|

市場調查報告書

商品編碼

1915208

全球兒童血管通路市場按類型、應用和最終用戶分類-預測至2030年Pediatric Vascular Access Market by Type (Catheters (CVC, PIVC, PICC), Ports, IV Sets, Infusion Pumps), Application (Drug Administration, Blood Transfusion, Diagnostics & Testing), End User (Hospitals, ASCs) - Global Forecast to 2030 |

||||||

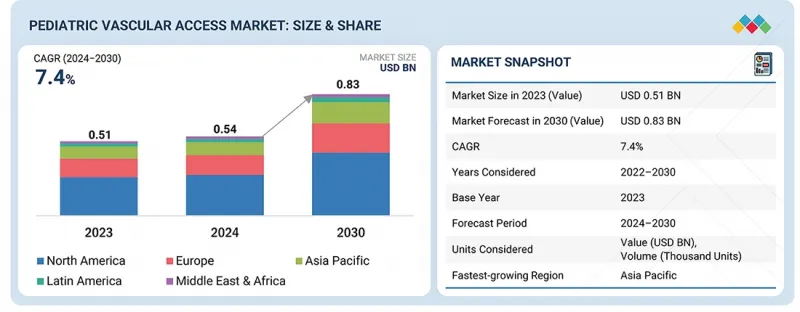

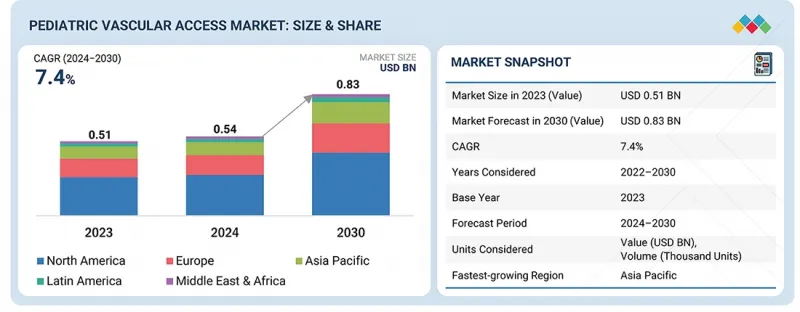

全球兒童血管通路市場預計將從2024年的5.43億美元成長到2030年的8.331億美元,預測期內複合年成長率(CAGR)為7.4%。兒科兒童通路市場呈現穩定成長的態勢,這主要得益於多種因素,例如早產兒數量的增加、導管材料安全性和舒適性的提升以及新生兒加護病房(NICU)收治患者數量的成長。

| 調查範圍 | |

|---|---|

| 調查期 | 2023-2030 |

| 基準年 | 2023 |

| 預測期 | 2024-2030 |

| 單元 | 100萬美元 |

| 部分 | 類型、用途、最終用戶、區域 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲 |

此外,智慧血管通路裝置的普及也推動了住院患者數量的成長,尤其是在北美、歐洲和亞太地區。總體而言,發展中國家醫療保健成本的不斷上漲為市場成長創造了新的機會。

根據導管類型分類,預計在預測期內,兒童血管通路市場的周邊靜脈導管 (PIVC) 部分將維持最高的複合年成長率。

由於周邊靜脈導管(PIVC)在為高風險新生兒提供安全有效的血管通路方面發揮著至關重要的作用,預計在預測期內,兒童血管通路市場中的PIVC細分市場將實現最高的複合年成長率。 PIVC設計用於短期使用,通常持續24至96小時。在需要頻繁介入的新生兒加護病房(NICU)中,PIVC是輸注藥物、液體和血液製品的首選。

按最終用戶分類,兒童血管通路市場的門診手術中心 (ASC) 細分市場預計將迎來第二高的成長率。

由於日間手術中心(ASC)具有成本效益高、方便快速以及以患者為中心的護理理念,因此擴大被選為傳統醫院以外的新生兒干涉措施的替代方案。日間手術中心通常專注於需要使用先進血管通路裝置的手術,例如經外周靜脈置入的中心靜脈導管(PIVC)、周邊置入的中央靜脈導管(PICC)和中線導管。這些裝置對於在可控制的微創環境下處理先天性異常、早產併發症以及術後恢復等情況至關重要。在大型醫院之外進行這些手術能夠在降低成本的同時保持高標準的護理,使其成為醫護人員和患者都青睞的選擇。

