|

市場調查報告書

商品編碼

1876441

全球微塑膠分析市場(至2030年):依分析物、產品(顯微鏡、光譜、軟體、耗材)、應用及最終用戶分類Microplastic Analysis Market by Analyte, Product (Microscopy, Spectroscopy, Software, Consumables), Application, End User - Global Forecast to 2030 |

||||||

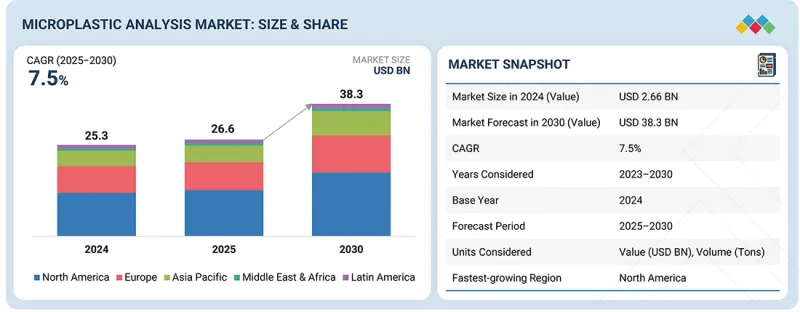

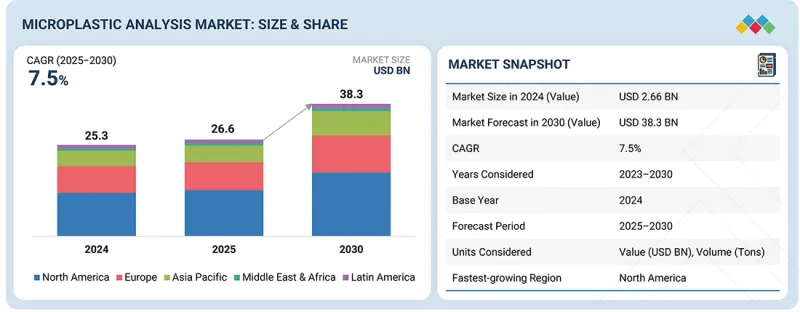

全球微塑膠分析市場預計將從 2025 年的 2.669 億美元成長到 2030 年的 3.831 億美元,2025 年至 2030 年的複合年成長率為 7.5%。

| 調查範圍 | |

|---|---|

| 調查期 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元) |

| 部分 | 產品類型、分析物類型、應用、最終用戶、地區 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲 |

增加研發資金和津貼、擴大蛋白質組學研究以及增加危及生命的疾病等因素正在促進市場成長。

“按產品類型分類,到2025年,設備類產品將佔據最大的市場佔有率。”

微塑膠分析試劑和耗材的需求主要受法規結構的強化驅動,這些框架要求定期進行環境和產品監測,導致濾膜、染色劑、溶劑和認證參考物質的持續消耗。公眾和產業對微塑膠健康和生態影響的日益關注,也促使食品飲料、化妝品、製藥和水處理等行業增加檢測頻率。從螢光染色和傅立葉變換紅外線/拉曼光譜到熱解-氣相層析/質譜聯用,分析工作流程的技術進步推動了專用耗材的使用,這些耗材旨在提高檢測靈敏度和準確度。此外,對分析方法標準化和全球品質合規性的日益重視,也使得對高純度參考物質和檢驗的試劑組的需求強勁。對研究計畫、微塑膠監測調查以及自動化高通量檢測平台開發投入的增加,進一步推動了耗材市場的成長。

從應用領域來看,水質檢測領域預計在預測期內將達到最高的複合年成長率。

隨著全球各地監管機構加強對飲用水、污水、自來水、瓶裝水和天然水體中微塑膠檢測的監管,水質檢測產業正經歷快速擴張。公眾對微塑膠污染潛在健康風險和生態破壞的認知不斷提高,促使公共產業、市政當局和私人供水事業增加檢測頻率並採用先進的分析方法。此外,攜帶式即時監測系統的出現以及更快速的樣品製備和處理技術的開發,推動了這些技術在現場作業和實驗室工作流程中的應用。歐洲、北美、亞太地區和其他地區加強水質監管和監測力度,進一步推動了市場成長。自動化系統、人工智慧分析軟體和微塑膠過濾套件的日益普及,以及對環境研究和水處理基礎設施投資的不斷增加,使水質檢測成為微塑膠分析市場最重要的成長引擎之一。

“按地區分類,預計北美市場在預測期內將呈現最高的成長率。”

預計北美地區2025年至2030年的複合年成長率將達到8.5%,位居全球之首。這一成長主要得益於人們對水、土壤和食品系統中微塑膠污染的環境和健康意識不斷提高,以及嚴格監管措施的實施。此外,傅立葉轉換紅外線光譜(FT-IR)、拉曼光譜和自動化檢測系統等分析技術的不斷進步,以及標準化工作的推進,使得全部區域微塑膠分析的擴充性、準確性和成本效益都得到了提升。

本報告調查了全球微塑膠分析市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、按各個細分市場、地區/主要國家進行的詳細分析、競爭格局以及主要企業的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 互聯市場與跨產業機遇

- 一級/二級/三級公司的策略性舉措

第6章 市場概覽

- 波特五力分析

- 總體經濟指標

- 價值鏈分析

- 供應鏈分析

- 生態系分析

- 定價分析

- 貿易分析

- 大型會議和活動

- 影響您業務的趨勢/顛覆性因素

- 投資和資金籌措方案

- 美國關稅對微塑膠分析市場的影響

第7章:科技、專利、數位化和人工智慧應用驅動的策略顛覆

- 技術分析

- 專利分析

- 人工智慧/生成式人工智慧對微塑膠分析市場的影響

- 成功案例和實際應用

第8章永續性和監管環境

- 地方法規和合規性

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第9章:顧客狀況與購買行為

- 決策流程

- 主要相關利益者和採購評估標準

- 招募障礙和內部挑戰

- 來自各個終端使用者產業的未滿足需求

第10章 依產品類型分類的微塑膠市場分析

- 裝置

- 顯微鏡設備

- 光譜設備

- 其他

- 軟體和服務

- 整合軟體

- 基於人工智慧的軟體

- 試劑和耗材

第11章 微塑膠分析市場(依分析物質分類)

