMPANY PROFILES

- 14.1 MAJOR PLAYERS

- 14.1.1 DOW

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 SHELL

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 BASF

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 AGC INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 REPSOL

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Expansions

- 14.1.7 TOKUYAMA CORPORATION

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 SUMITOMO CHEMICAL CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 SKC

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 EVONIK

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Expansions

- 14.1.11 SABIC

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Expansions

- 14.1.12 BALCHEM CORP.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 INDORAMA VENTURES PUBLIC COMPANY LIMITED

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.14 TOKYO CHEMICAL INDUSTRY CO., LTD.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.1 DOW

- 14.2 OTHER PLAYERS

- 14.2.1 PCC SE

- 14.2.2 WANHUA

- 14.2.3 OLTCHIM S.A.

- 14.2.4 WUDI XINYUE CHEMICAL

- 14.2.5 S-OIL CORPORATION

- 14.2.6 BEFAR GROUP CO., LTD.

- 14.2.7 CNOOC SHELL PETROCHEMICALS CO., LTD.

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 List of participating companies for primary research

- 15.1.2.3 Key industry insights

- 15.1.2.4 Breakdown of primary interviews

- 15.1.1 SECONDARY DATA

- 15.2 MARKET SIZE ESTIMATION

- 15.2.1 TOP-DOWN APPROACH

- 15.3 BASE NUMBER CALCULATION

- 15.3.1 DEMAND-SIDE APPROACH

- 15.3.2 SUPPLY-SIDE APPROACH

- 15.4 MARKET FORECAST APPROACH

- 15.4.1 SUPPLY SIDE

- 15.4.2 DEMAND SIDE

- 15.5 DATA TRIANGULATION

- 15.6 FACTOR ANALYSIS

- 15.7 RESEARCH ASSUMPTIONS

- 15.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PROPYLENE OXIDE MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

- TABLE 2 PROPYLENE OXIDE MARKET, BY PRODUCTION PROCESS: INCLUSIONS & EXCLUSIONS

- TABLE 3 PROPYLENE OXIDE MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

- TABLE 4 PROPYLENE OXIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 GDP PERCENTAGE CHANGE, BY KEY COUNTRIES, 2021-2029

- TABLE 6 GLOBAL OIL & GAS PRICES, USD/BBL (2023-2025)

- TABLE 7 PROPYLENE OXIDE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE RANGE OF PROPYLENE OXIDE, BY REGION, 2022-2025 (USD/TON)

- TABLE 9 AVERAGE SELLING PRICE RANGE OF PROPYLENE OXIDE, BY APPLICATION, 2022-2025 (USD/TON)

- TABLE 10 IMPORT DATA FOR HS CODE 291020-COMPLIANT PRODUCTS, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 291020-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- TABLE 12 PROPYLENE OXIDE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2026-2027

- TABLE 13 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 PROPYLENE OXIDE MARKET: TOTAL NUMBER OF PATENTS, 2015-2025

- TABLE 15 TOP USE CASES AND MARKET POTENTIAL

- TABLE 16 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 17 PROPYLENE OXIDE MARKET: CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION

- TABLE 18 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 GLOBAL STANDARDS IN PROPYLENE OXIDE MARKET

- TABLE 24 OCCUPATIONAL EXPOSURE LIMITS AND GUIDELINES FOR PROPYLENE OXIDE

- TABLE 25 CERTIFICATIONS, LABELING, AND ECO STANDARDS IN PROPYLENE OXIDE MARKET

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 27 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 28 PROPYLENE OXIDE MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES

- TABLE 29 PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 30 PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 31 PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 32 PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 33 PROPYLENE OXIDE MARKET IN POLYETHER POLYOLS, BY REGION, 2022-2024 (KILOTON)

- TABLE 34 PROPYLENE OXIDE MARKET IN POLYETHER POLYOLS, BY REGION, 2025-2030 (KILOTON)

- TABLE 35 PROPYLENE OXIDE MARKET IN POLYETHER POLYOLS, BY REGION, 2022-2024 (USD MILLION)

