|

市場調查報告書

商品編碼

1883937

全球醫療設備塑膠市場(至2030年):材質、原料、製造流程、應用及地區分類Medical Device Plastics Market by Material, Source, Manufacturing Process, Application, & Region - Global Forecast to 2030 |

||||||

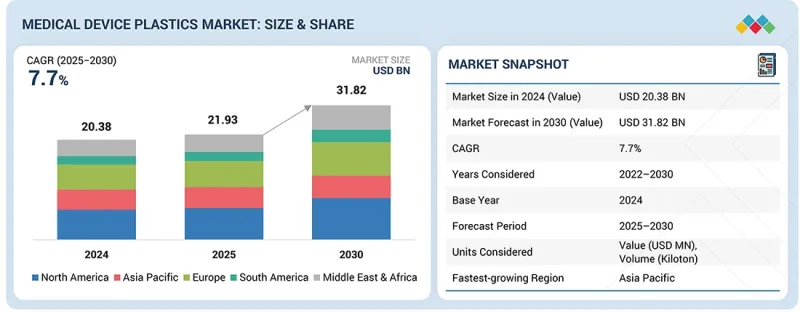

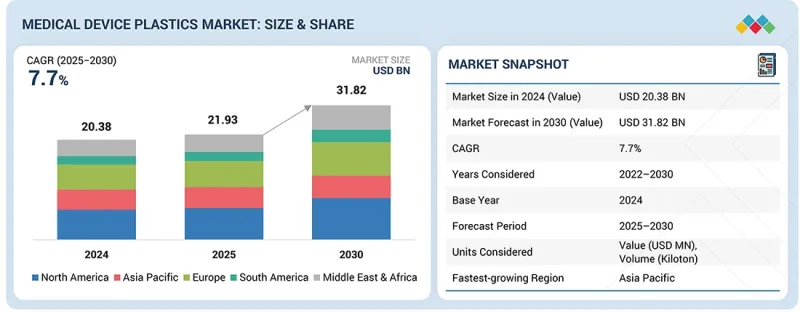

預計醫療設備塑膠市場將從 2025 年的 219.3 億美元成長到 2030 年的 318.2 億美元。

預計2025年至2030年,醫療器材塑膠市場將以7.7%的複合年成長率成長。按材料類型分類,工程塑膠在醫療設備塑膠市場中佔據第二大佔有率,這主要得益於其優異的機械強度、耐熱性和化學穩定性。這些塑膠具有出色的尺寸穩定性和良好的滅菌相容性,使其成為對耐用性和使用壽命要求較高的應用的理想選擇。

| 調查範圍 | |

|---|---|

| 調查期 | 2022-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元),數量(千噸) |

| 部分 | 材質、原料、製造流程、應用、地區 |

| 目標區域 | 歐洲、北美、亞太地區、中東和非洲、南美 |

此外,小型化、精密化的醫療設備(尤其是在診斷和病患監測領域)的日益普及,推動了對工程塑膠的需求。工程塑膠仍然是現代醫療設備製造中創新和可靠性的關鍵促進因素,因為原始設備製造商 (OEM) 正在尋求輕巧、經濟高效且符合監管規定的金屬替代品。

按應用領域分類,藥物輸送系統細分市場將佔最大佔有率。

按應用領域分類,藥物輸送系統細分市場佔據主導地位,收入佔有率最大。這一主導地位主要歸功於注射器、導管、輸液系統、吸入器、預填充藥物輸送裝置等產品中塑膠零件的廣泛應用。自我給藥和微創給藥系統的日益普及,以及需要持續用藥的慢性病患者數量的不斷增加,都推動了這一趨勢。此外,微成型和複合材料射出成型技術的進步,使得高度整合、一次性使用且病患友善的給藥裝置得以生產,進一步鞏固了該細分市場在醫療設備塑膠市場的主導地位。

預計在預測期內,北美將佔據最大的市場佔有率。

這主要得益於該地區完善的醫療基礎設施、高醫療設備消費量和先進的製造業生態系統。此外,眾多大型原始設備製造商 (OEM) 和專業契約製造也在此設立分支機構,這些企業專注於為非侵入式和藥物輸送應用提供精密注塑成型的塑膠零件,進一步鞏固了該地區的主導地位。捷普公司 (Jabil Inc.)、SMC 有限公司和飛利浦醫療 (Phillips-Medisize,莫仕集團旗下公司) 等主要企業企業在該市場中處於領先地位,提供先進的醫用級射出成型、潔淨室製造和組裝服務。

本報告調查了全球醫療設備用塑膠市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、按各個細分市場、地區/主要國家進行的詳細分析、競爭格局以及主要企業的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 波特五力分析

- 主要相關利益者和採購標準

- 總體經濟指標

- 價值鏈分析

- 生態系分析

- 案例研究分析

- 監管狀態

- 技術分析

- 影響您業務的趨勢/顛覆性因素

- 貿易分析

- 2025-2026 年重要會議與活動

- 定價分析

- 投資和資金籌措方案

- 專利分析

- 2025年美國關稅對醫療設備塑膠市場的影響

第6章醫療設備塑膠市場(依材質)

- 標準塑膠

- 工程塑膠

- 特種塑膠

第7章醫療設備塑膠市場(按原始材料分類)

- 石化燃料

- 生物基

第8章醫療設備塑膠市場依製造程序分類

- 擠壓

- CNC加工

- 射出成型

- 真空鑄造

- 熱成型

- 吹塑成型

- 其他

第9章醫療設備塑膠市場(依應用領域分類)

- 診斷設備

- 手術器械

- 配送系統

- 照護現場設備

- 穿戴式醫療設備

- 醫療設備外殼

- 其他

第10章醫療設備塑膠市場(按地區分類)

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 西班牙

- 其他

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他

- 南美洲

- 巴西

- 阿根廷

- 其他

- 中東和非洲

- 沙烏地阿拉伯

- 其他海灣合作理事會國家

- 南非

- 其他

第11章 競爭格局

- 概述

- 主要企業/主要企業的策略

- 收入分析

- 市佔率分析

- 品牌/產品對比

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小企業

- 估值和財務指標

- 競爭場景

第12章:公司簡介

- 主要企業

- JABIL INC.

- PHILLIPS MEDISIZE

- DONATELLE PLASTICS, LLC.

- FLEX LTD.

- BEMIS MANUFACTURING COMPANY

- NOLATO AB

- TRELLEBORG AB

- FREUDENBERG GROUP

- VIANT

- SMC LTD

- 其他公司

- ACCU-MOLD

- APL MANUFACTURING INC.

- C&J INDUSTRIES

- EUROPLAZ

- GE SHEN CORPORATION

- HOCHUEN MEDICAL

- HOFFER PLASTICS

- KAYSUN CORPORATION

- MACK MOLDING CO.

- PUTNAM PLASTICS

- THE RODON GROUP

- ROSTI GROUP AB

- SEASKYMEDICAL

- TECHNIMARK LLC.

- TESSY PLASTICS

第13章附錄

The medical device plastics market is estimated to be worth USD 21.93 billion in 2025 and is projected to reach USD 31.82 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The engineering plastics segment holds the second-largest share in the medical device plastics market based on material type, driven by its superior mechanical strength, heat resistance, and chemical stability. These plastics offer excellent dimensional stability and sterilization compatibility, making them ideal for applications requiring durability and long service life.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Material, Source, Manufacturing Process, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Furthermore, the growing adoption of miniaturized and high-performance medical devices, especially in diagnostics and patient monitoring, continues to boost demand for engineering plastics. As OEMs seek lightweight, cost-effective, and regulatory-compliant alternatives to metals, this segment remains a critical enabler of innovation and reliability in modern medical device manufacturing.

''In terms of value, the drug delivery systems segment accounted for the largest share of the overall medical device plastic market.''

The drug delivery systems segment leads the medical device plastics market in terms of application, accounting for the largest revenue share. This dominance is driven by the widespread use of plastic-based components in syringes, catheters, infusion systems, inhalers, and prefilled drug delivery devices. The increasing adoption of self-administrative and minimally invasive drug delivery systems, along with the rising prevalence of chronic diseases requiring continuous medication, is driving this trend. Additionally, advances in micro-molding and multi-material injection technologies are enabling the production of highly integrated, disposable, and patient-friendly delivery devices, further solidifying this segment's leadership in the medical device plastics market.

"North America is projected to account for the largest market share during the forecast period".

North America dominates the medical device plastics market, holding the largest regional share, primarily due to its strong healthcare infrastructure, high medical device consumption, and advanced manufacturing ecosystem. The region's leadership is further supported by the presence of major OEMs and specialized contract manufacturers that focus on precision-molded plastic components for noninvasive and drug delivery applications. Key players such as Jabil Inc., SMC Ltd., and Phillips-Medisize (a Molex company) are at the forefront of this market, offering advanced medical-grade injection molding, cleanroom manufacturing, and assembly services.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

- By Designation: C Level - 33%, Director Level - 33%, and Managers - 34%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 25%, Middle East & Africa - 15%, and Latin America - 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies in this market include Jabil Inc. (US), Phillips Medisize (US), Donatelle Plastics, LLC (US), Spectrum Plastics Group (US), Bemis Manufacturing Company (US), Nolato (Sweden), Trelleborg AB (Sweden), Freudenberg Medical (US), Viant (US), and SMC Ltd. (US).

Study Coverage

This research report categorizes the medical device plastics market by material type (standard plastics, engineering plastics, and other specialty types), source (fossil-based and bio-based), manufacturing process (extrusion, CNC machining, injection molding, vacuum casting, thermoforming, blow molding, and other manufacturing processes), application (diagnostics equipment, surgical instruments, delivery systems, point-of-care devices, wearable medical devices, medical device housings, and other applications), an region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the medical device plastics market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the medical device plastics market are all covered. This report includes a competitive analysis of upcoming startups in the medical device plastics market ecosystem.

Reasons to Buy this Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall medical device plastics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (continuous investment in the healthcare segment, growing aging population, and chronic diseases), restraints (volatility in raw material prices), opportunities (contract manufacturing boom), and challenges (quality and biocompatibility testing, skilled workforce, and technology gaps).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the medical device plastics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the medical device plastics market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the medical device plastics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Jabil Inc. (US), Phillips Medisize (US), Donatelle Plastics, LLC (US), Spectrum Plastics Group (US), Bemis Manufacturing Company (US), Nolato (Sweden), Trelleborg AB (Sweden), Freudenberg Medical (US), Viant (US), and SMC Ltd. (US) in the medical device plastics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.3.4.1 Currency/Value unit

- 1.3.4.2 Volume unit

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL DEVICE PLASTICS MARKET

- 4.2 MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL

- 4.3 MEDICAL DEVICE PLASTICS MARKET, BY SOURCE

- 4.4 MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS

- 4.5 MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION

- 4.6 MEDICAL DEVICE PLASTICS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for single-use and disposable medical devices due to infection-control protocols and preparedness

- 5.2.1.2 Rising investments in healthcare infrastructure globally

- 5.2.1.3 Industrialization and infrastructure growth in emerging economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental concerns and growing pressure to reduce plastic waste and adopt sustainable alternatives

- 5.2.2.2 Stringent regulatory and quality standards mandating extensive biocompatibility and sterilization testing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of plastics into smart devices, microfluidics, and wearable health monitors

- 5.2.3.2 Customization via 3D printing/additive manufacturing and advanced molding for patient-specific solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing between cost-efficiency, device safety, and recyclability to meet healthcare needs

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 MEDICAL DEVICE PROTOTYPING WITH MANTLE 3D METAL TOOLING

- 5.8.2 REDESIGNING CELLULAR OXYGEN SENSORS FOR HOSPITAL USE

- 5.8.3 LEVERAGING PLASTIC THERMOFORMING FOR ADVANCED MEDICAL DIAGNOSTIC ENCLOSURES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATIONS

- 5.9.1.1 Europe

- 5.9.1.2 Asia Pacific

- 5.9.1.3 North America

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATIONS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Over molding and micro molding

- 5.10.1.2 3D printing (Additive manufacturing)

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Microfluidics and lab-on-a-chip technology

- 5.10.2.2 Embedded electronics and smart sensors

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO

- 5.12.2 IMPORT SCENARIO

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND OF MEDICAL DEVICE PLASTICS, BY REGION, 2022-2024

- 5.14.2 AVERAGE SELLING PRICE TREND OF MEDICAL DEVICE PLASTICS, BY APPLICATION, 2022-2024

- 5.14.3 AVERAGE SELLING PRICES OF MEDICAL DEVICE PLASTICS OFFERED BY KEY PLAYERS, BY APPLICATION, 2024

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 PATENT ANALYSIS

- 5.16.1 APPROACH

- 5.16.2 DOCUMENT TYPES

- 5.16.3 PUBLICATION TRENDS, 2014-2024

- 5.16.4 INSIGHTS

- 5.16.5 LEGAL STATUS OF PATENTS

- 5.16.6 JURISDICTION ANALYSIS, 2014-2024

- 5.16.7 TOP COMPANIES/APPLICANTS

- 5.16.8 TOP 10 PATENT OWNERS (US), 2014-2024

- 5.17 IMPACT OF 2025 US TARIFF ON MEDICAL DEVICE PLASTICS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- 6.2 STANDARD PLASTICS

- 6.2.1 INCREASE IN USE OF STANDARD PLASTICS IN GLOBAL MEDICAL DEVICE MARKET

- 6.3 ENGINEERING PLASTICS

- 6.3.1 CRITICAL PERFORMANCE AND ECONOMIC DRIVERS TO INCREASE DEMAND

- 6.4 SPECIALTY PLASTICS

- 6.4.1 RISE OF BIORESORBABLE POLYMERS IN NEXT-GENERATION MEDICAL APPLICATIONS

7 MEDICAL DEVICE PLASTICS MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 FOSSIL-BASED

- 7.2.1 PROVEN PERFORMANCE TO SUSTAIN DEMAND

- 7.3 BIO-BASED

- 7.3.1 GREEN CHEMISTRY ACCELERATES ADOPTION OF BIO-ORIGIN POLYMERS IN HEALTHCARE

8 MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.2 EXTRUSION

- 8.2.1 HIGH-PERFORMANCE EXTRUSION ENSURES CONSISTENCY IN MEDICAL-GRADE DEVICE PLASTICS

- 8.3 CNC MACHINING

- 8.3.1 HIGH-PERFORMANCE CNC SYSTEMS ENHANCE PRODUCT INTEGRITY FOR IMPLANTABLE AND DIAGNOSTIC PARTS

- 8.4 INJECTION MOLDING

- 8.4.1 INJECTION MOLDING REMAINS BACKBONE OF COST-EFFECTIVE DEVICE MANUFACTURING

- 8.5 VACUUM CASTING

- 8.5.1 VACUUM-ASSISTED FORMING ENSURES PRECISE DETAIL AND SMOOTH FINISHES IN LARGE MEDICAL COMPONENTS

- 8.6 THERMOFORMING

- 8.6.1 VERSATILITY OF THERMOFORMING SUPPORTS QUICK CUSTOMIZATION IN HEALTHCARE EQUIPMENT

- 8.7 BLOW MOLDING

- 8.7.1 ENSURES SEAMLESS, LEAK-PROOF MEDICAL BOTTLES AND IV CONTAINERS

- 8.8 OTHER MANUFACTURING PROCESSES

9 MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DIAGNOSTIC EQUIPMENT

- 9.2.1 TRANSPARENT POLYMERS ENHANCE ACCURACY AND MINIATURIZATION IN DIAGNOSTIC DEVICES

- 9.3 SURGICAL INSTRUMENTS

- 9.3.1 STERILIZABLE PLASTICS ENHANCE PERFORMANCE IN REUSABLE AND SINGLE-USE INSTRUMENTS

- 9.4 DELIVERY SYSTEMS

- 9.4.1 SMART DELIVERY DEVICES RELY ON HIGH-PERFORMANCE AND FLEXIBLE PLASTIC DESIGNS

- 9.5 POINT-OF-CARE DEVICES

- 9.5.1 SMART POLYMER HOUSINGS ENABLE REAL-TIME DATA TRANSMISSION IN POC DEVICES

- 9.6 WEARABLE MEDICAL DEVICES

- 9.6.1 CONDUCTIVE PLASTICS INTEGRATE ELECTRONICS INTO SEAMLESS WEARABLE DESIGNS

- 9.7 MEDICAL DEVICE HOUSINGS

- 9.7.1 MECHANICAL STRENGTH, STERILIZATION RESISTANCE, AND AESTHETIC DESIGN FLEXIBILITY TO DRIVE DEMAND

- 9.8 OTHER APPLICATIONS

10 MEDICAL DEVICE PLASTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Growing aging population and strong manufacturing base to drive market

- 10.2.2 CANADA

- 10.2.2.1 High demand from aging population for chronic care and surgical procedures to boost market

- 10.2.3 MEXICO

- 10.2.3.1 Rising healthcare expenditure to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 High expenditure in medical infrastructure to fuel market growth

- 10.3.2 FRANCE

- 10.3.2.1 Growing demand for high-quality medical devices to boost market growth

- 10.3.3 ITALY

- 10.3.3.1 Government support and initiatives to drive demand

- 10.3.4 UK

- 10.3.4.1 Need for advancements in medical injection molding, rapid prototyping, and additive manufacturing to drive market

- 10.3.5 SPAIN

- 10.3.5.1 Government-financed healthcare spending to drive market for medical device plastics

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Advanced manufacturing and healthcare expansion to create new opportunities

- 10.4.2 JAPAN

- 10.4.2.1 Aging population to drive demand for advanced medical plastics

- 10.4.3 INDIA

- 10.4.3.1 Rising domestic manufacturing and policy support to drive demand

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Technological innovation and government support to drive growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Rising healthcare modernization to drive demand

- 10.5.2 ARGENTINA

- 10.5.2.1 Local manufacturing capacity to drive demand

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 SAUDI ARABIA

- 10.6.1.1 Healthcare expansion and localization under vision 2030 to drive demand

- 10.6.2 REST OF GCC COUNTRIES

- 10.6.3 SOUTH AFRICA

- 10.6.4 REST OF MIDDLE EAST & AFRICA

- 10.6.1 SAUDI ARABIA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Material footprint

- 11.6.5.4 Source footprint

- 11.6.5.5 Manufacturing process footprint

- 11.6.5.6 Application footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 JABIL INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 PHILLIPS MEDISIZE

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DONATELLE PLASTICS, LLC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 FLEX LTD.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 BEMIS MANUFACTURING COMPANY

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threat

- 12.1.6 NOLATO AB

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threat

- 12.1.7 TRELLEBORG AB

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Expansions

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 FREUDENBERG GROUP

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Right to win

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses and competitive threats

- 12.1.9 VIANT

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.9.3.1 Right to win

- 12.1.9.3.2 Strategic choices

- 12.1.9.3.3 Weaknesses and competitive threats

- 12.1.10 SMC LTD

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Right to win

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.1 JABIL INC.

- 12.2 OTHER PLAYERS

- 12.2.1 ACCU-MOLD

- 12.2.2 APL MANUFACTURING INC.

- 12.2.3 C&J INDUSTRIES

- 12.2.4 EUROPLAZ

- 12.2.5 GE SHEN CORPORATION

- 12.2.6 HOCHUEN MEDICAL

- 12.2.7 HOFFER PLASTICS

- 12.2.8 KAYSUN CORPORATION

- 12.2.9 MACK MOLDING CO.

- 12.2.10 PUTNAM PLASTICS

- 12.2.11 THE RODON GROUP

- 12.2.12 ROSTI GROUP AB

- 12.2.13 SEASKYMEDICAL

- 12.2.14 TECHNIMARK LLC.

- 12.2.15 TESSY PLASTICS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MEDICAL DEVICE PLASTICS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MEDICAL DEVICE PLASTICS MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030

- TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 MEDICAL DEVICE PLASTICS MARKET: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MEDICAL DEVICE PLASTICS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 AVERAGE SELLING PRICE TREND OF MEDICAL DEVICE PLASTICS, BY REGION, 2022-2032 (USD/KG)

- TABLE 10 TOTAL PATENT COUNT, 2014-2024

- TABLE 11 TOP 10 PATENT OWNERS, 2014-2014

- TABLE 12 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 14 MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 15 MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (KT)

- TABLE 16 MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (KT)

- TABLE 17 MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (USD MILLION)

- TABLE 18 MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 19 MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (KT)

- TABLE 20 MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 21 MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 22 MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 23 MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KT)

- TABLE 24 MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KT)

- TABLE 25 MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 26 MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 28 MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 29 MEDICAL DEVICE PLASTICS MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 30 MEDICAL DEVICE PLASTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 MEDICAL DEVICE PLASTICS MARKET, BY REGION, 2022-2024 (KT)

- TABLE 32 MEDICAL DEVICE PLASTICS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 33 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 34 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (KT)

- TABLE 36 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 37 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 38 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (KT)

- TABLE 40 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (KT)

- TABLE 41 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (USD MILLION)

- TABLE 42 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (KT)

- TABLE 44 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 45 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 46 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KT)

- TABLE 48 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KT)

- TABLE 49 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 50 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 52 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 53 US: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 54 US: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 55 US: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 56 US: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 57 CANADA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 58 CANADA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59 CANADA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 60 CANADA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 61 MEXICO: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 62 MEXICO: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 MEXICO: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 64 MEXICO: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 65 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 66 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (KT)

- TABLE 68 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 69 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 70 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (KT)

- TABLE 72 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (KT)

- TABLE 73 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (USD MILLION)

- TABLE 74 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (KT)

- TABLE 76 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 77 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 78 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KT)

- TABLE 80 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KT)

- TABLE 81 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 82 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 84 EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 85 GERMANY: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 86 GERMANY: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 GERMANY: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 88 GERMANY: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 89 FRANCE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 90 FRANCE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 FRANCE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 92 FRANCE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 93 ITALY: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 94 ITALY: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 ITALY: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 96 ITALY: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 97 UK: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 98 UK: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 UK: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 100 UK: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 101 SPAIN: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 102 SPAIN: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 SPAIN: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 104 SPAIN: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 105 REST OF EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 106 REST OF EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 REST OF EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 108 REST OF EUROPE: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 109 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (KT)

- TABLE 112 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 113 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (KT)

- TABLE 116 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (KT)

- TABLE 117 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (KT)

- TABLE 120 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 121 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KT)

- TABLE 124 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KT)

- TABLE 125 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 128 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 129 CHINA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 130 CHINA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 CHINA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 132 CHINA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 133 JAPAN: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 134 JAPAN: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 JAPAN: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 136 JAPAN: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 137 INDIA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 138 INDIA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 INDIA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 140 INDIA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 141 SOUTH KOREA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 142 SOUTH KOREA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 SOUTH KOREA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 144 SOUTH KOREA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 145 REST OF ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 148 REST OF ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 149 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 150 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (KT)

- TABLE 152 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 153 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 154 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 155 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (KT)

- TABLE 156 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (KT)

- TABLE 157 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (USD MILLION)

- TABLE 158 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 159 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (KT)

- TABLE 160 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 161 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 162 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 163 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KT)

- TABLE 164 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KT)

- TABLE 165 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 166 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 168 SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 169 BRAZIL: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 170 BRAZIL: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 171 BRAZIL: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 172 BRAZIL: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 173 ARGENTINA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 174 ARGENTINA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 ARGENTINA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 176 ARGENTINA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 177 REST OF SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 179 REST OF SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 180 REST OF SOUTH AMERICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 181 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2022-2024 (KT)

- TABLE 184 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 185 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2022-2024 (KT)

- TABLE 188 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL, 2025-2030 (KT)

- TABLE 189 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2022-2024 (KT)

- TABLE 192 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY SOURCE, 2025-2030 (KT)

- TABLE 193 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2022-2024 (KT)

- TABLE 196 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS, 2025-2030 (KT)

- TABLE 197 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 200 MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 201 SAUDI ARABIA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 202 SAUDI ARABIA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 SAUDI ARABIA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 204 SAUDI ARABIA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 205 REST OF GCC COUNTRIES: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 206 REST OF GCC COUNTRIES: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 207 REST OF GCC COUNTRIES: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 208 REST OF GCC COUNTRIES: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 209 SOUTH AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 210 SOUTH AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 211 SOUTH AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 212 SOUTH AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2022-2024 (KT)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 217 MEDICAL DEVICE PLASTICS MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 218 MEDICAL DEVICE PLASTICS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 219 MEDICAL DEVICE PLASTICS MARKET: REGION FOOTPRINT

- TABLE 220 MEDICAL DEVICE PLASTICS MARKET: MATERIAL FOOTPRINT

- TABLE 221 MEDICAL DEVICE PLASTICS MARKET: SOURCE FOOTPRINT

- TABLE 222 MEDICAL DEVICE PLASTICS MARKET: MANUFACTURING PROCESS FOOTPRINT

- TABLE 223 MEDICAL DEVICE PLASTICS MARKET: APPLICATION FOOTPRINT

- TABLE 224 MEDICAL DEVICE PLASTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 225 MEDICAL DEVICE PLASTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 226 MEDICAL DEVICE PLASTICS MARKET: PRODUCT LAUNCHES, JANUARY 2020-SEPTEMBER 2025

- TABLE 227 MEDICAL DEVICE PLASTICS MARKET: DEALS, JANUARY 2020-SEPTEMBER 2025

- TABLE 228 MEDICAL DEVICE PLASTICS MARKET: EXPANSIONS, JANUARY 2020-SEPTEMBER 2025

- TABLE 229 JABIL INC.: COMPANY OVERVIEW

- TABLE 230 JABIL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 JABIL INC.: EXPANSIONS, JANUARY 2020-SEPTEMBER 2025

- TABLE 232 PHILLIPS MEDISIZE: COMPANY OVERVIEW

- TABLE 233 PHILLIPS MEDISIZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 PHILLIPS MEDISIZE: PRODUCT LAUNCHES, JANUARY 2020-SEPTEMBER 2025

- TABLE 235 PHILLIPS MEDISIZE: DEALS, JANUARY 2020-SEPTEMBER 2025

- TABLE 236 PHILLIPS MEDISIZE: EXPANSIONS, JANUARY 2020-SEPTEMBER 2025

- TABLE 237 DONATELLE PLASTICS, LLC.: COMPANY OVERVIEW

- TABLE 238 DONATELLE PLASTICS, LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 FLEX LTD.: COMPANY OVERVIEW

- TABLE 240 FLEX LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 BEMIS MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 242 BEMIS MANUFACTURING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 NOLATO AB: COMPANY OVERVIEW

- TABLE 244 NOLATO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 NOLATO AB: DEALS, JANUARY 2020-SEPTEMBER 2025

- TABLE 246 TRELLEBORG AB: COMPANY OVERVIEW

- TABLE 247 TRELLEBORG AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 TRELLEBORG AB: PRODUCT LAUNCHES, JANUARY 2020-SEPTEMBER 2025

- TABLE 249 TRELLEBORG AB: EXPANSIONS, JANUARY 2020-SEPTEMBER 2025

- TABLE 250 FREUDENBERG GROUP: COMPANY OVERVIEW

- TABLE 251 FREUDENBERG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 VIANT: COMPANY OVERVIEW

- TABLE 253 VIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 SMC LTD: COMPANY OVERVIEW

- TABLE 255 SMC LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 ACCU-MOLD: COMPANY OVERVIEW

- TABLE 257 APL MANUFACTURING INC.: COMPANY OVERVIEW

- TABLE 258 C&J INDUSTRIES: COMPANY OVERVIEW

- TABLE 259 EUROPLAZ: COMPANY OVERVIEW

- TABLE 260 GE SHEN CORPORATION: COMPANY OVERVIEW

- TABLE 261 HOCHUEN MEDICAL: COMPANY OVERVIEW

- TABLE 262 HOFFER PLASTICS: COMPANY OVERVIEW

- TABLE 263 KAYSUN CORPORATION: COMPANY OVERVIEW

- TABLE 264 MACK MOLDING CO.: COMPANY OVERVIEW

- TABLE 265 PUTNAM PLASTICS: COMPANY OVERVIEW

- TABLE 266 THE RODON GROUP: COMPANY OVERVIEW

- TABLE 267 ROSTI GROUP AB: COMPANY OVERVIEW

- TABLE 268 SEASKYMEDICAL: COMPANY OVERVIEW

- TABLE 269 TECHNIMARK LLC.: COMPANY OVERVIEW

- TABLE 270 TESSY PLASTICS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEDICAL DEVICE PLASTICS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MEDICAL DEVICE PLASTICS MARKET: RESEARCH DESIGN

- FIGURE 3 MULTIFOLD APPROACH ADOPTED TO ARRIVE AT GLOBAL, REGIONAL, AND COUNTRY-LEVEL MEDICAL DEVICE PLASTICS MARKET SIZE

- FIGURE 4 MEDICAL DEVICE PLASTICS MARKET: BOTTOM-UP APPROACH AND TOP-DOWN APPROACH

- FIGURE 5 MEDICAL DEVICE PLASTICS MARKET: DATA TRIANGULATION

- FIGURE 6 STANDARD PLASTICS SEGMENT TO LEAD MEDICAL DEVICE PLASTICS MARKET BETWEEN 2025 AND 2030

- FIGURE 7 FOSSIL-BASED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 8 INJECTION MOLDING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 DIAGNOSTIC EQUIPMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING MEDICAL DEVICE PLASTICS MARKET

- FIGURE 11 ASIA PACIFIC TO OFFER LUCRATIVE OPPORTUNITIES IN MEDICAL DEVICE PLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 12 STANDARD PLASTICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 FOSSIL-BASED SEGMENT TO DOMINATE MEDICAL DEVICE PLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 14 INJECTION MOLDING TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 15 WEARABLE MEDICAL DEVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 17 MEDICAL DEVICE PLASTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 MEDICAL DEVICE PLASTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF KEY APPLICATIONS

- FIGURE 20 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 21 MEDICAL DEVICE PLASTICS MARKET VALUE CHAIN

- FIGURE 22 MEDICAL DEVICE PLASTICS MARKET: ECOSYSTEM

- FIGURE 23 MEDICAL DEVICE PLASTICS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 EXPORT DATA FOR HS CODE 340290-COMPLIANT PRODUCTS, BY COUNTRY (USD THOUSAND)

- FIGURE 25 IMPORT DATA HS CODE 340290-COMPLIANT PRODUCTS, BY COUNTRY (USD THOUSAND)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF MEDICAL DEVICE PLASTICS, BY REGION , 2022-2024 (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2024 (USD/KG)

- FIGURE 28 AVERAGE SELLING PRICES OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/KG)

- FIGURE 29 MEDICAL DEVICE PLASTICS MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 30 TOTAL NUMBER OF PATENTS FOR 2014-2024

- FIGURE 31 NUMBER OF PATENTS YEAR-WISE FROM 2014 TO 2024

- FIGURE 32 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 33 TOP JURISDICTION, BY DOCUMENT, 2014-2024

- FIGURE 34 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS FOR 2014-2024

- FIGURE 35 STANDARD PLASTICS MATERIAL SEGMENT TO HOLD LARGEST SHARE OF MEDICAL DEVICE PLASTICS MARKET IN 2025

- FIGURE 36 FOSSIL-BASED SOURCE TO HOLD LARGER SHARE OF MEDICAL DEVICE PLASTICS MARKET IN 2025

- FIGURE 37 INJECTION MOLDING MANUFACTURING PROCESS TO HOLD LARGEST SHARE OF MEDICAL DEVICE PLASTICS MARKET IN 2025

- FIGURE 38 DIAGNOSTIC EQUIPMENT APPLICATION TO HOLD LARGEST SHARE OF MEDICAL DEVICE PLASTICS MARKET IN 2025

- FIGURE 39 NORTH AMERICA: MEDICAL DEVICE PLASTICS MARKET SNAPSHOT

- FIGURE 40 EUROPE: MEDICAL DEVICE PLASTICS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: MEDICAL DEVICE PLASTICS MARKET SNAPSHOT

- FIGURE 42 MEDICAL DEVICE PLASTICS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 43 MEDICAL DEVICE PLASTICS MARKET SHARE ANALYSIS, 2024

- FIGURE 44 MEDICAL DEVICE PLASTICS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 45 MEDICAL DEVICE PLASTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 MEDICAL DEVICE PLASTICS MARKET: COMPANY FOOTPRINT

- FIGURE 47 MEDICAL DEVICE PLASTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 MEDICAL DEVICE PLASTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- FIGURE 49 MEDICAL DEVICE PLASTICS MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 50 MEDICAL DEVICE PLASTICS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 51 MEDICAL DEVICE PLASTICS MARKET: ENTERPRISE VALUATION OF KEY PLAYERS, 2025

- FIGURE 52 JABIL INC.: COMPANY SNAPSHOT

- FIGURE 53 FLEX LTD.: COMPANY SNAPSHOT

- FIGURE 54 NOLATO AB: COMPANY SNAPSHOT

- FIGURE 55 TRELLEBORG AB: COMPANY SNAPSHOT

- FIGURE 56 FREUDENBERG GROUP: COMPANY SNAPSHOT