- 聚乙烯

- 聚苯乙烯

- 聚丙烯

- 聚四氟乙烯

- 其他

第12章 微塑膠分析市場及其應用

- 水質檢測

- 土壤檢測

- 空氣測試

第13章 微塑膠分析市場(依最終用戶分類)

- 水處理廠

- 食品和飲料公司

- 製藥公司

- 化工和包裝行業

- 紡織業

- 其他

第14章 微塑膠分析市場(依地區分類)

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他

- 亞太地區

- 宏觀經濟展望

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他

- 拉丁美洲

- 宏觀經濟展望

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 宏觀經濟展望

- 海灣合作理事會國家

- 其他

第15章 競爭格局

- 主要企業的招募策略

- 主要企業排名

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小企業

- 競爭場景

- 估值和財務指標

- 品牌/產品對比

第16章:公司簡介

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- AGILENT TECHNOLOGIES, INC.

- BRUKER

- SHIMADZU CORPORATION

- JEOL LTD.

- MERCK KGAA

- OXFORD INSTRUMENTS

- ZEISS GROUP

- DANAHER CORPORATION

- PERKINELMER

- HORIBA, LTD.

- ENDRESS+HAUSER GROUP SERVICES AG

- JASCO GLOBAL

- LAMBDA SCIENTIFIC PTY LTD.

- TESCAN GROUP AS

- 其他公司

- MALVERN PANALYTICAL LTD.

- EDINBURGH INSTRUMENTS

- GERSTEL GMBH & CO. KG

- LIGHTNOVO

- KEYENCE INDIA PVT. LTD.

- OCEAN OPTICS

- RENISHAW PLC

- TECHNOS INSTRUMENTS

- TOKYO INSTRUMENTS, INC.

- HANGZHOU TIETAI AUTOMATION TECHNOLOGY CO., LTD.

第17章附錄

The global microplastic analysis market is projected to reach USD 383.1 million by 2030 from USD 266.9 million in 2025, at a CAGR of 7.5% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) |

| Segments | Product Type, Analyte Type, Application, End-Users, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Factors such as increasing funding and grants supporting research and development, rising proteomics research, and the growing prevalence of life-threatening diseases are contributing to the market's growth.

"The instruments segment held the largest share of the market in 2025."

Based on product type, the microplastic analysis market is classified by product type into instrument (microscopy instruments (optical microscopy, electronic microscopy, electronic microscopy), spectroscopy instruments (FTIR spectroscopy, raman spectroscopy, gas chromatography-mass spectrometry (GC-MS), gas chromatography-mass spectrometry (GC-MS)), software & services (integrated software, AI based software), and reagents and consumables. The demand for reagents and consumables in microplastic analysis is being fueled by tightening regulatory frameworks that mandate routine environmental and product-based monitoring, resulting in consistent consumption of filters, stains, solvents, and certified standards. Growing public and industry concern over the health and ecological impacts of microplastics is also prompting sectors such as food & beverages, cosmetics, pharmaceuticals, and water treatment to scale up testing frequency. Technological advancements in analytical workflows, ranging from fluorescent staining and FTIR/Raman spectroscopy to pyrolysis-GC/MS, are boosting the use of specialized consumables designed to enhance detection sensitivity and accuracy. Furthermore, the increasing emphasis on method standardization and global quality compliance is driving strong demand for high-purity reference materials and validated reagent kits. Rising investments in research programs, microplastic surveillance studies, and the development of automated, high-throughput testing platforms are further accelerating market growth for consumable products.

"The water testing applications segment is projected to register the highest CAGR during the forecast period."

Based on application, the market for microplastic analysis is divided into water testing, soil testing, air testing, and other applications. The water testing segment has a significant share in the application segment.

The water testing segment is witnessing rapid expansion as authorities worldwide tighten mandates for detecting microplastics in drinking water, wastewater, tap water, bottled water, and natural water bodies. Growing public awareness around the potential health risks and ecological damage associated with microplastic pollution is driving utilities, municipal bodies, and private water companies to increase testing frequency and adopt advanced analytical methods. In addition, the emergence of portable and real-time monitoring systems, along with faster sample preparation and processing technologies, is boosting adoption in field-based and laboratory workflows. Stricter water quality regulations and surveillance initiatives in regions such as Europe, North America, and the Asia Pacific are further strengthening market momentum. The growing integration of automated systems, AI-enabled analysis software, and microplastic filtration kits, coupled with rising investments in environmental research and water treatment infrastructure, is positioning water testing as one of the most significant growth engines for the microplastic analysis market.

.

"The North American market is expected to witness the highest growth during the forecast period."

The microplastic analysis market, based on region, is divided into five major areas: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, North America is anticipated to record the highest CAGR of 8.5% from 2025 to 2030. This growth is primarily driven by increasing environmental and health awareness about microplastic contamination in water, soil, and food systems, as well as the implementation of stringent regulatory measures. Additionally, ongoing advancements in analytical technologies-such as FT-IR, Raman spectroscopy, and automated detection systems-combined with continuous standardization efforts, are enhancing the scalability, accuracy, and cost-effectiveness of microplastic analysis across the region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-48%, Tier 2-36%, and Tier 3- 16%

- By Designation: C-level-10%, Director-level-14%, and Others-76%

- By Region: North America-40%, Europe-32%, Asia Pacific-20%, Latin America-5%, and the Middle East & Africa-3%

The prominent players in the microplastic analysis market are

Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Agilent Technologies, Inc. (US), Waters Corporation (US), Shimadzu Corporation (Japan), Becton, Dickinson and Company (US), PerkinElmer Inc. (US), Bio-Rad Laboratories, Inc. (US), Bruker (US), and Hitachi High-Technologies Corporation (Japan), among others.

Research Coverage

This report studies the microplastic analysis market based on product type, analyte type, application, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets in terms of their growth trends. It forecasts the revenue of the market segments with respect to five central regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will assist market leaders/new entrants with information on the closest approximations of revenue numbers for the overall microplastic analysis market and its subsegments. This report will help stakeholders understand the competitive landscape and gain valuable insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (Growing public concern over the potential health risks of microplastic exposure in the human body, Rising investments from government bodies and private organizations), restraints (Elevated costs of instruments used for microplastic analysis), opportunities (Expanding growth prospects in developing and emerging markets, Advancement of affordable and portable microplastic detection technologies), and challenges (Limited availability of trained technicians in microplastic detection, Lack of standardized protocols for microplastic detection) influencing the growth of the microplastic analysis market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the microplastic analysis market

- Market Development: Comprehensive information about lucrative markets-the report analyses the microplastic analysis market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the microplastic analysis market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like

- Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Agilent Technologies, Inc. (US), Waters Corporation (US), Shimadzu Corporation (Japan), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS SEGMENTTION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Customer-based market estimation

- 2.2.1.3 Growth forecast

- 2.2.1.4 CAGR projections

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 ASSUMPTIONS

- 2.5.1 STUDY ASSUMPTIONS

- 2.5.2 GROWTH RATE ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MICROPLASTICS ANALYSIS MARKET OVERVIEW

- 4.2 EUROPEAN MICROPLASTICS ANALYSIS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.3 MICROPLASTICS ANALYSIS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing public concern over potential health risks of microplastic exposure in human body

- 5.2.1.2 Technological advancements in spectroscopy and microscopy systems

- 5.2.1.3 Rising investments from government bodies and private organizations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Elevated costs of instruments used for microplastic analysis

- 5.2.2.2 Highly stringent regulatory and compliance requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding growth prospects in emerging economies

- 5.2.3.2 Integration of AI and ML technologies for microplastic analysis

- 5.2.3.3 Advancement of affordable and portable microplastic detection technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited availability of trained technicians in microplastic detection

- 5.2.4.2 Lack of standardized protocols for microplastic detection

- 5.2.1 DRIVERS

- 5.3 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 5.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

6 MARKET OVERVIEW

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMIC INDICATORS

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN GLOBAL ENVIRONMENTAL INDUSTRY

- 6.2.4 TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING

- 6.3.3 DISTRIBUTION AND MARKETING & SALES

- 6.3.4 POST-SALES SERVICES

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.4.1 RAW MATERIAL PROCUREMENT

- 6.4.2 MANUFACTURING

- 6.4.3 SALES & DISTRIBUTION

- 6.4.4 END USERS

- 6.5 ECOSYSTEM ANALYSIS

- 6.5.1 ROLE IN ECOSYSTEM

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF MICROSCOPY INSTRUMENTS, BY TYPE, 2024

- 6.6.2 AVERAGE SELLING PRICE TREND OF MICROSCOPY INSTRUMENTS, BY KEY PLAYER, 2024

- 6.6.3 AVERAGE SELLING PRICE OF MICROSCOPY INSTRUMENTS, BY REGION, 2023-2025

- 6.6.4 AVERAGE SELLING PRICE TREND OF SPECTROSCOPY INSTRUMENTS, BY TYPE, 2022-2024

- 6.6.5 AVERAGE SELLING PRICE TREND OF SPECTROSCOPY INSTRUMENTS, BY REGION, 2022-2024

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO FOR HS CODE 902730, 2020-2024

- 6.7.2 EXPORT SCENARIO FOR HS CODE 902730, 2020-2024

- 6.8 KEY CONFERENCES & EVENTS IN 2024-2025

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.10 INVESTMENT & FUNDING SCENARIO

- 6.11 IMPACT OF 2025 US TARIFF ON MICROPLASTICS ANALYSIS MARKET

- 6.11.1 INTRODUCTION

- 6.11.2 KEY TARIFF RATES

- 6.11.3 PRICE IMPACT ANALYSIS

- 6.11.4 IMPACT ON COUNTRY/REGION

- 6.11.4.1 North America

- 6.11.4.1.1 US

- 6.11.4.2 Europe

- 6.11.4.3 Asia Pacific

- 6.11.4.1 North America

- 6.11.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 7.1 TECHNOLOGY ANALYSIS

- 7.1.1 KEY TECHNOLOGIES

- 7.1.1.1 Fourier transform infrared spectroscopy (FTIR)

- 7.1.1.2 Raman spectroscopy

- 7.1.2 COMPLEMENTARY TECHNOLOGIES

- 7.1.2.1 Sample preparation technologies

- 7.1.3 ADJACENT TECHNOLOGIES

- 7.1.3.1 Nanoparticle analysis technologies

- 7.1.1 KEY TECHNOLOGIES

- 7.2 PATENT ANALYSIS

- 7.3 IMPACT OF AI/GEN AI ON MICROPLASTICS ANALYSIS MARKET

- 7.3.1 TOP USE CASES AND MARKET POTENTIAL

- 7.3.2 BEST MARKET PRACTICES

- 7.3.3 CASE STUDY ANALYSIS

- 7.3.4 INTERCONNECTED ADJACENT ECOSYSTEM & IMPACT ON MARKET PLAYERS

- 7.3.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN MICROPLASTICS ANALYSIS MARKET

- 7.4 SUCCESS STORIES & REAL-WORLD APPLICATIONS

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS & COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.1.2.1 North America

- 8.1.2.1.1 US

- 8.1.2.1.2 Canada

- 8.1.2.2 Europe

- 8.1.2.2.1 UK

- 8.1.2.2.2 France

- 8.1.2.2.3 Germany

- 8.1.2.3 Asia Pacific

- 8.1.2.3.1 China

- 8.1.2.3.2 Japan

- 8.1.2.3.3 India

- 8.1.2.4 Latin America

- 8.1.2.4.1 Brazil

- 8.1.2.4.2 Mexico

- 8.1.2.5 Middle East & Africa

- 8.1.2.5.1 UAE

- 8.1.2.5.2 South Africa

- 8.1.2.1 North America

- 8.2 SUSTAINABILITY IMPACT & REGULATORY POLICY INITIATIVES

- 8.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESSES

- 9.2 KEY STAKEHOLDERS & BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 KEY BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

10 MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE

- 10.1 INTRODUCTION

- 10.2 INSTRUMENTS

- 10.2.1 MICROSCOPY INSTRUMENTS

- 10.2.1.1 Optical microscopy

- 10.2.1.1.1 Cost-effectiveness, ease of use, and easy screening of microplastic particles to augment market growth

- 10.2.1.2 Electronic microscopy

- 10.2.1.2.1 Better capability to analyze microplastic surface structures and morphology to aid market adoption

- 10.2.1.3 Scanning electron microscopy

- 10.2.1.3.1 Scanning electron microscopy for high-resolution images of surface structures to augment adoption

- 10.2.1.1 Optical microscopy

- 10.2.2 SPECTROSCOPY INSTRUMENTS

- 10.2.2.1 FTIR SPETROSCOPY

- 10.2.2.1.1 FT-IR spectroscopy to deliver accurate and non-destructive characterization of polymers in environmental samples

- 10.2.2.2 Raman spectroscopy

- 10.2.2.2.1 Need for high sensitivity and resolution for rapid and non-destructive detection of microplastics to drive segment

- 10.2.2.3 Gas chromatography-mass spectroscopy

- 10.2.2.3.1 Gas chromatography-mass spectrometry to be effective in generating unique chemical signatures for polymer identification

- 10.2.2.4 Liquid chromatography-mass spectrometry

- 10.2.2.4.1 Enhanced microplastic detection by depolymerization-based analysis to propel segment growth

- 10.2.2.1 FTIR SPETROSCOPY

- 10.2.3 OTHER INSTRUMENTS

- 10.2.1 MICROSCOPY INSTRUMENTS

- 10.3 SOFTWARE & SERVICES

- 10.3.1 INTEGRATED SOFTWARE

- 10.3.1.1 Growing demand for faster, automated, and accurate identification and quantification of microplastics to drive market

- 10.3.2 AI-BASED SOFTWARE

- 10.3.2.1 Need for rapid, accurate, and high-throughput microplastic detection to aid adoption of AI-based analysis software

- 10.3.1 INTEGRATED SOFTWARE

- 10.4 REAGENTS & CONSUMABLES

- 10.4.1 NEED FOR CONTAMINATION-FREE SAMPLE PREPARATION AND ACCURATE MICROPLASTIC DETECTION TO DRIVE DEMAND

11 MICROPLASTICS ANALYSIS MARKET, BY ANALYTE TYPE

- 11.1 INTRODUCTION

- 11.2 POLYETHYLENE

- 11.2.1 INCREASING DEMAND IN FOOD PACKAGING, CONTAINERS, BOTTLES, AND HOUSEHOLD ITEMS TO DRIVE MARKET

- 11.3 POLYSTYRENE

- 11.3.1 BETTER DETECTION AND MANAGEMENT APPROACHES FOR POLYSTYRENE MICROPLASTICS TO STIMULATE MARKET GROWTH

- 11.4 POLYPROPYLENE

- 11.4.1 GROWING RELIANCE ON NON-DESTRUCTIVE MICROPLASTIC DETECTION METHODS TO AUGMENT MARKET GROWTH

- 11.5 POLYTETRAFLUOROETHYLENE

- 11.5.1 RISING ENVIRONMENTAL AND HEALTH RISKS DUE TO USE OF POLYTETRAFLUOROETHYLENE TO FUEL NEED FOR DETECTION

- 11.6 OTHER ANALYTE TYPES

12 MICROPLASTICS ANALYSIS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 WATER TESTING

- 12.2.1 CRITICAL NEED FOR IMPROVED DETECTION AND REGULATION OF PLASTIC WASTE IN AQUATIC SYSTEMS TO BOOST MARKET GROWTH

- 12.3 SOIL TESTING

- 12.3.1 PRESSING NEED TO REDUCE MICROPLASTIC CONTAMINATION IN AGRICULTURE TO PROPEL MARKET GROWTH

- 12.4 AIR TESTING

- 12.4.1 RISING AIRBORNE MICROPLASTIC THREAT TO SUPPORT ADVANCED TESTING NEEDS

- 12.4.2 OTHER APPLICATIONS

13 MICROPLASTICS ANALYSIS MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 WATER TREATMENT PLANTS

- 13.2.1 RISING ADOPTION OF ADVANCED SOLUTIONS TO TRANSFORM HEAVY-DUTY MANUFACTURING AND BOOST MARKET

- 13.3 FOOD & BEVERAGES COMPANIES

- 13.3.1 INCREASING CONCERNS OVER MICROPLASTIC CONTAMINATION IN PACKAGED FOOD & BEVERAGES TO FUEL MARKET GROWTH

- 13.4 PHARMACEUTICAL COMPANIES

- 13.4.1 PHARMACEUTICAL COMPANIES TO ENSURE DRUG SAFETY, MEET REGULATIONS, AND PREVENT MICROPLASTIC CONTAMINATION

- 13.5 CHEMICAL & PACKAGING INDUSTRIES

- 13.5.1 NEED TO ENSURE REGULATORY COMPLIANCE AND REDUCE ENVIRONMENTAL IMPACT TO DRIVE MARKET

- 13.6 TEXTILE INDUSTRIES

- 13.6.1 NEED FOR REDUCED ENVIRONMENTAL POLLUTION AND HIGH DEMAND FOR SUSTAINABLE PRODUCTS TO DRIVE MARKET

- 13.7 OTHER END USERS

14 MICROPLASTICS ANALYSIS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 US to dominate North American microplastics analysis market during forecast period

- 14.2.3 CANADA

- 14.2.3.1 Growing public concern and increased research funding for plastic pollution to fuel market demand

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Rising consumer awareness about microplastics in water bodies to propel market growth

- 14.3.3 UK

- 14.3.3.1 Rising demand for microplastic analysis technologies in cosmetics industry to augment market growth

- 14.3.4 FRANCE

- 14.3.4.1 Stricter regulatory compliance and enhanced environmental protection initiatives to aid market growth

- 14.3.5 ITALY

- 14.3.5.1 Severe environmental concerns and stronger regulatory frameworks to support market growth

- 14.3.6 SPAIN

- 14.3.6.1 Stringent public health safety regulations to demand microplastic analysis

- 14.3.7 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 CHINA

- 14.4.2.1 Rising concerns over microplastic pollution from textile industry to favor market growth

- 14.4.3 JAPAN

- 14.4.3.1 Growing use of advanced analytical techniques for detecting plastic contamination to spur market growth

- 14.4.4 INDIA

- 14.4.4.1 Shifting from EPR compliance to specialized public health and air quality analysis to propel market growth

- 14.4.5 AUSTRALIA

- 14.4.5.1 Policy-driven phase-outs and sophisticated national monitoring (CSIRO and IMOS) to drive market

- 14.4.6 SOUTH KOREA

- 14.4.6.1 Demand for microplastic analysis to be driven by sustained monitoring investment and international predictive modeling

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 LATIN AMERICA

- 14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 14.5.2 BRAZIL

- 14.5.2.1 Unparalleled scientific diagnosis mandates to propel high-fidelity morphological analytical methods

- 14.5.3 MEXICO

- 14.5.3.1 Targeted upstream regulation focused on product control to lead to high, mandatory demand for compliance verification

- 14.5.4 REST OF LATIN AMERICA

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 14.6.2 GCC COUNTRIES

- 14.6.2.1 Sovereign investment in proprietary methodology and state- of-the-art laboratory infrastructure to augment market growth

- 14.6.3 REST OF MIDDLE EAST & AFRICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MICROPLASTICS ANALYSIS MARKET

- 15.2 REVENUE ANALYSIS, 2020-2024

- 15.3 MARKET SHARE ANALYSIS, 2024

- 15.3.1 RANKING OF KEY PLAYERS, 2024

- 15.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.4.1 STARS

- 15.4.2 EMERGING LEADERS

- 15.4.3 PERVASIVE PLAYERS

- 15.4.4 PARTICIPANTS

- 15.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.4.5.1 Company footprint

- 15.4.5.2 Region footprint

- 15.4.5.3 Product type footprint

- 15.4.5.4 Analyte type footprint

- 15.4.5.5 Application footprint

- 15.4.5.6 End-user footprint

- 15.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.5.1 PROGRESSIVE COMPANIES

- 15.5.2 RESPONSIVE COMPANIES

- 15.5.3 DYNAMIC COMPANIES

- 15.5.4 STARTING BLOCKS

- 15.5.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 15.5.5.1 Detailed list of key startups/SMEs

- 15.5.5.2 Competitive benchmarking of key startups/SMEs

- 15.6 COMPETITIVE SCENARIO

- 15.6.1 PRODUCT LAUNCHES & APPROVALS

- 15.6.2 DEALS

- 15.6.3 EXPANSIONS

- 15.7 COMPANY VALUATION & FINANCIAL METRICS

- 15.7.1 FINANCIAL METRICS

- 15.7.2 COMPANY VALUATION

- 15.8 BRAND/PRODUCT COMPARISON

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 THERMO FISHER SCIENTIFIC INC.

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses & competitive threats

- 16.1.2 AGILENT TECHNOLOGIES, INC.

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product updates

- 16.1.2.3.2 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses & competitive threats

- 16.1.3 BRUKER

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses & competitive threats

- 16.1.4 SHIMADZU CORPORATION

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses & competitive threats

- 16.1.5 JEOL LTD.

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses & competitive threats

- 16.1.6 MERCK KGAA

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.7 OXFORD INSTRUMENTS

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.8 ZEISS GROUP

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.9 DANAHER CORPORATION

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.10 PERKINELMER

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Expansions

- 16.1.11 HORIBA, LTD.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.12 ENDRESS+HAUSER GROUP SERVICES AG

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.13 JASCO GLOBAL

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.14 LAMBDA SCIENTIFIC PTY LTD.

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.15 TESCAN GROUP A.S.

- 16.1.15.1 Business overview

- 16.1.15.2 Products offered

- 16.1.1 THERMO FISHER SCIENTIFIC INC.

- 16.2 OTHER PLAYERS

- 16.2.1 MALVERN PANALYTICAL LTD.

- 16.2.2 EDINBURGH INSTRUMENTS

- 16.2.3 GERSTEL GMBH & CO. KG

- 16.2.4 LIGHTNOVO

- 16.2.5 KEYENCE INDIA PVT. LTD.

- 16.2.6 OCEAN OPTICS

- 16.2.7 RENISHAW PLC

- 16.2.8 TECHNOS INSTRUMENTS

- 16.2.9 TOKYO INSTRUMENTS, INC.

- 16.2.10 HANGZHOU TIETAI AUTOMATION TECHNOLOGY CO., LTD.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MICROPLASTICS ANALYSIS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 MICROPLASTICS ANALYSIS MARKET: STUDY ASSUMPTIONS

- TABLE 3 MICROPLASTICS ANALYSIS MARKET: RISK ASSESSMENT

- TABLE 4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS IN MICROPLASTICS ANALYSIS MARKET

- TABLE 5 MICROPLASTICS ANALYSIS MARKET: PORTER'S FIVE FORCES

- TABLE 6 MICROPLASTICS ANALYSIS MARKET: ROLE IN ECOSYSTEM

- TABLE 7 AVERAGE SELLING PRICE TREND OF MICROSCOPY INSTRUMENTS, BY KEY PLAYER, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE OF MICROSCOPY INSTRUMENTS, BY REGION, 2023-2025 (USD)

- TABLE 9 IMPORT SCENARIO FOR HS CODE 902730, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 EXPORT SCENARIO FOR HS CODE 902730, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 LIST OF KEY CONFERENCES & EVENTS IN MICROPLASTICS ANALYSIS MARKET, JANUARY 2025-DECEMBER 2026

- TABLE 12 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 TOP USE CASES FOR MICROPLASTICS ANALYSIS MARKET

- TABLE 14 CASE STUDY 1: LEVERAGING AI FOR RAPID AND ACCURATE DETECTION OF MICROPLASTICS AND TOXIC SUBSTANCES IN WASTEWATER

- TABLE 15 CASE STUDY 2: MACHINE LEARNING WITH FTIR SPECTRA FROM TARA EXPEDITION / MEDITERRANEAN SEA

- TABLE 16 CASE STUDY 3: RAMAN SPECTROSCOPY WITH MACHINE LEARNING ON ENVIRONMENTAL SAMPLES

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE, TECHNOLOGY, AND APPLICATION (%)

- TABLE 23 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR END-USER SEGEMENTS (%)

- TABLE 24 KEY BARRIERS ADOPTION AND IMPLEMENTATION OF MICROPLASTIC ANALYSIS TECHNOLOGIES

- TABLE 25 UNMET NEEDS FOR MICROPLASTIC ANALYSIS FROM VARIOUS END-USE INDUSTRIES

- TABLE 26 MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 27 MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 28 MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 29 MICROSCOPY INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 OPTICAL MICROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 ELECTRONIC MICROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 SCANNING ELECTRONIC MICROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 34 SPECTROSCOPY INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 FITR SPETROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 RAMAN SPECTROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 GAS CHROMATOGRAPHY-MASS SPECTROSCOPY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 OTHER INSTRUMENTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 41 MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 INTEGRATED SOFTWARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 AI-BASED SOFTWARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 MICROPLASTIC ANALYSIS REAGENTS & CONSUMABLES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 MICROPLASTICS ANALYSIS MARKET, BY ANALYTE TYPE, 2023-2030 (USD MILLION)

- TABLE 46 MICROPLASTICS ANALYSIS MARKET FOR POLYETHYLENE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 MICROPLASTICS ANALYSIS MARKET FOR POLYSTYRENE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 MICROPLASTICS ANALYSIS MARKET FOR POLYPROPYLENE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 MICROPLASTICS ANALYSIS MARKET FOR POLYTETRAFLUOROETHYLENE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 MICROPLASTICS ANALYSIS MARKET FOR OTHER ANALYTE TYPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 MICROPLASTICS ANALYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 52 MICROPLASTICS ANALYSIS MARKET FOR WATER TESTING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 MICROPLASTICS ANALYSIS MARKET FOR SOIL TESTING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 MICROPLASTICS ANALYSIS MARKET FOR AIR TESTING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 MICROPLASTICS ANALYSIS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 MICROPLASTICS ANALYSIS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 57 MICROPLASTICS ANALYSIS MARKET FOR WATER TREATMENT PLANTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 MICROPLASTICS ANALYSIS MARKET FOR FOOD & BEVERAGE COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 MICROPLASTICS ANALYSIS MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 MICROPLASTICS ANALYSIS MARKET FOR CHEMICAL & PACKAGING INDUSTRIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 MICROPLASTICS ANALYSIS MARKET FOR TEXTILES INDUSTRIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 MICROPLASTICS ANALYSIS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 MICROPLASTICS ANALYSIS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: KEY MACROINDICTAORS

- TABLE 65 NORTH AMERICA: MICROPLASTICS ANALYSIS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: MICROPLASTICS ANALYSIS MARKET, BY ANALYTE TYPE, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: MICROPLASTICS ANALYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: MICROPLASTICS ANALYSIS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 74 US: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 75 US: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, TYPE, 2023-2030 (USD MILLION)

- TABLE 76 US: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 US: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 US: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 CANADA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 CANADA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: KEY MACROINDICATORS

- TABLE 85 EUROPE: MICROPLASTICS ANALYSIS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: MICROPLASTICS ANALYSIS MARKET, BY ANALYTE TYPE, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: MICROPLASTICS ANALYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: MICROPLASTICS ANALYSIS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 94 GERMANY: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 95 GERMANY: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 GERMANY: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 GERMANY: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 UK: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 100 UK: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 UK: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 UK: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 UK: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 FRANCE: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 ITALY: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 110 ITALY: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 111 ITALY: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 ITALY: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 SPAIN: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 115 SPAIN: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 SPAIN: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 SPAIN: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 SPAIN: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 125 ASIA PACIFIC: MICROPLASTICS ANALYSIS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MICROPLASTICS ANALYSIS MARKET, BY ANALYTE TYPE, 2023-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MICROPLASTICS ANALYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MICROPLASTICS ANALYSIS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 134 CHINA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 135 CHINA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 136 CHINA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 CHINA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 CHINA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 JAPAN: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 140 JAPAN: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 141 JAPAN: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 JAPAN: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 JAPAN: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 INDIA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 145 INDIA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 146 INDIA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 INDIA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 INDIA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 AUSTRALIA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 150 AUSTRALIA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 151 AUSTRALIA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 AUSTRALIA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 AUSTRALIA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 SOUTH KOREA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 155 SOUTH KOREA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 156 SOUTH KOREA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 SOUTH KOREA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 SOUTH KOREA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 165 LATIN AMERICA: MICROPLASTICS ANALYSIS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: MICROPLASTICS ANALYSIS MARKET, BY ANALYTE TYPE, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: MICROPLASTICS ANALYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: MICROPLASTICS ANALYSIS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 174 BRAZIL: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 175 BRAZIL: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 176 BRAZIL: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 BRAZIL: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 BRAZIL: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 MEXICO: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 180 MEXICO: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 181 MEXICO: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 MEXICO: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 MEXICO: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 REST OF LATIN AMERICA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 185 REST OF LATIN AMERICA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 REST OF LATIN AMERICA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 REST OF LATIN AMERICA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 REST OF LATIN AMERICA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 190 MIDDLE EAST & AFRICA: MICROPLASTICS ANALYSIS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MICROPLASTICS ANALYSIS MARKET, BY ANALYTE TYPE, 2023-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: MICROPLASTICS ANALYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MICROPLASTICS ANALYSIS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 199 GCC COUNTRIES: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 200 GCC COUNTRIES: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE TYPE, 2023-2030 (USD MILLION)

- TABLE 201 GCC COUNTRIES: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 GCC COUNTRIES: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 GCC COUNTRIES: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: MICROPLASTICS ANALYSIS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: MICROPLASTIC ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: MICROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: SPECTROSCOPY INSTRUMENTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: MICROPLASTIC ANALYSIS SOFTWARE & SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MICROPASTIC ANALYSIS MARKET

- TABLE 210 MICROPLASTICS ANALYSIS MARKET: DEGREE OF COMPETITION

- TABLE 211 MICROPLASTICS ANALYSIS MARKET: REGION FOOTPRINT

- TABLE 212 MICROPLASTICS ANALYSIS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 213 MICROPLASTICS ANALYSIS MARKET: ANALYTE TYPE FOOTPRINT

- TABLE 214 MICROPLASTICS ANALYSIS MARKET: APPLICATION FOOTPRINT

- TABLE 215 MICROPLASTICS ANALYSIS MARKET: END-USER FOOTPRINT

- TABLE 216 MICROPLASTICS ANALYSIS MARKET: DETAILED LIST OF KEY STARTUPS/ SME PLAYERS

- TABLE 217 MICROPLASTICS ANALYSIS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY PRODUCT TYPE AND REGION

- TABLE 218 MICROPLASTICS ANALYSIS MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 219 MICROPLASTICS ANALYSIS MARKET: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 220 MICROPLASTICS ANALYSIS MARKET: EXPANSIONS, JANUARY 2022- OCTOBER 2025

- TABLE 221 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 222 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 223 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES, JANUARY 2022-OCTOBER 2025

- TABLE 224 THERMO FISHER SCIENTIFIC INC.: EXPANSIONS, JANUARY 2022-OCTOBER 2025

- TABLE 225 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 226 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 227 AGILENT TECHNOLOGIES, INC.: PRODUCT UPDATES, JANUARY 2022- OCTOBER 2025

- TABLE 228 AGILENT TECHNOLOGIES, INC.: EXPANSIONS, JANUARY 2022-OCTOBER 2025

- TABLE 229 BRUKER: COMPANY OVERVIEW

- TABLE 230 BRUKER: PRODUCTS OFFERED

- TABLE 231 BRUKER: PRODUCT LAUNCHES, JANUARY 2022-OCTOBER 2025

- TABLE 232 BRUKER: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 233 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 234 SHIMADZU CORPORATION: PRODUCTS OFFERED

- TABLE 235 SHIMADZU CORPORATION: PRODUCT LAUNCHES, JANUARY 2022-OCTOBER 2025

- TABLE 236 SHIMADZU CORPORATION: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 237 SHIMADZU CORPORATION: EXPANSIONS, JANUARY 2022-OCTOBER 2025

- TABLE 238 JEOL LTD.: COMPANY OVERVIEW

- TABLE 239 JEOL LTD.: PRODUCTS OFFERED

- TABLE 240 JEOL LTD.: PRODUCT LAUNCHES, JANUARY 2022-OCTOBER 2025

- TABLE 241 MERCK KGAA: COMPANY OVERVIEW

- TABLE 242 MERCK KGAA: PRODUCTS OFFERED

- TABLE 243 OXFORD INSTRUMENTS: COMPANY OVERVIEW

- TABLE 244 OXFORD INSTRUMENTS: PRODUCTS OFFERED

- TABLE 245 ZEISS GROUP: COMPANY OVERVIEW

- TABLE 246 ZEISS GROUP: PRODUCTS OFFERED

- TABLE 247 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 248 DANAHER CORPORATION: PRODUCTS OFFERED

- TABLE 249 DANAHER CORPORATION: PRODUCT LAUNCHES, JANUARY 2022-OCTOBER 2025

- TABLE 250 PERKINELMER: COMPANY OVERVIEW

- TABLE 251 PERKINELMER: PRODUCTS OFFERED

- TABLE 252 PERKINELMER: EXPANSIONS, JANUARY 2022-OCTOBER 2025

- TABLE 253 HORIBA, LTD.: COMPANY OVERVIEW

- TABLE 254 HORIBA, LTD.: PRODUCTS OFFERED

- TABLE 255 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 256 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS OFFERED

- TABLE 257 JASCO GLOBAL: COMPANY OVERVIEW

- TABLE 258 JASCO GLOBAL: PRODUCTS OFFERED

- TABLE 259 LAMBDA SCIENTIFIC PTY LTD.: COMPANY OVERVIEW

- TABLE 260 LAMBDA SCIENTIFIC PTY LTD.: PRODUCTS OFFERED

- TABLE 261 TESCAN GROUP A.S.: COMPANY OVERVIEW

- TABLE 262 TESCAN GROUP A.S.: PRODUCTS OFFERED

- TABLE 263 MALVERN PANALYTICAL LTD.: COMPANY OVERVIEW

- TABLE 264 EDINBURGH INSTRUMENTS: COMPANY OVERVIEW

- TABLE 265 GERSTEL GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 266 LIGHTNOVO: COMPANY OVERVIEW

- TABLE 267 KEYENCE INDIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 268 OCEAN OPTICS: COMPANY OVERVIEW

- TABLE 269 RENISHAW PLC: COMPANY OVERVIEW

- TABLE 270 TECHNOS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 271 TOKYO INSTRUMENTS, INC.: COMPANY OVERVIEW

- TABLE 272 HANGZHOU TIETAL AUTOMATION TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MICROPLASTICS ANALYSIS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 MICROPLASTICS ANALYSIS MARKET: YEARS CONSIDERED

- FIGURE 3 MICROPLASTICS ANALYSIS MARKET: RESEARCH DESIGN

- FIGURE 4 KEY PRIMARY SOURCES IN MICROPLASTICS ANALYSIS MARKET

- FIGURE 5 INSIGHTS FROM KEY PRIMARY EXPERTS IN MICROPLASTICS ANALYSIS MARKET

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 9 MICROPLASTICS ANALYSIS MARKET SIZE ESTIMATION: COMPANY REVENUE ESTIMATION

- FIGURE 10 MICROPLASTICS ANALYSIS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 11 MICROPLASTICS ANALYSIS MARKET: CAGR PROJECTIONS (SUPPLY-SIDE ANALYSIS)

- FIGURE 12 MICROPLASTICS ANALYSIS MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 13 MICROPLASTICS ANALYSIS MARKET, PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 MICROPLASTICS ANALYSIS MARKET, BY ANALYTE TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 MICROPLASTICS ANALYSIS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 MICROPLASTICS ANALYSIS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 MICROPLASTICS ANALYSIS MARKET: REGIONAL SNAPSHOT

- FIGURE 18 GROWING ENVIRONMENTAL AND HEALTH CONCERNS TO DRIVE DEMAND FOR ADVANCED MICROPLASTIC DETECTION AND MONITORING

- FIGURE 19 GERMANY AND WATER TESTING TO ACQUIRE MAJOR EUROPEAN MARKET SHARE IN 2024

- FIGURE 20 NORTH AMERICA TO REGISTER HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MICROPLASTICS ANALYSIS MARKET

- FIGURE 22 MICROPLASTICS ANALYSIS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 MICROPLASTICS ANALYSIS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 MICROPLASTICS ANALYSIS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 MICROPLASTICS ANALYSIS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE OF MICROSCOPY INSTRUMENTS, BY TYPE, 2024 (USD THOUSAND)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF SPECTROSCOPY INSTRUMENTS, BY TYPE, 2022-2024 (USD THOUSAND)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF SPECTROSCOPY INSTRUMENTS, BY REGION, 2022-2024 (USD THOUSAND)

- FIGURE 29 IMPORT SCENARIO FOR HS CODE 902730, 2020-2024 (USD THOUSAND)

- FIGURE 30 EXPORT SCENARIO FOR HS CODE 902730, 2020-2024 (USD THOUSAND)

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES IN MICROPLASTICS ANALYSIS MARKET

- FIGURE 32 FUNDING AND NUMBER OF DEALS IN MICROPLASTICS ANALYSIS MARKET, 2019-2023 (USD MILLION)

- FIGURE 33 NUMBER OF DEALS IN MICROPLASTICS ANALYSIS MARKET, BY KEY PLAYER, 2019-2023

- FIGURE 34 VALUE OF DEALS IN MICROPLASTICS ANALYSIS MARKET, BY KEY PLAYER, 2019-2023 (USD)

- FIGURE 35 PATENT DETAILS FOR MICROPLASTICS ANALYSIS MARKET (JANUARY- 2014-SEPTEMBER 2025)

- FIGURE 36 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY TYPE, TECHNOLOGY, AND APPLICATION

- FIGURE 37 KEY BUYING CRITERIA FOR END USERS

- FIGURE 38 NORTH AMERICA: MICROPLASTICS ANALYSIS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MICROPLASTICS ANALYSIS MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN MICROPLASTICS ANALYSIS MARKET, 2020-2024

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MICROPLASTICS ANALYSIS MARKET (2024)

- FIGURE 42 RANKING OF KEY PLAYERS IN MICROPLASTICS ANALYSIS MARKET (2024)

- FIGURE 43 MICROPLASTICS ANALYSIS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 MICROPLASTICS ANALYSIS MARKET: COMPANY FOOTPRINT

- FIGURE 45 MICROPLASTICS ANALYSIS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 EV/EBITDA OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 MICROPLASTICS ANALYSIS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 49 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 50 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 51 BRUKER: COMPANY SNAPSHOT

- FIGURE 52 SHIMADZU CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 JEOL LTD.: COMPANY SNAPSHOT

- FIGURE 54 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 55 OXFORD INSTRUMENTS: COMPANY SNAPSHOT

- FIGURE 56 ZEISS GROUP: COMPANY SNAPSHOT

- FIGURE 57 DANAHER CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 PERKINELMER: COMPANY SNAPSHOT

- FIGURE 59 HORIBA, LTD.: COMPANY SNAPSHOT

- FIGURE 60 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT