|

市場調查報告書

商品編碼

1919589

全球車載資訊娛樂市場按組件、應用、作業系統、性別、外形規格、顯示器尺寸、地理位置、燃油/電動車和地區分類-預測至2032年In-vehicle Infotainment Market by Component, Application, OS, Connectivity, Form Factor, Display Size, Location, ICE & EV, and Region - Global Forecast to 2032 |

||||||

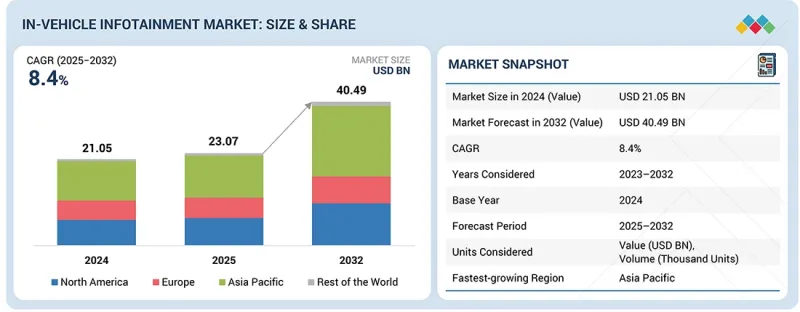

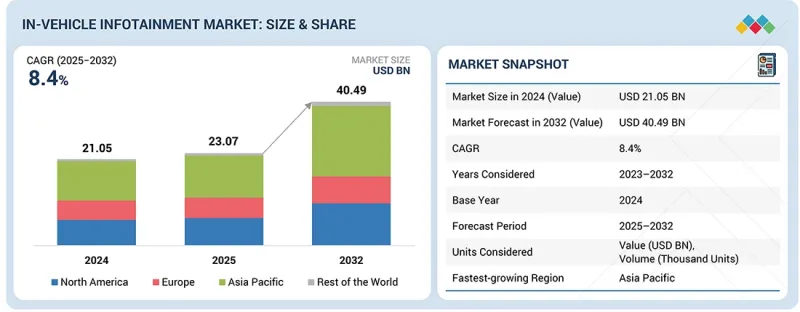

全球車載資訊娛樂市場預計將從 2025 年的 230.7 億美元成長到 2032 年的 404.9 億美元,複合年成長率為 8.4%。

德國、義大利和英國等歐洲國家對聯網汽車和高階汽車的需求不斷成長,先進的駕駛資訊和娛樂功能日益普及,以及消費者對增強型車載數位體驗的強烈偏好,預計將推動市場成長。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2032 |

| 基準年 | 2024 |

| 預測期 | 2025-2032 |

| 單元 | 數量(千單位),金額(百萬美元) |

| 部分 | 組件、作業系統、用途、佈局、連接方式、外形規格、顯示器尺寸、改裝、內燃機汽車類型、電動車類型 |

| 目標區域 | 亞太地區、北美地區、歐洲地區和世界其他地區 |

隨著中國、韓國和日本高級產品和高階電動車的擴張,亞太地區車載資訊娛樂市場持續成長。此外,5G的快速普及、消費者對互聯服務的高度接受以及政府主導的智慧出行計劃,都在推動車載資訊娛樂市場的成長,並加速了資訊娛樂系統在所有車型領域(尤其是乘用車領域)的普及。

“預計在預測期內,車載資訊娛樂系統細分市場將引領車載資訊娛樂市場。”

按組件分類,資訊娛樂系統預計仍將是關鍵細分市場,因為汽車製造商正加速向中高階乘用車和緊湊型車轉向中大型整合數位顯示器。在新興的亞洲市場,顯示器尺寸通常隨車輛價格的提升而增加,入門級車型為3-5英寸,中階車型為8-10英寸,而高階車型則為12英寸及以上。隨著導航、媒體、車輛功能、智慧型應用甚至某些ADAS(高級駕駛輔助系統)疊加功能的日益數位化,大型中央螢幕(10英吋以上)的需求強勁,因為它們能夠提供類似智慧型手機的豐富介面。在中檔車型中,配備8至10.25英寸的顯示器無需對內裝進行重大改動即可經濟有效地營造“高級感”,從而提升車輛的價值感知。此外,高階和豪華車型正在推動多螢幕座艙的普及,尤其是後座資訊娛樂系統。這些高解析度顯示器支援串流媒體播放、遊戲和無縫設備整合,在歐洲和北美等高階汽車普及率高的地區,其應用尤為顯著。隨著數位化車隊管理系統的日益普及,汽車製造商也在皮卡、廂型車和重型卡車領域整合更大、更強大的顯示器。

由於集中式運算和高性能汽車SoC,跨柱顯示器正成為高階汽車駕駛座的關鍵趨勢。透過將儀錶群和資訊娛樂系統整合到單一連續螢幕上,汽車製造商可以增強其豐富的人機互動介面(HMI)、即時視覺化效果和軟體差異化優勢。例如,Mercedes-Benz的MBUX Hyperscreen、BMW的下一代全景顯示概念(Panoramic iDrive)以及中國主要電動車製造商的類似產品。此外,乘客顯示器正在發展成為一個獨立的車載體驗層,支援媒體播放、遊戲和數位服務,同時符合有關駕駛員分心的法規。梅賽德斯-奔馳、奧迪和現代起亞等汽車製造商正將這些顯示器定位為透過連網服務和空中下載(OTA)功能升級來創造收入的介面。

隨著車載螢幕尺寸越來越大、多螢幕顯示越來越多,並日益被視為互聯數位生活方式的延伸,後排資訊娛樂系統在設計上也更加注重直覺操作、多功能性和提升乘客舒適度。因此,預計到2032年,資訊娛樂系統細分市場將繼續引領汽車零件市場。

本報告分析了全球車載資訊娛樂市場,並深入分析了關鍵促進因素和限制因素、產品開發和創新以及競爭格局。

目錄

第1章 引言

第2章執行摘要

第3章 主要發現

- 車載資訊娛樂市場的巨大機遇

- 車載資訊娛樂市場按類型分類

- 車載資訊娛樂系統市場(按組件分類)

- 車載資訊娛樂系統市場依部署位置分類

- 車載資訊娛樂系統市場

- 車載資訊娛樂市場按應用領域分類

- 以內燃機汽車類型分類的車載資訊娛樂市場

- 車載資訊娛樂市場:互聯性別

- 按車輛類型分類的電動車資訊娛樂市場

- 按車型分類的車載資訊娛樂改裝市場

- 按顯示器尺寸分類的車載資訊娛樂系統改裝市場

- 按地區分類的車載資訊娛樂市場

第4章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

第5章 產業趨勢

- 供應鏈分析

- 生態系分析

- 影響客戶業務的趨勢/顛覆性因素

- 定價分析

- 平均價格範圍:按地區分類的車載資訊娛樂系統(2023 年和 2024 年)

- 平均價格範圍:按車型分類的車載資訊娛樂系統(2023 年和 2024 年)

- 平均價格範圍:車載資訊娛樂系統各組件(2023 年及 2024 年)

- 參考價格趨勢:主要企業車載資訊娛樂系統(2023 年和 2024 年)

- 貿易分析

- 進口情境(2020-2024)

- 出口情境(2020-2024 年)

- 投資和資金籌措方案

- 重大會議和活動(2026 年)

- 案例研究分析

- 車載資訊娛樂市場:OEM廠商分析

第6章:技術進步、人工智慧影響、專利、創新與未來應用

- 專利分析

- 主要新技術

- 乘客顯示螢幕

- 柱間顯示螢幕

- 軟體定義車輛(SDV)

- 貨幣化與服務層生態系(車載支付、訂閱、內容串流)

- 互補技術

- 連接和遠端資訊處理模組(TCUS、V2X、雲端整合)

- 汽車人機介面(HMI)系統

- 未來應用

- 人工智慧驅動的駕駛座助手

- 跨裝置數位連續性

- 人工智慧/生成式人工智慧的影響

第7章永續性與監管環境

- 地方法規和合規性

- 監管機構、政府機構和其他組織

- 車載資訊娛樂系統法規/標準:依國家/地區分類

第8章:顧客狀況與購買行為

- 採購過程中的關鍵相關利益者

- 採購標準

- 搭乘用車

- 商用車輛

9. 依內燃機車輛類型分類的車載資訊娛樂市場

- 乘用車(PC)

