|

市場調查報告書

商品編碼

1883067

全球反向散射X光類型、組件、成像方式、應用、最終用戶和地區分類)-預測至2032年Backscatter X-ray Device Market by Type, Component, Imaging Mode, Application and Enduser and Region -Global Forecast To 2032 |

||||||

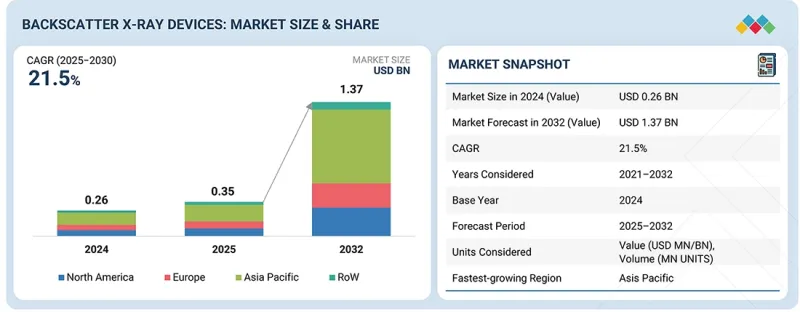

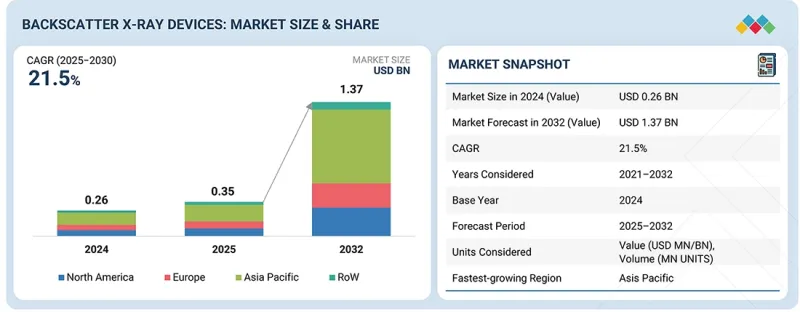

全球反向散射X光設備市場預計將從 2025 年的 3.5 億美元成長到 2032 年的 13.7 億美元,預測期內複合年成長率為 21.5%。

由於邊防安全、海關執法、交通樞紐和關鍵基礎設施領域對快速、準確、非侵入性偵測的需求不斷成長,市場正經歷強勁成長。走私活動日益猖獗、跨境貿易不斷擴張、安全法規日益嚴格以及對高通量篩檢的日益重視,進一步推動了對先進反向散射系統的需求。檢測器靈敏度、低劑量X光產生、成像演算法和人工智慧威脅辨識技術等方面的技術進步,正在提高檢測精度、吞吐量和運行可靠性。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2032 |

| 基準年 | 2024 |

| 預測期 | 2025-2032 |

| 單元 | 10億美元 |

| 部分 | 類型、移動性、成像方法、組件、應用、區域 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

此外,在機場、海港、邊境口岸、軍事設施和執法機關等地擴大部署,將創造巨大的成長機會。這些系統在偵測生物威脅、隱藏式走私貨、爆炸物和武器方面發揮著至關重要的作用,能夠支援國家安全行動,並加快檢查流程,從而在全球現代化安全基礎設施中實現安全、高效且擴充性的篩檢。

“按功率範圍分類,預計低功率在預測期內將佔據最大的市場佔有率。”

預計在預測期內,低功率反向散射X光系統將佔據最大的市場佔有率。這主要歸功於其在可攜式、手持式和行動篩檢應用中的廣泛應用,而這些應用正是市場成長最快的領域。這些設備的工作能量低於100 keV,可提供安全、低劑量的檢測,適用於海關、執法機關和保全機構的第一線使用。其緊湊的設計、低操作風險、較少的監管限制和低擁有成本使其成為快速現場部署的理想選擇。此外,低功率系統也適用於掃描人員、行李、車輛和小件貨物,在這些應用中,對有機威脅進行非侵入式、高對比度檢測至關重要。

“根據應用情況來看,執法機關在預測期內將實現最高的複合年成長率。”

執法機關預計將在反向散射X光市場中實現最高的複合年成長率,這主要得益於日常警務活動和戰術行動中對快速、非侵入性檢測武器、爆炸物、毒品和隱藏有機威脅的需求日益成長。日益嚴峻的都市區安全挑戰、不斷增加的毒品走私以及移動式和手持式反向散射系統的廣泛應用,都在加速該領域的普及。各機構越來越重視能夠支援在交通檢查站、突擊檢查站、安檢站和公共活動安保等場所進行即時檢查的緊湊型、現場即用型設備。此外,警務基礎設施現代化改造的持續投入以及政府對先進篩檢技術的資助,也推動了該領域的強勁成長動能。

“在預測期內,北美將佔據最大的市場佔有率。”

北美地區佔據反向散射X光設備市場最大佔有率,這主要歸功於該地區較早採用該技術,以及Rapiscan Systems、Tek84、Viken Detection和Videray等領先製造商的強大市場地位,以及政府對邊防安全和國土保護的持續投入。國土安全部(DHS)、海關與邊境保護局(CBP)、移民及海關執法局(ICE)等機構以及地方警察部隊已大規模部署手持式、車載式和移動式背散射設備,用於緝毒、貨物檢查和戰術性現場檢查。該地區嚴格的安全標準、高額的採購預算、持續的系統升級以及對先進檢測能力的需求,共同確保了北美地區在整個預測期內保持市場主導地位。

本報告分析了全球反向散射X光設備市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章執行摘要

第3章 主要發現

- 反向散射X光設備市場中,企業面臨極具吸引力的機會

- 按類型分類的反向散射X光設備市場

- 按移動性分類的反向散射X光設備市場

- 按組件分類的反向散射X光設備市場

- 反向散射X光設備市場:依應用領域分類

- 按地區反向散射X光設備市場

- 按國家/地區反向散射X光設備市場

第4章 市場概覽

- 介紹

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 未滿足的需求和閒置頻段

- 反向散射X光設備市場中尚未滿足的需求

- 閒置頻段機會

- 相互關聯的市場與跨產業機遇

- 互聯市場

- 跨職能機會

- 一級/二級/三級公司的策略性舉措

第5章 產業趨勢

- 介紹

- 波特五力分析

- 總體經濟指標

- 介紹

- GDP趨勢與預測

- 全球機場和航空業趨勢

- 全球海關和邊防安全趨勢

- 價值鏈分析

- 生態系分析

- 定價分析

- 各地區平均銷售價格趨勢(2021-2024 年)

- 主要製造商的反向散射X光設備平均售價趨勢

- 貿易分析

- 進口場景(HS編碼9022)

- 出口資料(HS編碼9022)

- 重大會議和活動(2025-2026)

- 影響客戶業務的趨勢/顛覆性因素

- 投資與資金籌措情境(2021-2025)

