|

市場調查報告書

商品編碼

1914124

全球汽車數位駕駛座市場(至2032年):按設備、應用、車輛類型、電動車類型、顯示器類型和顯示器尺寸分類Automotive Digital Cockpit Market by Equipment, Application, Vehicle Type, EV Type, Display Type, Display Size - Global Forecast to 2032 |

||||||

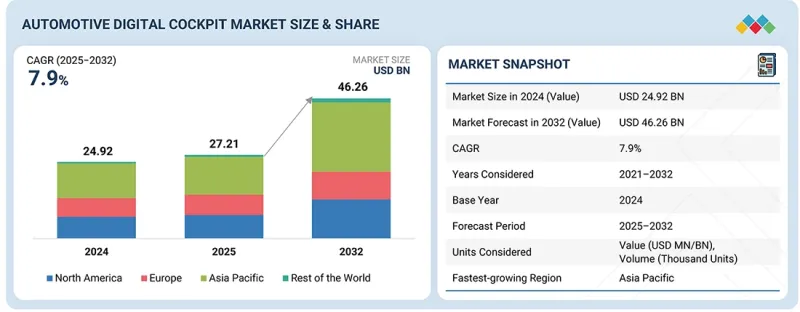

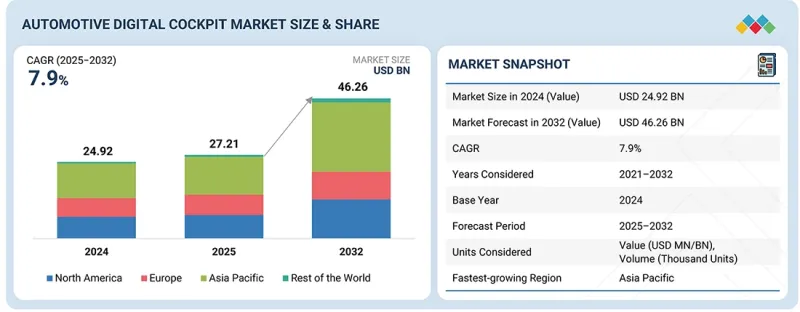

汽車數位駕駛座市場預計將從 2025 年的 272.1 億美元成長到 2032 年的 462.6 億美元,複合年成長率為 7.9%。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2032 |

| 基準年 | 2024 |

| 預測期 | 2025-2032 |

| 單元 | 價值(美元) |

| 部分 | 設備、用途、車輛類型、電動車類型、顯示器類型、顯示器尺寸 |

| 目標區域 | 北美洲、歐洲、亞太地區、世界其他地區 |

隨著汽車製造商在全部區域加速向高度互聯、軟體主導的汽車平臺轉型,市場持續成長。消費者對更大尺寸顯示器、整合資訊娛樂系統、數位叢集和智慧駕駛員監控的日益普及,推動了大眾市場和豪華車型駕駛座的升級。圖形處理、集中式運算和雲端連接服務的進步,使得更豐富的介面和持續的功能增強成為可能。電動車產量的擴張進一步推動了對具備能量分析和即時控制功能的駕駛座系統的需求。對數位駕駛座創新、語音互動和多螢幕佈局的大力投資,正在提升車內體驗。監管機構對駕駛注意力和安全的日益重視,也推動了先進駕駛座技術在新車型中的應用。

以顯示器尺寸計算,5-10吋顯示器將在2024年佔據最大佔有率。

這主要得益於緊湊型、中型以及部分高階車型對數位顯示器的廣泛應用。該細分市場在可視性、成本效益和儀錶板適應性方面實現了理想的平衡,使其成為數位儀表叢集、資訊娛樂顯示器和輔助控制螢幕的核心。汽車製造商青睞5-10吋顯示螢幕,因為它們既能支援導航、媒體、警報和系統診斷等關鍵車輛功能,又能保持經濟性和可擴展性。觸控響應速度的提升、亮度控制的改進以及高解析度影像的呈現,在不增加系統成本的情況下,顯著改善了使用者體驗。隨著駕駛座設計向軟體定義架構發展,5-10吋顯示器與現代運算平台和連接服務保持高度相容性。

“按電動汽車類型分類,預計純電動汽車細分市場在預測期內將呈現最快的成長速度。”

電動車產量不斷成長,以及向數位化優先的車輛平台轉型,推動了對先進駕駛座解決方案的需求,以配合電動動力傳動系統。電動車使用者需要功能豐富的座艙介面,提供充電狀態資訊、能源管理數據、路線最佳化和性能更新。這一趨勢正在推動高解析度螢幕、智慧型叢集和雲端資訊娛樂系統的廣泛應用。汽車製造商正在採用基於網域控制器的架構,將駕駛座功能與核心電源管理操作整合。政策獎勵和充電網路的快速擴張正在加速向更先進的駕駛座配置過渡。機械限制較少的電動車平台也有利於多螢幕和身臨其境型介面的整合。隨著全球電動車滲透率的穩定提升,擁有強大的顯示和人機互動(HMI)產品組合的技術供應商預計將在電動車開發平臺中獲得顯著成長。

“按應用領域分類,預計到 2032 年,資訊娛樂領域將佔據最大的市場佔有率。”

在互聯服務和個人化媒體體驗需求不斷成長的推動下,預計到2032年,車載資訊娛樂系統將佔據最大的市場佔有率。汽車製造商正優先開發能夠將導航、媒體、通話和訊息、智慧型手機整合以及車輛設定整合到單一介面中的平台。圖形處理技術和軟體定義駕駛座架構的進步使得透過空中下載(OTA)進行持續的功能升級成為可能。處理能力、圖形渲染和雲端整合技術的進步則催生了自然語音互動、預測提案和不間斷媒體存取等高級功能。原始設備製造商(OEM)也在拓展其訂閱服務,使車載資訊娛樂系統成為高收入管道。在人們對數位化便利性和身臨其境型互動日益成長的期望驅動下,預計到2032年,車載資訊娛樂系統仍將保持其主導地位。

本報告調查了全球汽車數位駕駛座市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、按各個細分市場、地區/主要國家/地區進行的詳細分析、競爭格局以及主要企業的概況。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 未滿足的需求和閒置頻段

- 與相關市場和不同產業相關的跨領域機遇

- 一級/二級/三級公司的策略性舉措

第5章:技術進步、人工智慧影響、專利、創新與未來應用

- 技術分析

- 技術藍圖

- 專利分析

- 未來應用

- 人工智慧/生成式人工智慧對汽車數位駕駛座市場的影響

- 成功案例和實際應用

第6章永續性和監管環境

- 地方法規和合規性

- 對永續性的承諾

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第7章:顧客狀況與購買行為

- 決策流程

- 相關利益者和採購標準

- 招募障礙和內部挑戰

- 來自各個終端使用者產業的未滿足需求

- 市場盈利

第8章 產業趨勢

- 總體經濟指標

- 生態系分析

- 供應鏈分析

- 定價分析

- 影響客戶業務的趨勢與干擾因素

- 投資和資金籌措方案

- 按用例資金籌措

- 2026-2027 年重要會議與活動

- 貿易分析

- 案例研究分析

- 2025年美國關稅的影響

- OEM和供應商計劃的策略轉變

- OEM分析

- XPENG

- NIO

- LEAPMOTOR

- GEELY ZEEKR

- TATA MOTORS

- VOLKSWAGEN AUDI

- BMW

- STELLANTIS

- MERCEDES BENZ

- FORD MOTOR COMPANY

- GENERAL MOTORS

第9章 按設備分類的汽車數位駕駛座市場

- 數位儀表叢集

- 數位中央主機

- 資訊娛樂單元

- 後座資訊娛樂單元

- 乘客資訊娛樂單元

- 抬頭顯示器(HUD)

- 駕駛員監控系統

- 關鍵產業洞察

第10章:按車輛類型分類的汽車數位駕駛座市場

- 搭乘用車

- 輕型商用車(LCV)

- 重型商用車(HCV)

- 關鍵產業洞察

第11章 按電動車類型分類的汽車數位駕駛座市場

- 電池電動車(BEV)

- 插電式混合動力電動車(PHEV)

- 關鍵產業洞察

第12章 汽車數位駕駛座市場(按應用分類)

- 資訊娛樂

- 駕駛員監控和援助

- 車輛和舒適控制系統

- 關鍵產業洞察

第13章:依顯示器尺寸分類的汽車數位駕駛座市場

- 小於5英寸

- 5到10英寸

- 超過10英寸

- 關鍵產業洞察

第14章 按顯示類型分類的汽車數位駕駛座市場

- 液晶顯示器(LCD)

- 有機發光二極體(OLED)

- 薄膜電晶體液晶顯示器(TFT-LCD)

- 關鍵產業洞察

第15章:汽車數位駕駛座市場區域分析

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 義大利

- 西班牙

- 英國

- 俄羅斯

- 其他

- 其他地區

- 巴西

- 伊朗

- 其他

第16章 競爭格局

- 主要參與企業的策略/優勢

- 市佔率分析

- 收入分析

- 估值和財務指標

- 品牌/產品對比

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小企業

- 競爭場景

第17章:公司簡介

- 主要企業

- CONTINENTAL AG

- ROBERT BOSCH GMBH

- HARMAN INTERNATIONAL

- VISTEON CORPORATION

- DENSO CORPORATION

- VALEO

- MITSUBISHI ELECTRIC CORPORATION

- TOMTOM INTERNATIONAL BV

- APTIV

- LG ELECTRONICS

- FORVIA

- MAGNA INTERNATIONAL INC.

- HYUNDAI MOBIS

- ALPS ALPINE CO., LTD.

- 其他公司

- QUALCOMM TECHNOLOGIES, INC.

- NXP SEMICONDUCTORS

- MARELLI HOLDINGS CO., LTD.

- ZF FRIEDRICHSHAFEN AG

- PIONEER CORPORATION

- SONY CORPORATION

- INFINEON TECHNOLOGIES AG

- JVCKENWOOD CORPORATION

- FUJITSU LIMITED

- FORYOU CORPORATION

- MAGNETI MARELLI SPA

第18章調查方法

第19章附錄

The automotive digital cockpit market is projected to grow from USD 27.21 billion in 2025 to USD 46.26 billion in 2032 at a CAGR of 7.9%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Equipment, Application, Vehicle Type, EV Type, Display Type, Display Size |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the world |

The market is growing as automakers accelerate the shift to connected, software-driven vehicle platforms across all major regions. The rising consumer adoption of large displays, integrated infotainment systems, digital clusters, and intelligent driver monitoring is driving cockpit upgrades in both mass-market and premium vehicles. Advancements in graphics processing, centralized computing, and cloud-linked services are enabling richer interfaces and continuous feature enhancements. Growing electric vehicle production is further increasing demand for cockpit systems that provide energy insights and real-time control functions. Strong investments in digital cockpit innovation, voice interaction, and multiscreen layouts are improving in-cabin experiences. Expanding regulatory focus on driver attention and safety is also supporting the integration of advanced cockpit technologies across new model launches.

"The 5-10" display segment accounted for the largest share of the automotive digital cockpit market in 2024."

The 5-10" display segment accounted for the largest share of the automotive digital cockpit market in 2024, driven by its extensive deployment across compact, mid-range, and selected premium vehicles. This segment offers the right mix of clarity, cost efficiency, and dashboard adaptability, making it central to digital instrument clusters, infotainment displays, and auxiliary control screens. Automakers favor 5-10" displays because these displays support essential vehicle functions such as navigation, media, alerts, and system diagnostics while maintaining strong affordability and production scalability. Enhancements in touch responsiveness, brightness control, and high-resolution visuals have improved user experience without raising system expense. As cockpit designs shift toward software-defined architectures, 5-10" displays remain highly compatible with modern compute platforms and connected services.

"The BEV segment is projected to register the fastest growth during the forecast period."

The battery electric vehicle (BEV) segment is expected to register the fastest growth in the automotive digital cockpit market during the forecast period. Increasing EV output and the transition to digital-first automotive platforms are driving the need for advanced cockpit solutions that complement electric powertrains. EV users seek feature-rich cabin interfaces that provide charging insights, energy management data, route optimization, and performance updates. This trend is increasing the use of high-resolution screens, smart clusters, and cloud-enabled infotainment systems. Automakers are standardizing domain controller-based architectures to unify cockpit functions with core power management operations. Policy incentives and rapid expansion of charging networks are accelerating the shift toward more sophisticated cockpit setups. EV platforms, with fewer mechanical limitations, also support easier integration of multiscreen and immersive interfaces. With global EV penetration rising steadily, technology providers with strong display and HMI portfolios are positioned to capture substantial growth across EV development pipelines.

"The infotainment segment is projected to hold the largest share of the automotive digital cockpit market in 2032."

The infotainment segment is expected to hold the largest share of the automotive digital cockpit market in 2032 as demand grows for connected services and personalized media experiences. Automakers are prioritizing platforms that integrate navigation, media, calls, and messaging, smartphone features, and vehicle settings within a single interface. Advancements in graphics processing and software-defined cockpit architectures enable continuous feature upgrades through over-the-air updates. Advancements in processing capability, graphic rendering, and cloud integration are enabling advanced functions such as natural voice interaction, predictive suggestions, and uninterrupted media access. OEMs are also expanding subscription-based offerings that make infotainment a high-value revenue channel. With rising expectations for digital convenience and immersive interaction, infotainment systems are set to remain the dominant application segment by 2032.

"The Asia Pacific is projected to hold the largest share of the automotive digital cockpit market in 2032."

The Asia Pacific accounted for the largest share of the automotive digital cockpit market in 2032. Strong vehicle production in China, India, Japan, and South Korea, combined with rapid EV adoption, is driving substantial demand for advanced cockpit systems. Automakers in the region are integrating digital clusters, infotainment units, passenger displays, and driver monitoring systems to meet rising customer expectations for connected and intelligent in-cabin experiences. Government support for electrification, connectivity standards, and safety compliance is further accelerating technology uptake. With continuous investments in software-defined vehicle platforms and cockpit electronics, the Asia Pacific region remains a crucial market for digital cockpit solutions.