- 輕型商用車(LCV)

- 重型商用車(HCV)

- 主要發現

第10章 以電動車類型分類的電動車資訊娛樂市場

- 電池電動車(BEV)

- 插電式混合動力電動車(PHEV)

- 燃料電池電動車(FCEV)

- 主要發現

第11章 車載資訊娛樂改裝市場(依車型分類)

- 搭乘用車

- 商用車輛

- 主要發現

第12章:按應用分類的車載資訊娛樂市場

- 導航

- 虛擬個人助理(VPA)

- App Store

- 音樂

- 後座資訊娛樂系統

- 主要發現

第13章:車載資訊娛樂系統市場(依組件分類)

- 資訊娛樂單元

- 乘客顯示螢幕

- 數位儀錶群

- 抬頭顯示器

- 主要發現

第14章 車載資訊娛樂市場:互聯性別

- 3G/4G

- 5G

- 主要發現

第15章 依顯示幕尺寸分類的車載資訊娛樂市場

- 顯示器尺寸小於5英寸

- 顯示器尺寸從 5 英寸到 10 英寸

- 顯示器尺寸超過10英寸

- 主要發現

第16章:車載資訊娛樂市場(依類型分類)

- 內建格式

- 繫繩

- 整合格式

- 主要發現

第17章:按地區分類的車載資訊娛樂市場

- 前排資訊娛樂系統

- 後座資訊娛樂系統

- 主要發現

第18章:依作業系統分類的車載資訊娛樂市場

- Linux

- QNX

- Android

- 其他作業系統

- Wind River

- OEM/內部生產

- 主要發現

第19章 車載資訊娛樂市場區域分析

- 亞太地區

- 宏觀經濟展望

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 歐洲

- 宏觀經濟展望

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 其他地區

- 宏觀經濟展望

- 巴西

- 南非

- 其他

- 主要發現

第20章 競爭格局

- 概述

- 主要參與企業的策略/優勢(2023-2025)

- 市佔率分析(2024 年)

- 主要企業營收分析(2020-2024)

- 企業估值與財務指標(2024)

- 品牌/產品對比

- 公司估值矩陣:車載資訊娛樂主要企業(2024 年)

- 公司估值矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第21章 公司簡介

- 主要企業

- ALPS ALPINE CO., LTD.

- GARMIN LTD

- PIONEER CORPORATION

- HARMAN INTERNATIONAL

- PANASONIC CORPORATION

- ROBERT BOSCH GMBH

- MITSUBISHI ELECTRIC CORPORATION

- TOMTOM INTERNATIONAL BV

- CONTINENTAL AG

- VISTEON CORPORATION

- 其他公司

- DESAY INDUSTRY

- DENSO CORPORATION

- JVCKENWOOD CORPORATION

- FUJITSU

- FORYOU CORPORATION

- HYUNDAI MOBIS

- FORD MOTOR COMPANY

- APTIV

- MARELLI HOLDINGS CO., LTD.

- GENERAL MOTORS

- AUDI AG

- BMW GROUP

- AISIN CORPORATION

- ALLEGRO MICROSYSTEMS, INC.

- FAURECIA SE

第22章調查方法

第23章附錄

The in-vehicle infotainment market is projected to grow from USD 23.07 billion in 2025 to USD 40.49 billion by 2032 at a CAGR of 8.4%. The increasing demand for connected and premium vehicles from European countries, such as Germany, Italy, and the UK, combined with the expanding integration of advanced driver information and entertainment features, as well as stronger customer preference for enhanced in-cabin digital experiences, will accelerate market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (000 Units) and Value (USD Million) |

| Segments | By Component, Operating System, Application, Location, Connectivity, Form Factor, Display Size, Retrofit by Vehicle Type, ICE Vehicle Type, and Electric Vehicle by Vehicle Type |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World |

The Asia Pacific market for in-vehicle infotainment is expanding as China, South Korea, and Japan scale premium and premium EV products. In addition, the rapid deployment of 5G, strong consumer adoption of connected services, and government-backed intelligent mobility programs are accelerating infotainment adoption across vehicle segments, particularly in passenger cars, driven by the growth in in-vehicle infotainment.

"The infotainment unit segment is projected to lead the in-vehicle infotainment market during the forecast period."

By component, the infotainment unit segment is projected to remain the dominant segment as OEMs accelerate the move toward mid- to large-size integrated digital displays across medium to high-end passenger and light-duty vehicles. In developing Asian markets, display sizes typically scale with vehicle price bracket: 3-5 inches in entry-level cars, 8-10 inches in the mid-segment, and above 12 inches in premium models. Larger central screens (> 10") are gaining strong traction because they enable a richer, more smartphone-like interface while supporting the growing shift of navigation, media, vehicle functions, smart apps, and even specific ADAS overlays into digital form. For mid-priced cars, offering an 8-10.25" display unit also delivers a cost-effective 'premium feel', boosting perceived value without major interior redesigns. Furthermore, premium and luxury models are simultaneously driving growth in multi-screen cabins, especially rear-seat infotainment systems. These high-resolution displays enable streaming, gaming, and seamless device integration, and their adoption is quite prominent in regions with higher premium-vehicle penetration, such as Europe and North America. The rising adoption of digital fleet-management systems is prompting OEMs to integrate larger, more capable displays in the pickup, van, and heavy truck segments.

Pillar-to-pillar displays are becoming a key cockpit trend in premium vehicles, enabled by centralized computers and high-performance automotive SoCs. By integrating the instrument cluster and infotainment systems into a single, continuous screen, OEMs can enhance HMI richness, real-time visualization, and software-led differentiation. Examples include Mercedes-Benz MBUX Hyperscreen and next-generation panoramic display concepts from BMW (Panoramic iDrive) and leading Chinese EV OEMs. Additionally, passenger displays are evolving as a distinct in-cabin experience layer, supporting media consumption, gaming, and digital services while remaining compliant with driver-distraction regulations. OEMs such as Mercedes-Benz, Audi, and Hyundai-Kia are positioning these displays as revenue-generating interfaces through connected services and OTA-enabled feature upgrades.

As larger and more numerous screens in vehicles are increasingly viewed as an extension of a connected, digital lifestyle, and rear-seat infotainment systems are designed for intuitive control, multi-functionality, and enhanced passenger comfort, the infotainment unit segment is projected to continue dominating the components market by 2032.

"The embedded segment is projected to grow at the highest rate in the in-vehicle infotainment market during the forecast period."

By form factor, the embedded segment is poised to be the fastest-growing segment in the in-vehicle infotainment market during the forecast period. This is primarily due to the increasing integration of OEM-fitted units in SUVs and mid-range passenger vehicles. Automakers are increasingly standardizing embedded platforms across their vehicle lineups, offering features such as 4G/5G connectivity, ADAS-linked human-machine interfaces, head-up displays, and manufacturer-grade navigation systems. This approach ensures consistent performance, seamless integration, and secure delivery of infotainment functions across models.

Regulatory changes are further driving the adoption of embedded infotainment systems across regions. For example, in Europe, requirements like eCall expansion, cybersecurity compliance (UNECE R155), and updated software update mandates (UNECE R156) encourage OEMs to implement embedded systems capable of managing emergency services, over-the-air updates, and safety-critical applications reliably. Similarly, in North America, the 2024 NHTSA mandate for automatic emergency braking (FMVSS 127) underscores the importance of seamless integration between infotainment and safety alerts.

With consumer demand for connected, digitally rich cabins on the rise, advances in embedded technology, including 5G connectivity, AI-driven voice control, and cloud-based navigation, are expected to drive the strong growth of embedded infotainment units during the forecast period.

"North America is projected to be the second-largest market for in-vehicle infotainment during the forecast period."

