|

市場調查報告書

商品編碼

1873971

全球晶片市場按處理器和封裝技術分類-預測至2030年Chiplet Market by Processor (Field-Programmable Gate Array (FPGA), Central Processing Unit (CPU), Graphics Processing Unit (GPU), SOC, AI ASIC Co-Processor), Packaging Technology (SiP, FCCSP, FCBGA,2.5D/3D, WLCSP, Fan-Out) - Global Forecast to 2030 |

||||||

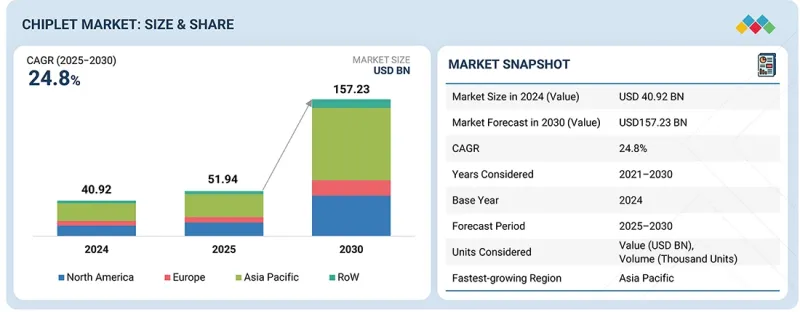

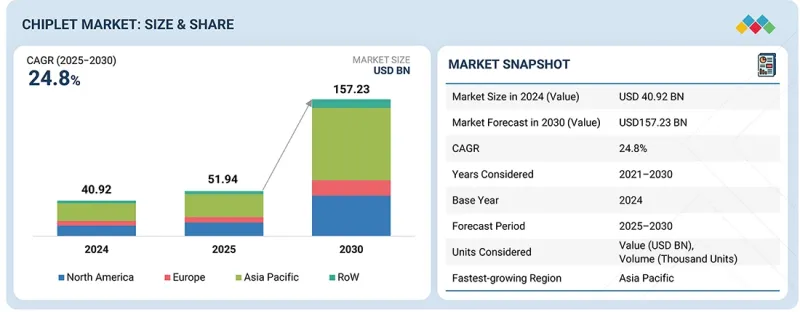

全球晶片市場預計將從 2025 年的 519.4 億美元成長到 2030 年的 1,572.3 億美元,預測期內複合年成長率為 24.8%。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 加工商、終端用戶產業、包裝技術、地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

晶片組市場的發展動力源自於人工智慧、資料中心和高效能運算應用領域對高效能、高能源效率且高成本高效的半導體解決方案日益成長的需求。與傳統的單片式晶片相比,晶片組的模組化設計能夠縮短開發週期並提高可擴展性。然而,晶片組也面臨著許多挑戰,例如複雜的整合設計、互通性問題以及較高的初始開發成本。此外,不同廠商晶片組之間缺乏標準化介面也限制了其在更廣泛生態系統中的應用。

“晶片市場中的人工智慧專用積輔助處理器細分市場預計在預測期內將呈現高速成長。”

由於對專為人工智慧和機器學習工作負載最佳化的專用硬體的需求不斷成長,預計人工智慧專用積體電路(AI ASIC)輔助處理器領域在預測期內將實現最高成長率。與通用CPU和GPU相比,這些處理器具有更優異的效能、更低的延遲和更高的能源效率。人工智慧在資料中心、自主系統和邊緣設備中的日益普及,進一步加速了這些處理器的採用。此外,基於晶片組的AI ASIC設計的進步,也使得人工智慧應用的擴充性和交付速度得到提升。

“預計在預測期內,企業電子產品領域將佔據晶片市場最大的佔有率。”

隨著企業擴大採用高效能運算 (HPC) 和人工智慧 (AI) 解決方案進行資料分析、雲端服務和自動化,企業領域預計將成為晶片組市場的主要驅動力。企業需要可擴展且節能的處理器來管理複雜的工作負載,這使得基於晶片組的架構成為理想之選。晶片組的模組化設計能夠提供根據企業特定需求量身定做的運算解決方案,從而提升效能並降低成本。資料中心、數位轉型和邊緣運算領域不斷成長的投資也進一步推動了市場需求。此外,領先的科技公司正在利用晶片組設計來加速創新並最佳化基礎設施效能,從而進一步促進市場成長。

“預計在預測期內,中國晶片市場將呈現最快的成長速度。”

預計亞太地區將在預測期內主導晶片市場。中國預計將憑藉其快速發展的半導體製造和封裝生態系統,佔據亞太地區最大的市場佔有率。透過「中國製造2025」等政府舉措,中國正大力投資國內晶片生產,以減少對外國技術的依賴。中國領先企業正擴大採用晶片架構,以提升人工智慧、5G和消費性電子應用的運算效能和設計靈活性。強大的電子供應鏈和旺盛的消費需求進一步推動了市場成長。此外,中國晶圓代工廠與全球半導體公司的合作正在加速技術應用,並促進產能擴張。

本報告分析了全球晶片市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 晶片市場對企業而言極具吸引力的機遇

- 按處理器分類的晶片市場

- 按封裝技術和最終用途分類的晶片市場

- 按國家/地區分類的晶片市場

第5章 市場概覽

- 介紹

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 價值鏈分析

- 生態系測繪

- 投資和資金籌措方案

- 影響客戶業務的趨勢/顛覆性因素

- 波特五力分析

- 定價分析

- 主要企業處理器平均售價(2024 年)

- 各地區GPU平均售價趨勢(2021-2024)

- 案例研究分析

- 貿易分析

- 標準與監管環境

- 監管機構、政府機構和其他組織

- 標準

- 規定

- 專利分析

- 重大會議和活動(2025-2026)

- 主要相關利益者和採購標準

- 人工智慧/生成式人工智慧對晶片市場的影響

- 2025年美國關稅對晶片市場的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對最終用途應用的影響

第6章 晶片市場依最終用途分類

- 介紹

- 企業電子

- 消費性電子產品

- 車

- 工業自動化

- 醫療保健

- 軍事/航太

- 其他最終用途

第7章 依封裝技術分類的晶片市場

- 介紹

- 系統級封裝(SIP)

- 覆晶封裝(FCCSP)

- 覆晶球柵陣列(FCBGA)

- 2.5D/3D

- 晶圓級晶片封裝(WLCSP)

- 扇出 (FO)

第8章:按處理器分類的晶片市場

- 介紹

- FPGA

- GPU

- CPU

- APU

- AI ASIC輔助處理器

第9章 晶片市場區域分類

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 波蘭

- 北歐的

- 其他歐洲

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 其他地區

- 其他地區的宏觀經濟展望

- 南美洲

- 中東

- 非洲

第10章 競爭格局

- 概述

- 主要企業採取的關鍵策略(2021年1月至2025年10月)

- 收入分析(2021-2024)

- 市佔率分析(2024 年)

- 公司估值與財務指標(2024)

- 品牌/產品對比

- 企業評估矩陣:主要企業(2024)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第11章:公司簡介

- 主要企業

- INTEL CORPORATION

- ADVANCED MICRO DEVICES, INC.

- APPLE INC.

- IBM

- MARVELL

- MEDIATEK INC.

- NVIDIA CORPORATION

- ACHRONIX SEMICONDUCTOR CORPORATION

- RANOVUS

- ASE

- 其他公司

- CADENCE DESIGN SYSTEMS, INC.

- SYNOPSYS, INC.

- ALPHAWAVE SEMI

- ELIYAN

- NETRONOME

- TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

- NHANCED SEMICONDUCTORS

- CHIPULLER

- SIFIVE, INC.

- RAMBUS

- AYAR LABS, INC.

- TACHYUM

- X-CELEPRINT

- KANDOU BUS SA

- RAIN NEUROMORPHICS

- TENSTORRENT

- RENESAS ELECTRONICS CORPORATION

- BAYA SYSTEMS

- VEEVX

第12章附錄

The chiplet market is projected to reach USD 157.23 billion by 2030 from USD 51.94 billion in 2025, at a CAGR of 24.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Processor, End-user Industry, Packaging Technology and Region |

| Regions covered | North America, Europe, APAC, RoW |

The chiplet market is driven by the increasing demand for high-performance, power-efficient, and cost-effective semiconductor solutions in AI, data center, and HPC applications. Its modular design enables faster development cycles and better scalability compared to traditional monolithic chips. However, the market faces challenges such as complex design integration, interoperability issues, and high initial development costs. Additionally, the absence of standardized interfaces among chiplets from different vendors limits broader ecosystem adoption.

"AI ASIC coprocessor segment of chiplet market to witness high growth during forecast period."

The AI ASIC processor segment is expected to record the highest growth rate during the forecast period due to increasing demand for specialized hardware optimized for AI and machine learning workloads. These processors provide superior performance, lower latency, and greater energy efficiency compared to general-purpose CPUs or GPUs. The growing use of AI in data centers, autonomous systems, and edge devices is further speeding up their adoption. Additionally, advancements in chiplet-based AI ASIC designs are allowing for better scalability and quicker delivery of AI-driven applications.

"Enterprise electronics segment will hold the largest share in the chiplet market during the forecast period."

The enterprise sector is expected to significantly drive the chiplet market as organizations increasingly adopt high-performance computing and AI-driven solutions for data analytics, cloud services, and automation. Enterprises need scalable, energy-efficient processors to manage complex workloads, making chiplet-based architectures an ideal choice. The modularity of chiplets allows for customized computing solutions tailored to specific enterprise needs, boosting performance and cost efficiency. Growing investments in data centers, digital transformation, and edge computing further increase demand. Additionally, leading tech companies are utilizing chiplet designs to accelerate innovation and optimize infrastructure performance, fueling market growth.

"China is expected to witness the fastest growth in the chiplet market during the forecast period."

Asia Pacific is expected to dominate the chiplet market during the forecast period. China is predicted to hold the largest share within the Asia Pacific chiplet market due to its rapidly growing semiconductor manufacturing and packaging ecosystem. The country is heavily investing in domestic chip production through government initiatives like the "Made in China 2025" plan to reduce reliance on foreign technologies. Major Chinese companies are increasingly adopting chiplet architectures to improve computing performance and design flexibility for AI, 5G, and consumer electronics applications. A strong electronics supply chain and high consumer demand further support market growth. Additionally, partnerships between Chinese foundries and global semiconductor firms are speeding up technology adoption and expanding production capacity.

Extensive primary interviews were conducted with key industry experts in the chiplet market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below:

By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

By Designation: C Level - 20%, Director Level - 50%, Others-30%

By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, ROW- 10%

The report highlights key players in the chiplet market along with their market rankings. Prominent companies profiled include Intel Corporation (US), Advanced Micro Devices, Inc. (US), Apple Inc. (US), IBM (US), Marvell (US), MediaTek Inc. (Taiwan), NVIDIA Corporation (US), Achronix Semiconductor Corporation (US), Ranovus (Canada), and ASE Technology Holding Co., Ltd. (Taiwan).

Besides these, Netronome (US), Cadence Design Systems, Inc. (US), and Synopsys, Inc. (US), SiFive, Inc. (US), ALPHAWAVE SEMI (UK), Eliyan (US), Ayar Labs, Inc. (US), Tachyum (US), X-Celeprint (Ireland), Kandou Bus SA (Switzerland), NHanced Semiconductors (US), Tenstorrent (Canada), Chipuller (China), and Rain Neuromorphics (US) are among the emerging companies in the chiplet market.

Research Coverage:

This research report classifies the chiplet market based on processor type, packaging technology, end-use application, and region. It outlines the major drivers, restraints, challenges, and opportunities related to the chiplet market and provides forecasts through 2030. Additionally, the report includes leadership mapping and analysis of all the companies involved in the chiplet ecosystem.

Reason to Buy This Report

The report will assist market leaders and new entrants by providing approximate revenue figures for the overall chiplet market and its subsegments. It will help stakeholders understand the competitive landscape, gain insights to better position their businesses, and develop effective go-to-market strategies. Additionally, the report offers stakeholders an understanding of market trends and key factors such as drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (adoption of high-performance computing servers in various sectors, proliferation of data centers worldwide, adoption of advanced packaging technologies), restraints (heat management issues, lack of industry-wide interoperability standards), opportunities (development of quantum chiplets, rapid expansion of 5G infrastructure, rising incorporation of high-performance and power-efficient chiplets in medical devices, adoption of chiplets in AI and edge computing applications, increasing investments in autonomous vehicles) and challenges (challenges related to intellectual property (IP) protection and licensing, cybersecurity and vulnerability issues associated with chiplet-based systems) influencing the growth of the chiplet market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the chiplet market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the chiplet market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the chiplet market

- Competitive Assessment: In-depth assessment of market share, growth strategies and service offerings of leading players such as Intel Corporation (US), Advanced Micro Devices, Inc. (US), Apple Inc. (US), IBM (US), and Marvell (US), among others in the chiplet market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.2.2 Supply-side analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CHIPLET MARKET

- 4.2 CHIPLET MARKET, BY PROCESSOR

- 4.3 CHIPLET MARKET, BY PACKAGING TECHNOLOGY AND END-USE APPLICATION

- 4.4 CHIPLET MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of HPC servers in various sectors

- 5.2.1.2 Increasing number of data centers

- 5.2.1.3 Transition to advanced packaging technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Heat management issues

- 5.2.2.2 Lack of industry-wide interoperability standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of quantum chiplets

- 5.2.3.2 Rapid expansion of 5G infrastructure

- 5.2.3.3 Rising incorporation of high-performance and power-efficient chiplets into medical devices

- 5.2.3.4 Adoption of chiplets in AI and edge computing applications

- 5.2.3.5 Increasing investments in autonomous vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges related to IP protection and licensing

- 5.2.4.2 Cybersecurity and vulnerability issues associated with chiplet-based systems

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Heterogeneous integration via chiplets

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 SoIC-COW

- 5.3.2.2 Infinity architecture

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 FDX FD-SOI

- 5.3.1 KEY TECHNOLOGIES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM MAPPING

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE OF PROCESSORS, BY KEY PLAYER, 2024

- 5.9.2 AVERAGE SELLING PRICE TREND OF GPUS, BY REGION, 2021-2024

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 INTEL AND SIEMENS HEALTHINEERS DEVELOPED STATE-OF-THE-ART AI-POWERED IMAGING SOLUTIONS USING CHIPLETS

- 5.10.2 ACHRONIX'S EMBEDDED FPGAS (EFPGAS) EMPOWERED HETEROGENEOUS CHIPLET INTEGRATION

- 5.10.3 ELIYAN PARTNERED WITH TMSC TO ADVANCE CHIPLET INTEGRATION

- 5.11 TRADE ANALYSIS

- 5.12 STANDARDS AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 STANDARDS

- 5.12.3 REGULATIONS

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON CHIPLET MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON CHIPLET MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE APPLICATIONS

6 CHIPLET MARKET, BY END-USE APPLICATION

- 6.1 INTRODUCTION

- 6.2 ENTERPRISE ELECTRONICS

- 6.2.1 INCREASING DEMAND FOR ENERGY EFFICIENCY IN ORGANIZATIONAL OPERATIONS TO DRIVE SEGMENTAL GROWTH

- 6.3 CONSUMER ELECTRONICS

- 6.3.1 RAPID TRANSITION TO DIGITAL ELECTRONICS TO DRIVE MARKET

- 6.4 AUTOMOTIVE

- 6.4.1 EMPHASIS ON ENHANCING VEHICLE SAFETY TO FOSTER MARKET GROWTH

- 6.5 INDUSTRIAL AUTOMATION

- 6.5.1 IMPLEMENTATION OF INDUSTRY 4.0 TECHNOLOGIES TO FUEL MARKET GROWTH

- 6.6 HEALTHCARE

- 6.6.1 EVOLUTION OF PERSONALIZED MEDICINE TO OFFER GROWTH OPPORTUNITIES

- 6.7 MILITARY & AEROSPACE

- 6.7.1 ABILITY TO FUNCTION EFFICIENTLY IN HARSH CONDITIONS TO BOOST DEMAND

- 6.8 OTHER END-USE APPLICATIONS

7 CHIPLET MARKET, BY PACKAGING TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 SYSTEM-IN-PACKAGE (SIP)

- 7.2.1 GROWING APPLICATION IN CONSUMER ELECTRONICS, AUTOMOTIVE, HEALTHCARE, AND INDUSTRIAL IOT TO DRIVE MARKET

- 7.3 FLIP CHIP CHIP SCALE PACKAGE (FCCSP)

- 7.3.1 IMPROVED ELECTRICAL AND THERMAL PERFORMANCE TO BOOST DEMAND

- 7.4 FLIP CHIP BALL GRID ARRAY (FCBGA)

- 7.4.1 ABILITY TO DISSIPATE HEAT EFFICIENTLY TO FUEL MARKET GROWTH

- 7.5 2.5D/3D

- 7.5.1 ABILITY TO INTEGRATE MULTIPLE ICS INTO SINGLE PACKAGE TO DRIVE MARKET

- 7.6 WAFER-LEVEL CHIP-SCALE PACKAGE (WLCSP)

- 7.6.1 ENHANCED PERFORMANCE WITH SHORTER INTERCONNECTS, AND COST-EFFECTIVENESS TO FUEL MARKET GROWTH

- 7.7 FAN-OUT (FO)

- 7.7.1 SIMPLIFIED INTEGRATION OF SENSORS AND RF COMPONENTS TO FOSTER MARKET GROWTH

8 CHIPLET MARKET, BY PROCESSOR

- 8.1 INTRODUCTION

- 8.2 FPGA

- 8.2.1 ABILITY TO ENHANCE DEVICE PERFORMANCE, FLEXIBILITY, AND CUSTOMIZATION TO DRIVE MARKET

- 8.3 GPU

- 8.3.1 GROWING DEPLOYMENT IN AI, ML, AND DATA CENTERS TO BOOST DEMAND

- 8.4 CPU

- 8.4.1 ABILITY TO ENHANCE THERMAL MANAGEMENT TO FUEL MARKET GROWTH

- 8.5 APU

- 8.5.1 ENHANCED OVERALL COMPUTING PERFORMANCE TO FOSTER MARKET GROWTH

- 8.6 AI ASIC COPROCESSOR

- 8.6.1 PENETRATION OF AI IN AUTONOMOUS VEHICLES, HEALTHCARE, AND FINANCE TO DRIVE MARKET

9 CHIPLET MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Growing need for cost-effective manufacturing approach to drive market

- 9.2.3 CANADA

- 9.2.3.1 Government-led initiatives to boost domestic semiconductor industry to fuel market growth

- 9.2.4 MEXICO

- 9.2.4.1 Expanding automotive industry to foster market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Surging semiconductor production to drive market

- 9.3.3 UK

- 9.3.3.1 Rising demand for consumer electronics to fuel market growth

- 9.3.4 FRANCE

- 9.3.4.1 Optimization of interconnection technologies to foster market growth

- 9.3.5 ITALY

- 9.3.5.1 Optimization of interconnection technologies to support market growth

- 9.3.6 SPAIN

- 9.3.6.1 Growing importance of advanced packaging to foster market growth

- 9.3.7 POLAND

- 9.3.7.1 Focus on building local R&D centers and pilot production lines to boost demand

- 9.3.8 NORDICS

- 9.3.8.1 Emphasis on startups focusing on AI, edge computing, and 5G to boost demand

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Emphasis on reducing dependence on foreign semiconductor innovations to fuel market growth

- 9.4.3 JAPAN

- 9.4.3.1 Technological advancements across automotive sector to fuel market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Thriving consumer electronics industry to drive demand

- 9.4.5 INDIA

- 9.4.5.1 Emphasis on IoT, telecom infrastructure, and automotive electronics to support market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Focus on producing specialized high-reliability and low-power chiplet to boost demand

- 9.4.7 MALAYSIA

- 9.4.7.1 Rising foreign investments from global OSAT players to support market growth

- 9.4.8 THAILAND

- 9.4.8.1 Growing investments in infrastructure to drive market

- 9.4.9 VIETNAM

- 9.4.9.1 Rising FDIs and infrastructure development to fuel market growth

- 9.4.10 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Increased need for data centers to drive market growth

- 9.5.3 MIDDLE EAST

- 9.5.3.1 Bahrain

- 9.5.3.1.1 Expanding telecom and automotive sectors to fuel market growth

- 9.5.3.2 Kuwait

- 9.5.3.2.1 Growing importance of local manufacturing to offer growth opportunities

- 9.5.3.3 Oman

- 9.5.3.3.1 Initiatives to boost electronics manufacturing to support market growth

- 9.5.3.4 Qatar

- 9.5.3.4.1 Development of smart infrastructure to fuel market growth

- 9.5.3.5 Saudi Arabia

- 9.5.3.5.1 Emphasis on developing diversified tech ecosystem to boost demand

- 9.5.3.6 UAE

- 9.5.3.6.1 Rising focus on digital transformation to drive market

- 9.5.3.7 Rest of Middle East

- 9.5.3.1 Bahrain

- 9.5.4 AFRICA

- 9.5.4.1 Emphasis on smart agriculture, connectivity, and industrial automation to foster market growth

- 9.5.4.2 South Africa

- 9.5.4.2.1 Focus on data center modernization to boost demand

- 9.5.4.3 Rest of Africa

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, JANUARY 2021-OCTOBER 2025

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Processor footprint

- 10.7.5.4 End-use application footprint

- 10.7.5.5 Packaging technology footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 List of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 INTEL CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 ADVANCED MICRO DEVICES, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 APPLE INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 IBM

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 MARVELL

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 MEDIATEK INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Other developments

- 11.1.7 NVIDIA CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.8 ACHRONIX SEMICONDUCTOR CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Deals

- 11.1.9 RANOVUS

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.10 ASE

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.10.3.3 Other developments

- 11.1.1 INTEL CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 CADENCE DESIGN SYSTEMS, INC.

- 11.2.2 SYNOPSYS, INC.

- 11.2.3 ALPHAWAVE SEMI

- 11.2.4 ELIYAN

- 11.2.5 NETRONOME

- 11.2.6 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

- 11.2.7 NHANCED SEMICONDUCTORS

- 11.2.8 CHIPULLER

- 11.2.9 SIFIVE, INC.

- 11.2.10 RAMBUS

- 11.2.11 AYAR LABS, INC.

- 11.2.12 TACHYUM

- 11.2.13 X-CELEPRINT

- 11.2.14 KANDOU BUS SA

- 11.2.15 RAIN NEUROMORPHICS

- 11.2.16 TENSTORRENT

- 11.2.17 RENESAS ELECTRONICS CORPORATION

- 11.2.18 BAYA SYSTEMS

- 11.2.19 VEEVX

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 RISK ASSESSMENT

- TABLE 2 CHIPLET MARKET: ROLE OF KEY PLAYERS IN CHIPLET ECOSYSTEM

- TABLE 3 CHIPLET MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF PROCESSORS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF GPUS, BY REGION, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF CPUS, BY REGION, 2021-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF FPGA, BY REGION, 2021-2024 (USD)

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PATENTS APPLIED AND GRANTED, 2019-2024

- TABLE 13 CHIPLET MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 CHIPLET MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 18 CHIPLET MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 19 ENTERPRISE ELECTRONICS: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 20 ENTERPRISE ELECTRONICS: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 21 CONSUMER ELECTRONICS: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 22 CONSUMER ELECTRONICS: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 23 AUTOMOTIVE: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 24 AUTOMOTIVE: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 25 INDUSTRIAL AUTOMATION: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 26 INDUSTRIAL AUTOMATION: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 27 HEALTHCARE: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 28 HEALTHCARE: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 29 MILITARY & AEROSPACE: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 30 MILITARY & AEROSPACE: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 31 OTHER END-USE APPLICATIONS: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 32 OTHER END-USE APPLICATIONS: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 33 CHIPLET MARKET, BY PACKAGING TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 34 CHIPLET MARKET, BY PACKAGING TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 35 CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 36 CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 37 CHIPLET MARKET, BY PROCESSOR, 2021-2024 (THOUSAND UNITS)

- TABLE 38 CHIPLET MARKET, BY PROCESSOR, 2025-2030 (THOUSAND UNITS)

- TABLE 39 FPGA: CHIPLET MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 40 FPGA: CHIPLET MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 41 FPGA: CHIPLET MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 FPGA: CHIPLET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 FPGA: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 FPGA: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 FPGA: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 FPGA: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 FPGA: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 FPGA: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 FPGA: CHIPLET MARKET IN ROW, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 FPGA: CHIPLET MARKET IN ROW, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 GPU: CHIPLET MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 52 GPU: CHIPLET MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 GPU: CHIPLET MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 GPU: CHIPLET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 GPU: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 GPU: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 GPU: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 GPU: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 GPU: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 GPU: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 GPU: CHIPLET MARKET IN ROW, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 GPU: CHIPLET MARKET IN ROW, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 CPU: CHIPLET MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 64 CPU: CHIPLET MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 CPU: CHIPLET MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 CPU: CHIPLET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 CPU: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 CPU: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 CPU: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 CPU: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 CPU: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 CPU: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 CPU: CHIPLET MARKET IN ROW, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 CPU: CHIPLET MARKET IN ROW, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 APU: CHIPLET MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 76 APU: CHIPLET MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 APU: CHIPLET MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 APU: CHIPLET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 APU: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 APU: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 APU: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 APU: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 APU: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 APU: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 APU: CHIPLET MARKET IN ROW, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 APU: CHIPLET MARKET IN IN ROW, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 AI ASIC COPROCESSOR: CHIPLET MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 88 AI ASIC COPROCESSOR: CHIPLET MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 AI ASIC COPROCESSOR: CHIPLET MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 AI ASIC COPROCESSOR: CHIPLET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 AI ASIC COPROCESSOR: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 AI ASIC COPROCESSOR: CHIPLET MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 AI ASIC COPROCESSOR: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 AI ASIC COPROCESSOR: CHIPLET MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 AI ASIC COPROCESSOR: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 AI ASIC COPROCESSOR: CHIPLET MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 AI ASIC COPROCESSOR: CHIPLET MARKET IN ROW, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 AI ASIC COPROCESSOR: CHIPLET MARKET IN ROW, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 CHIPLET MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 CHIPLET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: CHIPLET MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: CHIPLET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: CHIPLET MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: CHIPLET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: CHIPLET MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: CHIPLET MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 113 ROW: CHIPLET MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 ROW: CHIPLET MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 ROW: CHIPLET MARKET, BY PROCESSOR, 2021-2024 (USD MILLION)

- TABLE 116 ROW: CHIPLET MARKET, BY PROCESSOR, 2025-2030 (USD MILLION)

- TABLE 117 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 118 CHIPLET MARKET SHARE ANALYSIS, 2024

- TABLE 119 CHIPLET MARKET: REGION FOOTPRINT

- TABLE 120 CHIPLET MARKET: PROCESSOR FOOTPRINT

- TABLE 121 CHIPLET MARKET: END-USE APPLICATION FOOTPRINT

- TABLE 122 CHIPLET MARKET: PACKAGING TECHNOLOGY FOOTPRINT

- TABLE 123 CHIPLET MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 124 CHIPLET MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 125 CHIPLET MARKET: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 126 CHIPLET MARKET: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 127 CHIPLET MARKET: OTHER DEVELOPMENTS, JANUARY 2021-OCTOBER 2025

- TABLE 128 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 129 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 131 INTEL CORPORATION: DEALS

- TABLE 132 INTEL CORPORATION: OTHER DEVELOPMENTS

- TABLE 133 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 134 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 136 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 137 ADVANCED MICRO DEVICES, INC.: OTHER DEVELOPMENTS

- TABLE 138 APPLE INC.: COMPANY OVERVIEW

- TABLE 139 APPLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 APPLE INC.: PRODUCT LAUNCHES

- TABLE 141 APPLE INC.: DEALS

- TABLE 142 APPLE INC.: OTHER DEVELOPMENTS

- TABLE 143 IBM: COMPANY OVERVIEW

- TABLE 144 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 IBM: PRODUCT LAUNCHES

- TABLE 146 IBM: DEALS

- TABLE 147 MARVELL: COMPANY OVERVIEW

- TABLE 148 MARVELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 MARVELL: PRODUCT LAUNCHES

- TABLE 150 MARVELL: DEALS

- TABLE 151 MEDIATEK INC.: COMPANY OVERVIEW

- TABLE 152 MEDIATEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 MEDIATEK, INC.: PRODUCT LAUNCHES

- TABLE 154 MEDIATEK, INC.: DEALS

- TABLE 155 MEDIATEK INC: OTHER DEVELOPMENTS

- TABLE 156 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 157 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 159 NVIDIA CORPORATION: DEALS

- TABLE 160 ACHRONIX SEMICONDUCTOR CORPORATION: COMPANY OVERVIEW

- TABLE 161 ACHRONIX SEMICONDUCTOR CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 162 ACHRONIX SEMICONDUCTOR CORPORATION: PRODUCT LAUNCHES

- TABLE 163 ACHRONIX SEMICONDUCTOR CORPORATION: DEALS

- TABLE 164 RANOVUS: COMPANY OVERVIEW

- TABLE 165 RANOVUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 RANOVUS: PRODUCT LAUNCHES

- TABLE 167 RANOVUS: DEALS

- TABLE 168 ASE: COMPANY OVERVIEW

- TABLE 169 ASE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 ASE: PRODUCT LAUNCHES

- TABLE 171 ASE: DEALS

- TABLE 172 ASE: OTHER DEVELOPMENTS

List of Figures

- FIGURE 1 CHIPLET MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 CHIPLET MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS

- FIGURE 9 CPU SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 10 2.5D/3D SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 11 ENTERPRISE ELECTRONICS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 12 ASIA PACIFIC HELD LARGEST SHARE OF CHIPLET MARKET IN 2024

- FIGURE 13 RISING DEMAND FOR CONSUMER ELECTRONICS AND EVS TO DRIVE MARKET

- FIGURE 14 CPU SEGMENT TO DOMINATE CHIPLET MARKET IN 2030

- FIGURE 15 2.5D/3D AND ENTERPRISE ELECTRONICS SEGMENTS HELD LARGEST MARKET SHARES IN 2024

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN CHIPLET MARKET DURING FORECAST PERIOD

- FIGURE 17 CHIPLET MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 NUMBER OF DATA CENTERS, 2025

- FIGURE 19 CHIPLET MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 CHIPLET MARKET: ANALYSIS OF IMPACT OF RESTRAINTS

- FIGURE 21 CHIPLET MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS OF OPPORTUNITIES: CHIPLET MARKET

- FIGURE 23 CHIPLET MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 ECOSYSTEM ANALYSIS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD BILLION)

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 AVERAGE SELLING OF PROCESSORS OFFERED BY KEY PLAYERS, 2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF GPUS, BY REGION, 2021-2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF CPUS, BY REGION, 2021-2024

- FIGURE 31 AVERAGE SELLING PRICE TREND OF FPGA, BY REGION, 2021-2024

- FIGURE 32 IMPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 33 EXPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

- FIGURE 37 CHIPLET MARKET: IMPACT OF AI

- FIGURE 38 ENTERPRISE ELECTRONICS SEGMENT TO DOMINATE CHIPLET MARKET DURING FORECAST PERIOD

- FIGURE 39 2.5D/3D PACKAGING SEGMENT TO DOMINATE CHIPLET MARKET DURING FORECAST PERIOD

- FIGURE 40 CPU SEGMENT HELD LARGEST MARKET SHARE IN 2025

- FIGURE 41 NORTH AMERICA: CHIPLET MARKET SNAPSHOT

- FIGURE 42 EUROPE: CHIPLET MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: CHIPLET MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2020-2024

- FIGURE 45 CHIPLET MARKET SHARE ANALYSIS, 2024

- FIGURE 46 COMPANY VALUATION, 2024

- FIGURE 47 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 48 BRAND/PRODUCT COMPARISON

- FIGURE 49 CHIPLET MARKET: EVALUATION MATRIX OF KEY PLAYERS, 2024

- FIGURE 50 CHIPLET MARKET: COMPANY FOOTPRINT

- FIGURE 51 CHIPLET MARKET: EVALUATION MATRIX OF STARTUPS/SMES, 2024

- FIGURE 52 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 54 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 55 IBM: COMPANY SNAPSHOT

- FIGURE 56 MARVELL: COMPANY SNAPSHOT

- FIGURE 57 MEDIATEK INC.: COMPANY SNAPSHOT

- FIGURE 58 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 ASE: COMPANY SNAPSHOT