Extensive primary interviews have been conducted with key industry experts in the automotive digital cockpit market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study draws insights from a range of industry experts, including component suppliers, Tier 1 companies, and OEMs. The break-up of the primaries is as follows:

- By Company Type -OEM - 45%, Tier 1 - 35%, and Others - 20%

- By Designation -Directors- 35%, C- C-level Executives - 35%, and Others - 30%

- By Region - Asia Pacific - 32%, Europe - 28%, North America - 36%, and RoW - 4%

The automotive digital cockpit market is dominated by a few globally established players, such as Continental AG, Robert Bosch GmbH, Denso Corporation, Visteon Corporation, and HARMAN International. The study includes an in-depth competitive analysis of these key players in the automotive digital cockpit market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the automotive digital cockpit market. It forecasts its size by equipment (infotainment unit, rear infotainment unit, passenger infotainment unit, HUD, digital instrument cluster, digital center console, driver monitoring system), by electric vehicle type (battery electric vehicle and plug in hybrid electric vehicle), by vehicle type (passenger car, light commercial vehicle, heavy commercial vehicle), by display type (LCD, OLED, TFT LCD), by display size (<5", 5 to 10", >10"), and by application (infotainment, driver monitoring & assistance, vehicle and comfort control system). It also discusses market drivers, restraints, opportunities, and challenges. The report provides detailed market analysis across four key regions (North America, Europe, the Asia Pacific, and the Rest of the World). The report includes a review of the supply chain and the competitive landscape of key players operating in the automotive digital cockpit ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (growing consumer demand for premium in-cabin experiences, rising shift toward software-defined vehicles), restraints (high cost of advanced cockpit electronics), opportunities (growth in multimodal HMI, AR visualization, and interior sensing systems, increasing adoption of highway driving assist technology), challenges (increasing cybersecurity, data governance, and OTA coordination pressures, managing OTA complexity across distributed cockpit and vehicle compute units)

- Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product launches in the automotive digital cockpit market

- Market Development: Comprehensive information about lucrative markets by analyzing the automotive digital cockpit market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the automotive digital cockpit market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Continental AG, Robert Bosch GmbH, Denso Corporation, Visteon Corporation, and HARMAN International

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AUTOMOTIVE DIGITAL COCKPIT MARKET

- 2.4 HIGH-GROWTH SEGMENTS IN AUTOMOTIVE DIGITAL COCKPIT MARKET

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE DIGITAL COCKPIT MARKET

- 3.2 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT

- 3.3 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE

- 3.4 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION

- 3.5 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE

- 3.6 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EV TYPE

- 3.7 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE

- 3.8 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising shift toward software-defined vehicles

- 4.2.1.2 Growing consumer demand for premium in-cabin experiences

- 4.2.1.3 Regulatory mandates driving expansion of cockpit safety technologies

- 4.2.1.4 Expansion of electric vehicles increasing demand for digital-centric cabin interfaces

- 4.2.2 RESTRAINTS

- 4.2.2.1 High cost of advanced cockpit electronics

- 4.2.2.2 Semiconductor and display supply vulnerabilities affecting cockpit system production

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Increasing investment in AR and HUD technologies

- 4.2.3.2 Increasing adoption of highway driving assist technology

- 4.2.3.3 Growth in multimodal HMI, advanced visualization, and interior sensing systems

- 4.2.4 CHALLENGES

- 4.2.4.1 Increasing cybersecurity, data governance, and OTA coordination pressures in connected cockpits

- 4.2.4.2 Managing OTA complexity across distributed cockpit and vehicle computing units

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 5.1 TECHNOLOGY ANALYSIS

- 5.1.1 KEY TECHNOLOGIES

- 5.1.1.1 Advanced Display Technologies (LCD, OLED, Mini LED)

- 5.1.1.2 Cockpit Domain Controllers and High-performance SoCs

- 5.1.1.3 Natural Language Processing and Voice Assistants

- 5.1.2 COMPLEMENTARY TECHNOLOGIES

- 5.1.2.1 Interior Cameras and Driver Monitoring Systems

- 5.1.2.2 Gesture Control, Haptic Interaction, and Ambient Interfaces

- 5.1.3 ADJACENT TECHNOLOGIES

- 5.1.3.1 Central Vehicle Compute and Zonal Architectures

- 5.1.3.2 Connectivity, Telematics, and V2X Integration

- 5.1.1 KEY TECHNOLOGIES

- 5.2 TECHNOLOGY ROADMAP

- 5.3 PATENT ANALYSIS

- 5.4 FUTURE APPLICATIONS

- 5.5 IMPACT OF AI/GENERATIVE AI ON AUTOMOTIVE DIGITAL COCKPIT MARKET

- 5.5.1 TOP USE CASES AND MARKET POTENTIAL

- 5.5.2 BEST PRACTICES

- 5.5.3 CASE STUDIES

- 5.5.4 ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.5.5 CLIENTS' READINESS TO ADOPT AI/GENERATIVE AI

- 5.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 5.6.1 TOYOTA MOTOR CORPORATION: DIGITAL COCKPIT INTEGRATION THROUGH TOYOTA SAFETY CONNECT

- 5.6.2 HYUNDAI MOTOR COMPANY: PANORAMIC DISPLAY AND DOMAIN-BASED COCKPIT ARCHITECTURE

- 5.6.3 GENERAL MOTORS: GOOGLE BUILT-IN SERVICES FOR CONNECTED COCKPIT EXPERIENCES

6 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 6.1 REGIONAL REGULATIONS AND COMPLIANCE

- 6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1.2 REGULATORY LANDSCAPE FOR AUTOMOTIVE DIGITAL COCKPIT SYSTEMS

- 6.1.3 INDUSTRY STANDARDS

- 6.2 SUSTAINABILITY INITIATIVES

- 6.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 6.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 7.5 MARKET PROFITABILITY

- 7.5.1 REVENUE POTENTIAL

- 7.5.2 COST DYNAMICS

8 INDUSTRY TRENDS

- 8.1 MACROECONOMIC INDICATORS

- 8.1.1 INTRODUCTION

- 8.1.2 GDP TRENDS AND FORECAST

- 8.1.3 TRENDS IN GLOBAL AUTOMOTIVE INFOTAINMENT INDUSTRY

- 8.1.4 TRENDS IN GLOBAL AUTOMOTIVE AND TRANSPORTATION INDUSTRY

- 8.2 ECOSYSTEM ANALYSIS

- 8.2.1 RAW MATERIAL & DISPLAY COMPONENT SUPPLIERS

- 8.2.2 COMPONENT & SEMICONDUCTOR SUPPLIERS

- 8.2.3 COCKPIT SOFTWARE & HMI PROVIDERS

- 8.2.4 TIER 1 SUPPLIERS/SYSTEM INTEGRATORS

- 8.2.5 OEMS (AUTOMAKERS)

- 8.3 SUPPLY CHAIN ANALYSIS

- 8.4 PRICING ANALYSIS

- 8.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT, 2024

- 8.4.2 AVERAGE SELLING PRICE TREND, BY EQUIPMENT, 2022-2024

- 8.4.3 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 8.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 8.6 INVESTMENT AND FUNDING SCENARIO

- 8.7 FUNDING, BY USE CASE

- 8.8 KEY CONFERENCES AND EVENTS, 2026-2027

- 8.9 TRADE ANALYSIS

- 8.9.1 IMPORT SCENARIO (HS CODE 8537)

- 8.9.2 EXPORT SCENARIO (HS CODE 8537)

- 8.10 CASE STUDY ANALYSIS

- 8.10.1 CONTINENTAL DELIVERED HIGH-PERFORMANCE COCKPIT COMPUTING FOR VOLKSWAGEN

- 8.10.2 VISTEON SUPPLIED SMARTCORE DOMAIN CONTROLLER FOR BMW MINI

- 8.10.3 HARMAN INTERNATIONAL'S READY CARE AI-BASED COGNITIVE DISTRACTION MONITORING FOR BMW

- 8.10.4 LG'S PANORAMIC AUTOMOTIVE DISPLAY FOR MERCEDES-BENZ

- 8.10.5 VALEO DEVELOPED SMARTCOCKPIT DIGITAL SOLUTIONS IN COLLABORATION WITH GOOGLE AND RENAULT

- 8.10.6 MAGNA'S GEN5 FRONT CAMERA MODULE FOR EUROPEAN OEM

- 8.10.7 APTIV'S SOFTWARE-DEFINED VEHICLE COCKPIT PLATFORM FOR GLOBAL OEM

- 8.10.8 DENSO'S ADVANCED DRIVE COMPONENTS FOR LEXUS LS AND TOYOTA MIRAI

- 8.11 IMPACT OF 2025 US TARIFFS

- 8.11.1 INTRODUCTION

- 8.11.2 KEY TARIFF RATES

- 8.11.3 PRICE IMPACT ANALYSIS

- 8.11.4 IMPACT ON COUNTRIES/REGIONS

- 8.11.5 IMPACT ON AUTOMOTIVE INDUSTRY

- 8.12 STRATEGIC SHIFTS IN OEM AND SUPPLIER PROGRAMS

- 8.13 OEM ANALYSIS

- 8.13.1 XPENG

- 8.13.1.1 Digital cockpit strategy overview

- 8.13.1.2 Key digital cockpit technologies and components used

- 8.13.1.3 Key programs and model adoption

- 8.13.2 NIO

- 8.13.2.1 Digital cockpit strategy overview

- 8.13.2.2 Key programs and model adoption

- 8.13.3 LEAPMOTOR

- 8.13.3.1 Digital cockpit strategy overview

- 8.13.3.2 Key programs and component architecture

- 8.13.3.3 Featured models and adoption pathway

- 8.13.4 GEELY ZEEKR

- 8.13.4.1 Digital cockpit strategy overview

- 8.13.4.2 Key programs and model adoption

- 8.13.5 TATA MOTORS

- 8.13.5.1 Digital cockpit strategy overview

- 8.13.5.2 Digital cockpit components used

- 8.13.5.3 Key programs and model adoption

- 8.13.6 VOLKSWAGEN AUDI

- 8.13.6.1 Digital cockpit strategy overview

- 8.13.6.2 Key programs and model adoption

- 8.13.7 BMW

- 8.13.7.1 Digital cockpit strategy overview

- 8.13.7.2 Key programs and model adoption

- 8.13.8 STELLANTIS

- 8.13.8.1 Digital cockpit strategy overview

- 8.13.8.2 Key programs and model adoption

- 8.13.9 MERCEDES BENZ

- 8.13.9.1 Digital cockpit strategy overview

- 8.13.9.2 Key programs and model adoption

- 8.13.10 FORD MOTOR COMPANY

- 8.13.10.1 Digital cockpit strategy overview

- 8.13.10.2 Cockpit architecture and technology focus

- 8.13.10.3 Key programs and model adoption

- 8.13.11 GENERAL MOTORS

- 8.13.11.1 Digital cockpit strategy overview

- 8.13.11.2 Key programs and model adoption

- 8.13.1 XPENG

9 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT

- 9.1 INTRODUCTION

- 9.1.1 OPERATIONAL DATA

- 9.2 DIGITAL INSTRUMENT CLUSTER

- 9.2.1 SHIFT FROM ANALOG CLUSTERS TO FULLY DIGITAL AND RECONFIGURABLE DISPLAYS TO DRIVE DEMAND

- 9.3 DIGITAL CENTRAL CONSOLE

- 9.3.1 GROWING ADOPTION OF LARGE-FORMAT CENTRAL CONSOLES FOR NAVIGATION, MEDIA, AND CONNECTED SERVICES TO DRIVE DEMAND

- 9.4 INFOTAINMENT UNIT

- 9.4.1 INCREASING INTEGRATION OF CONNECTED INFOTAINMENT PLATFORMS AND EMBEDDED SOFTWARE ECOSYSTEMS TO DRIVE DEMAND

- 9.5 REAR INFOTAINMENT UNIT

- 9.5.1 EXPANDING USE OF REAR INFOTAINMENT SYSTEMS TO ENHANCE ENTERTAINMENT AND CABIN PERSONALIZATION

- 9.6 PASSENGER INFOTAINMENT UNIT

- 9.6.1 INCREASED INSTALLATION OF PASSENGER INFOTAINMENT UNITS FOR CO-NAVIGATION AND ENTERTAINMENT

- 9.7 HEAD-UP DISPLAY (HUD)

- 9.7.1 GROWING USE OF HUDS TO SUPPORT SAFETY VISUALIZATION AND DRIVER AWARENESS

- 9.8 DRIVER MONITORING SYSTEM

- 9.8.1 INCREASED DEPLOYMENT OF CAMERA-BASED DRIVER MONITORING TO SUPPORT SAFETY REGULATION AND ADAS ALIGNMENT

- 9.9 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CAR (PC)

- 10.2.1 PASSENGER VEHICLE DIGITALIZATION DRIVING ADOPTION OF ADVANCED DISPLAYS AND UNIFIED COCKPIT COMPUTE PLATFORMS

- 10.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 10.3.1 EXPANDING FLEET CONNECTIVITY TO DRIVE DEMAND FOR FUNCTIONAL TELEMATICS-DRIVEN COCKPIT PLATFORMS

- 10.4 HEAVY COMMERCIAL VEHICLE (HCV)

- 10.4.1 HIGHER OPERATIONAL COMPLEXITY ACCELERATING DEPLOYMENT OF DURABLE DIAGNOSTICS-FOCUSED COCKPIT SYSTEMS

- 10.5 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 BATTERY ELECTRIC VEHICLE (BEV)

- 11.2.1 GROWING BEV PENETRATION DRIVING RAPID ADOPTION OF MULTI-DISPLAY AND SOFTWARE-CENTRIC COCKPIT ARCHITECTURES

- 11.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 11.3.1 RISING PHEV ADOPTION INCREASING DEMAND FOR HYBRID MODE VISUALIZATION AND INTEGRATED DUAL POWERTRAIN INTERFACES

- 11.4 KEY INDUSTRY INSIGHTS

12 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 INFOTAINMENT

- 12.2.1 EXPANDING USE OF CONNECTED MEDIA, NAVIGATION, AND CLOUD SERVICES TO DRIVE GROWTH

- 12.3 DRIVER MONITORING & ASSISTANCE

- 12.3.1 INCREASING SOFTWARE INTEGRATION BETWEEN CLUSTER DISPLAYS, HEAD-UP DISPLAYS, AND DRIVER MONITORING SYSTEMS TO DRIVE DEMAND

- 12.4 VEHICLE & COMFORT CONTROL SYSTEM

- 12.4.1 INCREASING SHIFT TOWARD CENTRALIZED DIGITAL CONTROL OF VEHICLE FUNCTIONS TO ENHANCE USER EXPERIENCE

- 12.5 KEY INDUSTRY INSIGHTS

13 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE

- 13.1 INTRODUCTION

- 13.2 <5"

- 13.2.1 GROWING ROLE OF SMALL FORMAT DISPLAYS IN COST-OPTIMIZED VEHICLES TO SUPPORT DEMAND

- 13.3 5-10"

- 13.3.1 STRONG GROWTH IN COMPACT SUVS AND CROSSOVER MODELS TO SUPPORT DEMAND

- 13.4 >10"

- 13.4.1 RAPID ELECTRIFICATION AND PREMIUM VEHICLE LAUNCHES TO DRIVE DEMAND

- 13.5 KEY INDUSTRY INSIGHTS

14 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE

- 14.1 INTRODUCTION

- 14.2 LIQUID CRYSTAL DISPLAY (LCD)

- 14.2.1 LCD MAINTAINING BROAD MARKET COVERAGE THROUGH COST EFFICIENCY, RELIABILITY, AND SCALABLE ADOPTION ACROSS GLOBAL VEHICLE SEGMENTS

- 14.3 ORGANIC LIGHT EMITTING DIODE (OLED)

- 14.3.1 OLED ADVANCING PREMIUM COCKPIT EXPERIENCES WITH HIGH CONTRAST OUTPUT, FLEXIBLE FORM FACTORS, AND IMMERSIVE VISUAL PERFORMANCE

- 14.4 THIN FILM TRANSISTOR-LIQUID CRYSTAL DISPLAY (TFT-LCD)

- 14.4.1 TFT LCD STRENGTHENING MID-PREMIUM COCKPIT DEPLOYMENTS THROUGH HIGHER BRIGHTNESS, IMPROVED VIEWING ANGLES, AND STABLE OPERATIONAL RESILIENCE

- 14.5 KEY INDUSTRY INSIGHTS

15 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 CHINA

- 15.2.1.1 Strengthening domestic digital cockpit ecosystem through technology capability and local supply support to drive market

- 15.2.2 INDIA

- 15.2.2.1 Scaling digital cockpit adoption through connectivity and cost-efficient local engineering to drive market

- 15.2.3 JAPAN

- 15.2.3.1 Advancing digital cockpit systems through engineering quality and connected service expansion to drive market

- 15.2.4 SOUTH KOREA

- 15.2.4.1 Growing software-defined vehicle programs and premium display integration to drive demand

- 15.2.5 THAILAND

- 15.2.5.1 Expanding EV production and local electronics investment to drive market

- 15.2.6 REST OF ASIA PACIFIC

- 15.2.1 CHINA

- 15.3 NORTH AMERICA

- 15.3.1 US

- 15.3.1.1 Expansion of connected services and multi-display EV platforms to drive demand

- 15.3.2 CANADA

- 15.3.2.1 Growth in safety regulation compliance and expanding fleet digitalization to drive demand

- 15.3.3 MEXICO

- 15.3.3.1 Strong assembly and export orientation to drive demand

- 15.3.1 US

- 15.4 EUROPE

- 15.4.1 GERMANY

- 15.4.1.1 Premium-vehicle programs and software-centric cockpit architectures to drive market

- 15.4.2 FRANCE

- 15.4.2.1 Scaled rollout of modular digital cockpits across mass-market vehicles to drive demand

- 15.4.3 ITALY

- 15.4.3.1 Design-driven cockpit refresh cycles and feature standardization to drive growth

- 15.4.4 SPAIN

- 15.4.4.1 Export-focused compact vehicle manufacturing and compliance-driven feature upgrades to drive demand

- 15.4.5 UK

- 15.4.5.1 Luxury interior differentiation and brand-specific cockpit design to drive market

- 15.4.6 RUSSIA

- 15.4.6.1 Production stabilization and localized platform simplification to sustain cockpit integration

- 15.4.7 REST OF EUROPE

- 15.4.1 GERMANY

- 15.5 REST OF THE WORLD (ROW)

- 15.5.1 BRAZIL

- 15.5.1.1 High smartphone penetration and standardized infotainment adoption to drive demand

- 15.5.2 IRAN

- 15.5.2.1 Platform continuity and cost-controlled digital upgrades to sustain demand

- 15.5.3 OTHERS

- 15.5.1 BRAZIL

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT, 2024

- 16.7.5.1 Company footprint, 2024

- 16.7.5.2 Region footprint, 2024

- 16.7.5.3 Equipment footprint, 2024

- 16.7.5.4 Vehicle type footprint, 2024

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.8.5.1 List of startups

- 16.8.5.2 Competitive benchmarking of startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 CONTINENTAL AG

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches/developments

- 17.1.1.3.2 Expansions

- 17.1.1.3.3 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 ROBERT BOSCH GMBH

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches/developments

- 17.1.2.3.2 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 HARMAN INTERNATIONAL

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches/developments

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Expansions

- 17.1.3.3.4 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 VISTEON CORPORATION

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches/developments

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Expansions

- 17.1.4.3.4 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 DENSO CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 VALEO

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches/developments

- 17.1.6.3.2 Expansions

- 17.1.6.4 MnM view

- 17.1.6.4.1 Right to win

- 17.1.6.4.2 Strategic choices

- 17.1.6.4.3 Weaknesses and competitive threats

- 17.1.7 MITSUBISHI ELECTRIC CORPORATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches/developments

- 17.1.7.3.2 Deals

- 17.1.7.3.3 Other developments

- 17.1.8 TOMTOM INTERNATIONAL BV

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches/developments

- 17.1.8.3.2 Deals

- 17.1.8.3.3 Other developments

- 17.1.9 APTIV

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Deals

- 17.1.9.3.2 Expansions

- 17.1.10 LG ELECTRONICS

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions offered

- 17.1.10.2.1 Product launches/developments

- 17.1.10.2.2 Deals

- 17.1.11 FORVIA

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches/developments

- 17.1.11.3.2 Deals

- 17.1.12 MAGNA INTERNATIONAL INC.

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches/developments

- 17.1.12.3.2 Deals

- 17.1.12.3.3 Expansions

- 17.1.12.3.4 Other developments

- 17.1.13 HYUNDAI MOBIS

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product launches/developments

- 17.1.13.3.2 Deals

- 17.1.13.3.3 Other developments

- 17.1.14 ALPS ALPINE CO., LTD.

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product launches/developments

- 17.1.14.3.2 Deals

- 17.1.14.3.3 Other developments

- 17.1.1 CONTINENTAL AG

- 17.2 OTHER PLAYERS

- 17.2.1 QUALCOMM TECHNOLOGIES, INC.

- 17.2.2 NXP SEMICONDUCTORS

- 17.2.3 MARELLI HOLDINGS CO., LTD.

- 17.2.4 ZF FRIEDRICHSHAFEN AG

- 17.2.5 PIONEER CORPORATION

- 17.2.6 SONY CORPORATION

- 17.2.7 INFINEON TECHNOLOGIES AG

- 17.2.8 JVCKENWOOD CORPORATION

- 17.2.9 FUJITSU LIMITED

- 17.2.10 FORYOU CORPORATION

- 17.2.11 MAGNETI MARELLI S.P.A

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 List of secondary sources

- 18.1.1.2 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary interviews: Demand and supply sides

- 18.1.2.2 Key industry insights and breakdown of primary interviews

- 18.1.2.3 List of primary participants

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.2 TOP-DOWN APPROACH

- 18.3 DATA TRIANGULATION

- 18.4 FACTOR ANALYSIS

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 RESEARCH LIMITATIONS

- 18.7 RISK ASSESSMENT

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION, AT THE REGIONAL LEVEL (FOR REGIONS COVERED IN THE REPORT)

- 19.4.2 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, AT THE REGIONAL LEVEL (FOR THE REGIONS COVERED IN THE REPORT)

- 19.4.3 COMPANY INFORMATION

- 19.4.4 PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 5)

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 AUTOMOTIVE DIGITAL COCKPIT MARKET DEFINITION, BY EQUIPMENT

- TABLE 2 AUTOMOTIVE DIGITAL COCKPIT MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- TABLE 3 AUTOMOTIVE DIGITAL COCKPIT MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 4 AUTOMOTIVE DIGITAL COCKPIT MARKET DEFINITION, BY DISPLAY TYPE