- TABLE 36 PROPYLENE OXIDE MARKET IN POLYETHER POLYOLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 PROPYLENE OXIDE MARKET IN POLYETHER GLYCOLS, BY REGION, 2022-2024 (KILOTON)

- TABLE 38 PROPYLENE OXIDE MARKET IN POLYETHER GLYCOLS, BY REGION, 2025-2030 (KILOTON)

- TABLE 39 PROPYLENE OXIDE MARKET IN POLYETHER GLYCOLS, BY REGION, 2022-2024 (USD MILLION)

- TABLE 40 PROPYLENE OXIDE MARKET IN POLYETHER GLYCOLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 PROPYLENE OXIDE MARKET IN GLYCOL ETHERS, BY REGION, 2022-2024 (KILOTON)

- TABLE 42 PROPYLENE OXIDE MARKET IN GLYCOL ETHERS, BY REGION, 2025-2030 (KILOTON)

- TABLE 43 PROPYLENE OXIDE MARKET IN GLYCOL ETHERS, BY REGION, 2022-2024 (USD MILLION)

- TABLE 44 PROPYLENE OXIDE MARKET IN GLYCOL ETHERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 PROPYLENE OXIDE MARKET IN OTHER APPLICATIONS, BY REGION, 2022-2024 (KILOTON)

- TABLE 46 PROPYLENE OXIDE MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (KILOTON)

- TABLE 47 PROPYLENE OXIDE MARKET IN OTHER APPLICATIONS, BY REGION, 2022-2024 (USD MILLION)

- TABLE 48 PROPYLENE OXIDE MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 PROPYLENE OXIDE MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 50 PROPYLENE OXIDE MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 51 PROPYLENE OXIDE MARKET, BY PRODUCTION PROCESS, 2022-2024 (KILOTON)

- TABLE 52 PROPYLENE OXIDE MARKET, BY PRODUCTION PROCESS, 2025-2030 (KILOTON)

- TABLE 53 PROPYLENE OXIDE MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 54 PROPYLENE OXIDE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 55 PROPYLENE OXIDE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 56 PROPYLENE OXIDE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 58 ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 59 ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 62 ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 63 ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 CHINA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 66 CHINA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 67 CHINA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 68 CHINA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 JAPAN: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 70 JAPAN: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 71 JAPAN: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 72 JAPAN: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 INDIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 74 INDIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 75 INDIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 76 INDIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 SOUTH KOREA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 78 SOUTH KOREA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 79 SOUTH KOREA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 80 SOUTH KOREA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 THAILAND: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 82 THAILAND: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 83 THAILAND: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 84 THAILAND: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 AUSTRALIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 86 AUSTRALIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 87 AUSTRALIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 88 AUSTRALIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 90 REST OF ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 91 REST OF ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 94 NORTH AMERICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 95 NORTH AMERICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 98 NORTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 99 NORTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 US: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 102 US: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 103 US: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 104 US: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 CANADA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 106 CANADA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 107 CANADA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 108 CANADA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 MEXICO: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 110 MEXICO: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 111 MEXICO: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 112 MEXICO: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 114 EUROPE: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 115 EUROPE: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 116 EUROPE: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 118 EUROPE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 119 EUROPE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 120 EUROPE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 GERMANY: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 122 GERMANY: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 123 GERMANY: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 124 GERMANY: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 FRANCE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 126 FRANCE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 127 FRANCE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 128 FRANCE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 UK: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 130 UK: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 131 UK: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 132 UK: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 134 ITALY: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 135 ITALY: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 136 ITALY: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 SPAIN: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 138 SPAIN: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 139 SPAIN: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 140 SPAIN: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 NETHERLANDS: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 142 NETHERLANDS: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 143 NETHERLANDS: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 144 NETHERLANDS: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 RUSSIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 146 RUSSIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 147 RUSSIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 148 RUSSIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 REST OF EUROPE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 150 REST OF EUROPE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 151 REST OF EUROPE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 152 REST OF EUROPE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 154 MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 158 MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 SAUDI ARABIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 162 SAUDI ARABIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 163 SAUDI ARABIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 164 SAUDI ARABIA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 UAE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 166 UAE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 167 UAE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 168 UAE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 REST OF GCC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 170 REST OF GCC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 171 REST OF GCC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 172 REST OF GCC: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 174 SOUTH AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 175 SOUTH AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 176 SOUTH AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 182 SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 183 SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 184 SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 186 SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 187 SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 BRAZIL: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 190 BRAZIL: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 191 BRAZIL: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 192 BRAZIL: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193 ARGENTINA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 194 ARGENTINA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 195 ARGENTINA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 196 ARGENTINA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 CHILE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 198 CHILE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 199 CHILE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 200 CHILE: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 202 REST OF SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 203 REST OF SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: PROPYLENE OXIDE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 PROPYLENE OXIDE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS (2020-2025)

- TABLE 206 PROPYLENE OXIDE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 207 PROPYLENE OXIDE MARKET: REGION FOOTPRINT

- TABLE 208 PROPYLENE OXIDE MARKET: PRODUCTION PROCESS FOOTPRINT

- TABLE 209 PROPYLENE OXIDE MARKET: APPLICATION FOOTPRINT

- TABLE 210 PROPYLENE OXIDE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 211 PROPYLENE OXIDE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 212 PROPYLENE OXIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 213 PROPYLENE OXIDE MARKET: DEALS, JANUARY 2020-DECEMBER 2025

- TABLE 214 PROPYLENE OXIDE MARKET: EXPANSIONS, JANUARY 2020-DECEMBER 2025

- TABLE 215 DOW: COMPANY OVERVIEW

- TABLE 216 DOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 DOW: EXPANSIONS

- TABLE 218 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY OVERVIEW

- TABLE 219 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: EXPANSIONS

- TABLE 221 SHELL: COMPANY OVERVIEW

- TABLE 222 SHELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 BASF: COMPANY OVERVIEW

- TABLE 224 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 AGC INC.: COMPANY OVERVIEW

- TABLE 226 AGC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 REPSOL: COMPANY OVERVIEW

- TABLE 228 REPSOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 REPSOL: EXPANSIONS

- TABLE 230 TOKUYAMA CORPORATION: COMPANY OVERVIEW

- TABLE 231 TOKUYAMA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 SUMITOMO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 233 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 SKC: COMPANY OVERVIEW

- TABLE 235 SKC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 EVONIK: COMPANY OVERVIEW

- TABLE 237 EVONIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 EVONIK: EXPANSIONS

- TABLE 239 SABIC: COMPANY OVERVIEW

- TABLE 240 SABIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 SABIC: EXPANSIONS

- TABLE 242 BALCHEM CORP.: COMPANY OVERVIEW

- TABLE 243 BALCHEM CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 245 INDORAMA VENTURES PUBLIC COMPANY LIMITED: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 246 INDORAMA VENTURES PUBLIC COMPANY LIMITED: DEALS

- TABLE 247 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 248 TOKYO CHEMICAL INDUSTRY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 PCC SE: COMPANY OVERVIEW

- TABLE 250 WANHUA: COMPANY OVERVIEW

- TABLE 251 OLTCHIM S.A.: COMPANY OVERVIEW

- TABLE 252 WUDI XINYUE CHEMICAL: COMPANY OVERVIEW

- TABLE 253 S-OIL CORPORATION: COMPANY OVERVIEW

- TABLE 254 BEFAR GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 255 CNOOC SHELL PETROCHEMICALS CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PROPYLENE OXIDE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL PROPYLENE OXIDE MARKET, 2025-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN PROPYLENE OXIDE MARKET (2020-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF PROPYLENE OXIDE MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN PROPYLENE OXIDE MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 HIGH DEMAND IN AUTOMOTIVE AND PHARMACEUTICALS INDUSTRIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 9 POLYETHER POLYOLS ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 STYRENE MONOMER PROCESS ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 PROPYLENE OXIDE: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 POLYURETHANE FOAM DEMAND FROM 2023 TO 2028 (KILOTON)

- FIGURE 15 GLOBAL BEV AND PHEV DEMAND, 2024-2035 (MILLION LIGHT VEHICLES)

- FIGURE 16 WORLD POPULATION CONCENTRATION, 2023

- FIGURE 17 ASIA PACIFIC AVERAGE GDP GROWTH, 2015-2030 (%)

- FIGURE 18 GLOBAL VEHICLE PRODUCTION IN EMERGING COUNTRIES/ REGIONS (MILLION UNITS)

- FIGURE 19 PROPYLENE OXIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 WORLD OIL DEMAND, BY REGION, 2019-2030 (MB/D)

- FIGURE 21 PROPYLENE OXIDE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 PROPYLENE OXIDE MARKET: KEY PARTICIPANTS IN ECOSYSTEM

- FIGURE 23 PROPYLENE OXIDE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2025 (USD/TON)

- FIGURE 25 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2025 (USD/TON)

- FIGURE 26 IMPORT SCENARIO FOR HS CODE 291020-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024

- FIGURE 27 EXPORT SCENARIO FOR HS CODE 291020-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 PROPYLENE OXIDE MARKET: INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 30 PATENT ANALYSIS, BY DOCUMENT TYPE, 2015-2025

- FIGURE 31 PATENT PUBLICATION TRENDS, 2015-2025

- FIGURE 32 LEGAL STATUS OF PATENT, JANUARY 2015-DECEMBER 2025

- FIGURE 33 JURISDICTION OF US REGISTERED HIGHEST SHARE OF PATENTS, 2015-2025

- FIGURE 34 TOP PATENT APPLICANTS, 2015-2025

- FIGURE 35 FUTURE APPLICATIONS OF PROPYLENE OXIDE MARKET

- FIGURE 36 PROPYLENE OXIDE MARKET: DECISION-MAKING FACTORS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 38 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 39 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 40 PROPYLENE OXIDE MARKET, BY APPLICATION, 2025 & 2030

- FIGURE 41 AUTOMOTIVE END-USE INDUSTRY TO LEAD PROPYLENE OXIDE MARKET

- FIGURE 42 STYRENE MONOMER PROCESS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO DOMINATE PROPYLENE OXIDE MARKET DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC: PROPYLENE OXIDE MARKET SNAPSHOT

- FIGURE 45 NORTH AMERICA: PROPYLENE OXIDE MARKET SNAPSHOT

- FIGURE 46 EUROPE: PROPYLENE OXIDE MARKET SNAPSHOT

- FIGURE 47 PROPYLENE OXIDE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024

- FIGURE 48 PROPYLENE OXIDE MARKET SHARE ANALYSIS, 2024

- FIGURE 49 PROPYLENE OXIDE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 50 PROPYLENE OXIDE MARKET: EV/EBITDA

- FIGURE 51 PROPYLENE OXIDE MARKET: EV/REVENUE

- FIGURE 52 PROPYLENE OXIDE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 53 PROPYLENE OXIDE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 PROPYLENE OXIDE MARKET: COMPANY FOOTPRINT

- FIGURE 55 PROPYLENE OXIDE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 DOW: COMPANY SNAPSHOT

- FIGURE 57 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

- FIGURE 58 SHELL: COMPANY SNAPSHOT

- FIGURE 59 BASF: COMPANY SNAPSHOT

- FIGURE 60 AGC INC.: COMPANY SNAPSHOT

- FIGURE 61 REPSOL: COMPANY SNAPSHOT

- FIGURE 62 TOKUYAMA CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 64 SKC: COMPANY SNAPSHOT

- FIGURE 65 EVONIK: COMPANY SNAPSHOT

- FIGURE 66 SABIC: COMPANY SNAPSHOT

- FIGURE 67 BALCHEM CORP.: COMPANY SNAPSHOT

- FIGURE 68 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 69 PROPYLENE OXIDE MARKET: RESEARCH DESIGN

- FIGURE 70 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 71 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 72 BASE NUMBER CALCULATION METHODOLOGY: DEMAND-SIDE APPROACH (VOLUME)

- FIGURE 73 BASE NUMBER CALCULATION METHODOLOGY: SUPPLY-SIDE APPROACH (VALUE)

- FIGURE 74 DATA TRIANGULATION