|

市場調查報告書

商品編碼

1883939

全球三聚磷酸鈉市場按形態、等級、製造流程、最終用途、應用和地區分類-預測至2030年Sodium Tripolyphosphate Market by Application, Form, End-Use, Grade, and Region - Global Forecast to 2030 |

||||||

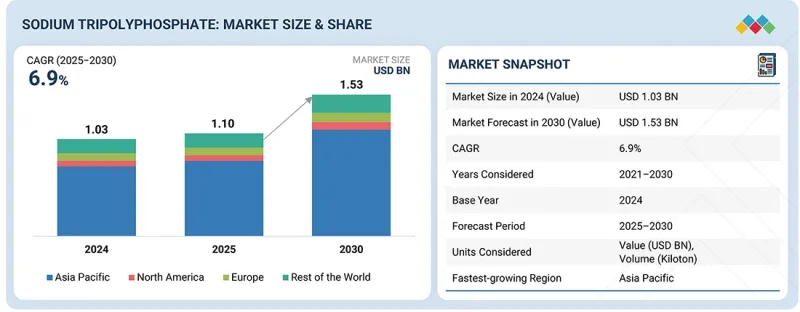

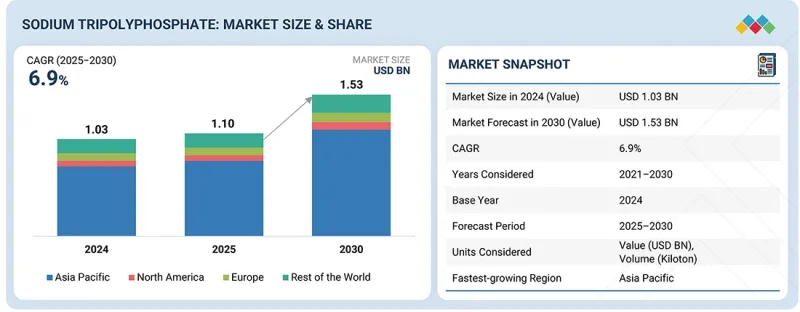

全球三聚磷酸鈉(STPP)市場預計將從 2025 年的 11 億美元成長到 2030 年的 15.3 億美元,預測期內複合年成長率為 6.9%。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(百萬美元),數量(千噸) |

| 部分 | 按形狀、等級、製造流程、最終用途、應用和地區分類 |

| 目標區域 | 北美、亞太地區、歐洲及其他地區 |

受清潔劑、水處理和食品加工行業需求成長的推動,全球三聚磷酸鈉(STPP)市場正穩步成長。工業和家用清潔市場的擴張,尤其是在亞太地區,是主要的成長要素。儘管人們對磷酸鹽相關的環境問題有所擔憂,但環保三聚磷酸鈉技術的持續創新仍在支撐著市場的擴張。

預計在預測期內,食品加工添加劑領域將繼續佔據三聚磷酸鈉(STPP)市場第二大佔有率(按以金額為準),這主要得益於全球對加工食品和簡便食品需求的不斷成長。 STPP廣泛用作保水劑、調質劑和防腐劑,應用於肉品、魚貝類、乳製品和烘焙產品中,以改善其品質、質地和保存期限。新興國家的都市化、飲食習慣的改變以及低溫運輸基礎設施的完善推動了市場成長。此外,食品安全標準的加強和高純度食品級STPP的普及也促進了其更廣泛的應用。預計食品加工行業的這種不斷成長的需求將繼續成為確保市場長期穩定成長的關鍵驅動力。

由於顆粒狀三聚氰胺(STPP)易於操作、溶解性優異且在最終用途配方中分散均勻,預計在預測期內,顆粒狀STPP仍將保持其在STPP市場以金額為準中的第二大地位。顆粒狀STPP因其優異的流動性和在生產過程中的穩定性,被廣泛應用於清潔劑、食品加工和水處理等領域。高效能清潔劑需求的不斷成長、食品加工廠自動化程度的提高以及工業規模的混配製程(這些製程更傾向於使用顆粒狀物料以實現精確計量)是推動顆粒狀STPP市場成長的主要因素。此外,顆粒狀STPP還能最大限度地減少粉塵產生並提高產品穩定性,這些優勢也進一步促進了其應用。

預計在預測期內,歐洲將佔據三聚磷酸鈉(STPP)市場第二大佔有率(以價值計),這主要得益於其強大的工業基礎和不斷擴張的食品加工業。該地區水處理和陶瓷應用領域需求的成長持續支撐著穩定的消費。然而,由於磷酸鹽排放帶來的環境問題,家用清潔劑中STPP的使用受到監管限制,這在一定程度上抑制了其成長。儘管如此,工業和機構清潔應用仍支撐全部區域STPP的顯著需求。

本報告考察了全球三聚磷酸鈉市場,並按類型、等級、製造流程、最終用途、應用、區域趨勢和公司概況對市場進行了全面分析。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 介紹

- 市場動態

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 新的經營模式和生態系統變化

- 一級/二級/三級公司的策略性舉措

第6章 產業趨勢

- 波特五力分析

- 宏觀經濟展望

- 價值鏈分析

- 生態系分析

- 定價分析

- 貿易數據

- 2025-2026 年主要會議和活動

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 成功案例和實際應用

- 川普關稅對三聚磷酸鈉市場的影響

第7章:技術進步、人工智慧的影響、專利、創新與未來應用

- 關鍵新興技術

- 互補技術

- 技術/產品藍圖

- 專利分析

- 未來應用

- 生成式人工智慧對三聚磷酸鈉市場的影響

第8章永續性和監管環境

- 監管狀態

- 對永續性的承諾

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第9章:顧客狀況與購買行為

- 決策流程

- 主要相關人員和採購標準

- 招募障礙和內部挑戰

- 各個終端用戶產業尚未滿足的需求

- 市場盈利

第10章 三聚磷酸鈉市場(依形態分類)

