|

市場調查報告書

商品編碼

1876465

全球地面行動無線(LMR) 市場(至 2030 年)按類型(攜帶式/車載式)、技術和頻段(25-174MHz、200-512MHz 和 700MHz 以上)分類Land Mobile Radio Market by Type (Hand Portable, In-Vehicle), Technology, Frequency (25-174 MHz, 200-512 MHz, 700 MHZ & above) - Global Forecast to 2030 |

||||||

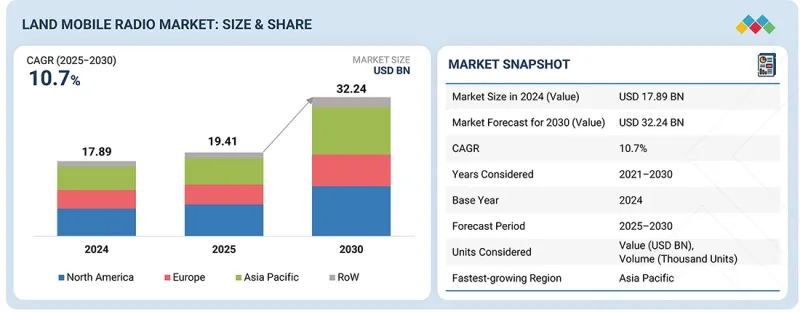

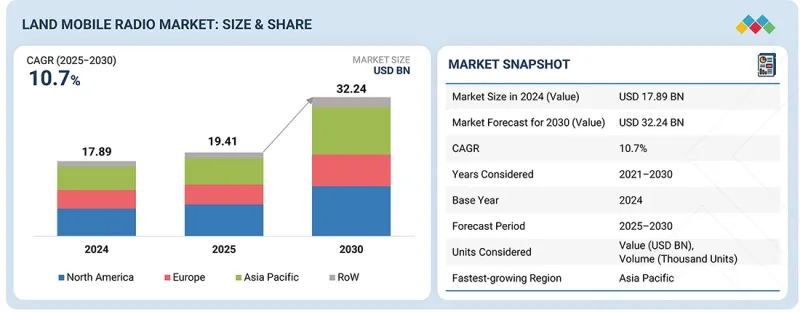

預計地面行動無線(LMR) 市場將從 2024 年的 178.9 億美元成長到 2030 年的 322.4 億美元,2025 年至 2030 年的複合年成長率為 10.7%。

陸地移動無線電(LMR)服務被警察、消防和緊急醫療服務部門用於與指揮中心進行互通性和協調。 LMR服務通訊廣,可遠距使用,高度可靠。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元) |

| 部分 | 按技術、類型、頻率、應用和區域分類 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

此外,LMR系統還具有在行動電話覆蓋不到或手機連接不穩定的地區發揮作用的潛力。同時,公共部門也擴大採用這些方法作為其最關鍵的通訊鏈路。

「按類型分類,在預測期內,攜帶式的增速將超過車載(移動)設備。”

攜帶式無線電因其便利的移動性,被安全負責人和建築、電力等行業的員工廣泛使用。雖然車載通訊設備也能在行駛過程中運作,但攜帶式兼具行動性和基本功能。此外,這些攜帶式無線電通訊即時訊息,無需現場等待,即可將訊息直接傳遞給所有操作人員,從而提高職場效率。

從技術角度來看,在預測期內,數位技術將在市場佔有率上超越類比技術。

數位陸地行動無線電 (LMR) 系統擁有傳統雙向無線對講機系統所不具備的獨特功能,例如文字通訊、遙測和高品質資料傳輸。它採用分時多工(TDM) 和頻分複用 (FDM) 等先進技術,能夠有效利用無線電頻譜。數位 LMR 的主要優勢在於其音訊品質的提升,這得益於先進的糾錯和噪音抑制技術。此外,數位 LMR 的容量也比類比系統更大,允許多個用戶同時共用單一頻道。

預計在預測期內,美國將佔據北美最大的市場佔有率。

美國市場的成長歸功於主要企業的存在以及政府對滿足日益成長的陸地行動無線電(LMR)需求的重視,包括先進的資訊服務(LTE)、群組通訊和4G技術,以及為各種行動分配高頻率。在美國,LMR設備的主要客戶是政府相關人員及其主要承包商,他們需要用於軍事和商業用途的先進加密解決方案。此外,在軍事和商業領域,安全負責人使用各種無線電系統,包括車載無線電、手持無線電和機載無線電,這些系統使用不同的頻段進行通訊和資料通訊。

本報告調查了全球地面行動無線(LMR) 市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、按各個細分市場、地區/主要國家/地區進行的詳細分析、競爭格局以及主要企業的概況。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 一級/二級/三級公司的策略性舉措

第5章 產業趨勢

- 波特五力分析

- 宏觀經濟展望

- 價值鏈分析

- 生態系分析

- 定價分析

- 貿易分析

- 大型會議和活動

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 案例研究分析

- 美國關稅

第6章:透過科技、專利、數位化和人工智慧的應用實現策略顛覆

- 主要技術

- 互補技術

- 鄰近技術

- 技術藍圖

- 專利分析

- 人工智慧將如何影響陸地移動機器人市場

- 相互關聯的鄰近市場生態系統及其對市場參與者的影響

第7章 監理環境

- 地方法規和合規性

第8章:顧客狀況與購買行為

- 決策流程

- 主要相關利益者和採購評估標準

- 招募障礙和內部挑戰

- 各行業尚未滿足的需求

第9章地面行動無線(LMR)市場按類型分類

- 攜帶式的

- 車載(移動)

第10章 按技術分類的地面行動無線(LMR)市場

- 模擬

- 數位的

- TETRA

- DIGITAL MOBILE RADIO

- PROJECT 25

第11章 依頻率分類的地面行動無線(LMR)市場

- 25-174 MHz (VHF)

- 200~512 MHz (UHF)

- 700 MHz 以上(超高頻)

第12章地面行動無線(LMR)市場依應用領域分類

- 商業的

- 零售

- 運輸

- 公用事業

- 礦業

- 其他

- 公安

- 軍事/國防

- 國防安全保障

- 緊急醫療服務

- 消防部門

- 其他

第13章地面行動無線(LMR)市場區域分類

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 其他

- 亞太地區

- 宏觀經濟展望

- 中國

- 日本

- 韓國

- 印度

- 其他

- 其他地區

- 宏觀經濟展望

- 中東和非洲

- 南美洲

第14章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收入分析

- 市佔率分析

- 估值和財務指標

- 品牌/產品對比

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小企業

- 競爭場景

第15章:公司簡介

- 主要企業

- SEPURA LIMITED

- MOTOROLA SOLUTIONS, INC.

- L3HARRIS TECHNOLOGIES, INC.

- JVCKENWOOD CORPORATION

- THALES

- ICOM INC.

- BK TECHNOLOGIES

- HYTERA COMMUNICATIONS CORPORATION LIMITED

- LEONARDO SPA

- CODAN LIMITED

- 其他公司

- WEAVIX

- REPLAY INC

- GOTENNA

- TALKPOD TECHNOLOGY CO., LTD.

- QUANZHOU YANTON ELECTRONICS CO., LTD

- KMOBILE COMMUNICATION CO., LTD (ESTALKY)

- COMMCRETE

- ESCHAT

- BOTTLE

- BEARTOOTH

- AIRACOM LIMITED

- TELDIO CORPORATION

- COMMUNICATIONS-APPLIED TECHNOLOGY

- ZETRON

- POWERTRUNK

第16章調查方法

第17章附錄

The land mobile radio market is projected to grow from USD 17.89 billion in 2024 to reach USD 32.24 billion by 2030, growing at a CAGR of 10.7% from 2025 to 2030. Land mobile radio services are used by police, fire, and emergency medical service agencies for interoperability amongst themselves as well as with dispatch centers. Land mobile radio services have a wide range that extends over long distances, which makes them dependable.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Type, Frequency, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Furthermore, LMR systems may be utilized in areas devoid of any mobile phone signal whatsoever or those with an erratic pattern of cell connectivity. At the same time, public safety departments are progressively employing these methods on the most essential lines of communication.

"By type, the hand-portable segment is projected to witness a higher growth rate than the in-vehicle (mobile) segment during the forecast period."

Hand-portable radios are widely utilized by safety officials and employees in sectors like building and power supply, providing ease of movement and comfort. Mobile communication devices in cars work during travel, but portable ones provide mobility and basic features. Additionally, instant messaging is facilitated through these hand-held radios. They eliminate languidness and facilitate issues targeted to all operators directly, leading to an increase in workplace effectiveness.

"By technology, the digital segment is projected to account for a larger market share than the analog segment during the forecast period."

Digital land mobile radio brings out unique aspects of conventional two-way radio systems, including text messaging, telemetry, and high-quality transmission of data. They allow better utilization of radio spectrum by employing sophisticated techniques like time-division multiplexing (TDM) and frequency-division multiplexing (FDM). The significant benefits accruing from using digital LMR are enhanced sound quality resulting from advanced error correction as well as noise suppression methods. Additionally, digital LMRs possess more room compared to their analog counterparts; hence, numerous users could share one channel at a time.

"The US is projected to account for the largest market size in North America during the forecast period."

The growth of the US market is due to the presence of major players and the government's focus on meeting the increasing demand for land mobile radios, including advanced data services (LTE), group communications, 4th generation technology, as well as allocating high-frequency bands for versatile operations. Major customers of LMR devices in the US are government officials and their prime contractors who require high-level encryption solutions for military and commercial purposes. Moreover, in the military and commercial sectors, safety personnel use various radio systems, such as vehicle-mounted radios, hand-held radios, or airborne radios, which operate on different frequencies for voice and data communication.

The study contains insights from various industry experts, such as component suppliers, Tier 1 companies, and OEMs. Extensive primary interviews were conducted with key industry experts in the land mobile radio market space to determine and verify the market size for various segments and subsegments gathered through secondary research.

The breakdown of primary participants for the report is shown below.

- By Company Type: Tier 1 - 20%, Tier 2 - 25%, and Tier 3 - 55%

- By Designation: C-level Executives - 30%, Directors - 30%, and Others - 40%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, and RoW - 10%

Notes:

- Others include Technology Heads, Media Analysts, Sales Managers, Marketing Managers, and Product Managers.

The three tiers of companies are based on their total revenue as of 2024. Given below is the classification of tiers:

Tier : > USD 1 billion; Tier 2: USD 500 million-1 billion; and Tier 3: < USD 500 million

Prominent players profiled in this report include Sepura Limited (UK), Motorola Solutions, Inc. (US), L3Harris Technologies, Inc. (US), JVCKENWOOD Corporation (Japan), Thales (France), Icom Inc. (Japan), BK Technologies (US), Hytera Communications Corporation Limited (China), Leonardo S.p.A. (Italy), and Codan Limited (Australia). Scottish Communications Group (UK), JNB Electronics PTY LTD. (Australia), Burk Technology (US), Anritsu (Japan), Midland Radio (US), Maxon America, Inc. (US), Helios (Australia), Retevis (China), Crescend Technologies, LLC3 (US), Viavi Solutions Inc. (US), Tait Communications (New Zealand), Simoco Wireless Solutions (UK), Entel Group (UK), Tera (US), and PierCon Solutions (US).

Report Coverage

The report defines, describes, and forecasts the land mobile radio market based on type, technology, frequency, application, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the land mobile radio market. Additionally, it analyzes competitive developments, such as acquisitions, product launches, expansions, and actions carried out by the key players.

Reasons to Buy This Report

The report will help market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall land mobile radio market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. It will help them understand the pulse of the market and will provide them with information on key drivers, restraints, opportunities, and challenges.

Additionally, the report will provide insights into the following pointers:

- Analysis of key drivers (Transition from analog to digital LMR technologies), restraints (High deployment and maintenance costs for large-scale LMR infrastructure), opportunities (Integration of LMR with IoT, GPS, and data analytics for advanced field operations), and challenges (Interoperability issues between multi-vendor and multi-technology systems) of the land mobile radio market

- Product development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the land mobile radio market

- Market Development: Comprehensive information about lucrative markets across various regions

- Market Diversification: Exhaustive information about products launched, untapped geographies, recent developments, and investments in the land mobile radio market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players like Sepura Limited (UK), Motorola Solutions, Inc. (US), L3Harris Technologies, Inc. (US), JVCKENWOOD Corporation (Japan), and Thales (France), among others, in the land mobile radio market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING LAND MOBILE RADIO MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAND MOBILE RADIO MARKET

- 3.2 LAND MOBILE RADIO MARKET, BY TECHNOLOGY

- 3.3 LAND MOBILE RADIO MARKET, BY TYPE

- 3.4 LAND MOBILE RADIO MARKET, BY FREQUENCY

- 3.5 LAND MOBILE RADIO MARKET, BY APPLICATION

- 3.6 LAND MOBILE RADIO MARKET, BY REGION

- 3.7 LAND MOBILE RADIO MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Transition from analog to digital LMR technologies

- 4.2.1.2 Adoption of hybrid LMR-LTE/5G systems for seamless communication

- 4.2.1.3 Growing government investments in public safety and defense communication networks

- 4.2.1.4 Increasing demand for secure and encrypted communication channels

- 4.2.2 RESTRAINTS

- 4.2.2.1 High deployment and maintenance costs of large-scale LMR infrastructure

- 4.2.2.2 Limited spectrum availability and regulatory constraints

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of LMR with IoT, GPS, and data analytics for advanced field operations

- 4.2.3.2 Expansion in emerging markets driven by smart city and infrastructure projects

- 4.2.4 CHALLENGES

- 4.2.4.1 Interoperability issues between multi-vendor and multi-technology systems

- 4.2.4.2 Cybersecurity risks in digital and hybrid communication environments

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN LAND MOBILE RADIO MARKET

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT FROM NEW ENTRANTS

- 5.2.2 THREAT FROM SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL LAND MOBILE RADIO (LMR) MARKET

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIO TYPES, BY KEY PLAYER

- 5.6.2 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY FREQUENCY

- 5.6.3 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY APPLICATION

- 5.6.4 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA (HS CODE 852560)

- 5.7.2 EXPORT DATA (HS CODE 852560)

- 5.8 KEY CONFERENCES & EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT & FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 MOTOROLA HELPED OAKLAND COUNTY IMPLEMENT ADVANCED COMMUNICATION SOLUTION TO BOOST OPERATIONAL EFFICIENCY

- 5.11.2 ISTANBUL NEW AIRPORT IMPLEMENTED DIGITAL RADIO SYSTEM TO ENSURE RELIABLE AND SECURE COMMUNICATION ACROSS AIRPORT

- 5.11.3 CODON RADIO SOLUTIONS ASSISTED ROYAL MALAYSIA POLICE IN IMPLEMENTING NEW COMMUNICATION SYSTEM TO IMPROVE COVERAGE AND RELIABILITY

- 5.11.4 NESA IMPLEMENTED SEPURA SINE RAKEL SYSTEM TO PROVIDE IMPROVED COVERAGE AND INTEGRATION CAPABILITIES

- 5.11.5 THALES APPROVED IRISH DEFENSE FORCES' SOFTWARE-DEFINED RADIOS TO EXPEDITE DIGITAL TRANSFORMATION

- 5.12 US 2025 TARIFF

- 5.12.1 KEY TARIFF RATES

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT OF REGION/COUNTRY

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON KEY APPLICATIONS

- 5.12.4.1 Commercial

- 5.12.4.2 Public safety

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 KEY TECHNOLOGIES

- 6.1.1 DIGITAL SIGNAL PROCESSING

- 6.1.2 TRUNKED RADIO SYSTEMS

- 6.1.3 PUSH-TO-TALK OVER CELLULAR

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ENCRYPTION

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 IOT

- 6.4 TECHNOLOGY ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON LAND MOBILE RADIO MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN LAND MOBILE RADIO MARKET

- 6.6.3 CLIENTS' READINESS TO ADOPT AI IN LAND MOBILE RADIO MARKET

- 6.7 INTERCONNECTED ADJACENT MARKET ECOSYSTEM AND IMPACT ON MARKET PLAYERS

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.3 REGULATIONS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS VERTICALS

9 LAND MOBILE RADIO MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 HAND-PORTABLE 91 9.2.1 GROWING DEMAND FOR HAND-PORTABLE AND EASY-TO-USE MOBILE COMMUNICATION TO DRIVE MARKET

- 9.3 IN-VEHICLE (MOBILE)

- 9.3.1 PRESSING NEED FOR SECURED OPERATIONS AND CONSTANT CONNECTIVITY TO BOOST DEMAND

10 LAND MOBILE RADIO MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 ANALOG

- 10.2.1 GROWING USE OF ANALOG LAND MOBILE RADIO SYSTEMS IN PUBLIC SAFETY SECTOR TO BOOST DEMAND

- 10.3 DIGITAL

- 10.3.1 IMPROVED VOICE CLARITY AND ENHANCED DATA CAPABILITIES TO FOSTER MARKET GROWTH

- 10.3.2 TETRA

- 10.3.2.1 Ability to offer advanced functionalities to boost demand

- 10.3.3 DIGITAL MOBILE RADIO

- 10.3.3.1 Increasing need for DMR in domestic and short-range industrial settings to boost demand

- 10.3.4 PROJECT 25

- 10.3.4.1 Ability to offer backward compatibility and interoperability with other systems to drive market

- 10.3.5 OTHER DIGITAL TECHNOLOGIES

11 LAND MOBILE RADIO MARKET, BY FREQUENCY

- 11.1 INTRODUCTION

- 11.2 25-174 MHZ (VHF)

- 11.2.1 RISING USE IN FM BROADCASTING AND MISSION-CRITICAL COMMUNICATIONS TO DRIVE MARKET

- 11.3 200-512 MHZ (UHF)

- 11.3.1 ABILITY TO OFFER ENHANCED MOBILITY AND IMPROVED SOUND QUALITY IN ADVERSE WEATHER CONDITIONS TO SPUR DEMAND

- 11.4 700 MHZ & ABOVE (SHF)

- 11.4.1 INCREASING USE IN COMMERCIAL, INDUSTRIAL, AND MILITARY SECTORS TO FOSTER MARKET GROWTH

12 LAND MOBILE RADIO MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 COMMERCIAL

- 12.2.1 RETAIL

- 12.2.1.1 Growing demand for multi-language settings to drive market

- 12.2.2 TRANSPORTATION

- 12.2.2.1 Rising focus on security across land, air, and sea transport to boost demand

- 12.2.3 UTILITY

- 12.2.3.1 Focus on regulating power outage to foster growth

- 12.2.4 MINING

- 12.2.4.1 Pressing need for improved communication and safety technologies at mining sites to accelerate demand

- 12.2.5 OTHER COMMERCIAL APPLICATIONS

- 12.2.1 RETAIL

- 12.3 PUBLIC SAFETY

- 12.3.1 MILITARY & DEFENSE

- 12.3.1.1 Ability to offer encrypted channels and secured communication to boost demand

- 12.3.2 HOMELAND SECURITY

- 12.3.2.1 Advent of new technology standards to drive market

- 12.3.3 EMERGENCY & MEDICAL SERVICES

- 12.3.3.1 Integration of digital and trunked systems to accelerate demand

- 12.3.4 FIRE DEPARTMENT

- 12.3.4.1 Rising demand for reliable and uninterrupted radio communication tools to foster market growth

- 12.3.5 OTHER PUBLIC SAFETY APPLICATIONS

- 12.3.1 MILITARY & DEFENSE

13 LAND MOBILE RADIO MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 US

- 13.2.2.1 Advancements in wideband technology to offer lucrative growth opportunities

- 13.2.3 CANADA

- 13.2.3.1 Rising emphasis on developing digital trunking systems and narrowband technologies to drive market

- 13.2.4 MEXICO

- 13.2.4.1 Government-led initiatives to modernize communication infrastructure to spur demand

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Growing shift from analog to digital communication systems to boost demand

- 13.3.3 UK

- 13.3.3.1 Rising demand for reliable and secure communication systems in transportation and utilities sectors to drive market

- 13.3.4 FRANCE

- 13.3.4.1 Increasing deployment of standardized technologies to offer lucrative growth opportunities

- 13.3.5 ITALY

- 13.3.5.1 Digital transformation and public safety modernization to drive growth

- 13.3.6 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 CHINA

- 13.4.2.1 Low cost of digital terminals to boost demand

- 13.4.3 JAPAN

- 13.4.3.1 Growing application of LMR technology in railways to spur demand

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Ongoing developments in mobile communication devices to accelerate demand

- 13.4.5 INDIA

- 13.4.5.1 Ongoing developments in mobile communication to accelerate demand

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW (REST OF THE WORLD)

- 13.5.1 MACROECONOMIC OUTLOOK

- 13.5.2 MIDDLE EAST & AFRICA

- 13.5.2.1 Rising need to enhance security and emergency response capabilities to accelerate demand

- 13.5.2.2 GCC Countries

- 13.5.2.3 Rest of Middle East

- 13.5.3 SOUTH AMERICA

- 13.5.3.1 Growing privatization of telecommunication services to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 REVENUE ANALYSIS, 2021-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Regional footprint

- 14.7.5.3 Application footprint

- 14.7.5.4 Technology footprint

- 14.7.5.5 Type footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 SEPURA LIMITED

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches/developments

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 MOTOROLA SOLUTIONS, INC.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches/developments

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 L3HARRIS TECHNOLOGIES, INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches/developments

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 JVCKENWOOD CORPORATION

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches/developments

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 THALES

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches/developments

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 ICOM INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.7 BK TECHNOLOGIES

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches/developments

- 15.1.7.3.2 Deals

- 15.1.8 HYTERA COMMUNICATIONS CORPORATION LIMITED

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches/developments

- 15.1.8.3.2 Deals

- 15.1.9 LEONARDO S.P.A.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 CODAN LIMITED

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.1 SEPURA LIMITED

- 15.2 OTHER PLAYERS

- 15.2.1 WEAVIX

- 15.2.2 REPLAY INC

- 15.2.3 GOTENNA

- 15.2.4 TALKPOD TECHNOLOGY CO., LTD.

- 15.2.5 QUANZHOU YANTON ELECTRONICS CO., LTD

- 15.2.6 KMOBILE COMMUNICATION CO., LTD (ESTALKY)

- 15.2.7 COMMCRETE

- 15.2.8 ESCHAT

- 15.2.9 BOTTLE

- 15.2.10 BEARTOOTH

- 15.2.11 AIRACOM LIMITED

- 15.2.12 TELDIO CORPORATION

- 15.2.13 COMMUNICATIONS-APPLIED TECHNOLOGY

- 15.2.14 ZETRON

- 15.2.15 POWERTRUNK

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 List of key secondary sources

- 16.1.1.2 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 List of key interview participants

- 16.1.2.2 Breakdown of primaries

- 16.1.2.3 Key data from primary sources

- 16.1.2.4 Key industry insights

- 16.1.3 SECONDARY AND PRIMARY RESEARCH

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.1.1 Approach to estimate market size using bottom-up analysis (supply side)

- 16.2.2 TOP-DOWN APPROACH

- 16.2.2.1 Approach to estimate market size using top-down analysis (demand side)

- 16.2.1 BOTTOM-UP APPROACH

- 16.3 DATA TRIANGULATION

- 16.4 RESEARCH ASSUMPTIONS

- 16.5 RISK ASSESSMENT

- 16.6 RESEARCH LIMITATIONS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LAND MOBILE RADIO MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 3 ROLE OF PLAYERS IN LAND MOBILE RADIO MARKET ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY TYPE, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY FREQUENCY, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY APPLICATION, 2021-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- TABLE 8 IMPORT DATA FOR HS CODE 852560-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 852560-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 11 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 12 LIST OF PATENTS APPLIED/GRANTED, JUNE 2021-NOVEMBER 2025

- TABLE 13 TOP USE CASES AND MARKET POTENTIAL

- TABLE 14 BEST PRACTICES: COMPANIES IMPLEMENTING AI IN LAND MOBILE RADIO MARKET

- TABLE 15 INTERCONNECTED ADJACENT MARKET ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- TABLE 21 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 22 UNMET NEEDS IN LAND MOBILE RADIO MARKET, BY APPLICATION

- TABLE 23 LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 24 LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 26 LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 27 HAND-PORTABLE: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 HAND-PORTABLE: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 IN-VEHICLE (MOBILE): LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 IN-VEHICLE (MOBILE): LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 32 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 33 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 34 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 35 ANALOG: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 ANALOG: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 DIGITAL: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 DIGITAL: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 DIGITAL: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 DIGITAL: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 DIGITAL: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 42 DIGITAL: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 43 TETRA: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 TETRA: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 DMR: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 DMR: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 P25: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 P25: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 OTHER DIGITAL TECHNOLOGIES: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 OTHER DIGITAL TECHNOLOGIES: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 52 LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 53 LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 54 LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 55 25-174 MHZ (VHF): LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 25-174 MHZ (VHF): LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 200-512 MHZ (UHF): LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 200-512 MHZ (UHF): LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 700 MHZ & ABOVE (SHF): LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 700 MHZ & ABOVE (SHF): LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 64 LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 65 COMMERCIAL: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 COMMERCIAL: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 COMMERCIAL: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 68 COMMERCIAL: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 69 COMMERCIAL: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 70 COMMERCIAL: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 71 RETAIL: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 RETAIL: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 TRANSPORTATION: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 TRANSPORTATION: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 UTILITY: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 UTILITY: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 MINING: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 MINING: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 OTHER COMMERCIAL APPLICATIONS: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 OTHER COMMERCIAL APPLICATIONS: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 84 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 86 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 87 MILITARY & DEFENSE: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 MILITARY & DEFENSE: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 HOMELAND SECURITY: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 HOMELAND SECURITY: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 EMERGENCY & MEDICAL SERVICES: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 EMERGENCY & MEDICAL SERVICES: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 FIRE DEPARTMENT: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 FIRE DEPARTMENT: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 OTHER PUBLIC SAFETY APPLICATIONS: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 OTHER PUBLIC SAFETY APPLICATIONS: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 100 LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 101 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 104 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 105 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 108 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 109 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 112 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 113 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 116 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 117 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 122 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 123 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 126 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 127 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 US: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 130 US: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 US: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 132 US: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 133 US: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 134 US: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 135 US: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 136 US: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 137 US: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 138 US: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 139 US: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 140 US: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 141 US: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 142 US: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 143 US: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 144 US: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 145 US: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 US: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 US: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 148 US: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 149 US: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 US: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 US: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 152 US: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 153 US: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 154 US: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 155 US: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 156 US: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 157 EUROPE: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 EUROPE: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 160 EUROPE: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 161 EUROPE: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 162 EUROPE: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 164 EUROPE: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 165 EUROPE: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 EUROPE: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 168 EUROPE: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 169 EUROPE: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 170 EUROPE: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 172 EUROPE: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 173 EUROPE: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 EUROPE: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 EUROPE: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 176 EUROPE: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 177 EUROPE: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 178 EUROPE: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 EUROPE: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 180 EUROPE: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 181 EUROPE: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 182 EUROPE: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 183 EUROPE: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 184 EUROPE: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 185 EUROPE: LAND MOBILE RADIO MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 186 EUROPE: LAND MOBILE RADIO MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 190 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 191 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 192 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 194 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 195 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 196 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 198 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 199 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 200 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 202 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 203 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 206 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 207 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 210 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 211 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 214 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 215 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 216 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 217 ROW: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 218 ROW: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 ROW: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 220 ROW: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 221 ROW: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 222 ROW: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 223 ROW: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 224 ROW: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 225 ROW: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 226 ROW: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 227 ROW: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 228 ROW: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 229 ROW: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 230 ROW: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 231 ROW: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 232 ROW: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 233 ROW: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 234 ROW: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 235 ROW: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 236 ROW: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 237 ROW: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 238 ROW: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 239 ROW: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 240 ROW: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 241 ROW: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 242 ROW: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 243 ROW: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 244 ROW: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 247 OVERVIEW OF STRATEGIES ADOPTED BY LAND MOBILE RADIO PROVIDERS

- TABLE 248 LAND MOBILE RADIO MARKET SHARE ANALYSIS, 2024

- TABLE 249 LAND MOBILE RADIO MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 250 LAND MOBILE RADIO MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 251 LAND MOBILE RADIO MARKET: TECHNOLOGY FOOTPRINT, 2024

- TABLE 252 LAND MOBILE RADIO MARKET: TYPE FOOTPRINT, 2024

- TABLE 253 LAND MOBILE RADIO MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 254 LAND MOBILE RADIO MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 255 LAND MOBILE RADIO MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-SEPTEMBER 2025

- TABLE 256 LAND MOBILE RADIO MARKET: DEALS, JANUARY 2021-SEPTEMBER 2025

- TABLE 257 SEPURA LIMITED: COMPANY OVERVIEW

- TABLE 258 SEPURA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 SEPURA LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 260 SEPURA LIMITED: DEALS

- TABLE 261 MOTOROLA SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 262 MOTOROLA SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 MOTOROLA SOLUTIONS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 264 MOTOROLA SOLUTIONS, INC.: DEALS

- TABLE 265 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 266 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 268 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 269 JVCKENWOOD CORPORATION: COMPANY OVERVIEW

- TABLE 270 JVCKENWOOD CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERING

- TABLE 271 JVCKENWOOD CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 272 JVCKENWOOD CORPORATION: DEALS

- TABLE 273 THALES: COMPANY OVERVIEW

- TABLE 274 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 THALES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 276 THALES: DEALS

- TABLE 277 THALES: OTHER DEVELOPMENTS

- TABLE 278 ICOM INC.: COMPANY OVERVIEW

- TABLE 279 ICOM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 ICOM INC.: DEALS

- TABLE 281 BK TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 282 BK TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 BK TECHNOLOGIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 284 BK TECHNOLOGIES: DEALS

- TABLE 285 HYTERA COMMUNICATIONS CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 286 HYTERA COMMUNICATIONS CORPORATION LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 287 HYTERA COMMUNICATIONS CORPORATION LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 288 HYTERA COMMUNICATIONS CORPORATION LIMITED: DEALS

- TABLE 289 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 290 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 CODAN LIMITED: COMPANY OVERVIEW

- TABLE 292 CODAN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 WEAVIX: COMPANY OVERVIEW

- TABLE 294 RELAY INC: COMPANY OVERVIEW

- TABLE 295 GOTENNA: COMPANY OVERVIEW

- TABLE 296 TALKPOD TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 297 QUANZHOU YANTON ELECTRONICS CO., LTD: COMPANY OVERVIEW

- TABLE 298 KMOBILE COMMUNICATION CO., LTD (ESTALKY): COMPANY OVERVIEW

- TABLE 299 COMMCRETE: COMPANY OVERVIEW

- TABLE 300 ESCHAT: COMPANY OVERVIEW

- TABLE 301 BOTTLE: COMPANY OVERVIEW

- TABLE 302 BEARTOOTH: COMPANY OVERVIEW

- TABLE 303 AIRACOM LIMITED: COMPANY OVERVIEW

- TABLE 304 TELDIO CORPORATION: COMPANY OVERVIEW

- TABLE 305 COMMUNICATIONS-APPLIED TECHNOLOGY: COMPANY OVERVIEW

- TABLE 306 ZETRON: COMPANY OVERVIEW

- TABLE 307 POWERTRUNK: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL LAND MOBILE RADIO MARKET, 2025-2030 (USD MILLION)

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN LAND MOBILE RADIO MARKET (2021-2025)

- FIGURE 5 DISRUPTIONS INFLUENCING LAND MOBILE RADIO MARKET GROWTH

- FIGURE 6 HIGH-GROWTH SEGMENTS IN LAND MOBILE RADIO MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 INCREASING DEMAND FOR SECURE AND ENCRYPTED COMMUNICATION CHANNELS TO DRIVE MARKET

- FIGURE 9 DIGITAL SEGMENT TO ACHIEVE HIGHER CAGR THAN ANALOG SEGMENT DURING FORECAST PERIOD

- FIGURE 10 HAND-PORTABLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 700 MHZ & ABOVE (SHF) SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 COMMERCIAL SEGMENT TO WITNESS HIGHER GROWTH THAN PUBLIC SAFETY SEGMENT DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 LAND MOBILE RADIO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 IMPACT ANALYSIS OF MARKET DRIVERS

- FIGURE 17 IMPACT ANALYSIS OF MARKET RESTRAINTS

- FIGURE 18 IMPACT ANALYSIS OF MARKET OPPORTUNITIES

- FIGURE 19 IMPACT ANALYSIS OF MARKET CHALLENGES

- FIGURE 20 LAND MOBILE RADIO MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 LAND MOBILE RADIO MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 LAND MOBILE RADIO MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIO TYPES, BY KEY PLAYER, 2024 (USD)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY TYPE, 2021-2024 (USD)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY FREQUENCY 2021-2024 (USD)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY APPLICATION, 2021-2024 (USD)

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- FIGURE 28 IMPORT DATA FOR HS CODE 852560-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR HS CODE 852560-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR LAND MOBILE RADIO MARKET PLAYERS

- FIGURE 31 INVESTMENT & FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 32 EVOLUTION OF LAND MOBILE RADIO TECHNOLOGIES

- FIGURE 33 PATENTS APPLIED AND GRANTED, 2013-2024

- FIGURE 34 LAND MOBILE RADIO MARKET: FACTORS INFLUENCING DECISION-MAKING

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 37 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 38 HAND-PORTABLE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE THAN IN-VEHICLE (MOBILE) SEGMENT BY 2030

- FIGURE 39 DIGITAL SEGMENT TO EXHIBIT SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 40 700 MHZ & ABOVE (SHF) SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 41 PUBLIC SAFETY SEGMENT TO LEAD MARKET IN 2025

- FIGURE 42 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET IN 2030

- FIGURE 43 NORTH AMERICA: LAND MOBILE RADIO MARKET SNAPSHOT

- FIGURE 44 US TO ACCOUNT FOR LARGEST MARKET IN 2025

- FIGURE 45 EUROPE: LAND MOBILE RADIO MARKET SNAPSHOT

- FIGURE 46 GERMANY TO ACCOUNT FOR LARGEST MARKET IN 2025

- FIGURE 47 ASIA PACIFIC: LAND MOBILE RADIO MARKET SNAPSHOT

- FIGURE 48 CHINA TO ACCOUNT FOR LARGEST SHARE IN 2030

- FIGURE 49 MIDDLE EAST & AFRICA TO LEAD LAND MOBILE RADIO MARKET IN 2030

- FIGURE 50 REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 51 LAND MOBILE RADIO MARKET: MARKET SHARE OF KEY PLAYERS

- FIGURE 52 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 53 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 54 BRAND/PRODUCT COMPARISON

- FIGURE 55 LAND MOBILE RADIO MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 LAND MOBILE RADIO MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 57 LAND MOBILE RADIO MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 MOTOROLA SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 59 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 60 JVCKENWOOD CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 THALES: COMPANY SNAPSHOT

- FIGURE 62 ICOM INC.: COMPANY SNAPSHOT

- FIGURE 63 BK TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 64 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 65 CODAN LIMITED: COMPANY SNAPSHOT

- FIGURE 66 LAND MOBILE RADIO MARKET: RESEARCH DESIGN

- FIGURE 67 LAND MOBILE RADIO MARKET: RESEARCH FLOW

- FIGURE 68 LAND MOBILE RADIO MARKET: BOTTOM-UP APPROACH

- FIGURE 69 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY LAND MOBILE RADIO MANUFACTURERS

- FIGURE 70 LAND MOBILE RADIO MARKET: TOP-DOWN APPROACH

- FIGURE 71 DATA TRIANGULATION