預計在預測期內,亞太地區兒童血管通路市場的複合年成長率將最高。

亞太地區兒童血管通路市場正因人口結構、經濟和醫療基礎設施的動態而快速成長。人口的快速成長和早產兒發病率的上升,尤其是在中國和印度,正推動新生兒專用血管器械需求的激增。該地區各國政府正將改善新生兒護理作為優先事項,投資興建先進的新生兒加護病房(NICU),並依照國際標準發展醫療設施。例如,中國國家衛生健康委員會已啟動一項旨在改善新生兒關鍵護理(包括血管通路技術)可近性的計畫。日本先進的醫療生態系統正擴大採用先進技術,例如人工智慧整合監測系統和超小型導管。亞太地區的經濟擴張進一步推動了市場成長,因為可支配收入的增加和中產階級的壯大擴大了人們獲得優質醫療解決方案的機會。在韓國和新加坡,由於醫療領域技術融合的文化,智慧血管器材的應用正在激增。

本報告分析了全球兒童血管通路市場,深入探討了關鍵促進因素和限制因素、產品開發和創新以及競爭格局。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 兒童血管通路市場中企業面臨的誘人機會

- 按地區分類的兒童血管通路市場

第5章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 產業趨勢

- 微創血管通路手術

- 導管材料和塗層的創新

- 價值鏈分析

- 生態系分析

- 供應鏈分析

- 貿易分析

- 進口方案(HS編碼901839)

- 出口方案(HS編碼901839)

- 波特五力分析

- 主要相關利益者和採購標準

- 監管環境

- 法規結構

- 監管機構、政府機構和其他組織

- 專利分析

- 定價分析

- 主要企業平均售價趨勢

- 各地區平均銷售價格趨勢

- 重大會議和活動(2025-2026)

- 鄰近市場分析

- 未滿足的需求/最終用戶期望

- 影響客戶業務的趨勢與干擾因素

- 投資和資金籌措方案

- 人工智慧/生成式人工智慧的影響

- 美國2025年關稅

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對終端用戶產業的影響

第6章兒童血管通路市場(按類型分類)

- 導管

- 導管固定穩定

- 植入式連接埠

- 端口針

- 點滴幫浦

- 靜脈輸液連接器

- 注射器/針頭

- 血管閉合裝置

- 點滴器及配件

- 麻醉注射器

- 導向裝置

- 導管蓋子與封口裝置

- 骨內注射裝置

- 其他類型

第7章 依應用分類的兒童血管通路市場

- 輸液和營養液

- 劑量

- 診斷和檢測

- 輸血

第8章 以最終用戶分類的兒童血管通路市場

- 醫院

- 門診手術中心及診所

- 居家照護環境

- 其他最終用戶

第9章 各地區兒童血管通路市場

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 宏觀經濟展望

- 日本

- 中國

- 亞太其他地區

第10章 競爭格局

- 主要參與企業的策略/優勢(2022-2024)

- 收入分析(2022-2024)

- 市佔率分析(2024 年)

- 企業評估矩陣:主要企業(2024)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 公司估值和財務指標

- 品牌/產品對比

- 競爭場景

第11章:公司簡介

- 主要企業

- BECTON, DICKINSON AND COMPANY

- TELEFLEX INCORPORATED

- ICU MEDICAL, INC.

- B. BRAUN SE

- TERUMO CORPORATION

- MEDTRONIC

- VYGON

- NIPRO CORPORATION

- ANGIODYNAMICS

- COOK MEDICAL

- 其他公司

- CANADIAN HOSPITAL SPECIALTIES LIMITED

- MERIT MEDICAL SYSTEMS, INC.

- MEDICAL COMPONENTS, INC.

- AMECATH

- ARGON MEDICAL DEVICES

- HEALTH LINE INTERNATIONAL CORPORATION

- DELTA MED

- ACCESS VASCULAR, INC.

- PAKUMEDMEDICAL PRODUCTS GMBH

- GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD.

- PFM MEDICAL

- POLY MEDICURE LTD

- NEWTECH MEDICAL DEVICES PVT. LTD.

- SHANGHAI PUYI MEDICAL INSTRUMENTS CO., LTD.

- ANGIPLAST PRIVATE LIMITED

第12章附錄

The global pediatric vascular access market is projected to reach USD 833.1 million by 2030 from USD 543.0 million in 2024, at a CAGR of 7.4% during the forecast period. The pediatric vascular access market is witnessing consistent growth due to various factors such as preterm births, advancement in catheter materials in terms of safety and comfort, and growing NICU admissions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific , Latin America, Middle East & Africa |

There has also been a shift towards smart vascular access devices, particularly in North America, Europe, and the Asia Pacific, where there is an increase in hospitalizations. Overall, increased healthcare expenditure in developing markets is bringing new opportunities to market growth.

The Peripheral Intravenous Catheters (PIVC) segment of the pediatric vascular access market, by the type of catheters, is expected to hold the highest CAGR during the forecast period.

The Peripheral Intravenous Catheters (PIVC) segment within the Pediatric Vascular Access market is anticipated to exhibit the highest CAGR during the forecast period due to its critical role in facilitating safe and efficient vascular access for high-risk newborns. PIVCs are designed for short-term use, typically lasting 24-96 hours. They are preferred for administering medications, fluids, and blood products in neonatal intensive care units (NICUs), where frequent interventions are required.

The Ambulatory Surgical Centers (ASCs) segment of the pediatric vascular access market, by end user, is expected to show the second-highest growth.

ASCs are increasingly becoming a preferred alternative to traditional hospital settings for certain neonatal interventions due to their cost-effectiveness, convenience, and focus on patient-centered care. ASCs often specialize in procedures that require advanced vascular access devices, such as peripheral intravenous catheters (PIVCs), peripherally inserted central catheters (PICCs), and midline catheters. These devices are essential for managing conditions such as congenital anomalies, preterm complications, or post-surgical recovery in a controlled, less intensive setting. The ability to perform these procedures outside of a full-scale hospital environment reduces costs while maintaining high standards of care, making ASCs an attractive option for providers and patients.

Asia Pacific is expected to grow at the highest CAGR during the forecast period in the pediatric vascular access market.

The pediatric vascular access market in the Asia Pacific region is growing rapidly due to demographic, economic, and healthcare infrastructure dynamics. With a rapidly growing population and rising incidence of preterm births, particularly in China and India, the demand for specialized vascular devices tailored to neonates is surging. Governments across the region are prioritizing improvements in neonatal care, investing in advanced NICUs, and upgrading healthcare facilities to align with global standards. For instance, China's National Health Commission has launched initiatives to enhance access to critical neonatal interventions, including vascular access technologies. Japan's sophisticated healthcare ecosystem continues to adopt cutting-edge technologies such as AI-integrated monitoring systems and ultra-miniaturized catheters. Economic expansion in the Asia Pacific is further fueling market growth as rising disposable incomes and expanding middle-class populations increase access to premium medical solutions. South Korea and Singapore are witnessing heightened adoption of smart vascular devices, driven by a culture of technological integration in healthcare.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 28%, Tier 2: 34%, and Tier 3: 38%

- By Designation: C-level: 40%, Director Level: 26%, and Others: 34%

- By Region: North America: 25%, Europe: 41%, Asia Pacific: 30%, Latin America: 3%, and Middle East & Africa: 1%

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the Pediatric Vascular Access market include BD (US), Teleflex Incorporated (US), ICU Medical, Inc. (US), B. Braun SE (Germany), Angiodynamics, Inc. (US), Terumo Corporation (Japan), Nipro Medical Corporation (Japan), and Medtronic Plc (Ireland)

