|

市場調查報告書

商品編碼

1881286

全球獸醫參考實驗室市場按服務、應用、動物類型、最終用戶和地區分類-預測至2030年Veterinary Reference Laboratory Market by Service (Microbiology, Immunodiagnostics, Molecular Diagnostics, PCR, ELISA, Hematology, Urinalysis), Animal (Companion, Livestock), Application (Clinical Pathology, Toxicology), Region - Global Forecast to 2030 |

||||||

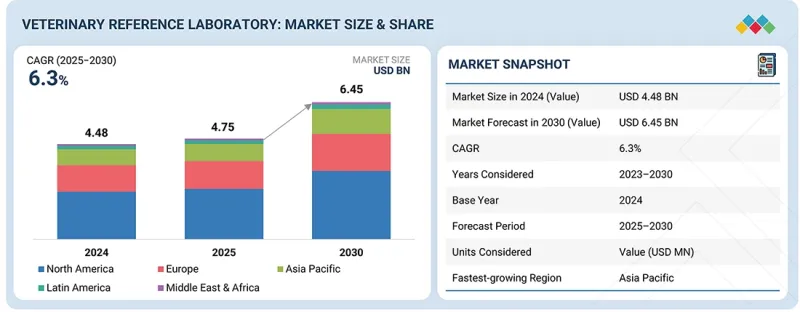

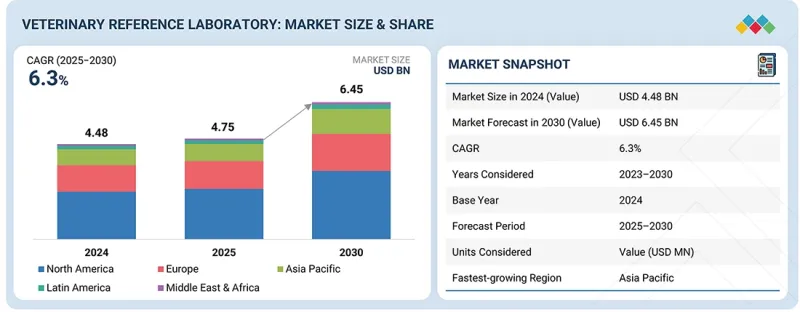

預計獸醫參考實驗室市場規模將從 2025 年的 475 萬美元成長到 2030 年的 646 萬美元,複合年成長率為 6.3%。

感染疾病和慢性動物疾病的增加、通用動物飼養率的提高以及對預防性醫療保健的日益重視,是市場擴張的主要促進因素。

| 調查範圍 | |

|---|---|

| 調查期 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(十億美元) |

| 部分 | 按服務、按用途、按動物類型、按最終用戶、按地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

對包括分子診斷、免疫診斷和臨床化學檢測在內的先進診斷測試的需求日益成長,正在加速已開發經濟體和新興經濟體高通量參考實驗室的建立。此外,自動化、基於人工智慧的影像分析和分子檢測等技術的進步,使得檢測結果的交付速度更快,診斷準確性更高,從而進一步加深了獸醫和寵物飼主之間的信任。

同時,診斷服務與數位平台和檢查室資訊管理系統(LIMS)的日益整合,正在推動更有效率的工作流程、更完善的檢體可追溯性以及對檢測結果的遠端存取。人們對疾病早期檢測和伴侶動物健康管理計畫的日益關注,進一步促進了檢測的普及;而獸醫護理的商業化以及診所與參考實驗室之間日益密切的合作,也帶來了源源不斷的檢體湧入。然而,市場也面臨許多挑戰,包括高昂的營運和檢測成本、熟練的實驗室技術人員短缺以及獸醫診斷領域嚴格的監管標準。此外,如何在不同地區保持品質保證,以及如何應對生物安全措施和檢體運輸方面的挑戰,仍然是實驗室為維持準確性、可靠性和持續成長而必須優先考慮的關鍵事項。

根據應用領域,獸醫參考實驗室市場可細分為臨床病理學、細菌學、病毒學、寄生蟲學和其他應用。 2024年,臨床病理學佔了最大的市場。這一主導地位歸功於該領域在提供詳細的診斷資訊方面發揮的關鍵作用,這些資訊透過血液學、細胞學和臨床化學檢測得以提供。這些分析使獸醫能夠準確診斷全身性疾病、追蹤治療進展並有效管理複雜的病理。伴侶動物數量的增加和獸醫就診頻率的上升推動了對常規病理檢測服務的需求。此外,自動化分析儀和數位病理系統的技術進步顯著提高了診斷的準確性、效率和結果出具時間,進一步促進了該領域的市場成長。

根據最終用戶,獸醫參考實驗室市場可細分為獸醫醫院和診所、研究機構和大學、照護現場/內部檢查室以及其他最終用戶。預計到2024年,獸醫診所和醫院將佔據全球市場最大的佔有率。這一主導地位主要歸因於越來越多的診所將分子診斷、免疫診斷和臨床化學檢測等先進和專業檢測外包,以提高診斷的準確性和效率,以及透過與中心實驗室合作增加診斷檢測量。

伴侶動物數量的增加、寵物醫療支出的成長以及小規模的獸醫院網路的擴張,也導致了診所和醫院檢體量的增加。這些機構透過依賴參考實驗室進行確診和進行院內無法有效完成的複雜檢測,從而改善了治療效果和工作流程。此外,診所和參考實驗室之間數位化檢體管理系統和自動化結果報告系統的整合,縮短了檢測結果的周轉時間,並支持了實證獸醫診療。

獸醫參考實驗室市場分為北美、歐洲、亞太以及中東和非洲四個區域。截至2024年,北美在全球市場中佔最大佔有率。這一主導地位歸功於幾個關鍵因素,包括全部區域較高的寵物擁有率、對預防性獸醫保健的高度重視以及在醫療費用支出。 IDEXX Laboratories、Zoetis Services LLC 和 Mars, Incorporated 等主要企業的存在,以及完善的獸醫醫院和診斷中心網路,進一步鞏固了該地區的主導地位。在北美,美國佔據最大的市場佔有率,這得益於該國先進的獸醫基礎設施、對專業和分子診斷測試日益成長的需求,以及自動化和數位病理解決方案的快速普及。此外,美國市場還受益於寵物保險的高滲透率、強大的獸醫服務提供者生態系統以及對伴侶動物和牲畜診斷創新研發的積極投資。

本報告對全球獸醫參考實驗室市場進行了分析,並按服務、應用、動物類型、最終用戶、區域趨勢以及參與市場的公司的概況進行了細分。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 市場動態

- 產業趨勢

- 技術分析

- 波特五力分析

- 主要相關人員和採購標準

- 監管分析

- 專利分析

- 定價分析

- 報銷分析

- 寵物主人行為

- 2025-2026 年主要會議和活動

- 最終使用者觀點和未滿足的需求

- 人工智慧/基因工程人工智慧對獸醫參考實驗室市場的影響

- 生態系圖

- 在生態系中的作用

- 價值鏈分析

- 投資和資金籌措方案

- 案例研究分析

- 影響客戶業務的趨勢/顛覆性因素

- 2025年美國關稅對獸醫檢測市場的影響

6. 獸醫參考實驗室市場(依服務分類)

- 介紹

- 臨床化學

- 免疫診斷

- 分子診斷

- 血液學

- 尿液檢查

- 組織病理學和細胞學

- 微生物學

- 其他

7. 獸醫參考實驗室市場(按應用領域分類)

- 介紹

- 臨床病理

- 細菌學

- 病毒學

- 寄生蟲學

- 生產力測試

- 妊娠測試

- 毒性測試

- 其他

8. 獸醫參考實驗室市場(依動物類型分類)

- 介紹

- 伴侶動物

- 家畜

9. 按最終用戶分類的獸醫參考實驗室市場

- 介紹

- 獸醫醫院和診所

- 照護現場/院內檢測

- 獸醫研究機構和大學

- 其他

10. 各地區獸醫參考實驗室市場

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 泰國

- 紐西蘭

- 其他

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 阿根廷

- 其他

- 中東和非洲

- 中東和非洲宏觀經濟展望

- 海灣合作理事會國家

- 其他

第11章 競爭格局

- 介紹

- 主要參與企業的策略/優勢

- 2020-2024年收入分析

- 2024年市佔率分析

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 品牌/產品對比

- 主要企業的研發支出

- 估值和財務指標

- 競爭場景

第12章:公司簡介

- 主要參與企業

- IDEXX LABORATORIES, INC.

- MARS, INCORPORATED

- ZOETIS SERVICES LLC

- GD(ROYAL GD ANIMAL HEALTH)

- LABOKLIN GMBH & CO. KG

- CVS(UK)LIMITED

- NATIONAL VETERINARY SERVICES LABORATORY USDA-APHIS

- ANIMAL AND PLANT HEALTH AGENCY

- ICAR-NIVEDI(NATIONAL INSTITUTE OF VETERINARY EPIDEMIOLOGY AND DISEASE INFORMATICS)

- NATIONAL VETERINARY SERVICES

- TEXAS A&M VETERINARY MEDICAL DIAGNOSTIC LABORATORY(TVMDL)

- ANIMAL HEALTH DIAGNOSTIC CENTER, CORNELL UNIVERSITY

- COLORADO STATE UNIVERSITY(VETERINARY DIAGNOSTIC LABORATORY)

- BIOBEST LABORATORIES LTD.

- PRIVATE VETERINARY CLINIC SAN MARCO SRL UNIPERSONALE

- 其他公司

- ROYAL VETERINARY COLLEGE, UNIVERSITY OF LONDON

- UNIVERSITY OF GUELPH, ANIMAL HEALTH LABORATORY

- VAXXINOVA

- MIRA VISTA LABS

- ELLIE DIAGNOSTICS

- PROTATEK INTERNATIONAL, INC.

- THE PIRBRIGHT INSTITUTE

- CVR LABORATORY(CVRL)

- VETERINARY PATHOLOGY GROUP

- FRIEDRICH-LOEFFLER-INSTITUT(FLI)

第13章附錄

The veterinary reference laboratory market is forecasted to grow from USD 4.75 million in 2025 to USD 6.46 million by 2030, recording a CAGR of 6.3%. The increasing prevalence of zoonotic and chronic animal diseases, rising companion animal ownership, and the growing emphasis on preventive healthcare primarily drive market expansion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Service, Application, Animal type, End User, Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising demand for advanced diagnostic testing, including molecular diagnostics, immunodiagnostics, and clinical chemistry, has accelerated the establishment of high-throughput reference laboratories in both developed and emerging regions. Moreover, technological advancements in automation, AI-based image analysis, and molecular testing are enabling faster turnaround times and improved diagnostic accuracy, fostering greater trust among veterinarians and pet owners.

At the same time, the increasing integration of diagnostic services with digital platforms and laboratory information management systems (LIMS) is streamlining workflows, enhancing sample traceability, and enabling remote access to test results. The rising focus on early disease detection and companion animal wellness programs further supports test adoption, while expanding veterinary corporatization and partnerships between clinics and reference labs are driving consistent sample inflows. However, the market faces challenges such as high operational and testing costs, a shortage of skilled laboratory professionals, and stringent regulatory standards governing veterinary diagnostics. Additionally, maintaining quality assurance across diverse geographies and addressing biosecurity and sample transport challenges remain key priorities for laboratories aiming to sustain accuracy, reliability, and growth momentum.

The clinical pathology segment accounted for the largest share of the market, by application, in 2024.

Based on application, the veterinary reference laboratory market is segmented into clinical pathology, bacteriology, virology, parasitology, and other applications. In 2024, clinical pathology accounted for the largest share of the market. This dominance is attributed to the segment's critical role in delivering detailed diagnostic insights through hematology, cytology, and clinical chemistry testing. These analyses enable veterinarians to accurately diagnose systemic disorders, track therapeutic progress, and effectively manage complex disease conditions. The rising companion animal population and increasing frequency of veterinary consultations have fueled the demand for routine pathology services. Moreover, technological advancements in automated analyzers and digital pathology systems have significantly improved diagnostic precision, efficiency, and turnaround time, further driving market growth in this segment.

The veterinary clinics & hospitals segment is expected to dominate the market, by end user, during the forecast period.

Based on end user, the veterinary reference laboratory market is segmented into veterinary clinics and hospitals, research institutes and universities, point-of-care/in-house labs, and other end users. In 2024, veterinary clinics and hospitals accounted for the largest share of the global market. This dominance is primarily driven by the rising volume of diagnostic testing conducted through referral partnerships with centralized laboratories, as clinics increasingly outsource advanced and specialized tests such as molecular diagnostics, immunodiagnostics, and clinical chemistry to improve diagnostic accuracy and efficiency.

The growing companion animal population, higher pet healthcare expenditure, and expanding network of small and large veterinary practices have further contributed to the rising sample inflow from clinics and hospitals. These facilities rely on reference laboratories for confirmatory and complex testing that cannot be efficiently performed in-house, thereby enhancing treatment outcomes and operational workflows. Additionally, the integration of digital sample management systems and automated result reporting between clinics and reference labs is improving turnaround times and supporting evidence-based veterinary care.

In 2024, North America dominated the veterinary reference laboratory market.

The veterinary reference laboratory market is segmented into North America, Europe, Asia Pacific, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global market. This dominance can be attributed to several key factors, including the high prevalence of companion animal ownership, strong awareness of preventive veterinary care, and significant healthcare expenditure on pets across the region. The presence of leading industry players such as IDEXX Laboratories, Zoetis Services LLC, and Mars, Incorporated, coupled with a well-established network of veterinary hospitals and diagnostic centers, has further reinforced the region's leadership. Within North America, the United States held the largest market share, supported by the country's advanced veterinary infrastructure, growing demand for specialized and molecular diagnostic testing, and rapid adoption of automation and digital pathology solutions. Additionally, the U.S. market benefits from favorable pet insurance penetration, a robust ecosystem of veterinary service providers, and strong investment in R&D for companion and livestock diagnostic innovations.

Breakdown of supply-side primary interviews:

- By Company Type: Tier 1 (45%), Tier 2 (20%), and Tier 3 (35%)

- By Designation: C-level Executives (35%), Directors (25%), and Other Designations (40%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and Middle East & Africa (5%)

Breakdown of demand-side primary interviews:

- By Company Type: Veterinary Clinics & Hospitals (70%), POC/In-house labs (15%), Research Institutions and Universities (10%), and Other End Users (5%)

- By Designation: Veterinary Healthcare Professionals (35%), Department Heads (27%), Procurement Heads (22%), and Other Designations (16%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and Middle East & Africa (5%)

Research Coverage

This report studies the veterinary reference laboratory market based on service, application, animal type, end user, and region. It also studies factors affecting market growth (drivers, restraints, opportunities, and challenges). It analyzes the market's opportunities and challenges and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to six main regions and respective countries.

Reasons to Buy the Report

The report can help established companies and new or smaller firms understand market trends, which will help them capture a larger market share. Firms that purchase the report can utilize one or more of the five strategies mentioned below.

This report provides insights into the following points:

- Analysis of key drivers, opportunities, restraints, and challenges influencing the growth of the veterinary reference laboratory market.

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and service launches in the veterinary reference laboratory market

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of veterinary reference laboratory services across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the veterinary reference laboratory market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the veterinary reference laboratory market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH METHODOLOGY DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key sources of secondary research

- 2.2.1.2 Key objectives of secondary research

- 2.2.1.3 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key primary sources

- 2.2.2.2 Key objectives of primary research

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 REVENUE SHARE ANALYSIS

- 2.3.2 COMPANY PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.4 TOP-DOWN APPROACH

- 2.3.5 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.6.1 MARKET ASSUMPTIONS

- 2.6.2 GROWTH RATE ASSUMPTIONS

- 2.7 RISK ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.8.1 METHODOLOGY-RELATED LIMITATIONS

- 2.8.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 VETERINARY REFERENCE LABORATORY MARKET OVERVIEW

- 4.2 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET, BY PRODUCT AND COUNTRY (2024)

- 4.3 VETERINARY REFERENCE LABORATORY MARKET: REGIONAL MIX

- 4.4 VETERINARY REFERENCE LABORATORY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 VETERINARY REFERENCE LABORATORY MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Growing routine wellness and oncology screening in companion animals

- 5.1.1.2 Rapid adoption of digital pathology and telepathology

- 5.1.1.3 Increasing prevalence/awareness of zoonotic and emerging diseases

- 5.1.1.4 Growth in companion animal population

- 5.1.1.5 Rising demand for animal-derived food products

- 5.1.1.6 Increasing demand for pet insurance and growing animal health expenditure

- 5.1.2 RESTRAINTS

- 5.1.2.1 Competition from in-clinic and point-of-care testing

- 5.1.2.2 High capital investment and fixed cost burden in veterinary reference laboratories

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Potential growth opportunities in emerging economies

- 5.1.3.2 Investment in advanced technologies in veterinary reference laboratories

- 5.1.4 CHALLENGES

- 5.1.4.1 Competitive pressure and margin pressure in veterinary reference laboratories

- 5.1.4.2 Data privacy, biosecurity, and sample ownership in veterinary reference laboratories

- 5.1.1 DRIVERS

- 5.2 INDUSTRY TRENDS

- 5.2.1 DIGITAL PATHOLOGY, TELECYTOLOGY, AND AI FROM PILOT TO COMMERCIAL SERVICES

- 5.2.2 CONTINUED CONSOLIDATION AND VERTICAL INTEGRATION ACROSS ANIMAL-HEALTH ECOSYSTEM

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Real-time PCR/Quantitative PCR (qPCR) and digital PCR (dPCR)

- 5.3.1.2 Next-generation/Metagenomic sequencing (NGS/mNGS)

- 5.3.1.3 CRISPR-based diagnostics

- 5.3.2 ADJACENT TECHNOLOGIES

- 5.3.2.1 Integrated LIMS and one health surveillance platforms

- 5.3.2.2 AI-driven diagnostic tools

- 5.3.3 COMPLEMENTARY TECHNOLOGIES

- 5.3.3.1 Telepathology

- 5.3.3.2 Breath and saliva-based diagnostic tools

- 5.3.1 KEY TECHNOLOGIES

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.5.2 KEY BUYING CRITERIA

- 5.6 REGULATORY ANALYSIS

- 5.6.1 REGULATORY LANDSCAPE

- 5.6.1.1 North America

- 5.6.1.1.1 US

- 5.6.1.2 Europe

- 5.6.1.1 North America

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.1 REGULATORY LANDSCAPE

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR VETERINARY REFERENCE LABORATORY

- 5.7.2 JURISDICTION & TOP APPLICANT ANALYSIS

- 5.7.3 MAJOR PATENTS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF VETERINARY REFERENCE LABORATORY SERVICES, BY KEY PLAYER, 2022-2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF CLINICAL CHEMISTRY AND IMMUNODIAGNOSTIC SERVICES, BY REGION, 2022-2024

- 5.9 REIMBURSEMENT ANALYSIS

- 5.10 PET PARENT BEHAVIOUR

- 5.11 KEY CONFERENCES & EVENTS, 2025-2026

- 5.12 END-USER PERSPECTIVE & UNMET NEEDS

- 5.13 IMPACT OF AI/GEN AI ON VETERINARY REFERENCE LABORATORY MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 MARKET POTENTIAL IN VETERINARY REFERENCE LABORATORY ECOSYSTEM

- 5.13.3 AI-USE CASES

- 5.13.4 KEY COMPANIES IMPLEMENTING AI

- 5.14 ECOSYSTEM MAP

- 5.15 ROLE IN ECOSYSTEM

- 5.16 VALUE CHAIN ANALYSIS

- 5.17 INVESTMENT & FUNDING SCENARIO

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 DIGITAL CYTOLOGY WORKFLOW ACCELERATION TO ENHANCE DIAGNOSTIC TURNAROUND IN VETERINARY PRACTICES

- 5.18.2 IDEXX-CANCERDX (LYMPHOMA DIAGNOSTIC SERVICE) TO ADVANCE ONCOLOGY DETECTION THROUGH BLOOD-BASED TESTING

- 5.18.3 VIRTUAL LABORATORY INTEGRATION TO ENHANCE CYTOLOGY TURNAROUND AND CLINICAL WORKFLOW

- 5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.20 IMPACT OF 2025 US TARIFF ON VETERINARY REFERENCE LABORATORY MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 North America

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.4.4 Latin America

- 5.20.5 IMPACT ON END-USE INDUSTRIES

- 5.20.5.1 Veterinary hospitals & clinics

- 5.20.5.2 Point-of-care (POC) and in-house testing setups

- 5.20.5.3 Veterinary research institutes & universities

- 5.20.5.4 Other end users

6 VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE

- 6.1 INTRODUCTION

- 6.2 CLINICAL CHEMISTRY

- 6.2.1 VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE

- 6.2.1.1 Companion animals

- 6.2.1.1.1 Rising pet ownership and preventive health trends to drive segment growth

- 6.2.1.2 Livestock animals

- 6.2.1.2.1 Rising focus on herd health, food safety, and export compliance to strengthen segment growth

- 6.2.1.1 Companion animals

- 6.2.1 VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE

- 6.3 IMMUNODIAGNOSTICS

- 6.3.1 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE

- 6.3.1.1 ELISA

- 6.3.1.1.1 ELISA tests to dominate immunodiagnostics segment owing to widespread use in infectious disease detection

- 6.3.1.1 ELISA

- 6.3.2 LATERAL FLOW ASSAYS

- 6.3.2.1 Technological advancements and cost-effectiveness to aid market growth

- 6.3.3 ALLERGEN-SPECIFIC IMMUNODIAGNOSTIC TESTS

- 6.3.3.1 Rising prevalence of atopic disorders and adoption of precision allergy testing to augment market growth

- 6.3.4 OTHER IMMUNODIAGNOSTIC SERVICES

- 6.3.5 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE

- 6.3.5.1 Companion animals

- 6.3.5.1.1 High pet care spending and preventive diagnostics to propel market growth

- 6.3.5.2 Livestock animals

- 6.3.5.2.1 Regulatory compliance, food safety, and disease surveillance to sustain steady demand

- 6.3.5.1 Companion animals

- 6.3.1 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE

- 6.4 MOLECULAR DIAGNOSTICS

- 6.4.1 VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE

- 6.4.2 PCR TESTS

- 6.4.2.1 High sensitivity and diagnostic accuracy to drive dominance of PCR tests

- 6.4.3 MICROARRAYS

- 6.4.3.1 Advancements in genetic profiling and pharmacogenomics to expand microarray applications

- 6.4.4 NUCLEIC ACID SEQUENCING

- 6.4.4.1 Rising adoption of next-generation sequencing and precision genomics to fuel market growth

- 6.4.5 OTHER MOLECULAR DIAGNOSTIC SERVICES

- 6.4.6 VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE

- 6.4.6.1 Companion animals

- 6.4.6.1.1 High pet-owner spending, precision diagnostics, and rapid turnaround to drive dominance

- 6.4.6.2 Livestock animals

- 6.4.6.2.1 Regulatory mandates, disease surveillance, and one health initiatives to strengthen market presence

- 6.4.6.1 Companion animals

- 6.5 HEMATOLOGY

- 6.5.1 VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE

- 6.5.1.1 Companion animals

- 6.5.1.1.1 High diagnostic frequency and technological advancements TO sustain segment growth

- 6.5.1.2 Livestock animals

- 6.5.1.2.1 Rising focus on herd health, biosecurity, and productivity optimization to drive steady market growth

- 6.5.1.1 Companion animals

- 6.5.1 VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE

- 6.6 URINALYSIS

- 6.6.1 VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE

- 6.6.1.1 Companion animals

- 6.6.1.1.1 Rising incidences of renal diseases in companion animals to drive market

- 6.6.1.2 Livestock animals

- 6.6.1.2.1 Growing emphasis on metabolic profiling and precision herd management to strengthen livestock urinalysis segment

- 6.6.1.1 Companion animals

- 6.6.1 VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE

- 6.7 HISTOPATHOLOGY & CYTOLOGY

- 6.7.1 VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE

- 6.7.1.1 Companion animals

- 6.7.1.1.1 Clinical reliance on laboratory-based tissue and cellular diagnostics for definitive case management to drive market

- 6.7.1.2 Livestock animals

- 6.7.1.2.1 Biosecurity investments and disease surveillance programs to drive steady demand

- 6.7.1.1 Companion animals

- 6.7.1 VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE

- 6.8 MICROBIOLOGY

- 6.8.1 VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE

- 6.8.1.1 Companion animals

- 6.8.1.1.1 Rising AMR awareness and shift toward rapid and automated testing to spur market growth

- 6.8.1.2 Livestock animals

- 6.8.1.2.1 Antimicrobial resistance monitoring and food safety compliance to sustain demand

- 6.8.1.1 Companion animals

- 6.8.1 VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE

- 6.9 OTHER SERVICES

- 6.9.1 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER SERVICES, BY ANIMAL TYPE

- 6.9.1.1 Companion animals

- 6.9.1.2 Livestock animals

- 6.9.1 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER SERVICES, BY ANIMAL TYPE

7 VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 CLINICAL PATHOLOGY

- 7.2.1 INCREASING AWARENESS OF ANIMAL HEALTH TO DRIVE MARKET

- 7.3 BACTERIOLOGY

- 7.3.1 GROWTH IN VETERINARY HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 7.4 VIROLOGY

- 7.4.1 EMERGING INFECTIOUS DISEASES IN ANIMALS TO PROPEL MARKET GROWTH

- 7.5 PARASITOLOGY

- 7.5.1 RISING PREVALENCE OF ZOONOTIC DISEASES TO AUGMENT MARKET GROWTH

- 7.6 PRODUCTIVITY TESTING

- 7.6.1 EXPANSION OF LIVESTOCK INDUSTRIES TO SUPPORT MARKET GROWTH

- 7.7 PREGNANCY TESTING

- 7.7.1 ADVANCED BREEDING TECHNIQUES AND RESPONSIBLE PET OWNERSHIP TO DRIVE MARKET GROWTH

- 7.8 TOXICOLOGY TESTING

- 7.8.1 GLOBALIZATION OF FOOD SUPPLY CHAINS TO PROPEL MARKET GROWTH

- 7.9 OTHER APPLICATIONS

8 VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE

- 8.1 INTRODUCTION

- 8.2 COMPANION ANIMALS

- 8.2.1 DOGS

- 8.2.1.1 High insurance coverage and availability of reimbursements to drive market

- 8.2.2 CATS

- 8.2.2.1 Increasing pet cat population to support market uptake

- 8.2.3 HORSES

- 8.2.3.1 Growing awareness regarding equine health to fuel market growth

- 8.2.4 OTHER COMPANION ANIMALS

- 8.2.1 DOGS

- 8.3 LIVESTOCK ANIMALS

- 8.3.1 CATTLE

- 8.3.1.1 Growing consumption of dairy products to drive market growth

- 8.3.2 SWINE

- 8.3.2.1 Increasing incidence of infectious diseases to fuel market growth

- 8.3.3 POULTRY

- 8.3.3.1 Increasing demand for poultry meat to spur market growth

- 8.3.4 SHEEP & GOATS

- 8.3.4.1 International trade and strict health regulations to drive market

- 8.3.5 OTHER LIVESTOCK ANIMALS

- 8.3.1 CATTLE

9 VETERINARY REFERENCE LABORATORY MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 VETERINARY HOSPITALS & CLINICS

- 9.2.1 RISING PET OWNERSHIP AND GROWING DIAGNOSTIC AWARENESS TO DRIVE DEMAND FOR VETERINARY REFERENCE LABS

- 9.3 POINT-OF-CARE/IN-HOUSE TESTING

- 9.3.1 INCREASING COLLABORATIONS BETWEEN IN-HOUSE DIAGNOSTIC SETUPS AND REFERENCE LABORATORIES TO AID MARKET GROWTH

- 9.4 VETERINARY RESEARCH INSTITUTES & UNIVERSITIES

- 9.4.1 INCREASING ACADEMIC COLLABORATIONS AND FUNDING TO DRIVE UTILIZATION OF REFERENCE LABORATORY SERVICES

- 9.5 OTHER END USERS

10 VETERINARY REFERENCE LABORATORY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate Norths American veterinary reference laboratory market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Growing pet adoption, rising animal healthcare expenditure, and increasing number of veterinary practices to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Increasing pet healthcare expenditure and rising demand for animal-derived food products to aid market growth

- 10.3.3 UK

- 10.3.3.1 Increased pet ownership and availability of animal health insurance policies to augment market growth

- 10.3.4 FRANCE

- 10.3.4.1 Growth of livestock industry and high companion animal population to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Rising awareness about pet healthcare to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Growing demand for pig and poultry products to drive market

- 10.3.7 NETHERLANDS

- 10.3.7.1 Increasing animal healthcare expenditure to drive market growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Large pool of food-producing animals to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Awareness about zoonotic diseases and increased pet expenditure to propel market growth

- 10.4.4 INDIA

- 10.4.4.1 Growing demand for livestock products and increasing awareness about animal health to support market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing investments in pet services and products to aid market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing pet population in urban households to drive market

- 10.4.7 THAILAND

- 10.4.7.1 Rapidly expanding companion animal population to create higher demand for advanced diagnostic testing

- 10.4.8 NEW ZEALAND

- 10.4.8.1 Increased demand for preventive care and high aging pet population to drive market growth

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Increasing use of reproductive technologies in livestock industry to propel market growth

- 10.5.3 MEXICO

- 10.5.3.1 Increasing adoption of advanced diagnostic technologies to propel market growth

- 10.5.4 ARGENTINA

- 10.5.4.1 Focus on advanced healthcare and regular disease monitoring among companion animals to drive market

- 10.5.5 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Kingdom of Saudi Arabia

- 10.6.2.1.1 Technology advancements in veterinary diagnostics to boost market growth

- 10.6.2.2 UAE

- 10.6.2.2.1 Government support and favorable initiatives to fuel market growth

- 10.6.2.3 Rest of GCC Countries

- 10.6.2.1 Kingdom of Saudi Arabia

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN VETERINARY REFERENCE LABORATORY MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 RANKING OF KEY MARKET PLAYERS

- 11.4.2 GLOBAL MARKET SHARE ANALYSIS

- 11.4.3 US MARKET SHARE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Service footprint

- 11.5.5.4 Animal type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SME PLAYERS, 2024

- 11.6.5.1 Detailed list of key startups/SME players

- 11.6.5.2 Competitive benchmarking of key emerging players/startups

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 R&D EXPENDITURE OF KEY PLAYERS

- 11.9 COMPANY VALUATION & FINANCIAL METRICS

- 11.9.1 FINANCIAL METRICS

- 11.9.2 COMPANY VALUATION

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 SERVICE LAUNCHES & ENHANCEMENTS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 IDEXX LABORATORIES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Service launches and enhancements

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 MARS, INCORPORATED

- 12.1.2.1 Business overview

- 12.1.2.2 Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Service launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 ZOETIS SERVICES LLC

- 12.1.3.1 Business overview

- 12.1.3.2 Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 GD (ROYAL GD ANIMAL HEALTH)

- 12.1.4.1 Business overview

- 12.1.4.2 Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Service launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 LABOKLIN GMBH & CO. KG

- 12.1.5.1 Business overview

- 12.1.5.2 Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Service launches

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 CVS (UK) LIMITED

- 12.1.6.1 Business overview

- 12.1.6.2 Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Service launches

- 12.1.7 NATIONAL VETERINARY SERVICES LABORATORY USDA-APHIS

- 12.1.7.1 Business overview

- 12.1.7.2 Services offered

- 12.1.8 ANIMAL AND PLANT HEALTH AGENCY

- 12.1.8.1 Business overview

- 12.1.8.2 Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Other developments

- 12.1.9 ICAR-NIVEDI (NATIONAL INSTITUTE OF VETERINARY EPIDEMIOLOGY AND DISEASE INFORMATICS)

- 12.1.9.1 Business overview

- 12.1.9.2 Services offered

- 12.1.10 NATIONAL VETERINARY SERVICES

- 12.1.10.1 Business overview

- 12.1.10.2 Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Expansions

- 12.1.10.3.2 Other developments

- 12.1.11 TEXAS A&M VETERINARY MEDICAL DIAGNOSTIC LABORATORY (TVMDL)

- 12.1.11.1 Business overview

- 12.1.11.2 Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Service launches and enhancements

- 12.1.12 ANIMAL HEALTH DIAGNOSTIC CENTER, CORNELL UNIVERSITY

- 12.1.12.1 Business overview

- 12.1.12.2 Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Service launches

- 12.1.12.3.2 Expansions

- 12.1.13 COLORADO STATE UNIVERSITY (VETERINARY DIAGNOSTIC LABORATORY)

- 12.1.13.1 Business overview

- 12.1.13.2 Services offered

- 12.1.14 BIOBEST LABORATORIES LTD.

- 12.1.14.1 Business overview

- 12.1.14.2 Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Expansions

- 12.1.15 PRIVATE VETERINARY CLINIC SAN MARCO SRL UNIPERSONALE

- 12.1.15.1 Business overview

- 12.1.15.2 Services offered

- 12.1.1 IDEXX LABORATORIES, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 ROYAL VETERINARY COLLEGE, UNIVERSITY OF LONDON

- 12.2.2 UNIVERSITY OF GUELPH, ANIMAL HEALTH LABORATORY

- 12.2.3 VAXXINOVA

- 12.2.4 MIRA VISTA LABS

- 12.2.5 ELLIE DIAGNOSTICS

- 12.2.6 PROTATEK INTERNATIONAL, INC.

- 12.2.7 THE PIRBRIGHT INSTITUTE

- 12.2.8 CVR LABORATORY (CVRL)

- 12.2.9 VETERINARY PATHOLOGY GROUP

- 12.2.10 FRIEDRICH-LOEFFLER-INSTITUT (FLI)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.3.1 SERVICE ANALYSIS

- 13.3.2 COMPANY INFORMATION

- 13.3.3 GEOGRAPHIC ANALYSIS

- 13.3.4 REGIONAL/COUNTRY-LEVEL MARKET SHARE ANALYSIS

- 13.3.5 COUNTRY-LEVEL VOLUME ANALYSIS BY PRODUCT

- 13.3.6 BY SERVICE MARKET SHARE ANALYSIS (TOP 5 PLAYERS)

- 13.3.7 ANY CONSULT/CUSTOM REQUIREMENTS AS PER CLIENT REQUESTS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 VETERINARY REFERENCE LABORATORY MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

- TABLE 3 VETERINARY REFERENCE LABORATORY MARKET: MARKET ASSUMPTIONS

- TABLE 4 VETERINARY REFERENCE LABORATORY MARKET: RISK ANALYSIS

- TABLE 5 ANIMAL DISEASE OUTBREAKS IN ASIA PACIFIC COUNTRIES, 2009-2023

- TABLE 6 NUMBER OF US HOUSEHOLDS THAT OWN A PET IN 2024, BY ANIMAL TYPE (MILLIONS)

- TABLE 7 US: AVERAGE PREMIUMS PAID, 2020 VS. 2023

- TABLE 8 NORTH AMERICA: PET HEALTH INSURANCE MARKET, 2012-2023 (USD MILLION)

- TABLE 9 VETERINARY REFERENCE LABORATORY MARKET: PORTER'S FIVE FORCES

- TABLE 10 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY REFERENCE LABORATORY PRODUCTS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MAJOR PATENTS IN VETERINARY REFERENCE LABORATORY MARKET

- TABLE 16 AVERAGE SELLING PRICE TREND OF VETERINARY REFERENCE LABORATORY SERVICES, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 17 AVERAGE SELLING PRICE TREND OF CLINICAL CHEMISTRY SERVICES, BY REGION, 2022-2024 (USD)

- TABLE 18 AVERAGE SELLING PRICE TREND OF IMMUNODIAGNOSTIC SERVICES, BY REGION, 2022-2024 (USD)

- TABLE 19 AVERAGE SELLING PRICE TREND OF MOLECULAR DIAGNOSTIC SERVICES, BY REGION, 2022-2024 (USD)

- TABLE 20 AVERAGE SELLING PRICE TREND OF HAEMATOLOGY SERVICES, BY REGION, 2022-2024 (USD)

- TABLE 21 AVERAGE SELLING PRICE TREND OF HISTOPATHOLOGY &CYTOLOGY SERVICES, BY REGION, 2022-2024 (USD)

- TABLE 22 AVERAGE SELLING PRICE TREND OF URINALYSIS SERVICES, BY REGION, 2022-2024 (USD)

- TABLE 23 KEY CONFERENCES & EVENTS IN VETERINARY REFERENCE LABORATORY MARKET, JANUARY 2025-DECEMBER 2026

- TABLE 24 KEY COMPANIES IMPLEMENTING AI IN VETERINARY REFERENCE LABORATORY MARKET

- TABLE 25 VETERINARY REFERENCE LABORATORY PROVIDERS: ROLE IN ECOSYSTEM

- TABLE 26 CASE STUDY 1: DIGITAL CYTOLOGY WORKFLOW ACCELERATION TO ENHANCE DIAGNOSTIC TURNAROUND IN VETERINARY PRACTICES

- TABLE 27 CASE STUDY 2: IDEXX-CANCERDX (LYMPHOMA DIAGNOSTIC SERVICE) TO ADVANCE ONCOLOGY DETECTION THROUGH BLOOD-BASED TESTING

- TABLE 28 CASE STUDY 3: VIRTUAL LABORATORY INTEGRATION TO ENHANCE CYTOLOGY TURNAROUND AND CLINICAL WORKFLOW

- TABLE 29 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 30 KEY PRODUCT-RELATED TARIFF EFFECTIVE VETERINARY REFERENCE LABORATORY

- TABLE 31 IMPACT OF US TARIFF ON CANADA

- TABLE 32 IMPACT OF US TARIFF ON GERMANY AND UK

- TABLE 33 IMPACT OF US TARIFF ON CHINA, JAPAN, AND INDIA

- TABLE 34 IMPACT OF US TARIFF ON MEXICO

- TABLE 35 VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 36 KEY PLAYERS PROVIDING CLINICAL CHEMISTRY SERVICES

- TABLE 37 VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 39 CLINICAL CHEMISTRY MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 CLINICAL CHEMISTRY MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 KEY PLAYERS PROVIDING IMMUNODIAGNOSTIC TECHNOLOGIES

- TABLE 42 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 44 IMMUNODIAGNOSTICS MARKET FOR ELISA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 IMMUNODIAGNOSTICS MARKET FOR LATERAL FLOW ASSAYS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 IMMUNODIAGNOSTICS MARKET FOR ALLERGEN-SPECIFIC IMMUNODIAGNOSTIC TESTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 OTHER IMMUNODIAGNOSTICS SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE , 2023-2030 (USD MILLION)

- TABLE 49 IMMUNODIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 IMMUNODIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 KEY PLAYERS PROVIDING MOLECULAR DIAGNOSTIC SERVICES

- TABLE 52 VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 54 MOLECULAR DIAGNOSTICS MARKET FOR PCR TESTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 MOLECULAR DIAGNOSTICS MARKET FOR MICROARRAYS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 MOLECULAR DIAGNOSTICS MARKET FOR NUCLEIC ACID SEQUENCING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 OTHER MOLECULAR DIAGNOSTIC SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 59 MOLECULAR DIAGNOSTICS MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 MOLECULAR DIAGNOSTICS MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 KEY PLAYERS PROVIDING HAEMATOLOGY SERVICES

- TABLE 62 VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 64 HAEMATOLOGY MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 HAEMATOLOGY MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 KEY PLAYERS PROVIDING URINALYSIS TECHNOLOGIES

- TABLE 67 VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 69 URINALYSIS MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 URINALYSIS MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 KEY PLAYERS PROVIDING HISTOPATHOLOGY & CYTOLOGY SERVICES

- TABLE 72 VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 74 HISTOPATHOLOGY & CYTOLOGY MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 HISTOPATHOLOGY & CYTOLOGY MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 KEY PLAYERS PROVIDING MICROBIOLOGY SERVICES

- TABLE 77 VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 79 MICROBIOLOGY MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 MICROBIOLOGY MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 KEY PLAYERS PROVIDING OTHER VETERINARY REFERENCE LABORATORY SERVICES

- TABLE 82 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER SERVICES, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 84 OTHER VETERINARY REFERENCE LABORATORY SERVICES MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 OTHER VETERINARY REFERENCE LABORATORY SERVICES MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 87 KEY PLAYERS PROVIDING CLINICAL PATHOLOGY SERVICES

- TABLE 88 VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL PATHOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 KEY PLAYERS PROVIDING BACTERIOLOGY SERVICES

- TABLE 90 VETERINARY REFERENCE LABORATORY MARKET FOR BACTERIOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 KEY PLAYERS PROVIDING VIROLOGY SERVICES

- TABLE 92 VETERINARY REFERENCE LABORATORY MARKET FOR VIROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 KEY PLAYERS PROVIDING PARASITOLOGY SERVICES

- TABLE 94 VETERINARY REFERENCE LABORATORY MARKET FOR PARASITOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 KEY PLAYERS PROVIDING PRODUCTIVITY TESTING SERVICES

- TABLE 96 VETERINARY REFERENCE LABORATORY MARKET FOR PRODUCTIVITY TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 KEY PLAYERS PROVIDING PREGNANCY TESTING SERVICES

- TABLE 98 VETERINARY REFERENCE LABORATORY MARKET FOR PREGNANCY TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 KEY PLAYERS PROVIDING TOXICOLOGY TESTING SERVICES

- TABLE 100 VETERINARY REFERENCE LABORATORY MARKET FOR TOXICOLOGY TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 103 KEY PLAYERS PROVIDING VETERINARY REFERENCE LABORATORY SERVICES FOR COMPANION ANIMALS

- TABLE 104 VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 KEY PLAYERS PROVIDING VETERINARY REFERENCE LABORATORY SERVICES FOR DOGS

- TABLE 107 VETERINARY REFERENCE LABORATORY MARKET FOR DOGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 KEY PLAYERS PROVIDING VETERINARY REFERENCE LABORATORY SERVICES FOR CATS

- TABLE 109 VETERINARY REFERENCE LABORATORY MARKET FOR CATS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 KEY PLAYERS PROVIDING VETERINARY REFERENCE LABORATORY SERVICES FOR HORSES

- TABLE 111 VETERINARY REFERENCE LABORATORY MARKET FOR HORSES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER COMPANION ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 KEY PLAYERS PROVIDING VETERINARY REFERENCE LABORATORY SERVICES FOR LIVESTOCK ANIMALS

- TABLE 114 VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 KEY PLAYERS PROVIDING VETERINARY REFERENCE LABORATORY SERVICES FOR CATTLE

- TABLE 117 VETERINARY REFERENCE LABORATORY MARKET FOR CATTLE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 KEY PLAYERS PROVIDING VETERINARY REFERENCE LABORATORY SERVICES FOR SWINE

- TABLE 119 VETERINARY REFERENCE LABORATORY MARKET FOR SWINE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 KEY PLAYERS PROVIDING VETERINARY REFERENCE LABORATORY SERVICES FOR POULTRY

- TABLE 121 VETERINARY REFERENCE LABORATORY MARKET FOR POULTRY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 VETERINARY REFERENCE LABORATORY MARKET FOR SHEEP & GOATS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER LIVESTOCK ANIMALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 125 US: BASIC ANNUAL EXPENSES FOR CATS AND DOGS, 2023 (USD)

- TABLE 126 VETERINARY REFERENCE LABORATORY MARKET FOR VETERINARY HOSPITALS & CLINICS BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 VETERINARY REFERENCE LABORATORY MARKET FOR POINT-OF-CARE/IN-HOUSE TESTING BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 VETERINARY REFERENCE LABORATORY MARKET FOR VETERINARY RESEARCH INSTITUTES & UNIVERSITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 VETERINARY REFERENCE LABORATORY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 148 US: KEY MACROINDICATORS

- TABLE 149 US: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 150 US: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 151 US: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 152 US: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 153 US: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 154 US: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 155 US: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 156 US: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 157 US: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 158 US: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 159 US: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 160 US: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 161 US: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 162 US: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 US: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 US: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 165 CANADA: KEY MACROINDICATORS

- TABLE 166 CANADA: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 167 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 168 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 169 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 170 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 171 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 172 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 173 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 174 CANADA: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 175 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 176 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 177 CANADA: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 178 CANADA: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 179 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 CANADA: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 CANADA: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 182 EUROPE: COMPANION POPULATION, BY COUNTRY, 2023 (MILLION)

- TABLE 183 EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 184 EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 185 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 186 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 187 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 188 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 189 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 190 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 191 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 192 EUROPE: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 193 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 194 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 195 EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 196 EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 197 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 200 GERMANY: KEY MACROINDICATORS

- TABLE 201 GERMANY: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 202 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 203 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 204 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 205 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 206 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 207 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 208 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 209 GERMANY: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 210 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 211 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 212 GERMANY: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 213 GERMANY: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 214 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 GERMANY: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 GERMANY: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 217 UK: KEY MACROINDICATORS

- TABLE 218 UK: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 219 UK: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 220 UK: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 221 UK: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 222 UK: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 223 UK: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 224 UK: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 225 UK: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 226 UK: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 227 UK: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 228 UK: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 229 UK: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 230 UK: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 231 UK: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 UK: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 UK: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 234 FRANCE: KEY MACROINDICATORS

- TABLE 235 FRANCE: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 236 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 237 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 238 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 239 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 240 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 241 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 242 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 243 RANCE: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 244 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 245 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 246 FRANCE: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 247 FRANCE: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 248 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 FRANCE: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 FRANCE: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 251 ITALY: KEY MACROINDICATORS

- TABLE 252 ITALY: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 253 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 254 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 255 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 256 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 257 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 258 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 259 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 260 ITALY: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 261 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 262 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 263 ITALY: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 264 ITALY: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 265 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 ITALY: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 ITALY: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 268 SPAIN: KEY MACROINDICATORS

- TABLE 269 SPAIN: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 270 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 271 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 272 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 273 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 274 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 275 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 276 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 277 SPAIN: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 278 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 279 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 280 SPAIN: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 281 SPAIN: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 282 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 SPAIN: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 SPAIN: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 285 NETHERLANDS: KEY MACROINDICATORS

- TABLE 286 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 287 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 288 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 289 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 290 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 291 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 292 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 293 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 294 NETHERLANDS: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 295 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 296 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 297 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 298 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 299 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 NETHERLANDS: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 302 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 303 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 304 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 305 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 306 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 307 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 308 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 309 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 310 REST OF EUROPE: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 311 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 312 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 313 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 314 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 315 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 REST OF EUROPE: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 318 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 319 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 320 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 321 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 322 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 323 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 324 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 325 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 326 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 327 ASIA PACIFIC: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 328 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 329 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 330 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 331 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 332 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 333 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 335 CHINA: KEY MACROINDICATORS

- TABLE 336 CHINA: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 337 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 338 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 339 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 340 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 341 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 342 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 343 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 344 CHINA: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 345 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 346 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 347 CHINA: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 348 CHINA: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 349 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 350 CHINA: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 351 CHINA: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 352 JAPAN: PRODUCTION, CONSUMPTION, IMPORT, AND EXPORT OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

- TABLE 353 JAPAN: KEY MACROINDICATORS

- TABLE 354 JAPAN: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 355 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 356 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 357 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 358 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 359 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 360 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 361 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 362 JAPAN: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 363 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 364 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 365 JAPAN: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 366 JAPAN: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 367 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 368 JAPAN: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 369 JAPAN: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 370 INDIA: PRODUCTION AND CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

- TABLE 371 INDIA: KEY MACROINDICATORS

- TABLE 372 INDIA: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 373 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 374 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 375 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 376 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 377 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 378 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 379 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 380 INDIA: OTHER VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 381 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 382 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 383 INDIA: VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 384 INDIA: VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 385 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR COMPANION ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 386 INDIA: VETERINARY REFERENCE LABORATORY MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 387 INDIA: VETERINARY REFERENCE LABORATORY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 388 AUSTRALIA: KEY MACROINDICATORS

- TABLE 389 AUSTRALIA: VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 390 AUSTRALIA: VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 391 AUSTRALIA: VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 392 AUSTRALIA: VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE, 2023-2030 (USD MILLION)