North America remains the second-largest regional market, supported by strong demand for mid- and full-size SUVs and pickup trucks in the US and Canada, higher disposable incomes, and rapid adoption of connected-vehicle features. Automotive OEMs, such as Ford, General Motors, Toyota, Hyundai-Kia, and Tesla, are integrating advanced HMIs, cloud-based navigation, voice-driven interfaces, and OTA-enabled cockpit systems into their mainstream models. The regulatory framework is also shaping this growth, with the 2024 NHTSA mandate requiring automatic emergency braking with pedestrian detection for all light vehicles. As a result, OEMs are accelerating the integration of enhanced digital displays, sensor-fusion alert layers, and real-time ADAS feedback into their infotainment clusters. Additionally, the increasing amount of time drivers spend in vehicles, averaging nearly an hour per day in the US, further reinforces the demand for more capable, intuitive, and connected in-car systems. Moreover, newly launched electric and premium models, such as the Ford F-150 Lightning, Mercedes-Benz GLC, Hyundai Ioniq 6, and BMW i7, demonstrate the shift toward multi-screen layouts, AI-enabled voice assistants, app-store-style ecosystems, and seamless phone-to-vehicle continuity.

Furthermore, the region is witnessing a more substantial uptake of larger central displays, fully digital clusters, co-passenger screens, and integrated infotainment-ADAS interface-features that are increasingly expected, even in mid-segment SUVs. Together, these technological and regulatory forces will continue to strengthen the demand for the in-vehicle infotainment market across the region through the forecast period.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: In-vehicle Infotainment Suppliers - 45%, Automotive OEMs - 35%, and Others - 20%

- By Designation: C-Level - 35%, Directors - 35%, and Others - 30%

- By Region: Asia Pacific - 65%, Europe - 10%, and North America - 25%

The in-vehicle Infotainment market is led by established players, such as Harman International (US), Panasonic Corporation (Japan), Alps Alpine Co., Ltd. (Japan), Robert Bosch GmbH (Germany), and Continental AG (Germany).

Research Coverage:

The study segments the in-vehicle infotainment market and forecasts the market size based on ICE Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), Component (Infotainment Unit, Passenger Display, Display Instrument Cluster, and Head-Up Display), Operating System (Android, Linux, QNX, Microsoft, and Others), Application [Navigation, Virtual Personal Assistant (VPA), App Store, Music, and Rear Seat], Location (Front Row and Rear Row), Connectivity (3G/4G and 5G), Form (Embedded, Tethered, and Integrated), Display Size (< 5", 5"-10", and > 10"), Retrofit by Vehicle Type (Passenger Car and Commercial Vehicle), Electric Vehicle by Vehicle Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, and Fuel-Cell Electric Vehicle), and Region (Asia Pacific, North America, Europe, and the Rest of the World).

The study includes an in-depth competitive analysis of the significant In-vehicle infotainment manufacturers, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall In-vehicle infotainment market and its sub-segments. This report will help stakeholders understand the competitive landscape and gain valuable insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insight into the following points:

- Analysis of key drivers (Expansion of connected and intelligent in-cabin ecosystem enhancing Safety, Comfort, and Experience, increase in demand for rear-seat entertainment, expansion of the global smartphone ecosystem and integration of cloud-based connectivity), restraints (Additional cost of annual subscriptions in infotainment systems, lack of seamless connectivity fragmented operating systems (Android Automotive, QNX, AGL), opportunities (Government mandates on telematics and e-call services; emergence of technologies such as 5G and AI), and challenges (Cybersecurity challenge))

- Product Development/Innovation: Insights into next-generation IVI platforms, AI-enabled human-machine interfaces, multi-display cockpits, and software-defined infotainment architectures

- Market Development: Analysis of demand trends across North America, Europe, and Asia Pacific driven by connected vehicle adoption, regulatory requirements, and rising consumer expectations for digital experiences

- Market Diversification: Evaluation of infotainment solutions across passenger cars, commercial vehicles, and electric vehicles, including opportunities in subscription-based services and cloud-enabled features

- Competitive Assessment: In-depth assessment of market positioning, technology focus, and growth strategies of key players, such as ALPS ALPINE CO., LTD. (Japan), Garmin (US), Pioneer Corporation (Japan), Harman International (US), and Panasonic Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IN-VEHICLE INFOTAINMENT MARKET

- 3.2 IN-VEHICLE INFOTAINMENT MARKET, BY FORM

- 3.3 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT

- 3.4 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION

- 3.5 IN-VEHICLE INFOTAINMENT MARKET, BY OPERATING SYSTEM (OS)

- 3.6 IN-VEHICLE INFOTAINMENT MARKET, BY APPLICATION

- 3.7 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE

- 3.8 IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY

- 3.9 ELECTRIC VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE

- 3.10 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE

- 3.11 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY DISPLAY SIZE

- 3.12 IN-VEHICLE INFOTAINMENT MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Expansion of connected and intelligent in-cabin ecosystems enhancing safety, comfort, and experience

- 4.2.1.2 Increase in demand for rear-seat entertainment

- 4.2.1.3 Expansion of global smartphone ecosystem and integration of cloud-based connectivity

- 4.2.2 RESTRAINTS

- 4.2.2.1 Additional cost of annual subscriptions in infotainment systems

- 4.2.2.2 Lack of seamless connectivity

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Government mandates on telematics and e-call services

- 4.2.3.2 Emergence of 5G, AI, and other technologies

- 4.2.3.2.1 5G

- 4.2.3.2.2 AI

- 4.2.4 CHALLENGES

- 4.2.4.1 Cybersecurity issues

- 4.2.1 DRIVERS

5 INDUSTRY TRENDS

- 5.1 SUPPLY CHAIN ANALYSIS

- 5.2 ECOSYSTEM ANALYSIS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE PRICE RANGE: IN-VEHICLE INFOTAINMENT SYSTEMS, BY REGION, 2023 VS. 2024 (USD)

- 5.4.2 AVERAGE PRICE RANGE: IN-VEHICLE INFOTAINMENT SYSTEMS, BY VEHICLE TYPE, 2023 VS. 2024 (USD)

- 5.4.3 AVERAGE PRICE RANGE: IN-VEHICLE INFOTAINMENT SYSTEMS, BY COMPONENT, 2023 VS. 2024 (USD)

- 5.4.4 INDICATIVE PRICE TREND: IN-VEHICLE INFOTAINMENT SYSTEMS, BY KEY PLAYERS, 2023 VS. 2024 (USD)

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT SCENARIO, 2020-2024

- 5.5.2 EXPORT SCENARIO, 2020-2024

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 KEY CONFERENCES AND EVENTS, 2026

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 ACCURACY, TRACEABILITY, AND REPEATABILITY DRIVING BATTENBERG'S HAPTIC TESTING SUCCESS

- 5.8.2 VOLVO & POLESTAR'S ANDROID AUTOMOTIVE INFOTAINMENT PLATFORM BUILT WITH APTIV

- 5.8.3 AUTOSYNC - DESIGNING SAFER, SMARTER INFOTAINMENT DASHBOARD

- 5.8.4 SNAPP AUTOMOTIVE'S QUEST FOR EXCELLENCE IN IN-CAR LANGUAGE INPUT

- 5.8.5 APTERA DELIVERED WORLD'S MOST EFFICIENT ELECTRIC VEHICLE IN UNDER ONE YEAR

- 5.9 IN-VEHICLE INFOTAINMENT MARKET: OEM ANALYSIS

- 5.9.1 DISPLAY SIZES OF IN-VEHICLE INFOTAINMENT SYSTEMS, BY OEM

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 PATENT ANALYSIS

- 6.2 KEY EMERGING TECHNOLOGIES

- 6.2.1 PASSENGER DISPLAY

- 6.2.2 PILLAR-TO-PILLAR DISPLAY

- 6.2.3 SOFTWARE-DEFINED VEHICLE (SDV)

- 6.2.4 MONETIZATION & SERVICE-LAYER ECOSYSTEMS (IN-CAR PAYMENTS, SUBSCRIPTIONS, AND CONTENT STREAMING)

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.3.1 CONNECTIVITY & TELEMATICS MODULES (TCUS, V2X, CLOUD INTEGRATION)

- 6.3.2 AUTOMOTIVE HUMAN-MACHINE INTERFACE (HMI) SYSTEMS

- 6.4 FUTURE APPLICATIONS

- 6.4.1 AI-DRIVEN COCKPIT ASSISTANTS

- 6.4.2 CROSS-DEVICE DIGITAL CONTINUITY

- 6.5 IMPACT OF AI/ GENERATIVE AI

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 IN-VEHICLE INFOTAINMENT REGULATIONS/STANDARDS, BY COUNTRY/REGION

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2 BUYING CRITERIA

- 8.2.1 PASSENGER CARS

- 8.2.2 COMMERCIAL VEHICLES

9 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE

- 9.1 INTRODUCTION

- 9.2 PASSENGER CAR (PC)

- 9.2.1 GROWING CONSUMER PREFERENCE FOR CONNECTED, PERSONALIZED CABIN EXPERIENCES TO DRIVE SEGMENTAL GROWTH

- 9.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 9.3.1 DEMAND FOR CONNECTED COCKPIT SOLUTIONS TO DRIVE SEGMENTAL GROWTH

- 9.4 HEAVY COMMERCIAL VEHICLE (HCV)

- 9.4.1 DEMAND FOR INFOTAINMENT PLATFORMS THAT INTEGRATE NAVIGATION, ADVANCED TELEMATICS, ADAS INTERFACES, AND REAL-TIME FLEET MONITORING TO DRIVE SEGMENTAL GROWTH

- 9.5 PRIMARY INSIGHTS

10 ELECTRIC VEHICLE INFOTAINMENT MARKET, BY ELECTRIC VEHICLE (EV) TYPE

- 10.1 INTRODUCTION

- 10.2 BATTERY ELECTRIC VEHICLE (BEV)

- 10.2.1 INCREASING BEV SHIPMENTS TO DRIVE SEGMENTAL GROWTH

- 10.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 10.3.1 INCREASING SALES IN ASIA PACIFIC TO DRIVE SEGMENTAL GROWTH

- 10.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 10.4.1 GROWING DEMAND FOR ALTERNATIVE FUEL VEHICLES TO DRIVE SEGMENTAL GROWTH

- 10.5 PRIMARY INSIGHTS

11 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 PASSENGER CAR

- 11.2.1 INCREASING ADOPTION OF SMARTPHONE-INTEGRATED ECOSYSTEMS TO DRIVE SEGMENTAL GROWTH

- 11.3 COMMERCIAL VEHICLE

- 11.3.1 INVESTMENT IN SCALABLE AFTERMARKET INFOTAINMENT AND TELEMATICS UPGRADES TO DRIVE SEGMENTAL GROWTH

- 11.4 PRIMARY INSIGHTS

12 IN-VEHICLE INFOTAINMENT MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 NAVIGATION

- 12.2.1 INTEGRATION WITH TRAFFIC DATA TO DRIVE SEGMENTAL GROWTH

- 12.3 VIRTUAL PERSONAL ASSISTANT (VPA)

- 12.3.1 ENHANCED CONVENIENCE, SAFETY, AND CONNECTIVITY TO DRIVE SEGMENTAL GROWTH

- 12.4 APP STORE

- 12.4.1 GROWING OEM PARTNERSHIPS WITH SOFTWARE SUPPLIERS TO DRIVE SEGMENTAL GROWTH

- 12.5 MUSIC

- 12.5.1 SMARTPHONE INTEGRATION WITH VARIOUS MUSIC STREAMING APPLICATIONS TO DRIVE SEGMENTAL GROWTH

- 12.6 REAR-SEAT INFOTAINMENT

- 12.6.1 MEDLEY OF FEATURES IN REAR-SEAT INFOTAINMENT SYSTEMS TO DRIVE SEGMENTAL GROWTH

- 12.7 PRIMARY INSIGHTS

13 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT

- 13.1 INTRODUCTION

- 13.2 INFOTAINMENT UNIT

- 13.2.1 SHIFT TOWARD RICHER NAVIGATION, SAFETY VISUALIZATION, VEHICLE DIAGNOSTICS, AND AI-DRIVEN INTERFACES TO DRIVE SEGMENTAL GROWTH

- 13.3 PASSENGER DISPLAY

- 13.3.1 AVAILABILITY OF PASSENGER DISPLAYS IN HIGH-SEGMENT VEHICLES TO DRIVE SEGMENTAL GROWTH

- 13.4 DIGITAL INSTRUMENT CLUSTER

- 13.4.1 TRANSITION TOWARD SOFTWARE-DEFINED ARCHITECTURE TO DRIVE SEGMENTAL GROWTH

- 13.5 HEAD-UP DISPLAY

- 13.5.1 SHIFT TO AR-ENABLED HUDS, INTEGRATED WITH ADVANCED SENSORS AND CONNECTED NAVIGATION TO DRIVE SEGMENTAL GROWTH

- 13.6 PRIMARY INSIGHTS

14 IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY

- 14.1 INTRODUCTION

- 14.2 3G/4G

- 14.2.1 OPERATIONAL BACKBONE FOR MASS-MARKET AND MID-RANGE VEHICLES

- 14.3 5G

- 14.3.1 TO BECOME FOUNDATION FOR NEXT-GENERATION IN-VEHICLE INFOTAINMENT SYSTEMS

- 14.4 PRIMARY INSIGHTS

15 IN-VEHICLE INFOTAINMENT MARKET, BY DISPLAY SIZE

- 15.1 INTRODUCTION

- 15.2 <5" DISPLAY SIZE

- 15.2.1 SPACE AND COST MANAGEMENT IN VEHICLES TO DRIVE DEMAND

- 15.3 5"-10" DISPLAY SIZE

- 15.3.1 DEMAND FOR LUXURY FEATURES IN MID-TO-HIGH-END PASSENGER CAR SEGMENTS TO DRIVE GROWTH

- 15.4 >10" DISPLAY SIZE

- 15.4.1 INCREASED USE IN LUXURY CARS TO DRIVE DEMAND

- 15.5 PRIMARY INSIGHTS

16 IN-VEHICLE INFOTAINMENT MARKET, BY FORM

- 16.1 INTRODUCTION

- 16.2 EMBEDDED FORM

- 16.2.1 INCREASING DEMAND FOR CLOUD-ENABLED NAVIGATION, VEHICLE DIAGNOSTICS, AND SUBSCRIPTION-BASED SERVICES TO DRIVE SEGMENTAL GROWTH

- 16.3 TETHERED FORM

- 16.3.1 RISE OF APP-BASED NAVIGATION, MUSIC STREAMING, AND PAYMENT SERVICES TO DRIVE SEGMENTAL GROWTH

- 16.4 INTEGRATED FORM

- 16.4.1 EMPHASIS ON INTEGRATED CLUSTERS THAT CONSOLIDATE NAVIGATION, TELEMATICS, AND DRIVER-ASSIST INFORMATION TO DRIVE SEGMENTAL GROWTH

- 16.5 PRIMARY INSIGHTS

17 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION

- 17.1 INTRODUCTION

- 17.2 FRONT-ROW INFOTAINMENT SYSTEM

- 17.2.1 GROWING DEMAND FOR FRONT-ROW SYSTEMS THAT COMBINE ENTERTAINMENT WITH REAL-TIME DRIVING INTELLIGENCE TO DRIVE SEGMENTAL GROWTH

- 17.3 REAR-ROW INFOTAINMENT SYSTEM

- 17.3.1 INCREASING SALES OF LUXURY VEHICLES TO DRIVE SEGMENTAL GROWTH

- 17.4 PRIMARY INSIGHTS

18 IN-VEHICLE INFOTAINMENT MARKET, BY OPERATING SYSTEM

- 18.1 INTRODUCTION

- 18.2 LINUX

- 18.2.1 OPEN-SOURCE AND CUSTOMIZABLE

- 18.3 QNX

- 18.3.1 STRONG ADOPTION IN PREMIUM AND COMMERCIAL SEGMENTS

- 18.4 ANDROID

- 18.4.1 SUPPORTS RICHER, SOFTWARE-DEFINED USER EXPERIENCES

- 18.5 OTHER OPERATING SYSTEMS

- 18.5.1 WIND RIVER

- 18.5.2 OEM/IN-HOUSE

- 18.6 PRIMARY INSIGHTS

19 IN-VEHICLE INFOTAINMENT MARKET, BY REGION

- 19.1 INTRODUCTION

- 19.2 ASIA PACIFIC

- 19.2.1 MACROECONOMIC OUTLOOK

- 19.2.2 CHINA

- 19.2.2.1 Rapid innovation cycles in smart cockpits to drive market

- 19.2.2.2 China: Vehicle production data

- 19.2.3 INDIA

- 19.2.3.1 Strong investments in semiconductor and electronics manufacturing to drive market

- 19.2.3.2 India: Vehicle production data

- 19.2.4 JAPAN

- 19.2.4.1 Regulatory push on ADAS, cybersecurity, and connected car data standards to drive market

- 19.2.4.2 Japan: Vehicle production data

- 19.2.5 SOUTH KOREA

- 19.2.5.1 Development of connected mobility infrastructure to drive market

- 19.2.5.2 South Korea: Vehicle production data

- 19.2.6 REST OF ASIA PACIFIC

- 19.3 EUROPE

- 19.3.1 MACROECONOMIC OUTLOOK

- 19.3.2 UK

- 19.3.2.1 Growing affordability of high-end vehicles to drive market

- 19.3.2.2 UK: Vehicle production data

- 19.3.3 GERMANY

- 19.3.3.1 Strong demand for premium vehicles to drive market

- 19.3.3.2 Germany: Vehicle production data

- 19.3.4 FRANCE

- 19.3.4.1 Heavy investments by OEMs in security technologies to drive market

- 19.3.4.2 France: Vehicle production data

- 19.3.5 SPAIN

- 19.3.5.1 Adoption of AI and cognitive computing to drive market

- 19.3.5.2 Spain: Vehicle production data

- 19.3.6 ITALY

- 19.3.6.1 Intelligent mobility infrastructure through large-scale C-ITS and smart city programs to drive market

- 19.3.6.2 Italy: Vehicle production data

- 19.3.7 RUSSIA

- 19.3.7.1 Growing adoption of embedded software systems to drive market

- 19.3.7.2 Russia: Vehicle production data

- 19.3.8 REST OF EUROPE

- 19.3.8.1 Rest of Europe: Vehicle production data

- 19.4 NORTH AMERICA

- 19.4.1 MACROECONOMIC OUTLOOK

- 19.4.2 US

- 19.4.2.1 Growing reliance on real-time navigation, streaming, diagnostics, and AI-based driver-assist functions to drive market

- 19.4.2.2 US: Vehicle production data

- 19.4.3 CANADA

- 19.4.3.1 Growing demand for reliable navigation, diagnostics, and OTA-enabled infotainment platforms to drive market

- 19.4.3.2 Canada: Vehicle production data

- 19.4.4 MEXICO

- 19.4.4.1 Shift toward electric and software-defined vehicles to drive market

- 19.4.4.2 Mexico: Vehicle production data

- 19.5 REST OF THE WORLD (ROW)

- 19.5.1 MACROECONOMIC OUTLOOK

- 19.5.2 BRAZIL

- 19.5.2.1 Development of low-cost infotainment units to drive market

- 19.5.2.2 Brazil: Vehicle production data

- 19.5.3 SOUTH AFRICA

- 19.5.3.1 Establishment of advanced product testing and automotive homologation centers to drive market

- 19.5.3.2 South Africa: Vehicle production data

- 19.5.4 OTHERS

- 19.5.4.1 Others: Vehicle production data

- 19.6 PRIMARY INSIGHTS

20 COMPETITIVE LANDSCAPE

- 20.1 OVERVIEW

- 20.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 20.3 MARKET SHARE ANALYSIS, 2024

- 20.4 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- 20.5 COMPANY VALUATION & FINANCIAL METRICS, 2024

- 20.5.1 COMPANY VALUATION

- 20.5.2 FINANCIAL METRICS

- 20.6 BRAND/PRODUCT COMPARISON

- 20.7 COMPANY EVALUATION MATRIX: IN-VEHICLE INFOTAINMENT KEY PLAYERS, 2024

- 20.7.1 STARS

- 20.7.2 EMERGING LEADERS

- 20.7.3 PERVASIVE PLAYERS

- 20.7.4 PARTICIPANTS

- 20.7.5 COMPANY FOOTPRINT

- 20.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 20.8.1 PROGRESSIVE COMPANIES

- 20.8.2 RESPONSIVE COMPANIES

- 20.8.3 DYNAMIC COMPANIES

- 20.8.4 STARTING BLOCKS

- 20.8.5 COMPETITIVE BENCHMARKING

- 20.8.5.1 List of startups/SMEs

- 20.8.5.2 Competitive benchmarking of startups/SMEs

- 20.9 COMPETITIVE SCENARIO

- 20.9.1 PRODUCT LAUNCHES

- 20.9.2 DEALS

- 20.9.3 OTHER DEVELOPMENTS

21 COMPANY PROFILES

- 21.1 KEY PLAYERS

- 21.1.1 ALPS ALPINE CO., LTD.

- 21.1.1.1 Business overview

- 21.1.1.2 Products offered

- 21.1.1.3 Recent developments

- 21.1.1.3.1 Product launches

- 21.1.1.3.2 Deals

- 21.1.1.3.3 Expansions

- 21.1.1.4 MnM view

- 21.1.1.4.1 Right to win

- 21.1.1.4.2 Strategic choices

- 21.1.1.4.3 Weaknesses & competitive threats

- 21.1.2 GARMIN LTD

- 21.1.2.1 Business overview

- 21.1.2.2 Products offered

- 21.1.2.3 Recent developments

- 21.1.2.3.1 Product launches

- 21.1.2.3.2 Deals

- 21.1.2.4 MnM view

- 21.1.2.4.1 Right to win

- 21.1.2.4.2 Strategic choices

- 21.1.2.4.3 Weaknesses & competitive threats

- 21.1.3 PIONEER CORPORATION

- 21.1.3.1 Business overview

- 21.1.3.2 Products offered

- 21.1.3.3 Recent developments

- 21.1.3.3.1 Product launches

- 21.1.3.3.2 Deals

- 21.1.3.3.3 Expansions

- 21.1.3.4 MnM view

- 21.1.3.4.1 Right to win

- 21.1.3.4.2 Strategic choices

- 21.1.3.4.3 Weaknesses and competitive threats

- 21.1.4 HARMAN INTERNATIONAL

- 21.1.4.1 Business overview

- 21.1.4.2 Products offered

- 21.1.4.3 Recent developments

- 21.1.4.3.1 Product launches

- 21.1.4.3.2 Deals

- 21.1.4.3.3 Expansions

- 21.1.4.4 MnM view

- 21.1.4.4.1 Right to win

- 21.1.4.4.2 Strategic choices

- 21.1.4.4.3 Weaknesses & competitive threats

- 21.1.5 PANASONIC CORPORATION

- 21.1.5.1 Business overview

- 21.1.5.2 Products offered

- 21.1.5.3 Recent developments

- 21.1.5.3.1 Product launches

- 21.1.5.3.2 Deals

- 21.1.5.3.3 Other developments

- 21.1.5.4 MnM view

- 21.1.5.4.1 Right to win

- 21.1.5.4.2 Strategic choices

- 21.1.5.4.3 Weaknesses & competitive threats

- 21.1.6 ROBERT BOSCH GMBH

- 21.1.6.1 Business overview

- 21.1.6.2 Products offered

- 21.1.6.3 Recent developments

- 21.1.6.3.1 Product launches

- 21.1.6.3.2 Deals

- 21.1.7 MITSUBISHI ELECTRIC CORPORATION

- 21.1.7.1 Business overview

- 21.1.7.2 Products offered

- 21.1.7.3 Recent developments

- 21.1.7.3.1 Product launches

- 21.1.7.3.2 Deals

- 21.1.7.3.3 Other developments

- 21.1.8 TOMTOM INTERNATIONAL BV

- 21.1.8.1 Business overview

- 21.1.8.2 Products offered

- 21.1.8.3 Recent developments

- 21.1.8.3.1 Product launches

- 21.1.8.3.2 Deals

- 21.1.8.3.3 Other developments

- 21.1.9 CONTINENTAL AG

- 21.1.9.1 Business overview

- 21.1.9.2 Products offered

- 21.1.9.3 Recent developments

- 21.1.9.3.1 Product launches

- 21.1.9.3.2 Deals

- 21.1.9.3.3 Expansions

- 21.1.9.3.4 Other developments

- 21.1.10 VISTEON CORPORATION

- 21.1.10.1 Business overview

- 21.1.10.2 Products offered

- 21.1.10.3 Recent developments

- 21.1.10.3.1 Product launches

- 21.1.10.3.2 Deals

- 21.1.10.3.3 Expansions

- 21.1.10.3.4 Other developments

- 21.1.1 ALPS ALPINE CO., LTD.

- 21.2 OTHER PLAYERS

- 21.2.1 DESAY INDUSTRY

- 21.2.2 DENSO CORPORATION

- 21.2.3 JVCKENWOOD CORPORATION

- 21.2.4 FUJITSU

- 21.2.5 FORYOU CORPORATION

- 21.2.6 HYUNDAI MOBIS

- 21.2.7 FORD MOTOR COMPANY

- 21.2.8 APTIV

- 21.2.9 MARELLI HOLDINGS CO., LTD.

- 21.2.10 GENERAL MOTORS

- 21.2.11 AUDI AG

- 21.2.12 BMW GROUP

- 21.2.13 AISIN CORPORATION

- 21.2.14 ALLEGRO MICROSYSTEMS, INC.

- 21.2.15 FAURECIA S.E.

22 RESEARCH METHODOLOGY

- 22.1 RESEARCH DATA

- 22.1.1 SECONDARY DATA

- 22.1.1.1 List of key secondary sources

- 22.1.1.2 Key data from secondary sources

- 22.1.2 PRIMARY DATA

- 22.1.1 SECONDARY DATA

- 22.2 MARKET SIZE ESTIMATION

- 22.2.1 BOTTOM-UP APPROACH: IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT, VEHICLE TYPE, AND COUNTRY (ICE VEHICLES)

- 22.2.2 TOP-DOWN APPROACH: IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY

- 22.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 22.3 FACTOR ANALYSIS

- 22.4 DATA TRIANGULATION

- 22.5 RESEARCH ASSUMPTIONS & RISK ASSESSMENT

- 22.6 RESEARCH LIMITATIONS

23 APPENDIX

- 23.1 INSIGHTS OF INDUSTRY EXPERTS

- 23.2 DISCUSSION GUIDE

- 23.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 23.4 CUSTOMIZATION OPTIONS

- 23.5 RELATED REPORTS

- 23.6 AUTHOR DETAILS

List of Tables

- TABLE 1 CURRENCY EXCHANGE RATES, 2020-2024

- TABLE 2 EVOLVING REGULATORY LANDSCAPE

- TABLE 3 ROLE OF COMPANIES IN IN-VEHICLE INFOTAINMENT MARKET ECOSYSTEM

- TABLE 4 AVERAGE PRICE RANGE: IN-VEHICLE INFOTAINMENT SYSTEMS, BY REGION, 2023-2024

- TABLE 5 AVERAGE PRICE RANGE: IN-VEHICLE INFOTAINMENT SYSTEMS, BY VEHICLE TYPE, 2023-2024

- TABLE 6 AVERAGE PRICE RANGE, BY COMPONENT, 2023-2024

- TABLE 7 INDICATIVE PRICE TREND, BY KEY PLAYERS, 2023-2024

- TABLE 8 US: IMPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 9 GERMANY: IMPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 10 CHINA: IMPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 11 JAPAN: IMPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 12 INDIA: IMPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 13 US: EXPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 14 GERMANY: EXPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 15 CHINA: EXPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 16 JAPAN: EXPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 17 INDIA: EXPORT SCENARIO FOR HS CODE: 852691, BY COUNTRY, 2020-2024 (USD)

- TABLE 18 IN-VEHICLE INFOTAINMENT MARKET: KEY CONFERENCES & EVENTS, 2026

- TABLE 19 PATENTS GRANTED IN IN-VEHICLE INFOTAINMENT MARKET, 2023-2025

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 IN-VEHICLE SAFETY STANDARDS, BY REGION/COUNTRY

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%), BY VEHICLE TYPE

- TABLE 25 KEY BUYING CRITERIA IN IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE

- TABLE 26 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 27 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 28 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 29 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 30 PASSENGER CAR INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 31 PASSENGER CAR INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 32 PASSENGER CAR INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 PASSENGER CAR INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 34 LIGHT COMMERCIAL VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 35 LIGHT COMMERCIAL VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 36 LIGHT COMMERCIAL VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 LIGHT COMMERCIAL VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 38 HEAVY COMMERCIAL VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 39 HEAVY COMMERCIAL VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 40 HEAVY COMMERCIAL VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 HEAVY COMMERCIAL VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 42 ELECTRIC VEHICLE INFOTAINMENT MARKET, BY EV TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 43 ELECTRIC VEHICLE INFOTAINMENT MARKET, BY EV TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 44 ELECTRIC VEHICLE INFOTAINMENT MARKET, BY EV TYPE, 2021-2024 (USD MILLION)

- TABLE 45 ELECTRIC VEHICLE INFOTAINMENT MARKET, BY EV TYPE, 2025-2032 (USD MILLION)

- TABLE 46 BEV INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 47 BEV INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 48 BEV INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 BEV INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 50 PHEV INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 51 PHEV INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 52 PHEV INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 PHEV INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 54 FCEV INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 55 FCEV INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 56 FCEV INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 FCEV INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 58 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 59 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 60 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 61 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 62 PASSENGER CAR: IN-VEHICLE INFOTAINMENT SYSTEM RETROFIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 63 PASSENGER CAR: IN-VEHICLE INFOTAINMENT SYSTEM RETROFIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 64 PASSENGER CAR: IN-VEHICLE INFOTAINMENT SYSTEM RETROFIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 PASSENGER CAR: IN-VEHICLE INFOTAINMENT SYSTEM RETROFIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 66 COMMERCIAL VEHICLE: IN-VEHICLE INFOTAINMENT SYSTEM RETROFIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 67 COMMERCIAL VEHICLE: IN-VEHICLE INFOTAINMENT SYSTEM RETROFIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 68 COMMERCIAL VEHICLE: IN-VEHICLE INFOTAINMENT SYSTEM RETROFIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 COMMERCIAL VEHICLE: IN-VEHICLE INFOTAINMENT SYSTEM RETROFIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 70 IN-VEHICLE INFOTAINMENT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 71 IN-VEHICLE INFOTAINMENT MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 72 NAVIGATION: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 NAVIGATION: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 74 VIRTUAL PERSONAL ASSISTANT: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 VIRTUAL PERSONAL ASSISTANT: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 76 APP STORE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 APP STORE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 78 MUSIC: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 MUSIC: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 80 REAR-SEAT INFOTAINMENT: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 REAR-SEAT INFOTAINMENT: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 82 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT, 2021-2024 (THOUSAND UNITS)

- TABLE 83 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT, 2025-2032 (THOUSAND UNITS)

- TABLE 84 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 85 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 86 INFOTAINMENT UNIT: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 87 INFOTAINMENT UNIT: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 88 INFOTAINMENT UNIT: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 INFOTAINMENT UNIT: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 PASSENGER DISPLAY: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 91 PASSENGER DISPLAY: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 92 PASSENGER DISPLAY: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 PASSENGER DISPLAY: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 94 DIGITAL INSTRUMENT CLUSTER: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 95 DIGITAL INSTRUMENT CLUSTER: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 96 DIGITAL INSTRUMENT CLUSTER: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 DIGITAL INSTRUMENT CLUSTER: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 98 HEAD-UP DISPLAY: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 99 HEAD-UP DISPLAY: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 100 HEAD-UP DISPLAY: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 HEAD-UP DISPLAY: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 102 IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY, 2021-2024 (THOUSAND UNITS)

- TABLE 103 IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY, 2025-2032 (THOUSAND UNITS)

- TABLE 104 3G/4G: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 105 3G/4G: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 106 5G: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 107 5G: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 108 IN-VEHICLE INFOTAINMENT MARKET, BY DISPLAY SIZE, 2021-2024 (THOUSAND UNITS)

- TABLE 109 IN-VEHICLE INFOTAINMENT MARKET, BY DISPLAY SIZE, 2025-2032 (THOUSAND UNITS)

- TABLE 110 IN-VEHICLE INFOTAINMENT MARKET, BY DISPLAY SIZE, 2021-2024 (USD MILLION)

- TABLE 111 IN-VEHICLE INFOTAINMENT MARKET, BY DISPLAY SIZE, 2025-2032 (USD MILLION)

- TABLE 112 <5" DISPLAY SIZE: IN-INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 113 <5" DISPLAY SIZE: IN-INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 114 <5" DISPLAY SIZE: IN-INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 <5" DISPLAY SIZE: IN-INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 116 5"-10" DISPLAY SIZE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 117 5"-10" DISPLAY SIZE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 118 5"-10" DISPLAY SIZE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 5"-10" DISPLAY SIZE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 120 >10" DISPLAY SIZE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 121 >10" DISPLAY SIZE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 122 >10" DISPLAY SIZE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 >10" DISPLAY SIZE: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 124 IN-VEHICLE INFOTAINMENT MARKET, BY FORM, 2021-2024 (THOUSAND UNITS)

- TABLE 125 IN-VEHICLE INFOTAINMENT MARKET, BY FORM, 2025-2032 (THOUSAND UNITS)

- TABLE 126 IN-VEHICLE INFOTAINMENT MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 127 IN-VEHICLE INFOTAINMENT MARKET, BY FORM, 2025-2032 (USD MILLION)

- TABLE 128 EMBEDDED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 129 EMBEDDED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 130 EMBEDDED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 131 EMBEDDED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 132 TETHERED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 133 TETHERED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 134 TETHERED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 TETHERED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 136 INTEGRATED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 137 INTEGRATED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 138 INTEGRATED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 139 INTEGRATED FORM: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 140 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION, 2021-2024 (THOUSAND UNITS)

- TABLE 141 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION, 2025-2032 (THOUSAND UNITS)

- TABLE 142 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION, 2021-2024 (USD MILLION)

- TABLE 143 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION, 2025-2032 (USD MILLION)

- TABLE 144 FRONT ROW: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 145 FRONT ROW: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 146 FRONT ROW: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 147 FRONT ROW: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 148 REAR ROW: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 149 REAR ROW: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 150 REAR ROW: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 151 REAR ROW: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 152 IN-VEHICLE INFOTAINMENT MARKET, BY OPERATING SYSTEM, 2021-2024 (THOUSAND UNITS)

- TABLE 153 IN-VEHICLE INFOTAINMENT MARKET, BY OPERATING SYSTEM, 2025-2032 (THOUSAND UNITS)

- TABLE 154 LINUX: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 155 LINUX: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 156 QNX: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 157 QNX: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 158 ANDROID: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 159 ANDROID: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 160 OTHERS: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 161 OTHERS: IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 162 IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 163 IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 164 IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 165 IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 166 ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 167 ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 168 ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 170 CHINA: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 171 CHINA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 172 CHINA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 173 CHINA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 174 CHINA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 175 INDIA: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 176 INDIA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 177 INDIA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 178 INDIA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 179 INDIA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 180 JAPAN: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 181 JAPAN: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 182 JAPAN: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 183 JAPAN: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 184 JAPAN: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 185 SOUTH KOREA: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 186 SOUTH KOREA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 187 SOUTH KOREA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 188 SOUTH KOREA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 189 SOUTH KOREA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 191 REST OF ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 192 REST OF ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 194 EUROPE: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 195 EUROPE: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 196 EUROPE: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 197 EUROPE: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 198 UK: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 199 UK: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 200 UK: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 201 UK: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 202 UK: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 203 GERMANY: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 204 GERMANY: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 205 GERMANY: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 206 GERMANY: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 207 GERMANY: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 208 FRANCE: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 209 FRANCE: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 210 FRANCE: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 211 FRANCE: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 212 FRANCE: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 213 SPAIN: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 214 SPAIN: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 215 SPAIN: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 216 SPAIN: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 217 SPAIN: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 218 ITALY: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 219 ITALY: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 220 ITALY: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 221 ITALY: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 222 ITALY: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 223 RUSSIA: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 224 RUSSIA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 225 RUSSIA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 226 RUSSIA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 227 RUSSIA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 228 REST OF EUROPE: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 229 REST OF EUROPE: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 230 REST OF EUROPE: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 231 REST OF EUROPE: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 232 REST OF EUROPE: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 233 NORTH AMERICA: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 234 NORTH AMERICA: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 235 NORTH AMERICA: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 236 NORTH AMERICA: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 237 US: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 238 US: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 239 US: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 240 US: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 241 US: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 242 CANADA: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 243 CANADA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 244 CANADA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 245 CANADA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 246 CANADA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 247 MEXICO: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 248 MEXICO: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 249 MEXICO: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 250 MEXICO: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 251 MEXICO: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 252 ROW: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 253 ROW: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 254 ROW: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 255 ROW: IN-VEHICLE INFOTAINMENT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 256 BRAZIL: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 257 BRAZIL: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 258 BRAZIL: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 259 BRAZIL: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 260 BRAZIL: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 261 SOUTH AFRICA: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 262 SOUTH AFRICA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 263 SOUTH AFRICA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 264 SOUTH AFRICA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 265 SOUTH AFRICA: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 266 OTHERS: VEHICLE PRODUCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 267 OTHERS: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 268 OTHERS: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 ( THOUSAND UNITS)

- TABLE 269 OTHERS: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 270 OTHERS: IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 271 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- TABLE 272 MARKET SHARE ANALYSIS, 2024

- TABLE 273 IN-VEHICLE INFOTAINMENT MARKET: COMPONENT FOOTPRINT

- TABLE 274 IN-VEHICLE INFOTAINMENT MARKET: LOCATION FOOTPRINT

- TABLE 275 IN-VEHICLE INFOTAINMENT MARKET: REGION FOOTPRINT

- TABLE 276 LIST OF STARTUPS/SMES

- TABLE 277 COMPETITIVE BENCHMARKING OF STARTUPS/SMES (1/2)

- TABLE 278 COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2)

- TABLE 279 PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2025

- TABLE 280 DEALS, JANUARY 2021-NOVEMBER 2025

- TABLE 281 OTHER DEVELOPMENTS, JANUARY 2021-NOVEMBER 2025

- TABLE 282 ALPS ALPINE CO., LTD.: COMPANY OVERVIEW

- TABLE 283 ALPS ALPINE CO., LTD.: PRODUCTS OFFERED

- TABLE 284 ALPS ALPINE CO., LTD.: PRODUCT LAUNCHES

- TABLE 285 ALPS ALPINE CO., LTD.: DEALS

- TABLE 286 ALPS ALPINE CO., LTD.: EXPANSIONS

- TABLE 287 GARMIN LTD: COMPANY OVERVIEW

- TABLE 288 GARMIN LTD: PRODUCTS OFFERED

- TABLE 289 GARMIN LTD: PRODUCT LAUNCHES

- TABLE 290 GARMIN LTD: DEALS

- TABLE 291 PIONEER CORPORATION: COMPANY OVERVIEW

- TABLE 292 PIONEER CORPORATION: PRODUCTS OFFERED

- TABLE 293 PIONEER CORPORATION: PRODUCT LAUNCHES

- TABLE 294 PIONEER CORPORATION: DEALS

- TABLE 295 PIONEER CORPORATION: EXPANSIONS

- TABLE 296 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 297 HARMAN INTERNATIONAL: PRODUCTS OFFERED

- TABLE 298 HARMAN INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 299 HARMAN INTERNATIONAL: DEALS

- TABLE 300 HARMAN INTERNATIONAL: EXPANSIONS

- TABLE 301 PANASONIC CORPORATION: COMPANY OVERVIEW

- TABLE 302 PANASONIC CORPORATION: PRODUCTS OFFERED

- TABLE 303 PANASONIC CORPORATION: PRODUCT LAUNCHES

- TABLE 304 PANASONIC CORPORATION: DEALS

- TABLE 305 PANASONIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 306 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 307 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 308 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 309 ROBERT BOSCH GMBH: DEALS