- 介紹

- 顆粒

- 粉末

- 液體

第11章 三聚磷酸鈉市場(依等級分類)

- 介紹

- 工業級

- 食品級

12. 三聚磷酸鈉市場(依生產製程分類)

- 介紹

- 乾法工藝

- 濕式/漿料工藝

13. 三聚磷酸鈉市場(依最終用途分類)

- 介紹

- 居家清潔

- 工業和公共設施清潔

- 食品/飲料

- 農業

- 纖維

- 製藥

- 化妝品

- 水處理

- 其他

第14章 三聚磷酸鈉市場(依應用領域分類)

- 介紹

- 清潔劑和清潔劑

- 食品加工添加物

- 防銹除垢劑

- 磁磚

- 分散劑和顏料穩定劑

- 金屬處理

- 其他

15. 三聚磷酸鈉市場(依地區分類)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 越南

- 馬來西亞

- 其他

- 歐洲

- 德國

- 法國

- 義大利

- 西班牙

- 英國

- 比利時

- 其他

- 其他地區

- 中東和非洲

- 南美洲

- 哈薩克

- 前蘇聯

第16章 競爭格局

- 介紹

- 主要參與企業的策略/優勢

- 收入分析

- 市佔率分析

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

- 估值和財務指標

第17章:公司簡介

- 主要參與企業

- WENGFU GROUP CO. LTD.

- YUNTIANHUA CO., LTD.

- YUNPHOS

- WUHAN INORGANIC SALT CHEMICAL PLANT

- PHOSAGRO GROUP

- YIBIN TIANYUAN GROUP

- NDPP

- HUBEI XINGFA CHEMICALS GROUP CO., LTD.

- JIANGSU CHENGXING PHOSPH-CHEMICALS CO., LTD.

- DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY

- YUNNAN CHENGJIANG HUAYE PHOSPHORUS CHEMICALS CO., LTD.

- ICL

- INNOPHOS

- CHONGQING CHUANDONG CHEMICAL(GROUP)CO., LTD.

- STPP GROUP

- SICHUAN SUNDIA CHEMICAL CO., LTD.

- PRAYON

- SOCIETE CHIMIQUE ALKIMIA

- THEONE CHEMICAL CO., LTD

- HAIFA NEGEV TECHNOLOGIES LTD

- GUIZHOU SINO-PHOS CHEMICAL CO., LTD.

- NIPPON CHEMICAL INDUSTRIAL CO., LTD.

- AADHUNIK INDUSTRIES

- MOLYCHEM INDIA LLP

- ADITYA BIRLA CHEMICALS

- SICHUAN BLUE SWORD CHEMICAL(GROUP)CO., LTD.

- 其他公司

第18章:鄰近及相關市場

第19章附錄

The global sodium tripolyphosphate (STPP) market is projected to grow from USD 1.10 billion in 2025 to USD 1.53 billion by 2030, at a CAGR of 6.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Grade, Form, Manufacturing Process, End-use, and Application |

| Regions covered | North America, Asia Pacific, Europe, and the Rest of the World |

The global STPP market is growing steadily, driven by rising demand in detergents, water treatment, and food processing. Expanding industrial and household cleaning sectors, especially in the Asia Pacific, are key growth drivers. Despite phosphate-related environmental concerns, ongoing innovation in green STPP continues to support market expansion.

"By application, the food processing additives segment accounted for the second-largest share in terms of value during the forecast period."

The food processing additives segment is anticipated to hold the second-largest share in terms of value in the STPP market during the forecast period, driven by rising global demand for processed and convenience foods. STPP is widely used as a water retention agent, texturizer, emulsifier, and preservative in meat, seafood, dairy, and bakery products to enhance quality, texture, and shelf life. The market's growth is fueled by urbanization, changing dietary habits, and the expansion of cold-chain infrastructure in emerging economies. Additionally, increasing food safety standards and the adoption of high-purity food-grade STPP are supporting broader usage. This growing demand in food processing is expected to remain a key driver, ensuring stable and long-term growth for the market.

"By form, the granule segment accounted for the second-largest share in terms of value during the forecast period."

The granule segment is anticipated to hold the second-largest share in terms of value in the STPP market during the forecast period, due to its ease of handling, superior solubility, and uniform dispersion in end-use formulations. It is widely preferred in detergents, food processing, and water treatment applications as it offers better flow properties and consistent performance during production. The growth of granular STPP is driven by rising demand for high-efficiency detergents, automation in food processing plants, and industrial-scale formulation processes that favor granulated materials for dosing precision. Its ability to minimize dust generation and improve product stability further strengthens its adoption.

"Europe is estimated to account for the second-largest share in terms of value during the forecast period."

Europe is estimated to account for the second-largest share in the STPP market in terms of value during the forecast period, due to its strong industrial base and expanding food processing sector. The region's increasing demand for water treatment and ceramic applications continues to support steady consumption. However, regulatory restrictions on the use of STPP in household detergents, owing to environmental concerns related to phosphate discharge, have slightly restrained its growth. Despite this, industrial and institutional cleaning applications continue to sustain significant demand across the region.

Profile breakup of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors - 25%, Managers - 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, and the Rest of the World - 10%

WENGFU GROUP CO. LTD. (China), Yuntianhua Co., Ltd. (China), Yunphos (China), Wuhan Inorganic Salt Chemical Plant (China), PhosAgro Group (Russia), and Yibin Tianyuan Group (China) are some of the major players operating in the STPP market.