- 案例研究分析

- 2025年美國關稅的影響

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對使用的影響

第6章:技術進步、人工智慧影響、專利、創新與未來應用

- 主要新技術

- 互補技術

- 鄰近技術

- 技術/產品藍圖

- 短期目標(2025-2027年):系統最佳化與人工智慧整合

- 中期(2027-2030 年):混合成像和平台擴充性

- 長期目標(2030-2035年及以後):一般可重構運算與系統層級融合

- 專利分析

- 人工智慧對反向散射X光設備的影響

- 主要應用案例和市場潛力

- 反向散射X光設備市場的最佳實踐

- 人工智慧在反向散射X光設備市場的應用案例研究

- 相互關聯的相鄰生態系及其對市場參與者的影響

- 反向散射X光設備市場中客戶對人工智慧應用的準備情況

第7章:監理環境

- 介紹

- 監管機構、政府機構和其他組織

- 標準

- 政府法規

第8章:顧客狀況與購買行為

- 決策流程

- 主要相關利益者和採購標準

- 招募障礙和內部挑戰

- 各種應用中未滿足的需求

第9章反向散射X光設備市場:依應用領域分類

- 介紹

- 海關和邊防安全

- 執法

- 機場/航空公司

- 軍事/國防

- 工業和關鍵用途

- 其他用途

第10章 按組件分類的反向散射X光設備市場

- 介紹

- 硬體

- 軟體

- 服務

第11章 依偵測方法反向散射X光設備市場

- 介紹

- 筆射束光柵掃描系統

- Z 向後散射/飛點實現

- 大面積檢測器面板

第12章 按成像方式反向散射X光設備市場

- 介紹

- 單視角後向散射成像

- 雙視角後向散射成像

- 多重視角後向散射成像

- 混合成像

第13章反向散射X光設備市場:移動性別

- 介紹

- 固定類型

- 移動/汽車

- 可攜式/手持式

第14章 按功率範圍分類的反向散射X光設備市場

- 介紹

- 低能量反向散射系統

- 中能後向散射系統

- 高能量反向散射系統

第15章反向散射X光設備市場(依類型分類)

- 介紹

- 可攜式/手持設備

- 車載設備

- 車輛/搬運工掃描設備

- 行李檢查設備

- 龍門架/貨物設備

- 混合多感測器裝置

第16章反向散射X光設備市場:依部署環境分類

- 介紹

- 戶外/現場

- 室內/設施

第17章 按銷售管道反向散射X光設備市場

- 介紹

- 政府直接招標/競標

- 整合商/OEM合作夥伴

- 經銷商/經銷商

第18章 依解析度/影像品質分類的反向散射X光設備市場

- 介紹

- 標準(間距小於1毫米)

- 高(0.5毫米)

- 超高(小於0.25毫米)

第19章 依擁有型號分類的反向散射X光設備市場

- 介紹

- 政府所有採購

- 租賃/服務協議

- 私人商業所有權

第20章反向散射X光設備市場:依地區分類

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 比利時

- 北歐國家

- 其他歐洲

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 澳洲

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 其他地區

- 其他地區的宏觀經濟展望

- 中東

第21章 競爭情勢

- 概述

- 主要參與企業的策略/優勢(2021-2024)

- 市佔率分析(2024 年)

- 品牌/產品對比

- 企業評估矩陣:主要企業(2024)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第22章:公司簡介

- 介紹

- 主要企業

- RAPISCAN SYSTEMS

- NUCTECH COMPANY LIMITED

- VIKEN DETECTION

- SCANNA MSC LTD.

- TEK84, INC

- VIDERAY TECHNOLOGIES

- AUTOCLEAR

- BEIJING HEWEIYONGTAI

- SMITHS DETECTION GROUP LTD.

- MICRO-X LIMITED

- 其他主要企業

- ANALYTICON INSTRUMENTS GMBH

- HAMAMATSU PHOTONICS KK

- DONGGUAN JUZHENG ELECTRONIC TECHNOLOGY CO., LTD.

- INSTECH NETHERLANDS

- MS SPEKTRAL

- CGN BEGOOD TECHNOLOGY CO., LTD.

- SHANGHAI FOCUS INTELLIGENT TECHNOLOGY CO., LTD.

- XIA RUI INTELLIGENT TECHNOLOGY CO., LTD.

- RAYSCAN TECHNOLOGIES PVT. LTD.

- MEKONG TECHNOLOGIES CO., LTD.

- NORDION INC.

- CHENGDU LIYANG ELECTRONICS TECHNOLOGY CO., LTD.

- JME LTD.

- X-TEK SYSTEMS

第23章調查方法

第24章附錄

The backscatter X-ray Devices market is expected to reach USD 1.37 billion by 2032 from USD 0.35 billion in 2025, at a CAGR of 21.5% during the forecast period. The market is witnessing strong growth driven by the increasing need for rapid, accurate, and non-intrusive inspection across border security, customs enforcement, transportation hubs, and critical infrastructure. Rising smuggling activities, expanding cross-border trade, stricter security regulations, and the growing emphasis on high-throughput screening are further boosting demand for advanced backscatter systems. Technological advancements in detector sensitivity, low-dose X-ray generation, imaging algorithms, and AI-enabled threat identification are enhancing detection accuracy, throughput efficiency, and operational reliability.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Mobility, Imaging Mode, Component, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, expanding deployment across airports, seaports, land borders, military facilities, and law enforcement agencies is creating significant growth opportunities. These systems play a vital role in detecting organic threats, hidden contraband, explosives, and weapons, supporting national security operations, accelerating inspection workflows, and enabling safe, efficient, and scalable screening across modern security infrastructures worldwide.

"Based on power range, the low power range will account for the largest market size during the forecast period"

Low-power backscatter X-ray systems are expected to hold the largest market share during the forecast period, primarily due to their widespread adoption in portable, handheld, and mobile screening applications, which represent the fastest-growing segments of the market. These devices operate at energies below 100 keV, enabling safe, low-dose inspections suitable for frontline use by customs, law enforcement, and security agencies. Their compact design, lower operational risks, reduced regulatory restrictions, and lower cost of ownership make them ideal for rapid field deployment. Additionally, low-power systems are favored for scanning people, baggage, vehicles, and small cargo, where non-intrusive, high-contrast detection of organic threats is essential.

"Based on application, law enforcement is projected to register the highest CAGR during the forecast period"

Law enforcement is projected to register the highest CAGR in the Backscatter X-ray Devices Market due to the increasing need for rapid, non-intrusive detection of weapons, explosives, narcotics, and concealed organic threats in routine policing and tactical operations. Rising urban security challenges, growth in drug trafficking, and expanding deployment of mobile and handheld backscatter systems are accelerating adoption. Agencies are increasingly prioritizing compact, field-ready devices that support real-time inspections during traffic stops, raids, checkpoints, and public event security. Additionally, growing investments in modernizing policing infrastructure, combined with government funding for advanced screening technologies, are driving strong growth momentum in this segment.

