|

市場調查報告書

商品編碼

1861053

全球醫療設備製造設備市場按類型、最終用戶、應用和地區分類-預測至2030年Medical Device Manufacturing Equipment (by Production) Market by Type (Material Processing, Sterilization & Cleaning Equipment), Application (Consumables & Disposables), End User (OEMs, Contract Manufacturing Organizations) - Global Forecast to 2030 |

||||||

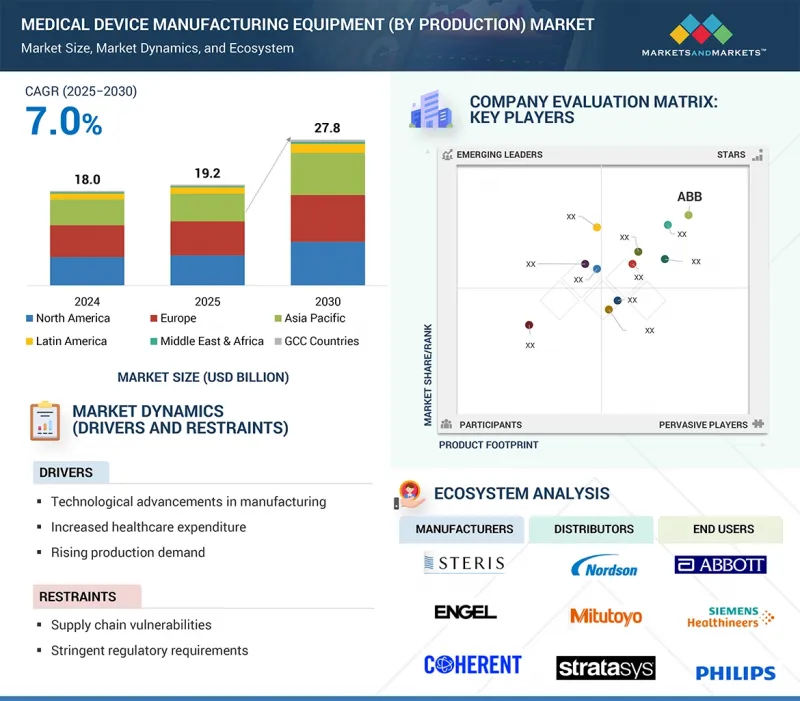

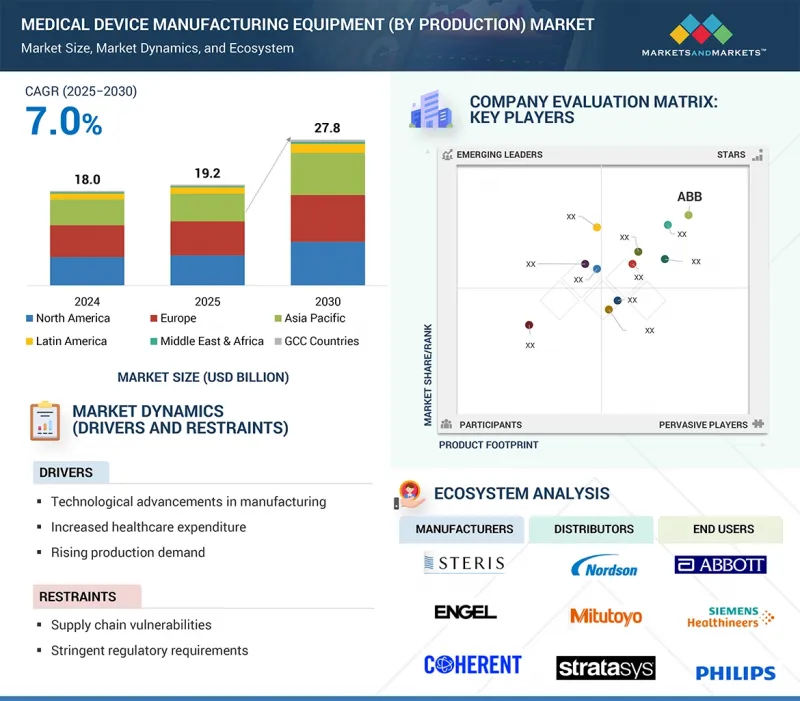

預計醫療設備製造設備市場(以生產單位計)將從 2025 年的 192.4 億美元成長到 2030 年的 278 億美元,預測期內複合年成長率為 7.6%。

| 調查範圍 | |

|---|---|

| 調查年度 | 2023-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 考慮單位 | 金額(百萬美元) |

| 部分 | 按類型、最終用戶、應用程式、區域 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲、海灣合作理事會國家 |

醫療設備製造設備市場的發展主要受自動化、機器人和精密加工等技術進步以及對高品質、高合規性設備日益成長的需求所驅動。然而,高昂的資本成本、複雜的監管要求和供應鏈的脆弱性限制市場成長。新興市場蘊藏著機遇,這些市場對本地製造的投資不斷增加,而3D列印和先進材料支援的客製化、微創醫療器材生產也帶來了發展機會。物聯網和人工智慧等數位化整合進一步提升了生產效率和擴充性。

在各類材料加工設備中,積層製造/3D列印系統預計將在預測期內實現最高成長率,這得益於其能夠快速生產複雜、客製化的設備,減少材料浪費,縮短生產週期,並支援原型製作和小批量生產。其靈活性、精確性和與先進材料的兼容性,為微創、患者客製化的醫療設備提供了極高的價值,從而推動了其在全球範圍內的普及應用。

按最終用戶分類,受託製造廠商預計將在預測期內實現最高成長率,因為它們能夠提供專業化、具成本效益的製造解決方案,而無需大量資本投資。透過提供可擴展的製造能力、法規遵循的專業知識以及先進技術,受託製造廠商使醫療設備製造商能夠專注於研發和行銷,同時確保在全球市場高效、高品質地生產醫療器材。

預計亞太地區在預測期內將實現最高成長率。推動這一成長的因素包括醫療基礎設施的快速擴張、政府投資的增加以及醫療設備產量的增加。中國、印度和日本等國家正在採用包括自動化和3D列印在內的先進製造技術。此外,低廉的人事費用、有利的監管改革以及對患者客製化醫療器材日益成長的需求,也推動了該地區市場的快速成長。

本報告分析了全球醫療設備製造設備市場,按類型、最終用戶、應用和地區細分了市場趨勢,並提供了參與該市場的公司的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 介紹

- 市場動態

- 影響客戶業務的趨勢/顛覆性因素

- 定價分析

- 價值鏈分析

- 供應鏈分析

- 生態系分析

- 投資和資金籌措方案

- 技術分析

- 產業趨勢

- 專利分析

- 貿易分析

- 2025-2026 年主要會議和活動

- 案例研究分析

- 監管分析

- 波特五力分析

- 主要相關人員和採購標準

- 人工智慧/生成式人工智慧對醫療設備製造設備市場的影響

- 2025年美國關稅對醫療設備製造設備市場的影響

第6章醫療設備製造設備市場(按類型分類)

- 介紹

- 材料加工設備

- 組裝和自動化系統

- 表面處理和塗層設備

- 測試和檢驗系統

- 消毒和清潔設備

- 包裝和貼標設備

- 潔淨室與環境系統

第7章醫療設備製造設備市場(依最終用戶分類)

- 介紹

- 醫療設備OEM

- CMO

- 研究與學術原型製作中心

第8章醫療設備製造設備市場(按應用領域分類)

- 介紹

- 耗材和拋棄式用品

- 手術器械

- 植入

- 診斷和治療設備

- 藥物輸送裝置

- 其他

第9章醫療設備製造設備市場(按地區分類)

- 介紹

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 其他

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 亞太地區

- 亞太宏觀經濟展望

- 日本

- 中國

- 印度

- 韓國

- 澳洲

- 其他

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 醫療保健產業化計畫旨在加速無塵室、檢測和標籤技術的應用

- 中東和非洲宏觀經濟展望

- 海灣合作理事會國家

- 本地製造能力的提升推動了對滅菌、成型和包裝系統的需求。

- 海灣合作理事會國家宏觀經濟展望

第10章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 2020-2024年收入分析

- 2024年市佔率分析

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 品牌/產品對比

- 競爭場景

第11章:公司簡介

- 主要參與企業

- ABB

- STERIS

- ZEISS GROUP

- TRUMPF

- NORDSON CORPORATION

- ENGEL

- HUSKY INJECTION MOLDING SYSTEMS LTD.

- EMERSON

- COHERENT CORP.

- OC OERLIKON MANAGEMENT AG

- NIKON CORPORATION

- DURR GROUP

- MULTIVAC

- MIKRON

- STRATASYS LTD.

- 其他公司

- BORCHE NORTH AMERICA INC.

- RP INJECTION SRL

- LASERAX

- LITHIUM LASERS SRL

- AXIAL3D

- MOLD HOTRUNNER SOLUTIONS LTD.

- ATLAS ENVIRONMENTS, LTD.

- BERKSHIRE CORPORATION

- CLEAN ROOMS INTERNATIONAL, INC.

- CLEAN AIR TECHNOLOGY, INC.

第12章附錄

The medical device manufacturing equipment (by production) market is projected to reach USD 27.80 billion by 2030 from USD 19.24 billion in 2025, at a CAGR of 7.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Equipment Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

The medical device manufacturing equipment market is driven by technological advancements in automation, robotics, and precision machining, and increasing demand for high-quality, compliant devices. Growth is restrained by high capital costs, complex regulatory requirements, and supply chain vulnerabilities. Opportunities exist in emerging markets, where investments in local manufacturing are rising, and in customized and minimally invasive device production, supported by 3D printing and advanced materials. Digital integration, like IoT and AI, further enhances production efficiency and scalability.

Based on material processing equipment type, the additive manufacturing/3D printing systems are expected to witness the highest growth rate during the forecast period due to their ability to produce complex, customized devices rapidly, reduce material waste, shorten production cycles, and support prototyping and small-batch production. Their flexibility, precision, and compatibility with advanced materials make them highly valuable for minimally invasive and patient-specific medical devices, driving widespread adoption globally.

Based on end user, contract manufacturing organizations are expected to have the highest growth rate during the forecast year. This is driven by the ability to provide specialized, cost-effective production solutions without heavy capital investment. They offer scalable manufacturing, regulatory compliance expertise, and access to advanced technologies, enabling medical device companies to focus on R&D and marketing while ensuring efficient, high-quality device production across global markets.

Asia Pacific is projected to exhibit the highest growth rate during the forecast year. The surge is driven by rapidly expanding healthcare infrastructure, rising government investments, and increasing medical device production. Countries like China, India, and Japan are adopting advanced manufacturing technologies, including automation and 3D printing. Additionally, low labor costs, favorable regulatory reforms, and growing demand for patient-specific devices are driving the region's high market growth rate.

A breakdown of the primary participants (supply-side) for the medical device manufacturing equipment (by production) market referred to in this report is provided below:

- By Company Type: Tier 1: 34%, Tier 2: 38%, and Tier 3: 28%

- By Designation: C-level: 26%, Director Level: 35%, and Others: 39%

- By Region: North America: 17%, Europe: 39%, Asia Pacific: 28%, Latin America: 8%, Middle East & Africa: 3%, GCC Countries: 5%

Prominent players in the medical device manufacturing equipment (by production) market are STERIS (US), Nordson Corporation (US), ENGEL (Austria), Zeiss Group (Germany), Multivac (Germany), Coherent Corp. (US), KUKA AG (Germany), ABB (Switzerland), TRUMPF (Germany), OC Oerlikon Management AG (Switzerland), Arburg (Germany), Stratasys Ltd (US), Plasmatreat (Germany), Nikon Corporation (Japan), and Mitutoyo Corporation (Japan), among others.

Research Coverage

The report evaluates the medical device manufacturing equipment (by production) market and estimates the market size and future growth potential of this market based on various segments including equipment type, application, end user, and region. The report also includes a competitive analysis of the major players in this market, along with company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will assist the market leader/new entrants in the market with data on the nearest approximations of the revenue numbers for the overall, the medical device manufacturing equipment (by production) market and the subsegments. The report will assist stakeholders in understanding the competitive landscape and gain further insights into better positioning their businesses and making appropriate go-to-market strategies. The report assists the stakeholders in understanding the market pulse and gives them data on influential drivers, hindrances, obstacles, and opportunities in the market.

This report provides insights into the following points:

- Analysis of key drivers (technological advancements in manufacturing, increased healthcare expenditure, and rising production demand), restraints (supply chain vulnerabilities and stringent regulatory requirements), opportunities (customization and personalization and adoption of digital health solutions), and challenges (trade tariffs and import restrictions)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global medical device manufacturing equipment (by production) market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by equipment type, application, end user, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global medical device manufacturing equipment (by production) market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global medical device manufacturing equipment (by production) market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY USED

- 1.5 STAKEHOLDERS

- 1.6 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET OVERVIEW

- 4.2 ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE AND COUNTRY (2024)

- 4.3 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, REGIONAL MIX, 2023-2030

- 4.5 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: EMERGING VS. DEVELOPED ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in manufacturing

- 5.2.1.2 Increased healthcare expenditure

- 5.2.1.3 Rising production demand

- 5.2.2 RESTRAINTS

- 5.2.2.1 Supply chain vulnerabilities

- 5.2.2.2 Stringent regulatory requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Customization and personalization

- 5.2.3.2 Adoption of digital health solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Trade tariffs and import restrictions

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF INJECTION MOLDING MACHINES, BY REGION, 2022-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Injection molding systems

- 5.9.1.2 Additive manufacturing (3D printing)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Metrology & inspection equipment

- 5.9.2.2 Cleanroom & contamination control systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Industrial robotics & automation

- 5.9.3.2 Industrial IoT (IIoT) & AI analytics

- 5.9.1 KEY TECHNOLOGIES

- 5.10 INDUSTRY TRENDS

- 5.10.1 SHIFT TOWARD SMART MANUFACTURING & INDUSTRY 4.0 INTEGRATION

- 5.10.2 RISING DEMAND FOR CUSTOMIZATION AND ADDITIVE MANUFACTURING

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 8477)

- 5.12.2 EXPORT DATA (HS CODE 8477)

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: MMT/SOMEX AUTOMATION - MANDREL REMOVAL/INSERTION FOR CATHETER SHAFTS

- 5.14.2 CASE STUDY 2: HAHN AUTOMATION GROUP - AUTOMATED COILING FOR VASCULAR DEVICE OEM

- 5.14.3 CASE STUDY 3: AMS MACHINES - ADHESIVE DISPENSE AND UV CURE AUTOMATION FOR WEARABLE INJECTOR OEM

- 5.15 REGULATORY ANALYSIS

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATORY FRAMEWORK

- 5.15.2.1 North America

- 5.15.2.1.1 US

- 5.15.2.1.2 Canada

- 5.15.2.2 Europe

- 5.15.2.2.1 Germany

- 5.15.2.2.2 France

- 5.15.2.2.3 UK

- 5.15.2.3 Asia Pacific

- 5.15.2.3.1 India

- 5.15.2.3.2 China

- 5.15.2.3.3 Japan

- 5.15.2.4 Latin America

- 5.15.2.4.1 Brazil

- 5.15.2.4.2 Mexico

- 5.15.2.5 Middle East & Africa

- 5.15.2.5.1 Middle East

- 5.15.2.5.2 Africa

- 5.15.2.1 North America

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 BARGAINING POWER OF SUPPLIERS

- 5.16.2 BARGAINING POWER OF BUYERS

- 5.16.3 THREAT OF NEW ENTRANTS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 IMPACT OF AI/GENERATIVE AI ON MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET

- 5.18.1 AI USE CASES

- 5.18.2 KEY COMPANIES IMPLEMENTING AI

- 5.18.3 FUTURE OF AI/GEN AI

- 5.19 IMPACT OF 2025 US TARIFFS ON MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET

- 5.19.1 KEY TARIFF RATES

- 5.19.2 PRICE IMPACT ANALYSIS

- 5.19.3 KEY IMPACT ON COUNTRY/REGION

- 5.19.3.1 US

- 5.19.3.2 Europe

- 5.19.3.3 Asia Pacific

- 5.19.4 IMPACT ON END-USE INDUSTRIES

6 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 MATERIAL PROCESSING EQUIPMENT

- 6.2.1 INJECTION MOLDING MACHINES

- 6.2.1.1 Growing need for high-volume disposables and diagnostics to drive precision molding capacity

- 6.2.2 LASER CUTTING & WELDING SYSTEMS

- 6.2.2.1 UDI compliance to accelerates adoption of corrosion-resistant, permanent laser black marking

- 6.2.3 ADDITIVE MANUFACTURING/3D PRINTING SYSTEMS

- 6.2.3.1 Personalization and complexity advantages to shift AM from prototyping to production

- 6.2.4 OTHER MATERIAL PROCESSING EQUIPMENT

- 6.2.1 INJECTION MOLDING MACHINES

- 6.3 ASSEMBLY & AUTOMATION SYSTEMS

- 6.3.1 ROBOTIC ASSEMBLY LINES

- 6.3.1.1 Ability of cobots with AI vision to elevate yield and reduce contamination risk to drive adoption

- 6.3.2 PICK & PLACE ROBOTICS

- 6.3.2.1 Ability of SCARA and delta robots to standardize repeatable handling across ISO cleanrooms to boost demand

- 6.3.3 DISPENSING & GLUING SYSTEMS

- 6.3.3.1 Growing demand for miniaturized devices to drive need for precise, biocompatible bonding with closed-loop control

- 6.3.4 ULTRASONIC WELDING & BONDING SYSTEMS

- 6.3.4.1 ISO 11607 validation to drive demand for ultrasonic sealing across sterile packaging lines

- 6.3.1 ROBOTIC ASSEMBLY LINES

- 6.4 SURFACE TREATMENT & COATING EQUIPMENT

- 6.4.1 PLASMA TREATMENT SYSTEMS

- 6.4.1.1 Solvent-free surface activation to boost adhesion, yield, and sustainability metrics

- 6.4.2 ELECTROPOLISHING & ANODIZING SYSTEMS

- 6.4.2.1 Demand for corrosion-resistant, ultraclean finishes to drive standardized electropolishing investments

- 6.4.3 COATING SYSTEMS

- 6.4.3.1 Infection prevention and performance gains to fuel validated medical coating investments

- 6.4.1 PLASMA TREATMENT SYSTEMS

- 6.5 TESTING & INSPECTION SYSTEMS

- 6.5.1 OPTICAL INSPECTION SYSTEMS

- 6.5.1.1 Growing adoption of AI-driven 2D/3D machine vision to support growth

- 6.5.2 LEAK & PRESSURE TESTERS

- 6.5.2.1 ISO 11607 compliance mandates to drive demand for robust, automated leak and seal testing

- 6.5.3 METROLOGY EQUIPMENT

- 6.5.3.1 ISO 13485 traceability to elevate advanced metrology investments

- 6.5.4 ELECTRICAL & FUNCTIONAL TESTERS

- 6.5.4.1 IEC 60601 compliance requirements to drive demand for automated electrical and functional testing

- 6.5.1 OPTICAL INSPECTION SYSTEMS

- 6.6 STERILIZATION & CLEANING EQUIPMENT

- 6.6.1 STEAM STERILIZERS

- 6.6.1.1 Infection prevention priorities to drive upgrades to networked, efficient autoclaves

- 6.6.2 HYDROGEN PEROXIDE PLASMA SYSTEMS

- 6.6.2.1 EtO emission pressures to accelerate adoption of VHP/H2O2 plasma systems

- 6.6.3 ETHYLENE OXIDE SYSTEMS

- 6.6.3.1 Irreplaceable material compatibility to preserve EtO demand despite tighter regulations

- 6.6.4 ULTRASONIC CLEANING SYSTEMS

- 6.6.4.1 ISO-driven validations to accelerate adoption of automated, aqueous ultrasonic cleaning

- 6.6.1 STEAM STERILIZERS

- 6.7 PACKAGING & LABELING EQUIPMENT

- 6.7.1 BLISTER PACKAGING MACHINES

- 6.7.1.1 Need for unit dose, tamper evident formats to drive blister capacity investments globally

- 6.7.2 FORM-FILL-SEAL (FFS) SYSTEMS

- 6.7.2.1 Inline seal monitoring to accelerate validations and time to market

- 6.7.3 LABELING & CODING SYSTEMS

- 6.7.3.1 UDI deadlines to drive serialization, printing, and vision verified coding investments

- 6.7.4 OTHER PACKAGING & LABELING EQUIPMENT

- 6.7.1 BLISTER PACKAGING MACHINES

- 6.8 CLEANROOM & ENVIRONMENTAL SYSTEMS

- 6.8.1 CLEANROOM INFRASTRUCTURE

- 6.8.1.1 ISO 14644 compliance to drive demand for HVAC, zoning, and continuous environmental monitoring

- 6.8.2 HVAC, HUMIDITY, AND ESD PROTECTION SYSTEMS

- 6.8.2.1 Annex 1 and ISO 14644 to elevate HVAC control and monitoring

- 6.8.3 CONTAMINATION CONTROL SYSTEMS

- 6.8.3.1 Annex 1 mandates to boost contamination control investments

- 6.8.1 CLEANROOM INFRASTRUCTURE

7 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 MEDICAL DEVICE OEMS

- 7.2.1 ABILITY OF OEMS TO DRIVE INNOVATION AND ENSURE REGULATORY COMPLIANCE TO DRIVE MARKET GROWTH

- 7.3 CONTRACT MANUFACTURING ORGANIZATIONS

- 7.3.1 PIVOTAL ROLE PLAYED BY CMOS IN DRIVING EQUIPMENT DEMAND TO SUPPORT MARKET GROWTH

- 7.4 RESEARCH & ACADEMIC PROTOTYPING CENTERS

- 7.4.1 ABILITY TO MITIGATE RISKS AND SPEED UP TRANSFER OF CONCEPTS TO BOOST GROWTH

8 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CONSUMABLES & DISPOSABLES

- 8.2.1 RISING SINGLE-USE ADOPTION TO MEET STERILITY, COMPLIANCE, AND THROUGHPUT REQUIREMENTS TO DRIVE MARKET

- 8.3 SURGICAL INSTRUMENTS

- 8.3.1 GROWTH IN MINIMALLY INVASIVE PROCEDURES TO BOOST PRECISION MACHINING INVESTMENTS AND DRIVE MARKET GROWTH

- 8.4 IMPLANTS

- 8.4.1 AGING DEMOGRAPHICS AND EXPANDING ORTHOPEDIC VOLUMES TO DRIVE MARKET

- 8.5 DIAGNOSTIC & THERAPEUTIC DEVICES

- 8.5.1 GROWING DEMAND FOR POINT-OF-CARE TESTING TO DRIVE HIGH-SPEED CARTRIDGE MOLDING AND SEALING CAPACITY

- 8.6 DRUG DELIVERY DEVICES

- 8.6.1 PREFILLED SYRINGE ADOPTION TO ACCELERATE HIGH-SPEED ASSEMBLY AND INSPECTION

- 8.7 OTHER DEVICES

9 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 EUROPE

- 9.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.2.2 GERMANY

- 9.2.2.1 Germany's engineering expertise and EU MDR compliance to drive adoption of advanced medical device production equipment

- 9.2.3 FRANCE

- 9.2.3.1 Rising demand for implants and disposables to fuel French investment in molding, coating, and automation systems

- 9.2.4 UK

- 9.2.4.1 Regulatory compliance and export competitiveness to drive adoption of automation, packaging, and inspection equipment

- 9.2.5 ITALY

- 9.2.5.1 Italy's packaging leadership and EU MDR compliance to drive strong adoption of medical device manufacturing equipment

- 9.2.6 SPAIN

- 9.2.6.1 Spain's regulatory compliance and growing CMO base to accelerate adoption of medical device production equipment

- 9.2.7 REST OF EUROPE

- 9.3 NORTH AMERICA

- 9.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.3.2 US

- 9.3.2.1 FDA compliance and reshoring strategies to accelerate adoption of automation, sterilization, and inspection systems

- 9.3.3 CANADA

- 9.3.3.1 Growing modernization of production facilities with cleanroom equipment to enhance export competitiveness

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Japan's robotics and precision engineering strengths to drive accelerated adoption of medical device production equipment

- 9.4.3 CHINA

- 9.4.3.1 Government policies and domestic demand to fuel China's adoption of molding, sterilization, and automation equipment

- 9.4.4 INDIA

- 9.4.4.1 Government incentives and medical device parks to accelerate adoption of molding, sterilization, and automation equipment

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Regulatory rigor and Industry 4.0 integration to drive South Korea's rapid adoption of medical device production equipment

- 9.4.6 AUSTRALIA

- 9.4.6.1 Australia's innovation clusters and strict TGA compliance to drive adoption of advanced medical device production equipment

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 ANVISA compliance and domestic demand to drive Brazil's adoption of advanced medical device production equipment

- 9.5.3 MEXICO

- 9.5.3.1 USMCA integration and FDA compliance to accelerate Mexico's adoption of advanced medical device manufacturing equipment

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 HEALTHCARE INDUSTRIALIZATION PROGRAMS TO ACCELERATE ADOPTION OF CLEANROOM, INSPECTION, AND LABELING TECHNOLOGIES

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 RISING LOCAL MANUFACTURING CAPACITY TO FUEL DEMAND FOR STERILIZATION, MOLDING, AND PACKAGING SYSTEMS

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Equipment footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ABB

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 STERIS

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 ZEISS GROUP

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 TRUMPF

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 NORDSON CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 ENGEL

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 HUSKY INJECTION MOLDING SYSTEMS LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 EMERSON

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 COHERENT CORP.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.10 OC OERLIKON MANAGEMENT AG

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.11 NIKON CORPORATION

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches

- 11.1.11.3.2 Deals

- 11.1.12 DURR GROUP

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.13 MULTIVAC

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 MIKRON

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 STRATASYS LTD.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.1 ABB

- 11.2 OTHER PLAYERS

- 11.2.1 BORCHE NORTH AMERICA INC.

- 11.2.2 R.P. INJECTION SRL

- 11.2.3 LASERAX

- 11.2.4 LITHIUM LASERS SRL

- 11.2.5 AXIAL3D

- 11.2.6 MOLD HOTRUNNER SOLUTIONS LTD.

- 11.2.7 ATLAS ENVIRONMENTS, LTD.

- 11.2.8 BERKSHIRE CORPORATION

- 11.2.9 CLEAN ROOMS INTERNATIONAL, INC.

- 11.2.10 CLEAN AIR TECHNOLOGY, INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT: MEDICAL DEVICE MANUFACTURING EQUIPMENT

- TABLE 3 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: IMPACT OF ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF INJECTION MOLDING MACHINES, BY REGION, 2022-2024 (USD)

- TABLE 6 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 IMPORT DATA FOR HS CODE 8477-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 8477-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCTS (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE PRODUCTS

- TABLE 18 KEY COMPANIES IMPLEMENTING AI IN MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR MEDICAL DEVICE MANUFACTURING EQUIPMENT

- TABLE 21 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 22 MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 23 MATERIAL PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 INJECTION MOLDING MACHINES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 INJECTION MOLDING MACHINES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 26 LASER CUTTING & WELDING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 ADDITIVE MANUFACTURING/3D PRINTING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 LASER CUTTING & WELDING SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 29 OTHER MATERIAL PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ADDITIVE MANUFACTURING/3D PRINTING SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 31 ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 32 ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 ROBOTIC ASSEMBLY LINES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 ROBOTIC ASSEMBLY LINES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 35 PICK & PLACE ROBOTICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 PICK & PLACE ROBOTICS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 37 DISPENSING & GLUING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 DISPENSING & GLUING SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 39 ULTRASONIC WELDING & BONDING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 ULTRASONIC WELDING & BONDING SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 41 SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 42 SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 PLASMA TREATMENT SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 PLASMA TREATMENT SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 45 ELECTROPOLISHING & ANODIZING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 ELECTROPOLISHING & ANODIZING SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 47 COATING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 COATING SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 49 TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 50 TESTING & INSPECTION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 OPTICAL INSPECTION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 OPTICAL INSPECTION SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 53 LEAK & PRESSURE TESTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 LEAK & PRESSURE TESTERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 55 METROLOGY EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 METROLOGY EQUIPMENT MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 57 ELECTRICAL & FUNCTIONAL TESTERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 ELECTRICAL & FUNCTIONAL TESTERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 59 STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 60 STERILIZATION & CLEANING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 STEAM STERILIZERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 STEAM STERILIZERS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 63 HYDROGEN PEROXIDE PLASMA SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 HYDROGEN PEROXIDE PLASMA SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 65 ETHYLENE OXIDE SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 ETHYLENE OXIDE SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 67 ULTRASONIC CLEANING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 ULTRASONIC CLEANING SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 69 PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 PACKAGING & LABELING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 BLISTER PACKAGING MACHINES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 BLISTER PACKAGING MACHINES MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 73 FORM-FILL-SEAL (FFS) SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 FORM-FILL-SEAL (FFS) SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 75 LABELING & CODING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 LABELING & CODING MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 77 OTHER PACKAGING & LABELING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 CLEANROOM INFRASTRUCTURE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 CLEANROOM INFRASTRUCTURE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 82 HVAC, HUMIDITY, AND ESD PROTECTION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 HVAC, HUMIDITY, AND ESD PROTECTION SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 84 CONTAMINATION CONTROL SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 CONTAMINATION CONTROL SYSTEMS MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 86 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR MEDICAL DEVICE OEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR CONTRACT MANUFACTURING ORGANIZATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR RESEARCH & ACADEMIC PROTOTYPING CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR CONSUMABLES & DISPOSABLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR SURGICAL INSTRUMENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR IMPLANTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR DIAGNOSTIC & THERAPEUTIC DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR DRUG DELIVERY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET FOR OTHER DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 98 EUROPE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 EUROPE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 EUROPE: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 EUROPE: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 EUROPE: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 EUROPE: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 EUROPE: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 EUROPE: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 EUROPE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 108 EUROPE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 109 GERMANY: MACROECONOMIC INDICATORS

- TABLE 110 GERMANY: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 GERMANY: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 GERMANY: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 GERMANY: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 GERMANY: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 GERMANY: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 GERMANY: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 GERMANY: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 GERMANY: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 119 GERMANY: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 120 FRANCE: MACROECONOMIC INDICATORS

- TABLE 121 FRANCE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 FRANCE: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 FRANCE: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 FRANCE: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 FRANCE: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 FRANCE: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 FRANCE: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 FRANCE: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 FRANCE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 130 FRANCE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 UK: MACROECONOMIC INDICATORS

- TABLE 132 UK: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 UK: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 UK: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 UK: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 UK: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 UK: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 UK: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 UK: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 UK: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 141 UK: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 142 ITALY: MACROECONOMIC INDICATORS

- TABLE 143 ITALY: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 ITALY: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 ITALY: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 ITALY: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 ITALY: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 ITALY: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 ITALY: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 ITALY: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 ITALY: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 152 ITALY: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 153 SPAIN: MACROECONOMIC INDICATORS

- TABLE 154 SPAIN: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 SPAIN: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 SPAIN: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 SPAIN: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 SPAIN: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 SPAIN: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 SPAIN: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 SPAIN: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 SPAIN: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 163 SPAIN: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 164 REST OF EUROPE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF EUROPE: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 REST OF EUROPE: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 REST OF EUROPE: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 REST OF EUROPE: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 REST OF EUROPE: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 REST OF EUROPE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 173 REST OF EUROPE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 175 NORTH AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 NORTH AMERICA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 NORTH AMERICA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 NORTH AMERICA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 NORTH AMERICA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 NORTH AMERICA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 NORTH AMERICA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 184 NORTH AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 185 US: MACROECONOMIC INDICATORS

- TABLE 186 US: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 US: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 US: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 US: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 US: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 US: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 US: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 US: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 US: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 195 US: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 196 CANADA: MACROECONOMIC INDICATORS

- TABLE 197 CANADA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 CANADA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 CANADA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 CANADA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 CANADA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 CANADA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 CANADA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 CANADA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 CANADA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 206 CANADA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 208 ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 ASIA PACIFIC: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 ASIA PACIFIC: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 ASIA PACIFIC: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 217 ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 218 JAPAN: MACROECONOMIC INDICATORS

- TABLE 219 JAPAN: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 JAPAN: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 JAPAN: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 JAPAN: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 JAPAN: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 JAPAN: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 JAPAN: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 JAPAN: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 JAPAN: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 228 JAPAN: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 229 CHINA: MACROECONOMIC INDICATORS

- TABLE 230 CHINA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 CHINA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 CHINA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 CHINA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 CHINA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 CHINA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 CHINA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 CHINA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 CHINA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 239 CHINA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 240 INDIA: MACROECONOMIC INDICATORS

- TABLE 241 INDIA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 INDIA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 INDIA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 INDIA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 INDIA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 INDIA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 INDIA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 INDIA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 INDIA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 250 INDIA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 251 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 252 SOUTH KOREA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 SOUTH KOREA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 SOUTH KOREA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 SOUTH KOREA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 SOUTH KOREA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 SOUTH KOREA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 SOUTH KOREA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 SOUTH KOREA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 SOUTH KOREA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 261 SOUTH KOREA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 262 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 263 AUSTRALIA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 AUSTRALIA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 AUSTRALIA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 AUSTRALIA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 AUSTRALIA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 AUSTRALIA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 AUSTRALIA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 AUSTRALIA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 271 AUSTRALIA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 272 AUSTRALIA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 273 REST OF ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 REST OF ASIA PACIFIC: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 REST OF ASIA PACIFIC: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 REST OF ASIA PACIFIC: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 283 LATIN AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 284 LATIN AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 LATIN AMERICA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 LATIN AMERICA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 LATIN AMERICA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 LATIN AMERICA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 LATIN AMERICA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 LATIN AMERICA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 LATIN AMERICA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 LATIN AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 293 LATIN AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 294 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 295 BRAZIL: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 BRAZIL: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 BRAZIL: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 BRAZIL: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 299 BRAZIL: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 BRAZIL: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 BRAZIL: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 BRAZIL: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 303 BRAZIL: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 304 BRAZIL: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 305 MEXICO: MACROECONOMIC INDICATORS

- TABLE 306 MEXICO: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 307 MEXICO: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 MEXICO: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 MEXICO: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 MEXICO: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 MEXICO: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 312 MEXICO: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 313 MEXICO: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 MEXICO: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 315 MEXICO: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 316 REST OF LATIN AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 REST OF LATIN AMERICA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 318 REST OF LATIN AMERICA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 REST OF LATIN AMERICA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 REST OF LATIN AMERICA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 321 REST OF LATIN AMERICA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 REST OF LATIN AMERICA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 REST OF LATIN AMERICA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 324 REST OF LATIN AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 325 REST OF LATIN AMERICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 326 MIDDLE EAST & AFRICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 327 MIDDLE EAST & AFRICA: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 MIDDLE EAST & AFRICA: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 329 MIDDLE EAST & AFRICA: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 MIDDLE EAST & AFRICA: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 331 MIDDLE EAST & AFRICA: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 332 MIDDLE EAST & AFRICA: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 333 MIDDLE EAST & AFRICA: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 334 MIDDLE EAST & AFRICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 335 MIDDLE EAST & AFRICA: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 336 GCC COUNTRIES: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 337 GCC COUNTRIES: MATERIAL PROCESSING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 338 GCC COUNTRIES: ASSEMBLY & AUTOMATION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 339 GCC COUNTRIES: SURFACE TREATMENT & COATING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 GCC COUNTRIES: TESTING & INSPECTION SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 341 GCC COUNTRIES: STERILIZATION & CLEANING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 342 GCC COUNTRIES: PACKAGING & LABELING EQUIPMENT MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 343 GCC COUNTRIES: CLEANROOM & ENVIRONMENTAL SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 GCC COUNTRIES: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 345 GCC COUNTRIES: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 346 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MEDICAL DEVICE MANUFACTURING EQUIPMENT COMPANIES

- TABLE 347 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 348 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 349 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: TYPE FOOTPRINT

- TABLE 350 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: APPLICATION FOOTPRINT

- TABLE 351 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: END-USER FOOTPRINT

- TABLE 352 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 353 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 354 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 355 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 356 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 357 ABB: COMPANY OVERVIEW

- TABLE 358 ABB: PRODUCTS OFFERED

- TABLE 359 ABB: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 360 ABB: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 361 STERIS: COMPANY OVERVIEW

- TABLE 362 STERIS: PRODUCTS OFFERED

- TABLE 363 STERIS: PRODUCT LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 364 ZEISS GROUP: COMPANY OVERVIEW

- TABLE 365 ZEISS GROUP: PRODUCTS OFFERED

- TABLE 366 ZEISS GROUP: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 367 TRUMPF: COMPANY OVERVIEW

- TABLE 368 TRUMPF: PRODUCTS OFFERED

- TABLE 369 TRUMPF: PRODUCT LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 370 TRUMPF: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 371 NORDSON CORPORATION: COMPANY OVERVIEW

- TABLE 372 NORDSON CORPORATION: PRODUCTS OFFERED

- TABLE 373 NORDSON CORPORATION: PRODUCT LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 374 NORDSON CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 375 NORDSON CORPORATION: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 376 ENGEL: COMPANY OVERVIEW

- TABLE 377 ENGEL: PRODUCTS OFFERED

- TABLE 378 HUSKY INJECTION MOLDING SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 379 HUSKY INJECTION MOLDING SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 380 EMERSON: COMPANY OVERVIEW

- TABLE 381 EMERSON: PRODUCTS OFFERED

- TABLE 382 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 383 COHERENT CORP.: PRODUCTS OFFERED

- TABLE 384 COHERENT CORP.: PRODUCT LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 385 OC OERLIKON MANAGEMENT AG: COMPANY OVERVIEW

- TABLE 386 OC OERLIKON MANAGEMENT AG: PRODUCTS OFFERED

- TABLE 387 OC OERLIKON MANAGEMENT AG: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 388 NIKON CORPORATION: COMPANY OVERVIEW

- TABLE 389 NIKON CORPORATION: PRODUCTS OFFERED

- TABLE 390 NIKON CORPORATION: PRODUCT LAUNCHES, JANUARY 2022-AUGUST 2025

- TABLE 391 NIKON CORPORATION: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 392 DURR GROUP: COMPANY OVERVIEW

- TABLE 393 DURR GROUP: PRODUCTS OFFERED

- TABLE 394 DURR GROUP: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 395 MULTIVAC: COMPANY OVERVIEW

- TABLE 396 MULTIVAC: PRODUCTS OFFERED

- TABLE 397 MIKRON: COMPANY OVERVIEW

- TABLE 398 MIKRON: PRODUCTS OFFERED

- TABLE 399 STRATASYS LTD.: COMPANY OVERVIEW

- TABLE 400 STRATASYS LTD.: PRODUCTS OFFERED

- TABLE 401 BORCHE NORTH AMERICA INC.: COMPANY OVERVIEW

- TABLE 402 R.P. INJECTION SRL: COMPANY OVERVIEW

- TABLE 403 LASERAX: COMPANY OVERVIEW

- TABLE 404 LITHIUM LASERS SRL: COMPANY OVERVIEW

- TABLE 405 AXIAL3D: COMPANY OVERVIEW

- TABLE 406 MOLD HOTRUNNER SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 407 ATLAS ENVIRONMENTS, LTD.: COMPANY OVERVIEW

- TABLE 408 BIRKSHIRE CORPORATION: COMPANY OVERVIEW

- TABLE 409 CLEAN ROOMS INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 410 CLEAN AIR TECHNOLOGY, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: ABB

- FIGURE 9 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: SUPPLY-SIDE MARKET SIZE ESTIMATION (2024)

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 TOP-DOWN APPROACH

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 GEOGRAPHICAL SNAPSHOT OF MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET

- FIGURE 18 RISING DEMAND FOR ADVANCED MEDICAL DEVICES IS DRIVING ROBUST DEMAND FOR MEDICAL DEVICE MANUFACTURING EQUIPMENT

- FIGURE 19 MATERIAL PROCESSING EQUIPMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF APAC MARKET IN 2024

- FIGURE 20 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA TO DOMINATE MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET

- FIGURE 22 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 23 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 AVERAGE SELLING PRICE TREND OF INJECTION MOLDING MACHINES, BY REGION, 2022-2024 (USD)

- FIGURE 26 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: VALUE CHAIN ANALYSIS (2024)

- FIGURE 27 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS (2024)

- FIGURE 28 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: INVESTMENT & FUNDING SCENARIO, 2019-2023

- FIGURE 30 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 31 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 32 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: PATENT ANALYSIS, JANUARY 2015-JULY 2025

- FIGURE 33 IMPORT DATA FOR HS CODE 8477-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 34 EXPORT DATA FOR HS CODE 8477-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 35 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCTS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE PRODUCTS

- FIGURE 38 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: IMPACT OF AI/GEN AI

- FIGURE 39 EUROPE: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, 2020-2024 (USD MILLION)

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET, 2024

- FIGURE 43 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: COMPANY FOOTPRINT

- FIGURE 45 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 EV/EBITDA OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 MEDICAL DEVICE MANUFACTURING EQUIPMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 ABB: COMPANY SNAPSHOT (2024)

- FIGURE 50 STERIS: COMPANY SNAPSHOT (2024)

- FIGURE 51 ZEISS GROUP: COMPANY SNAPSHOT (2024)

- FIGURE 52 TRUMPF: COMPANY SNAPSHOT (2024)

- FIGURE 53 NORDSON CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 54 EMERSON: COMPANY SNAPSHOT (2024)

- FIGURE 55 COHERENT CORP.: COMPANY SNAPSHOT (2024)

- FIGURE 56 OC OERLIKON MANAGEMENT AG: COMPANY SNAPSHOT (2024)

- FIGURE 57 NIKON CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 58 DURR GROUP: COMPANY SNAPSHOT (2024)

- FIGURE 59 MIKRON: COMPANY SNAPSHOT (2024)

- FIGURE 60 STRATASYS LTD.: COMPANY SNAPSHOT (2024)