Research Coverage:

The report defines segments and projects in the STPP market based on grade, form, manufacturing process, application, end-use, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles STPP manufacturers, comprehensively analyzing their market shares and core competencies.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the STPP market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses, and develop suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (growing usage of STPP in the food processing sector, continued household detergent consumption in the Asia Pacific supports stable demand, and growth from water treatment, ceramics, and paint industries enhances STPP use), restraints (stringent phosphorus limits restrict consumer detergent use in EU, Canada, and US and enhanced nutrient discharge regulations impose upstream compliance challenges), opportunities (expansion in industrial & institutional detergents, ceramics, glass, flame retardants, and rubber manufacturing industries and growing demand in ready-to-cook and cold-chain food sectors with recognized standards), and challenges (replacement risk by phosphate-free detergent builders like zeolites, supply chain vulnerability from geographically concentrated raw materials, and increased likelihood of stricter regulations, especially in the EU wastewater sector) influencing the growth of the STPP market.

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the STPP market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the STPP market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as WENGFU GROUP CO. LTD. (China), Yuntianhua Co., Ltd. (China), Yunphos (China), Wuhan Inorganic Salt Chemical Plant (China), PhosAgro Group (Russia), and Yibin Tianyuan Group (China) in the STPP market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants (demand and supply sides)

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH AND TOP-DOWN APPROACH

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.3.2.1 Calculations for supply-side analysis

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SODIUM TRIPOLYPHOSPHATE MARKET

- 4.2 SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION

- 4.3 SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE

- 4.4 SODIUM TRIPOLYPHOSPHATE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing usage of STPP in food processing sector

- 5.2.1.2 Continued household detergent consumption in Asia Pacific supports stable demand

- 5.2.1.3 Growth from water treatment, ceramics, and paint industries enhances STPP use

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent phosphorus limits restrict consumer detergent use in EU, Canada, and US

- 5.2.2.2 Enhanced nutrient discharge regulations impose upstream compliance challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion in industrial & institutional detergents, ceramics, glass, flame retardants, and rubber manufacturing industries

- 5.2.3.2 Growing demand in ready-to-cook and cold-chain food sectors with recognized standards

- 5.2.4 CHALLENGES

- 5.2.4.1 Replacement risk by phosphate-free detergent builders like zeolites

- 5.2.4.2 Supply chain vulnerability from geographically concentrated raw materials

- 5.2.4.3 Increased likelihood of stricter regulations, especially in EU wastewater sector

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN STPP MARKET

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 5.5.1 EMERGING BUSINESS MODELS

- 5.5.2 ECOSYSTEM SHIFTS

- 5.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.6.1 KEY MOVES AND STRATEGIC FOCUS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 BARGAINING POWER OF BUYERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMIC OUTLOOK

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN GLOBAL SODIUM TRIPOLYPHOSPHATE INDUSTRY

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND OF SODIUM TRIPOLYPHOSPHATE, BY REGION, 2022-2024

- 6.5.2 AVERAGE SELLING PRICE OF SODIUM TRIPOLYPHOSPHATE, BY KEY PLAYERS, 2024

- 6.6 TRADE DATA

- 6.6.1 IMPORT SCENARIO (HS CODE 283531)

- 6.6.2 EXPORT SCENARIO (HS CODE 283531)

- 6.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 INVESTMENT AND FUNDING SCENARIO

- 6.10 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.10.1 INNOPHOS HOLDINGS INC.: HIGH-PURITY STPP FOR FOOD AND BEVERAGE

- 6.10.2 SICHUAN BLUE SWORD CHEMICAL CO., LTD. - SUSTAINABLE WET-PROCESS STPP PRODUCTION

- 6.10.3 ADITYA BIRLA CHEMICALS: STPP FOR INDUSTRIAL CLEANING AND WATER TREATMENT

- 6.11 TRUMP TARIFF IMPACT ON SODIUM TRIPOLYPHOSPHATE MARKET

- 6.11.1 KEY TARIFF RATES IMPACTING MARKET

- 6.11.2 PRICE IMPACT ANALYSIS

- 6.11.3 KEY IMPACT ON VARIOUS REGIONS

- 6.11.3.1 US

- 6.11.3.2 Europe

- 6.11.3.3 Asia Pacific

- 6.11.4 IMPACT ON END-USE INDUSTRIES OF SODIUM TRIPOLYPHOSPHATE

- 6.11.4.1 Household cleaning

- 6.11.4.2 Industrial & institutional cleaning

- 6.11.4.3 Food & beverages

- 6.11.4.4 Agriculture

- 6.11.4.5 Textile

- 6.11.4.6 Pharmaceuticals

- 6.11.4.7 Cosmetics

- 6.11.4.8 Water treatment

7 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 SPRAY DRYING AND ROTARY KILN CALCINATION PROCESS

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 DRY PROCESS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT-TERM (2025-2027) | PROCESS OPTIMIZATION & ENVIRONMENTAL COMPLIANCE

- 7.3.2 MID-TERM (2027-2030) | INNOVATION & SUSTAINABLE TRANSFORMATION

- 7.3.3 LONG-TERM (2030-2035+) | CIRCULARITY, DECARBONIZATION & NEW APPLICATIONS

- 7.4 PATENT ANALYSIS

- 7.4.1 METHODOLOGY

- 7.5 FUTURE APPLICATIONS

- 7.5.1 DETERGENTS & CLEANERS: HOUSEHOLD AND INDUSTRIAL CLEANING REVOLUTION

- 7.5.2 FOOD PROCESSING ADDITIVES: PRESERVATION AND TEXTURE ENHANCEMENT

- 7.5.3 ANTICORROSION & ANTISCALE AGENTS: INDUSTRIAL WATER TREATMENT OPTIMIZATION

- 7.5.4 CERAMIC TILES: SURFACE STRENGTH AND GLAZING INNOVATION

- 7.5.5 DISPERSANT & PIGMENT STABILIZER: ADVANCED PAINTS AND COATING FORMULATION

- 7.6 IMPACT OF GENERATIVE AI ON SODIUM TRIPOLYPHOSPHATE MARKET

- 7.6.1 INTRODUCTION

- 7.6.2 ENHANCING MATERIAL DISCOVERY AND DESIGN

- 7.6.3 OPTIMIZING SYNTHESIS PROCESS

- 7.6.4 TAILORING APPLICATIONS IN END-USE SECTORS

- 7.6.5 BROADER MARKET IMPLICATIONS

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGULATORY LANDSCAPE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.2 SUSTAINABILITY INITIATIVES

- 8.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF SODIUM TRIPOLYPHOSPHATE

- 8.2.1.1 Carbon impact reduction

- 8.2.1.2 Eco-applications

- 8.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF SODIUM TRIPOLYPHOSPHATE

- 8.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 9.5 MARKET PROFITABILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

10 SODIUM TRIPOLYPHOSPHATE MARKET, BY FORM

- 10.1 INTRODUCTION

- 10.2 GRANULE

- 10.2.1 EASE OF HANDLING, BETTER FLOW PROPERTIES, AND CONTROLLED SOLUBILITY TO DRIVE MARKET

- 10.3 POWDER

- 10.3.1 ENHANCING PERFORMANCE AND SAFETY IN POLYMERS AND COATINGS TO DRIVE MARKET

- 10.4 LIQUID

- 10.4.1 GROWTH IN PREFERENCE FOR READY-TO-USE AND ECO-EFFICIENT FORMULATIONS TO DRIVE DEMAND

11 SODIUM TRIPOLYPHOSPHATE MARKET, BY GRADE

- 11.1 INTRODUCTION

- 11.2 INDUSTRIAL GRADE

- 11.2.1 ENHANCING EFFICIENCY AND SUSTAINABILITY ACROSS INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 11.3 FOOD GRADE

- 11.3.1 RISING DEMAND FOR PROCESSED FOODS AND ADVANCED PRESERVATION TECHNOLOGIES TO DRIVE MARKET

12 SODIUM TRIPOLYPHOSPHATE MARKET, BY MANUFACTURING PROCESS

- 12.1 INTRODUCTION

- 12.2 DRY PROCESS

- 12.2.1 IMPROVED SHELF LIFE AND EASE OF HANDLING DUE TO MINIMAL MOISTURE CONTENT TO DRIVE MARKET

- 12.3 WET/SLURRY PROCESS

- 12.3.1 EXPANDING FOOD PROCESSING APPLICATIONS TO INCREASE DEMAND

13 SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE

- 13.1 INTRODUCTION

- 13.2 HOUSEHOLD CLEANING

- 13.2.1 COMPATIBILITY WITH VARIOUS DETERGENT FORMULATIONS TO DRIVE MARKET

- 13.3 INDUSTRIAL & INSTITUTIONAL CLEANING

- 13.3.1 CRITICAL ROLE IN HEAVY-DUTY FORMULATIONS TO DRIVE MARKET

- 13.4 FOOD & BEVERAGES

- 13.4.1 ABILITY TO IMPROVE PRODUCT STABILITY, TEXTURE, AND SHELF LIFE TO INCREASE DEMAND

- 13.5 AGRICULTURE

- 13.5.1 ABILITY TO ENHANCE NUTRIENT AVAILABILITY AND STABILIZE ACTIVE INGREDIENTS TO INCREASE DEMAND

- 13.6 TEXTILE

- 13.6.1 ABILITY TO ENSURE UNIFORM DYEING AND IMPROVED FABRIC QUALITY TO DRIVE MARKET

- 13.7 PHARMACEUTICALS

- 13.7.1 ABILITY TO MAINTAIN PH BALANCE, STABILIZE ACTIVE INGREDIENTS, AND IMPROVE SOLUBILITY TO DRIVE MARKET

- 13.8 COSMETICS

- 13.8.1 ABILITY TO STRENGTHEN PRODUCT CONSISTENCY AND EMULSION STABILITY TO INCREASE DEMAND

- 13.9 WATER TREATMENT

- 13.9.1 ABILITY TO PREVENT SCALING AND CORROSION FOR EFFICIENT WATER MANAGEMENT TO DRIVE MARKET

- 13.10 OTHER END USES

14 SODIUM TRIPOLYPHOSPHATE MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 DETERGENT & CLEANERS

- 14.2.1 ABILITY TO IMPROVE OVERALL TEXTURE AND FLOW OF POWDERED DETERGENTS TO DRIVE MARKET

- 14.3 FOOD PROCESSING ADDITIVES

- 14.3.1 ABILITY TO PRESERVE FOOD QUALITY AND EXTEND SHELF LIFE TO INCREASE DEMAND

- 14.4 ANTICORROSION & ANTISCALE AGENTS

- 14.4.1 ABILITY TO IMPROVE EQUIPMENT LONGEVITY AND SYSTEM PERFORMANCE TO DRIVE MARKET

- 14.5 CERAMIC TILES

- 14.5.1 ABILITY TO ENHANCE UNIFORMITY, STRENGTH, AND SURFACE QUALITY TO DRIVE MARKET

- 14.6 DISPERSANT AND PIGMENT STABILIZER

- 14.6.1 STRONG DISPERSING CAPABILITY TO INCREASE DEMAND

- 14.7 METAL TREATMENT

- 14.7.1 ABILITY TO IMPROVE ADHESION AND CORROSION RESISTANCE OF SUBSEQUENT COATINGS TO INCREASE DEMAND

- 14.8 OTHER APPLICATIONS

15 SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Growing urbanization and industrial activity to increase demand

- 15.2.2 CANADA

- 15.2.2.1 Sustainable water management and industrial growth to drive STPP demand

- 15.2.3 MEXICO

- 15.2.3.1 Expanding industrial and wastewater infrastructure to drive market

- 15.2.1 US

- 15.3 ASIA PACIFIC

- 15.3.1 CHINA

- 15.3.1.1 Expanding food processing and water treatment industries to drive market

- 15.3.2 JAPAN

- 15.3.2.1 Wide usage in advanced processed food sector to drive market

- 15.3.3 INDIA

- 15.3.3.1 Growing food processing industry to drive market

- 15.3.4 SOUTH KOREA

- 15.3.4.1 Rising processed food production and industrial water treatment to drive market

- 15.3.5 VIETNAM

- 15.3.5.1 Expanding detergent and food processing industries to drive market

- 15.3.6 MALAYSIA

- 15.3.6.1 Growth in industrial cleaning, food processing, and water treatment to drive market

- 15.3.7 REST OF ASIA PACIFIC

- 15.3.1 CHINA

- 15.4 EUROPE

- 15.4.1 GERMANY

- 15.4.1.1 Expanding Food Processing and Sustainable Cleaning Applications to drive market

- 15.4.2 FRANCE

- 15.4.2.1 Steady demand for food-grade sodium tripolyphosphate to drive market

- 15.4.3 ITALY

- 15.4.3.1 Ceramic Manufacturing and Diverse Industrial Uses to increase demand

- 15.4.4 SPAIN

- 15.4.4.1 Growing Ceramics and Household Care Industries to drive market

- 15.4.5 UK

- 15.4.5.1 Investments in water and wastewater infrastructure to drive market

- 15.4.6 BELGIUM

- 15.4.6.1 Expansion of food processing, detergent manufacturing, and water treatment sectors to drive market

- 15.4.7 REST OF EUROPE

- 15.4.1 GERMANY

- 15.5 REST OF WORLD

- 15.5.1 MIDDLE EAST & AFRICA

- 15.5.1.1 Expanding food processing and water infrastructure to drive demand

- 15.5.2 SOUTH AMERICA

- 15.5.2.1 Growth in food processing and ceramics sector to drive market

- 15.5.3 KAZAKHSTAN

- 15.5.3.1 Growth in food processing and detergent production to drive market

- 15.5.4 FORMER USSR

- 15.5.4.1 STPP Growth in household cleaning, food manufacturing, and textile processing sectors to drive market

- 15.5.1 MIDDLE EAST & AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS

- 16.3.1 TOP 7 PLAYERS' REVENUE ANALYSIS

- 16.4 MARKET SHARE ANALYSIS

- 16.4.1 MARKET SHARE OF KEY PLAYERS

- 16.5 BRAND/PRODUCT COMPARISON

- 16.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.6.5.1 Company footprint

- 16.6.5.2 Region footprint

- 16.6.5.3 Grade footprint

- 16.6.5.4 End use footprint

- 16.6.5.5 Application footprint

- 16.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.7.1 PROGRESSIVE COMPANIES

- 16.7.2 RESPONSIVE COMPANIES

- 16.7.3 DYNAMIC COMPANIES

- 16.7.4 STARTING BLOCKS

- 16.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.7.5.1 Detailed list of key startups/SMEs

- 16.7.6 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 16.8 COMPETITIVE SCENARIO

- 16.8.1 PRODUCT LAUNCHES

- 16.8.2 EXPANSIONS

- 16.9 VALUATION AND FINANCIAL METRICS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 WENGFU GROUP CO. LTD.

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 MnM View

- 17.1.1.3.1 Right to Win

- 17.1.1.3.2 Strategic choices

- 17.1.1.3.3 Weaknesses and competitive threats

- 17.1.2 YUNTIANHUA CO., LTD.

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.2.1 Right to win

- 17.1.2.2.2 Strategic choices

- 17.1.2.2.3 Weaknesses and competitive threats

- 17.1.3 YUNPHOS

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Right to win

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses and competitive threats

- 17.1.4 WUHAN INORGANIC SALT CHEMICAL PLANT

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 MnM view

- 17.1.4.3.1 Right to win

- 17.1.4.3.2 Strategic choices

- 17.1.4.3.3 Weaknesses and competitive threats

- 17.1.5 PHOSAGRO GROUP

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Expansions

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 YIBIN TIANYUAN GROUP

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 MnM view

- 17.1.6.3.1 Right to win

- 17.1.6.3.2 Strategic choices

- 17.1.6.3.3 Weaknesses and competitive threats

- 17.1.7 NDPP

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.8 HUBEI XINGFA CHEMICALS GROUP CO., LTD.

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.9 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD.

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.10 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.11 YUNNAN CHENGJIANG HUAYE PHOSPHORUS CHEMICALS CO., LTD.

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.12 ICL

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.13 INNOPHOS

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.14 CHONGQING CHUANDONG CHEMICAL (GROUP) CO., LTD.

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.15 STPP GROUP

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.16 SICHUAN SUNDIA CHEMICAL CO., LTD.

- 17.1.16.1 Business overview

- 17.1.16.2 Products/Solutions/Services offered

- 17.1.17 PRAYON

- 17.1.17.1 Business overview

- 17.1.17.2 Products/Solutions/Services offered

- 17.1.17.3 Recent developments

- 17.1.17.3.1 Product Launches

- 17.1.18 SOCIETE CHIMIQUE ALKIMIA

- 17.1.18.1 Business overview

- 17.1.18.2 Products/Solutions/Services offered

- 17.1.19 THEONE CHEMICAL CO., LTD

- 17.1.19.1 Business overview

- 17.1.19.2 Products/Solutions/Services offered

- 17.1.20 HAIFA NEGEV TECHNOLOGIES LTD

- 17.1.20.1 Business overview

- 17.1.20.2 Products/Solutions/Services offered

- 17.1.21 GUIZHOU SINO-PHOS CHEMICAL CO., LTD.

- 17.1.21.1 Business overview

- 17.1.21.2 Products/Solutions/Services offered

- 17.1.22 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

- 17.1.22.1 Business overview

- 17.1.22.2 Products/Solutions/Services offered

- 17.1.23 AADHUNIK INDUSTRIES

- 17.1.23.1 Business overview

- 17.1.23.2 Products/Solutions/Services offered

- 17.1.24 MOLYCHEM INDIA LLP

- 17.1.24.1 Business overview

- 17.1.24.2 Products/Solutions/Services offered

- 17.1.25 ADITYA BIRLA CHEMICALS

- 17.1.25.1 Business overview

- 17.1.25.2 Products/Solutions/Services offered

- 17.1.26 SICHUAN BLUE SWORD CHEMICAL (GROUP) CO., LTD.

- 17.1.26.1 Business overview

- 17.1.26.2 Products/Solutions/Services offered

- 17.1.1 WENGFU GROUP CO. LTD.

- 17.2 OTHER PLAYERS

18 ADJACENT AND RELATED MARKETS

- 18.1 INTRODUCTION

- 18.2 LIMITATIONS

- 18.3 INTERCONNECTED MARKETS

- 18.4 PHOSPHATE MARKET

- 18.4.1 MARKET DEFINITION

- 18.4.2 MARKET OVERVIEW

- 18.4.3 PHOSPHATE MARKET, BY TYPE

- 18.4.4 PHOSPHORIC ACID

- 18.4.4.1 Growing demand in various industries to drive market

- 18.4.5 AMMONIUM PHOSPHATE

- 18.4.5.1 Rising fertilizer consumption to drive demand

- 18.4.6 CALCIUM PHOSPHATE

- 18.4.6.1 High use in healthcare applications to propel market

- 18.4.7 SODIUM PHOSPHATE

- 18.4.7.1 Extensive applications in detergent industry to fuel market growth

- 18.4.8 POTASSIUM PHOSPHATE

- 18.4.8.1 Booming agriculture industry to drive demand

- 18.4.9 OTHER TYPES

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SODIUM TRIPOLYPHOSPHATE MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 SODIUM TRIPOLYPHOSPHATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 4 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 6 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 & 2023 (USD BILLION)

- TABLE 7 ROLES OF COMPANIES IN SODIUM TRIPOLYPHOSPHATE ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE TREND OF SODIUM TRIPOLYPHOSPHATE, BY REGION, 2022-2024 (USD/TON)

- TABLE 9 AVERAGE SELLING PRICE OF SODIUM TRIPOLYPHOSPHATE, BY KEY PLAYER, 2024 (USD/TON)

- TABLE 10 IMPORT DATA FOR HS CODE 283531, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 283531, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 12 SODIUM TRIPOLYPHOSPHATE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 SODIUM TRIPOLYPHOSPHATE MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 GLOBAL STANDARDS IN SODIUM TRIPOLYPHOSPHATE MARKET

- TABLE 18 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN STPP MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE (%)

- TABLE 20 KEY BUYING CRITERIA, BY END USE

- TABLE 21 SODIUM TRIPOLYPHOSPHATE MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES

- TABLE 22 SODIUM TRIPOLYPHOSPHATE MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 23 SODIUM TRIPOLYPHOSPHATE MARKET, BY FORM, 2024-2030 (USD MILLION)

- TABLE 24 SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 25 SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 26 SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 27 SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 28 HOUSEHOLD CLEANING: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 29 HOUSEHOLD CLEANING: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 30 HOUSEHOLD CLEANING: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 31 HOUSEHOLD CLEANING: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 32 INDUSTRIAL AND INSTITUTIONAL CLEANING: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 INDUSTRIAL AND INSTITUTIONAL CLEANING: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 34 INDUSTRIAL AND INSTITUTIONAL CLEANING: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 35 INDUSTRIAL AND INSTITUTIONAL CLEANING: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 36 FOOD & BEVERAGES: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 FOOD & BEVERAGES: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 38 FOOD & BEVERAGES: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 39 FOOD & BEVERAGES: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 40 AGRICULTURE: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 AGRICULTURE: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 42 AGRICULTURE: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 43 AGRICULTURE: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 44 TEXTILE: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 45 TEXTILE: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 46 TEXTILE: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 47 TEXTILE: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 48 PHARMACEUTICALS: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 PHARMACEUTICALS: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 50 PHARMACEUTICALS: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 51 PHARMACEUTICALS: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 52 COSMETICS: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 COSMETICS: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 54 COSMETICS: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 55 COSMETICS: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 56 WATER TREATMENT: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 WATER TREATMENT: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 58 WATER TREATMENT: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 59 WATER TREATMENT: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 60 OTHER END USES: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 OTHER END USES: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 62 OTHER END USES: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 63 OTHER END USES: SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 64 SODIUM TRIPOLYPHOSPHATE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 65 SODIUM TRIPOLYPHOSPHATE MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 66 SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 68 SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 69 SODIUM TRIPOLYPHOSPHATE MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 70 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 71 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 73 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 74 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 77 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 78 US: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 79 US: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 80 US: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 81 US: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 82 CANADA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 83 CANADA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 84 CANADA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 85 CANADA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 86 MEXICO: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 87 MEXICO: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 88 MEXICO: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 89 MEXICO: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 90 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 93 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 94 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 97 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 98 CHINA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 99 CHINA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 100 CHINA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 101 CHINA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 102 JAPAN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 103 JAPAN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 104 JAPAN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 105 JAPAN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 106 INDIA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 107 INDIA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 108 INDIA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 109 INDIA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 110 SOUTH KOREA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 111 SOUTH KOREA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 112 SOUTH KOREA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 113 SOUTH KOREA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 114 VIETNAM: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 115 VIETNAM: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 116 VIETNAM: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 117 VIETNAM: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 118 MALAYSIA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 119 MALAYSIA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 120 MALAYSIA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 121 MALAYSIA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 122 REST OF ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 125 REST OF ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 126 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 127 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 128 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 129 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 130 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 131 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 132 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 133 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 134 GERMANY: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 135 GERMANY: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 136 GERMANY: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 137 GERMANY: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 138 FRANCE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 139 FRANCE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 140 FRANCE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 141 FRANCE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 142 ITALY: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 143 ITALY: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 144 ITALY: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 145 ITALY: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 146 SPAIN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 147 SPAIN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 148 SPAIN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 149 SPAIN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 150 UK: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 151 UK: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 152 UK: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 153 UK: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 154 BELGIUM: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 155 BELGIUM: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 156 BELGIUM: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 157 BELGIUM: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 158 REST OF EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 159 REST OF EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 160 REST OF EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 161 REST OF EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 162 REST OF WORLD: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 163 REST OF WORLD: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 164 REST OF WORLD: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 165 REST OF WORLD: SODIUM TRIPOLYPHOSPHATE MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 166 REST OF WORLD: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 167 REST OF WORLD: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 168 REST OF WORLD: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 169 REST OF WORLD: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 170 MIDDLE EAST & AFRICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 173 MIDDLE EAST & AFRICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 174 SOUTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 175 SOUTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 176 SOUTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 177 SOUTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 178 KAZAKHSTAN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 179 KAZAKHSTAN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 180 KAZAKHSTAN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 181 KAZAKHSTAN: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 182 FORMER USSR: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 183 FORMER USSR: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 184 FORMER USSR: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 185 FORMER USSR: SODIUM TRIPOLYPHOSPHATE MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 186 SODIUM TRIPOLYPHOSPHATE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, (2021-2025)

- TABLE 187 SODIUM TRIPOLYPHOSPHATE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 188 SODIUM TRIPOLYPHOSPHATE MARKET: REGION FOOTPRINT (26 COMPANIES)

- TABLE 189 SODIUM TRIPOLYPHOSPHATE MARKET: GRADE FOOTPRINT (26 COMPANIES)

- TABLE 190 SODIUM TRIPOLYPHOSPHATE MARKET: END USE FOOTPRINT (26 COMPANIES)

- TABLE 191 SODIUM TRIPOLYPHOSPHATE MARKET: APPLICATION FOOTPRINT (26 COMPANIES)

- TABLE 192 SODIUM TRIPOLYPHOSPHATE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 193 SODIUM TRIPOLYPHOSPHATE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 194 SODIUM TRIPOLYPHOSPHATE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 195 SODIUM TRIPOLYPHOSPHATE MARKET: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 196 SODIUM TRIPOLYPHOSPHATE MARKET: EXPANSIONS, JANUARY 2021- OCTOBER 2025

- TABLE 197 WENGFU GROUP CO. LTD.: COMPANY OVERVIEW

- TABLE 198 WENGFU GROUP CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 YUNTIANHUA CO., LTD.: COMPANY OVERVIEW

- TABLE 200 YUNTIANHUA CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 YUNPHOS: COMPANY OVERVIEW

- TABLE 202 YUNPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 WUHAN INORGANIC SALT CHEMICAL PLANT: COMPANY OVERVIEW

- TABLE 204 WUHAN INORGANIC SALT CHEMICAL PLANT: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 205 PHOSAGRO GROUP: COMPANY OVERVIEW

- TABLE 206 PHOSAGRO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 PHOSAGRO GROUP: EXPANSIONS (JANUARY 2021- SEPTEMBER 2025)

- TABLE 208 YIBIN TIANYUAN GROUP: COMPANY OVERVIEW

- TABLE 209 YIBIN TIANYUAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NDPP: COMPANY OVERVIEW

- TABLE 211 NDPP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 HUBEI XINGFA CHEMICALS GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 213 HUBEI XINGFA CHEMICALS GROUP CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 214 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 215 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY: COMPANY OVERVIEW

- TABLE 217 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 YUNNAN CHENGJIANG HUAYE PHOSPHORUS CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 219 YUNNAN CHENGJIANG HUAYE PHOSPHORUS CHEMICALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 ICL: COMPANY OVERVIEW

- TABLE 221 ICL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 INNOPHOS: COMPANY OVERVIEW

- TABLE 223 INNOPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 CHONGQING CHUANDONG CHEMICAL (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 225 CHONGQING CHUANDONG CHEMICAL (GROUP) CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 STPP GROUP: COMPANY OVERVIEW

- TABLE 227 STPP GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 SICHUAN SUNDIA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 229 SICHUAN SUNDIA CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 230 PRAYON: COMPANY OVERVIEW

- TABLE 231 PRAYON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 PRAYON: PRODUCT LAUNCHES

- TABLE 233 SOCIETE CHIMIQUE ALKIMIA: COMPANY OVERVIEW

- TABLE 234 SOCIETE CHIMIQUE ALKIMIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 THEONE CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 236 THEONE CHEMICAL CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 HAIFA NEGEV TECHNOLOGIES LTD: COMPANY OVERVIEW

- TABLE 238 HAIFA NEGEV TECHNOLOGIES LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 GUIZHOU SINO-PHOS CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 240 GUIZHOU SINO-PHOS CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 241 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 242 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 243 AADHUNIK INDUSTRIES: COMPANY OVERVIEW

- TABLE 244 AADHUNIK INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 MOLYCHEM INDIA LLP: COMPANY OVERVIEW

- TABLE 246 MOLYCHEM INDIA LLP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 ADITYA BIRLA CHEMICALS: COMPANY OVERVIEW

- TABLE 248 ADITYA BIRLA CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 SICHUAN BLUE SWORD CHEMICAL (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 250 SICHUAN BLUE SWORD CHEMICAL (GROUP) CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 WUHAN HUACHUANG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 252 YUNNAN BK GIULINI TIANCHUANG PHOSPHATE CO., LTD.: COMPANY OVERVIEW

- TABLE 253 SICHUAN BANGYUAN TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 254 HENAN TECHWAY CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 255 PHOSPHATE MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 256 PHOSPHATE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 257 PHOSPHATE MARKET, BY TYPE, 2018-2023 (KILOTON)

- TABLE 258 PHOSPHATE MARKET, BY TYPE, 2024-2029 (KILOTON)

List of Figures

- FIGURE 1 SODIUM TRIPOLYPHOSPHATE MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SODIUM TRIPOLYPHOSPHATE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR SODIUM TRIPOLYPHOSPHATES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH AND TOP-DOWN APPROACH

- FIGURE 5 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF SODIUM TRIPOLYPHOSPHATES

- FIGURE 6 SODIUM TRIPOLYPHOSPHATE MARKET: DATA TRIANGULATION

- FIGURE 7 GRANULE FORM SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 8 DETERGENT & CLEANERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 HOUSEHOLD CLEANING SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 EXPANSION IN END-USE INDUSTRIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 12 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 HOUSEHOLD CLEANING SEGMENT TO LEAD MARKET FROM 2025 TO 2030

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 SODIUM TRIPOLYPHOSPHATE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 SUBSTANTIAL PROGRESS WAS ACHIEVED FROM 2015 TO 2022 IN TOTAL WASTEWATER TREATED

- FIGURE 17 SODIUM TRIPOLYPHOSPHATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 SODIUM TRIPOLYPHOSPHATE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 SODIUM TRIPOLYPHOSPHATE MARKET: ECOSYSTEM MAPPING

- FIGURE 20 AVERAGE SELLING PRICE TREND OF SODIUM TRIPOLYPHOSPHATE, BY REGION, 2022-2024 (USD/TON)

- FIGURE 21 AVERAGE SELLING PRICE TREND OF SODIUM TRIPOLYPHOSPHATE, BY KEY PLAYERS, 2024

- FIGURE 22 IMPORT DATA RELATED TO HS CODE 283531, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA RELATED TO HS CODE 283531, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 24 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 25 SODIUM TRIPOLYPHOSPHATE MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 26 LIST OF MAJOR PATENTS RELATED TO SODIUM TRIPOLYPHOSPHATE, 2014-2024

- FIGURE 27 FUTURE APPLICATIONS OF SODIUM TRIPOLYPHOSPHATE

- FIGURE 28 SODIUM TRIPOLYPHOSPHATE MARKET: DECISION-MAKING FACTORS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE

- FIGURE 30 KEY BUYING CRITERIA, BY END USE

- FIGURE 31 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 32 POWDER TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 33 HOUSEHOLD CLEANING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 DETERGENT & CLEANERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: SODIUM TRIPOLYPHOSPHATE MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: SODIUM TRIPOLYPHOSPHATE MARKET SNAPSHOT

- FIGURE 38 EUROPE: SODIUM TRIPOLYPHOSPHATE MARKET SNAPSHOT

- FIGURE 39 SODIUM TRIPOLYPHOSPHATE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 40 SODIUM TRIPOLYPHOSPHATE MARKET SHARE ANALYSIS, 2024

- FIGURE 41 BRAND/PRODUCT COMPARISON

- FIGURE 42 SODIUM TRIPOLYPHOSPHATE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 SODIUM TRIPOLYPHOSPHATE MARKET: COMPANY FOOTPRINT (26 COMPANIES)

- FIGURE 44 SODIUM TRIPOLYPHOSPHATE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 EV/EBITDA

- FIGURE 46 ENTERPRISE VALUE

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 48 YUNTIANHUA CO., LTD.: COMPANY SNAPSHOT

- FIGURE 49 PHOSAGRO GROUP: COMPANY SNAPSHOT

- FIGURE 50 YIBIN TIANYUAN GROUP: COMPANY SNAPSHOT

- FIGURE 51 HUBEI XINGFA CHEMICALS GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY: COMPANY SNAPSHOT

- FIGURE 54 ICL: COMPANY SNAPSHOT

- FIGURE 55 SOCIETE CHIMIQUE ALKIMIA: COMPANY SNAPSHOT

- FIGURE 56 NIPPON CHEMICAL INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT