|

市場調查報告書

商品編碼

1859662

全球系統整合服務市場按服務類型、組織規模、產業垂直領域和地區分類-預測至2030年System Integration Services Market by Service Type (Infrastructure Integration Services, Enterprise Application Integration Services, Consulting Services, and Managed Integration Services) - Global Forecast to 2030 |

||||||

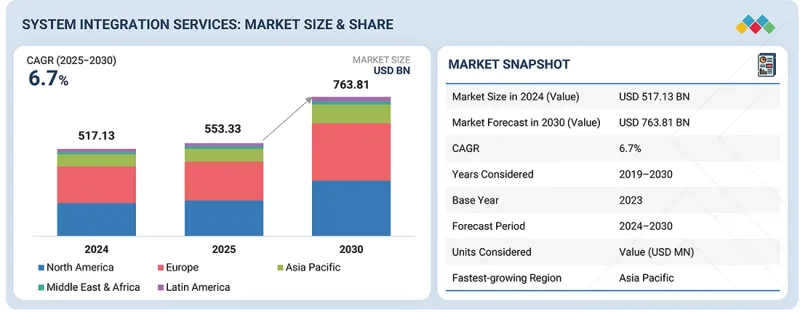

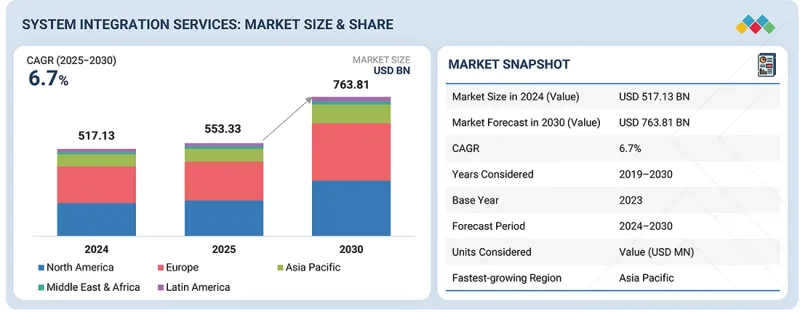

預計系統整合服務市場規模將從 2025 年的 5,533.3 億美元成長到 2030 年的 7,638.1 億美元,預測期內複合年成長率為 6.7%。

| 調查範圍 | |

|---|---|

| 調查年度 | 2020-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 考慮單位 | 金額(百萬美元/十億美元) |

| 部分 | 按服務類型、組織規模、產業和地區分類 |

| 目標區域 | 北美洲、歐洲、亞太地區、中東和非洲、拉丁美洲 |

北美是系統整合服務最大的市場,這主要得益於大型企業、雲端服務供應商的集中以及對人工智慧基礎設施的大規模投資。在健全的監管框架和強大的技術生態系統的支持下,美國和加拿大正在加速採用整合式IT和OT系統、高級自動化技術以及企業級數位轉型計畫。對人工智慧、雲端運算和工業自動化的大規模投資進一步鞏固了該地區的領先地位。

亞太地區是系統整合服務成長最快的市場,這主要得益於中國、印度、日本和韓國等國家智慧製造、機器人和工業自動化技術的快速普及。不斷擴大的數位轉型計畫、對企業資源規劃 (ERP)、製造執行系統 (MES) 和工業人工智慧 (AI) 解決方案日益成長的需求,以及政府支持的技術項目,都在加速整合計劃的推進。資訊科技 (IT) 和營運技術 (OT) 系統的整合,以及全球和區域企業不斷增加的投資,使亞太地區成為系統整合服務的高速成長中心,為提升營運效率、實現即時監控和提供可擴展的企業解決方案提供支援。

銀行、金融服務和保險 (BFSI) 行業高度依賴整合式 IT 系統來安全且有效率地管理銀行營運、保險流程和金融交易。系統整合服務能夠實現核心銀行平台、客戶關係管理 (CRM) 系統、付款閘道和監管報告工具之間的無縫連接,從而確保即時資料流和業務連續性。隨著數位銀行、人工智慧主導的分析和雲端基礎平台的日益普及,整合對於維護安全性、合規性和客戶經驗至關重要。服務供應商提供端到端解決方案,將舊有系統與現代應用程式整合,實現工作流程自動化,並增強分散式環境下的網路安全。可擴展的整合框架支援新服務的快速部署,加快交易處理速度,並提高營運彈性。透過連接不同的系統並最佳化流程,系統整合服務可幫助 BFSI 機構最大限度地減少停機時間、降低錯誤率並提高效率,從而建立可靠、敏捷且數位轉型的金融生態系統的基石。

系統整合市場的諮詢服務提供最高層級的策略指導,幫助企業設計、規劃和實施複雜的IT和OT整合舉措。這些服務確保企業系統、雲端平台、人工智慧應用和傳統基礎設施無縫協作,從而支援關鍵業務營運。服務供應商提供端到端的架構設計、工作流程最佳化、網路安全和合規性諮詢服務,幫助企業最大限度地降低風險、減少停機時間並加速數位轉型。諮詢服務通常包括可行性評估、技術藍圖和流程標準化,以確保整合舉措擴充性、面向未來,並與業務目標保持一致。透過將技術專長與策略洞察力結合,諮詢服務可協助企業實現營運彈性、無縫互通性和高效的系統效能。提供這些服務的供應商在大型整合計劃中扮演著值得信賴的合作夥伴的角色,幫助企業最大限度地提高投資回報率、增強敏捷性,並在日益數位化化的生態系統中保持競爭力。

北美是系統整合服務最大的市場,這主要得益於大型企業、雲端服務供應商和人工智慧基礎設施投資的集中。在健全的監管框架和成熟的技術生態系統的支持下,美國和加拿大正在大規模部署整合的IT和OT系統、先進的自動化技術以及企業級數位轉型舉措。對人工智慧、雲端運算和工業自動化的巨額投資進一步鞏固了該地區的領先地位。

由於中國、印度、日本和韓國等國家智慧製造、舉措和工業自動化技術的快速普及,亞太地區有望成為系統整合服務蓬勃發展的市場。不斷擴大的數位轉型計劃、對企業資源計劃 (ERP)、製造執行系統 (MES) 和工業人工智慧 (AI) 解決方案日益成長的需求,以及政府支持的技術項目,都在加速整合計劃的推進。資訊科技 (IT) 和營運技術 (OT) 系統的整合,以及全球和區域企業不斷增加的投資,正使該地區成為系統整合服務的高速成長中心,為提升營運效率、實現即時監控和提供可擴展的企業解決方案提供支援。

本報告分析了全球系統整合服務市場,提供了按服務類型、組織規模、行業和地區分類的趨勢資訊,以及參與該市場的公司的概況。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 介紹

- 市場動態

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 新的經營模式和生態系統變化

- 一級/二級/三級公司的策略性舉措

第5章 產業趨勢

- 波特五力分析

- 總體經濟指標

- 供應鏈分析

- 生態系分析

- 定價分析

- 2025-2026 年主要會議和活動

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 案例研究分析

- 2025年美國關稅的影響 - 系統整合服務市場

第6章:科技、專利、數位化和人工智慧應用帶來的策略顛覆

- 關鍵新興技術

- 互補技術

- 技術/產品藍圖

- 專利分析

- 人工智慧/生成式人工智慧對系統整合服務市場的影響

第7章 監理環境

第8章:顧客狀況與購買行為

- 決策流程

- 買方相關人員和採購評估標準

- 採購標準

- 招募障礙和內部挑戰

- 各個終端用戶產業尚未滿足的需求

- 市場盈利

第9章:系統整合服務市場(依服務類型分類)

- 介紹

- 基礎設施整合服務

- 企業應用整合服務

- 諮詢服務

- 託管整合服務

第10章:系統整合服務市場(依組織規模分類)

- 介紹

- 主要企業

- 小型企業

第11章 系統整合服務市場(依產業分類)

- 介紹

- BFSI

- 零售與電子商務

- 資訊科技/通訊

- 醫療保健和生命科學

- 政府/國防

- 製造業

- 媒體與娛樂

- 運輸/物流

- 其他

第12章 系統整合服務市場(按地區分類)

- 介紹

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他

- 亞太地區

- 中國

- 日本

- 印度

- 其他

- 中東和非洲

- 海灣合作理事會(GCC)

- 南非

- 其他

- 拉丁美洲

- 巴西

- 墨西哥

- 其他

第13章 競爭格局

- 介紹

- 主要參與企業的策略/優勢,2023-2025年

- 2020-2024年收入分析

- 2024年市佔率分析

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 估值和財務指標

- 競爭場景

第14章:公司簡介

- 介紹

- 主要參與企業

- ACCENTURE

- TCS

- COGNIZANT

- DELOITTE

- IBM

- CAPGEMINI

- WIPRO

- DXC TECHNOLOGY

- HCLTECH

- INFOSYS

- 其他公司

- ATOS

- ORACLE

- HPE

- DELL TECHNOLOGIES

- MICROSOFT

- FUJITSU

- ASPIRE SYSTEMS

- CGI

- ITRANSITION

- CELIGO

- 3INSYS

- WORK HORSE INTEGRATIONS

- DOC INFUSION

- FLOWGEAR

- JITTERBIT

- SAMLINK

- STEFANINI IT SOLUTIONS

- HEXAWARE

- LTIMINDTREE

- CISCO

第15章調查方法

第16章:鄰近/相關市場

第17章附錄

The system integration services market is projected to grow from USD 553.33 billion in 2025 to USD 763.81 billion by 2030 at a compounded annual growth rate (CAGR) of 6.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Service Type, Organization Size, Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

North America is the largest market for system integration services, driven by the concentration of large enterprises, cloud providers, and significant investments in AI infrastructure. The US and Canada are witnessing significant deployments of integrated IT and OT systems, advanced automation, and enterprise-wide digital transformation initiatives, supported by robust regulatory frameworks and strong technology ecosystems. Major investments in AI, cloud, and industrial automation further strengthen the region's leadership.

The Asia Pacific region is the fastest-growing market for system integration services, with rapid adoption of smart manufacturing, robotics, and industrial automation in countries like China, India, Japan, and South Korea. Expanding digital transformation initiatives, rising demand for ERP, MES, and industrial AI solutions, and government-backed technology programs are accelerating integration projects. The convergence of IT and OT systems, along with growing investments by global and regional enterprises, positions the Asia Pacific region as a high-growth hub for system integration services, supporting operational efficiency, real-time monitoring, and scalable enterprise solutions.

"Based on vertical, the BFSI segment is estimated to lead the market during the forecast period."

The BFSI sector relies heavily on integrated IT systems to manage banking operations, insurance processes, and financial transactions securely and efficiently. System integration services enable seamless connectivity between core banking platforms, customer relationship management (CRM) systems, payment gateways, and regulatory reporting tools, ensuring real-time data flow and operational continuity. With growing adoption of digital banking, AI-driven analytics, and cloud-based platforms, integration is critical to maintaining security, compliance, and customer experience. Service providers deliver end-to-end solutions that unify legacy systems with modern applications, automate workflows, and strengthen cybersecurity across distributed environments. Scalable integration frameworks support rapid deployment of new services, enable faster transaction processing, and improve operational resilience. By connecting disparate systems and optimizing processes, system integration services help BFSI organizations minimize downtime, reduce errors, and enhance efficiency, forming the backbone of a reliable, agile, and digitally transformed financial ecosystem.

"Based on service type, the consulting services segment is projected to register the highest CAGR during the forecast period."

Consulting services in the system integration market offer the highest level of strategic guidance, enabling organizations to design, plan, and implement complex IT and OT integration initiatives. These services ensure that enterprise systems, cloud platforms, AI applications, and legacy infrastructure work together seamlessly to support mission-critical operations. Providers deliver end-to-end advisory on architecture design, workflow optimization, cybersecurity, and compliance, enabling organizations to minimize risks, reduce downtime, and accelerate digital transformation. Consulting engagements often include feasibility assessments, technology roadmaps, and process standardization, ensuring that integration initiatives are scalable, future-ready, and aligned with business objectives. By combining technical expertise with strategic insights, consulting services enable enterprises to achieve operational resilience, seamless interoperability, and efficient system performance. Vendors offering these services position themselves as trusted partners for large-scale integration projects, helping organizations maximize ROI, enhance agility, and maintain a competitive edge in an increasingly digital ecosystem.

"North America is estimated to lead the market while Asia Pacific is expected to emerge as the fastest-growing market during the forecast period."

North America is the largest market for system integration services, driven by the concentration of large enterprises, cloud providers, and AI infrastructure investments. The US and Canada are witnessing significant deployments of integrated IT and OT systems, advanced automation, and enterprise-wide digital transformation initiatives, supported by robust regulatory frameworks and well-established technology ecosystems. Major investments in AI, cloud, and industrial automation further strengthen the region's leadership.

The Asia Pacific region is projected to be the fastest-growing market for system integration services, with rapid adoption of smart manufacturing, robotics, and industrial automation in countries like China, India, Japan, and South Korea. Expanding digital transformation initiatives, rising demand for ERP, MES, and industrial AI solutions, and government-backed technology programs are accelerating integration projects. The convergence of IT and OT systems, along with growing investments by global and regional enterprises, positions the region as a high-growth hub for system integration services, supporting operational efficiency, real-time monitoring, and scalable enterprise solutions.

Breakdown of primaries

Chief executive officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant system integration services market companies were interviewed to gain insights into this market.

- By Company: Tier I: 40%, Tier II: 25%, and Tier III: 35%

- By Designation: C-Level Executives: 45%, Director Level: 30%, and Others: 25%

- By Region: North America: 30%, Europe: 20%, Asia Pacific: 25%, Rest of the World: 15%

Some of the key system integration services market vendors are Accenture (Ireland), TCS (India), Cognizant (US), Deloitte (UK), IBM (US), Capgemini (France), Wipro (India), DXC Technology (US), HCLTech (India), Infosys (India), HPE (US), Atos (France), Oracle (US), Dell Technologies (US), Microsoft (US), Fujitsu (Japan), Aspire Systems (India), CGI (Canada), Itransition (US), Celigo (US), 3Insys (US), Work Horse Integrations (US), DOCInfusion (US), Flowgear (South Africa), Jitterbit (US), Samlink (Finland), Stefanini (Brazil), Hexaware (India), LTIMindtree (India), and Cisco (US).

Research Coverage

The market report covers the system integration services market across segments. The market size and growth potential for many segments were estimated based on service type, organization size, vertical, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to Buy This Report:

This research provides the most accurate revenue estimates for the entire system integration services industry and its subsegments, benefiting both established leaders and new entrants. Stakeholders will gain valuable insights into the competitive landscape, enabling them to better position their companies and develop effective go-to-market strategies. The report outlines key market drivers, constraints, opportunities, and challenges, helping industry players understand the current state of the market.

The report provides insights on the following pointers:

- Analysis of key drivers (API fragmentation driving middleware integration), restraints (budget overrun and extended deployment timelines impacting ROI), opportunities (AI/ML operationalization requiring legacy system integration), and challenges (continuous maintenance and support burden) influencing the growth of the system integration services market

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the system integration service market

- Market Development: In-depth details regarding profitable markets, examining the global system integration services market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, and new solutions and services

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and offerings of the top competitors in the system integration services industry, such as Accenture (Ireland), TCS (India), Cognizant (US), Deloitte (UK), IBM (US), Capgemini (France), Wipro (India), DXC Technology (US), HCLTech (India), Infosys (India), HPE (US), Atos (France), Oracle (US), Dell Technologies (US), Microsoft (US), Fujitsu (Japan), Aspire Systems (India), CGI (Canada), Itransition (US), Celigo (US), 3Insys (US), Work Horse Integrations (US), DOCInfusion (US), Flowgear (South Africa), Jitterbit (US), Samlink (Finland), Stefanini (Brazil), Hexaware (India), LTIMindtree (India), and Cisco (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 STAKEHOLDERS

- 1.4 SUMMARY OF STRATEGIC CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SYSTEM INTEGRATION SERVICES MARKET

- 3.2 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE

- 3.3 SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE

- 3.4 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL

- 3.5 SYSTEM INTEGRATION SERVICES MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 IT and OT system integration strengthening industrial operations

- 4.2.1.2 Legacy system migration to cloud

- 4.2.1.3 API fragmentation driving middleware integration

- 4.2.2 RESTRAINTS

- 4.2.2.1 Budget overrun and extended deployment timelines impacting ROI

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rise of cloud-native integration platforms

- 4.2.3.2 Cybersecurity integration services for distributed enterprises

- 4.2.3.3 AI/ML operationalization requiring legacy system integration

- 4.2.4 CHALLENGES

- 4.2.4.1 Complex integration requirements and skill shortages

- 4.2.4.2 Continuous maintenance and support burden

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN SYSTEM INTEGRATION SERVICES

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL ICT INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF SYSTEM INTEGRATION SERVICES, BY REGION, 2022-2024

- 5.5.2 INDICATIVE PRICING OF KEY PLAYERS, BY SERVICE, 2025

- 5.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 VORWERK: TRANSFORMING PERSON-TO-PERSON SALES EXPERIENCE BY DIGITALIZING DIRECT SELLING PROCESSES

- 5.9.2 BUCHI'S CUSTOMER-CENTRIC VISION ACCELERATES INNOVATION USING AZURE INTEGRATION SERVICES

- 5.9.3 MOVING MOUNTAINS WITH CLOUD INTEGRATION

- 5.9.4 VEDANTA PURSUES CENTRALIZED PERSPECTIVE TO BETTER CONTROL MINING-RELATED ACTIVITIES

- 5.10 IMPACT OF 2025 US TARIFF - SYSTEM INTEGRATION SERVICES MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRY/REGION

- 5.10.4.1 North America

- 5.10.4.1.1 US

- 5.10.4.1.2 Canada

- 5.10.4.1.3 Mexico

- 5.10.4.2 Europe

- 5.10.4.2.1 Germany

- 5.10.4.2.2 France

- 5.10.4.2.3 UK

- 5.10.4.3 Asia Pacific

- 5.10.4.3.1 China

- 5.10.4.3.2 India

- 5.10.4.1 North America

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING (AI/ML)

- 6.1.2 ROBOTIC PROCESS AUTOMATION (RPA)

- 6.1.3 LOW-CODE/NO-CODE PLATFORMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 CLOUD COMPUTING & HYBRID CLOUD PLATFORMS

- 6.2.2 API MANAGEMENT & MICROSERVICES

- 6.2.3 DATA ANALYTICS & BUSINESS INTELLIGENCE TOOLS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & HYBRID ADOPTION

- 6.3.2 MID-TERM (2027-2030) | AUTOMATION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+) | AI-NATIVE & QUANTUM-ENABLED INTEGRATION

- 6.4 PATENT ANALYSIS

- 6.4.1 LIST OF MAJOR PATENTS

- 6.5 IMPACT OF AI/GEN AI ON SYSTEM INTEGRATION SERVICES MARKET

- 6.5.1 CASE STUDY

- 6.5.1.1 Keeping patients front and center in establishing a new company

- 6.5.2 VENDOR INITIATIVES

- 6.5.2.1 Transforming enterprise workflows through IBM's AI integration services

- 6.5.2.2 Accelerating AI-driven financial transformation through TCS-Google Cloud collaboration

- 6.5.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.1 CASE STUDY

7 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.2 REGIONAL REGULATIONS AND COMPLIANCE

- 7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2.2 REGULATIONS BASED ON REGION

- 7.2.2.1 North America

- 7.2.2.2 Europe

- 7.2.2.3 Asia Pacific

- 7.2.2.4 Middle East & Africa

- 7.2.2.5 Latin America

- 7.2.3 INDUSTRY STANDARDS

- 7.2.3.1 General Data Protection Regulation

- 7.2.3.2 SEC Rule 17a-4

- 7.2.3.3 ISO/IEC 27001

- 7.2.3.4 COBIT (Control Objectives for Information and Related Technologies)

- 7.2.3.5 ISA (International Society of Automation)

- 7.2.3.6 System and Organization Controls 2 Type II

- 7.2.3.7 Financial Industry Regulatory Authority

- 7.2.3.8 Freedom of Information Act

- 7.2.3.9 Health Insurance Portability and Accountability Act

8 CUSTOMER LANDSCAPE AND BUYING BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 8.6 MARKET PROFITABILITY

- 8.6.1 REVENUE POTENTIAL

- 8.6.2 COST DYNAMICS

- 8.6.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE

- 9.1 INTRODUCTION

- 9.2 INFRASTRUCTURE INTEGRATION SERVICES

- 9.2.1 BUILDING CONNECTED AND SCALABLE IT FOUNDATIONS

- 9.2.2 ERP AND CRM INTEGRATION

- 9.2.3 API & MIDDLEWARE INTEGRATION

- 9.2.4 LEGACY SYSTEM MODERNIZATION

- 9.3 ENTERPRISE APPLICATIONS INTEGRATION SERVICES

- 9.3.1 ENABLING SEAMLESS DATA AND WORKFLOW CONNECTIVITY

- 9.3.2 CLOUD & HYBRID INTEGRATION SERVICES

- 9.3.3 API MANAGEMENT AND INTEGRATION

- 9.3.4 DATA SYNCHRONIZATION AND MASTER DATA MANAGEMENT

- 9.4 CONSULTING SERVICES

- 9.4.1 DESIGNING STRATEGIC INTEGRATION ROADMAPS FOR DIGITAL TRANSFORMATION

- 9.4.2 IT AND INTEGRATION STRATEGY CONSULTING

- 9.4.3 DIGITAL TRANSFORMATION CONSULTING

- 9.4.4 ARCHITECTURE DESIGN AND GOVERNANCE CONSULTING

- 9.5 MANAGED INTEGRATION SERVICES

- 9.5.1 OPTIMIZING AND SUSTAINING INTEGRATED IT ECOSYSTEMS

- 9.5.2 SLA-BASED INTEGRATION SUPPORT

- 9.5.3 INCIDENT AND CHANGE MANAGEMENT FOR INTEGRATION WORKFLOWS

10 SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.2 LARGE ENTERPRISES

- 10.2.1 DIGITAL TRANSFORMATION THROUGH UNIFIED, SCALABLE INTEGRATION FRAMEWORKS

- 10.3 SMES

- 10.3.1 ENABLING AGILITY AND COST-EFFECTIVE INNOVATION THROUGH SIMPLIFIED SYSTEM INTEGRATION

11 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.2 BFSI

- 11.2.1 ENHANCING OPERATIONAL RESILIENCE AND CUSTOMER EXPERIENCE THROUGH SECURE SYSTEM INTEGRATION

- 11.2.2 BFSI: USE CASES

- 11.2.2.1 Core banking integration

- 11.2.2.2 Payment system integration

- 11.2.2.3 Other use cases

- 11.3 RETAIL & E-COMMERCE

- 11.3.1 POWERING OMNICHANNEL EXPERIENCES THROUGH SEAMLESS PLATFORM INTEGRATION

- 11.3.2 RETAIL & E-COMMERCE: USE CASES

- 11.3.2.1 Supply chain & warehouse integration

- 11.3.2.2 Payment gateway integration

- 11.3.2.3 Other use cases

- 11.4 IT & TELECOM

- 11.4.1 ENABLING NETWORK MODERNIZATION AND CLOUD-DRIVEN INNOVATION THROUGH INTEGRATED IT SYSTEMS

- 11.4.2 IT & TELECOM: USE CASES

- 11.4.2.1 5G core integration

- 11.4.2.2 IOT & edge integration

- 11.4.2.3 Other use cases

- 11.5 HEALTHCARE & LIFE SCIENCES

- 11.5.1 ADVANCING PATIENT CARE AND DATA INTEROPERABILITY WITH UNIFIED HEALTH SYSTEMS

- 11.5.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 11.5.2.1 Electronic health records integration

- 11.5.2.2 Pharma R&D integration

- 11.5.2.3 Other use cases

- 11.6 GOVERNMENT & DEFENSE

- 11.6.1 STRENGTHENING DIGITAL GOVERNANCE AND SECURITY THROUGH INTEGRATED INFRASTRUCTURE

- 11.6.2 GOVERNMENT & DEFENSE: USE CASES

- 11.6.2.1 National ID & e-governance

- 11.6.2.2 Defense command & control system

- 11.6.2.3 Other use cases

- 11.7 MANUFACTURING

- 11.7.1 DRIVING SMART FACTORY EVOLUTION WITH CONNECTED AND AUTOMATED SYSTEMS

- 11.7.2 MANUFACTURING: USE CASES

- 11.7.2.1 Smart factory integration

- 11.7.2.2 IoT & industrial automation

- 11.7.2.3 Other use cases

- 11.8 MEDIA & ENTERTAINMENT

- 11.8.1 TRANSFORMING CONTENT DELIVERY AND ENGAGEMENT THROUGH INTEGRATED DIGITAL ECOSYSTEMS

- 11.8.2 MEDIA & ENTERTAINMENT: USE CASES

- 11.8.2.1 Content distribution platforms

- 11.8.2.2 Audience analytics

- 11.8.2.3 Other use cases

- 11.9 TRANSPORTATION & LOGISTICS

- 11.9.1 OPTIMIZING SUPPLY CHAINS WITH REAL-TIME, CONNECTED INTEGRATION SOLUTIONS

- 11.9.2 TRANSPORTATION & LOGISTICS: USE CASES

- 11.9.2.1 Fleet management integration

- 11.9.2.2 Warehouse automation

- 11.9.2.3 Other use cases

- 11.10 OTHERS

12 SYSTEM INTEGRATION SERVICES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Multi-year investment by Jabil in AI and cloud data center infrastructure to boost market

- 12.2.2 CANADA

- 12.2.2.1 AI and cloud investments to fuel demand for system integration services

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 UK

- 12.3.1.1 Rising demand for EAM solutions across asset-intensive industries to drive market

- 12.3.2 GERMANY

- 12.3.2.1 Demand for automation and compliance to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Strategic investments and policy initiatives to fuel demand for system integration services

- 12.3.4 ITALY

- 12.3.4.1 Government investments to fuel demand for system integration services

- 12.3.5 SPAIN

- 12.3.5.1 Strategic investments to boost demand for system integration services

- 12.3.6 REST OF EUROPE

- 12.3.1 UK

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Increasing digital transformation initiatives to drive demand for system integration services

- 12.4.2 JAPAN

- 12.4.2.1 Growing focus on digitalization through system integration to drive market

- 12.4.3 INDIA

- 12.4.3.1 AWS investment to strengthen demand for system integration services

- 12.4.4 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GULF COOPERATION COUNCIL (GCC)

- 12.5.1.1 UAE

- 12.5.1.1.1 Increasing ATS adoption through policy-driven hiring and AI-enabled recruitment systems to drive market

- 12.5.1.2 Saudi Arabia

- 12.5.1.2.1 Development of AI, fintech, and smart city applications through integration services to drive market

- 12.5.1.3 Rest of GCC

- 12.5.1.1 UAE

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Global cloud investments to fuel demand for system integration services

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GULF COOPERATION COUNCIL (GCC)

- 12.6 LATIN AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Rise of industrial and digital ecosystem through system integration to drive market

- 12.6.2 MEXICO

- 12.6.2.1 Rising demand for system integration in digital transformation to drive market

- 12.6.3 REST OF LATIN AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Service type footprint

- 13.6.5.4 Vertical footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8.1 COMPANY VALUATION OF KEY VENDORS

- 13.8.2 FINANCIAL METRICS OF KEY VENDORS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 MAJOR PLAYERS

- 14.2.1 ACCENTURE

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 TCS

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Deals

- 14.2.2.4 MnM view

- 14.2.2.4.1 Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 COGNIZANT

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 DELOITTE

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 IBM

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 CAPGEMINI

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches

- 14.2.6.3.2 Deals

- 14.2.7 WIPRO

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Deals

- 14.2.8 DXC TECHNOLOGY

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Deals

- 14.2.9 HCLTECH

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Deals

- 14.2.10 INFOSYS

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product launches

- 14.2.10.3.2 Deals

- 14.2.1 ACCENTURE

- 14.3 OTHER PLAYERS

- 14.3.1 ATOS

- 14.3.2 ORACLE

- 14.3.3 HPE

- 14.3.4 DELL TECHNOLOGIES

- 14.3.5 MICROSOFT

- 14.3.6 FUJITSU

- 14.3.7 ASPIRE SYSTEMS

- 14.3.8 CGI

- 14.3.9 ITRANSITION

- 14.3.10 CELIGO

- 14.3.11 3INSYS

- 14.3.12 WORK HORSE INTEGRATIONS

- 14.3.13 DOC INFUSION

- 14.3.14 FLOWGEAR

- 14.3.15 JITTERBIT

- 14.3.16 SAMLINK

- 14.3.17 STEFANINI IT SOLUTIONS

- 14.3.18 HEXAWARE

- 14.3.19 LTIMINDTREE

- 14.3.20 CISCO

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH APPROACH

- 15.1.1 SECONDARY DATA

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 Breakup of primary profiles

- 15.1.2.3 Key industry insights

- 15.2 MARKET BREAKUP AND DATA TRIANGULATION

- 15.3 MARKET SIZE ESTIMATION

- 15.3.1 TOP-DOWN APPROACH

- 15.3.2 BOTTOM-UP APPROACH

- 15.3.3 MARKET ESTIMATION APPROACHES

- 15.4 MARKET FORECAST

- 15.5 RESEARCH ASSUMPTIONS

- 15.6 RESEARCH LIMITATIONS

16 ADJACENT/RELATED MARKET

- 16.1 INTRODUCTION

- 16.1.1 RELATED MARKETS

- 16.1.2 LIMITATIONS

- 16.2 CLOUD PROFESSIONAL SERVICES MARKET

- 16.3 NORTH AMERICA IT SERVICES MARKET

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES ON SYSTEM INTEGRATION SERVICES MARKET

- TABLE 3 GDP PERCENTAGE CHANGE, BY KEY COUNTRIES, 2021-2029

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 INDICATIVE PRICING ANALYSIS, BY SERVICE, 2025

- TABLE 6 SYSTEM INTEGRATION SERVICES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 7 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 8 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USER MARKET DUE TO TARIFF IMPACT

- TABLE 9 LIST OF MAJOR PATENTS, 2014-2024

- TABLE 10 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 17 SYSTEM INTEGRATION SERVICES MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES

- TABLE 18 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 19 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 20 INFRASTRUCTURE INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 21 INFRASTRUCTURE INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 ENTERPRISE APPLICATION INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 ENTERPRISE APPLICATION INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 CONSULTING SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 CONSULTING SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 MANAGED INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 MANAGED INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 29 SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 30 LARGE ENTERPRISES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 LARGE ENTERPRISES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 SMES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 SMES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 35 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 36 BFSI: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 BFSI: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 RETAIL & E-COMMERCE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 RETAIL & E-COMMERCE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 IT & TELECOM: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 IT & TELECOM: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 HEALTHCARE & LIFE SCIENCES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 HEALTHCARE & LIFE SCIENCES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 GOVERNMENT & DEFENSE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 GOVERNMENT & DEFENSE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 MANUFACTURING: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 MANUFACTURING: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 MEDIA & ENTERTAINMENT: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 MEDIA & ENTERTAINMENT: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 TRANSPORT & LOGISTICS: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 TRANSPORT & LOGISTICS: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 OTHERS: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 OTHERS: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 57 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 US: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 65 US: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 66 CANADA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 67 CANADA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 68 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 69 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 70 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 71 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 72 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 73 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 75 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 UK: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 77 UK: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 78 GERMANY: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 79 GERMANY: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 80 FRANCE: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 81 FRANCE: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 82 ITALY: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 83 ITALY: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 84 SPAIN: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 85 SPAIN: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 86 REST OF EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 87 REST OF EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 89 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 91 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 93 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 CHINA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 97 CHINA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 98 JAPAN: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 99 JAPAN: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 100 INDIA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 101 INDIA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 GCC: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 113 GCC: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 GCC: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 115 GCC: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 116 UAE: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 117 UAE: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 118 SAUDI ARABIA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 119 SAUDI ARABIA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 120 REST OF GCC: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 121 REST OF GCC: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 122 SOUTH AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 123 SOUTH AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 125 REST OF MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 126 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 127 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 129 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 131 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 133 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 BRAZIL: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 135 BRAZIL: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 136 MEXICO: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 137 MEXICO: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 138 REST OF LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 139 REST OF LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 140 SYSTEM INTEGRATION SERVICES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 141 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 142 SYSTEM INTEGRATION SERVICES MARKET: REGION FOOTPRINT

- TABLE 143 SYSTEM INTEGRATION SERVICES MARKET: SERVICE TYPE FOOTPRINT

- TABLE 144 SERVICE INTEGRATION SERVICES MARKET: VERTICAL FOOTPRINT

- TABLE 145 SYSTEM INTEGRATION SERVICES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 146 SYSTEM INTEGRATION SERVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 147 SYSTEM INTEGRATION SERVICES MARKET: PRODUCT LAUNCHES, 2024-OCTOBER 2025

- TABLE 148 SYSTEM INTEGRATION SERVICES MARKET: DEALS, 2024-OCTOBER 2025

- TABLE 149 ACCENTURE: COMPANY OVERVIEW

- TABLE 150 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 ACCENTURE: PRODUCT LAUNCHES

- TABLE 152 ACCENTURE: DEALS

- TABLE 153 TCS: COMPANY OVERVIEW

- TABLE 154 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 TCS: DEALS

- TABLE 156 COGNIZANT: COMPANY OVERVIEW

- TABLE 157 COGNIZANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 COGNIZANT: PRODUCT LAUNCHES

- TABLE 159 COGNIZANT: DEALS

- TABLE 160 DELOITTE: COMPANY OVERVIEW

- TABLE 161 DELOITTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 DELOITTE: PRODUCT LAUNCHES

- TABLE 163 DELOITTE: DEALS

- TABLE 164 IBM: COMPANY OVERVIEW

- TABLE 165 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 IBM: PRODUCT LAUNCHES

- TABLE 167 IBM: DEALS

- TABLE 168 CAPGEMINI: COMPANY OVERVIEW

- TABLE 169 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 CAPGEMINI: PRODUCT LAUNCHES

- TABLE 171 CAPGEMINI: DEALS

- TABLE 172 WIPRO: COMPANY OVERVIEW

- TABLE 173 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 WIPRO: DEALS

- TABLE 175 DXC TECHNOLOGY: COMPANY OVERVIEW

- TABLE 176 DXC TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 WIPRO: DEALS

- TABLE 178 HCLTECH: COMPANY OVERVIEW

- TABLE 179 HCLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 HCLTECH: DEALS

- TABLE 181 INFOSYS: COMPANY OVERVIEW

- TABLE 182 INFOSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 INFOSYS: PRODUCT LAUNCHES

- TABLE 184 INFOSYS: DEALS

- TABLE 185 FACTOR ANALYSIS

- TABLE 186 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 187 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 188 CLOUD PROFESSIONAL CONSULTING SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 189 CLOUD PROFESSIONAL CONSULTING SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 190 NORTH AMERICA IT SERVICES MARKET, BY SERVICE TYPE, 2017-2021 (USD BILLION)

- TABLE 191 NORTH AMERICA IT SERVICES MARKET, BY SERVICE TYPE, 2022-2027 (USD BILLION)

- TABLE 192 NORTH AMERICA IT SERVICES MARKET, BY PROFESSIONAL SERVICE, 2017-2021 (USD BILLION)

- TABLE 193 NORTH AMERICA IT SERVICES MARKET, BY PROFESSIONAL SERVICE, 2022-2027 (USD BILLION)

List of Figures

- FIGURE 1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 2 SYSTEM INTEGRATION SERVICES MARKET, 2025-2030

- FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN SYSTEM INTEGRATION SERVICES MARKET (2020-2025)

- FIGURE 4 DISRUPTIVE TRENDS IMPACTING GROWTH OF SYSTEM INTEGRATION SERVICES MARKET

- FIGURE 5 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN SYSTEM INTEGRATION SERVICES MARKET, 2024

- FIGURE 6 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 7 HIGH DEMAND IN MANUFACTURING, BFSI, AND IT & TELECOM VERTICALS TO CREATE LUCRATIVE OPPORTUNITIES FOR SYSTEM INTEGRATION SERVICE PROVIDERS

- FIGURE 8 INFRASTRUCTURE INTEGRATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 9 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

- FIGURE 11 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 12 SYSTEM INTEGRATION SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 SYSTEM INTEGRATION SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 14 INTERNATIONAL INVESTMENTS IN DIGITAL ECONOMY

- FIGURE 15 SYSTEM INTEGRATION SERVICES MARKET: SUPPLY CHAIN

- FIGURE 16 SYSTEM INTEGRATION SERVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 17 AVERAGE SELLING PRICE, BY REGION, 2022-2024

- FIGURE 18 SYSTEM INTEGRATION SERVICES MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 19 LEADING SYSTEM INTEGRATION SERVICES MARKET VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2025

- FIGURE 20 PATENTS APPLIED AND PUBLISHED, 2014-2024

- FIGURE 21 IMPACT OF AI/GEN AI ON SYSTEM INTEGRATION SERVICES MARKET

- FIGURE 22 SYSTEM INTEGRATION SERVICES MARKET: DECISION-MAKING FACTORS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 25 SYSTEM INTEGRATION SERVICES MARKET: ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 26 INFRASTRUCTURE INTEGRATION SERVICES SEGMENT TO LEAD MARKET DURING THE FORECAST PERIOD

- FIGURE 27 LARGE ENTERPRISES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 28 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS OF KEY VENDORS, 2021-2024

- FIGURE 33 SYSTEM INTEGRATION SERVICES MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 34 SYSTEM INTEGRATION SERVICES MARKET: COMPARATIVE ANALYSIS OF VENDOR BRANDS/PRODUCTS

- FIGURE 35 SYSTEM INTEGRATION SERVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 36 SYSTEM INTEGRATION SERVICES MARKET: COMPANY FOOTPRINT

- FIGURE 37 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 38 SYSTEM INTEGRATION SERVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 39 COMPANY VALUATION OF KEY VENDORS

- FIGURE 40 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 41 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 42 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 43 TCS: COMPANY SNAPSHOT

- FIGURE 44 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 45 IBM: COMPANY SNAPSHOT

- FIGURE 46 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 47 WIPRO: COMPANY SNAPSHOT

- FIGURE 48 DXC TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 49 HCLTECH: COMPANY SNAPSHOT

- FIGURE 50 INFOSYS: COMPANY SNAPSHOT

- FIGURE 51 SYSTEM INTEGRATION SERVICES MARKET: RESEARCH DESIGN

- FIGURE 52 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 53 SYSTEM INTEGRATION SERVICES MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 54 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 55 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 56 SYSTEM INTEGRATION SERVICES MARKET: RESEARCH FLOW

- FIGURE 57 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 58 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 59 SYSTEM INTEGRATION SERVICES MARKET: DEMAND-SIDE APPROACH