- TABLE 5 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE

- TABLE 6 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION

- TABLE 7 CURRENCY EXCHANGE RATES, 2021-2025

- TABLE 8 EXAMPLES OF SOFTWARE-DRIVEN VEHICLE PROGRAMS AND CONNECTIVITY IMPACT

- TABLE 9 COLLABORATIONS BETWEEN TIER 1 COMPANIES AND OEMS

- TABLE 10 KEY INDICATORS OF RISING CONSUMER DEMAND FOR PREMIUM IN-CABIN EXPERIENCES

- TABLE 11 VEHICLES EQUIPPED WITH HEAD-UP DISPLAYS, 2021-2024

- TABLE 12 REGULATORY MILESTONES INFLUENCING COCKPIT SAFETY SYSTEM ADOPTION

- TABLE 13 DIGITAL COCKPIT COMPONENTS MAPPING FOR TOP SELLING ELECTRIC VEHICLES, 2024

- TABLE 14 ELECTRIC VEHICLE GROWTH INDICATORS SUPPORTING DIGITAL-CENTRIC CABIN INTERFACE ADOPTION

- TABLE 15 MONETARY INCENTIVES FOR ELECTRIC VEHICLES IN WESTERN EUROPE, 2024

- TABLE 16 COST INDICATORS FOR ADVANCED COCKPIT ELECTRONICS

- TABLE 17 SUPPLY CHAIN IMPACT INDICATORS

- TABLE 18 STRATEGIC OPPORTUNITIES IN NEXT-GEN ELECTRIC VEHICLE SILICON

- TABLE 19 LEVEL OF AUTONOMY IN ELECTRIC VEHICLES, 2019-2024

- TABLE 20 MARKET INDICATORS FOR MULTIMODAL HMI, AR VISUALIZATION, AND INTERIOR SENSING

- TABLE 21 VEHICULAR CYBER ATTACKS

- TABLE 22 AUTOMOTIVE DIGITAL COCKPIT MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 23 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 24 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- TABLE 25 CURRENT STATUS AND SHORT, MEDIUM, LONG-TERM PROSPECTS OF DIGITAL COCKPIT TECHNOLOGIES

- TABLE 26 PATENT ANALYSIS, JANUARY 2022-AUGUST 2025

- TABLE 27 FUTURE APPLICATIONS OF AUTOMOTIVE DIGITAL COCKPIT SYSTEMS

- TABLE 28 TOP USE CASES AND MARKET POTENTIAL

- TABLE 29 COMPANIES IMPLEMENTING AI/GENERATIVE AI

- TABLE 30 CASE STUDIES OF DIGITAL COCKPIT IMPLEMENTATION IN AUTOMOTIVE MARKET

- TABLE 31 ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 32 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 33 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 34 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 35 REGULATORY REQUIREMENTS FOR DIGITAL COCKPIT SYSTEMS

- TABLE 36 GLOBAL INDUSTRY STANDARDS

- TABLE 37 POLICY INITIATIVES AFFECTING SUSTAINABILITY, SAFETY, PRIVACY, AND TECHNOLOGY COMPLIANCE FOR DIGITAL COCKPITS

- TABLE 38 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

- TABLE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY EQUIPMENT (%)

- TABLE 40 KEY BUYING CRITERIA FOR AUTOMOTIVE DIGITAL COCKPIT, BY EQUIPMENT

- TABLE 41 AUTOMOTIVE SEMICONDUCTOR PROFITABILITY, BY COMPONENT

- TABLE 42 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 43 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 44 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT, 2024 (USD)

- TABLE 45 AVERAGE SELLING PRICE TREND, BY EQUIPMENT, 2022-2024 (USD)

- TABLE 46 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 47 KEY CONFERENCES AND EVENTS, 2026-2027

- TABLE 48 IMPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 49 EXPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 50 TARIFF SNAPSHOT FOR SEMICONDUCTOR-RELATED GOODS

- TABLE 51 IMPACT OF TARIFFS ON AUTOMOTIVE DIGITAL COCKPIT COSTS

- TABLE 52 REGIONAL EXPOSURE PROFILE

- TABLE 53 INDUSTRY-LEVEL EXPOSURE AND TYPICAL MITIGATION ACTIONS

- TABLE 54 STRATEGIC INDICATORS OF OEM AND SUPPLIER TRANSFORMATION IN COCKPIT ELECTRONICS

- TABLE 55 DIGITAL COCKPIT COMPONENT MAPPING FOR XPENG

- TABLE 56 DIGITAL COCKPIT COMPONENT MAPPING FOR NIO

- TABLE 57 DIGITAL COCKPIT COMPONENT MAPPING FOR LEAPMOTOR

- TABLE 58 DIGITAL COCKPIT COMPONENT MAPPING FOR GEELY ZEEKR

- TABLE 59 DIGITAL COCKPIT COMPONENT MAPPING FOR TATA MOTORS

- TABLE 60 DIGITAL COCKPIT COMPONENT MAPPING FOR VOLKSWAGEN AUDI

- TABLE 61 DIGITAL COCKPIT COMPONENT MAPPING FOR BMW

- TABLE 62 DIGITAL COCKPIT COMPONENT MAPPING FOR STELLANTIS

- TABLE 63 DIGITAL COCKPIT COMPONENT MAPPING FOR MERCEDES BENZ

- TABLE 64 DIGITAL COCKPIT COMPONENT MAPPING FOR FORD

- TABLE 65 DIGITAL COCKPIT COMPONENT MAPPING FOR GENERAL MOTORS

- TABLE 66 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 67 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 68 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 69 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 70 EQUIPMENT OFFERINGS BY LEADING DIGITAL COCKPIT SUPPLIERS

- TABLE 71 FUNCTIONAL DIFFERENTIATION ACROSS DIGITAL COCKPIT EQUIPMENT

- TABLE 72 MODELS EQUIPPED WITH DIGITAL INSTRUMENT CLUSTERS, 2024

- TABLE 73 KEY FEATURE COMPARISON ACROSS DIGITAL CLUSTERS

- TABLE 74 DIGITAL INSTRUMENT CLUSTER: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 75 DIGITAL INSTRUMENT CLUSTER: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 76 DIGITAL INSTRUMENT CLUSTER: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 DIGITAL INSTRUMENT CLUSTER: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 78 VEHICLE FUNCTIONS ROUTED THROUGH DIGITAL CENTRAL CONSOLE

- TABLE 79 SOFTWARE PLATFORMS USED FOR CENTRAL CONSOLES ACROSS OEM GROUPS

- TABLE 80 DIGITAL CENTRAL CONSOLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 81 DIGITAL CENTRAL CONSOLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 82 DIGITAL CENTRAL CONSOLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 DIGITAL CENTRAL CONSOLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 84 INFOTAINMENT SOFTWARE STRATEGIES BY GLOBAL OEMS

- TABLE 85 INFOTAINMENT FEATURES RELEVANT FOR DIGITAL COCKPIT PERFORMANCE

- TABLE 86 INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 87 INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 88 INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 KEY FUNCTIONS ENABLED BY REAR INFOTAINMENT UNITS

- TABLE 91 REAR INFOTAINMENT IMPLEMENTATION ACROSS BRANDS

- TABLE 92 REAR INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 93 REAR INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 94 REAR INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 REAR INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 PASSENGER INFOTAINMENT FUNCTIONS

- TABLE 97 PASSENGER INFOTAINMENT OFFERINGS BY OEM

- TABLE 98 PASSENGER INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 99 PASSENGER INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 100 PASSENGER INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 PASSENGER INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 102 HUD CAPABILITIES ACROSS VEHICLE SEGMENTS

- TABLE 103 HUD SUPPLIER LANDSCAPE

- TABLE 104 HUD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 105 HUD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 106 HUD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 HUD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 108 CORE FUNCTIONS OF DRIVER MONITORING SYSTEMS