"North America holds the largest market size during the forecast period"

North America holds the largest market share in the backscatter X-ray Devices market due to its early adoption of technology, the strong presence of leading manufacturers such as Rapiscan Systems, Tek84, Viken Detection, and Videray, and sustained government investments in border security and homeland protection. Agencies such as DHS, CBP, ICE, and local law enforcement deploy large fleets of handheld, vehicle-mounted, and mobile backscatter units for narcotics interdiction, cargo screening, and tactical field inspections. The region's strict security standards, high procurement budgets, continuous system upgrades, and demand for advanced detection capabilities collectively ensure North America maintains the dominant market position throughout the forecast period.

Extensive primary interviews were conducted with key industry experts in the backscatter X-ray devices market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study draws insights from a range of industry experts, including component suppliers, Tier 1 companies, and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - North America - 45%, Europe - 30%, Asia Pacific - 20%, and RoW - 5%

The backscatter X-ray devices market is dominated by a few globally established players, such as Rapiscan Systems (US), Nuctech Company Limited (China), Viken Detection Corp. (US), Tek84, Inc. (US), Videray Technologies Inc. (US), Autoclear LLC (US), Smiths Detection Group Ltd. (UK), Scanna MSC Ltd. (UK).

The study includes an in-depth competitive analysis of these key players in the backscatter X-ray devices market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the backscatter X-ray devices market. It forecasts its size by type (portable/handheld devices, vehicle mounted devices, vehicle/porter scanner devices, baggage scanner devices, gantry/cargo devices, hybrid multisensor devices), by application (customs & border protection, law enforcement, airport/aviation, military & defense, industrial & critical, other applications), by imaging mode (single-view backscatter imaging, dual-view backscatter imaging, multi-view backscatter imaging, hybrid imaging), by mobility (fixed/stationary, mobile/vehicle mounted, portable/handheld), by detection mode (pencil-beam raster-scan systems, z-backscatter/flying-spot implementations, large-area detector panels), by component (hardware, software, services), by power range (low, medium, high). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four central regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the backscatter X-ray devices ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (increasing deployment of security solutions at public gathering spaces, rising number of terrorist attacks, illegal immigration), restraints (high installation & maintenance costs, privacy concerns), opportunities (technological advancements in X-ray screening systems, development of low-cost products), and challenges (rapid technological advancements)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the backscatter x-ray devices market

- Market Development: Comprehensive information about lucrative markets - the report analyses the backscatter X-ray devices market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the backscatter x-ray devices market

- Competitive Assessment: In-depth assessment of market shares and growth strategies of leading players, such as Rapiscan Systems (US), Nuctech Company Limited (China), Viken Detection Corp. (US), Tek84, Inc. (US), Videray Technologies Inc. (US), Autoclear LLC (US), Smiths Detection Group Ltd. (UK), Scanna MSC Ltd. (UK), ADANI Systems, Inc. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BACKSCATTER X-RAY DEVICES MARKET

- 3.2 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE

- 3.3 BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY

- 3.4 BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT

- 3.5 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION

- 3.6 BACKSCATTER X-RAY DEVICES MARKET, BY REGION

- 3.7 BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing deployment of security solutions in public spaces

- 4.2.1.2 Increase in terrorist attacks and illegal immigration

- 4.2.2 RESTRAINT

- 4.2.2.1 High installation and maintenance costs

- 4.2.2.2 Privacy concerns associated with backscatter X-ray devices

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Technological advancements in X-ray screening systems

- 4.2.3.2 Development of low-cost products

- 4.2.4 CHALLENGES

- 4.2.4.1 Rapid technological advancements

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN THE BACKSCATTER X-RAY DEVICES MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 MARKET DYNAMICS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL AIRPORT/AVIATION INDUSTRY

- 5.3.4 TRENDS IN GLOBAL CUSTOMS & BORDER PROTECTION

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF BACKSCATTER X-RAY DEVICES, BY KEY PLAYER

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 9022)

- 5.7.2 EXPORT DATA (HS CODE 9022)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 BACKSCATTER X-RAY SECURITY SYSTEM DEPLOYED AT A NATIONAL BORDER CHECKPOINT

- 5.11.2 BACKSCATTER X-RAY SYSTEM INTEGRATED IN AIRPORT SECURITY FOR RAPID PERSONNEL SCREENING

- 5.11.3 MOBILE BACKSCATTER X-RAY UNITS DEPLOYED FOR URBAN LAW ENFORCEMENT OPERATIONS

- 5.11.4 BACKSCATTER X-RAY CARGO INSPECTION SOLUTION IMPLEMENTED AT A MAJOR SEAPORT

- 5.12 IMPACT OF 2025 US TARIFFS

- 5.12.1 KEY TARIFF RATES

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT ON VARIOUS COUNTRIES/REGIONS

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON APPLICATIONS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 MULTI-ENERGY BACKSCATTER X-RAY

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 IMAGE RECONSTRUCTION ALGORITHM

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 TERAHERTZ IMAGING SYSTEM

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): SYSTEM OPTIMIZATION AND AI INTEGRATION

- 6.4.2 MID-TERM (2027-2030): HYBRID IMAGING & PLATFORM SCALABILITY

- 6.4.3 LONG-TERM (2030-2035+): UNIVERSAL RECONFIGURABLE COMPUTING AND SYSTEM-LEVEL CONVERGENCE

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON BACKSCATTER X-RAY DEVICES

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN BACKSCATTER X-RAY DEVICES MARKET

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN BACKSCATTER X-RAY DEVICES MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI IN BACKSCATTER X-RAY DEVICES MARKET

7 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 STANDARDS

- 7.1.2.1 IEC 61010 - Safety Requirements for Electrical Equipment

- 7.1.2.2 IEC/ISO 2919 - Sealed Radioactive Source Classification

- 7.1.3 GOVERNMENT REGULATIONS

- 7.1.3.1 US

- 7.1.3.2 Europe

- 7.1.3.3 China

- 7.1.3.4 Japan

- 7.1.3.5 India

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS APPLICATIONS

9 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CUSTOMS & BORDER PROTECTION

- 9.2.1 RISING CROSS-BORDER SECURITY DEMANDS TO DRIVE ADOPTION

- 9.3 LAW ENFORCEMENT

- 9.3.1 INCREASING ADOPTION FOR TACTICAL THREAT DETECTION IN LAW ENFORCEMENT

- 9.4 AIRPORTS/AVIATION

- 9.4.1 RISING SECURITY REQUIREMENTS IN AIRPORT AND AVIATION INFRASTRUCTURE TO FUEL MARKET

- 9.5 MILITARY & DEFENSE

- 9.5.1 GROWING USE FOR FORCE PROTECTION AND TACTICAL INTELLIGENCE TO BOOST GROWTH

- 9.6 INDUSTRIAL & CRITICAL

- 9.6.1 INCREASING DEPLOYMENT IN INDUSTRIAL AND CRITICAL INFRASTRUCTURE PROTECTION

- 9.7 OTHER APPLICATIONS

10 BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 ADVANCEMENTS IN HIGH-PERFORMANCE HARDWARE TO ACCELERATE MARKET GROWTH

- 10.2.2 X-RAY SOURCE/TUBE ASSEMBLIES

- 10.2.3 DETECTORS

- 10.2.4 CONTROL & POWER ELECTRONICS

- 10.2.5 SENSOR MODULES

- 10.2.6 SHIELDING AND CABINETS

- 10.2.7 MECHANICAL & MOBILITY STRUCTURES

- 10.2.8 OTHER HARDWARE

- 10.3 SOFTWARE

- 10.3.1 AI-DRIVEN IMAGING AND AUTOMATED THREAT DETECTION TO ACCELERATE SOFTWARE GROWTH

- 10.3.2 IMAGE PROCESSING AND ANALYSIS

- 10.3.3 AI/ML-BASED IMAGE ENHANCEMENT

- 10.3.4 AUTOMATIC THREAT RECOGNITION

- 10.4 SERVICES

- 10.4.1 RISING DEMAND FOR TRAINING, CALIBRATION, AND MAINTENANCE SERVICES TO DRIVE MARKET

11 BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION MODE

- 11.1 INTRODUCTION

- 11.2 PENCIL-BEAM RASTER-SCAN SYSTEMS

- 11.2.1 SEGMENT TO GROW AS AGENCIES PRIORITIZE PORTABLE, HIGH-ACCURACY INSPECTION TOOLS

- 11.3 Z-BACKSCATTER/FLYING-SPOT IMPLEMENTATIONS

- 11.3.1 RISING NEED FOR HIGH-SPEED VEHICLE SCREENING TO DRIVE SEGMENT

- 11.4 LARGE-AREA DETECTOR PANELS

- 11.4.1 RISING NEED FOR HIGH-THROUGHPUT CARGO SCREENING TO DRIVE GROWTH

12 BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE

- 12.1 INTRODUCTION

- 12.2 SINGLE-VIEW BACKSCATTER IMAGING

- 12.2.1 RISING DEMAND FOR RAPID FRONTLINE SCREENING TO PROPEL GROWTH

- 12.3 DUAL-VIEW BACKSCATTER IMAGING

- 12.3.1 RISING NEED FOR ENHANCED DETECTION ACCURACY TO DRIVE GROWTH

- 12.4 MULTI-VIEW BACKSCATTER IMAGING

- 12.4.1 EXPANSION OF BORDER AND CARGO MODERNIZATION PROGRAMS TO BOOST GROWTH

- 12.5 HYBRID IMAGING

- 12.5.1 RISING DEMAND FOR ADVANCED MULTI-MODAL DETECTION TO DRIVE SEGMENT

13 BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY

- 13.1 INTRODUCTION

- 13.2 FIXED/STATIONARY

- 13.2.1 RISING DEMAND FOR HIGH-THROUGHPUT SECURITY TO DRIVE GROWTH

- 13.3 MOBILE/VEHICLE MOUNTED

- 13.3.1 INCREASED SMUGGLING AND TACTICAL SECURITY DEMANDS DRIVE ADOPTION OF VEHICLE-MOUNTED BACKSCATTER SCANNERS

- 13.4 PORTABLE/HANDHELD

- 13.4.1 INCREASED SMUGGLING AND TACTICAL SECURITY DEMANDS DRIVE ADOPTION

14 BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE

- 14.1 INTRODUCTION

- 14.2 LOW-ENERGY BACKSCATTER SYSTEMS

- 14.2.1 DEMAND FOR SAFE, PORTABLE SCREENING TO DRIVE SEGMENT

- 14.3 MEDIUM-ENERGY BACKSCATTER SYSTEMS

- 14.3.1 RISING DEMAND FOR DEEPER, MID-LEVEL SCREENING TO BOOST SEGMENT

- 14.4 HIGH-ENERGY BACKSCATTER SYSTEMS

- 14.4.1 RISING NEED FOR DEEP, HIGH-THROUGHPUT CARGO SCREENING TO DRIVE GROWTH

15 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE

- 15.1 INTRODUCTION

- 15.2 PORTABLE/HANDHELD DEVICES

- 15.2.1 GROWING DEMAND FOR RAPID FIELD SCREENING TO DRIVE SEGMENT

- 15.3 VEHICLE-MOUNTED DEVICES

- 15.3.1 INCREASING USE OF MOBILE SCREENING PLATFORMS TO PROPEL SEGMENT

- 15.4 VEHICLE/PORTER SCANNER DEVICES

- 15.4.1 GROWING NEED FOR CHECKPOINT FLEXIBILITY TO SUPPORT SEGMENT GROWTH

- 15.5 BAGGAGE SCANNER DEVICES

- 15.5.1 RISING PASSENGER AND PARCEL SCREENING REQUIREMENTS TO DRIVE SEGMENT

- 15.6 GANTRY/CARGO DEVICES

- 15.6.1 INCREASING CARGO INSPECTION NEEDS TO ACCELERATE DEMAND

- 15.7 HYBRID MULTISENSOR DEVICES

- 15.7.1 INCREASING DEMAND FOR INTEGRATED THREAT DETECTION TO DRIVE SEGMENT

16 BACKSCATTER X-RAY DEVICES MARKET, BY DEPLOYMENT ENVIRONMENT

- 16.1 INTRODUCTION

- 16.2 OUTDOOR/FIELD

- 16.2.1 DEMAND FOR MOBILE, FLEXIBLE, AND RAPID INSPECTION CAPABILITIES ACROSS BORDER SECURITY TO DRIVE SEGMENT

- 16.3 INDOOR/FACILITY

- 16.3.1 INCREASING ADOPTION IN AIRPORTS, SEAPORTS, LOGISTICS HUBS, AND SECURE GOVERNMENT FACILITIES TO BOOST MARKET GROWTH

17 BACKSCATTER X-RAY DEVICES MARKET, BY SALES CHANNEL

- 17.1 INTRODUCTION

- 17.2 DIRECT TO GOVERNMENT/TENDERS

- 17.2.1 GOVERNMENT PROCUREMENT AND TENDER-DRIVEN EXPANSION TO STRENGTHEN MARKET GROWTH

- 17.3 INTEGRATORS/OEM PARTNERS

- 17.3.1 SYSTEM INTEGRATION AND OEM PARTNERSHIP GROWTH TO ENABLE HIGH-VALUE SOLUTIONS

- 17.4 DISTRIBUTORS/RESELLERS

- 17.4.1 DISTRIBUTOR AND RESELLER NETWORK EXPANSION TO BROADEN MARKET PENETRATION

18 BACKSCATTER X-RAY DEVICES MARKET, BY RESOLUTION/IMAGE QUALITY

- 18.1 INTRODUCTION

- 18.2 STANDARD (<1 MM SPATIAL)

- 18.2.1 NEED FOR HIGH THROUGHPUT SCREENING AND RAPID OPERATIONAL READINESS TO DRIVE MARKET GROWTH

- 18.3 HIGH (=0.5 MM)

- 18.3.1 RISING NEED FOR FINER DETECTION SENSITIVITY TO BOOST GROWTH

- 18.4 ULTRA-HIGH (<0.25 MM)

- 18.4.1 SEGMENT TO GAIN MOMENTUM THROUGH PRECISION SCREENING IN HIGH-SECURITY ZONES

19 BACKSCATTER X-RAY DEVICES MARKET, BY OWNERSHIP MODEL

- 19.1 INTRODUCTION

- 19.2 GOVERNMENT-OWNED PROCUREMENT

- 19.2.1 DRIVES LONG-TERM STABILITY IN BACKSCATTER X-RAY DEVICES MARKET

- 19.3 LEASED/SERVICE CONTRACTS

- 19.3.1 LEASED & SERVICE CONTRACT MODELS TO GAIN TRACTION THROUGH FLEXIBLE DEPLOYMENT AND LOWER CAPITAL BURDEN

- 19.4 PRIVATE COMMERCIAL OWNERSHIP

- 19.4.1 SEGMENT SET TO EXPAND WITH RISING INDUSTRIAL SECURITY NEEDS AND AUTONOMOUS SCREENING OPERATIONS

20 BACKSCATTER X-RAY DEVICES MARKET, BY REGION

- 20.1 INTRODUCTION

- 20.2 NORTH AMERICA

- 20.2.1 MACROECONOMIC OUTLOOK IN NORTH AMERICA

- 20.2.2 US

- 20.2.2.1 Growing investments in border security and mobile scanning fleets to boost market

- 20.2.3 CANADA

- 20.2.3.1 Growing focus on airport security and critical infrastructure protection to drive market

- 20.2.4 MEXICO

- 20.2.4.1 Growing need for anti-smuggling surveillance across trade corridors - key driver

- 20.3 EUROPE

- 20.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 20.3.2 GERMANY

- 20.3.2.1 Growing demand for advanced cargo and automotive security screening to fuel market

- 20.3.3 UK

- 20.3.3.1 Market to be driven by upgrades in airport and urban security modernization

- 20.3.4 FRANCE

- 20.3.4.1 Growing emphasis on counterterrorism and transportation security to lead to growth

- 20.3.5 SPAIN

- 20.3.5.1 Growing modernization of ports and maritime cargo screening - key driver

- 20.3.6 ITALY

- 20.3.6.1 Increase in security needs across ports, logistics, and urban policing to drive market

- 20.3.7 NETHERLANDS

- 20.3.7.1 Growing security enhancements across high volume logistics hubs to boost growth

- 20.3.8 BELGIUM

- 20.3.8.1 Growing customs modernization and cross border inspection needs to propel market

- 20.3.9 NORDIC COUNTRIES

- 20.3.9.1 Growing adoption for infrastructure security and high technology integration

- 20.3.10 REST OF EUROPE

- 20.4 ASIA PACIFIC

- 20.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 20.4.2 CHINA

- 20.4.2.1 Growing border modernization and high-volume cargo screening demand to fuel market growth

- 20.4.3 AUSTRALIA

- 20.4.3.1 Market drive by increasing emphasis on border protection and biosecurity screening

- 20.4.4 JAPAN

- 20.4.4.1 Growing adoption in airport security and technology infrastructure to lead to market growth

- 20.4.5 INDIA

- 20.4.5.1 Growing security infrastructure upgrades across borders and airports to serve as key driver

- 20.4.6 SOUTH KOREA

- 20.4.6.1 Growing deployment in high security facilities and trade gateways to boost market

- 20.4.7 SOUTHEAST ASIA

- 20.4.7.1 Demand from cross-border trade and port expansion sectors to drive market

- 20.4.8 REST OF ASIA PACIFIC

- 20.5 ROW

- 20.5.1 ROW: MACROECONOMIC OUTLOOK

- 20.5.2 MIDDLE EAST

- 20.5.2.1 Bahrain

- 20.5.2.1.1 Growing border security modernization to drive backscatter adoption

- 20.5.2.2 Kuwait

- 20.5.2.2.1 Expanding port and oil sector security to boost backscatter deployment

- 20.5.2.3 Oman

- 20.5.2.3.1 Rising trade and infrastructure expansion supporting advanced screening systems to boost growth

- 20.5.2.4 Qatar

- 20.5.2.4.1 Growing aviation and critical infrastructure investments to fuel market growth

- 20.5.2.5 Saudi Arabia

- 20.5.2.5.1 Large-scale security modernization to drive high demand for backscatter X-ray devices

- 20.5.2.6 UAE

- 20.5.2.6.1 Strong customs excellence and airport innovation to boost adoption

- 20.5.2.7 Rest of Middle East

- 20.5.2.8 Africa

- 20.5.2.8.1 Growing customs modernization and trade security to strengthen adoption

- 20.5.2.9 South America

- 20.5.2.1 Bahrain

21 COMPETITIVE LANDSCAPE

- 21.1 OVERVIEW

- 21.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 21.3 MARKET SHARE ANALYSIS, 2024

- 21.4 BRAND/PRODUCT COMPARISON

- 21.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 21.5.1 STARS

- 21.5.2 EMERGING LEADERS

- 21.5.3 PERVASIVE PLAYERS

- 21.5.4 PARTICIPANTS

- 21.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 21.5.5.1 Company footprint

- 21.5.5.2 Region footprint

- 21.5.5.3 Type footprint

- 21.5.5.4 Mobility footprint

- 21.5.5.5 Imaging mode footprint

- 21.5.5.6 Component footprint

- 21.5.5.7 Application footprint

- 21.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 21.6.1 PROGRESSIVE COMPANIES

- 21.6.2 RESPONSIVE COMPANIES

- 21.6.3 DYNAMIC COMPANIES

- 21.6.4 STARTING BLOCKS

- 21.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 21.6.5.1 List of startups/SMEs

- 21.6.5.2 Competitive benchmarking of startups/SMEs

- 21.7 COMPETITIVE SCENARIO

- 21.7.1 PRODUCT LAUNCHES

- 21.7.2 DEALS

22 COMPANY PROFILES

- 22.1 INTRODUCTION

- 22.2 KEY PLAYERS

- 22.2.1 RAPISCAN SYSTEMS

- 22.2.1.1 Business overview

- 22.2.1.2 Products/Solutions/Services offered

- 22.2.1.3 Recent developments

- 22.2.1.3.1 Deals

- 22.2.1.4 MnM view

- 22.2.1.4.1 Right to win

- 22.2.1.4.2 Strategic choices

- 22.2.1.4.3 Weaknesses and competitive threats

- 22.2.2 NUCTECH COMPANY LIMITED

- 22.2.2.1 Business overview

- 22.2.2.2 Products/Solutions/Services offered

- 22.2.2.3 Recent developments

- 22.2.2.3.1 Deals

- 22.2.2.4 MnM view

- 22.2.2.4.1 Right to win

- 22.2.2.4.2 Strategic choices

- 22.2.2.4.3 Weaknesses and competitive threats

- 22.2.3 VIKEN DETECTION

- 22.2.3.1 Business overview

- 22.2.3.2 Products/Solutions/Services offered

- 22.2.3.3 Recent developments

- 22.2.3.3.1 Product launches

- 22.2.3.3.2 Deals

- 22.2.3.4 MnM view

- 22.2.3.4.1 Right to win

- 22.2.3.4.2 Strategic choices

- 22.2.3.4.3 Weaknesses and competitive threats

- 22.2.4 SCANNA MSC LTD.

- 22.2.4.1 Business overview

- 22.2.4.2 Products/Solutions/Services offered

- 22.2.4.3 MnM view

- 22.2.4.3.1 Right to win

- 22.2.4.3.2 Strategic choices

- 22.2.4.3.3 Weaknesses and competitive threats

- 22.2.5 TEK84, INC

- 22.2.5.1 Business overview

- 22.2.5.2 Products/Solutions/Services offered

- 22.2.5.3 Recent developments

- 22.2.5.3.1 Deals

- 22.2.5.4 MnM view

- 22.2.5.4.1 Right to win

- 22.2.5.4.2 Strategic choices

- 22.2.5.4.3 Weaknesses and competitive threats

- 22.2.6 VIDERAY TECHNOLOGIES

- 22.2.6.1 Business overview

- 22.2.6.2 Products/Solutions/Services offered

- 22.2.6.3 Recent developments

- 22.2.6.3.1 Product launches

- 22.2.7 AUTOCLEAR

- 22.2.7.1 Business overview

- 22.2.7.2 Products/Solutions/Services offered

- 22.2.8 BEIJING HEWEIYONGTAI

- 22.2.8.1 Business overview

- 22.2.8.2 Products/Solutions/Services offered

- 22.2.9 SMITHS DETECTION GROUP LTD.

- 22.2.9.1 Business overview

- 22.2.9.2 Products/Solutions/Services offered

- 22.2.10 MICRO-X LIMITED

- 22.2.10.1 Business overview

- 22.2.10.2 Products/Solutions/Services offered

- 22.2.1 RAPISCAN SYSTEMS

- 22.3 OTHER KEY PLAYERS

- 22.3.1 ANALYTICON INSTRUMENTS GMBH

- 22.3.2 HAMAMATSU PHOTONICS K.K.

- 22.3.3 DONGGUAN JUZHENG ELECTRONIC TECHNOLOGY CO., LTD.

- 22.3.4 INSTECH NETHERLANDS

- 22.3.5 MS SPEKTRAL

- 22.3.6 CGN BEGOOD TECHNOLOGY CO., LTD.

- 22.3.7 SHANGHAI FOCUS INTELLIGENT TECHNOLOGY CO., LTD.

- 22.3.8 XIA RUI INTELLIGENT TECHNOLOGY CO., LTD.

- 22.3.9 RAYSCAN TECHNOLOGIES PVT. LTD.

- 22.3.10 MEKONG TECHNOLOGIES CO., LTD.

- 22.3.11 NORDION INC.

- 22.3.12 CHENGDU LIYANG ELECTRONICS TECHNOLOGY CO., LTD.

- 22.3.13 JME LTD.

- 22.3.14 X-TEK SYSTEMS

23 RESEARCH METHODOLOGY

- 23.1 RESEARCH DATA

- 23.1.1 SECONDARY DATA

- 23.1.1.1 List of key secondary sources

- 23.1.1.2 Key data from secondary sources

- 23.1.2 PRIMARY DATA

- 23.1.2.1 List of primary interview participants

- 23.1.2.2 Breakdown of primary interviews

- 23.1.2.3 Key data from primary sources

- 23.1.2.4 Key industry insights

- 23.1.3 SECONDARY AND PRIMARY RESEARCH

- 23.1.1 SECONDARY DATA

- 23.2 MARKET SIZE ESTIMATION

- 23.2.1 BOTTOM-UP APPROACH

- 23.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 23.2.2 TOP-DOWN APPROACH

- 23.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 23.2.1 BOTTOM-UP APPROACH

- 23.3 FACTOR ANALYSIS

- 23.3.1 DEMAND-SIDE ANALYSIS

- 23.3.2 SUPPLY-SIDE ANALYSIS

- 23.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 23.5 RESEARCH ASSUMPTIONS

- 23.6 RISK ASSESSMENT

- 23.7 RESEARCH LIMITATIONS

24 APPENDIX

- 24.1 INSIGHTS FROM INDUSTRY EXPERTS

- 24.2 DISCUSSION GUIDE

- 24.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 24.4 CUSTOMIZATION OPTIONS

- 24.5 RELATED REPORTS

- 24.6 AUTHOR DETAILS

List of Tables

- TABLE 1 BACKSCATTER X-RAY DEVICES MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 3 ROLE OF COMPANIES IN BACKSCATTER X-RAY DEVICE ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND OF PORTABLE/HANDHELD DEVICES, BY REGION, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF VEHICLE-MOUNTED DEVICES, BY REGION, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE OF PORTABLE/HANDHELD DEVICES, BY KEY PLAYER, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE OF VEHICLE-MOUNTED DEVICES, BY KEY PLAYER, 2024 (USD)

- TABLE 8 IMPORT DATA FOR HS CODE 9022-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 9022-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 12 BACKSCATTER X-RAY DEVICES MARKET: MAJOR PATENTS, 2023-2024

- TABLE 13 TOP USE CASES AND MARKET POTENTIAL

- TABLE 14 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 15 BACKSCATTER X-RAY DEVICES MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 16 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 23 UNMET NEEDS IN BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION

- TABLE 24 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 25 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 26 CUSTOMS & BORDER PROTECTION: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 CUSTOMS & BORDER PROTECTION: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 28 LAW ENFORCEMENT: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 LAW ENFORCEMENT: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 30 AIRPORTS/AVIATION: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 31 AIRPORTS/AVIATION: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 32 MILITARY & DEFENSE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 MILITARY & DEFENSE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 34 INDUSTRIAL & CRITICAL: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 35 INDUSTRIAL & CRITICAL: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 36 OTHER APPLICATIONS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 37 OTHER APPLICATIONS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 38 BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 39 BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 40 HARDWARE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 41 HARDWARE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 42 SOFTWARE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 43 SOFTWARE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 44 SERVICES: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 SERVICES: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 46 BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION MODE, 2021-2024 (USD MILLION)

- TABLE 47 BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION MODE, 2025-2032 (USD MILLION)

- TABLE 48 PENCIL-BEAM RASTER-SCAN SYSTEMS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 49 PENCIL-BEAM RASTER-SCAN SYSTEMS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 50 Z-BACKSCATTER/FLYING-SPOT IMPLEMENTATION: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 51 Z-BACKSCATTER/FLYING-SPOT IMPLEMENTATION: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 52 LARGE-AREA DETECTOR PANELS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 LARGE-AREA DETECTOR PANELS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 54 BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2021-2024 (USD MILLION)

- TABLE 55 BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2025-2032 (USD MILLION)

- TABLE 56 SINGLE-VIEW: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 57 SINGLE-VIEW: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 58 DUAL-VIEW: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 DUAL-VIEW: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 60 MULTI-VIEW: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 MULTI-VIEW: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 62 HYBRID: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 HYBRID: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 64 BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY, 2021-2024 (USD MILLION)

- TABLE 65 BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY, 2025-2032 (USD MILLION)

- TABLE 66 FIXED/STATIONARY: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 FIXED/STATIONARY: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 68 MOBILE/VEHICLE-MOUNTED: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 MOBILE/VEHICLE-MOUNTED: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 70 PORTABLE/HANDHELD: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 71 PORTABLE/HANDHELD: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 72 BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2021-2024 (USD MILLION)

- TABLE 73 BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2025-2032 (USD MILLION)

- TABLE 74 LOW-ENERGY BACKSCATTER SYSTEMS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 LOW-ENERGY BACKSCATTER SYSTEMS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 76 MEDIUM-ENERGY BACKSCATTER SYSTEMS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 77 MEDIUM-ENERGY BACKSCATTER SYSTEMS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 78 HIGH-ENERGY BACKSCATTER SYSTEMS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 79 HIGH-ENERGY BACKSCATTER SYSTEMS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 80 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 81 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 82 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 83 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 84 PORTABLE/HANDHELD DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 85 PORTABLE/HANDHELD DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 86 PORTABLE/HANDHELD DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2021-2024 (USD MILLION)

- TABLE 87 PORTABLE/HANDHELD DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2025-2032 (USD MILLION)

- TABLE 88 PORTABLE/HANDHELD DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 PORTABLE/HANDHELD DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 90 PORTABLE/HANDHELD DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 PORTABLE/HANDHELD DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2021-2024 (USD MILLION)

- TABLE 93 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2025-2032 (USD MILLION)

- TABLE 94 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 95 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 96 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2021-2024 (USD MILLION)

- TABLE 97 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2025-2032 (USD MILLION)

- TABLE 98 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2021-2024 (USD MILLION)

- TABLE 99 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2025-2032 (USD MILLION)

- TABLE 100 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 102 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 VEHICLE-MOUNTED DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 104 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2021-2024 (USD MILLION)

- TABLE 105 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2025-2032 (USD MILLION)

- TABLE 106 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY, 2021-2024 (USD MILLION)

- TABLE 107 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY, 2025-2032 (USD MILLION)

- TABLE 108 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 109 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 110 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2021-2024 (USD MILLION)

- TABLE 111 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2025-2032 (USD MILLION)

- TABLE 112 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2021-2024 (USD MILLION)

- TABLE 113 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2025-2032 (USD MILLION)

- TABLE 114 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 116 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 VEHICLE/PORTER SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 118 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2021-2024 (USD MILLION)

- TABLE 119 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2025-2032 (USD MILLION)

- TABLE 120 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 121 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 122 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2021-2024 (USD MILLION)

- TABLE 123 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2025-2032 (USD MILLION)

- TABLE 124 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 126 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 BAGGAGE SCANNER DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 128 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2021-2024 (USD MILLION)

- TABLE 129 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2025-2032 (USD MILLION)

- TABLE 130 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY, 2021-2024 (USD MILLION)

- TABLE 131 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY, 2025-2032 (USD MILLION)

- TABLE 132 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 133 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 134 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2021-2024 (USD MILLION)

- TABLE 135 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2025-2032 (USD MILLION)

- TABLE 136 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2021-2024 (USD MILLION)

- TABLE 137 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2025-2032 (USD MILLION)

- TABLE 138 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 140 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 141 GANTRY/CARGO DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 142 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2021-2024 (USD MILLION)

- TABLE 143 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE, 2025-2032 (USD MILLION)

- TABLE 144 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY, 2021-2024 (USD MILLION)

- TABLE 145 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY, 2025-2032 (USD MILLION)

- TABLE 146 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 147 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 148 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2021-2024 (USD MILLION)

- TABLE 149 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE, 2025-2032 (USD MILLION)

- TABLE 150 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2021-2024 (USD MILLION)

- TABLE 151 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION, 2025-2032 (USD MILLION)

- TABLE 152 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 153 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 154 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 155 HYBRID MULTISENSOR DEVICES: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 156 BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 157 BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 158 NORTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 159 NORTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 160 NORTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 161 NORTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 162 US: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 163 US: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 164 CANADA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 CANADA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 166 MEXICO: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 167 MEXICO: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 168 EUROPE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 169 EUROPE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 170 EUROPE: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 171 EUROPE: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 172 GERMANY: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 173 GERMANY: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 174 UK: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 175 UK: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 176 FRANCE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 177 FRANCE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 178 SPAIN: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 179 SPAIN: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 180 ITALY: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 181 ITALY: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 182 NETHERLANDS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 183 NETHERLANDS: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 184 BELGIUM: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 185 BELGIUM: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 186 NORDIC COUNTRIES: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 187 NORDIC COUNTRIES: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 188 REST OF EUROPE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 189 REST OF EUROPE: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 190 ASIA PACIFIC: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 191 ASIA PACIFIC: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 192 ASIA PACIFIC: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 193 ASIA PACIFIC: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 194 CHINA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 195 CHINA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 196 AUSTRALIA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 197 AUSTRALIA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 198 JAPAN: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 199 JAPAN: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 200 INDIA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 201 INDIA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 202 SOUTH KOREA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 203 SOUTH KOREA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 204 SOUTHEAST ASIA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 205 SOUTHEAST ASIA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 208 ROW: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 209 ROW: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 210 ROW: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 211 ROW: BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 212 MIDDLE EAST: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 213 MIDDLE EAST: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 214 AFRICA: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 215 AFRICA: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 216 SOUTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 217 SOUTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 218 MIDDLE EAST: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 219 MIDDLE EAST: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 220 AFRICA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 221 AFRICA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 222 SOUTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 223 SOUTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 224 BACKSCATTER X-RAY DEVICES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 225 BACKSCATTER X-RAY DEVICES MARKET: MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 226 BACKSCATTER X-RAY DEVICES MARKET: REGION FOOTPRINT

- TABLE 227 BACKSCATTER X-RAY DEVICES MARKET: TYPE FOOTPRINT

- TABLE 228 BACKSCATTER X-RAY DEVICES MARKET: MOBILITY FOOTPRINT

- TABLE 229 BACKSCATTER X-RAY DEVICES MARKET: IMAGING MODE FOOTPRINT

- TABLE 230 BACKSCATTER X-RAY DEVICES MARKET: COMPONENT FOOTPRINT

- TABLE 231 BACKSCATTER X-RAY DEVICES MARKET: APPLICATION FOOTPRINT

- TABLE 232 BACKSCATTER X-RAY DEVICES MARKET: LIST OF STARTUPS/SMES

- TABLE 233 BACKSCATTER X-RAY DEVICES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 234 BACKSCATTER X-RAY DEVICES MARKET: PRODUCT LAUNCHES, NOVEMBER 2021-OCTOBER 2024

- TABLE 235 BACKSCATTER X-RAY DEVICES MARKET: DEALS, NOVEMBER 2021-OCTOBER 2024

- TABLE 236 RAPISCAN SYSTEMS: COMPANY OVERVIEW

- TABLE 237 RAPISCAN SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 RAPISCAN SYSTEMS: DEALS

- TABLE 239 NUCTECH COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 240 NUCTECH COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 NUCTECH COMPANY LIMITED: DEALS

- TABLE 242 VIKEN DETECTION: COMPANY OVERVIEW

- TABLE 243 VIKEN DETECTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 VIKEN DETECTION: PRODUCT LAUNCHES

- TABLE 245 VIKEN DETECTION: DEALS

- TABLE 246 SCANNA MSC LTD.: COMPANY OVERVIEW

- TABLE 247 SCANNA MSC LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 TEK84, INC: COMPANY OVERVIEW

- TABLE 249 TEK84, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 TEK84, INC: DEALS

- TABLE 251 VIDERAY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 252 VIDERAY TECHNOLOGIES.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 VIDERAY TECHNOLOGIES.: PRODUCT LAUNCHES

- TABLE 254 AUTOCLEAR: COMPANY OVERVIEW

- TABLE 255 AUTOCLEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 BEIJING HEWEIYONGTAI: COMPANY OVERVIEW

- TABLE 257 BEIJING HEWEIYONGTAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 SMITHS DETECTION GROUP LTD: COMPANY OVERVIEW

- TABLE 259 SMITHS DETECTION GROUP LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 MICRO-X LIMITED: COMPANY OVERVIEW

- TABLE 261 MICRO-X LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 BACKSCATTER X-RAY DEVICES MARKET: RISK ASSESSMENT

List of Figures

- FIGURE 1 BACKSCATTER X-RAY DEVICES MARKET AND REGIONAL SEGMENTATION

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL BACKSCATTER X-RAY DEVICES MARKET, 2025-2032

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN BACKSCATTER X-RAY DEVICES MARKET (2021-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF BACKSCATTER X-RAY DEVICES MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN BACKSCATTER X-RAY DEVICES MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 INCREASING EMPHASIS ON NON-INTRUSIVE INSPECTION AND BORDER SECURITY TO DRIVE MARKET GROWTH OPPORTUNITIES

- FIGURE 9 VEHICLE-MOUNTED DEVICES TO CAPTURE PROMINENT MARKET SHARE IN 2032

- FIGURE 10 MOBILE/VEHICLE-MOUNTED DEVICES TO DOMINATE BACKSCATTER X-RAY DEVICES MARKET IN 2032

- FIGURE 11 HARDWARE SEGMENT TO LEAD BACKSCATTER X-RAY DEVICES MARKET IN 2032

- FIGURE 12 CUSTOMS & BORDER PROTECTION TO BE KEY APPLICATION SEGMENT IN BACKSCATTER X-RAY DEVICES MARKET IN 2032

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE IN 2025

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR IN BACKSCATTER X-RAY DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 15 BACKSCATTER X-RAY DEVICES MARKET DYNAMICS

- FIGURE 16 IMPACT ANALYSIS OF DRIVERS ON BACKSCATTER X-RAY DEVICES MARKET

- FIGURE 17 IMPACT ANALYSIS OF RESTRAINTS ON BACKSCATTER X-RAY DEVICES MARKET

- FIGURE 18 IMPACT ANALYSIS OF OPPORTUNITIES IN BACKSCATTER X-RAY DEVICES MARKET

- FIGURE 19 IMPACT ANALYSIS OF CHALLENGES IN BACKSCATTER X-RAY DEVICES MARKET

- FIGURE 20 BACKSCATTER X-RAY DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 BACKSCATTER X-RAY DEVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF PORTABLE/HANDHELD DEVICES, BY REGION, 2021-2024

- FIGURE 24 AVERAGE SELLING PRICE TREND OF VEHICLE-MOUNTED DEVICES, BY REGION, 2021-2024

- FIGURE 25 AVERAGE SELLING PRICE OF PORTABLE/HANDHELD DEVICES OFFERED BY KEY PLAYERS, 2024

- FIGURE 26 AVERAGE SELLING PRICE OF VEHICLE-MOUNTED DEVICES OFFERED BY KEY PLAYERS, 2024

- FIGURE 27 IMPORT SCENARIO FOR HS CODE 9022-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 28 EXPORT DATA FOR HS CODE 9022-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 32 DECISION-MAKING FACTORS IN BACKSCATTER X-RAY DEVICES MARKET

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 35 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 36 CUSTOMS & BORDER PROTECTION TO DOMINATE MARKET IN 2032

- FIGURE 37 SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 LARGE-AREA DETECTOR PANELS TO HOLD LARGEST MARKET SIZE IN 2032

- FIGURE 39 SINGLE-VIEW BACKSCATTER IMAGING TO HOLD LARGEST MARKET SIZE IN 2025 AND 2032

- FIGURE 40 MOBILE/VEHICLE-MOUNTED DEVICES TO HOLD LARGEST MARKET SIZE IN 2032

- FIGURE 41 LOW-ENERGY BACKSCATTER SYSTEMS TO DOMINATE MARKET IN 2032

- FIGURE 42 VEHICLE0-MOUNTED DEVICES TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 43 ASIA PACIFIC TO LEAD BACKSCATTER X-RAY DEVICES MARKET IN 2032

- FIGURE 44 NORTH AMERICA: BACKSCATTER X-RAY DEVICES MARKET SNAPSHOT

- FIGURE 45 EUROPE: BACKSCATTER X-RAY DEVICES MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: BACKSCATTER X-RAY DEVICES MARKET SNAPSHOT

- FIGURE 47 BACKSCATTER X-RAY DEVICES MARKET SHARE ANALYSIS, 2024

- FIGURE 48 BACKSCATTER X RAY DEVICES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 BACKSCATTER X-RAY DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 BACKSCATTER X-RAY DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 51 BACKSCATTER X-RAY DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 BACKSCATTER X-RAY DEVICES MARKET: RESEARCH DESIGN

- FIGURE 53 BACKSCATTER X-RAY DEVICES MARKET: BOTTOM-UP APPROACH

- FIGURE 54 BACKSCATTER X-RAY DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 55 BACKSCATTER X-RAY DEVICES MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 56 BACKSCATTER X-RAY DEVICES MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 57 BACKSCATTER X-RAY DEVICES MARKET: DATA TRIANGULATION

- FIGURE 58 BACKSCATTER X-RAY DEVICES MARKET: RESEARCH ASSUMPTIONS