|

市場調查報告書

商品編碼

1856026

全球骨盆器官脫垂(POP)治療與管理市場(至2030年):依產品、治療細分、應用、最終使用者和地區分類POP Treatment and Management / Pelvic Organ Prolapse Market by Product, Treatment, Application, End User, Region - Global Forecast to 2030 |

||||||

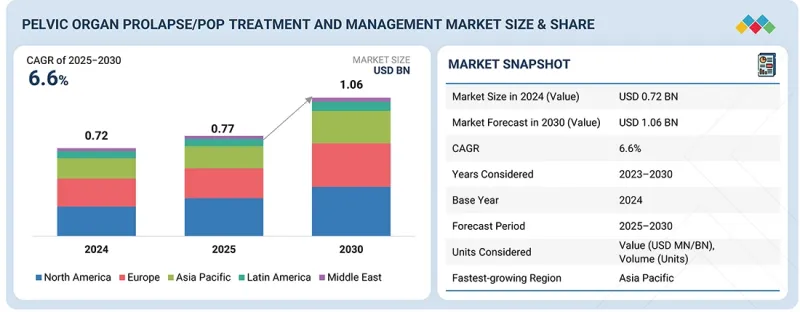

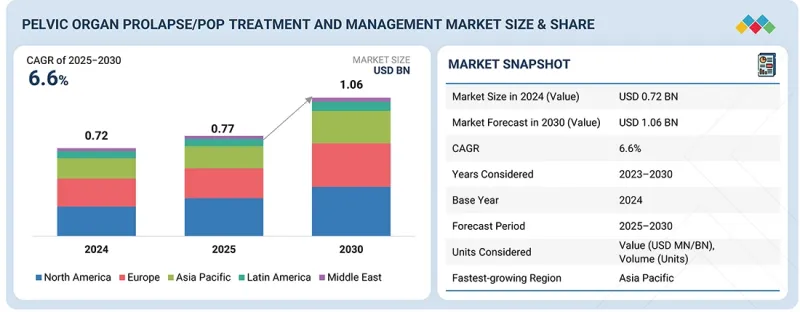

全球骨盆器官脫垂(POP)治療和管理市場預計將從 2025 年的 7.7 億美元成長到 2030 年的 10.6 億美元,預測期內複合年成長率為 6.6%。

| 調查範圍 | |

|---|---|

| 調查年度 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元) |

| 部分 | 產品、治療類別、用途、最終用戶 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲 |

由於骨盆器官脫垂(POP)在全球範圍內的高發病率、老年女性人口的成長、人們對POP的認知不斷提高以及早期診斷技術的進步,再加上微創和機器人輔助手術技術的進步,預計骨盆器官脫垂市場未來將顯著成長。然而,可能阻礙市場成長的因素包括與陰道網片相關的併發症和召回問題、開發中國家醫療保健資源的可及性和可負擔性方面的限制、社會歧視導致的診斷延遲以及POP產品的安全風險。

“按最終用戶分類,醫院在預測期內將保持最大佔有率。”

到2024年,醫院和診所將佔據最大的市場佔有率。醫院的優勢在於其集中採購系統,這使其能夠有效率地引進新的骨盆器官脫垂(POP)治療技術。此外,醫院還可以透過政府和公共機構的資金籌措,輕鬆購買先進的醫療設備,例如昂貴的機器人手術系統。另外,醫院往往是唯一能夠處理術中併發症、複雜重組手術以及老年病患合併症的醫療機構。基於這些原因,預計醫院將繼續保持在骨盆器官脫垂治療領域的領先地位。

“按治療類型分類,手術治療部分佔據了大部分市場佔有率。”

預計到2024年,手術治療將佔據市場的大部分佔有率。對於合併多腔室器官脫垂和應力性尿失禁等併發症的患者,手術介入通常是首選。近年來,微創手術和機器人輔助手術的普及縮短了患者的恢復時間,減少了術後併發症,使其成為患者和醫生都可接受的選擇。此外,手術網片、生物移植物和能量輔助消融裝置等技術的不斷創新也促進了手術效果的提升。臨床指引也強烈建議手術治療,並將其視為中重度骨盆器官脫垂的一線治療方法,從而保持了其市場主導地位。

“亞太地區是成長最快的區域市場”

亞太地區人口老化速度加快,導致老年女性骨盆器官脫垂的發生率上升,尤其是在中國和日本。此外,女性健康意識提升以及對骨盆底功能障礙治療接受度的提高,推動了診斷和治療率的提升。各國政府積極投資醫療基礎設施,改善手術設施的可近性,並推廣包括機器人輔助手術在內的先進醫療技術。此外,印度和韓國等國醫療旅遊的蓬勃發展進一步加速了市場成長。這些國家的優勢在於能夠以低成本提供高品質的醫療保健服務。然而,挑戰依然存在,例如農村地區醫療資源分配不均以及熟練醫生短缺。不過,加大對醫學教育的投入、推廣數位化醫療以及進行公眾宣傳活動可望彌合這些差距。這些因素使亞太地區成為全球成長最快的骨盆器官脫垂治療和管理市場。

本報告調查了全球骨盆器官脫垂(POP)治療和管理市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、按各個細分市場、地區/主要國家進行的詳細分析、競爭格局以及主要企業的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 影響客戶業務的趨勢與干擾因素

- 定價分析

- 價值鏈分析

- 供應鏈分析

- 生態系分析

- 投資和資金籌措方案

- 技術分析

- 專利分析

- 貿易分析

- 大型會議和活動

- 案例研究分析

- 監管狀態

- 波特五力分析

- 主要相關利益者和採購標準

- 人工智慧的影響

- 美國2025年關稅

第6章骨盆器官脫垂/骨盆底重建市場(依產品分類)

- 合成網

- 生物植入材料

- 縫合線

- 陰道托

- 骨盆底治療設備

- 機器人手術系統

- 診斷和評估工具

第7章骨盆器官脫垂/骨盆底重建市場(依治療細分)

- 手術治療

- 閉合技術

- 陰道修復手術

- 骶骨陰道固定術

- 骶骨陰道固定術

- 子宮薦椎和薦骨韌帶固定術

- 非手術治療

- 陰道託管理

- 骨盆底肌肉療法

第8章骨盆器官脫垂/骨盆底重建市場(依應用領域分類)

- 膀胱膨出

- 尿道囊腫

- 腸疝

- 子宮脫垂

- 直腸膨出

第9章骨盆器官脫垂/骨盆底重建市場(依最終用戶分類)

- 醫院

- 專科診所

- 門診手術中心

- 其他

第10章骨盆器官脫垂/骨盆底重建市場(依地區分類)

- 北美洲

- 宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 宏觀經濟展望

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 其他

- 亞太地區

- 宏觀經濟展望

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他

- 拉丁美洲

- 宏觀經濟展望

- 巴西

- 墨西哥

- 其他

- 中東和非洲

- 宏觀經濟展望

第11章 競爭格局

- 主要參與企業的策略/優勢

- 收入分析

- 市佔率分析

- 公司評估矩陣:主要企業

- 公司估值矩陣:新興企業/中小企業

- 估值和財務指標

- 品牌/產品對比

- 競爭場景

第12章:公司簡介

- 主要企業

- BOSTON SCIENTIFIC CORPORATION

- COLOPLAST GROUP

- INTUITIVE SURGICAL OPERATIONS, INC.

- COOPERCOMPANIES

- JOHNSON & JOHNSON

- GE HEALTHCARE

- INTEGRA LIFESCIENCES CORPORATION

- B. BRAUN SE

- PFM MEDICAL GMBH

- CALDERA MEDICAL

- 其他公司

- KEGEL8

- MEDGYN PRODUCTS INC.

- BETATECH MEDICAL

- FEG TEXTILTECHNIK FORSCHUNGS-UND ENTWICKLUNGSGESELLSCHAFT MBH

- BIOTEQUE AMERICA INC.

- PERSONAL MEDICAL CORP.

- DIPROMED SRL

- AMI GMBH

- BRAY GROUP

- DIGITIMER LTD

- MEDESIGN IC GMBH

- DR. ARABIN GMBH & CO. KG

- FOR.ME.SA.

- COSM MEDICAL

- WILLOW INNOVATIONS, INC.

第13章附錄

The global POP Treatment and Management / Pelvic Organ Prolapse market is projected to reach USD 1.06 billion by 2030 from USD 0.77 billion in 2025, at a CAGR of 6.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Treatment, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The market is expected to witness high growth due to the high global prevalence of pelvic organ prolapse, rising geriatric female population, growing awareness and early diagnosis, and advancements in minimally invasive and robotic surgical techniques. Complications and recalls associated with vaginal mesh, limited access and affordability in developing markets, underdiagnosis due to social stigma, and the risk of POP products are likely to restrain market growth.

"The hospitals segment of the POP Treatment and Management / Pelvic Organ Prolapse market, by end user, is expected to hold the largest position during the forecast period."

Based on end user, the market is segmented into hospitals, specialty clinics, ambulatory surgery centers (ASCs), and others. In 2024, hospitals and clinics accounted for the largest share of the market. Hospitals benefit from centralized procurement systems, allowing for efficient integration of new POP technologies. Their access to government or institutional funding also facilitates the acquisition of expensive devices, such as robotic surgical systems, which may not be feasible in smaller outpatient facilities. Furthermore, hospitals are often the only facilities equipped to manage intraoperative complications, complex reconstructions, and comorbid conditions in elderly patients-ensuring their continued dominance in the pelvic organ prolapse treatment landscape.

"The surgical segment accounted for the larger market share in the POP Treatment and Management / Pelvic Organ Prolapse market."

The POP Treatment and Management / Pelvic Organ Prolapse market is segmented into surgical and non-surgical. The surgical segment accounted for the larger share of the market in 2024. Surgical intervention is often preferred in cases involving multiple-compartment prolapses or associated conditions like stress urinary incontinence. Moreover, with the growing availability of minimally invasive and robotic-assisted methods, surgical options now offer quicker recovery and reduced postoperative complications, making them more acceptable to both patients and clinicians. Continuous innovation in surgical meshes, biologic grafts, and energy-assisted dissection tools further enhances procedural outcomes. Importantly, surgical treatments are backed by strong clinical guidelines and are often the first-line recommendation in moderate to severe POP, reinforcing their dominant position in the market.

"Asia Pacific is the fastest-growing market for POP Treatment and Management / Pelvic Organ Prolapse."

The global POP Treatment and Management / Pelvic Organ Prolapse market is segmented into five segments, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is experiencing rapid population aging, especially in countries like China and Japan, leading to a rising incidence of pelvic organ prolapse disorders among elderly women. Increasing awareness of women's health and growing acceptance of pelvic floor treatments are driving higher diagnosis and treatment rates. Governments across the region are investing in healthcare infrastructure, expanding access to surgical facilities, and supporting the adoption of advanced medical technologies, including robotic-assisted procedures. The rise of medical tourism in countries such as India and South Korea further fuels market growth, offering high-quality care at lower costs. While access disparities and a shortage of trained specialists still exist in rural areas, ongoing investments in healthcare training, digital health platforms, and public awareness campaigns are helping to close these gaps, positioning Asia Pacific as the fastest-growing regional market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America: 51%, Europe: 21%, Asia Pacific: 18%, Latin America: 6%, and Middle East & Africa: 4%

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the POP Treatment and Management / Pelvic Organ Prolapse market are Boston Scientific Corporation (US), Coloplast Group (Denmark), Intuitive Surgical Operations, Inc. (US), CooperCompanies (US), and Johnson & Johnson (US).

Research Coverage

This report studies the POP Treatment and Management / Pelvic Organ Prolapse market based on product, treatment, application, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, will help them to garner a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights into the following pointers:

Analysis of key drivers (High global prevalence of pelvic organ prolapse, rising geriatric female population, growing awareness and early diagnosis, and advancements in minimally invasive and robotic surgical techniques), restraints (complications and recalls associated with vaginal mesh, limited access and affordability in developing market, and underdiagnosis due to social stigma), opportunities (growth opportunities in emerging economies, development of bioengineered and absorbable mesh and digital health and pelvic floor therapy devices), and challenges (inconsistent clinical guidelines and treatment standards, and high recurrence and reoperation rates)

Market Penetration: Comprehensive information on the product portfolios offered by the top players in the POP Treatment and Management / Pelvic Organ Prolapse market

Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the POP Treatment and Management / Pelvic Organ Prolapse market

Market Development: Comprehensive information on lucrative emerging regions

Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the POP Treatment and Management / Pelvic Organ Prolapse market

Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Revenue estimation of key players

- 2.2.1.2 Approach 2: Study of annual reports and investor presentations

- 2.2.1.3 Approach 3: Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 STUDY-RELATED ASSUMPTIONS

- 2.4.2 PARAMETRIC ASSUMPTIONS

- 2.4.3 GROWTH RATE ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PELVIC ORGAN PROLAPSE/ PELVIC FLOOR RECONSTRUCTION MARKET

- 4.2 ASIA PACIFIC PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER AND COUNTRY

- 4.3 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY REGION

- 4.4 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Global prevalence of pelvic organ prolapse

- 5.2.1.2 Rise in female geriatric population

- 5.2.1.3 Improved awareness and early diagnosis

- 5.2.1.4 Advancements in robotic surgical techniques

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complications and recalls associated with transvaginal synthetic mesh

- 5.2.2.2 Limited access in emerging economies

- 5.2.2.3 Underdiagnosis due to social stigma

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased investments in pelvic organ prolapse care from emerging economies

- 5.2.3.2 Rapid development of bioengineered and absorbable mesh

- 5.2.3.3 Advent of digital pelvic health solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Inconsistent clinical guidelines and treatment standards

- 5.2.4.2 High recurrence and reoperation rates

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY PRODUCT

- 5.4.2 AVERAGE SELLING PRICE TREND, BY TREATMENT AND KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Pelvic mesh implants

- 5.9.1.2 Vaginal pessaries

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Wearable and app-based pelvic therapy devices

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Urinary incontinence devices

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 901890)

- 5.11.2 EXPORT SCENARIO (HS CODE 901890)

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 NEGLECTED PESSARY IN PATIENT WITH PELVIC ORGAN PROLAPSE

- 5.13.2 SUCCESSFUL USE OF PESSARY FOR UTERINE PROLAPSE AFTER PELVIC TRAUMA IN YOUNG, NULLIPAROUS FEMALE

- 5.13.3 ROBOTIC AND LAPAROSCOPIC SACROCOLPOPEXY FOR PELVIC ORGAN PROLAPSE

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY ANALYSIS

- 5.14.1.1 North America

- 5.14.1.1.1 US

- 5.14.1.1.2 Canada

- 5.14.1.2 Europe

- 5.14.1.2.1 Germany

- 5.14.1.2.2 UK

- 5.14.1.2.3 France

- 5.14.1.3 Asia Pacific

- 5.14.1.3.1 China

- 5.14.1.3.2 Japan

- 5.14.1.3.3 India

- 5.14.1.4 Latin America

- 5.14.1.5 Middle East

- 5.14.1.1 North America

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1 REGULATORY ANALYSIS

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 BARGAINING POWER OF SUPPLIERS

- 5.15.2 BARGAINING POWER OF BUYERS

- 5.15.3 THREAT FROM NEW ENTRANTS

- 5.15.4 THREAT FROM SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 IMPACT OF AI

- 5.17.1 INTRODUCTION

- 5.17.2 POTENTIAL OF AI IN PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET

- 5.17.3 KEY COMPANIES IMPLEMENTING AI

- 5.17.4 FUTURE OF AI IN PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET

- 5.18 US 2025 TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Hospitals

6 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SYNTHETIC MESH

- 6.2.1 ADOPTION OF ADVANCED, PATIENT-FOCUSED MESH TECHNOLOGIES

- 6.3 BIOLOGICAL GRAFTS

- 6.3.1 SHIFT TOWARD BIOCOMPATIBLE ALTERNATIVES

- 6.4 SUTURES

- 6.4.1 NEED FOR PRECISION IN PELVIC REPAIRS WITH ABSORBABLE AND ANTIBACTERIAL PRODUCTS

- 6.5 VAGINAL PESSARIES

- 6.5.1 INTRODUCTION OF CUSTOM-FIT, HOME-USE PESSARY SOLUTIONS

- 6.6 PELVIC FLOOR THERAPY DEVICES

- 6.6.1 PATIENT PREFERENCE FOR MANAGING PELVIC FLOOR DISORDERS INDEPENDENTLY

- 6.7 ROBOTIC SURGERY SYSTEMS

- 6.7.1 ELEVATED DEMAND FOR MINIMALLY INVASIVE SOLUTIONS IN COMPLEX PELVIC REPAIRS

- 6.8 DIAGNOSTIC & ASSESSMENT TOOLS

- 6.8.1 ACCURATE DETECTION WITH ADVANCED IMAGING AND SMART DEVICES

7 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT

- 7.1 INTRODUCTION

- 7.2 SURGICAL

- 7.2.1 COLPOCLEISIS

- 7.2.1.1 Large-scale adoption among older women

- 7.2.2 COLPORRHAPY

- 7.2.2.1 Increased preference for foundational repair techniques

- 7.2.3 SACROCOLPOPEXY

- 7.2.3.1 Reduced postoperative discomfort and quicker recovery

- 7.2.4 SACROHYSTEROPEXY

- 7.2.4.1 Rise in demand for uterine-preserving options for prolapse repair

- 7.2.5 UTEROSACRAL OR SACROSPINOUS LIGAMENT FIXATION

- 7.2.5.1 Surge in native tissue repairs without mesh-based interventions

- 7.2.1 COLPOCLEISIS

- 7.3 NON-SURGICAL

- 7.3.1 VAGINAL PESSARY MANAGEMENT

- 7.3.1.1 Emphasis on early intervention

- 7.3.2 PELVIC FLOOR MUSCLE THERAPY

- 7.3.2.1 Extensive use in early-stage prolapse and postpartum women

- 7.3.1 VAGINAL PESSARY MANAGEMENT

8 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CYSTOCELE

- 8.2.1 WEAKENED PELVIC FLOOR MUSCLES PROMPT DEVELOPMENT

- 8.3 URETHROCELE

- 8.3.1 CHRONIC INCREASE IN INTRA-ABDOMINAL PRESSURE

- 8.4 ENTEROCELE

- 8.4.1 SURGE IN APICAL VAGINAL SUPPORT DEFICIENCY

- 8.5 UTERINE PROLAPSE

- 8.5.1 GROWTH IN PROLAPSE BURDEN

- 8.6 RECTOCELE

- 8.6.1 PREVALENCE OF RECTOVAGINAL SEPTUM DEFICIENCY

9 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 HIGH PATIENT INFLOW AND WIDESPREAD AVAILABILITY OF REIMBURSEMENTS

- 9.3 SPECIALTY CLINICS

- 9.3.1 HEIGHTENED DEMAND FOR TAILORED, NON-INVASIVE, AND ACCESSIBLE CARE

- 9.4 AMBULATORY SURGERY CENTERS

- 9.4.1 COST ADVANTAGES AND FAVORABLE CLINICAL OUTCOMES

- 9.5 OTHER END USERS

10 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Rise in female geriatric population to drive market

- 10.2.3 CANADA

- 10.2.3.1 High symptom prevalence and demographic trends to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 GERMANY

- 10.3.2.1 Advanced surgical innovations to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Increased clinical focus on pelvic floor disorders and pelvic organ prolapse to drive market

- 10.3.4 UK

- 10.3.4.1 Women's health policy initiatives to drive market

- 10.3.5 ITALY

- 10.3.5.1 Demographic shifts to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Rising popularity of non-surgical interventions to drive market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Growing incidence of pelvic organ prolapse to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Evolving healthcare delivery and infrastructure landscape to drive market

- 10.4.4 INDIA

- 10.4.4.1 Booming medical tourism to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Rapid growth of medical manufacturing companies to drive market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Surge in healthcare spending to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 BRAZIL

- 10.5.2.1 Improving healthcare infrastructure to drive market

- 10.5.3 MEXICO

- 10.5.3.1 Expanding healthcare awareness and services to drive market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Treatment footprint

- 11.5.5.5 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.6.5.1 List of start-ups/SMEs

- 11.6.5.2 Competitive benchmarking of start-ups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES/APPROVALS

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 BOSTON SCIENTIFIC CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 COLOPLAST GROUP

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 INTUITIVE SURGICAL OPERATIONS, INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches/approvals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 COOPERCOMPANIES

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 JOHNSON & JOHNSON

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches/approvals

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 GE HEALTHCARE

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches/approvals

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 INTEGRA LIFESCIENCES CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 B. BRAUN SE

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 PFM MEDICAL GMBH

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 CALDERA MEDICAL

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.1 BOSTON SCIENTIFIC CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 KEGEL8

- 12.2.2 MEDGYN PRODUCTS INC.

- 12.2.3 BETATECH MEDICAL

- 12.2.4 FEG TEXTILTECHNIK FORSCHUNGS- UND ENTWICKLUNGSGESELLSCHAFT MBH

- 12.2.5 BIOTEQUE AMERICA INC.

- 12.2.6 PERSONAL MEDICAL CORP.

- 12.2.7 DIPROMED SRL

- 12.2.8 A.M.I. GMBH

- 12.2.9 BRAY GROUP

- 12.2.10 DIGITIMER LTD

- 12.2.11 MEDESIGN I.C. GMBH

- 12.2.12 DR. ARABIN GMBH & CO. KG

- 12.2.13 FOR.ME.SA.

- 12.2.14 COSM MEDICAL

- 12.2.15 WILLOW INNOVATIONS, INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 POPULATION OF FEMALES AGED 50 AND ABOVE, 2024

- TABLE 2 AVERAGE SELLING PRICING TREND OF PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION PRODUCTS, BY TYPE, 2023-2025

- TABLE 3 AVERAGE SELLING PRICE TREND OF PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION PRODUCTS, BY TREATMENT AND KEY PLAYER, 2023-2025

- TABLE 4 AVERAGE SELLING PRICE TREND OF PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION PRODUCTS, BY REGION, 2023-2025

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 PATENT ANALYSIS

- TABLE 7 IMPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS IN JAPAN

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 IMPACT OF PORTER'S FIVE FORCES ON PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR PRODUCTS (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP FOUR PRODUCTS

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 21 KEY PRODUCTS IN SYNTHETIC MESH MARKET

- TABLE 22 SYNTHETIC MESH SALES, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 23 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SYNTHETIC MESH, BY REGION, 2023-2030 (USD MILLION)

- TABLE 24 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SYNTHETIC MESH, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SYNTHETIC MESH, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SYNTHETIC MESH, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SYNTHETIC MESH, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 KEY PRODUCTS IN BIOLOGICAL GRAFTS MARKET

- TABLE 29 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR BIOLOGICAL GRAFTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR BIOLOGICAL GRAFTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR BIOLOGICAL GRAFTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION FOR BIOLOGICAL GRAFTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR BIOLOGICAL GRAFTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 KEY PRODUCTS IN SUTURES MARKET

- TABLE 35 SUTURE SALES, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 36 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SUTURES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SUTURES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SUTURES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SUTURES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SUTURES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 KEY PRODUCTS IN VAGINAL PESSARIES MARKET

- TABLE 42 VAGINAL PESSARY SALES, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 43 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARIES, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 48 KEY PRODUCTS IN PELVIC FLOOR THERAPY DEVICES MARKET

- TABLE 49 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR THERAPY DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR THERAPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR THERAPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR THERAPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR THERAPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 KEY PRODUCTS IN ROBOTIC SURGERY SYSTEMS MARKET

- TABLE 55 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ROBOTIC SURGERY SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ROBOTIC SURGERY SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ROBOTIC SURGERY SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ROBOTIC SURGERY SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ROBOTIC SURGERY SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 KEY PRODUCTS IN DIAGNOSTIC & ASSESSMENT TOOLS MARKET

- TABLE 61 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR DIAGNOSTIC & ASSESSMENT TOOLS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR DIAGNOSTIC & ASSESSMENT TOOLS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR DIAGNOSTIC & ASSESSMENT TOOLS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR DIAGNOSTIC & ASSESSMENT TOOLS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR DIAGNOSTIC & ASSESSMENT TOOLS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 67 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SURGICAL, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SURGICAL, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPOCLEISIS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPOCLEISIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPOCLEISIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION FOR COLPOCLEISIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPOCLEISIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPORRHAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPORRHAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPORRHAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPORRHAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR COLPORRHAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROCOLPOPEXY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROCOLPOPEXY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROCOLPOPEXY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROCOLPOPEXY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROCOLPOPEXY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 88 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROHYSTEROPEXY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROHYSTEROPEXY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROHYSTEROPEXY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROHYSTEROPEXY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SACROHYSTEROPEXY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 93 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTEROSACRAL OR SACROSPINOUS LIGAMENT FIXATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTEROSACRAL OR SACROSPINOUS LIGAMENT FIXATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTEROSACRAL OR SACROSPINOUS LIGAMENT FIXATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTEROSACRAL OR SACROSPINOUS LIGAMENT FIXATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTEROSACRAL OR SACROSPINOUS LIGAMENT FIXATION, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 98 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR NON-SURGICAL, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR NON-SURGICAL, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR NON-SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR NON-SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR NON-SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR NON-SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARY MANAGEMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARY MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARY MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION FOR VAGINAL PESSARY MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR VAGINAL PESSARY MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR MUSCLE THERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR MUSCLE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR MUSCLE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR MUSCLE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR PELVIC FLOOR MUSCLE THERAPY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 115 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR CYSTOCELE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR CYSTOCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR CYSTOCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR CYSTOCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR CYSTOCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR URETHROCELE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR URETHROCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR URETHROCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION FOR URETHROCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR URETHROCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ENTEROCELE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ENTEROCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ENTEROCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ENTEROCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR ENTEROCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTERINE PROLAPSE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTERINE PROLAPSE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTERINE PROLAPSE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTERINE PROLAPSE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR UTERINE PROLAPSE, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 135 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR RECTOCELE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR RECTOCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR RECTOCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR RECTOCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR RECTOCELE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 141 HOSPITALS PER CAPITA, BY COUNTRY, 2024

- TABLE 142 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 147 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SPECIALTY CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION FOR SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR SPECIALTY CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 162 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 163 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 164 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 165 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 166 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 167 NORTH AMERICA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 NORTH AMERICA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 170 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 171 US: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 172 US: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 173 US: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 US: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 US: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 176 US: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 CANADA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 178 CANADA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 179 CANADA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 CANADA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 CANADA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 182 CANADA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 183 EUROPE: MACROECONOMIC INDICATORS

- TABLE 184 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 185 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 186 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 187 EUROPE: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 EUROPE: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 190 EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 191 GERMANY: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 192 GERMANY: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 193 GERMANY: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 GERMANY: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 GERMANY: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 196 GERMANY: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 197 FRANCE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 198 FRANCE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 199 FRANCE: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 FRANCE: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 FRANCE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 202 FRANCE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 203 UK: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 204 UK: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 205 UK: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 UK: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 UK: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 208 UK: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 209 ITALY: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 210 ITALY: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 211 ITALY: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 ITALY: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 ITALY: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 214 ITALY: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 215 SPAIN: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 216 SPAIN: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 217 SPAIN: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 SPAIN: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 SPAIN: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 220 SPAIN: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 221 REST OF EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 222 REST OF EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 223 REST OF EUROPE: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 REST OF EUROPE: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 REST OF EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 226 REST OF EUROPE: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 227 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 228 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 229 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 230 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 231 ASIA PACIFIC: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 ASIA PACIFIC: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 234 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 235 CHINA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 236 CHINA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 237 CHINA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 CHINA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 CHINA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 240 CHINA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 241 JAPAN: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 242 JAPAN: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 243 JAPAN: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 JAPAN: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 JAPAN: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 246 JAPAN: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 247 INDIA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 248 INDIA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 249 INDIA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 INDIA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 INDIA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 252 INDIA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 253 AUSTRALIA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 254 AUSTRALIA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 255 AUSTRALIA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 AUSTRALIA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 AUSTRALIA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 258 AUSTRALIA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 259 SOUTH KOREA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 260 SOUTH KOREA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 261 SOUTH KOREA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 SOUTH KOREA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 SOUTH KOREA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 264 SOUTH KOREA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 265 REST OF ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 266 REST OF ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 267 REST OF ASIA PACIFIC: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 REST OF ASIA PACIFIC: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 REST OF ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 270 REST OF ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 271 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 272 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 273 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 274 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 275 LATIN AMERICA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 LATIN AMERICA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 278 LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 279 BRAZIL: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 280 BRAZIL: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 281 BRAZIL: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 BRAZIL: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 BRAZIL: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 284 BRAZIL: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 285 MEXICO: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 286 MEXICO: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 287 MEXICO: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 MEXICO: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 MEXICO: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 290 MEXICO: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 291 REST OF LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 292 REST OF LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 293 REST OF LATIN AMERICA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 294 REST OF LATIN AMERICA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 REST OF LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 296 REST OF LATIN AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 298 MIDDLE EAST & AFRICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2023-2030 (USD MILLION)

- TABLE 300 MIDDLE EAST & AFRICA: SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: NON-SURGICAL PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 MIDDLE EAST & AFRICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 304 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- TABLE 305 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET: DEGREE OF COMPETITION

- TABLE 306 REGION FOOTPRINT

- TABLE 307 PRODUCT FOOTPRINT

- TABLE 308 TREATMENT FOOTPRINT

- TABLE 309 APPLICATION FOOTPRINT

- TABLE 310 LIST OF START-UPS/SMES

- TABLE 311 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 312 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET: PRODUCT LAUNCHES/APPROVALS, 2022-2025

- TABLE 313 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET: DEALS, 2022-2025

- TABLE 314 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET: OTHER DEVELOPMENTS, 2022-2025

- TABLE 315 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 316 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 317 BOSTON SCIENTIFIC CORPORATION: DEALS

- TABLE 318 COLOPLAST GROUP: COMPANY OVERVIEW

- TABLE 319 COLOPLAST GROUP: PRODUCTS OFFERED

- TABLE 320 INTUITIVE SURGICAL OPERATIONS, INC.: COMPANY OVERVIEW

- TABLE 321 INTUITIVE SURGICAL OPERATIONS, INC.: PRODUCTS OFFERED

- TABLE 322 INTUITIVE SURGICAL OPERATIONS, INC.: PRODUCT LAUNCHES/APPROVALS

- TABLE 323 COOPERCOMPANIES: COMPANY OVERVIEW

- TABLE 324 COOPERCOMPANIES: PRODUCTS OFFERED

- TABLE 325 COOPERCOMPANIES: DEALS

- TABLE 326 JOHNSON & JOHNSON: COMPANY OVERVIEW

- TABLE 327 JOHNSON & JOHNSON: PRODUCTS OFFERED

- TABLE 328 JOHNSON & JOHNSON: PRODUCT LAUNCHES/APPROVALS

- TABLE 329 JOHNSON & JOHNSON: DEALS

- TABLE 330 JOHNSON & JOHNSON: OTHER DEVELOPMENTS

- TABLE 331 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 332 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 333 GE HEALTHCARE: PRODUCT LAUNCHES/APPROVALS

- TABLE 334 GE HEALTHCARE: DEALS

- TABLE 335 GE HEALTHCARE: OTHER DEVELOPMENTS

- TABLE 336 INTEGRA LIFESCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 337 INTEGRA LIFESCIENCES CORPORATION: PRODUCTS OFFERED

- TABLE 338 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 339 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 340 B. BRAUN SE: DEALS

- TABLE 341 PFM MEDICAL GMBH: COMPANY OVERVIEW

- TABLE 342 PFM MEDICAL GMBH: PRODUCTS OFFERED

- TABLE 343 CALDERA MEDICAL: COMPANY OVERVIEW

- TABLE 344 CALDERA MEDICAL: PRODUCTS OFFERED

- TABLE 345 CALDERA MEDICAL: DEALS

List of Figures

- FIGURE 1 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 6 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY TREATMENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 7 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 8 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 9 GEOGRAPHICAL SNAPSHOT OF PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET

- FIGURE 10 RISE IN FEMALE GERIATRIC POPULATION TO DRIVE MARKET

- FIGURE 11 HOSPITALS AND CHINA ACCOUNTED FOR SIGNIFICANT SHARES IN 2024

- FIGURE 12 ASIA PACIFIC TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET DYNAMICS

- FIGURE 15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 SUPPLY CHAIN ANALYSIS

- FIGURE 18 ECOSYSTEM ANALYSIS

- FIGURE 19 INVESTMENT AND FUNDING SCENARIO, 2020-2025 (USD MILLION)

- FIGURE 20 PATENT ANALYSIS

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR PRODUCTS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP FOUR PRODUCTS

- FIGURE 24 IMPACT OF AI ON PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET

- FIGURE 25 NORTH AMERICA: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET SNAPSHOT

- FIGURE 26 ASIA PACIFIC: PELVIC ORGAN PROLAPSE/PELVIC FLOOR RECONSTRUCTION MARKET SNAPSHOT

- FIGURE 27 REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD MILLION)

- FIGURE 28 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 29 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 30 COMPANY FOOTPRINT

- FIGURE 31 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 32 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 33 EV/EBITDA OF KEY VENDORS

- FIGURE 34 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 35 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 36 COLOPLAST GROUP: COMPANY SNAPSHOT

- FIGURE 37 INTUITIVE SURGICAL OPERATIONS, INC.: COMPANY SNAPSHOT

- FIGURE 38 COOPERCOMPANIES: COMPANY SNAPSHOT

- FIGURE 39 JOHNSON & JOHNSON: COMPANY SNAPSHOT

- FIGURE 40 GE HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 41 INTEGRA LIFESCIENCES CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 B. BRAUN SE: COMPANY SNAPSHOT