|

市場調查報告書

商品編碼

1854900

全球雷射干涉儀市場(至 2030 年)按技術(零差式、外差式)、類型(邁克爾遜干涉儀、FABRY-PEROT干涉儀、菲佐干涉儀、馬赫-曾德爾干涉儀、薩尼亞克乾涉儀、特懷曼-格林干涉儀)、組件(雷射器、檢測器、光學元件)和應用(表面形貌、生物醫學)Laser Interferometer Market by Technique (Homodyne, Heterodyne), Type (Michelson, Fabry-Perot, Fizeau, Mach-Zehnder, Sagnac, Twyman-green), Component (Laser, Photodetector, Optical), Application (Surface Topology, Biomedical) - Global Forecast to 2030 |

||||||

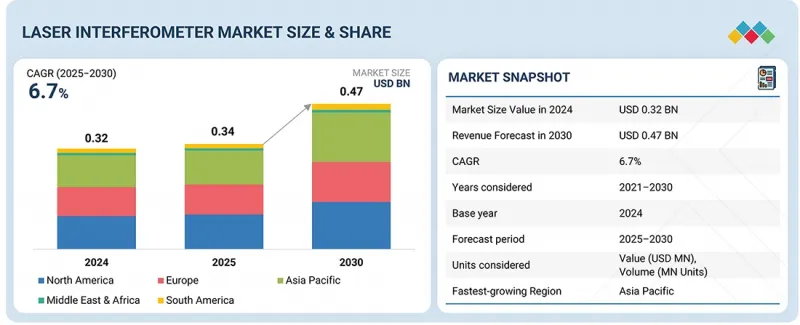

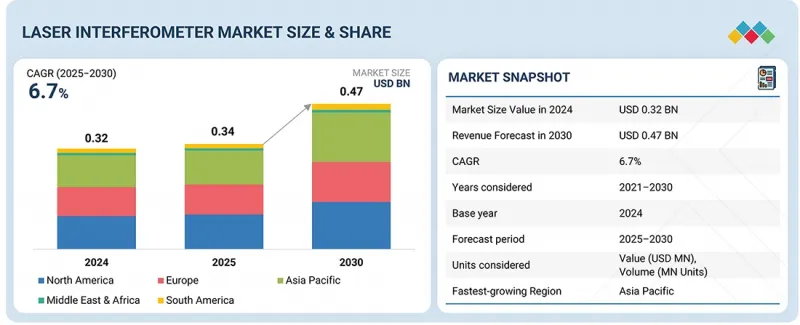

預計雷射干涉儀市場將從 2025 年的 3.4 億美元成長到 2030 年的 4.7 億美元,預測期內複合年成長率為 6.7%。

| 調查範圍 | |

|---|---|

| 調查年度 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 考慮單位 | 金額(美元) |

| 部分 | 按技術、類型、組件、應用和地區分類 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

半導體裝置的日益小型化顯著推動了對雷射干涉儀的需求。奈米級小型化的趨勢對高精度、高可靠性的計量技術提出了更高的要求。雷射干涉儀能夠提供亞奈米級的精度,使半導體製造商能夠精確測量、檢測和控制晶圓表面的平整度、均勻性和缺陷——這對於確保裝置性能至關重要。雷射干涉儀在微機電系統(MEMS)的開發中也發揮關鍵作用,透過精確測量表面形狀來確保微型化元件的可靠性。此外,隨著半導體產業向3D堆疊和系統級封裝(SiP)等先進封裝技術轉型,對高精度對準和尺寸計量的需求更加迫切。在多層元件中,對每一層的厚度、位置和完整性進行干涉驗證,直接影響元件的效率和功能。

此外,隨著新型半導體材料、製程和架構的不斷湧現,干涉儀製造商正與半導體產業攜手合作,推動技術創新並持續提升系統效能。這種協同效應促成了客製化計量解決方案的誕生,從而應對不斷變化的生產挑戰。雷射干涉儀的非接觸式高解析度測量能力使其成為確保半導體品質、推動下一代電子產品研發以及促進全球雷射干涉儀市場成長的關鍵工具。

“預計在2025年至2030年間,外差式射頻技術將佔據較大佔有率。”

這得歸功於其卓越的測量精度和多功能性。外差干涉儀能夠進行高解析度的位移和速度測量,使其成為航太、汽車、半導體和精密工程等產業不可或缺的工具。其低相位雜訊和穩定的即時資料擷取能力在晶圓曝光設備校準和微機電系統(MEMS)測試等超高精度環境中尤為重要。在製造業,其應用範圍正在擴展到工具機校準、機器人對準和動態振動分析,有助於提高生產效率並減少誤差。奈米技術和微型元件的日益普及也推動了對能夠進行亞奈米級測量的外差干涉儀的需求。此外,科研院所和大學也擴大將其應用於光學實驗和材料研究。雷射穩定性的提高以及小型化和成本降低的進步也推動了其廣泛應用。預計在需要高精度、自動化和高可靠性的行業中,外差干涉儀仍將保持主流地位。

到2024年,北美將佔據最大的市場佔有率。

這主要歸功於該地區先進製造業的集中、高額的研發投入以及精密測量技術的廣泛應用。該地區的優勢主要源於其在航太、汽車、半導體和醫療行業的領先地位,這些行業都需要高精度的檢測和測試設備。美國半導體製造商和大型航太公司以率先採用者乾涉測量解決方案來滿足嚴格的品質和性能標準而聞名。此外,電動車 (EV) 和自動駕駛技術日益成長的需求也推動了雷射干涉儀在校準、組件測試和表面形貌測量等應用領域的需求。北美擁有強大的技術供應商和研究機構生態系統,促進了乾涉測量技術的持續創新。此外,政府的先進製造業計劃以及對計量和工業自動化的投資也推動了市場成長。同時,全球領導企業的光學和雷射系統企業在美國的存在也加強了供應鏈和技術進步。這種創新實力、強大的產業基礎和早期應用文化使北美在2024年繼續保持其在雷射干涉儀市場的領先地位。

本報告調查了全球雷射干涉儀市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、按各個細分市場、地區/主要國家進行的詳細分析、競爭格局以及主要企業的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章 市場概覽

- 市場動態

- 促進要素

- 抑制因素

- 機會

- 任務

- 價值鏈分析

- 生態系分析

- 影響客戶業務的趨勢/干擾因素

- 定價分析

- 技術分析

- 波特五力分析

- 主要相關利益者和採購標準

- 案例研究分析

- 貿易分析

- 專利分析

- 2025-2026 年重要會議與活動

- 關稅和監管狀況

- 人工智慧/生成式人工智慧對雷射干涉儀市場的影響

- 2025年美國關稅對雷射干涉儀市場的影響

第6章:雷射干涉儀的組成部分

- 雷射光源

- 檢測器

- 光學元件

- 控制系統

- 軟體

第7章 雷射干涉儀測量技術

- 相位測量

- 頻率測量

- 幅度測量

- 飛行時間測量

第8章 雷射干涉儀設計

- 桌上型系統

- 可攜式/手持系統

- 線上/流程系統

- 模組化系統

- 飛行時間系統

第9章 雷射干涉儀市場(按類型分類)

- 邁克爾遜干涉儀

- FABRY-PEROT干涉儀

- 菲索干涉儀

- 馬赫-曾德爾干涉儀

- Sagnac 干涉儀

- 特懷曼-格林干擾

第10章 雷射干涉儀市場(依技術分類)

- 同頻

- 異差

第11章 雷射干涉儀市場依應用領域分類

- 表面拓撲

- 工程

- 應用科學

- 生物醫學

- 半導體檢測

第12章 雷射干涉儀市場(依產業分類)

- 車

- 航太/國防

- 工業

- 醫療保健

- 電子和半導體

- 電訊

第13章 雷射干涉儀市場(依地區分類)

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 其他

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 韓國

- 其他

- 其他地區

- 世界其他地區宏觀經濟展望

- 中東

- 非洲

- 南美洲

第14章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收入分析

- 市佔率分析

- 估值和財務指標

- 產品對比

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小企業

- 競爭場景

第15章 公司簡介

- 主要企業

- RENISHAW PLC

- KEYSIGHT TECHNOLOGIES

- ZEISS GROUP

- ZYGO CORPORATION

- BRUKER

- MAHR GMBH

- MOLLER-WEDEL OPTICAL GMBH

- QED TECHNOLOGIES

- SIOS MEBTECHNIK GMBH

- TOSEI ENGINEERING CORP.

- AUTOMATED PRECISION INC (API)

- 其他公司

- PRATT AND WHITNEY MEASUREMENT SYSTEMS, INC.

- SMARACT GMBH

- LASERTEX

- LUNA

- 4D TECHNOLOGY CORP.

- APRE INSTRUMENTS

- ADLOPTICA OPTICAL SYSTEMS GMBH

- LOGITECH

- HOLMARC OPTO-MECHATRONICS LTD.

- ATTOCUBE SYSTEMS GMBH

- HIGHFINESSE GMBH

- XONOX TECHNOLOGY GMBH

- THORLABS, INC.

- LASERTEC CORPORATION

- FUJIFILM HOLDINGS CORPORATION

- OLYMPUS CORPORATION

第16章附錄

The laser interferometer market is projected to grow from USD 0.34 billion in 2025 to USD 0.47 billion by 2030, at a CAGR of 6.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technique, Type, Component, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growing trend of semiconductor device miniaturization is significantly boosting the demand for laser interferometers, as shrinking feature sizes to the nanometre scale require precise and reliable metrology tools. Laser interferometers provide sub-nanometre accuracy, enabling semiconductor manufacturers to measure, inspect, and control wafer surfaces for flatness, uniformity, and defects, which are crucial for ensuring device performance. They are equally vital in supporting the development of micro-electromechanical systems (MEMS), where accurate surface topology measurements ensure the reliability of miniature components. With the semiconductor industry shifting toward advanced packaging techniques such as 3D stacking and system-in-package (SiP), the need for precision alignment and measurement becomes even more critical. Multi-layer device architectures rely on interferometers to verify the thickness, placement, and alignment of each layer, directly impacting efficiency and functionality.

Additionally, as new semiconductor materials, processes, and architectures emerge, interferometer manufacturers continuously advance system capabilities, fostering innovation through collaboration with the semiconductor industry. This synergy enables the creation of tailored metrology solutions to meet evolving production challenges. The ability of laser interferometers to deliver non-contact, high-resolution measurements positions them as indispensable tools for ensuring semiconductor quality, driving next-generation electronics development, and fuelling growth in the global laser interferometer market.

"Heterodyne segment is likely to contribute a major share of the laser interferometer market from 2025 to 2030."

The heterodyne segment is likely to contribute a major share of the laser interferometer market from 2025 to 2030, owing to its superior measurement accuracy and versatility across diverse applications. Heterodyne interferometers offer high-resolution displacement and velocity measurements, making them invaluable in industries such as aerospace, automotive, semiconductor, and precision engineering. Their ability to minimize phase noise and provide stable, real-time data is especially important in environments requiring ultra-high precision, such as wafer lithography alignment and microelectromechanical systems (MEMS) testing. In manufacturing, heterodyne systems are increasingly used for machine tool calibration, robotic alignment, and dynamic vibration analysis, all of which are critical to ensuring productivity and minimizing operational errors. The growing use of nanotechnology and miniaturized components is also amplifying demand for heterodyne interferometers due to their ability to measure at the sub-nanometre scale. Furthermore, research and academic institutions are expanding their adoption of these systems for advanced optical experiments and material studies. Continuous innovations in laser stability, coupled with the trend toward compact, cost-efficient heterodyne solutions, are further boosting adoption. As industries pursue higher precision, tighter tolerances, and greater automation, heterodyne interferometers are set to remain the dominant choice, solidifying their large market share during the forecast period.

"Surface topology application segment is expected to record a significant CAGR in the laser interferometer market from 2025 to 2030."

The surface topology application segment is projected to record a significant CAGR in the laser interferometer market between 2025 and 2030, driven by the rising demand for ultra-precise surface characterization across industries. Surface topology measurement enables manufacturers to detect minute irregularities, roughness, and flatness on critical components, ensuring reliability and compliance with stringent quality standards. In the semiconductor industry, where wafer surfaces must achieve near-perfect flatness, laser interferometers play a crucial role in reducing defects and improving yield rates. Similarly, in optics and photonics, accurate measurement of lens and mirror surfaces ensures optimal performance of imaging systems. Automotive and aerospace manufacturers are also investing in surface topology solutions to validate advanced materials and components used in electric vehicles, aircraft engines, and lightweight structures. With the growing adoption of additive manufacturing and nanotechnology, the need for non-contact, high-resolution, and real-time surface topology inspection is accelerating. Advances in laser stability and digital imaging technologies further enhance the efficiency of these interferometers. The increasing integration of AI-driven analysis for faster defect detection and automation-friendly solutions is also supporting growth. Collectively, these factors position surface topology as one of the fastest-growing application segments in the laser interferometer market over the forecast period.

"North America accounted for the largest share of the laser interferometer market in 2024."

North America accounted for the largest share of the laser interferometer market in 2024, supported by its strong base of advanced manufacturing industries, high R&D spending, and widespread adoption of precision measurement technologies. The region's dominance is largely attributed to its leadership in aerospace, automotive, semiconductor, and healthcare sectors, all of which require high-accuracy inspection and testing tools. U.S.-based semiconductor manufacturers, along with major aerospace companies, have been early adopters of interferometer solutions to meet stringent quality and performance standards. The growing demand for electric vehicles and autonomous driving technologies has further increased the need for laser interferometers in calibration, component testing, and surface topology measurements. Additionally, North America has a robust ecosystem of technology providers and research institutions driving continuous innovation in laser interferometry. The region also benefits from favourable government support for advanced manufacturing initiatives and increasing investments in metrology and industrial automation. Healthcare applications, including optical diagnostics and ophthalmology, add another dimension to market growth. Furthermore, the presence of global leaders in laser and optical systems in the US strengthens supply capabilities and technological advancements. With its combination of innovation, strong end-user industries, and early adoption trends, North America maintained its lead in the laser interferometer market in 2024.

- By Company Type: Tier 1 - 26%, Tier 2 - 32%, and Tier 3 - 42%

- By Designation: C-level Executives - 40%, Managers - 30%, and Others - 30%

- By Region: North America - 34%, Europe - 25%, Asia Pacific- 30%, and RoW - 11%

Prominent players profiled in this report include Renishaw plc (UK), Keysight Technologies (US), ZEISS Group (Germany), Zygo Corporation (US), and Bruker (US).

Report Coverage

The report defines, describes, and forecasts the laser interferometer market based on type (michelson interferometer, fabry-perot interferometer, fizeau interferometer, mach-zehnder interferometer, sagnac interferometer, twyman-green interferometer), technique (homodyne, heterodyne), application (surface topology, engineering, applied science, biomedical, semiconductor detection), vertical (automotive, aerospace & defense, industrial, healthcare, electronics & semiconductor, telecommunications) and region (North America, Europe, Asia Pacific, RoW). It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall laser interferometer market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following points:

- Analysis of key drivers (Surging demand for precision in manufacturing and quality control, Growing trend of miniaturization of semiconductor devices, Extremely tight tolerances in aerospace & defence and automotive verticals), restraints (High ownership and maintenance costs, Adverse impact of environmental conditions on measurement accuracy, Availability of alternative measurement tools, Risks associated with constant technological upgrades and obsolescence of existing equipment), opportunities (Industrialization in emerging markets, Integration of laser interferometry with automated production lines,

cloud-based platforms, and Industry 4.0 technologies, growing emphasis on developing more user-friendly and cost-effective models, elevating demand for advanced medical devices, and challenges (Requirement for skilled personnel to handle complex operations) of the laser interferometer market

- Product development /Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the laser interferometer market

- Market Development: Comprehensive information about lucrative markets; the report analyses the laser interferometer market across various regions

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the laser interferometer market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including Renishaw plc (UK), Keysight Technologies (US), ZEISS Group (Germany), Zygo Corporation (US), Bruker (US), Mahr GmbH (Germany), MOLLER-WEDEL OPTICAL GMBH (Switzerland), QED Technologies (US), SIOS MeBtechnik GmbH (Germany), in the laser interferometer market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LASER INTERFEROMETER MARKET

- 4.2 LASER INTERFEROMETER MARKET, BY APPLICATION

- 4.3 LASER INTERFEROMETER MARKET, BY VERTICAL

- 4.4 LASER INTERFEROMETER MARKET, BY TECHNIQUE

- 4.5 LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY VERTICAL AND COUNTRY

- 4.6 LASER INTERFEROMETER MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing need for precise manufacturing and quality control

- 5.2.1.2 Growing trend of miniaturization of semiconductor devices

- 5.2.1.3 Requirement for extremely tight tolerances in aerospace & defense and automotive verticals

- 5.2.2 RESTRAINTS

- 5.2.2.1 High ownership and maintenance costs

- 5.2.2.2 Adverse impact of environmental conditions on measurement accuracy

- 5.2.2.3 Availability of alternative measurement tools

- 5.2.2.4 Risks associated with constant technological upgrades and obsolescence of existing equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid industrialization in emerging markets

- 5.2.3.2 Integration of laser interferometry with automated production lines, cloud-based platforms, and Industry 4.0 technologies

- 5.2.3.3 Growing emphasis on developing user-friendly and cost-effective models

- 5.2.3.4 Mounting demand for advanced medical devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Requirement for skilled personnel to handle complex operations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF FABRY-PEROT LASER INTERFEROMETERS, BY KEY PLAYER, 2024

- 5.6.2 PRICING RANGE OF LASER INTERFEROMETERS, BY TYPE, 2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF LASER INTERFEROMETERS, BY REGION, 2021-2024

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Laser sources

- 5.7.1.2 Beam splitters

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Coordinate measuring machines

- 5.7.2.2 Liner encoders

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Fourier transform infrared spectroscopy

- 5.7.3.2 Optical coherence tomography

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 US DEPARTMENT OF DEFENSE USES LASER INTERFERENCE STRUCTURING SYSTEM TO PREPARE SURFACES FOR PROTECTIVE COATINGS

- 5.10.2 MATERIAL INSPECTION MACHINES USE WHITE-LIGHT INTERFEROMETRY TO ACHIEVE FAST PRECISION MEASUREMENTS

- 5.10.3 SCIENTISTS FROM GERMANY DEMONSTRATE ATOM INTERFEROMETRY IN SPACE TO MEASURE GRAVITATIONAL FORCE

- 5.10.4 MACHINE REPAIR SPECIALIST INVESTS IN MULTI-AXIS CALIBRATORS TO EXPAND ITS SERVICES

- 5.10.5 BOST REDUCES MACHINE SETUP TIME BY 50% USING RENISHAW'S MACHINE CALIBRATOR AND LASER INTERFEROMETER

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 903149)

- 5.11.2 EXPORT SCENARIO (HS CODE 903149)

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 STANDARDS AND REGULATIONS

- 5.15 IMPACT OF AI/GEN AI ON LASER INTERFEROMETER MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 TOP AI/GEN AI USE CASES

- 5.15.2.1 Wafer metrology & lithography alignment

- 5.15.2.2 Satellite component testing

- 5.15.2.3 Optical coherence tomography (OCT)

- 5.15.2.4 Real-time fault detection

- 5.15.2.5 Precision tool calibration

- 5.16 IMPACT OF 2025 US TARIFF ON LASER INTERFEROMETER MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON VERTICALS

6 COMPONENTS OF LASER INTERFEROMETERS

- 6.1 INTRODUCTION

- 6.2 LASER SOURCES

- 6.3 PHOTODETECTORS

- 6.4 OPTICAL ELEMENTS

- 6.5 CONTROL SYSTEMS

- 6.6 SOFTWARE

7 MEASUREMENT TECHNIQUES OF LASER INTERFEROMETERS

- 7.1 INTRODUCTION

- 7.2 PHASE MEASUREMENT

- 7.3 FREQUENCY MEASUREMENT

- 7.4 AMPLITUDE MEASUREMENT

- 7.5 TIME-OF-FLIGHT MEASUREMENT

8 DESIGNS OF LASER INTERFEROMETERS

- 8.1 INTRODUCTION

- 8.2 BENCHTOP SYSTEMS

- 8.3 PORTABLE/HANDHELD SYSTEMS

- 8.4 IN-LINE/PROCESS SYSTEMS

- 8.5 MODULAR SYSTEMS

- 8.6 TIME-OF-FLIGHT SYSTEMS

9 LASER INTERFEROMETER MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 MICHELSON INTERFEROMETERS

- 9.2.1 ABILITY TO IMPROVE METROLOGY WITH ACCURATE CALIBRATION STANDARDS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.3 FABRY-PEROT INTERFEROMETERS

- 9.3.1 VERSATILITY IN ADVANCED OPTICAL APPLICATIONS TO SEGMENTAL MARKET GROWTH

- 9.4 FIZEAU INTERFEROMETERS

- 9.4.1 RISING DEVELOPMENT TO ENABLE HIGH-PRECISION OPTICAL MEASUREMENTS AND ADDRESS VIBRATION CHALLENGES TO DRIVE MARKET

- 9.5 MACH-ZEHNDER INTERFEROMETERS

- 9.5.1 HIGH DEMAND FOR FIBER-OPTIC COMMUNICATION SYSTEMS AND ELECTRONIC DEVICES TO BOOST ADOPTION

- 9.6 SAGNAC INTERFEROMETERS

- 9.6.1 USE OF INERTIAL NAVIGATION SYSTEMS AND GYROSCOPES IN AIRCRAFT AND AUV MANUFACTURING TO FOSTER SEGMENTAL GROWTH

- 9.7 TWYMAN-GREEN INTERFEROMETERS

- 9.7.1 RAPID ADVANCEMENTS TO ENABLE FAST, VIBRATION-IMMUNE MEASUREMENTS TO AUGMENT SEGMENTAL GROWTH

10 LASER INTERFEROMETER MARKET, BY TECHNIQUE

- 10.1 INTRODUCTION

- 10.2 HOMODYNE

- 10.2.1 ABILITY TO MEASURE SMALL DISPLACEMENTS AND VIBRATIONS IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 10.3 HETERODYNE

- 10.3.1 RISING ADOPTION TO MEASURE HIGH-FREQUENCY VIBRATIONS TO FUEL MARKET GROWTH

11 LASER INTERFEROMETER MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 SURFACE TOPOLOGY

- 11.2.1 NEED TO UNDERSTAND SURFACE FEATURES AT MICROSCOPIC LEVEL TO BOOST SEGMENTAL GROWTH

- 11.3 ENGINEERING

- 11.3.1 REQUIREMENT FOR HIGH-PRECISION MEASUREMENTS IN QUALITY CONTROL, R&D, AND MANUFACTURING APPLICATIONS TO DRIVE MARKET

- 11.4 APPLIED SCIENCE

- 11.4.1 DEMAND FOR PRECISE, SENSITIVE, AND SPECIFIC MEASUREMENTS IN APPLIED SCIENCE FIELDS TO EXPEDITE SEGMENTAL GROWTH

- 11.5 BIOMEDICAL

- 11.5.1 EXTENSIVE USE IN IMAGING AND DIAGNOSTIC APPLICATIONS TO ACCELERATE SEGMENTAL GROWTH

- 11.6 SEMICONDUCTOR DETECTION

- 11.6.1 STRINGENT PRECISION AND QUALITY CONTROL REQUIREMENTS TO CONTRIBUTE TO SEGMENTAL GROWTH

12 LASER INTERFEROMETER MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.2 AUTOMOTIVE

- 12.2.1 FOCUS ON ENHANCING MANUFACTURING PRECISION TO BOOST SEGMENTAL GROWTH

- 12.3 AEROSPACE & DEFENSE

- 12.3.1 NEED TO ENSURE OPTIMAL PRECISION AND RELIABILITY OF SYSTEMS TO FUEL SEGMENTAL GROWTH

- 12.4 INDUSTRIAL

- 12.4.1 REQUIREMENT FOR ADVANCED VIBRATION AND DYNAMIC ANALYSIS OF MACHINERY TO FOSTER SEGMENTAL GROWTH

- 12.5 HEALTHCARE

- 12.5.1 HIGH EMPHASIS ON SAFETY AND EFFICACY OF MEDICAL DEVICES TO DRIVE MARKET

- 12.6 ELECTRONICS & SEMICONDUCTOR

- 12.6.1 INCREASING DEMAND FOR NANOSCALE DEVICES TO AUGMENT SEGMENTAL GROWTH

- 12.7 TELECOMMUNICATIONS

- 12.7.1 RISING NEED FOR FASTER AND RELIABLE DATA COMMUNICATION SERVICES TO CREATE LUCRATIVE GROWTH OPPORTUNITIES

13 LASER INTERFEROMETER MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Rising adoption of high-precision engineering components to drive market

- 13.2.3 CANADA

- 13.2.3.1 Mounting demand for commercial vehicles to create lucrative market growth opportunities

- 13.2.4 MEXICO

- 13.2.4.1 Increasing investment in manufacturing sector to foster market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Booming automotive and aerospace industries to contribute to market growth

- 13.3.3 GERMANY

- 13.3.3.1 Prominent presence of automobile companies to spur demand

- 13.3.4 FRANCE

- 13.3.4.1 Rising deployment of Industry 4.0 and smart manufacturing techniques to support market growth

- 13.3.5 ITALY

- 13.3.5.1 Growing focus on precision measurement and industrial innovation to expedite market growth

- 13.3.6 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Rapid industrialization and urbanization to accelerate market growth

- 13.4.3 JAPAN

- 13.4.3.1 Rising implementation of just-in-time manufacturing approach to augment market growth

- 13.4.4 INDIA

- 13.4.4.1 Expanding industrial landscape to accelerate market growth

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Rising semiconductor and electronics manufacturing to create market growth opportunities

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Thriving aerospace sector to contribute to market growth

- 13.5.3 AFRICA

- 13.5.3.1 Growing focus on quality control in industrial sectors to boost market growth

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Steady rise of industrialization to foster market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Technique footprint

- 14.7.5.4 Vertical footprint

- 14.7.5.5 Application footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 RENISHAW PLC

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 MnM view

- 15.1.1.3.1 Key strengths/Right to win

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses/Competitive threats

- 15.1.2 KEYSIGHT TECHNOLOGIES

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 ZEISS GROUP

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths/Right to win

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses/Competitive threats

- 15.1.4 ZYGO CORPORATION

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 BRUKER

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 MAHR GMBH

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.7 MOLLER-WEDEL OPTICAL GMBH

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 QED TECHNOLOGIES

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 SIOS MEBTECHNIK GMBH

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 TOSEI ENGINEERING CORP.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 AUTOMATED PRECISION INC (API)

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.1 RENISHAW PLC

- 15.2 OTHER PLAYERS

- 15.2.1 PRATT AND WHITNEY MEASUREMENT SYSTEMS, INC.

- 15.2.2 SMARACT GMBH

- 15.2.3 LASERTEX

- 15.2.4 LUNA

- 15.2.5 4D TECHNOLOGY CORP.

- 15.2.6 APRE INSTRUMENTS

- 15.2.7 ADLOPTICA OPTICAL SYSTEMS GMBH

- 15.2.8 LOGITECH

- 15.2.9 HOLMARC OPTO-MECHATRONICS LTD.

- 15.2.10 ATTOCUBE SYSTEMS GMBH

- 15.2.11 HIGHFINESSE GMBH

- 15.2.12 XONOX TECHNOLOGY GMBH

- 15.2.13 THORLABS, INC.

- 15.2.14 LASERTEC CORPORATION

- 15.2.15 FUJIFILM HOLDINGS CORPORATION

- 15.2.16 OLYMPUS CORPORATION

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

List of Tables

- TABLE 1 LASER INTERFEROMETER MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 LASER INTERFEROMETER MARKET: SUMMARY OF CHANGES

- TABLE 3 MAJOR SECONDARY SOURCES

- TABLE 4 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 5 LASER INTERFEROMETER MARKET: RESEARCH ASSUMPTIONS

- TABLE 6 LASER INTERFEROMETER MARKET: RISK ANALYSIS

- TABLE 7 ROLE OF COMPANIES IN LASER INTERFEROMETER ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE OF FABRY-PEROT LASER INTERFEROMETERS PROVIDED BY KEY PLAYERS, 2024

- TABLE 9 PRICING RANGE OF LASER INTERFEROMETERS, BY TYPE, 2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF LASER INTERFEROMETERS, BY REGION, 2021-2024 (USD)

- TABLE 11 IMPACT OF PORTER'S FIVE FORCES, 2024

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE LASER INTERFEROMETER APPLICATIONS

- TABLE 14 IMPORT DATA FOR HS CODE 903149-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 EXPORT DATA FOR HS CODE 903149-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 LIST OF KEY PATENTS, 2025

- TABLE 17 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 MFN TARIFF FOR HS CODE 903149-COMPLIANT PRODUCTS EXPORTED BY US, 2024

- TABLE 19 MFN TARIFF FOR HS CODE 903149-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2024

- TABLE 20 MFN TARIFF FOR HS CODE 903149-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 21 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKETS DUE TO TARIFF

- TABLE 27 LASER INTERFEROMETER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 LASER INTERFEROMETER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 LASER INTERFEROMETER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 30 LASER INTERFEROMETER MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 31 MICHELSON INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 MICHELSON INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 FABRY-PEROT INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 FABRY-PEROT INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 FIZEAU INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 FIZEAU INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 MACH-ZEHNDER INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 MACH-ZEHNDER INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 SAGNAC INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 SAGNAC INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 TWYMAN-GREEN INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 TWYMAN-GREEN INTERFEROMETERS: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 LASER INTERFEROMETER MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 44 LASER INTERFEROMETER MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 45 LASER INTERFEROMETER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 LASER INTERFEROMETER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 LASER INTERFEROMETER MARKET, BY VERTICAL 2021-2024 (USD MILLION)

- TABLE 48 LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 49 AUTOMOTIVE: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 AUTOMOTIVE: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 AUTOMOTIVE: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 AUTOMOTIVE: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 AUTOMOTIVE: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 AUTOMOTIVE: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 AUTOMOTIVE: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 AUTOMOTIVE: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 AEROSPACE & DEFENSE: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 AEROSPACE & DEFENSE: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 AEROSPACE & DEFENSE: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 AEROSPACE & DEFENSE: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 AEROSPACE & DEFENSE: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 AEROSPACE & DEFENSE: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 AEROSPACE & DEFENSE: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 AEROSPACE & DEFENSE: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 INDUSTRIAL: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 INDUSTRIAL: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 INDUSTRIAL: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 INDUSTRIAL: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 INDUSTRIAL: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 INDUSTRIAL: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 INDUSTRIAL: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 INDUSTRIAL: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 HEALTHCARE: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 HEALTHCARE: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 HEALTHCARE: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 HEALTHCARE: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 HEALTHCARE: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 HEALTHCARE: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 HEALTHCARE: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 HEALTHCARE: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 ELECTRONICS & SEMICONDUCTOR: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 ELECTRONICS & SEMICONDUCTOR: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 ELECTRONICS & SEMICONDUCTOR: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 ELECTRONICS & SEMICONDUCTOR: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 ELECTRONICS & SEMICONDUCTOR: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 ELECTRONICS & SEMICONDUCTOR: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 ELECTRONICS & SEMICONDUCTOR: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 ELECTRONICS & SEMICONDUCTOR: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 TELECOMMUNICATIONS: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 TELECOMMUNICATIONS: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 TELECOMMUNICATIONS: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 TELECOMMUNICATIONS: LASER INTERFEROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 TELECOMMUNICATIONS: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 TELECOMMUNICATIONS: LASER INTERFEROMETER MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 TELECOMMUNICATIONS: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 TELECOMMUNICATIONS: LASER INTERFEROMETER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: LASER INTERFEROMETER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: LASER INTERFEROMETER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: LASER INTERFEROMETER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: LASER INTERFEROMETER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 US: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 106 US: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 107 CANADA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 108 CANADA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 109 MEXICO: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 110 MEXICO: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: LASER INTERFEROMETER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: LASER INTERFEROMETER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: LASER INTERFEROMETER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: LASER INTERFEROMETER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 UK: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 118 UK: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 119 GERMANY: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 120 GERMANY: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 121 FRANCE: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 122 FRANCE: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 123 ITALY: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 124 ITALY: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 125 REST OF EUROPE: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 126 REST OF EUROPE: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: LASER INTERFEROMETER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: LASER INTERFEROMETER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: LASER INTERFEROMETER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: LASER INTERFEROMETER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 CHINA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 134 CHINA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 135 JAPAN: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 136 JAPAN: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 137 INDIA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 138 INDIA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 139 SOUTH KOREA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 140 SOUTH KOREA: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 143 ROW: LASER INTERFEROMETER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 ROW: LASER INTERFEROMETER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 ROW: LASER INTERFEROMETER MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 146 ROW: LASER INTERFEROMETER MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 147 ROW: LASER INTERFEROMETER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 ROW: LASER INTERFEROMETER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 149 LASER INTERFEROMETER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-SEPTEMBER 2025

- TABLE 150 LASER INTERFEROMETER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 151 LASER INTERFEROMETER MARKET: REGION FOOTPRINT

- TABLE 152 LASER INTERFEROMETER MARKET: TECHNIQUE FOOTPRINT

- TABLE 153 LASER INTERFEROMETER MARKET: VERTICAL FOOTPRINT

- TABLE 154 LASER INTERFEROMETER MARKET: APPLICATION FOOTPRINT

- TABLE 155 LASER INTERFEROMETER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 156 LASER INTERFEROMETER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 157 LASER INTERFEROMETER MARKET: PRODUCT LAUNCHES, JANUARY 2021-SEPTEMBER 2025

- TABLE 158 LASER INTERFEROMETER MARKET: DEALS, JANUARY 2021-SEPTEMBER 2025

- TABLE 159 RENISHAW PLC: COMPANY OVERVIEW

- TABLE 160 RENISHAW PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 162 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 164 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 165 ZEISS GROUP: COMPANY OVERVIEW

- TABLE 166 ZEISS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 ZYGO CORPORATION: COMPANY OVERVIEW

- TABLE 168 ZYGO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 ZYGO CORPORATION: PRODUCT LAUNCHES

- TABLE 170 ZYGO CORPORATION: DEALS

- TABLE 171 BRUKER: COMPANY OVERVIEW

- TABLE 172 BRUKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 BRUKER: PRODUCT LAUNCHES

- TABLE 174 MAHR GMBH: COMPANY OVERVIEW

- TABLE 175 MAHR GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 MOLLER-WEDAL OPTICAL GMBH: COMPANY OVERVIEW

- TABLE 177 MOLLER-WEDAL OPTICAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 QED TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 179 QED TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 SIOS MEBTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 181 SIOS MEBTECHNIK GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 TOSEI ENGINEERING CORP.: COMPANY OVERVIEW

- TABLE 183 TOSEI ENGINEERING CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 AUTOMATED PRECISION INC (API): COMPANY OVERVIEW

- TABLE 185 AUTOMATED PRECISION INC (API): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 AUTOMATED PRECISION INC (API): PRODUCT LAUNCHES

- TABLE 187 PRATT AND WHITNEY MEASUREMENT SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 188 SMARACT GMBH: COMPANY OVERVIEW

- TABLE 189 LASERTEX: COMPANY OVERVIEW

- TABLE 190 LUNA: COMPANY OVERVIEW

- TABLE 191 4D TECHNOLOGY CORP.: COMPANY OVERVIEW

- TABLE 192 APRE INSTRUMENTS: COMPANY OVERVIEW

- TABLE 193 ADLOPTICA OPTICAL SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 194 LOGITECH: COMPANY OVERVIEW

- TABLE 195 HOLMARC OPTO-MECHATRONICS LTD.: COMPANY OVERVIEW

- TABLE 196 ATTOCUBE SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 197 HIGHFINESSE GMBH: COMPANY OVERVIEW

- TABLE 198 XONOX TECHNOLOGY GMBH: COMPANY OVERVIEW

- TABLE 199 THORLABS, INC.: COMPANY OVERVIEW

- TABLE 200 LASERTEC CORPORATION: COMPANY OVERVIEW

- TABLE 201 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 202 OLYMPUS CORPORATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LASER INTERFEROMETER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 LASER INTERFEROMETER MARKET: DURATION COVERED

- FIGURE 3 LASER INTERFEROMETER MARKET: RESEARCH DESIGN

- FIGURE 4 LASER INTERFEROMETER MARKET: RESEARCH APPROACH

- FIGURE 5 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 8 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 9 LASER INTERFEROMETER MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 10 LASER INTERFEROMETER MARKET: REPORT APPROACH

- FIGURE 11 LASER INTERFEROMETER MARKET: BOTTOM-UP APPROACH

- FIGURE 12 LASER INTERFEROMETER MARKET: TOP-DOWN APPROACH

- FIGURE 13 LASER INTERFEROMETER MARKET: DATA TRIANGULATION

- FIGURE 14 LASER INTERFEROMETER MARKET: RESEARCH LIMITATIONS

- FIGURE 15 HETERODYNE SEGMENT TO HOLD LARGER MARKET SHARE IN 2024 AND 2030

- FIGURE 16 SURFACE TOPOLOGY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 17 AUTOMOTIVE SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 18 FIZEAU INTERFEROMETERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 19 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2024

- FIGURE 20 DEVELOPMENT OF AFFORDABLE AND USER-FRIENDLY LASER INTERFEROMETERS TO BOOST MARKET GROWTH

- FIGURE 21 SURFACE TOPOLOGY TO CAPTURE LARGEST SHARE OF LASER INTERFEROMETER MARKET IN 2030

- FIGURE 22 AUTOMOTIVE VERTICAL TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 23 HETERODYNE TECHNIQUE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 AUTOMOTIVE SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC LASER INTERFEROMETER MARKET IN 2024

- FIGURE 25 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL LASER INTERFEROMETER MARKET FROM 2025 TO 2030

- FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 IMPACT ANALYSIS: DRIVERS

- FIGURE 28 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 29 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 30 IMPACT ANALYSIS: CHALLENGES

- FIGURE 31 VALUE CHAIN ANALYSIS

- FIGURE 32 LASER INTERFEROMETER ECOSYSTEM ANALYSIS

- FIGURE 33 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 34 AVERAGE SELLING PRICE OF FABRY-PEROT LASER INTERFEROMETERS OFFERED BY KEY PLAYERS, 2024

- FIGURE 35 AVERAGE SELLING PRICE TREND OF LASER INTERFEROMETERS IN DIFFERENT REGIONS, 2021-2024

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 39 IMPORT DATA FOR HS CODE 903149-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 40 EXPORT DATA FOR HS CODE 903149-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 41 PATENT APPLIED AND GRANTED, 2016-2025

- FIGURE 42 USE CASES AND IMPACT OF AI/GEN AI ON LASER INTERFEROMETER MARKET

- FIGURE 43 FIZEAU INTERFEROMETERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 44 HETERODYNE SEGMENT TO CAPTURE LARGER SHARE OF LASER INTERFEROMETER MARKET IN 2030

- FIGURE 45 SURFACE TOPOLOGY SEGMENT TO HOLD LARGEST SHARE OF LASER INTERFEROMETER MARKET IN 2025 AND 2030

- FIGURE 46 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025 AND 2030

- FIGURE 47 ASIA PACIFIC TO RECORD HIGHEST CAGR IN LASER INTERFEROMETER MARKET DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: LASER INTERFEROMETER MARKET SNAPSHOT

- FIGURE 49 EUROPE: LASER INTERFEROMETER MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: LASER INTERFEROMETER MARKET SNAPSHOT

- FIGURE 51 ROW: LASER INTERFEROMETER MARKET SNAPSHOT

- FIGURE 52 LASER INTERFEROMETER MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 53 MARKET SHARE ANALYSIS OF COMPANIES OFFERING LASER INTERFEROMETERS, 2024

- FIGURE 54 COMPANY VALUATION

- FIGURE 55 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 56 PRODUCT COMPARISON

- FIGURE 57 LASER INTERFEROMETER MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 58 LASER INTERFEROMETER MARKET: COMPANY FOOTPRINT

- FIGURE 59 LASER INTERFEROMETER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 60 RENISHAW PLC: COMPANY SNAPSHOT

- FIGURE 61 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 62 ZEISS GROUP: COMPANY SNAPSHOT

- FIGURE 63 BRUKER: COMPANY SNAPSHOT