- TABLE 310 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 311 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 312 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 313 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 314 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 315 TOMTOM INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 316 TOMTOM INTERNATIONAL BV: PRODUCTS OFFERED

- TABLE 317 TOMTOM INTERNATIONAL BV: PRODUCT LAUNCHES

- TABLE 318 TOMTOM INTERNATIONAL BV: DEALS

- TABLE 319 TOMTOM INTERNATIONAL: OTHER DEVELOPMENTS

- TABLE 320 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 321 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 322 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 323 CONTINENTAL AG: DEALS

- TABLE 324 CONTINENTAL AG: EXPANSIONS

- TABLE 325 CONTINENTAL AG: OTHER DEVELOPMENTS

- TABLE 326 VISTEON CORPORATION: COMPANY OVERVIEW

- TABLE 327 VISTEON CORPORATION: PRODUCTS OFFERED

- TABLE 328 VISTEON CORPORATION: PRODUCT LAUNCHES

- TABLE 329 VISTEON CORPORATION: DEALS

- TABLE 330 VISTEON CORPORATION: EXPANSIONS

- TABLE 331 VISTEON CORPORATION: OTHER DEVELOPMENTS

- TABLE 332 DESAY INDUSTRY: COMPANY OVERVIEW

- TABLE 333 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 334 JVCKENWOOD CORPORATION: COMPANY OVERVIEW

- TABLE 335 FUJITSU: COMPANY OVERVIEW

- TABLE 336 FORYOU CORPORATION: COMPANY OVERVIEW

- TABLE 337 HYUNDAI MOBIS: COMPANY OVERVIEW

- TABLE 338 FORD MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 339 APTIV: COMPANY OVERVIEW

- TABLE 340 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 341 GENERAL MOTORS: COMPANY OVERVIEW

- TABLE 342 AUDI AG: COMPANY OVERVIEW

- TABLE 343 BMW GROUP: COMPANY OVERVIEW

- TABLE 344 AISIN CORPORATION: COMPANY OVERVIEW

- TABLE 345 ALLEGRO MICROSYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 346 FAURECIA S.E.: COMPANY OVERVIEW

- TABLE 347 RESEARCH ASSUMPTIONS & RISK ASSESSMENT

List of Figures

- FIGURE 1 IN-VEHICLE INFOTAINMENT MARKET SEGMENTATION

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL IN-VEHICLE INFOTAINMENT MARKET, 2021-2032

- FIGURE 4 COMPARISON OF KEY PLAYERS IN IN-VEHICLE INFOTAINMENT MARKET

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF IN-VEHICLE INFOTAINMENT MARKET DURING FORECAST PERIOD

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN IN-VEHICLE INFOTAINMENT MARKET

- FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 8 GROWING DEMAND FOR ENTERTAINMENT, SAFETY, AND NAVIGATION SERVICES TO DRIVE MARKET

- FIGURE 9 EMBEDDED FORM TO DOMINATE MARKET IN 2032

- FIGURE 10 INFOTAINMENT UNIT HELD LARGEST MARKET SHARE IN 2025

- FIGURE 11 FRONT ROW TO HOLD LEADING MARKET SHARE IN 2032

- FIGURE 12 LINUX OS HELD LARGEST MARKET SHARE IN 2025

- FIGURE 13 NAVIGATION SEGMENT HELD LARGEST MARKET SHARE IN 2025

- FIGURE 14 PASSENGER CAR TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 15 3G/4G CONNECTIVITY HELD DOMINANT MARKET SHARE IN 2025

- FIGURE 16 BEV TO ACCOUNT FOR LARGEST MARKET SHARE BY 2032

- FIGURE 17 PASSENGER CAR SEGMENT HELD LARGEST MARKET SHARE IN 2025

- FIGURE 18 5" - 10" SEGMENT HELD LARGEST MARKET SHARE IN 2025

- FIGURE 19 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF IN-VEHICLE INFOTAINMENT MARKET IN 2025

- FIGURE 20 IN-VEHICLE INFOTAINMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 INSTALLED BASE OF ACTIVE EMBEDDED CAR OEM TELEMATICS UNITS (WORLD 2022-2028)

- FIGURE 22 NUMBER OF SMARTPHONE SHIPMENTS WORLDWIDE IN SECOND QUARTER OF 2024 AND 2025

- FIGURE 23 SUPPLY CHAIN ANALYSIS: IN-VEHICLE INFOTAINMENT MARKET

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN IN-VEHICLE INFOTAINMENT MARKET

- FIGURE 25 INVESTMENT SCENARIO, 2020-2025

- FIGURE 26 DISPLAY SIZES OF IN-VEHICLE INFOTAINMENT SYSTEMS, BY KEY PLAYERS, 2025

- FIGURE 27 PATENT ANALYSIS, 2016-2025

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 29 KEY BUYING CRITERIA IN IN-VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE

- FIGURE 30 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 31 ELECTRIC-VEHICLE INFOTAINMENT MARKET, BY ELECTRIC VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 32 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 33 IN-VEHICLE INFOTAINMENT MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 34 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT, 2025 VS. 2032 (USD MILLION)

- FIGURE 35 IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 36 IN-VEHICLE INFOTAINMENT MARKET, BY DISPLAY SIZE, 2025 VS. 2032 (USD MILLION)

- FIGURE 37 IN-VEHICLE INFOTAINMENT MARKET, BY FORM, 2025 VS. 2032 (USD MILLION)

- FIGURE 38 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 39 IN-VEHICLE INFOTAINMENT MARKET, BY OPERATING SYSTEM, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 40 IN-VEHICLE INFOTAINMENT MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 41 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 42 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 43 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 44 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 45 ASIA PACIFIC: IN-VEHICLE INFOTAINMENT MARKET SNAPSHOT

- FIGURE 46 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 47 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 48 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 49 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 50 EUROPE: IN-VEHICLE INFOTAINMENT MARKET SNAPSHOT

- FIGURE 51 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 52 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 53 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 54 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 55 NORTH AMERICA: IN-VEHICLE INFOTAINMENT MARKET, 2025 VS. 2032 (USD MILLION)

- FIGURE 56 ROW: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 57 ROW: GDP PER CAPITA, 2024-2026

- FIGURE 58 ROW: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 59 ROW: MANUFACTURING INDUSTRY VALUE (AS PART OF GDP), 2024

- FIGURE 60 ROW: IN-VEHICLE INFOTAINMENT MARKET, 2025 VS. 2032 (USD MILLION)

- FIGURE 61 IN-VEHICLE INFOTAINMENT MARKET SHARE ANALYSIS, 2024

- FIGURE 62 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 63 COMPANY VALUATION, 2024 (USD MILLION)

- FIGURE 64 EV/EBITDA OF KEY PLAYERS, 2024

- FIGURE 65 BRAND/PRODUCT COMPARISON

- FIGURE 66 IN-VEHICLE INFOTAINMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 67 IN-VEHICLE INFOTAINMENT MARKET: COMPANY FOOTPRINT

- FIGURE 68 IN-VEHICLE INFOTAINMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 69 ALPS ALPINE CO., LTD.: COMPANY SNAPSHOT

- FIGURE 70 GARMIN LTD: COMPANY SNAPSHOT

- FIGURE 71 PIONEER CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 73 PANASONIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 75 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 76 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT

- FIGURE 77 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 78 VISTEON CORPORATION: COMPANY SNAPSHOT

- FIGURE 79 IN-VEHICLE INFOTAINMENT MARKET: RESEARCH DESIGN

- FIGURE 80 RESEARCH PROCESS FLOW

- FIGURE 81 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 82 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 83 BOTTOM-UP APPROACH: IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT, VEHICLE TYPE, AND COUNTRY

- FIGURE 84 TOP-DOWN APPROACH: IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY

- FIGURE 85 DATA TRIANGULATION