Research Coverage

This report studies the pediatric vascular access market based on type, applications, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to gain a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing prevalence of preterm births, advancements in catheter materials in terms of safety and comfort, and growing NICU admissions), restraints (high prices of vascular access devices), opportunities (technological advancements), challenges (balancing innovations with cost-effectiveness)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the pediatric vascular access market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the Pediatric Vascular Access market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the pediatric vascular access industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as BD, Teleflex Incorporated, ICU Medical, Inc., B. Braun SE, AngioDynamics, Inc., Terumo Corporation, Nipro Medical Corporation, and Medtronic Plc.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.5.1 METHODOLOGY-RELATED LIMITATIONS

- 2.5.2 SCOPE-RELATED LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PEDIATRIC VASCULAR ACCESS MARKET

- 4.2 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapidly growing pediatric population

- 5.2.1.2 Rise of pediatric cancer

- 5.2.1.3 Heightened use of vascular access devices in pediatric patients

- 5.2.2 RESTRAINTS

- 5.2.2.1 Costly placement and maintenance of Pediatric vascular access devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in vascular access devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled healthcare professionals

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Imaging and navigation

- 5.3.1.2 Catheter securement and stabilization

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Artificial intelligence and machine learning

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Infection control technologies

- 5.3.1 KEY TECHNOLOGIES

- 5.4 INDUSTRY TRENDS

- 5.4.1 MINIMALLY INVASIVE VASCULAR ACCESS PROCEDURES

- 5.4.2 INNOVATIONS IN CATHETER MATERIALS AND COATINGS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 901839)

- 5.8.2 EXPORT SCENARIO (HS CODE 901839)

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY FRAMEWORK

- 5.11.1.1 North America

- 5.11.1.1.1 US

- 5.11.1.1.2 Canada

- 5.11.1.2 Europe

- 5.11.1.3 Asia Pacific

- 5.11.1.4 Latin America

- 5.11.1.5 Middle East & Africa

- 5.11.1.1 North America

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATORY FRAMEWORK

- 5.12 PATENT ANALYSIS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.13.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.15.1 VASCULAR ACCESS DEVICE MARKET

- 5.16 UNMET NEEDS/END USER EXPECTATIONS

- 5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 IMPACT OF AI/GEN AI

- 5.20 US 2025 TARIFF

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRY

6 PEDIATRIC VASCULAR ACCESS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 CATHETERS

- 6.2.1 CENTRAL VENOUS CATHETERS

- 6.2.1.1 Increased prevalence of preterm births to drive market

- 6.2.2 PERIPHERAL INTRAVENOUS CATHETERS

- 6.2.2.1 Rapid adoption of minimally invasive procedures to drive market

- 6.2.3 PERIPHERALLY INSERTED CENTRAL CATHETERS

- 6.2.3.1 Need for long-term vascular access in premature neonates to drive market

- 6.2.4 MIDLINE CATHETERS

- 6.2.4.1 Advancements in catheter materials and insertion techniques to drive market

- 6.2.1 CENTRAL VENOUS CATHETERS

- 6.3 CATHETER SECUREMENT & STABILIZATION

- 6.3.1 IMPROVED AWARENESS ABOUT CATHETER STABILIZATION TO DRIVE MARKET

- 6.4 IMPLANTABLE PORTS

- 6.4.1 RISING INCIDENCES OF PEDIATRIC CANCER TO DRIVE MARKET

- 6.5 PORT NEEDLES

- 6.5.1 INCREASED USE OF IMPLANTABLE PORTS IN PEDIATRIC CARE TO DRIVE MARKET

- 6.6 INFUSION PUMPS

- 6.6.1 HEIGHTENED DEMAND FOR PRECISE DRUG DELIVERY IN PEDIATRIC CARE TO DRIVE MARKET

- 6.7 IV CONNECTORS

- 6.7.1 STRINGENT HOSPITAL PROTOCOLS TO DRIVE MARKET

- 6.8 SYRINGES & NEEDLES

- 6.8.1 NEED FOR SAFE DRUG ADMINISTRATION IN PEDIATRICS TO DRIVE MARKET

- 6.9 VASCULAR CLOSURE DEVICES

- 6.9.1 SURGE IN MINIMALLY INVASIVE PROCEDURES IN PEDIATRIC TO DRIVE MARKET

- 6.10 IV SETS & ACCESSORIES

- 6.10.1 RISE IN PEDIATRIC CONDITIONS REQUIRING INTRAVENOUS THERAPY TO DRIVE MARKET

- 6.11 ANESTHESIA INJECTION DEVICES

- 6.11.1 GROWING PEDIATRICS PROCEDURES TO DRIVE MARKET

- 6.12 GUIDANCE DEVICES

- 6.12.1 ESCALATING DEMAND FOR SAFER AND MORE EFFECTIVE VASCULAR ACCESS PROCEDURES TO DRIVE MARKET

- 6.13 CATHETER CAPS & CLOSURES

- 6.13.1 ADOPTION OF INFECTION PREVENTION PROTOCOLS BY PEDIATRIC CARE UNITS TO DRIVE MARKET

- 6.14 INTRAOSSEOUS INFUSION DEVICES

- 6.14.1 RISING PEDIATRIC EMERGENCIES AND SEPSIS CASES TO DRIVE MARKET

- 6.15 OTHER TYPES

7 PEDIATRIC VASCULAR ACCESS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 FLUID & NUTRITION ADMINISTRATION

- 7.2.1 NEED FOR PRECISE, CONTINUOUS THERAPY IN PEDIATRIC POPULATION TO DRIVE MARKET

- 7.3 DRUG ADMINISTRATION

- 7.3.1 RISE IN PEDIATRIC HEALTH COMPLEXITIES TO DRIVE MARKET

- 7.4 DIAGNOSTICS & TESTING

- 7.4.1 ELEVATED DEMAND FOR EARLY DISEASE DETECTION, SEPSIS MANAGEMENT, AND MONITORING TO DRIVE MARKET

- 7.5 BLOOD TRANSFUSION

- 7.5.1 PREVALENCE OF PRETERM BIRTHS AND NEONATAL ANEMIA TO DRIVE MARKET

8 PEDIATRIC VASCULAR ACCESS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 GROWING NICU ADMISSIONS DUE TO PREMATURE BIRTHS AND CONGENITAL CONDITIONS TO DRIVE MARKET

- 8.3 AMBULATORY SURGICAL CENTERS & CLINICS

- 8.3.1 INCREASING PREFERENCE FOR OUTPATIENT CARE TO DRIVE MARKET

- 8.4 HOMECARE SETTINGS

- 8.4.1 EMERGING TREND OF EARLY HOSPITAL DISCHARGE TO DRIVE MARKET

- 8.5 OTHER END USERS

9 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Increasing burden of pediatric cancer to drive market

- 9.2.3 CANADA

- 9.2.3.1 Rising preterm births and NICU admissions to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK

- 9.4.2 JAPAN

- 9.4.2.1 Growing focus on pediatric care to drive market

- 9.4.3 CHINA

- 9.4.3.1 Substantial investments in healthcare infrastructure to drive market

- 9.4.4 REST OF ASIA PACIFIC

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End user footprint

- 10.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING

- 10.6.5.1 List of start-ups/SMEs

- 10.6.5.2 Competitive benchmarking of start-ups/SMEs

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BECTON, DICKINSON AND COMPANY

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses & competitive threats

- 11.1.2 TELEFLEX INCORPORATED

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 ICU MEDICAL, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 B. BRAUN SE

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 TERUMO CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choice

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 MEDTRONIC

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 VYGON

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 NIPRO CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 ANGIODYNAMICS

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.9.3.2 Deals

- 11.1.10 COOK MEDICAL

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.1 BECTON, DICKINSON AND COMPANY

- 11.2 OTHER PLAYERS

- 11.2.1 CANADIAN HOSPITAL SPECIALTIES LIMITED

- 11.2.2 MERIT MEDICAL SYSTEMS, INC.

- 11.2.3 MEDICAL COMPONENTS, INC.

