|

市場調查報告書

商品編碼

1881230

苯甲酸鈉市場按應用和地區分類-預測至2030年Sodium Benzoate Market by Application (Food & Beverages, Pharma, Cosmetics, Home Care) and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2030 |

||||||

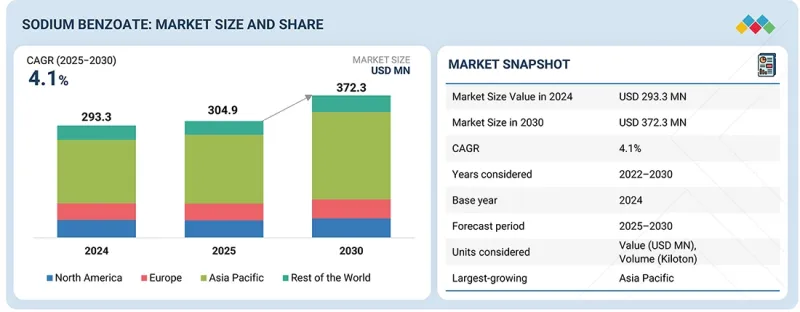

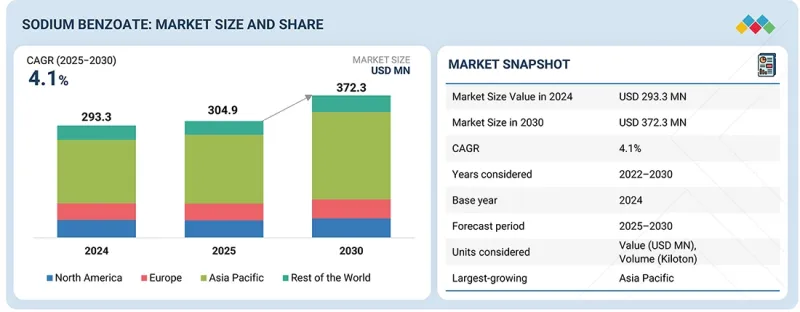

全球苯甲酸鈉市場預計將從 2025 年的 3.049 億美元成長到 2030 年的 3.723 億美元,預測期內複合年成長率為 4.1%。

市場成長的主要驅動力是其作為食品和飲料防腐劑的廣泛應用,這得益於包裝食品和簡便食品需求的不斷成長。此外,消費者對食品安全和保存期限的日益關注也進一步推動了市場成長。

| 調查範圍 | |

|---|---|

| 調查期 | 2022-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 價值(百億美元),數量(千噸) |

| 部分 | 用途和麵積 |

| 目標區域 | 亞太地區、歐洲、北美和世界其他地區 |

此外,製藥業的擴張也推動了需求成長。苯甲酸鈉因其抗菌和穩定特性而被廣泛應用於醫藥領域。化妝品和個人護理行業也促進了市場成長,苯甲酸鈉被用作乳霜、乳液、洗髮精等產品中的安全防腐劑。此外,苯甲酸鈉在油漆、塗料和潤滑劑等工業領域的應用日益廣泛,也因其防腐蝕性能而推動了市場擴張。美國食品藥物管理局(FDA)和歐洲食品安全局(EFSA)等機構核准苯甲酸鈉用於食品和化妝品,也刺激了全球需求。

預計在預測期內,化妝品產業將佔據苯甲酸鈉市場第二大佔有率。這一成長主要得益於全球個人護理和美容產品需求的不斷成長,尤其是在新興經濟體,這些地區的消費者可支配收入和護膚意識正在不斷提高。苯甲酸鈉廣泛用作化妝品和個人保健產品中的防腐劑,以防止微生物污染並延長產品保存期限,從而確保乳霜、乳液、洗髮精和彩妝產品的安全性和穩定性。美國食品藥物管理局(FDA) 和歐盟委員會等監管機構核准其用於沖洗型和免沖洗型產品,進一步促進了其應用。此外,消費者轉向不含對羥基苯甲酸酯和天然來源的配方,也推動了苯甲酸鈉作為一種更安全、更環保的替代品的使用。全球化妝品和個人護理行業的持續擴張,在都市化、社交媒體的影響以及產品配方創新等因素的推動下,預計將在預測期內支撐該行業對苯甲酸鈉的強勁需求。