- TABLE 109 DRIVER MONITORING TECHNOLOGY SUPPLIERS AND USE CASES

- TABLE 110 DRIVER MONITORING SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 111 DRIVER MONITORING SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 112 DRIVER MONITORING SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 DRIVER MONITORING SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 114 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 115 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 116 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 117 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 118 PASSENGER CAR DRIVERS FOR DIGITAL COCKPIT ADOPTION

- TABLE 119 PASSENGER CAR COCKPIT COMPONENTS AND THEIR FUNCTIONAL ROLE

- TABLE 120 PASSENGER CAR: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 121 PASSENGER CAR: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 122 PASSENGER CAR: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 PASSENGER CAR: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 124 LCV DIGITAL COCKPIT USE CASES

- TABLE 125 COCKPIT PRIORITIES FOR ELECTRIC LIGHT COMMERCIAL VEHICLES

- TABLE 126 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 127 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 128 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 130 HCV DIGITAL COCKPIT FUNCTIONAL REQUIREMENTS

- TABLE 131 HCV COCKPIT PRIORITIES UNDER ELECTRIFICATION TRENDS

- TABLE 132 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 133 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 134 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 136 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 137 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 138 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 139 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 140 TOP SELLING BEVS WORLDWIDE IN 2024 AND ASSOCIATED COCKPIT FEATURES

- TABLE 141 COCKPIT REQUIREMENTS DRIVEN BY BEV OWNERSHIP

- TABLE 142 BEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 143 BEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 144 BEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 BEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 REPRESENTATIVE PHEV MODELS AND KEY COCKPIT SYSTEM CAPABILITIES

- TABLE 147 COCKPIT INFORMATION REQUIREMENTS FOR PHEV DRIVERS

- TABLE 148 PHEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 149 PHEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 150 PHEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 151 PHEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 152 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 153 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 154 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 156 INFOTAINMENT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 157 INFOTAINMENT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 158 INFOTAINMENT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 159 INFOTAINMENT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 160 COMPONENTS USED IN DRIVER MONITORING SYSTEMS

- TABLE 161 DRIVER ASSISTANCE & MONITORING: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 162 DRIVER ASSISTANCE & MONITORING: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 163 DRIVER ASSISTANCE & MONITORING: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 DRIVER ASSISTANCE & MONITORING: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 165 FUNCTIONS COMMONLY CONTROLLED THROUGH DIGITAL COCKPITS

- TABLE 166 VEHICLE & COMFORT CONTROL SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 167 VEHICLE & COMFORT CONTROL SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 168 VEHICLE & COMFORT CONTROL SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 VEHICLE & COMFORT CONTROL SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 170 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE, 2021-2024 (THOUSAND UNITS)

- TABLE 171 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE, 2025-2032 (THOUSAND UNITS)

- TABLE 172 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE, 2021-2024 (USD MILLION)

- TABLE 173 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE, 2025-2032 (USD MILLION)

- TABLE 174 VEHICLE PROGRAMS USING SMALL FORMAT DISPLAYS

- TABLE 175 <5": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 176 <5": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 177 <5": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 <5": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 179 COMMON SPECIFICATIONS IN MID-SIZED AUTOMOTIVE DISPLAYS

- TABLE 180 5-10": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 181 5-10": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 182 5-10": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 183 5-10": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 184 SELECT VEHICLES USING LARGE FORMAT DISPLAYS

- TABLE 185 >10": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 186 >10": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 187 >10": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 188 >10": AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 189 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 190 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 191 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE, 2021-2024 (USD MILLION)

- TABLE 192 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE, 2025-2032 (USD MILLION)

- TABLE 193 OEM ADOPTION OF LCD DISPLAYS, 2024

- TABLE 194 LCD PERFORMANCE SUMMARY

- TABLE 195 LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 196 LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 197 LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 198 LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 199 PREMIUM VEHICLES USING OLED DISPLAYS, 2024

- TABLE 200 OLED PERFORMANCE CHARACTERISTICS

- TABLE 201 OLED: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 202 OLED: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 203 OLED: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 204 OLED: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 205 TFT-LCD ADOPTION ACROSS OEM PORTFOLIOS, 2024

- TABLE 206 TFT-LCD: ADVANCED ATTRIBUTES

- TABLE 207 TFT-LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 208 TFT-LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 209 TFT-LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 210 TFT-LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 211 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 212 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 213 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 214 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 215 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 216 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 217 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 218 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 219 CHINA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 220 CHINA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 221 CHINA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 222 CHINA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 223 INDIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 224 INDIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 225 INDIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 226 INDIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 227 JAPAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 228 JAPAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 229 JAPAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 230 JAPAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 231 SOUTH KOREA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 232 SOUTH KOREA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 233 SOUTH KOREA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 234 SOUTH KOREA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 235 THAILAND: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 236 THAILAND: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 237 THAILAND: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 238 THAILAND: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 240 REST OF ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 241 REST OF ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 243 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 244 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 245 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 246 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 247 US: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 248 US: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 249 US: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 250 US: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 251 CANADA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 252 CANADA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 253 CANADA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 254 CANADA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 255 MEXICO: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 256 MEXICO: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 257 MEXICO: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 258 MEXICO: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 259 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 260 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 261 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 262 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 263 GERMANY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 264 GERMANY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 265 GERMANY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 266 GERMANY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 267 FRANCE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 268 FRANCE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 269 FRANCE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 270 FRANCE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 271 ITALY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 272 ITALY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 273 ITALY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 274 ITALY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 275 SPAIN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 276 SPAIN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 277 SPAIN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 278 SPAIN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 279 UK: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 280 UK: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 281 UK: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 282 UK: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 283 RUSSIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 284 RUSSIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 285 RUSSIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 286 RUSSIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 287 REST OF EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 288 REST OF EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 289 REST OF EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 290 REST OF EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 291 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 292 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 293 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 294 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 295 BRAZIL: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 296 BRAZIL: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 297 BRAZIL: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 298 BRAZIL: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 299 IRAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 300 IRAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 301 IRAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 302 IRAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 303 OTHERS: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (THOUSAND UNITS)

- TABLE 304 OTHERS: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (THOUSAND UNITS)

- TABLE 305 OTHERS: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 306 OTHERS: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025-2032 (USD MILLION)

- TABLE 307 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 308 AUTOMOTIVE DIGITAL COCKPIT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 309 AUTOMOTIVE DIGITAL COCKPIT MARKET: REGION FOOTPRINT

- TABLE 310 AUTOMOTIVE DIGITAL COCKPIT MARKET: EQUIPMENT FOOTPRINT

- TABLE 311 AUTOMOTIVE DIGITAL COCKPIT MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 312 AUTOMOTIVE DIGITAL COCKPIT MARKET: LIST OF STARTUPS

- TABLE 313 AUTOMOTIVE DIGITAL COCKPIT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 314 AUTOMOTIVE DIGITAL COCKPIT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-NOVEMBER 2025

- TABLE 315 AUTOMOTIVE DIGITAL COCKPIT MARKET: DEALS, JANUARY 2021-NOVEMBER 2025

- TABLE 316 AUTOMOTIVE DIGITAL COCKPIT MARKET: EXPANSIONS, JANUARY 2021-NOVEMBER 2025

- TABLE 317 AUTOMOTIVE DIGITAL COCKPIT MARKET: OTHER DEVELOPMENTS, JANUARY 2021-NOVEMBER 2025

- TABLE 318 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 319 CONTINENTAL AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 320 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 321 CONTINENTAL AG: EXPANSIONS

- TABLE 322 CONTINENTAL AG: OTHER DEVELOPMENTS

- TABLE 323 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 324 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 325 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 326 ROBERT BOSCH GMBH: DEALS

- TABLE 327 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 328 HARMAN INTERNATIONAL: PRODUCTS/SOLUTIONS OFFERED

- TABLE 329 HARMAN INTERNATIONAL: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 330 HARMAN INTERNATIONAL: DEALS

- TABLE 331 HARMAN INTERNATIONAL: EXPANSIONS

- TABLE 332 HARMAN INTERNATIONAL: OTHER DEVELOPMENTS

- TABLE 333 VISTEON CORPORATION: COMPANY OVERVIEW

- TABLE 334 VISTEON CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 335 VISTEON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 336 VISTEON CORPORATION: DEALS

- TABLE 337 VISTEON CORPORATION: EXPANSIONS

- TABLE 338 VISTEON CORPORATION: OTHER DEVELOPMENTS

- TABLE 339 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 340 DENSO CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 341 DENSO CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 342 DENSO CORPORATION: DEALS

- TABLE 343 VALEO: COMPANY OVERVIEW

- TABLE 344 VALEO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 345 VALEO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 346 VALEO: EXPANSIONS

- TABLE 347 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 348 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 349 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 350 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 351 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 352 TOMTOM INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 353 TOMTOM INTERNATIONAL BV: PRODUCTS OFFERED

- TABLE 354 TOMTOM INTERNATIONAL BV: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 355 TOMTOM INTERNATIONAL BV: DEALS

- TABLE 356 TOMTOM INTERNATIONAL BV: OTHER DEVELOPMENTS

- TABLE 357 APTIV: COMPANY OVERVIEW

- TABLE 358 APTIV: PRODUCTS/SOLUTIONS OFFERED

- TABLE 359 APTIV: DEALS

- TABLE 360 APTIV: EXPANSIONS

- TABLE 361 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 362 LG ELECTRONICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 363 LG ELECTRONICS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 364 LG ELECTRONICS: DEALS

- TABLE 365 FORVIA: COMPANY OVERVIEW

- TABLE 366 FORVIA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 367 FORVIA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 368 FORVIA: DEALS

- TABLE 369 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 370 MAGNA INTERNATIONAL INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 371 MAGNA INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 372 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 373 MAGNA INTERNATIONAL INC.: EXPANSIONS

- TABLE 374 MAGNA INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 375 HYUNDAI MOBIS: COMPANY OVERVIEW

- TABLE 376 HYUNDAI MOBIS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 377 HYUNDAI MOBIS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 378 HYUNDAI MOBIS: DEALS

- TABLE 379 HYUNDAI MOBIS: OTHER DEVELOPMENTS

- TABLE 380 ALPS ALPINE CO., LTD.: COMPANY OVERVIEW

- TABLE 381 ALPS ALPINE CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 382 ALPS ALPINE CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 383 ALPS ALPINE CO., LTD.: DEALS

- TABLE 384 ALPS ALPINE CO., LTD.: OTHER DEVELOPMENTS

- TABLE 385 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 386 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 387 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 388 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 389 PIONEER CORPORATION: COMPANY OVERVIEW

- TABLE 390 SONY CORPORATION: COMPANY OVERVIEW

- TABLE 391 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 392 JVCKENWOOD CORPORATION: COMPANY OVERVIEW

- TABLE 393 FUJITSU LIMITED: COMPANY OVERVIEW

- TABLE 394 FORYOU CORPORATION: COMPANY OVERVIEW

- TABLE 395 MAGNETI MARELLI S.P.A: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE DIGITAL COCKPIT MARKET SCENARIO

- FIGURE 2 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, 2025-2032

- FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMOTIVE DIGITAL COCKPIT MARKET, 2021-2025

- FIGURE 4 DISRUPTIONS INFLUENCING GROWTH OF AUTOMOTIVE DIGITAL COCKPIT MARKET

- FIGURE 5 HIGH-GROWTH SEGMENTS IN AUTOMOTIVE DIGITAL COCKPIT MARKET, 2025-2032

- FIGURE 6 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMOTIVE DIGITAL COCKPIT MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 7 SOFTWARE-DEFINED VEHICLE ADOPTION AND ADVANCED IN-CABIN DISPLAYS TO DRIVE MARKET

- FIGURE 8 HUD TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 PASSENGER CAR SEGMENT TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 10 DRIVER ASSISTANCE & MONITORING TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 5-10" SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 BEV TO RECORD HIGHER CAGR THAN PHEV DURING FORECAST PERIOD

- FIGURE 13 TFT-LCD TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR AUTOMOTIVE DIGITAL COCKPIT DURING FORECAST PERIOD

- FIGURE 15 AUTOMOTIVE DIGITAL COCKPIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 ELECTRIC VEHICLE SALES IN SELECT MARKETS, 2019-2024

- FIGURE 17 CYBER ATTACK TARGET AREAS IN VEHICLES

- FIGURE 18 CONVENTIONAL AND AR HEAD-UP DISPLAY DEVELOPMENTS, 2017-2023

- FIGURE 19 BIOMETRIC DRIVER MONITORING

- FIGURE 20 CONNECTED VEHICLE

- FIGURE 21 TRANSITION OF DIGITAL COCKPIT TECHNOLOGIES ACROSS VEHICLE PLATFORMS

- FIGURE 22 PATENT ANALYSIS, 2015-2024

- FIGURE 23 AI/GENERATIVE AI IN AUTOMOTIVE MARKET, BY APPLICATION, 2025 (%)

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY EQUIPMENT

- FIGURE 25 KEY BUYING CRITERIA FOR AUTOMOTIVE DIGITAL COCKPIT, BY EQUIPMENT

- FIGURE 26 ECOSYSTEM ANALYSIS OF AUTOMOTIVE DIGITAL COCKPIT MARKET

- FIGURE 27 SUPPLY CHAIN ANALYSIS OF AUTOMOTIVE DIGITAL COCKPIT MARKET

- FIGURE 28 AVERAGE SELLING PRICE TREND BY KEY PLAYERS, 2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY EQUIPMENT, 2022-2024 (USD)

- FIGURE 30 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- FIGURE 31 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2022-2025 (USD BILLION)

- FIGURE 33 IMPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 34 EXPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 35 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025 VS. 2032 (USD MILLION)

- FIGURE 36 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 37 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 38 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 39 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE, 2025 VS. 2032 (USD MILLION)

- FIGURE 40 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 41 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 42 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET SNAPSHOT

- FIGURE 44 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET SNAPSHOT

- FIGURE 45 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET SNAPSHOT

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 47 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 48 COMPANY VALUATION (USD BILLION), 2025

- FIGURE 49 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 AUTOMOTIVE DIGITAL COCKPIT MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 53 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 55 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 56 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 57 VISTEON CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 VALEO: COMPANY SNAPSHOT

- FIGURE 60 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT

- FIGURE 62 APTIV: COMPANY SNAPSHOT

- FIGURE 63 LG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 64 FORVIA: COMPANY SNAPSHOT

- FIGURE 65 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 66 HYUNDAI MOBIS: COMPANY SNAPSHOT

- FIGURE 67 ALPS ALPINE CO., LTD.: COMPANY SNAPSHOT

- FIGURE 68 AUTOMOTIVE DIGITAL COCKPIT MARKET: RESEARCH DESIGN

- FIGURE 69 RESEARCH DESIGN MODEL

- FIGURE 70 KEY INDUSTRY INSIGHTS

- FIGURE 71 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 72 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 73 BOTTOM-UP APPROACH

- FIGURE 74 TOP-DOWN APPROACH

- FIGURE 75 DATA TRIANGULATION