- 11.2.4 AMECATH

- 11.2.5 ARGON MEDICAL DEVICES

- 11.2.6 HEALTH LINE INTERNATIONAL CORPORATION

- 11.2.7 DELTA MED

- 11.2.8 ACCESS VASCULAR, INC.

- 11.2.9 PAKUMEDMEDICAL PRODUCTS GMBH

- 11.2.10 GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD.

- 11.2.11 PFM MEDICAL

- 11.2.12 POLY MEDICURE LTD

- 11.2.13 NEWTECH MEDICAL DEVICES PVT. LTD.

- 11.2.14 SHANGHAI PUYI MEDICAL INSTRUMENTS CO., LTD.

- 11.2.15 ANGIPLAST PRIVATE LIMITED

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 IMPORT DATA FOR HS CODE 901839-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2024 (USD THOUSAND)

- TABLE 3 EXPORT DATA FOR HS CODE 901839-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2024 (USD THOUSAND)

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE TYPES

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 AVERAGE SELLING PRICE TREND, BY KEY PLAYERS, 2022-2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 14 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 UNMET NEEDS/END USER EXPECTATIONS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR VASCULAR ACCESS DEVICES

- TABLE 18 PEDIATRIC VASCULAR ACCESS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 19 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETERS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 20 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 21 PEDIATRIC VASCULAR ACCESS MARKET FOR CENTRAL VENOUS CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 PEDIATRIC VASCULAR ACCESS MARKET FOR PERIPHERAL INTRAVENOUS CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 23 PEDIATRIC VASCULAR ACCESS MARKET FOR PERIPHERALLY INSERTED CENTRAL CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 24 PEDIATRIC VASCULAR ACCESS MARKET FOR MIDLINE CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETER SECUREMENT & STABILIZATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 PEDIATRIC VASCULAR ACCESS MARKET FOR IMPLANTABLE PORTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 PEDIATRIC VASCULAR ACCESS MARKET FOR PORT NEEDLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 PEDIATRIC VASCULAR ACCESS MARKET FOR INFUSION PUMPS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 PEDIATRIC VASCULAR ACCESS MARKET FOR IV CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 PEDIATRIC VASCULAR ACCESS MARKET FOR SYRINGES & NEEDLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 PEDIATRIC VASCULAR ACCESS MARKET FOR VASCULAR CLOSURE DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 PEDIATRIC VASCULAR ACCESS MARKET FOR IV SETS & ACCESSORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 PEDIATRIC VASCULAR ACCESS MARKET FOR ANESTHESIA INJECTION DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 PEDIATRIC VASCULAR ACCESS MARKET FOR GUIDANCE DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETER CAPS & CLOSURES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 PEDIATRIC VASCULAR ACCESS MARKET FOR INTRAOSSEOUS INFUSION DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 PEDIATRIC VASCULAR ACCESS MARKET FOR OTHER TYPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 PEDIATRIC VASCULAR ACCESS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 39 PEDIATRIC VASCULAR ACCESS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 40 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: PEDIATRIC VASCULAR ACCESS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 US: KEY MACRO INDICATORS

- TABLE 43 CANADA: KEY MACRO INDICATORS

- TABLE 44 ASIA PACIFIC: PEDIATRIC VASCULAR ACCESS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 JAPAN: KEY MACRO INDICATORS

- TABLE 46 CHINA: KEY MACRO INDICATORS

- TABLE 47 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 48 PEDIATRIC VASCULAR ACCESS MARKET: DEGREE OF COMPETITION

- TABLE 49 REGION FOOTPRINT

- TABLE 50 TYPE FOOTPRINT

- TABLE 51 APPLICATION FOOTPRINT

- TABLE 52 END USER FOOTPRINT

- TABLE 53 LIST OF START-UPS/SMES

- TABLE 54 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 55 PEDIATRIC VASCULAR ACCESS MARKET: PRODUCT LAUNCHES & APPROVALS, 2022-2025

- TABLE 56 PEDIATRIC VASCULAR ACCESS MARKET: DEALS, 2022-2025

- TABLE 57 PEDIATRIC VASCULAR ACCESS MARKET: OTHER DEVELOPMENTS, 2022-2025

- TABLE 58 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 59 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 60 TELEFLEX INCORPORATED: COMPANY OVERVIEW

- TABLE 61 TELEFLEX INCORPORATED: PRODUCTS OFFERED

- TABLE 62 TELEFLEX INCORPORATED: PRODUCT LAUNCHES & APPROVALS

- TABLE 63 TELEFLEX INCORPORATED, INC:. DEALS

- TABLE 64 TELEFLEX INCORPORATED: OTHER DEVELOPMENTS

- TABLE 65 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 66 ICU MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 67 ICU MEDICAL, INC.: DEALS

- TABLE 68 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 69 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 70 B. BRAUN SE: PRODUCT LAUNCHES & APPROVALS

- TABLE 71 B. BRAUN SE: DEALS

- TABLE 72 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 73 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 74 MEDTRONIC: COMPANY OVERVIEW

- TABLE 75 MEDTRONIC: PRODUCTS OFFERED

- TABLE 76 VYGON: COMPANY OVERVIEW

- TABLE 77 VYGON: PRODUCTS OFFERED

- TABLE 78 NIPRO CORPORATION: COMPANY OVERVIEW

- TABLE 79 NIPRO CORPORATION: PRODUCTS OFFERED

- TABLE 80 ANGIODYNAMICS: COMPANY OVERVIEW

- TABLE 81 ANGIODYNAMICS: PRODUCTS OFFERED

- TABLE 82 ANGIODYNAMICS: PRODUCT LAUNCHES & APPROVALS

- TABLE 83 ANGIODYNAMICS: DEALS

- TABLE 84 COOK MEDICAL: COMPANY OVERVIEW

- TABLE 85 COOK MEDICAL: PRODUCTS OFFERED

List of Figures

- FIGURE 1 PEDIATRIC VASCULAR ACCESS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 7 PEDIATRIC VASCULAR ACCESS MARKET: CAGR PROJECTIONS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 CATHETERS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 FLUID & NUTRITION ADMINISTRATION SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 11 HOSPITALS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR VASCULAR ACCESS DEVICES DURING FORECAST PERIOD

- FIGURE 13 RISE OF PEDIATRIC POPULATION TO DRIVE MARKET

- FIGURE 14 NORTH AMERICA TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 15 PEDIATRIC VASCULAR ACCESS MARKET DYNAMICS

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 ECOSYSTEM ANALYSIS

- FIGURE 18 SUPPLY CHAIN ANALYSIS

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE TYPES

- FIGURE 22 PATENT ANALYSIS, 2014-2024

- FIGURE 23 TOP APPLICANT REGIONS, 2014-2025

- FIGURE 24 AVERAGE SELLING PRICE TREND OF CENTRAL VENOUS CATHETERS, BY REGION, 2022-2024 (USD)

- FIGURE 25 VASCULAR ACCESS DEVICE MARKET OVERVIEW

- FIGURE 26 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 28 IMPACT OF AI/GEN AI

- FIGURE 29 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION

- FIGURE 30 NORTH AMERICA: PEDIATRIC VASCULAR ACCESS DEVICE MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: PEDIATRIC VASCULAR ACCESS MARKET SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS OF TOP THREE PLAYERS, 2022-2024

- FIGURE 33 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 34 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 35 COMPANY FOOTPRINT

- FIGURE 36 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 37 EV/EBITDA OF KEY VENDORS

- FIGURE 38 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 39 BRAND/PRODUCT COMPARISON

- FIGURE 40 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

- FIGURE 41 TELEFLEX INCORPORATED: COMPANY SNAPSHOT

- FIGURE 42 ICU MEDICAL, INC.: COMPANY SNAPSHOT

- FIGURE 43 B. BRAUN SE: COMPANY SNAPSHOT

- FIGURE 44 TERUMO CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 46 NIPRO CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 ANGIODYNAMICS: COMPANY SNAPSHOT