|

市場調查報告書

商品編碼

1877355

全球暖通空調管路市場按分銷管道、材質、最終用途產業、實施方式及地區分類-預測至2030年HVAC Lineset Market by Material Type (Copper, Low Carbon, Other Material Types), Implementation (New Construction, Retrofit), End-use Industry (Commercial, Industrial, Residential), and Region - Global Forecast to 2030 |

||||||

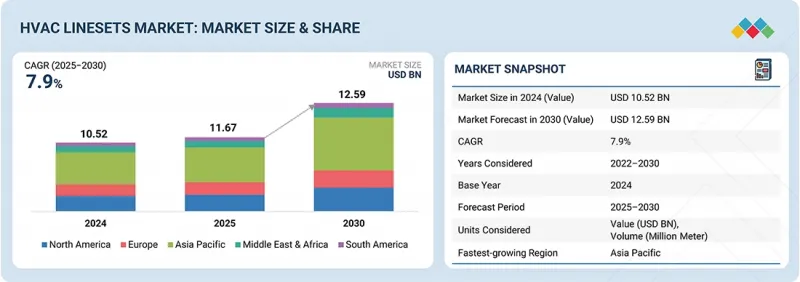

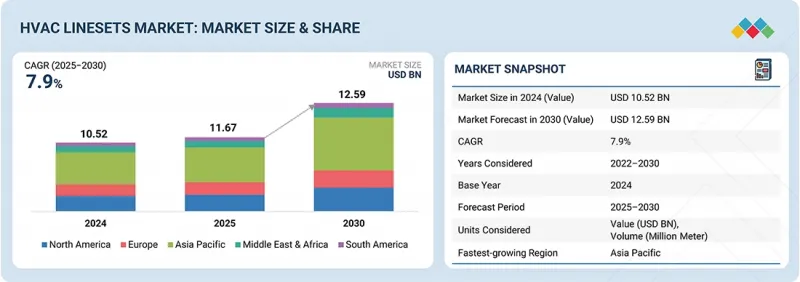

預計到 2025 年,HVAC 管路系統市場規模將達到 116.7 億美元,到 2030 年將達到 125.9 億美元,預測期內複合年成長率為 7.9%。

日益嚴格的建築能效和永續性法規推動了對節能環保型暖通空調系統需求的成長。快速的都市化以及住宅和商業建築的持續建設,促使暖通空調設備的安裝量不斷增加,進而帶動了對管線組件的需求。

| 調查範圍 | |

|---|---|

| 調查期 | 2022-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 價值(百萬美元)/數量(百萬米) |

| 部分 | 按分銷管道、材質、最終用途行業、包裝和地區分類 |

| 目標區域 | 北美洲、歐洲、亞太地區、南美洲、中東和非洲 |

此外,智慧化、物聯網賦能的高性能暖通空調系統的發展正在推動對密封管路組件的需求。為符合美國環保署《AIM法案》和F-Gas法規的要求,向低全球暖化潛勢(GWP)冷媒的過渡正在推動管路組件的重新設計,以提高其性能和安全性。此外,暖通空調維修和更換市場也將持續支撐售後市場對管路組件的需求。

低碳銅憑藉其卓越的性能、永續性,已成為暖通空調管路市場成長最快的材料類型。這種材料與傳統銅一樣具有優異的導熱性、耐腐蝕性和硬焊,同時顯著降低了碳足跡,符合整個產業的脫碳目標。為了滿足美國環保署《AIM法案》的要求以及企業永續發展目標(即減少暖通空調組件的排放),暖通空調製造商和安裝商越來越傾向於選擇低碳銅管路。此外,低碳銅還支援與下一代低永續性潛值(GWP)冷媒(例如R-32和R-454B)的兼容性,這些冷媒需要高度可靠且密封性良好的管道。威蘭集團(Wieland Group)和KME SE等主要銅生產商正在大力投資閉合迴路回收和低排放冶煉技術,進一步提高材料供應的安全性和成本效益。節能型暖通空調系統日益普及,LEED和能源之星等綠色建築認證的推廣,以及終端用戶對環保認證設備的需求,正在加速市場向低碳銅管線的轉型。這項轉變不僅提升了製造商的ESG(環境、社會和治理)信譽,也確保了其在以性能標準和永續性為雙重驅動的市場中的長期競爭力。

在暖通空調管路市場中,新建建築是成長第二快的安裝領域,這主要得益於快速都市化地區住宅、商業和公共建築計劃的激增。智慧城市的持續擴張,以及對節能基礎設施投資的增加,推動了對配備高性能管路的先進暖通空調系統的持續需求。新建建築中現代冷媒和高效能熱泵技術的日益普及,要求使用耐用、精密設計的管路,以確保最佳的熱性能和防止洩漏。政府推行的永續建築標準舉措,例如美國能源局的建築技術計畫和加拿大的淨零排放建築策略,進一步促進了在新暖通空調系統中安裝環保銅鋁管路。開發商也傾向於選擇工廠預保溫和預擴口的管路,這些管路具有安裝速度更快、人事費用更低、系統可靠性更高等優勢——這些特性在大型住宅和商業開發項目中尤為重要。此外,疫情後建築支出的復甦和郊區住宅的快速成長正在加速推動新建暖通空調系統的需求,而非維修。雖然維修應用在成熟市場仍占主導地位,但北美和亞太地區大量節能建築計劃預計將使新建項目在2030年前成為暖通空調管路市場第二大成長領域。

中東和非洲地區是全球暖通空調管路市場成長第二快的地區,這主要得益於快速的都市化、不斷擴大的建設活動以及人們對節能製冷解決方案日益成長的需求。該地區氣候條件惡劣,環境溫度高,因此對先進的暖通空調系統有著持續的需求,尤其是在住宅、商業和酒店業。沙烏地阿拉伯的NEOM新城、阿拉伯聯合大公國的智慧城市計畫以及卡達、埃及和南非的大型開發計劃等重大基礎設施項目,正在推動現代暖通空調系統的應用,而這些系統需要可靠耐用的管路。此外,各國政府正在加速綠色建築法規和永續性框架的實施,鼓勵使用環保材料和低全球暖化潛勢(GWP)冷媒,從而推動了對高品質銅鋁管路的需求。可支配收入的成長、人口的增加以及都市區住宅和商業設施的擴張,也進一步推動了空調設備的普及。此外,LG電子、大金和江森自控等國際空調製造商當地產業擴張,正在加強區域供應鏈和技術應用。加之資料中心、醫療設施和機場擴建等領域的投資不斷成長,預計到2030年,這些因素將使中東和非洲成為全球暖通空調管道組件成長速度第二快的區域市場。

本報告對全球 HVAC 管路市場進行了分析,按分銷管道、材質、最終用途行業、實施和地理位置進行細分,並對參與該市場的公司進行了概況介紹。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 介紹

- 市場動態

- 波特五力分析

- 主要相關人員和採購標準

- 總體經濟指標

- 價值鏈分析

- 監管狀態

- 貿易分析

- 生態系分析

- 影響客戶業務的趨勢與干擾因素

- 案例研究分析

- 技術分析

- 定價分析

- 大型會議和活動

- 專利分析

- 人工智慧/生成式人工智慧的影響

- 投資和資金籌措方案

- 2025年美國關稅

6. HVAC管線市場(依分銷通路分類)

- 介紹

- 直銷

- 零售

- 線上銷售

- 其他

第7章 HVAC管路市場(依材質)

- 介紹

- 管道

- 絕緣

8. HVAC管路市場(依最終用戶產業分類)

- 介紹

- 住宅

- 商業的

- 產業

9. HVAC管路系統市場(依應用領域分類)

- 介紹

- 新建工程

- 修改

第10章 各地區的暖通空調管路市場

- 介紹

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他

- 南美洲

- 巴西

- 阿根廷

- 其他

第11章 競爭格局

- 介紹

- 主要參與企業的策略/優勢,2021-2025年

- 2022-2024年收入分析

- 2024年市佔率分析

- 估值和財務指標

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭場景

第12章:公司簡介

- 主要參與企業

- HALCOR

- NORSK HYDRO ASA

- KME GERMANY GMBH

- MUELLER STREAMLINE CO.(MUELLER INDUSTRIES, INC.)

- CERRO FLOW PRODUCTS LLC

- PDM CORPORATION

- LINESETS INC.(MUELLER INDUSTRIES, INC.)

- ZHEJIANG HAILIANG CO., LTD.

- DIVERSITECH CORPORATION

- PTUBES, INC.(FEINROHREN SPA)

- 其他公司

- INABA DENKO AMERICA

- GREAT LAKES COPPER LTD.(MUELLER INDUSTRIES, INC.)

- HMAX

- ICOOL USA, INC.

- CAMBRIDGE-LEE INDUSTRIES LLC

- MM KEMBLA

- MANDEV TUBES

- UNIFLOW COPPER TUBES

- KMCT CORPORATION

- MEHTA TUBES LTD.

- JMF COMPANY

- KLIMA INDUSTRIES

- UNITED PIPE & STEEL

- THERMADUCT

第13章附錄

The HVAC linesets market is projected to reach USD 12.59 billion by 2030 from USD 11.67 billion in 2025, at a CAGR of 7.9% during the forecast period. The growing demand for energy-efficient and environmentally friendly HVAC systems is driven by stricter building energy and sustainability codes. Rapid urbanization and the ongoing construction of new residential and commercial buildings are increasing the installation of HVAC units, which in turn boosts the demand for linesets.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) / Volume (Million Meter) |

| Segments | Material Type, Implementation, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

Additionally, the development of smart, IoT-enabled, and high-performance HVAC systems has led to a higher need for leak-resistant linesets. The transition to refrigerants with lower global warming potential (GWP), in accordance with the US EPA AIM Act and F-Gas regulations, is prompting redesigns of linesets for improved performance and safety. Furthermore, the HVAC retrofit and replacement market will continue to support demand in the lineset aftermarket.

"Low carbon is the fastest-growing material type in the HVAC linesets market during the forecast period."

Low-carbon copper is emerging as the fastest-growing material type in the HVAC linesets market due to its superior balance of performance, sustainability, and regulatory compliance. The material offers excellent thermal conductivity, corrosion resistance, and brazing capability similar to traditional copper but with a significantly reduced carbon footprint, aligning with industry-wide decarbonization goals. HVAC manufacturers and contractors increasingly prefer low-carbon copper linesets to meet the US Environmental Protection Agency's AIM Act requirements and corporate sustainability targets that demand lower embodied emissions across HVAC components. Additionally, low-carbon copper supports compatibility with next-generation, low-GWP refrigerants such as R-32 and R-454B, which require high-integrity and leak-resistant tubing. Major copper producers like Wieland Group and KME SE are investing heavily in closed-loop recycling and low-emission smelting technologies, further enhancing material availability and cost efficiency. The combination of energy-efficient HVAC adoption, green building certifications such as LEED and ENERGY STAR, and end-user demand for eco-labeled equipment is accelerating the market shift toward low-carbon copper linesets. This transition not only strengthens manufacturers' ESG credentials but also ensures long-term competitiveness in a market driven by both performance standards and sustainability imperatives.

"New construction is the second-fastest-growing implementation segment in the HVAC linesets market during the forecast period."

New construction is the second fastest-growing implementation segment in the HVAC linesets market, driven by a surge in residential, commercial, and institutional building projects across rapidly urbanizing regions. The ongoing expansion of smart cities, coupled with rising investments in energy-efficient infrastructure, has fueled sustained demand for advanced HVAC systems equipped with high-performance linesets. New constructions increasingly integrate modern refrigerants and high-efficiency heat pump technologies, requiring durable and precisely engineered linesets to ensure optimal thermal performance and leak prevention. Government initiatives promoting sustainable building standards, such as the US Department of Energy's Building Technologies Program and Canada's Net-Zero Emissions Building Strategy, further stimulate installations of eco-friendly copper and aluminum linesets in new HVAC systems. Developers also favor factory-insulated and pre-flared linesets for faster installation, reduced labor costs, and enhanced system reliability-features highly valued in large-scale housing and commercial developments. Moreover, post-pandemic recovery in construction spending and the rapid growth of suburban housing are accelerating the demand for new HVAC installations rather than retrofits. While retrofit applications remain dominant in mature markets, the robust pipeline of energy-efficient building projects across North America and the Asia Pacific is positioning new construction as the second fastest-growing segment in the HVAC linesets market through 2030.

"The Middle East & Africa is the second-fastest growing region in the HVAC linesets market during the forecast period."

The Middle East & Africa is the second-fastest growing market in the HVAC linesets market, driven by rapid urbanization, expanding construction activity, and a growing focus on energy-efficient cooling solutions. The region's extreme climatic conditions, characterized by high ambient temperatures, create a continuous demand for advanced HVAC systems, particularly in residential, commercial, and hospitality sectors. Major infrastructure projects such as Saudi Arabia's NEOM City, the UAE's smart city initiatives, and large-scale developments across Qatar, Egypt, and South Africa are fueling installations of modern HVAC systems that require reliable and durable linesets. Additionally, governments are increasingly adopting green building regulations and sustainability frameworks, encouraging the use of eco-friendly materials and low-GWP refrigerants, which in turn drives demand for high-quality copper and aluminum linesets. Rising disposable incomes, population growth, and the expansion of urban housing and retail complexes further stimulate HVAC adoption. Moreover, the presence of international HVAC manufacturers expanding local operations, such as LG Electronics, Daikin, and Johnson Controls, enhances regional supply chains and technology penetration. Combined with growing investment in data centers, healthcare facilities, and airport expansions, these factors position the Middle East & Africa as the second-fastest-growing regional market for HVAC linesets through 2030.

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, and Middle East & Africa 5%

Mueller Streamline Co. (US), Cerro Flow Products LLC (US), JMF Company (US), Zhejiang ICE Loong Environmental Sci-Tech Co. Ltd. (China), Feinrohren S.p.A (Italy), Halcor (Greece), Hydro (Norway), KME SE (Germany), Diversitech Corporation (US), Inaba Denko (Japan), and Zhejiang Hailiang Co., Ltd (China), among others, are some of the key players in the HVAC linesets market. The study includes an in-depth competitive analysis of these key players in the HVAC linesets market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the HVAC linesets market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on material type, implementation, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the HVAC linesets market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall HVAC linesets market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (urbanization and increase in residential construction, growing trend of smart homes, rising demand for air conditioners, and increasing requirement for replacement and retrofitting HVAC systems), restraints (local cooling solutions, high installation and maintenance costs of HVAC systems, and rising environmental concerns), opportunities (rising global temperatures and heat islands and a combination of climate and income dynamics), challenges (passive cooling and free cooling solutions and adoption of new refrigerants).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the HVAC linesets market

- Market Development: Comprehensive information about lucrative markets - the report analyses the HVAC linesets market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the HVAC linesets market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Mueller Streamline Co. (US), Cerro Flow Products LLC (US), JMF Company (US), Zhejiang ICE Loong Environmental Sci-Tech Co. Ltd. (China), Fein Rohren S.p.A (Italy), Halcor (Greece), Hydro (Norway), KME SE (Germany), Diversitech Corporation (US), Inaba Denko (Japan), and Zhejiang Hailiang Co., Ltd (China), among others, are the top manufacturers covered in the HVAC linesets market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants: demand and supply side

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HVAC LINESET MARKET

- 4.2 HVAC LINESET MARKET, BY MATERIAL TYPE

- 4.3 HVAC LINESET MARKET, BY IMPLEMENTATION

- 4.4 HVAC LINESET MARKET, BY END-USE INDUSTRY

- 4.5 HVAC LINESET MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for energy-efficient HVAC systems

- 5.2.1.2 Increasing urbanization and ongoing residential construction

- 5.2.1.3 Heightened global demand for air conditioners

- 5.2.1.4 Replacement and retrofitting of HVAC systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and maintenance costs of HVAC systems

- 5.2.2.2 Skilled labor shortages and installation complexities

- 5.2.2.3 Growing environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High demand for cooling solutions amid increasing global warming

- 5.2.3.2 Surge in demand for low-GWP and environmentally friendly refrigerants

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions

- 5.2.4.2 Rapid evolution of regulatory and refrigerant landscape

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 NORTH AMERICA

- 5.7.1.1 US

- 5.7.1.2 Canada

- 5.7.2 ASIA PACIFIC

- 5.7.3 EUROPE

- 5.7.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 NORTH AMERICA

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 7411)

- 5.8.2 EXPORT SCENARIO (HS CODE 7411)

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 VRF SOLUTIONS ELEVATES NYC ELECTRIFICATION RETROFIT WITH INABA DENKO'S SLIMDUCT RD ROOFTOP LINESET PROTECTION

- 5.11.2 THERMADUCT STREAMLINES DETROIT MULTIFAMILY HVAC INSTALLATION WITH INSULATED LINESET PORTAL SYSTEM

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Pre-insulated linesets

- 5.12.1.2 Corrosion-resistant coatings

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 AI-enabled HVAC control systems

- 5.12.2.2 Heat pumps and VRF systems

- 5.12.1 KEY TECHNOLOGIES

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.13.2 AVERAGE SELLING PRICE OF HVAC LINESETS OFFERED BY KEY PLAYERS

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 PATENT ANALYSIS

- 5.16 IMPACT OF AI/GEN AI

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON KEY REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 HVAC LINESET MARKET, BY DISTRIBUTION CHANNEL

- 6.1 INTRODUCTION

- 6.2 DIRECT SALES

- 6.3 RETAIL

- 6.4 ONLINE SALES

- 6.5 OTHERS

7 HVAC LINESET MARKET, BY MATERIAL TYPE

- 7.1 INTRODUCTION

- 7.2 TUBING

- 7.2.1 RISING DEMAND FOR ENERGY-EFFICIENT AIR CONDITIONING SYSTEMS AND RETROFITTING OF OLDER BUILDINGS TO DRIVE MARKET

- 7.2.2 COPPER

- 7.2.2.1 Advantages

- 7.2.2.1.1 Malleability

- 7.2.2.1.2 Easy to join

- 7.2.2.1.3 Durable

- 7.2.2.1.4 100% recyclable

- 7.2.2.2 Applications

- 7.2.2.1 Advantages

- 7.2.3 OTHERS

- 7.2.4 COPPER VS. LOW-CARBON LINESETS

- 7.3 INSULATION

- 7.3.1 ONGOING DEVELOPMENT OF ECO-FRIENDLY AND HALOGEN-FREE MATERIALS TO DRIVE MARKET

8 HVAC LINESET MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL

- 8.2.1 ELEVATED DEMAND FOR AIR CONDITIONING SYSTEMS DUE TO EXPANDING GLOBAL POPULATION TO DRIVE MARKET

- 8.3 COMMERCIAL

- 8.3.1 IMPLEMENTATION OF STRINGENT ENERGY EFFICIENCY REGULATIONS TO DRIVE MARKET

- 8.4 INDUSTRIAL

- 8.4.1 EMPHASIS ON ENERGY EFFICIENCY, SUSTAINABILITY, AND COMPLIANCE WITH REGULATIONS TO DRIVE MARKET

9 HVAC LINESET MARKET, BY IMPLEMENTATION

- 9.1 INTRODUCTION

- 9.2 NEW CONSTRUCTION

- 9.2.1 RAPID URBANIZATION AND ROBUST ECONOMIC GROWTH TO DRIVE MARKET

- 9.3 RETROFIT

- 9.3.1 PUSH FOR SUSTAINABILITY TO DRIVE MARKET

10 HVAC LINESET MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Rapid urbanization and economic development to drive market

- 10.2.2 INDIA

- 10.2.2.1 Favorable government initiatives to drive market

- 10.2.3 JAPAN

- 10.2.3.1 Presence of leading HVAC system manufacturers to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Rising demand for smart home integration to drive market

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Surge in construction activities to drive market

- 10.3.2 CANADA

- 10.3.2.1 Rise of new housing projects to drive market

- 10.3.3 MEXICO

- 10.3.3.1 Heightened installations of HVAC systems to drive market

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Surge in construction of residential infrastructure to drive market

- 10.4.2 UK

- 10.4.2.1 Government subsidies for HVAC systems to drive market

- 10.4.3 FRANCE

- 10.4.3.1 Policy and financial incentives for building renovation and low-carbon heating to drive market

- 10.4.4 ITALY

- 10.4.4.1 Investments in residential buildings and renovation activities to drive market

- 10.4.5 SPAIN

- 10.4.5.1 High demand for commercial air conditioning units to drive market

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 SAUDI ARABIA

- 10.5.1.1 Trend of small and affordable housing units to drive market

- 10.5.2 UAE

- 10.5.2.1 Projects aimed at promoting economic development to drive market

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Regional copper trade expansion to drive market

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.1 SAUDI ARABIA

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Rapid industrial growth to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Economic stabilization to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 HALCOR

- 11.4.2 NORSK HYDRO ASA

- 11.4.3 KME GERMANY GMBH

- 11.4.4 MUELLER STREAMLINE CO.

- 11.4.5 ZHEJIANG HAILIANG CO., LTD.

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Material type footprint

- 11.7.5.4 Implementation footprint

- 11.7.5.5 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 11.8.5.1 List of start-ups/SMEs

- 11.8.5.2 Competitive benchmarking of start-ups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 HALCOR

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 NORSK HYDRO ASA

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 KME GERMANY GMBH

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 MUELLER STREAMLINE CO. (MUELLER INDUSTRIES, INC.)

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 CERRO FLOW PRODUCTS LLC

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 PDM CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.4 MnM view

- 12.1.7 LINESETS INC. (MUELLER INDUSTRIES, INC.)

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 MnM view

- 12.1.8 ZHEJIANG HAILIANG CO., LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.4 MnM view

- 12.1.9 DIVERSITECH CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.4 MnM view

- 12.1.10 PTUBES, INC. (FEINROHREN S.P.A.)

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 MnM view

- 12.1.1 HALCOR

- 12.2 OTHER PLAYERS

- 12.2.1 INABA DENKO AMERICA

- 12.2.2 GREAT LAKES COPPER LTD. (MUELLER INDUSTRIES, INC.)

- 12.2.3 HMAX

- 12.2.4 ICOOL USA, INC.

- 12.2.5 CAMBRIDGE-LEE INDUSTRIES LLC

- 12.2.6 MM KEMBLA

- 12.2.7 MANDEV TUBES

- 12.2.8 UNIFLOW COPPER TUBES

- 12.2.9 KMCT CORPORATION

- 12.2.10 MEHTA TUBES LTD.

- 12.2.11 JMF COMPANY

- 12.2.12 KLIMA INDUSTRIES

- 12.2.13 UNITED PIPE & STEEL

- 12.2.14 THERMADUCT

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 3 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 4 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 IMPORT SCENARIO FOR HS CODE 7411-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT SCENARIO FOR HS CODE 7411-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 11 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/METER)

- TABLE 12 AVERAGE SELLING PRICE OF HVAC LINESETS OFFERED BY KEY PLAYERS, 2024 (USD/METER)

- TABLE 13 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 16 HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 17 HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (MILLION METER)

- TABLE 18 HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (MILLION METER)

- TABLE 19 COPPER VS. LOW-CARBON LINESETS

- TABLE 20 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 21 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 22 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 23 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 24 HVAC LINESET MARKET, BY IMPLEMENTATION, 2022-2024 (USD MILLION)

- TABLE 25 HVAC LINESET MARKET, BY IMPLEMENTATION, 2025-2030 (USD MILLION)

- TABLE 26 HVAC LINESET MARKET, BY IMPLEMENTATION, 2022-2024 (MILLION METER)

- TABLE 27 HVAC LINESET MARKET, BY IMPLEMENTATION, 2025-2030 (MILLION METER)

- TABLE 28 HVAC LINESET MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 29 HVAC LINESET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 HVAC LINESET MARKET, BY REGION, 2022-2024 (MILLION METER)

- TABLE 31 HVAC LINESET MARKET, BY REGION, 2025-2030 (MILLION METER)

- TABLE 32 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 33 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 34 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (MILLION METER)

- TABLE 35 ASIA PACIFIC: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (MILLION METER)

- TABLE 36 ASIA PACIFIC: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 37 ASIA PACIFIC: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (MILLION METER)

- TABLE 39 ASIA PACIFIC: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (MILLION METER)

- TABLE 40 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 41 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 43 ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 44 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 45 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 46 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 47 CHINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 48 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 49 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 50 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 51 INDIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 52 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 53 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 54 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 55 JAPAN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 56 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 57 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 58 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 59 SOUTH KOREA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 60 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 63 REST OF ASIA PACIFIC: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 64 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (MILLION METER)

- TABLE 67 NORTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (MILLION METER)

- TABLE 68 NORTH AMERICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (MILLION METER)

- TABLE 71 NORTH AMERICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (MILLION METER)

- TABLE 72 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 75 NORTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 76 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 77 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 78 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 79 US: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 80 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 81 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 82 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 83 CANADA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 84 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 85 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 86 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 87 MEXICO: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 88 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 89 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (MILLION METER)

- TABLE 91 EUROPE: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (MILLION METER)

- TABLE 92 EUROPE: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 93 EUROPE: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (MILLION METER)

- TABLE 95 EUROPE: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (MILLION METER)

- TABLE 96 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 97 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 99 EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 100 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 101 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 102 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 103 GERMANY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 104 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 105 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 106 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 107 UK: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 108 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 109 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 110 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 111 FRANCE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 112 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 113 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 114 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 115 ITALY: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 116 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 117 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 118 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 119 SPAIN: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 120 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 121 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 123 REST OF EUROPE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 124 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (MILLION METER)

- TABLE 127 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (MILLION METER)

- TABLE 128 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (MILLION METER)

- TABLE 131 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (MILLION METER)

- TABLE 132 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 135 MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY 2025-2030 (MILLION METER)

- TABLE 136 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 137 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 138 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 139 SAUDI ARABIA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 140 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 141 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 142 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 143 UAE: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 144 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 145 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 146 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 147 SOUTH AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 152 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 153 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 154 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2022-2024 (MILLION METER)

- TABLE 155 SOUTH AMERICA: HVAC LINESET MARKET, BY COUNTRY, 2025-2030 (MILLION METER)

- TABLE 156 SOUTH AMERICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (USD MILLION)

- TABLE 157 SOUTH AMERICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2022-2024 (MILLION METER)

- TABLE 159 SOUTH AMERICA: HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (MILLION METER)

- TABLE 160 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 161 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 162 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 163 SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 164 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 165 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 166 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 167 BRAZIL: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 168 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 169 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 170 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 171 ARGENTINA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 172 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION METER)

- TABLE 175 REST OF SOUTH AMERICA: HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION METER)

- TABLE 176 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 177 HVAC LINESET MARKET: DEGREE OF COMPETITION

- TABLE 178 REGION FOOTPRINT

- TABLE 179 MATERIAL TYPE FOOTPRINT

- TABLE 180 IMPLEMENTATION FOOTPRINT

- TABLE 181 END-USE INDUSTRY FOOTPRINT

- TABLE 182 LIST OF START-UPS/SMES

- TABLE 183 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 184 HVAC LINESET MARKET: DEALS, 2021-2025

- TABLE 185 HVAC LINESET MARKET: EXPANSIONS, 2021-2025

- TABLE 186 HALCOR: COMPANY OVERVIEW

- TABLE 187 HALCOR: PRODUCTS OFFERED

- TABLE 188 NORSK HYDRO ASA: COMPANY OVERVIEW

- TABLE 189 NORSK HYDRO ASA: PRODUCTS OFFERED

- TABLE 190 NORSK HYDRO ASA: DEALS

- TABLE 191 KME GERMANY GMBH: COMPANY OVERVIEW

- TABLE 192 KME GERMANY GMBH: PRODUCTS OFFERED

- TABLE 193 MUELLER STREAMLINE CO.: COMPANY OVERVIEW

- TABLE 194 MUELLER STREAMLINE CO.: PRODUCTS OFFERED

- TABLE 195 MUELLER STREAMLINE CO.: DEALS

- TABLE 196 CERRO FLOW PRODUCTS LLC: COMPANY OVERVIEW

- TABLE 197 CERRO FLOW PRODUCTS LLC: PRODUCTS OFFERED

- TABLE 198 PDM CORPORATION: COMPANY OVERVIEW

- TABLE 199 PDM CORPORATION: PRODUCTS OFFERED

- TABLE 200 PDM CORPORATION: EXPANSIONS

- TABLE 201 LINESETS INC.: COMPANY OVERVIEW

- TABLE 202 LINESETS INC.: PRODUCTS OFFERED

- TABLE 203 ZHEJIANG HAILIANG CO., LTD.: COMPANY OVERVIEW

- TABLE 204 ZHEJIANG HAILIANG CO., LTD.: PRODUCTS OFFERED

- TABLE 205 ZHEJIANG HAILIANG CO., LTD.: DEALS

- TABLE 206 DIVERSITECH CORPORATION: COMPANY OVERVIEW

- TABLE 207 DIVERSITECH CORPORATION: PRODUCTS OFFERED

- TABLE 208 DIVERSITECH CORPORATION: DEALS

- TABLE 209 PTUBES, INC.: COMPANY OVERVIEW

- TABLE 210 PTUBES, INC.: PRODUCTS OFFERED

- TABLE 211 INABA DENKO AMERICA: COMPANY OVERVIEW

- TABLE 212 GREAT LAKES COPPER LTD.: COMPANY OVERVIEW

- TABLE 213 HMAX: COMPANY OVERVIEW

- TABLE 214 ICOOL USA, INC.: COMPANY OVERVIEW

- TABLE 215 CAMBRIDGE-LEE INDUSTRIES LLC: COMPANY OVERVIEW

- TABLE 216 MM KEMBLA: COMPANY OVERVIEW

- TABLE 217 MANDEV TUBES: COMPANY OVERVIEW

- TABLE 218 UNIFLOW COPPER TUBES: COMPANY OVERVIEW

- TABLE 219 KMCT CORPORATION: COMPANY OVERVIEW

- TABLE 220 MEHTA TUBES LTD.: COMPANY OVERVIEW

- TABLE 221 JMF COMPANY: COMPANY OVERVIEW

- TABLE 222 KLIMA INDUSTRIES: COMPANY OVERVIEW

- TABLE 223 UNITED PIPE & STEEL: COMPANY OVERVIEW

- TABLE 224 THERMADUCT: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HVAC LINESET MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH AND TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION NOTES

- FIGURE 5 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 TUBING TO BE LARGER THAN INSULATION DURING FORECAST PERIOD

- FIGURE 8 COMMERCIAL SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 9 RETROFIT TO RECORD FASTER GROWTH THAN NEW CONSTRUCTION DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 11 SURGE IN DEMAND FOR ENERGY-EFFICIENT HVAC SYSTEMS TO DRIVE MARKET

- FIGURE 12 TUBING SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 13 NEW CONSTRUCTION TO BE LARGER THAN RETROFIT DURING FORECAST PERIOD

- FIGURE 14 COMMERCIAL TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 15 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 HVAC LINESET MARKET DYNAMICS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 19 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 IMPORT DATA FOR HS CODE 7411-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 22 EXPORT DATA FOR HS CODE 7411-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 23 ECOSYSTEM ANALYSIS

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/METER)

- FIGURE 26 PATENT ANALYSIS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 28 HVAC LINESET MARKET, BY MATERIAL TYPE, 2025-2030 (USD MILLION)

- FIGURE 29 HVAC LINESET MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- FIGURE 30 HVAC LINESET MARKET, BY IMPLEMENTATION, 2025-2030 (USD MILLION)

- FIGURE 31 HVAC LINESET MARKET, BY COUNTRY, 2025-2030

- FIGURE 32 ASIA PACIFIC: HVAC LINESET MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: HVAC LINESET MARKET SNAPSHOT

- FIGURE 34 EUROPE: HVAC LINESET MARKET SNAPSHOT

- FIGURE 35 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2022-2024

- FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 37 COMPANY VALUATION (USD BILLION)

- FIGURE 38 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 39 BRAND/PRODUCT COMPARISON

- FIGURE 40 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 COMPANY FOOTPRINT

- FIGURE 42 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 43 HALCOR: COMPANY SNAPSHOT

- FIGURE 44 NORSK HYDRO ASA: COMPANY SNAPSHOT

- FIGURE 45 MUELLER STREAMLINE CO.: COMPANY SNAPSHOT