|

市場調查報告書

商品編碼

1883934

全球鋁粉市場按類型、工藝、純度、終端應用產業和地區分類-預測至2030年Aluminum Metal Powder Market by Type, Process, Purity, End-Use Industry and Region - Forecast to 2030 |

||||||

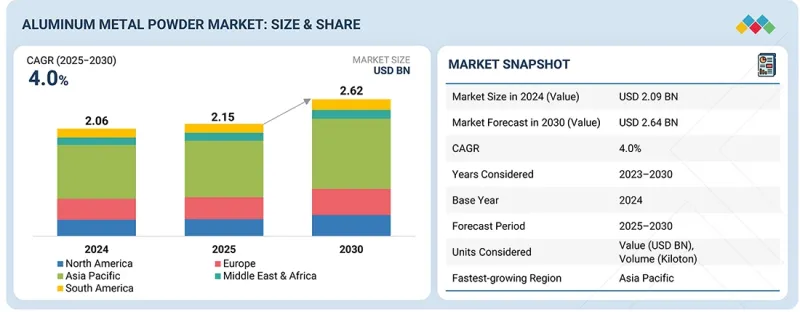

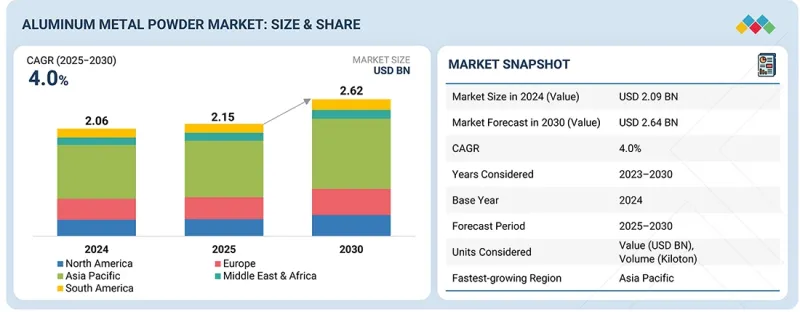

預計到 2025 年,鋁金屬粉末市場規模將達到 21.7 億美元,到 2030 年將達到 26.4 億美元,預測期內複合年成長率為 4.0%。

按類型分類,片狀金屬在整體市場中佔據第二大佔有率,這主要是因為其在油漆和塗料、印刷油墨、塑膠和工業塗料中的應用日益廣泛,在這些領域,金屬外觀、反射率和表面覆蓋率都很重要。

| 調查範圍 | |

|---|---|

| 調查期 | 2023-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(百萬美元)和數量(千噸) |

| 部分 | 按類型、工藝、純度、最終用途行業和地區分類 |

| 目標區域 | 歐洲、北美、亞太地區、中東和非洲、南美 |

鋁片在建築材料(例如加氣混凝土塊)和需要可控反應性和美觀性能的特殊塗料中的應用日益廣泛。在不斷變化的設計趨勢和日益嚴格的性能標準的推動下,鋁片在汽車塗料、建築飾面和工業防護塗料領域的應用不斷成長,進一步鞏固了其強大的市場地位。

預計在預測期內,電解粉市場將以第二高的複合年成長率成長,這主要得益於特殊應用領域對超高純度鋁粉的生產能力。電解粉具有卓越的化學純度和可控的顆粒特性,使其適用於電子、高性能冶金、航太零件和先進化學配方等領域。電池技術、導電漿料和精密積層製造領域對高純度材料的需求不斷成長,進一步推動了電解粉的應用。此外,與傳統生產方式相比,高規格製造領域的投資增加以及對無污染金屬粉末需求的行業擴張,也加速了該細分市場的成長。

預計在預測期內,純度高於99%的鋁粉市場將以第二高的複合年成長率成長,這主要得益於其在高性能和高精度應用領域日益成長的需求。超高純度鋁粉在電子、航太合金、積層製造和先進化學製程等領域至關重要,這些領域對污染控制、穩定的導電性和優異的材料穩定性都有嚴格的要求。此外,其在電動車電池組件、導熱介面材料和特殊冶金組合藥物中的應用不斷成長,也進一步推動了市場需求。隨著各行業向清潔、高效的製造流程和嚴格的品質標準轉型,純度高於99%的鋁粉市場持續擴張,因為終端用戶在下一代技術中更加重視可靠性和性能。

預計在預測期內,航太和國防領域的鋁粉市場將實現第二高的複合年成長率。這主要歸功於輕質高強度鋁合金在飛機零件、推進系統和結構件中的應用日益廣泛。鋁粉是積層製造和粉末冶金製程的關鍵組成部分,這些製程能夠生產出具有優異熱穩定性和抗疲勞性能的複雜、輕量化航太零件。固體推進劑、煙火材料和先進能源材料等國防應用也推動了對高純度和特殊鋁粉需求的成長。隨著該行業加速投資下一代飛機、航太系統和高性能材料,鋁粉在製造和現代化改造項目中的消費量持續擴大。

預計在預測期內,歐洲鋁粉市場將實現第三高的複合年成長率,這主要得益於汽車輕量化、工業機械以及航太和國防製造領域的強勁需求。積層製造技術的快速普及,尤其是在德國、法國和英國,正在加速高性能鋁粉在結構零件和高精度零件領域的應用。對永續建築材料、先進塗料和電動車(EV)生產的投資不斷增加,也進一步推動了市場成長。此外,歐洲嚴格的品質和環境標準也促進了高純度和特殊鋁粉的發展,鞏固了該地區在全球市場的穩定擴張。

本報告對全球鋁金屬粉末市場進行了分析,並按類型、工藝、純度、最終用途行業、區域趨勢以及參與市場的公司的概況進行了細分。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 介紹

- 市場動態

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 新的經營模式和生態系統變化

- 一級/二級/三級公司的策略性舉措

第5章 產業趨勢

- 波特五力分析

- 總體經濟指標

- 價值鏈分析

- 生態系分析

- 定價分析

- 貿易分析,2020-2024年

- 2025年至2027年主要會議及活動

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 案例研究分析

- 2025年美國關稅對鋁粉市場的影響

第6章:技術進步、人工智慧的影響、專利、創新與未來應用

- 關鍵新興技術

- 互補技術

- 技術/產品藍圖

- 專利分析

- 未來應用

- 人工智慧/生成式人工智慧對鋁粉市場的影響

- 成功案例和實際應用

第7章永續性和監管環境

- 地方法規和合規性

- 對永續性的承諾

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第8章:顧客狀況與購買行為

- 決策流程

- 買方相關人員和採購評估標準

- 招募障礙和內部挑戰

- 來自各個終端使用者產業的未滿足需求

- 市場盈利

9. 鋁金屬粉末市場(按類型)

- 介紹

- 粉末

- 薄片

第10章 鋁粉市場(依製程分類)

- 介紹

- 原子化

- 壓碎

- 電解

11. 鋁粉市場(依純度分類)

- 介紹

- 92%~98%

- 98%~99%

- 超過99%

12. 鋁粉市場(依終端用戶產業分類)

- 介紹

- 油漆和塗料

- 爆炸物和煙火

- 建築和基礎設施

- 工業的

- 電子學

- 汽車與運輸

- 航太與國防

- 其他

第13章 鋁金屬粉末市場(按地區分類)

- 介紹

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 南美洲

第14章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 2020-2024年收入分析

- 市佔率分析

- 產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 競爭場景

第15章:公司簡介

- 主要參與企業

- VALIMET, INC.

- MMP INDUSTRIES LTD.

- MEPCO

- KYMERA INTERNATIONAL

- HOGANAS AB

- NOVACENTRIX

- ZHANGQIU METALLIC PIGMENT CO., LTD.

- TOYO ALUMINIUM KK

- CNPC POWDER

- AMG

- CHINA ANSTEEL GROUP CORPORATION LIMITED

- HENAN YUANYANG POWDER TECHNOLOGY CO., LTD.

- CARLFORS BRUK

- AVL METAL POWDERS NV

- GRANGES

- 其他公司

- AMERICAN ELEMENTS

- SRI KALISWARI METAL POWDERS PVT LTD.

- THE ARASAN ALUMINIUM INDUSTRIES

- BELMONT METALS

- BN INDUSTRIES

- SHIVAM PROTECO PVT. LTD.

- SCHLENK SE

- UNITED STATES METAL POWDERS, INC.

- NB ENTERPRISES

- JAYESH GROUP

第16章調查方法

第17章附錄

The aluminum metal powder market is estimated at USD 2.17 billion in 2025 and is projected to reach USD 2.64 billion by 2030, registering a CAGR of 4.0% during the forecast period. Based on type, the flakes segment accounted for the second-largest share of the overall market, driven by its growing use in paints & coatings, printing inks, plastics, and industrial finishes where metallic appearance, reflectivity, and surface coverage are essential.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Process, Purity, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Aluminum flakes are also increasingly utilized in construction materials such as AAC blocks and specialty coatings that require controlled reactivity and aesthetic properties. Their rising adoption in automotive coatings, architectural finishes, and protective industrial coatings supported by evolving design trends and stricter performance standards continues to reinforce the strong market position of the flakes category.

"The electrolysis process segment is projected to be the second-fastest-growing segment during the forecast period."

The electrolysis segment of the aluminum metal powder market is projected to witness the second-highest CAGR during the forecast period, supported by its ability to produce ultra-high-purity aluminum powders required in specialized applications. Electrolysis-derived powders offer exceptional chemical purity and controlled particle characteristics, making them suitable for electronics, high-performance metallurgy, aerospace components, and advanced chemical formulations. Growing demand for high-purity materials in battery technologies, conductive pastes, and precision additive manufacturing is further strengthening the adoption of electrolysis-based powders. Additionally, increasing investments in high-specification manufacturing and the expansion of industries requiring contamination-free metal powders are driving the segment's accelerated growth relative to conventional production routes.

"The >99% purity segment is projected to register the second-highest growth rate during the forecast period."

The >99% purity segment of the aluminum metal powder market is projected to register the second-highest CAGR during the forecast period, driven by its growing use in high-performance and precision-critical applications. Ultra-high-purity aluminum powders are essential in electronics, aerospace alloys, additive manufacturing, and advanced chemical processes where contamination control, consistent conductivity, and superior material stability are required. Their increasing adoption in EV battery components, thermal interface materials, and specialized metallurgical formulations further supports demand. With industries shifting toward cleaner, higher-efficiency manufacturing and increasingly stringent quality standards, the >99% purity category continues to expand as end users prioritize reliability and performance in next-generation technologies.

"The aerospace & defense segment is projected to register the second-highest growth rate during the forecast period."

The aerospace & defense segment of the aluminum metal powder market is projected to register the second-highest CAGR during the forecast period, driven by the increasing adoption of lightweight, high-strength aluminum alloys in aircraft components, propulsion systems, and structural parts. Aluminum powders are essential in additive manufacturing and powder metallurgy processes used to produce complex, weight-optimized aerospace parts with superior thermal stability and fatigue resistance. Defense applications such as solid propellants, pyrotechnics, and advanced energetic materials also contribute to rising demand for high-purity and specialty aluminum powders. As the sector accelerates investment in next-generation aircraft, space systems, and high-performance materials, consumption of aluminum metal powder continues to expand across both manufacturing and modernization programs.

"Europe is projected to register the third-highest CAGR in the aluminum metal powder market during the forecast period."

Europe is projected to register the third-highest CAGR in the aluminum metal powder market during the forecast period, supported by strong demand from automotive lightweighting, industrial machinery, and aerospace & defense manufacturing. The region's rapid adoption of additive manufacturing, especially in Germany, France, and the U.K., is accelerating the use of high-performance aluminum powders for structural and high-precision components. Increasing investments in sustainable construction materials, advanced coatings, and EV production further contribute to market growth. Additionally, Europe's stringent quality and environmental standards are driving the development of high-purity, specialty aluminum powders, reinforcing the region's steady expansion in the global market.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 50%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Valimet, Inc. (US), MMP Industries Ltd. (India), MEPCO (India), Kymera International (US), Hoganas AB (Swden), NovaCentrix (US), Zhangqiu Metallic Pigment Co., Ltd. (China), Toyo Aluminium k.k (Japan), CNPC Powder (Canada), AMG Advanced Metallurgical Group NV (UK), China Ansteel Group Corporation Limited (China), Henan Yuanyang Powder Technology Co., Ltd. (China), Carlfors Bruk (Sweden), AVL Metal Powders n.v. (Belgium), Granges (Sweden).

Research Coverage

This research report categorizes the aluminum metal powder market by type (powder, flakes), process (atomization, comminution, electrolysis), Purity (92%-98%, 98%-99%, >99%), end-use industry (paints & coatings, construction & infrastructure, industrial, electronics, automotive, aerospace & defence), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the aluminum metal powder market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the aluminum metal powder market. This report includes a competitive analysis of upcoming startups in the aluminum metal powder market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aluminum metal powder market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing adoption of aluminum powders in AAC blocks, refractories, and construction chemicals due to rapid infrastructure expansion), restraints (High energy consumption and operational complexity associated with atomization and high-purity production), opportunities (Expanding use of aluminum powders in EV battery housings, conductive coatings, and heat dissipation applications), and challenges (Volatility in aluminum prices and energy costs directly impacting powder production economics) influencing the growth of the aluminum metal powder market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the aluminum metal powder market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aluminum metal powder market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the aluminum metal powder market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Valimet, Inc. (US), MMP Industries Ltd. (India), MEPCO (India), Kymera International (US), Hoganas AB (Swden), NovaCentrix (US), Zhangqiu Metallic Pigment Co., Ltd. (China), Toyo Aluminium k.k (Japan), CNPC Powder (Canada), AMG Advanced Metallurgical Group NV (UK), China Ansteel Group Corporation Limited (China), Henan Yuanyang Powder Technology Co., Ltd. (China), Carlfors Bruk (Sweden), AVL Metal Powders n.v. (Belgium), Granges (Sweden).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING ALUMINUM METAL POWDER MARKET

- 2.4 HIGH GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM METAL POWDER MARKET

- 3.2 ALUMINUM METAL POWDER, BY TYPE AND REGION, 2024

- 3.3 ALUMINUM METAL POWDER, BY PURITY

- 3.4 ALUMINUM METAL POWDER, BY PROCESS

- 3.5 ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 3.6 ALUMINUM METAL POWDER MARKET, BY KEY COUNTRIES

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growth of additive manufacturing and 3D printing

- 4.2.1.2 Strong infrastructure growth in emerging regions supporting construction material demand

- 4.2.1.3 Growing automotive production to drive higher consumption of aluminum metal powder

- 4.2.2 RESTRAINTS

- 4.2.2.1 Raw material price volatility and high energy consumption

- 4.2.2.2 Stringent environmental and safety regulations

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Growing demand for specialized aluminum powder grades for advanced applications

- 4.2.3.2 Shift toward sustainable, circular, and energy-efficient production

- 4.2.4 CHALLENGES

- 4.2.4.1 Competition from substitute materials

- 4.2.4.2 High technological and capital requirements limiting new market entry

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN ALUMINUM METAL POWDER MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN PAINTS AND COATINGS INDUSTRY

- 5.2.4 TRENDS IN GLOBAL CONSTRUCTION & INFRASTRUCTURE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYERS

- 5.6 TRADE ANALYSIS, 2020-2024

- 5.6.1 IMPORT SCENARIO (HS CODE 7603)

- 5.6.2 EXPORT SCENARIO (HS CODE 7603)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HOGANAS: ALUMINUM POWDER FOR LIGHTWEIGHT POWDER METALLURGY COMPONENTS

- 5.10.2 AMG ADVANCED METALLURGIC GROUP N.V.: SPHERICAL POWDERS FOR ADDITIVE MANUFACTURING

- 5.10.3 PPG INDUSTRIES: ALUMINUM POWDER FOR CORROSION-RESISTANT INDUSTRIAL COATINGS

- 5.11 IMPACT OF 2025 US TARIFF ON ALUMINUM METAL POWDER MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 GAS ATOMIZATION (GA)

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 PLASMA SPHEROIDIZATION (PS)

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 INSIGHTS

- 6.4.5 LEGAL STATUS OF PATENTS

- 6.4.6 JURISDICTION ANALYSIS

- 6.4.7 TOP APPLICANTS

- 6.4.8 PATENTS BY CENTRAL SOUTH UNIVERSITY

- 6.4.9 PATENTS BY KUNMING UNIVERSITY OF SCIENCE AND TECHNOLOGY

- 6.4.10 PATENTS BY GUANGDONG BRUNP RECYCLING TECHNOLOGY CO., LTD.

- 6.5 FUTURE APPLICATIONS

- 6.5.1 ADDITIVE MANUFACTURING COMPONENTS: LIGHTWEIGHT 3D-PRINTED STRUCTURES

- 6.5.2 CONDUCTIVE COATINGS AND PIGMENTS: ADVANCED SURFACE PROTECTION

- 6.5.3 HYDROGEN STORAGE MATERIALS: CLEAN ENERGY REVOLUTION

- 6.5.4 SOLID ROCKET PROPELLANTS: AEROSPACE & DEFENSE INNOVATION

- 6.5.5 THERMAL MANAGEMENT SYSTEMS: ELECTRONICS & EV COOLING

- 6.6 IMPACT OF AI/GEN AI ON ALUMINUM METAL POWDER MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN ALUMINUM POWDER PROCESSING

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN ALUMINUM METAL POWDER MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ALUMINUM METAL POWDER MARKET

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 EQUISPHERES & UNIVERSITY OF SOUTHERN DENMARK: SAFER ALUMINUM AM POWDER

- 6.7.2 TECHNICAL UNIVERSITY OF MUNICH & AMAZEMET: ALUMINUM SCRAP TO AM POWDER FOR CIRCULAR ECONOMY

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ALUMINUM METAL POWDER

- 7.2.1.1 Carbon impact reduction

- 7.2.1.2 Eco-Applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ALUMINUM METAL POWDER

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES BY APPLICATION

9 ALUMINUM METAL POWDER MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 POWDER

- 9.2.1 LIGHTWEIGHTING AND ADVANCED MANUFACTURING TO DRIVE DEMAND

- 9.3 FLAKES

- 9.3.1 ALUMINUM FLAKES ENHANCING PERFORMANCE AND DURABILITY IN INDUSTRIAL AND COATINGS MARKETS

10 ALUMINUM METAL POWDER MARKET, BY PROCESS

- 10.1 INTRODUCTION

- 10.2 ATOMIZATION

- 10.2.1 GROWING ADOPTION OF ATOMIZATION FOR HIGH-PERFORMANCE ALUMINUM METAL POWDERS

- 10.3 COMMINUTION

- 10.3.1 RISING INDUSTRIAL AND CONSTRUCTION DEMAND SUPPORTING GROWTH OF COMMINUTION-BASED ALUMINUM METAL POWDERS

- 10.4 ELECTROLYSIS

- 10.4.1 HIGH-PURITY REQUIREMENTS IN ELECTRONICS, DEFENSE, AND ADVANCED MANUFACTURING TO DRIVE ELECTROLYTIC ALUMINUM METAL POWDER ADOPTION

11 ALUMINUM METAL POWDER MARKET, BY PURITY

- 11.1 INTRODUCTION

- 11.2 92%-98%

- 11.2.1 POWERING COST-EFFECTIVE GROWTH ACROSS CONSTRUCTION, METALLURGY, AND CHEMICAL INDUSTRIES

- 11.3 98%-99%

- 11.3.1 RISING DEMAND FUELLED BY LIGHTWEIGHT MOBILITY, EV THERMAL SYSTEMS, AND HIGH-PERFORMANCE INDUSTRIAL APPLICATIONS

- 11.4 >99%

- 11.4.1 EFFECTIVE HANDLING AND SUPERIOR CORROSION RESISTANCE TO FUEL DEMAND

12 ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 PAINTS & COATINGS

- 12.2.1 GROWING NEED FOR HIGH-PERFORMANCE METALLIC AND PROTECTIVE COATINGS BOOSTING DEMAND

- 12.3 EXPLOSIVES & FIREWORKS

- 12.3.1 GROWING USE OF HIGH-REACTIVITY ALUMINUM METAL POWDERS DRIVING DEMAND IN PYROTECHNICS AND INDUSTRIAL EXPLOSIVES

- 12.4 CONSTRUCTION & INFRASTRUCTURE

- 12.4.1 RISING ADOPTION OF AAC BLOCKS AND LIGHTWEIGHT BUILDING MATERIALS DRIVING DEMAND

- 12.5 INDUSTRIAL

- 12.5.1 EXPANDING USE IN WELDING, METALLURGY, AND ADVANCED MANUFACTURING PROCESSES TO PROPEL DEMAND

- 12.6 ELECTRONICS

- 12.6.1 INCREASING DEMAND FOR CONDUCTIVE AND THERMAL MANAGEMENT MATERIALS TO BOOST DEMAND

- 12.7 AUTOMOTIVE & TRANSPORTATION

- 12.7.1 LIGHTWEIGHTING AND EV PRODUCTION ACCELERATING MATERIAL CONSUMPTION TO BOOST DEMAND

- 12.8 AEROSPACE & DEFENSE

- 12.8.1 HIGH-ENERGY PROPELLANT AND ADDITIVE MANUFACTURING APPLICATIONS DRIVING GROWTH

- 12.9 OTHER END-USE INDUSTRIES

13 ALUMINUM METAL POWDER MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.2.2 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.2.3 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.2.4 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.2.5 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.2.5.1 US

- 13.2.5.1.1 Rising adoption of lightweight materials to increase demand

- 13.2.5.2 Canada

- 13.2.5.2.1 Expanding advanced manufacturing capabilities to boost demand

- 13.2.5.3 Mexico

- 13.2.5.3.1 Growing industrial clusters drive specialized aluminum powder consumption

- 13.2.5.1 US

- 13.3 EUROPE

- 13.3.1 EUROPE: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.3.2 EUROPE: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.3.3 EUROPE: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.3.4 EUROPE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.3.5 EUROPE: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.3.5.1 Germany

- 13.3.5.1.1 Engineering-led manufacturing ecosystem to accelerate demand for high-performance aluminum metal powders

- 13.3.5.2 France

- 13.3.5.2.1 Advanced materials, aerospace integration, and industrial modernization to drive market

- 13.3.5.3 UK

- 13.3.5.3.1 Innovation-led manufacturing and aerospace engine programs to elevate demand

- 13.3.5.4 Spain

- 13.3.5.4.1 Expanding automotive supply base and industrial coatings to accelerate demand

- 13.3.5.5 Italy

- 13.3.5.5.1 High-precision manufacturing and surface engineering expansion to drive demand

- 13.3.5.6 Rest of Europe

- 13.3.5.1 Germany

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.4.2 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.4.3 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.4.4 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.4.5 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.4.5.1 China

- 13.4.5.1.1 Large-scale manufacturing, metallurgical capacity, and EV supply chain expansion to intensify demand

- 13.4.5.2 Japan

- 13.4.5.2.1 Precision engineering strength and advanced materials innovation to support demand

- 13.4.5.3 India

- 13.4.5.3.1 Expanding manufacturing base and infrastructure growth to increase consumption

- 13.4.5.4 South Korea

- 13.4.5.4.1 High technology manufacturing and electronics leadership to strengthen demand

- 13.4.5.5 Rest of Asia Pacific

- 13.4.5.1 China

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.5.2 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.5.3 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.5.4 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.5.5 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.5.5.1 GCC Countries

- 13.5.5.1.1 UAE

- 13.5.5.1.1.1 Advanced manufacturing push and aerospace ecosystem strengthen demand for aluminum metal powders

- 13.5.5.1.2 Saudi Arabia

- 13.5.5.1.2.1 Mega projects and industrial modernization to boost aluminum metal powder demand

- 13.5.5.1.3 Rest of GCC Countries

- 13.5.5.1.1 UAE

- 13.5.5.2 South Africa

- 13.5.5.2.1 Automotive components and mining equipment manufacturing support aluminum powder demand

- 13.5.5.3 Rest of Middle East & Africa

- 13.5.5.1 GCC Countries

- 13.6 SOUTH AMERICA

- 13.6.1 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.6.2 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.6.3 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.6.4 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.6.5 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.6.5.1 Brazil

- 13.6.5.1.1 Automotive, construction, and metallurgical strength to drive demand

- 13.6.5.2 Argentina

- 13.6.5.2.1 Industrial machinery, metalworking, and coatings applications to increase consumption

- 13.6.5.3 Rest of South America

- 13.6.5.1 Brazil

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS

- 14.5 PRODUCT COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Type footprint

- 14.6.5.4 Process footprint

- 14.6.5.5 Purity footprint

- 14.6.5.6 End-use industry footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 VALIMET, INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 MMP INDUSTRIES LTD.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Right to win

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses and competitive threats

- 15.1.3 MEPCO

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Right to win

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses and competitive threats

- 15.1.4 KYMERA INTERNATIONAL

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 HOGANAS AB

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 NOVACENTRIX

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 MnM view

- 15.1.6.3.1 Right to win

- 15.1.6.3.2 Strategic choices

- 15.1.6.3.3 Weaknesses and competitive threats

- 15.1.7 ZHANGQIU METALLIC PIGMENT CO., LTD.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 MnM view

- 15.1.7.3.1 Right to win

- 15.1.7.3.2 Strategic choices

- 15.1.7.3.3 Weaknesses and competitive threats

- 15.1.8 TOYO ALUMINIUM K.K.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 MnM view

- 15.1.8.3.1 Right to win

- 15.1.8.3.2 Strategic choices

- 15.1.8.3.3 Weaknesses and competitive threats

- 15.1.9 CNPC POWDER

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Product launches

- 15.1.9.4 MnM view

- 15.1.9.4.1 Right to win

- 15.1.9.4.2 Strategic choices

- 15.1.9.4.3 Weaknesses and competitive threats

- 15.1.10 AMG

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 MnM view

- 15.1.10.3.1 Right to win

- 15.1.10.3.2 Strategic choices

- 15.1.10.3.3 Weaknesses and competitive threats

- 15.1.11 CHINA ANSTEEL GROUP CORPORATION LIMITED

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 MnM view

- 15.1.11.3.1 Right to win

- 15.1.11.3.2 Strategic choices

- 15.1.11.3.3 Weaknesses and competitive threats

- 15.1.12 HENAN YUANYANG POWDER TECHNOLOGY CO., LTD.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 MnM view

- 15.1.12.3.1 Right to win

- 15.1.12.3.2 Strategic choices

- 15.1.12.3.3 Weaknesses and competitive threats

- 15.1.13 CARLFORS BRUK

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 MnM view

- 15.1.13.3.1 Right to win

- 15.1.13.3.2 Strategic choices

- 15.1.13.3.3 Weaknesses and competitive threats

- 15.1.14 AVL METAL POWDERS N.V.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 MnM view

- 15.1.14.3.1 Right to win

- 15.1.14.3.2 Strategic choices

- 15.1.14.3.3 Weaknesses and competitive threats

- 15.1.15 GRANGES

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.4 MnM view

- 15.1.15.4.1 Right to win

- 15.1.15.4.2 Strategic choices

- 15.1.15.4.3 Weaknesses and competitive threats

- 15.1.1 VALIMET, INC.

- 15.2 OTHER PLAYERS

- 15.2.1 AMERICAN ELEMENTS

- 15.2.2 SRI KALISWARI METAL POWDERS PVT LTD.

- 15.2.3 THE ARASAN ALUMINIUM INDUSTRIES

- 15.2.4 BELMONT METALS

- 15.2.5 BN INDUSTRIES

- 15.2.6 SHIVAM PROTECO PVT. LTD.

- 15.2.7 SCHLENK SE

- 15.2.8 UNITED STATES METAL POWDERS, INC.

- 15.2.9 N.B. ENTERPRISES

- 15.2.10 JAYESH GROUP

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Key primary interview participants

- 16.1.2.3 Breakdown of interviews with experts

- 16.1.2.4 Key industry insights

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.2 TOP-DOWN APPROACH

- 16.3 BASE NUMBER CALCULATION

- 16.3.1 APPROACH 1: DEMAND-SIDE ANALYSIS

- 16.3.2 APPROACH 2: SUPPLY-SIDE ANALYSIS

- 16.4 FORECAST NUMBER CALCULATION

- 16.5 DATA TRIANGULATION

- 16.6 FACTOR ANALYSIS

- 16.7 RESEARCH ASSUMPTIONS

- 16.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 ALUMINUM METAL POWDER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRIES, 2021-2029

- TABLE 3 ALUMINUM METAL POWDER MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF ALUMINUM METAL POWDER IN END-USE INDUSTRY, BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE TREND OF ALUMINUM METAL POWDER, BY REGION, 2023-2024 (USD/KG)

- TABLE 6 IMPORT DATA FOR HS CODE 7603-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 7603-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- TABLE 8 ALUMINUM METAL POWDER MARKET: KEY CONFERENCES AND EVENTS, 2025-2027

- TABLE 9 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 10 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 11 ALUMINUM METAL POWDER MARKET: TOTAL NUMBER OF PATENTS, OCTOBER 2015- OCTOBER 2025

- TABLE 12 TOP USE CASES AND MARKET POTENTIAL

- TABLE 13 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 14 ALUMINUM METAL POWDER MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 15 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 GLOBAL INDUSTRY STANDARDS IN ALUMINUM METAL POWDER MARKET

- TABLE 21 CERTIFICATIONS, LABELING, ECO-STANDARDS IN ALUMINUM METAL POWDER MARKET

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 23 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 24 UNMET NEEDS IN ALUMINUM METAL POWDER MARKET BY END-USE INDUSTRY

- TABLE 25 ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 26 ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 27 POWDER: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 POWDER: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 29 FLAKES: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 FLAKES: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 31 ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 32 ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (KILOTON)

- TABLE 33 ATOMIZATION: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 ATOMIZATION: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 35 COMMINUTION: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 COMMINUTION: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 37 ELECTROLYSIS: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 ELECTROLYSIS: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 39 ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (USD MILLION)

- TABLE 40 ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (KILOTON)

- TABLE 41 92%-98%: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 92%-98%: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 43 98%-99%: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 98%-99%: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 45 >99%: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 >99%: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 47 ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 48 ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 49 PAINTS & COATINGS: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 PAINTS & COATINGS: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 51 EXPLOSIVES & FIREWORKS: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 EXPLOSIVES & FIREWORKS: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 53 CONSTRUCTION & INFRASTRUCTURE: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 CONSTRUCTION & INFRASTRUCTURE: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 55 INDUSTRIAL: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 INDUSTRIAL: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 57 ELECTRONICS: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 ELECTRONICS: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 59 AUTOMOTIVE & TRANSPORTATION: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 AUTOMOTIVE & TRANSPORTATION: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 61 AEROSPACE & DEFENSE: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 AEROSPACE & DEFENSE: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 63 OTHER END-USE INDUSTRIES: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 OTHER END-USE INDUSTRIES: ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 65 ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 ALUMINUM METAL POWDER MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 67 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 69 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (KILOTON)

- TABLE 71 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (KILOTON)

- TABLE 73 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 75 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 77 US: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 78 US: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 79 CANADA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 81 MEXICO: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 82 MEXICO: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 83 EUROPE: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 85 EUROPE: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (KILOTON)

- TABLE 87 EUROPE: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (KILOTON)

- TABLE 89 EUROPE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 91 EUROPE: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 93 GERMANY: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 94 GERMANY: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 95 FRANCE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 96 FRANCE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 97 UK: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 98 UK: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 99 SPAIN: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 100 SPAIN: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 101 ITALY: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 102 ITALY: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 103 REST OF EUROPE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 105 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 107 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (KILOTON)

- TABLE 109 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (KILOTON)

- TABLE 111 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 113 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 115 CHINA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 116 CHINA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 117 JAPAN: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 118 JAPAN: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 119 INDIA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 120 INDIA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 121 SOUTH KOREA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 122 SOUTH KOREA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 123 REST OF ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 127 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 133 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 135 UAE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 136 UAE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 137 SAUDI ARABIA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 138 SAUDI ARABIA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 139 REST OF THE GCC COUNTRIES: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 140 REST OF THE GCC COUNTRIES: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 141 SOUTH AFRICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 142 SOUTH AFRICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 145 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 147 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 148 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PROCESS, 2023-2030 (KILOTON)

- TABLE 149 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (USD MILLION)

- TABLE 150 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PURITY, 2023-2030 (KILOTON)

- TABLE 151 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 152 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 153 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 155 BRAZIL: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 156 BRAZIL: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 157 ARGENTINA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 158 ARGENTINA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 159 REST OF SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 161 ALUMINUM METAL POWDER MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 162 ALUMINUM METAL POWDER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 163 ALUMINUM METAL POWDER MARKET: REGION FOOTPRINT

- TABLE 164 ALUMINUM METAL POWDER MARKET: TYPE FOOTPRINT

- TABLE 165 ALUMINUM METAL POWDER MARKET: PROCESS FOOTPRINT

- TABLE 166 ALUMINUM METAL POWDER MARKET: PURITY FOOTPRINT

- TABLE 167 ALUMINUM METAL POWDER MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 168 ALUMINUM METAL POWDER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 169 ALUMINUM METAL POWDER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 170 ALUMINUM METAL POWDER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 171 ALUMINUM METAL POWDER MARKET: PRODUCT LAUNCHES, JANUARY 2020-SEPTEMBER 2025

- TABLE 172 ALUMINUM METAL POWDER MARKET: DEALS, JANUARY 2020-SEPTEMBER 2025

- TABLE 173 ALUMINUM METAL POWDER MARKET: EXPANSIONS, JANUARY 2020- SEPTEMBER 2025

- TABLE 174 VALIMET, INC.: COMPANY OVERVIEW

- TABLE 175 VALIMET, INC.: PRODUCTS OFFERED

- TABLE 176 VALIMET, INC.: DEALS

- TABLE 177 MMP INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 178 MMP INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 MEPCO: COMPANY OVERVIEW

- TABLE 180 MEPCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 KYMERA INTERNATIONAL: COMPANY OVERVIEW

- TABLE 182 KYMERA INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 KYMERA INTERNATIONAL: DEALS

- TABLE 184 HOGANAS AB: COMPANY OVERVIEW

- TABLE 185 HOGANAS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 HOGANAS AB: EXPANSIONS

- TABLE 187 NOVACENTRIX: COMPANY OVERVIEW

- TABLE 188 NOVACENTRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 ZHANGQIU METALLIC PIGMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 190 ZHANGQIU METALLIC PIGMENT CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 191 TOYO ALUMINIUM K.K.: COMPANY OVERVIEW

- TABLE 192 TOYO ALUMINIUM K.K.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 CNPC POWDER: COMPANY OVERVIEW

- TABLE 194 CNPC POWDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 CNPC POWDER: PRODUCT LAUNCHES

- TABLE 196 AMG: COMPANY OVERVIEW

- TABLE 197 AMG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 CHINA ANSTEEL GROUP CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 199 CHINA ANSTEEL GROUP CORPORATION LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 HENAN YUANYANG POWDER TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 201 HENAN YUANYANG POWDER TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 CARLFORS BRUK: COMPANY OVERVIEW

- TABLE 203 CARLFORS BRUK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 AVL METAL POWDERS N.V.: COMPANY OVERVIEW

- TABLE 205 AVL METAL POWDERS N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 GRANGES: COMPANY OVERVIEW

- TABLE 207 GRANGES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 GRANGES: EXPANSIONS

- TABLE 209 GRANGES: PRODUCT LAUNCH

- TABLE 210 AMERICAN ELEMENTS: COMPANY OVERVIEW

- TABLE 211 SRI KALISWARI METAL POWDERS PVT LTD.: COMPANY OVERVIEW

- TABLE 212 THE ARASAN ALUMINIUM INDUSTRIES: COMPANY OVERVIEW

- TABLE 213 BELMONT METALS: COMPANY OVERVIEW

- TABLE 214 BN INDUSTRIES: COMPANY OVERVIEW

- TABLE 215 SHIVAM PROTECO PVT. LTD.: COMPANY OVERVIEW

- TABLE 216 SCHLENK SE: COMPANY OVERVIEW

- TABLE 217 UNITED STATES METAL POWDERS, INC.: COMPANY OVERVIEW

- TABLE 218 N.B. ENTERPRISES: COMPANY OVERVIEW

- TABLE 219 JAYESH GROUP: COMPANY OVERVIEW

- TABLE 220 LIST OF PRIMARY INTERVIEW PARTICIPANTS

List of Figures

- FIGURE 1 ALUMINUM METAL POWDER MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL ALUMINUM METAL POWDER MARKET, 2025-2030 (USD THOUSAND)

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ALUMINUM METAL POWDER MARKET, 2020-2025

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF ALUMINUM METAL POWDER MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN ALUMINUM METAL POWDER MARKET, 2025-2030

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 HIGH DEMAND FOR FLAKES TYPE TO DRIVE MARKET

- FIGURE 9 POWDER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 >99% SEGMENT DOMINATED ALUMINUM METAL POWDER MARKET IN 2024

- FIGURE 11 ATOMIZATION SEGMENT TO DOMINATE ALUMINUM METAL POWDER MARKET THROUGH 2030

- FIGURE 12 PAINTS & COATINGS SEGMENT TO REMAIN LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 13 CHINA TO BE FASTEST-GROWING ALUMINUM METAL POWDER MARKET DURING FORECAST PERIOD

- FIGURE 14 ALUMINUM METAL POWDER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 ALUMINUM METAL POWDER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 ALUMINUM METAL POWDER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 17 ALUMINUM METAL POWDER MARKET: KEY PARTICIPANTS IN ECOSYSTEM

- FIGURE 18 ALUMINUM METAL POWDER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 IMPORT SCENARIO FOR HS CODE 7603-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024

- FIGURE 21 EXPORT SCENARIO FOR HS CODE 7603-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 23 ALUMINUM METAL POWDER MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2025

- FIGURE 24 PATENT ANALYSIS, BY DOCUMENT TYPE, OCTOBER 2015-OCTOBER 2025

- FIGURE 25 PATENT PUBLICATION TRENDS, 2015-2025

- FIGURE 26 ALUMINUM METAL POWDER: LEGAL STATUS OF PATENTS, OCTOBER 2015-OCTOBER 2025

- FIGURE 27 JURISDICTION OF CHINA REGISTERED HIGHEST PERCENTAGE OF PATENTS, 2015-2025

- FIGURE 28 TOP PATENT APPLICANTS, OCTOBER 2015 - OCTOBER 2025

- FIGURE 29 FUTURE APPLICATIONS

- FIGURE 30 ALUMINUM METAL POWDER MARKET: DECISION-MAKING FACTORS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 32 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 33 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 34 FLAKES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 COMMINUTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 98%-99% SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 CONSTRUCTION & INFRASTRUCTURE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 CHINA TO REGISTER HIGHEST GROWTH IN ALUMINUM METAL POWDER MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: ALUMINUM METAL POWDER MARKET SNAPSHOT

- FIGURE 40 EUROPE: ALUMINUM METAL POWDER MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET SNAPSHOT

- FIGURE 42 ALUMINUM METAL POWDER MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 43 ALUMINUM METAL POWDER MARKET SHARE ANALYSIS, 2024

- FIGURE 44 ALUMINUM METAL POWDER MARKET: PRODUCT COMPARISON

- FIGURE 45 ALUMINUM METAL POWDER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 ALUMINUM METAL POWDER MARKET: COMPANY FOOTPRINT

- FIGURE 47 ALUMINUM METAL POWDER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 ALUMINUM METAL POWDER MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 49 ALUMINUM METAL POWDER MARKET: YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 50 ALUMINUM METAL POWDER MARKET: ENTERPRISE VALUATION OF KEY PLAYERS, 2025

- FIGURE 51 MMP INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 52 TOYO ALUMINIUM K.K.: COMPANY SNAPSHOT

- FIGURE 53 AMG: COMPANY SNAPSHOT

- FIGURE 54 GRANGES: COMPANY SNAPSHOT

- FIGURE 55 ALUMINUM METAL POWDER MARKET: RESEARCH DESIGN

- FIGURE 56 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 57 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 58 ALUMINUM METAL POWDER MARKET: DATA TRIANGULATION