北美預計將佔據苯甲酸鈉市場第二大佔有率,這主要得益於食品飲料、化妝品和製藥業的強勁需求。該地區成熟的包裝食品產業正大幅增加苯甲酸鈉作為防腐劑的使用量,這主要受消費者對便利性和長保存期限產品的偏好所驅動。此外,美國和加拿大蓬勃發展的製藥業也促進了市場成長,因為苯甲酸鈉因其抗菌和穩定特性而被廣泛用於配方中。個人護理和化妝品市場的不斷擴張,以及對產品安全性和合規性的重視,也推動了對苯甲酸鈉的需求,使其成為對羥基苯甲酸酯類防腐劑的可靠替代品。此外,美國食品藥物管理局(FDA) 和環境保護署 (EPA) 等機構的嚴格監管確保了苯甲酸鈉的安全使用,並增強了消費者的信任和產業的信心。主要生產商的存在以及食品保鮮和化妝品配方領域的持續技術創新,預計將進一步鞏固北美在全球苯甲酸鈉市場中的領先地位。

本報告分析了全球苯甲酸鈉市場,概述了按應用和地區分類的趨勢,並介紹了參與該市場的公司的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 介紹

- 市場動態

- 宏觀經濟展望

- 價值鏈分析

- 生態系分析

- 波特五力分析

- 2025-2026 年主要會議和活動

- 定價分析

- 專利分析

6. 苯甲酸鈉市場(依應用領域分類)

- 介紹

- 食品/飲料

- 製藥

- 化妝品

- 居家照護

- 其他

7. 苯甲酸鈉市場(依地區分類)

- 介紹

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他

- 歐洲

- 德國

- 法國

- 西班牙

- 英國

- 義大利

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他地區

第8章 競爭情勢

- 介紹

- 主要參與企業的策略/優勢

- 收入分析

- 2024年市佔率分析

- 競爭場景

- 估值和財務指標

第9章:公司簡介

- 主要參與企業

- LANXESS

- WUHAN YOUJI HOLDINGS LTD.

- TIANJIN DONGDA CHEMICAL GROUP CO., LTD

- EASTMAN CHEMICAL COMPANY

- TENGZHOU TENGLONG FOOD TECHNOLOGY DEVELOPMENT CO., LTD.

第10章:鄰近及相關市場

第11章附錄

The global sodium benzoate market is projected to grow from USD 304.9 million in 2025 to USD 372.3 million by 2030 at a CAGR of 4.1% during the forecast period. The growth of the market is primarily driven by its widespread use as a preservative in food and beverages due to the rising demand for packaged and convenience foods. Increasing consumer awareness about food safety and extended shelf life is further enhancing market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | Application and Region |

| Regions covered | Asia Pacific, Europe, North America, and Rest of the World |

Additionally, the expanding pharmaceuticals industry is fueling demand, as sodium benzoate is used in medicines for its antimicrobial and stabilizing properties. The cosmetics and personal care industry also contributes to market growth, utilizing sodium benzoate as a safe preservative in creams, lotions, and shampoos. Moreover, the growing application of sodium benzoate in industrial sectors such as paints, coatings, and lubricants due to its corrosion-inhibiting characteristics supports market expansion. Regulatory approvals from agencies like the FDA and EFSA for the use of sodium benzoate in food and cosmetics also stimulate global demand.

"The cosmetics segment of the sodium benzoate market, by application, is projected to account for the second-largest share during the forecast period".

The cosmetics segment is projected to account for the second-largest share of the sodium benzoate market during the forecast period. This growth is primarily driven by the increasing demand for personal care and beauty products worldwide, particularly in emerging economies where disposable incomes and consumer awareness of hygiene and skincare are on the rise. Sodium benzoate is widely used in cosmetics and personal care formulations as a preservative to prevent microbial contamination and extend product shelf life, ensuring safety and stability in creams, lotions, shampoos, and makeup products. Its approval by regulatory bodies such as the US Food and Drug Administration (FDA) and the European Commission for use in rinse-off and leave-on products has further strengthened its adoption. Additionally, the growing shift toward paraben-free and naturally derived formulations has led to an increase in the use of sodium benzoate as a safer and more environmentally friendly alternative. The continuous expansion of the global cosmetics and personal care industry, supported by urbanization, social media influence, and innovation in product formulations, is expected to sustain strong demand for sodium benzoate in this segment during the forecast period.

"North America is projected to account for the second-largest share of the sodium benzoate market".

North America is projected to account for the second-largest share of the sodium benzoate market, driven by strong demand from the food & beverage, cosmetics, and pharmaceuticals industries. The region's well-established packaged food sector, supported by high consumer preference for convenient and long-shelf-life products, has significantly boosted the consumption of sodium benzoate as a preservative. In addition, the robust pharmaceuticals industry in the US and Canada contributes to market growth, as sodium benzoate is commonly used in formulations for its antimicrobial and stabilizing properties. The growing personal care & cosmetics market, emphasizing product safety and regulatory compliance, also drives sodium benzoate demand as a reliable preservative alternative to parabens. Moreover, stringent regulations by authorities such as the US Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) ensure the safe use of sodium benzoate, fostering consumer trust and industry confidence. The presence of key manufacturers and ongoing innovations in food preservation and cosmetic formulations are further expected to sustain North America's strong position in the global sodium benzoate market.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 25%, and Tier 3 - 10%

- By Designation: C-level - 25%, Director Level - 30%, and Others - 45%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, and Rest of the World - 10%

LANXESS (Germany), Wuhan Youji Holdings Ltd. (China), Tianjin Dongda Chemical Group Co., Ltd (China), Eastman Chemical Company (US), and Tengzhou Tenglong Food Technology Development Co., Ltd. (China) are the major players in the sodium benzoate market. These players have adopted partnerships and expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the sodium benzoate market based on application and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles sodium benzoate manufacturers, comprehensively analyzes their market shares and core competencies, and tracks and analyzes competitive developments, such as expansions and partnerships, adopted by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the sodium benzoate market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It may also enable stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (rising demand for food and beverage preservatives, expanding use of sodium benzoate in pharmaceuticals, growing demand for cosmetics and home care products), restraints (growing shift toward natural preservatives), opportunities (growth prospects in animal feed segment of livestock industry, growing industrial applications), and challenges (regulatory restrictions) influencing the growth of the sodium benzoate market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the sodium benzoate market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the sodium benzoate market across varied regions)

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as LANXESS (Germany), Wuhan Youji Holdings Ltd. (China), Tianjin Dongda Chemical Group Co., Ltd (China), Eastman Chemical Company (US), and Tengzhou Tenglong Food Technology Development Co., Ltd. (China) in the sodium benzoate market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 CALCULATION FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SODIUM BENZOATE MARKET

- 4.2 SODIUM BENZOATE MARKET, BY APPLICATION

- 4.3 SODIUM BENZOATE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for food and beverage preservatives

- 5.2.1.2 Expanding use of sodium benzoate in pharmaceuticals

- 5.2.1.3 Growing demand for cosmetics and home care products

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing shift toward natural preservatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth prospects in animal feed segment of livestock industry

- 5.2.3.2 Growing industrial applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory restrictions

- 5.2.1 DRIVERS

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 GDP

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 BARGAINING POWER OF SUPPLIERS

- 5.6.2 BARGAINING POWER OF BUYERS

- 5.6.3 THREAT OF SUBSTITUTES

- 5.6.4 THREAT OF NEW ENTRANTS

- 5.6.5 DEGREE OF COMPETITION

- 5.7 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE, BY REGION

- 5.8.2 AVERAGE SELLING PRICE, BY APPLICATION

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 PATENT PUBLICATION TRENDS

- 5.9.3 INSIGHTS

- 5.9.3.1 LIST OF MAJOR PATENTS

6 SODIUM BENZOATE MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 FOOD & BEVERAGES

- 6.2.1 DOMINANT APPLICATION OF SODIUM BENZOATE

- 6.3 PHARMA

- 6.3.1 FASTEST-GROWING APPLICATION OF SODIUM BENZOATE

- 6.4 COSMETICS

- 6.4.1 GROWING DEMAND FOR PRESERVATIVES IN BEAUTY INDUSTRY TO DRIVE MARKET

- 6.5 HOME CARE

- 6.5.1 EXTENSIVE USE IN HOUSEHOLD CLEANING AND MAINTENANCE PRODUCTS TO DRIVE MARKET

- 6.6 OTHERS

7 SODIUM BENZOATE MARKET, BY REGION

- 7.1 INTRODUCTION

- 7.2 ASIA PACIFIC

- 7.2.1 CHINA

- 7.2.1.1 Increasing private-label food manufacturing to drive growth

- 7.2.2 INDIA

- 7.2.2.1 Expanding food and beverage production to drive market

- 7.2.3 JAPAN

- 7.2.3.1 Growth in food processing sector to drive demand

- 7.2.4 SOUTH KOREA

- 7.2.4.1 Rising demand for cosmetic products to drive growth

- 7.2.5 REST OF ASIA PACIFIC

- 7.2.1 CHINA

- 7.3 EUROPE

- 7.3.1 GERMANY

- 7.3.1.1 Strong cosmetics market to drive demand

- 7.3.2 FRANCE

- 7.3.2.1 Increase in premium beauty exports to drive market

- 7.3.3 SPAIN

- 7.3.3.1 Large-scale export of packaged food products to drive market

- 7.3.4 UK

- 7.3.4.1 Consistent preservative demand across low- and no-calorie beverages to drive market

- 7.3.5 ITALY

- 7.3.5.1 Strong pharmaceutical manufacturing base and extensive food processing industry to drive market

- 7.3.6 REST OF EUROPE

- 7.3.1 GERMANY

- 7.4 NORTH AMERICA

- 7.4.1 US

- 7.4.1.1 Increased pharmaceutical spending and high cosmetics export to drive demand

- 7.4.2 CANADA

- 7.4.2.1 Growing processed food & beverages industry to drive market

- 7.4.3 MEXICO

- 7.4.3.1 High soft drink consumption to drive demand

- 7.4.1 US

- 7.5 REST OF THE WORLD

8 COMPETITIVE LANDSCAPE

- 8.1 INTRODUCTION

- 8.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 8.3 REVENUE ANALYSIS

- 8.3.1 REVENUE ANALYSIS OF TOP 3 PLAYERS, 2021-2024

- 8.4 MARKET SHARE ANALYSIS, 2024

- 8.4.1 MARKET SHARE ANALYSIS

- 8.4.2 RANKING OF KEY MARKET PLAYERS

- 8.4.2.1 LANXESS

- 8.4.2.2 Wuhan Youji Holdings Ltd.

- 8.4.2.3 Eastman Chemical Company

- 8.4.2.4 Tianjin Dongda Chemical Group Co., Ltd.

- 8.4.2.5 Tengzhou Tenglong Food Technology Development Co., Ltd.

- 8.4.3 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 8.4.3.1 Company footprint

- 8.4.3.2 Region footprint

- 8.4.3.3 Application footprint

- 8.5 COMPETITIVE SCENARIO

- 8.5.1 PRODUCT LAUNCHES

- 8.5.2 DEALS

- 8.6 COMPANY VALUATION AND FINANCIAL METRICS

9 COMPANY PROFILES

- 9.1 KEY PLAYERS

- 9.1.1 LANXESS

- 9.1.1.1 Business overview

- 9.1.1.2 Products offered

- 9.1.1.3 Recent developments

- 9.1.1.3.1 Product launches

- 9.1.1.3.2 Deals

- 9.1.1.4 MnM view

- 9.1.1.4.1 Key strengths

- 9.1.1.4.2 Strategic choices

- 9.1.1.4.3 Weaknesses and competitive threats

- 9.1.2 WUHAN YOUJI HOLDINGS LTD.

- 9.1.2.1 Business overview

- 9.1.2.2 Products offered

- 9.1.2.3 Recent developments

- 9.1.2.3.1 Deals

- 9.1.2.3.2 Expansions

- 9.1.2.4 MnM view

- 9.1.2.4.1 Key strengths

- 9.1.2.4.2 Strategic choices

- 9.1.2.4.3 Weaknesses and competitive threats

- 9.1.3 TIANJIN DONGDA CHEMICAL GROUP CO., LTD

- 9.1.3.1 Business overview

- 9.1.3.2 Products offered

- 9.1.3.3 MnM View

- 9.1.3.3.1 Key strengths

- 9.1.3.3.2 Strategic choices

- 9.1.3.3.3 Weaknesses and competitive threats

- 9.1.4 EASTMAN CHEMICAL COMPANY

- 9.1.4.1 Business overview

- 9.1.4.2 Products offered

- 9.1.4.3 Recent developments

- 9.1.4.3.1 Deals

- 9.1.4.4 MnM view

- 9.1.4.4.1 Key strengths

- 9.1.4.4.2 Strategic choices

- 9.1.4.4.3 Weaknesses and competitive threats

- 9.1.5 TENGZHOU TENGLONG FOOD TECHNOLOGY DEVELOPMENT CO., LTD.

- 9.1.5.1 Business overview

- 9.1.5.2 Products offered

- 9.1.5.3 MnM view

- 9.1.5.3.1 Key strengths

- 9.1.5.3.2 Strategic choices

- 9.1.5.3.3 Weaknesses and competitive threats

- 9.1.1 LANXESS

10 ADJACENT AND RELATED MARKETS

- 10.1 INTRODUCTION

- 10.2 LIMITATIONS

- 10.3 SODIUM BENZOATE MARKET: INTERCONNECTED MARKET/S

- 10.4 BENZOATES MARKET: GLOBAL FORECAST TO 2027

- 10.4.1 MARKET DEFINITION

- 10.4.2 MARKET OVERVIEW

- 10.4.2.1 Potassium benzoate

- 10.4.2.2 Sodium benzoate

- 10.4.2.3 Ammonium benzoate

- 10.4.2.4 Others

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SODIUM BENZOATE MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY COUNTRY, 2021-2024

- TABLE 3 UNEMPLOYMENT RATE, BY COUNTRY, 2021-2024 (%)

- TABLE 4 INFLATION RATE (AVERAGE CONSUMER PRICES), BY COUNTRY, 2021-2024 (%)

- TABLE 5 FOREIGN DIRECT INVESTMENT, 2023 VS. 2024 (USD BILLION)

- TABLE 6 SODIUM BENZOATE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 SODIUM BENZOATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 SODIUM BENZOATE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 AVERAGE SELLING PRICE OF SODIUM BENZOATE, BY REGION, 2022-2025 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE OF SODIUM BENZOATE, BY APPLICATION, 2022-2025 (USD/KG)

- TABLE 11 SODIUM BENZOATE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 12 SODIUM BENZOATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 13 SODIUM BENZOATE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 14 SODIUM BENZOATE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 15 SODIUM BENZOATE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 16 SODIUM BENZOATE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17 SODIUM BENZOATE MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 18 SODIUM BENZOATE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 19 ASIA PACIFIC: SODIUM BENZOATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 20 ASIA PACIFIC: SODIUM BENZOATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 21 ASIA PACIFIC: SODIUM BENZOATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 22 ASIA PACIFIC: SODIUM BENZOATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 23 EUROPE: SODIUM BENZOATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 24 EUROPE: SODIUM BENZOATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 25 EUROPE: SODIUM BENZOATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 26 EUROPE: SODIUM BENZOATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 27 NORTH AMERICA: SODIUM BENZOATE MARKET BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 28 NORTH AMERICA: SODIUM BENZOATE MARKET BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: SODIUM BENZOATE MARKET BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 30 NORTH AMERICA: SODIUM BENZOATE MARKET BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 31 SODIUM BENZOATE: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 32 SODIUM BENZOATE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 33 SODIUM BENZOATE MARKET: REGION FOOTPRINT (5 COMPANIES)

- TABLE 34 SODIUM BENZOATE MARKET: APPLICATION FOOTPRINT (5 COMPANIES)

- TABLE 35 SODIUM BENZOATE MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 36 SODIUM BENZOATE MARKET: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 37 LANXESS: COMPANY OVERVIEW

- TABLE 38 LANXESS: PRODUCTS OFFERED

- TABLE 39 LANXESS: PRODUCT LAUNCHES

- TABLE 40 LANXESS: DEALS

- TABLE 41 WUHAN YOUJI HOLDINGS LTD.: COMPANY OVERVIEW

- TABLE 42 WUHAN YOUJI HOLDINGS LTD.: PRODUCTS OFFERED

- TABLE 43 WUHAN YOUJI HOLDINGS LTD.: DEALS

- TABLE 44 WUHAN YOUJI HOLDINGS LTD.: EXPANSIONS

- TABLE 45 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 46 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 47 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 48 EASTMAN CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 49 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 50 TENGZHOU TENGLONG FOOD TECHNOLOGY DEVELOPMENT CO., LTD: PRODUCTS OFFERED

- TABLE 51 BENZOATES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 52 BENZOATES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 SODIUM BENZOATE MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 SODIUM BENZOATE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR SODIUM BENZOATE

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF SODIUM BENZOATE MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF SODIUM BENZOATE MARKET (2/2)

- FIGURE 8 SODIUM BENZOATE MARKET: DATA TRIANGULATION

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 RISING DEMAND FOR TOPICAL DRUGS AND LIQUID ORAL SYRUPS TO DRIVE SODIUM BENZOATE MARKET

- FIGURE 11 PHARMA SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD (2025-2030)

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SODIUM BENZOATE MARKET

- FIGURE 14 PAINT AND VARNISH EXPORTS (HS CODE 3209), 2020-2024

- FIGURE 15 VALUE CHAIN ANALYSIS OF SODIUM BENZOATE MARKET

- FIGURE 16 SODIUM BENZOATE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS: SODIUM BENZOATE MARKET

- FIGURE 18 AVERAGE SELLING PRICE OF SODIUM BENZOATE, BY REGION, 2022-2025 (USD/KG)

- FIGURE 19 AVERAGE SELLING PRICE, BY APPLICATION, 2022-2025 (USD/KG)

- FIGURE 20 NUMBER OF PATENTS YEAR-WISE, 2014-2024

- FIGURE 21 FOOD & BEVERAGES TO BE LARGEST APPLICATION OF SODIUM BENZOATE IN 2025

- FIGURE 22 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 23 ASIA PACIFIC: SODIUM BENZOATE MARKET SNAPSHOT

- FIGURE 24 EUROPE: SODIUM BENZOATE MARKET SNAPSHOT

- FIGURE 25 NORTH AMERICA: SODIUM BENZOATE MARKET SNAPSHOT

- FIGURE 26 SODIUM BENZOATE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2021-2024 (USD BILLION)

- FIGURE 27 SODIUM BENZOATE MARKET SHARE ANALYSIS, 2024

- FIGURE 28 RANKING OF KEY PLAYERS IN SODIUM BENZOATE MARKET, 2024

- FIGURE 29 SODIUM BENZOATE MARKET: COMPANY FOOTPRINT

- FIGURE 30 SODIUM BENZOATE MARKET: EV/EBITDA, 2025

- FIGURE 31 SODIUM BENZOATE MARKET: ENTERPRISE VALUE, 2025 (USD BILLION)

- FIGURE 32 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 33 LANXESS: COMPANY SNAPSHOT

- FIGURE 34 WUHAN YOUJI HOLDINGS LTD.: COMPANY SNAPSHOT

- FIGURE 35 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT